- PMI shows new orders and output prices are up — and pressure on margins is easing. (Speed Round)

- The 0.25% healthcare tithe will definitely be on the top line this year, the Tax Authority says. Next year could be different. (Speed Round)

- Tourism revenues surge 50% y-o-y to c. USD 11.4 bn in 2018 on more arrivals and higher average daily spending. (Speed Round)

- IFC launches two-year program to support fintech startups in Egypt. (Speed Round)

- CIB Chairman Hisham Ezz Al Arab on economic reform, financial inclusion. (Speed Round)

- It’s going to be a DC-centric week with El Sisi heading to the White House and the spring meetings of the IMF and World Bank. (Speed Round)

- Go watch This Giant Beast That is the Global Economy on Amazon Prime Video. (Worth Watching)

- Does the ECA have legal grounds to stop Uber from buying Careem? Or to block any M&A, for that matter? (A Contrarian View)

- The Market Yesterday

Monday, 8 April 2019

PMI shows new orders and output prices are up — and pressure on margins is easing

TL;DR

What We’re Tracking Today

El Sisi heads to DC today: President Abdel Fattah El Sisi is heading today to Washington, DC, for a three-day visit to America, the highlight of which will be a meeting with US President Donald Trump. The president’s visit comes as the IMF and World Bank gear-up for their spring meetings, which will feature a meeting of G-20 finance ministers on the sidelines.

Presidential diplomacy will get plenty of headlines heading into Ramadan: El Sisi was in Guinea yesterday for talks with President Alpha Conde — the first time an Egyptian president has visited the country since 1965. Also in the cards for the president are visits to Senegal and Cote d’Ivoire, according to a presidential statement. El Sisi is also due in Beijing later this month to attend China’s Belt and Road Forum for International Cooperation, according to Xinhua.

The mood for the global economy this week is going to be set in Washington and in New York. Specifically:

The IMF looks set to downgrade this week its global growth forecasts for 2019 and 2020 just in time for the aforementioned spring meetings of the IMF and World Bank. IMF boss Christine Lagarde reportedly still expects an “an anaemic pick-up later this year” but “believes that a major fiscal easing may be needed to reverse the downward trend in the longer term,” according to the Financial Times. Lagard had said last week that the outlook is “precarious” for an “unsettled” global economy that is particularly vulnerable to trade wars, Brexit and financial markets shocks (including, say, a sell-off sparked by a run of poor earnings reports).

That comes as the global economy is entering a “synchronised slowdown,” according to an index compiled by the Financial Times and US think tank Brookings that looks at “sentiment indicators and economic data” across advanced and emerging economies.” The Brookings-Financial Times TIGER (Tracking Indexes for the Global Economic Recovery) index shows that investment is easing across the world due to falling business and consumer confidence as well as geopolitical tensions, Brookings writes. At the same time, record public debt levels mean that advanced economies are running low on ammunition to prevent a possible recession. The salmon-colored paper has coverage here.

So will poor 1Q earnings in Europe and the US be one of the triggers of Doomsday? Maybe, the Wall Street Journal suggests, noting that “dozens of companies have slashed their profit forecasts for the first quarter,” from Walgreen Boots to FedEx, Apple and 3M. CNBC is less certain, acknowledging that (expected) poor first-quarter earnings could hit market sentiment, but fretting more about what could happen on Wednesday. That’s when the US Federal Reserve releases the minutes of its last meeting — and when the EU meets to talk about Brexit.

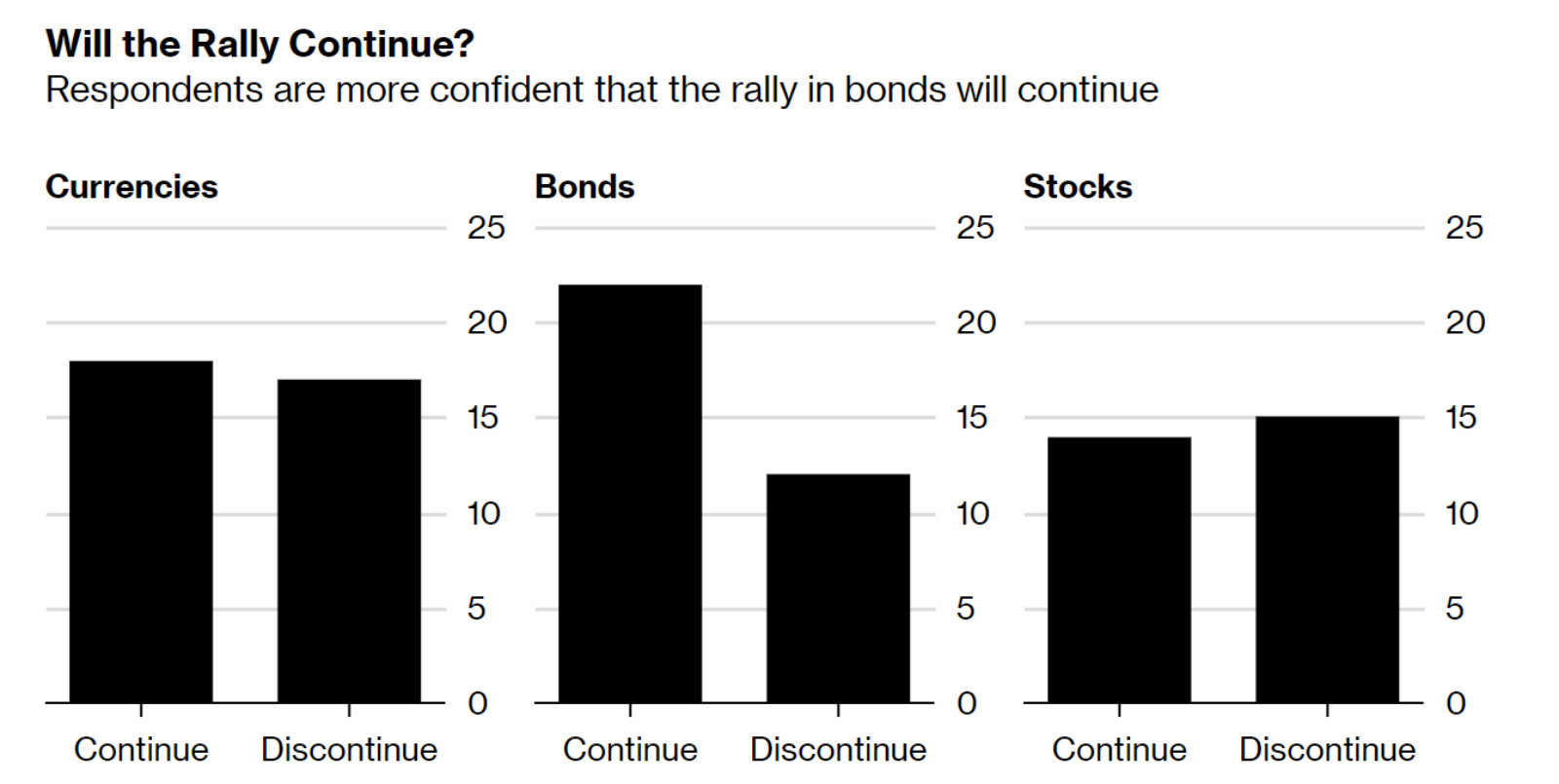

A ray of sunshine? Emerging market debt will continue to rally in the coming months despite the fading recovery in developing economies, according to Bloomberg’s monthly EM survey. “With the [US Federal Reserve’s] dovish turn and risks of economic slowdown globally, central banks in emerging markets won’t have to raise rates, which is a good environment for bond,” FPG Securities CEO Koji Fukaya said.

In regional goings-on:

- Saudi Aramco’s upcoming USD 10 bn bond issuance is already 3x oversubscribed as investors shrug off concerns related to the murder of journalist Jamal Khashoggi last year, the FT reports.

- The US is pulling troops from Libya as fighting between the east Libyan forces of Egypt-backed Gen. Khalifa Haftar and the UN-backed government of Fayez Al Serraj left 21 dead yesterday, according to the BBC. The clashes are “elevating the risk of new oil supply outages from the OPEC member,” says Bloomberg.

- Thousands of Sudanese protesters are holding a sit-in outside President Omar Al Bashir’s compound in Khartoum, Reuters reports.

- Israeli Prime Minister Benjamin Netanyahu vowed to annex Jewish settlements in the West Bank as he looks to secure rightwing support ahead of elections tomorrow that would determine whether or not he lands a fifth term in office, the FT notes.

Also happening in the next couple of days:

- Renaissance Capital’s annual Egypt Investors Conference takes place in Cape Town Tuesday and Wednesday. EGX Chairman Mohamed Farid will deliver the keynote address on expanding the role of capital markets in Egypt’s economy. Tap or click here to view the preliminary agenda for the event (pdf).

- Monthly inflation figures are due out on Wednesday. Annual headline inflation accelerated to 14.4% in February, up from 12.7% the previous month. In a report earlier this week, the IMF urged Egypt to take it easy with the monetary policy easing to avoid another surge in inflation, Bloomberg noted.

- AmCham is holding its annual HR Day at the Cairo Marriott Hotel on 10 April. You can register here.

- The House of Representatives will vote on the proposed constitutional amendments on Sunday, 14 April.

The New York Times would like to scare the hell out of you with what is shaping up to be a scary and insightful investigative series on superbugs. It’s not just a rich-country problem, and fungi are getting in on the act, too. Read:

- In a poor Kenyan community, cheap antibiotics fuel deadly drug-resistant infections

- A mysterious infection, spanning the globe in a climate of secrecy

QUESTION OF THE MORNING: Does anyone out there know of homegrown Egyptian businesses that have successfully scaled up and expanded beyond our borders (not necessarily just to shiny Dubai)? We’re looking at great growth stories to feature in a new product we’re developing. Know someone? Drop us a line at editorial@enterprise.press.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s tour of Guinea ahead of his US visit dominated the nation’s airwaves last night. The president is due to land in Washington DC today for talks with The Donald. He’s also due to visit Senegal and Cote d’Ivoire as part of a tour of West Africa.

El Hekaya’s Amr Adib framed the tour as a chance for Egypt to make use of its popularity in West Africa (watch, runtime: 4:21). Adib said the president kicked off his visit in a university named after Gamal Abdel Nasser (the late president and advocate, variously, of Arab socialism and pan-Africanism in the Guinean capital Conakry.

Masaa DMC’s Eman El Hosary noted this was the first visit to Guinea by an Egyptian president since 1965 (watch, runtime: 3:01). Hona Al Asema’s Reham Ibrahim, meanwhile, consulted with former deputy foreign minister for African affairs Ibrahim El Shwaimi, who positioned the visits as part of El Sisi’s strategy to re-engage with Africa (watch, runtime: 6:51). Egypt holds the presidency of the African Union this year.

On the other side of the ocean: Preparations in Washington are already underway. Egyptian expats in New Jersey and New York have flocked to DC to participate in “small scale” public discussions about the proposed constitutional amendments, Hona Al Asema’s Lama Gebreil reported from Washington (watch, runtime: 6:50). Gebreil suggested the war on terror would continue to shape Egypt-US relations for a long while to come.

El Hekaya’s Amr Adib drifted off on a tangent, wondering why the return of the Russian flights to the Red Sea, and with it plenty of RUB and USD, is constantly being delayed (watch, runtime: 3:10). Adib took note of El Sisi’s recent discussion of the flights with Russian Foreign Minister Sergey Lavrov, which we mentioned yesterday.

Speed Round

Speed Round is presented in association with

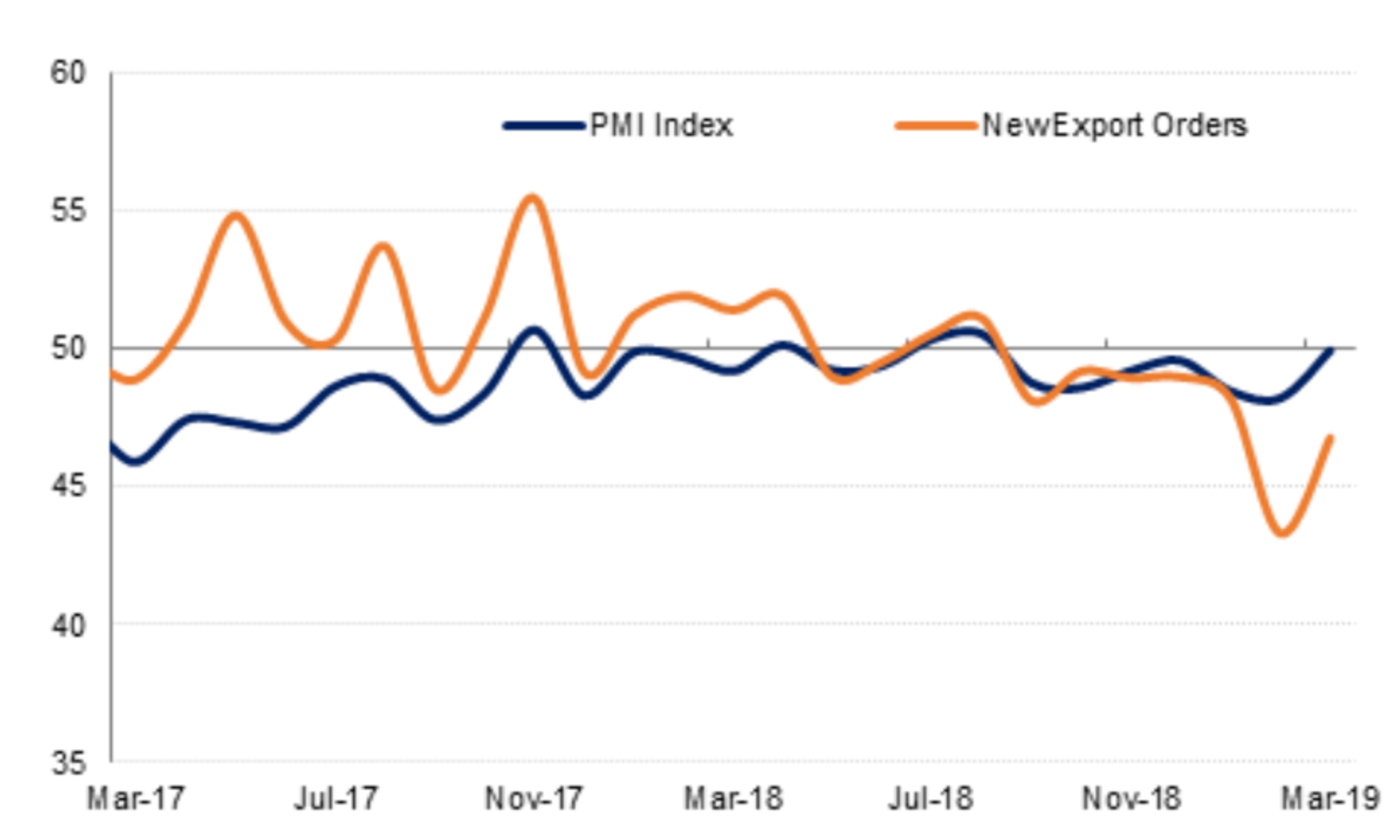

Non-oil businesses sees rise in orders and output prices — and improvement in margins: The Emirates NBD Egypt purchasing managers’ index (pdf) rose to 49.9 in March, marking “a significant improvement from the 17-month low of 48.2 recorded in February,” said Daniel Richards, MENA economist at Emirates NBD.

What does that mean? A reading above 50.0 indicates that activity is rising, while a reading below that mark means it is contracting. The March figure is the seventh consecutive month that the gauge has been in contraction territory.

What drove the month-on-month improvement? It came as orders increased for the first time since August of last year — and as companies were “able to raise output prices for the first time this year, while input prices were at a series-low, reducing pressure on firms’ margins,” Richards said.

Employment continued on its downward trajectory for the sixth month in a row amid retirements and staff members changing jobs.

Survey respondents were generally positive, expecting PMI to improve over the rest of the year and to hit the growth territory more frequently than in 2018 on the back of lower interest rates and an uptick in tourism. Future output expectations were revised downwards, however, amid concerns over economic stagnation over the coming year.

The caveat (beyond the fact that the gauge is still in contraction territory): “The continued negative performance of the private sector reaffirms our decision to downgrade our 2018-19 real GDP growth forecast from 5.5% to 5.3%.” Emirates NBD writes.

EXCLUSIVE- Healthcare tithe this year will definitely be on the top line: The 0.25% levy businesses will have to pay as part of the Universal Healthcare Act will definitely be on revenues for the current fiscal year, Tax Authority head Abdel Azim Hussein tells us, implying that it is just too late to change course this late into the FY2018 tax season.

What about the years to come? Hussein did tell us that the Finance Ministry was working on an amendment to the Universal Healthcare Act, but declined to say whether the amendments would see the tax shifted to the bottom line. He made sure to note that any changes made in the next fiscal year will not be applied retroactively. This means that if the ministry changes course and decides to tax company profits, no additional tax will be charged on profits from previous years. These amendments have yet to be completed.

He promised that we would see clarity on the accounting for the tax for outliers from an upcoming note that will be published by the ministry.

Still in question, as we see it: Whether the 0.25% levy on revenues would be tax deductible. Our take at present is that it is not.

Tourism revenues grew 50% y-o-y to c. USD 11.4 bn in 2018, from USD 7.6 bn in 2017, an unnamed government official told the local press. The growth came as more tourists arrived and spent more, on average, each day: Tourist arrivals came in at 11.34 mn visitors, while average spending was at USD 100 / night against USD 92.60 the previous year. European tourists accounted for the largest bloc, with around 7 mn visitors to Egypt last year, followed by Arabs and Asians. Germans alone accounted for 1.7 mn of the tourist arrivals in 2018.

Tourism Minister Rania Al Mashat has said that tourism growth in 2019 will be “strong” in an interview with the National, but declined to give specific projections. Figures from the World Travel & Tourism Council (pdf) show that 11.7 mn tourists are expected to visit Egypt this year.

The International Finance Corporation announced yesterday it has launched a two-year program to support fintech startups in Egypt, according to a statement (pdf). The program will be implemented in cooperation with Pharos’ Pride Capital / Startupbootcamp’s Fintech Cairo accelerator program and the American University in Cairo’s Venture Labs. “The two-year program will help two private sector fintech-focused accelerators improve their offering to startups in areas like mentorship, business development and technical training, to help them attract funding from investors.”

Egypt’s economic reform program is finally beginning to bear fruit as confidence and investment levels increase, our friend CIB Chairman Hisham Ezz Al Arab told The Banker. “Confidence is growing, as reflected in the IMF’s and rating agencies’ positive economic outlooks,” he says. “Perhaps most significantly, lowered interest rates have signalled the return of investment, which will clearly accelerate the positive momentum.”

Giving incentives to businesses to go legit is crucial: “The importance of financial inclusion to a sustainable Egyptian economy cannot be overstated it is clearly the government’s highest priority,” Al Arab says in a separate article in the FT’s monthly publication. The best way to achieve this is through new technology, he says. “This is why we have invested heavily in digital platforms, versus traditional channels, which has led to the launch of many significant products such as the smart wallet, internet banking and the CIB mobile banking app.”

Egypt’s banking sector a role model for progressive workplaces? A third piece in this month’s edition looks at the ways in which the Egyptian banking sector is working to stamp out workplace gender discrimination and hiring bias. The Egyptian government and the central bank “are actively committed to promoting fair opportunities for all,” Pakinam Essam, CIB’s chief risk officer, tells The Banker. Because of the highly competitive nature of the sector, “it is normal that the top candidates in the workplace, which happen to be overwhelmingly females, find their way into the banking industry,” she says.

New rules for market research companies: The Supreme Media Council’s newly formed regulatory committee for market research companies has issues five new rules for its subjects, according to an official statement. Top executives will need at least 10 years of experience in the field and companies must have a minimum EGP 5 mn of issued capital. All companies will need to inform the regulator of any changes of ownership, capital or funding sources.

Cairo arbitration center snags prestigious industry award: The Cairo Regional Center for International Commercial Arbitration (CRCICA) was selected by the Global Arbitration Review as “the winner for the Regional Arbitration Award for an Arbitral Institution that Impressed,” according to an emailed statement. CRCICA edged over several other major international and regional arbitration centers.

Karim Youssef, managing partner at Cairo-based firm Youssef & Partners, was also selected as the winner of the Best Global Lecture award for his presentation last December on “how Egypt aced the test of the Arab Spring.” Tap / click here for our coverage of the lecture late last year.

Lebanon’s Blom Bank expects profits from its operations in Egypt to offset its declining earnings in Lebanon, Chairman Saad Azhari tells the National. According to Azhari, the bank expects its Egypt operations to see a 50% growth in profitability this year, and plans to increase its physical presence as well as continue to push its digital banking expansion. “We are growing very fast there, we are opening new branches we are growing our lending portfolio in retail, [to] SMEs and corporates. We see big potential for us in Egypt and we will be pushing very hard to grow there,” Azhari said.

MOVES- Energy giant Royal Dutch Shell has appointed Khaled Kassem as chairman and managing director of its Egyptian business. Kassem had previously headed Tunisian operations for the company, reports Reuters.

** OUR PARENT COMPANY IS HIRING: Do you have a passion for Arabic writing? Make it your day job. We are looking for talented copywriters who love to write in their native language and want to join a dynamic and friendly environment that we believe is simply awesome. You’ll develop content for marketing and corporate communications material for both online and offline audiences, and since all our content is bilingual, you will need a decent command of the English language to be able to work here. If you think you are our next Arabic copywriter, please send us your CV and writing sample on jobs@inktankcommunications.com.

A Contrarian View

A CONTRARIAN VIEW- Does the ECA have the legal ground to stop Uber from buying Careem? Or to block any M&A, for that matter? That what we were asking ourselves when the Egyptian Competition Authority (ECA) sent a sharp, unprecedented warning to ride-hailing companies Uber and Careem that they could be fined up to EGP 500 mn each if they go through with the merger they announced (pdf). If you were wondering the same thing, dear reader, you are in luck. Firas El Samad (bio), founding and managing partner at Zulficar & Partners, outlines the legal repercussions of the ECA’s decision. It’s the best analysis we’ve read to date on the legal nuances and implications of the case on future M&As and the ECA’s ability to regulate them.

How to use a spoon to cut a steak: The Egyptian Competition Authority’s guide to how to use anti-cartel legislative provisions to control and review mergers

The decision: On one fine morning, on October 23rd, 2018, the world woke up to the Egyptian Competition Authority (ECA) issuing a first of its kind decision that requires ride-hailing giants Uber and Careem obtain the pre-approval of the ECA before completing their “contemplated” merger, which was brought to the attention of the ECA through media outlets. The decision looks at Uber and Careem as competing entities, and their contemplated merger a form of collusion that is penalized under Article 6 (a) and (d) of the Egyptian Competition Law No.3 for the year 2005 (the Antitrust Act) that governs the prevention of cartels. The decision itself was taken under Article 20, which entitles the ECA to intervene if they conclude from appearances and ostensible proof that a certain act, contemplated or committed, constitutes or would likely constitute a breach of the law with potential imminent and irreversible damages to consumers and/or to competition itself.

Egypt does not currently have a law that allows or empowers the ECA to review, approve or disapprove mergers whether prior to or following their completion. Since the adoption of the Antitrust Act more than a decade and a half ago, the ECA has been fighting and lobbying in vein for a proper pre-merger control regime. The law itself was originally and primarily conceived and passed as a tool to fight monopolistic practices, such as a merchant or a group of merchants who restrict supply in order to raise their prices. To date, there is still no confirmed and serious indication that a comprehensive pre-merger control regime is on the government’s legislative agenda.

What the ECA has managed to obtain since 2005 through the current law (as a compromise of sorts) is the power to gather some “post completion” information about transactions of a certain size and this in order to keep themselves up-to-date and to study relevant markets when needed. So as things currently stand, Article 19 of the law requires mergers and acquisitions of a certain size be notified to the ECA within 30 days from the date on which the merger (or the acquisition) comes to effect. The threshold for notification is the cumulative turnover of EGP 100 mn . Failure to make the notification will result in a fine that ranges between EGP 20,000 and EGP 500,000. It is therefore obvious that there is nothing in the act that would require the clearance or the pre-approval of the merger by the ECA.

So when faced with the question of whether the law should prevent companies from merging or assess in advance the presumed harmful effect of a merger and take preventive measures, the presumed answer by legislators has been so far: No. Let them merge and the ECA will oversee what the resulting entity would do. Why should we overwhelm and swamp the regulator with the task of having to study and review countless transactions and add another layer of bureaucracy to an already saturated environment, especially in an era of a supposedly post-socialist private sector-driven economy?

Frustrated by the lack of proper legislative tools, the ECA has finally decided to react and to take matters into its own hands. Choosing to ignore the fact that the Antitrust Act does not provide for the desired interventionist approach in regulating mergers, the ECA has taken it on itself to assume greater regulatory and authoritative powers by transforming the existing post-merger notification regime into a de facto pre-merger authorization requirement that is not legislatively supported by the law.

Egypt in the News

Leading the conversation on Egypt in the international press this morning: President Abdel Fattah El Sisi’s imminent visit to the US. Human rights groups are ramping up efforts to lobby Congress to take a tougher line on President El Sisi when he lands in Washington, DC, for talks today, CNN reports. The New Jersey Star Ledger has an opinion piece on the topic.

The growing international presence and influence of Al Azhar has caught the eye of the Egyptian government and the international press, as Al Monitor reports on the divergence in religious discourse between the Al Azhar Grand Imam Sheikh Ahmed El Tayeb and President Abdelfattah El Sisi. The piece comes as Al Azhar International Academy, which Tayeb established last year, began offering courses to train imams and preachers from 20 countries, including Iraq, Afghanistan and Nigeria earlier this month.

On The Front Pages

President Abdel Fattah El Sisi’s visit to Guinea yesterday topped the front pages of the government dailies this morning (Al Ahram | Al Gomhuria | Al Akhbar). The president is due to spend three days in Washington, DC, starting today, and will also visit Senegal and Cote d’Ivoire as part of a west African tour.

Worth Reading

Risk managers may worry, but the passionate among them seldom grow weary: You’d think a career in risk management would make you prone to premature aging and graying of hair. But it’s a function which seems precisely suited to forever young, inquisitive, and imaginative folks who enjoy meddling with data and thinking up real world scenarios akin to those in science fiction, according to group chief risk officer at Zurich Insurance Alison Martin (pictured above), the FT writes.

Data science: Martin’s company, both an insurer and a so-called impact investor, is interested in anything that cause losses for its customers, whether “wild weather patterns — or, increasingly, severe fires.” The insurer relies on “catastrophe models” that measure such occurrences and envisions two future scenarios in which governments either fail or succeed to act on climate change.

Technology: Cyber security is a major focus for any company, with hacking only one of a multitude of threats posed by new tech. This extends to companies beyond the insurance industry, but is particularly important for insurers who have access to sensitive customer data.

A complete risk manager needs to be able to see the forest from the trees, “to understand the wider risks” of a world that is evolving. For that, they need to grasp where our knowledge and modes of thinking are likely to lead us.

Worth Watching

This Giant Beast That is the Global Economyis a recently released documentary series on Amazon Prime branding itself as a cross-breed between Adam McKay’s The Big Short and Louis Theroux's Weird Weekends (watch the trailer, runtime: 2:20). Each episode of the eight-part ‘docu-series’ — hosted by American actor and former Obama Whit House official Kal Penn — explores the shortfalls, perils, and sheer complexity of an economy growing so big and interconnected that it’s near impossible to understand. From people growing ultra wealthy to money laundering and bitcoin to artificial intelligence threatening to “kill us all,” the world now seems as scary as it is hard to grasp.

Diplomacy + Foreign Trade

Egypt to work with Saudi on oil and gas exploration in Red Sea: The Oil Ministry is planning to cooperate with Saudi authorities in oil and gas exploration in Red Sea concessions, Oil Minister Tarek El Molla told The National on the sidelines of the World Economic Forum that kicked off at the Dead Sea resort city in Jordan yesterday. Egypt recently launched a tender for 10 blocks off the Red Sea coast neighbouring those of Saudi. The tender announcement came after the kingdom made major natural gas discoveries on its side. El Molla also met with his Saudi Arabian counterpart Khaled El Faleh for talks during the forum, according to a ministry statement.

Also from the forum:

- Egypt and Jordan will launch a joint investment cooperation council, Investment Minister Sahar Nasr said;

- Trade and Industry Minister Amr Nassar met with representatives of major companies to discuss potential opportunities, the ministry said. Nassar’s meetings included talks with Japan’s Sumitomo Electric CEO Masayoshi Matsumoto and Procter & Gamble Near East Vice President Tamer Hamed to discuss their companies’ operations in Egypt.

Correction: 9 April, 2019

An earlier version of this article mistakenly referred to Khaled El Faleh as the Jordanian oil minister.

Communications Minister Amr Talaat met with his Saudi counterpart Abdullah Al-Sawaha in Cairo yesterday to discuss areas of cooperation on the technology front, reports Arab News. The Saudi delegation also visited several Egyptian IT development organizations in an effort to gain insight on how to train and develop skills in IT and communications technology.

Energy

Eni to complete seventh Zohr gas processing station in July

Eni will complete the Zohr field’s seventh natural gas treatment plant in Port Said’s El Gameel region in July to raise output to 2.7 bcf/d from 2.3 bcf/d currently, an unnamed industry source tells the domestic press. The Italian company has also completed drilling the tenth well, the source says.

Basic Materials + Commodities

GASC purchases 114k tonnes of rice, cancels sugar tender

State grain purchaser GASC has acquired 114k tonnes of chinese rice at a price of USD 405 per tonne, reports Reuters Arabic service. An international tender for the purchase of at least 50k tonnes of sugar was also cancelled due to elevated prices. Meanwhile, the Supply Ministry is expecting local farmers to grow 3.6 mn tonnes of wheat this harvest season, which began this month, minister Ali Moselhy said, according to Al Mal. The ministry will start purchasing the wheat next week at an average price of EGP 670 per ardib.

Real Estate + Housing

Hyde Park gets greenlight for 6 October housing land plots

The General Authority for Urban Planning agreed last week to a request from Hyde Park Developments to purchase two land plots of a combined 100 feddans in 6 October City, CEO Amin Serag told Al Masry Al Youm. The plots will be used to build a housing project, Serag said.

Tourism

Hurghada receives first direct flights from Romania

Hurghada International Airport received its first direct flights from Romania yesterday on a new biweekly Hurghada-Bucharest route, reports Egypt Independent. The Sharm el-Sheikh airport is due to receive the first direct flights from Bucharest airport on Monday, with an average of four flights per month and up to eight flights per month starting in May.

Tourism minister discusses investment with the International Finance Corporation

Tourism Minister Rania Al Mashat met with head of the International Finance Corporation Stephanie von Friedeburg to explore investment opportunities in the Egyptian tourism industry, particularly in the north coast and Alamein regions, according to Al Shorouk. Separately, several financial institutions have indicated interest in being involved in the Egyptian hotels development fund that aims to revitalize struggling hotels and restructure the sector’s debts, per Al Shorouk.

Telecoms + ICT

CI Capital launches online trading platform Mahfazty

CI Capital announced yesterday it has launched Mahfazty, an online trading and brokerage services platform, according to a statement (pdf). The platform’s services include “smart orders, margin trading, same-day trading, and technical analysis, as well as ease of cash transfer requests and subscriptions to IPOs” and access to real-time stock price movements, according to the statement.

Automotive + Transportation

Egypt to add 250 new locomotives to its railway sector

Egypt aims to add 250 new locomotives to its railway system as part of wider efforts to improve the sector, Transport Minister Kamel El Wazir said. Talks with the European Bank for Reconstruction and Development (EBRD), General Electric and Progress Rail Locomotive are currently underway to finalize contracts, El Wazir said.

Other Business News of Note

MIDOR looks to expand paid-in capital by USD 800 mn

The Middle East Oil Refinery (MIDOR) aims to increase its paid-in capital by USD 800 mn to finance expansion plans, a company official said. The company aims to draw USD 200 mn from shareholders within two months and raise the rest gradually to expand its refinery plant, which is expected to attract USD 2.3 bn in investments. The Egyptian General Petroleum Corporation (EGPC) owns 78% of MIDOR.

Egypt Politics + Economics

Egypt court in Aswan clears seven Nubians of 2017 protest charges

A court in Aswan has acquitted seven Nubians of charges dating back to protests in 2017, reports Al Masry Al Youm. Conditional fines of up to EGP 50k were handed to 25 others “which would only be enforced if the defendants commit future crimes.” They were all arrested in September 2017 while marching to demand a return to their ancestral land on the banks of Lake Nasser, from which they were evicted in the 1960s after construction of the Aswan High Dam. Arab News also has the story.

Death sentences issued to seven people accused of hotel attack

An Egyptian court has issued preliminary death sentences to seven people accused of being involved in a Giza hotel attack in 2016, reports Sky News. They also face charges of illegal possession of weapons in addition to attacking police forces and vandalizing public property. Their case files will be transferred to Al Azhar Grand Imam Ahmed Al Tayeb to approve the sentences, with a final verdict date set for 22 June.

National Security

Prosecutor general orders investigation into Nozha shooting

Prosecutor General Nabil Sadek ordered yesterday a probe into a shooting in Nozha that left one police officer dead and others injured, state-owned MENA reports. According to preliminary investigations, the police officer was inspecting a suspicious-looking vehicle with four men inside, one of whom opened fire on the policemen. The driver of the police vehicle was also killed in the attack.

The Market Yesterday

EGP / USD CBE market average: Buy 17.27 | Sell 17.37

EGP / USD at CIB: Buy 17.26 | Sell 17.36

EGP / USD at NBE: Buy 17.26 | Sell 17.36

EGX30 (Sunday): 15,135 (-0.7%)

Turnover: EGP 347 mn (62% below the 90-day average)

EGX 30 year-to-date: +16.1%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 0.7%. CIB, the index heaviest constituent ended down 1.2%. The EGX30’s top performing constituents were Egyptian Iron & Steel up 2.8%, Egyptian Resorts up 2.5%, and Emaar Misr up 2.3%. Yesterday’s worst performing stocks were Orascom Investment Holding down 4.9%, Qalaa Holdings down 2.3% and Ezz Steel down 1.9%. The market turnover was EGP 347 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -14.7 mn

Regional: Net Long | EGP +8.6 mn

Domestic: Net Long | EGP +6.1 mn

Retail: 77.9% of total trades | 80.7% of buyers | 75.2% of sellers

Institutions: 22.1% of total trades | 19.3% of buyers | 24.8% of sellers

WTI: USD 63.46 (+0.60%)

Brent: USD 70.72 (+0.54%)

Natural Gas (Nymex, futures prices) USD 2.67 MMBtu, (+0.30%, May 2019)

Gold: USD 1,297.30 / troy ounce (+0.52%)

TASI: 9,011.11 (-0.58%) (YTD: +15.13%)

ADX: 5,052.49 (+0.40%) (YTD: +2.80%)

DFM: 2,780.95 (+0.17%) (YTD: +9.93%)

KSE Premier Market: 6,222.39 (+1.38%)

QE: 10,192.19 (+0.03%) (YTD: -1.04%)

MSM: 3,970.49 (+0.79%) (YTD: -8.17%)

BB: 1,440.32 (+1.48%) (YTD: +7.71%)

Calendar

April: Russian companies will receive the first 1 square-km plot in the 5.2 square-km Russian Industrial Zone within the Suez Canal Economic Zone

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

7-8 April (Sunday-Monday): Sanad Conference for Alternative Care, Cairo Marriott Hotel – Zamalek.

9 April (Tuesday): President Abdel Fattah El Sisi travels to Washington, DC.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

10 April (Wednesday): The Seamless Awards 2019, The Armani Hotel, Dubai.

10 April (Wednesday): Egyptian Retail Summit (ERS 2019), Nile Ritz Carlton, Garden City, Cairo, Egypt.

10 April (Wednesday): Live season finale premiere of the Womentum series, Startup Haus, Cairo

12-14 April (Friday-Sunday): IMF and World Bank spring meetings in Washington, DC.

14 April (Sunday): The House of Representatives votes on the proposed constitutional amendments.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen. The lawsuit, seeking EUR 150 mn in damages, was postponed from 17 March.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

25 April (Thursday): Sinai Liberation Day, national holiday.

25 April (Thursday): Belt and Road Forum for International Cooperation, Beijing, China.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

May: 50 Egyptian companies are set to visit Libya to discuss trade, investment and reconstruction.

May: An IMF delegation will be in town to conduct its final review of the reform program.ahead of the disbursement of the fifth and final tranche of Egypt’s USD 12 bn IMF loan.

1 May (Wednesday): Labor Day, national holiday.

4 May (Saturday) An administrative court will look into an appeal by Emirati business figure Mohamed Alabbar’s Adeptio AD Investments against a Financial Regulatory Authority order to submit a mandatory tender offer (MTO) for Americana.

6 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

4-5 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

5-6 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International

Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.