- The government is set to embark on an Asia, Gulf bond roadshow next week. (Speed Round)

- Shrinking the informal economy is going to require more investment in digitization and financial inclusion. (Speed Round)

- Acwa Power planning to invest USD 3 bn in Egyptian electricity projects this year. (Speed Round)

- A new cabinet-level committee is going to help investors sort out their problems. (Last Night’s Talk Shows)

- The cabinet has signed-off on German development loans. (Speed Round)

- Egyptian exports from Qualifying Industrial Zones rose 17% last year. (Speed Round)

- Exxon could be stepping up its involvement in the East Med gas race. (Speed Round)

- The sun could save us all from climate catastrophe. (On Your Way Out)

- The Market Yesterday

Thursday, 14 March 2019

All aboard for the Asia, Gulf bond roadshow

TL;DR

What We’re Tracking Today

The news cycle is so slow this morning, it’s as if time stood still, with the nothing much of note happening here at home and the global press still focused on the worldwide grounding of Boeing’s 737 Max 8, Brexit, and a college cheating scandal that has embroiled US business figures and Hollywood actors.

Some more doom and gloom with which to start the weekend: One in three asset managers could disappear in the next five years, says Invesco chief Martin Flanagan. A record 253 M&A transactions in the field last year was triggered by the continued erosion of fees amid the rise of passive funds at the same time as the bottom half of the income statement is being pressured by the need to invest in compliance, tech and cyber security. This comes as “many institutional investors, sovereign wealth funds or private banks are trimming how many companies they work with, which means that asset managers need to bulk up,” the Financial Times writes.

Case in point: Canada’s Brookfield Asset Management said yesterday it has taken a majority stake in Oaktree Capital in a USD 4.7 bn transaction that will “create one of the world’s largest alternative asset managers.”

Wait, we’re not done: The number of people working in fund management (globally) is going to decline this yearfor the first time in more than a decade thanks to these rising costs and lower fees.

And on a random note of doom and gloom: With one in 10 jobs possibly being destroyed over the next decade, a 30-country study by the IMF finds that women will be hit harder than men because of how many toil in clerical and other jobs that are especially vulnerable to automation.

Doom and gloom aside, have we mentioned we’re particularly delighted we have just hours left until the weekend?

The weighting of tech in investors’ portfolios have fallen to its lowest level since May 2016,equity and quantitative strategist at Bank of America Merrill Lynch Savita Subramanian said, according to the Financial Times. Apple and a handful of other tech companies have been a magnet for investors for years, but the US-China trade war and last year’s signs of a slowing sector resulted in a bearish sentiment.

Tech hasn’t fallen out of favor everywhere, though: The drive to amp up tech expertise has pushed mergers and acquisitions in the global enterprise-software sector to a five-year high, according to a recently-published report by acquisitions advisory firm Hampleton Partners. With the value M&A rising to USD 182.2 bn in 2018 on 1,241 transactions (against 1,050 the year before), there are indications that players in both tech and traditional industries are looking to buy new knowledge and capabilities rather than build it from within, the Wall Street Journal reports.

Boeing has grounded all 371 of its 737 Max 8 aircraft following Sunday’s crash in Ethiopia, the BBC reports. The decision came as investigators found evidence of similarities between the Ethiopia crash and an accident involving a 737 Max in Indonesia last October. Egypt’s Civil Aviation Ministry had earlier banned the aircraft from Egyptian airspace. The US and Canada had followed suit immediately before Boeing’s announcement.

Facebook’s core app as well as Facebook-owned WhatsApp and Instagram were down last night as users had trouble logging into and posting on the platforms, CNBC reports. Users around the world faced issues, the broadcaster says. Mashable has more.

Speaking of Facebook: The creepy company has become the subject of a criminal investigation by prosecutors in the US looking into agreements the company struck with other tech companies to access customer data, according to the NYT. The probe couldn’t have come at a worse time for the embattled tech giant, with presidential hopeful Senator Elizabeth Warren this week calling for Big Tech to be broken up.

The Red Hot Chili Peppers have arrived in Egypt ahead of their performance at the Giza Pyramids tomorrow. Tickets for the show sold quickly, but the performance will be live streamed via the band’s official YouTube page and on Facebook and Twitter, the Chili Peppers announced.

PSA- Yesterday’s sand storm, which forced four ports to close yesterday, has subsided, but we’re still looking at a breezy day today with winds at 30-50 km/h gusting to more than 65 km/h. Winds will taper off over the weekend, according to our favourite weather app. Look for daytime highs of 22-24°C in the capital city today through Sunday with overnight lows of 12°C.

Enterprise+: Last Night’s Talk Shows

A new cabinet-level committee will be charged with working with investors to resolve their problems, Al Hayah Al Youm’s Khaled Abu Bakr said last night (watch, runtime: 01:45). The committee, constituted by Prime Minister Moustafa Madbouly at cabinet’s weekly meeting yesterday, aims to improve the country’s investment environment, cabinet spokesperson Nader Saad said (watch, runtime: 06:42).

Cabinet also dedicated time during its meeting to discuss pre-Ramadan preparations, Yahduth Fi Masr's Sherif Amer said (watch, runtime: 01:07). We have more on yesterday’s cabinet meeting in Speed Round, below.

A EUR 53 mn facility from the International Fund for Agricultural Development (IFAD) also earned some airtime last night.

Diplomacy-heavy day for El Sisi: President Abdel Fattah El Sisi told Slovenian Vice Prime Minister and Minister of Foreign Affairs Miro Cerar in a meeting yesterday that Egypt is keen to boost ties with the central European country (watch, runtime: 02:26). El Sisi also met with South Sudanese National Pre-Transitional Committee, Al Hayah Al Youm’s Lobna Assal said. El Sisi reaffirmed Egypt’s support for maintaining stability in South Sudan.

The president’s agenda yesterday also included a meeting with Tanzanian Defense and National Service Minister Hussein Mwinyi (watch, runtime: 01:29), Masaa DMC’s Osama Kamal reported.

Speed Round

Speed Round is presented in association with

EXCLUSIVE- Gov’t to kick off Asia, Gulf roadshow to drum up investment, support coming debt issuances: The Madbouly government is heading to Asia and the Gulf next week for a roadshow to drum up interest in Egypt’s upcoming debt issuances and to promote Egypt as an investment destination, a senior government official tells Enterprise. The roadshow will include meetings with a number of investors to discuss Egypt’s plans for its maiden issuance of a sovereign sukuk (a form of Islamic bonds). Our sources had previously told us that the issuance could be worth USD 1-1.5 bn and could go to market in FY2019-20.

Background: The potential sukuk issue is part of the Finance Ministry’s plan to deploy new debt instruments as it tweaks the mix and tenor the funding at its disposal. Other tools under consideration include green bonds and returning to zero-coupon bonds. The ministry is planning to sell up to USD 7 bn in foreign-currency bonds in 1Q2019, and more USD- and EUR-denominated bonds by the end of 2Q2019, Minister Mohamed Maait had said in January.

INVESTMENT WATCH- Acwa Power to invest USD 3 bn in Egypt this year: Saudi energy developer Acwa Power is planning to invest USD 3 bn in electricity projects in Egypt this year, Country Development Director Hassan Aly tells Al Mal. The investments will be directed toward energy projects in Luxor and the Benban solar power complex in Aswan, among others. Acwa Power is currently building with Hassan Allam Holding a 2.3 GW, USD 2.3 bn Luxor power plant.

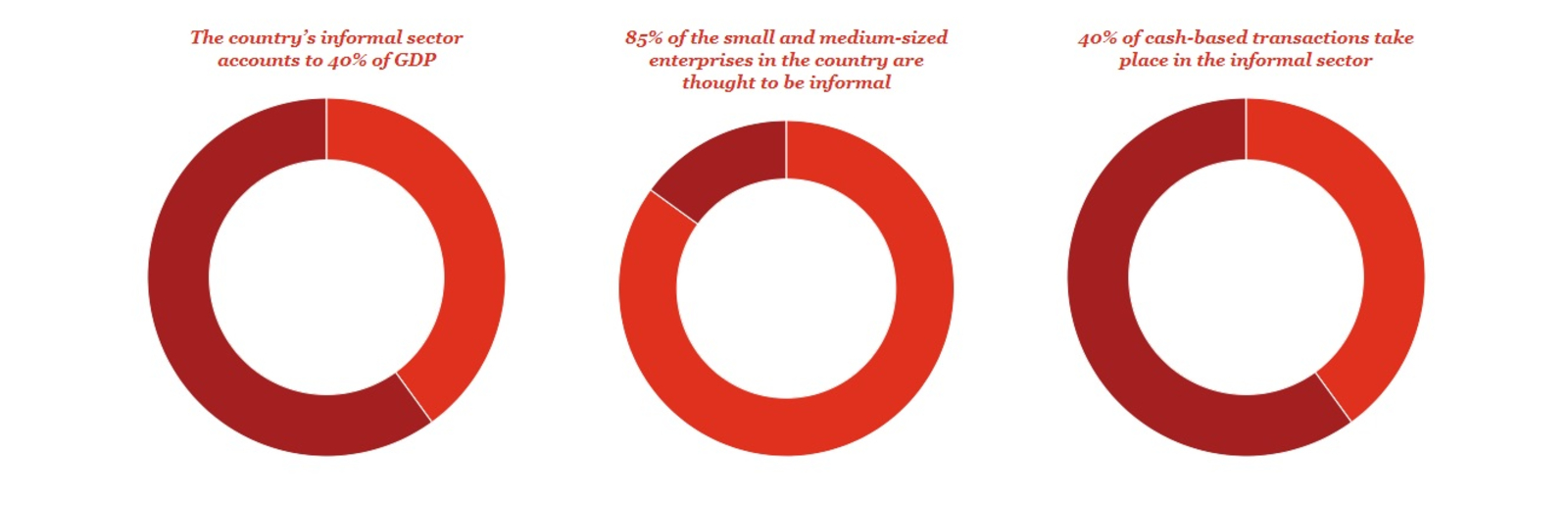

Egypt’s drive to make the informal economy go legit hinges on its investment in digitalization and financial inclusion, our friend Maged EzzEldeen, country senior partner at PricewaterhouseCoopers, argues in a report on the shadow economy. The government, Ezzeldeen says, is cognizant of the importance of incorporating the informal economy and the issues that come with an informal economy as large as Egypt’s: “Its very size distorts GDP and therefore policy making for the whole economy. Unregulated goods and services rarely comply with health and safety codes and legal redress for faulty goods or poor service is impossible to obtain.” There are also key policies being put in place that reflect state-led efforts to go digital as part of the push to incorporate the informal economy, including the availability of electronic tax return filing and the draft SME taxation framework.

That said, the prevalence of cash payments and cultural issues such as the institutionalization of corruption threaten to undermine the government’s digitalization drive, Ezzeldeen argues. As it currently stands, there are no legal limits on the size of cash transactions (except for the EGP 500 limit the Finance Ministry plans to apply on the cash payment of government fees as of May). The lack of an upper limit on cash transactions feeds into the growth of tax evasion and other illicit activities. This “limits the development of financial services and reinforces the financial exclusion of the most vulnerable sectors of the population.”

CABINET WATCH- Cabinet approves development loans, grant worth combined EUR 278.9 mn: The Madbouly Cabinet approved yesterday a second, EUR 225 mn (c. USD 250 mn) tranche of a USD 450 mn facility from Germany’s KfW development bank to close the state budget’s financing gap, according to a cabinet statement. The agreement on the tranche was signed last month. Cabinet also approved a recently-signed EUR 53 mn facility and a EUR 860k grant from the International Fund for Agricultural Development to finance the Promoting Resilience in Desert Environments (PRIDE) project. The project aims to improve the productivity of desert land reclaimed in rural areas around Marsa Matrouh.

Cabinet also approved yesterday:

- A cooperation protocol between the Antiquities Ministry and the Armed Forces Engineering Authority to move ahead with EGP 320 mn-worth of renovation works in Luxor’s Sphinx Avenue;

- A request by the Irrigation Ministry to build an inland port on the Nile near the Egyptian Revolutionary Command Council in Zamalek.

In a potential boost to Egypt’s regional gas ambitions, Exxon considers Israeli oil and gas exploration: US oil giant ExxonMobil is considering oil and gas exploration in Israeli waters, giving a further boost to regional plans for an East Med natural gas market, a source told Reuters. Company execs reportedly held discussions with Israeli Energy Minister Yuval Steinitz this week regarding a bid for offshore blocks up for auction in June, the source said.

Exxon is growing into the region: Entry into Israeli gas exploration would be the latest in a string of recent agreements signed between Exxon and East Med countries. Egypt last month announced that Exxon would for the first time undertake exploration activities in Egyptian waters. And at the end of 2018 it began drilling for gas in Cypriot waters, recently claiming to have found giant gas field south of the island. Growing interest from another major player comes at a good time for the region as Eni — the biggest source of international investment for Egypt’s Mediterranean concessions — increasingly focuses its efforts in the Gulf in a bid to lessen its dependency on African hydrocarbons.

Egypt’s exports from Qualifying Industrial Zones (QIZ) rose 17% to USD 878 mn in 2018, up from USD 751 mn in 2017, a source from the Trade Ministry’s QIZ unit said. Some 93% of QIZ exports were textiles and readymade garments. Egypt has exported USD 9.7 bn-worth of products enjoying no-tariff access to the US, provided they meet a minimum required amount of Israeli content, since we signed the agreement in 2004.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- A head of product — a technical person who speaks editorial or an editorial /person who speaks tech;

- Software developers who want to help us make something amazing.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Egypt in the News

EU-Arab relations is topping coverage of Egypt in the foreign press this morning, with Bloomberg urging a revision of bilateral trade agreements to ensure that EU countries offer more concrete support to their Arab partners in terms of job creation, technology transfer and resource diversification. The Guardian, meanwhile, asks why the EU and the UK failed to provide “moral leadership” on human rights issues during last month’s EU-Arab League summit. A more pertinent question to ask perhaps — after looking through the history books — is whether European countries have the right to give lectures on morality. But we digress.

Other stories worth noting in brief:

- Higher ed plans: Doubts remain as to whether the government will be able to achieve its goal of opening eight branches of international universities in the new capital by 2020, the Times Higher Education reports.

- Two Egyptians and seven Emiratis have been freed in Iran, the UAE has announced, reports the AP. They had been detained since January.

- Egypt “is sliding towards authoritarianism,” laments Australian-based publication The Conversation, noting that the proposed constitutional amendments would effectively end the separation of powers.

On The Front Pages

Talks between President Abdel Fattah El Sisi with the South Sudanese National Pre-Transitional Committee, Slovenian Vice Prime Minister and Minister of Foreign Affairs Miro Cerar and Tanzania’s Defense and National Service Minister Hussein Mwinyi topped the front pages of all three state-owned newspapers this morning (Al Ahram | Al Gomhuria | Al Akhbar).

Energy

Egypt’s El Molla holds talks with US counterpart, four US energy companies

Oil Minister Tarek El Molla discussed US investments in Egypt’s energy sector and the regional energy hub strategy with US Secretary of Energy Rick Perry on the sidelines of the gathering of senior energy officials at CERAWeek in Houston, according to a ministry statement. El Molla also held talks with the leaders of ExxonMobil, Chevron, Schlumberger, and BP.

Greek energy investors eye Egypt’s renewables sector

A delegation of Greece-based energy investors have expressed interest in establishing wind and solar energy projects in the Red Sea and Minya areas, the domestic press reports. This came during a meeting with Electricity Minister Mohamed Shaker and Arab Women Investors Union head Hoda Yassa.

Canada’s Giant Oil Tools to provide services for Egyptian oil and gas concessions

Canada’s Giant Oil Tools has won 10 contracts in a tender to provide petroleum services and well-drilling equipment for Egyptian oil and gas concessions, company sources said, according to Amwal Al Ghad. The company entered the Egyptian market in 2017 after it began working with Agiba Petroleum.

Basic Materials + Commodities

Egypt to boost rice cultivation to 1.1 mn feddans

The Agriculture Ministry is planning to increase rice cultivation this year to 1.1 mn feddans, up from 800k feddans last year, in a bid to reduce Egypt’s reliance on imports, Minister Ezz El Din Abou Steit said, according to Al Watan. Egypt used to produce some 4.3 mn tonnes of rice a year, but the government recently adopted a strategy to save water by limiting water-intensive crop cultivation. However the minister said the use of new, drought-tolerant seeds will mean that the same amount of water will be used despite the increase in cultivation. The minister’s comments came on the same day that the General Authority for Supply Commodities announced a new tender for 20k tonnes of short or medium grain white rice.The deadline for submitting bids is 30 March and the shipments should arrive in June.

Egypt’s cotton exports rise 75% y-o-y this season to 1.4 mn qintars

Egypt’s cotton exports have so far seen a 75% y-o-y increase to 1.4 mn qintars this season, compared to 800k qintars in the same period last year, Cotton Exporters Association chief Nabil El Santrissi said. The increase came in response to higher global demands from the largest importers, including India, El Santrissi added. The cotton export season began last December and is set to wrap up in August.

Other Business News of Note

Egypt receives offers to develop pyramids sound and light show area

The Sound and Light Cinema Company (SLCC) has received offers from Chinese, Indian, German, and Italian companies to develop the exhibition area near the pyramids, Chairman Sameh Saad told Youm7. The company is now drawing up the tender conditions so it can begin receiving official offers. A JV between Orascom Investment Holding and Prism International had been contracted to develop and run the show, but the latter allegedly failed to uphold contractual obligations, leading SLCC to annul the contract.

Misr Trade and Investment begins assembly of Whirlpool washing machines

Misr Trade and Investment has started assembling Whirlpool washing machines locally after a EGP 150 mn investment in a new factory, according to statements from chief executive Ashraf Omran reported by the local press. Target sales for the year between March 2019 to March 2020 are EGP 450 mn, with an expected output of 25k washing machines.

AOI signs cooperation protocol with Sudan defense industry group

The Arab Organization for Industrialization (AOI) has signed a cooperation protocol with Sudan’s Defence Industry Group (DIG) to boost ties in railway development, energy, electronics, among other fields, Al Mal reported. The agreement came in light of talks between AOI Chairman Abdel Monem El Taras and a Sudanese delegation visiting Cairo headed by DIG Executive Director Major General Dafa Allah Khamis Ali.

Egypt Politics + Economics

Court jails 27 policemen for labor strike

Egypt’s highest appellate court upheld three-year prison sentences against 27 policemen for staging a strike in 2017 against a decision to reduce their vacations, according to the official MENA news agency. Another 13 officers were acquitted in the same case,

National Security

Egypt arms imports grow 206% in five years

Egypt has retained its position as the world’s third largest arms importer, with its imports having tripled between 2009–13 and 2014–18 (an increase of 206%), according to data recently released by the Stockholm International Peace Research Institute (SIPRI). Major suppliers include the US and the UK, with Russia, France and Germany having also “dramatically increased” their arms sales to Egypt over the last five years. Arms inflows into the wider MENA region have also surged, increasing by 87% between 2009–13 and 2014–18. The region accounted for 35% of the global volume of imports of major weapons in 2014–18.

US Navy commander discusses Egypt-US security ties with navy leaders

US Navy commander Vice Admiral Jim Malloy discussed Egypt-US “strategic security” ties with senior navy leaders during a visit to Alexandria, according to a US embassy statement.

On Your Way Out

The sun could be the answer to all of our climate problems: Solar geo-engineering is the process of injecting sulfate aerosols into the high atmosphere to dim the sun’s rays — essentially replicating a huge volcanic eruption in our skies. The technology could mitigate some of the worst effects of climate change, according to a research paper co-authored by a team of climate scientists. The research indicates that the technique could potentially cut the dangers of climate change in half, the Atlantic reports. While critics say that an excessively rosy outlook could discourage society from making much-needed emissions cuts, the paper’s authors argue that the technology deserves further research to assess its potential.

The Market Yesterday

EGP / USD CBE market average: Buy 17.37 | Sell 17.47

EGP / USD at CIB: Buy 17.37 | Sell 17.47

EGP / USD at NBE: Buy 17.37 | Sell 17.47

EGX30 (Wednesday): 15,126 (-0.1%)

Turnover: EGP 1.1 bn (17% above the 90-day average)

EGX 30 year-to-date: +16.0%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.1%. CIB, the index heaviest constituent ended down 0.4%. EGX30’s top performing constituents were Heliopolis Housing 8.5%, SODIC up 3.2%, and GB Auto up 2.5%. Yesterday’s worst performing stocks were Arab Cotton Ginning down 3.4%, Ezz Steel down 2.2% and Qalaa Holdings down 1.7%. The market turnover was EGP 1.1 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -54.9 mn

Regional: Net Short | EGP -1.5 mn

Domestic: Net Long | EGP +56.4 mn

Retail: 62.6% of total trades | 61.8% of buyers | 63.4% of sellers

Institutions: 37.4% of total trades | 38.2% of buyers | 36.6% of sellers

WTI: USD 58.34 (+2.58%)

Brent: USD 67.69 (+1.53%)

Natural Gas (Nymex, futures prices) USD 2.83 MMBtu, (+1.80%, Apr 2019)

Gold: USD 1,309.50 / troy ounce (+0.88%)

TASI: 8,526.68 (+0.95%) (YTD: +8.94%)

ADX: 4,819.83 (-0.86%) (YTD: -1.94%)

DFM: 2,599.82 (+0.05%) (YTD: +2.77%)

KSE Premier Market: 5,599.94 (-0.03%)

QE: 9,761.69 (-0.04%) (YTD: -5.22%)

MSM: 4,074.27 (-0.21%) (YTD: -5.77%)

BB: 1,411.21 (+0.44%) (YTD: +5.53%)

Calendar

14-16 March (Thursday-Saturday): Metal & Steel, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): WINDOOREX, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): Egypt Projects, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 March (Thursday-Saturday): FabEx Middle East, Egypt International Exhibition Center, Nasr City, Cairo.

March (date TBD): Traders Fair, Nile Ritz Carlton, Garden City, Cairo, Egypt.

15 March (Friday): Arab World Social Innovation Forum, American University in Cairo, Cairo, Egypt.

16-18 March (Saturday-Monday): Automation Technology Expo, Cairo International Convention Center, Nasr City, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg).

18 March (Monday): Amcham Annual Real Estate Conference, Nile Ritz Carlton, Garden City, Cairo, Egypy

18-19 March (Monday-Tuesday): Coaltrans, Four Seasons Nile Plaza, Garden City, Cairo, Egypt.

19-20 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19 March (Tuesday): Portfolio Egypt Conference for non-banking financial services, venue TBD, Cairo, Egypt.

20-22 March (Wednesday-Friday): Egypt International Green Building Conference, Egypt International Exhibition Center, Nasr City, Cairo.

20-22 March (Wednesday-Friday): Watrex, Egypt International Exhibition Center, Nasr City, Cairo.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 March (Thursday-Saturday): International Conference on Advanced Machine Learning Technologies and Applications, Venue TBD, Cairo, Egypt.

30-31 March (Saturday-Sunday): International Conference on Architecture Engineering and Technologies, Grand Nile Tower Hotel, Cairo, Egypt.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe said.

April: A World Bank delegation will be in town to review current investment legislation, economic policies and administrative reforms as part of the preparations for next year’s Ease of Doing Business Report. Egypt jumped eight spots to rank 120th out of 190 countries in the 2019 Doing Business report.

April: Russian companies will receive the first 1 square-km plot in the 5.2 square-km Russian Industrial Zone within the Suez Canal Economic Zone

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

1-3 April (Monday-Wednesday): Infra Africa & Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

2-5 April: APPO Cape VII petroleum and energy conference, Malabo, Equatorial Guinea.

4 April: Egypt’s Emirates NBD PMI for March released.

4-6 April: LafargeHolcim Forum for sustainable Construction, American University in Cairo.

10 April: Egyptian Retail Summit (ERS 2019), Nile Ritz Carlton, Garden City, Cairo, Egypt.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

June: International Forum for small and medium enterprises (SMEs).

04-05 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.