- Budget deficit shrank to 3.6% of GDP in 1H2018-19. (Speed Round)

- Tax Authority to mark “cost of investment” in treasuries as deductible in new tax treatment. (Speed Round)

- Campaign against high car prices takes fire on the airwaves. (Last Night’s Talk Shows)

- The House is looking to force the private sector to raise wages. (Speed Round)

- Housing Committee planning sweeping regulatory changes for real estate industry. (Speed Round)

- Court delays hearing on lawsuit designed to scrap term limits for the presidency. (Speed Round)

- EM shares have had their best three weeks in a long, long time — but China just reported its worst growth figure in nearly 30 years. (What We’re Tracking Today)

- It’s a super blood wolf moon kinda morning. (What We’re Tracking Today)

- The Market Yesterday

Monday, 21 January 2019

Banks may get room to breathe on new tax treatment of income from treasuries

TL;DR

What We’re Tracking Today

It’s a pleasantly quiet news morning today with no single story dominating the headlines.

The only lunar eclipse this year is this morning and the so-called “super blood wolf moon” will not be as spectacular in Egypt as in some other countries this time around. A partial eclipse began at 5:33am CLT and the total eclipse is due to start at 6:41am, reaching its maximum in Cairo at 6:51am. Look west, north west, and down toward the horizon. The actual maximum eclipse will take place at 7:12am, but the moon will be below the horizon in the capital city by then.

Miss this one? The next total lunar eclipse won’t take place until 26 May 2021 — but there’s a total solar eclipse coming up on 2 July of this year.

The World Economic Forum gets underway in Davos, Switzerland, tomorrow. The annual meeting of the global chattering class runs 22-25 January to discuss “Globalization 4.0: Shaping global architecture in the age of the fourth industrial revolution.” You can drill down into the agenda here, watch about 100 live sessions here and follow the WEF’s blog (resplendent with thought leadership pieces) here.

The only catch: Plenty of world leaders are giving Davos a pass this year, the global business press reports. The Donald pulled out and Theresa May apparently has other priorities. Emmanuel Macron is staying home, and both China’s Xi Jinping and India’s Narendra Modi are giving it a pass. But Germany’s Angela Merkel is going to be in town to discuss AI, Africa and the future of Europe. You can read t-up pieces this morning in the Financial Times, Reuters and CNBC or check out the Wall Street Journal’s Davos section.

Our friend Ahmed Heikal penned a blog post for the Forum on the upcoming launch of the USD 4.3 bn Egyptian Refining Company. It is today’s Worth Reading, below.

As the trading week begins in the west, it’s worth remembering that emerging market shares have posted their longest rally in a year, Bloomberg and the Financial Times tell us — surely invoking the Evil Eye. “EM funds attracted USD 3.3 bn for the week ending Thursday, according to EPFR Global data, extending the run of inflows for the asset class to 14 weeks,” the salmon-colored paper reports. That brings total inflows over the past three months to USD 27.5 bn.

That comes as US equities have staged a “remarkable turnaround” in the early days of 2019, the New York Times writes, erasing nearly all of last year’s losses and posting their best start to a year since 1987. Still, the Gray Lady warns, anything could happen: China’s economy is slowing. The US is still debating whether it’s heading for recession. Washington and Beijing are still locked in a trade war. Britain is still leaving the EU. You get the picture…

One of those warning signs flashed brightly this morning as China posted its lowest growth figure since 1990 just a few hours ago, CNBC reports. Beijing announced that economic growth came at 6.6% in 2018, on par with expectations in a Reuters poll and down 0.2 percentage points from 2017. The Wall Street Journal also has the story, noting that the slowdown may be gathering steam as the “downturn deepened in the final months of 2017.”

Is the US government shutdown helping the Fed temper its rate hikes? President of the New York Federal Reserve Bank John Williams urged an approach of “prudence, patience, and good judgment” when it comes to raising interest rates, citing predictions that quarterly growth could be cut by 0.5-1 percentage point as a result of the shutdown, the FT reports. The Fed had guided for two quarter-point increases in short-term rates in 2019, but some pundits now think the final rate hike of the current cycle has already taken place.

In miscellany this morning:

Gulf countries may slow down bond issuances in 2019, spooked by the prospect of higher borrowing costs if the US Fed raises interest rates and by prospect of a slowing global economy, among other factors, JPMorgan Chase suggests.

Aoun calls for Arab bank for reconstruction: Lebanese President Michel Aoun has called for the establishment of an Arab bank for reconstruction to spur economic development in the region, Reuters reports. A regional development bank will “help all affected Arab states overcome adversity and contribute to their sustainable economic growth,” he said at the Arab League’s poorly attended (at the leadership level) Arab Economic and Social Development summit, which ended yesterday.

PSA- Banks and the EGX are off on Thursday in observance of Revolution / Police Day and re-open on Sunday, according to a circular from the central bank picked up by the local press. Thursday is also a day off for the public sector. We’ll be sleeping in on Thursday and will return to your inboxes on Sunday before 7am.

Enterprise+: Last Night’s Talk Shows

“Let it Rust,” a social media campaign to boycott the purchase of new cars in protest against high prices, dominated the airwaves last night, albeit with variance in opinion. Car prices declined earlier this month after the country lifted customs on European cars, but activists calling for the boycott say prices are still too high.

Misinformation and the lack of a complete picture among campaigners is behind the stir, Alaa El Sabaa, member of the Federation of Egyptian Chamber of Commerce’s auto division, said on Hona Al Asema. El Sabaa pointed out that dealerships have to pay taxes and claimed customers are inflating their alleged profit margins. Auto industry analyst Mohamed Sheta disagreed with El Sabaa, however, saying the campaigners have every right to be upset about the prices. Sheta said the campaign’s main purpose is to raise awareness and not actually boycott car dealerships (watch, runtime: 30:20).

Dealerships actually only take home “modest” profits from each sale, since their profit margins are distributed among several other parties that are part of the process, vice president of the chamber’s auto division Noureldin Darwish told Al Hayah Al Youm’s Lobna Assal (watch, runtime: 02:37).

El Hekaya’s Amr Adib boisterously praised the “increase in awareness” the campaign is indicative of, and urged traders to set “fair" prices (watch, runtime: 04:36).

Talks between President Abdel Fattah El Sisi and French Finance Minister Bruno Le Maire, which we cover in detail in Speed Round, below, also got some play on the airwaves last night (watch, runtime: 05:46). Coverage of the topic will likely pick up steam as French President Emmanuel Macron’s visit to Cairo approaches.

The Trade and Industry Ministry has ordered the formation of a technical team to oversee the new Mercedes-Benz project, Al Hayat Al Youm’s Khaled Abu Bakr said (watch, runtime: 03:58).

Governorates will bear the cost of the campaign to paint red brick buildings, Assistant Local Development Minister Khaled Kassem told Al Hayah Al Youm (watch, runtime: 04:32).

A lack of ethics is behind the atrocity that is hugging on campus, House Rep. Amr Hamroush suggested on Masaa DMC. Hamroush suggested that imposing mandatory lessons on ethics at universities would help avoid to avoid incidents similar to one that stirred controversy earlier this month that involved two students hugging on campus (watch, runtime: 04:56).

And for your dose of strange (but very Egypt) news for the day: Apparently, an “armed gang” is running around Tagamoa, where they are robbing chocolate stores, El Hekaya’s Amr Adib said (watch, runtime: 02:04). Hide yo kids, hide yo chocolate.

Speed Round

Egypt’s budget deficit shrank to 3.6% of GDP in 1H2018-19, down from 4.2% the previous year. The state treasury recorded a primary budget surplus of 0.4% of GDP, up from a deficit of 0.3% during the same period last year, Finance Minister Mohamed Maait said during a meeting yesterday with President Abdel Fattah El Sisi and Prime Minister Moustafa Madbouly, according to an Ittihadiya statement. The three discussed measures to cut unemployment rates, the budget deficit, and public debt, in addition to the digitization of the state’s tax collection. Egypt is targeting a budget deficit of 8.4% for the full 2018-19 fiscal year.

EXCLUSIVE- Tax Authority to mark “cost of investment” in treasuries as deductible in new tax treatment: The Tax Authority could allow banks to count the “cost of investment” in state treasuries as an expense that would lower their pre-tax income, authority head Abdel Azim Hussein told Enterprise.

Why does this matter? A new tax treatment for income from investment in government debt (announced this past November, but still not enshrined in law) would force banks and companies to separately account for income derived from their holdings of government debt. Analysts initially said that the new accounting mechanism would result in a c.37% effective tax rate for a model bank.

So what’s the news here? Hussein is holding out the possibility that the hard costs associated with investment in treasuries could be effectively considered tax deductible, helping mitigate the impact of the new tax treatment. He added that the Finance Ministry is working with the Federation of Egyptian Banks to set an industry average for the cost of investing in government debt that will be applied industry-wide. The measure would be introduced in amendments to the executive regulations of the amended Income Tax Act, Hussein said.

Government T-bill yields go the way of bonds: Meanwhile, it appears that yields on government bills are following bonds downwards. Yields on 6-month and 1-year notes fell to 18.829% and 18.904%, respectively, marking their lowest since June and August, CBE data showed. The government sold about EGP 27 bn of 6-month and 1-year T-bills during a Thursday auction, far exceeding the EGP 18 bn initially targeted. Yields on Egyptian securities have been falling in recent auctions as the emerging markets selloff appeared to dissipate earlier in the year and banks rush to lock down profits from bills before the new tax treatment goes into effect.

The House is looking to force the private sector to raise wages: MP Sahar Etman is working on a draft law that would raise wages for employees in both the public and private sector, Al Mal reports. In a statement picked up by the newspaper, Etman says that there is no current legislation that could compel the private sector to raise wages as a result of inflation. Can someone please yell over her soap box that this is not 1956?

LEGISLATION WATCH- Housing Committee planning sweeping regulatory changes for real estate industry: The House of Representatives’ Housing Committeewill approve in one month’s time a law to establish a federation for real estate developers and set up a fund to hedge against sector-related risks, committee Secretary Mohamed Ismail told Al Shorouk. The committee is now reviewing the legislation, which would set up a state-sanctioned Egyptian Federation for Real Estate Developers. Al Mal has a draft of what it says is the current text of the proposed bill.

The 84-article bill will introduce new licensing requirements for developers and make the federation the primary licensing body. Developers found operating without a license will be subject to fines of up to EGP 1 mn. The insurance fund, meanwhile, will protect customers against a developer’s failure to deliver units within a contractually specified timeline, among other risks. The fund will be backed by federation membership fees, property and project registration fees, premiums collected from insurance certificates, grants and donations. The House committee is also reviewing a bill that would amend the Real Estate Registry Act, Ismail added.

Mercedes-Benz says new policies, clarity were behind its return to Egypt: New policies adopted by the Madbouly government provided clarity for car makers and encouraged Mercedes-Benz to return to the market with an assembly plant, Mercedes-Benz Egypt CEO Thomas Zorn said, according to a Trade and Industry Ministry statement. The statement said Zorn agreed with Minister Amr Nassar during a meeting on Sunday to form a committee of senior officials from the ministry to ensure that Mercedes assembly line is up and running as soon as possible. Nassar said his ministry is in talks with other major carmakers to bring them to Egypt with similar manufacturing facilities. Daimler said in a statement this weekend that it plans to build a new assembly plant for Mercedes-Benz in Egypt, but did not disclose the size of the investment or the time frame for the project.

Court delays hearing on lawsuit designed to scrap term limits for the presidency: The Cairo Court of Urgent Matters has postponed until 24 February a hearing into a third-party lawsuit that aims to extend presidential term limits, according to a MENA news agency report picked up by Xinhua. The constitution only allows presidents to be re-elected once, but a lawsuit spearheaded by a Cairo lawyer aims to force the House of Representatives to call a referendum to do away with term limits by amending Article 140 of the constitution. President Abdel Fattah El Sisi’s second four-year term expires in 2022.

French President Emmanuel Macron gave President Abdel Fattah El Sisi a call yesterday to lay the groundwork for Macron’s visit to Cairo at the end of this month, according to an Ittihadiya statement. The visit would be Macron’s first to Cairo as president. The call came as French Finance Minister Bruno Le Maire arrived in Cairo yesterday for talks with El Sisi and Prime Minister Moustafa Madbouly. Talks centered on opportunities in the health, renewable energy, transport and logistics sectors, according to a separate Ittihadiya statement.

MOVES- Our friend Nader Ghabbour has been named deputy CEO of GB Auto, according to a bourse filing (pdf). Ghabbour, who was previously GB Auto’s COO, will be replaced by Karim Gaddas.

CORRECTION- We mistakenly referred yesterday to Compass-owned Bonyan for Development and Trade’s new outdoor complex in Sheikh Zayed as The Walk of Life. The complex is named The Walk of Cairo. We regret the error. The entry has since been updated on our website.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

FinMin to select adviser on eurobond issuance on Thursday: The Finance Ministry will select this Thursday the investment banks that will advise on its upcoming USD 4-7 bn eurobond issuance, set to take place sometime in 1Q2019, local news reports.

Also coming up in the next few weeks:

- The Environment Ministry will set a tariff structure for waste-generated electricity in the coming weeks, Minister Yasmine Fouad said.

- The Social Solidarity Ministry should be presenting a draft of the new Social Welfare Act to the House of Representatives sometime soon, according to previous statements by Minister Ghada Wali.

- The Egypt-Sudan electricity grid connection will live in February, Electricity Minister Mohamed Shaker said.

- A government committee mandated with defining Egypt’s informal economy is set to meet for the first time this month.

Image of the Day

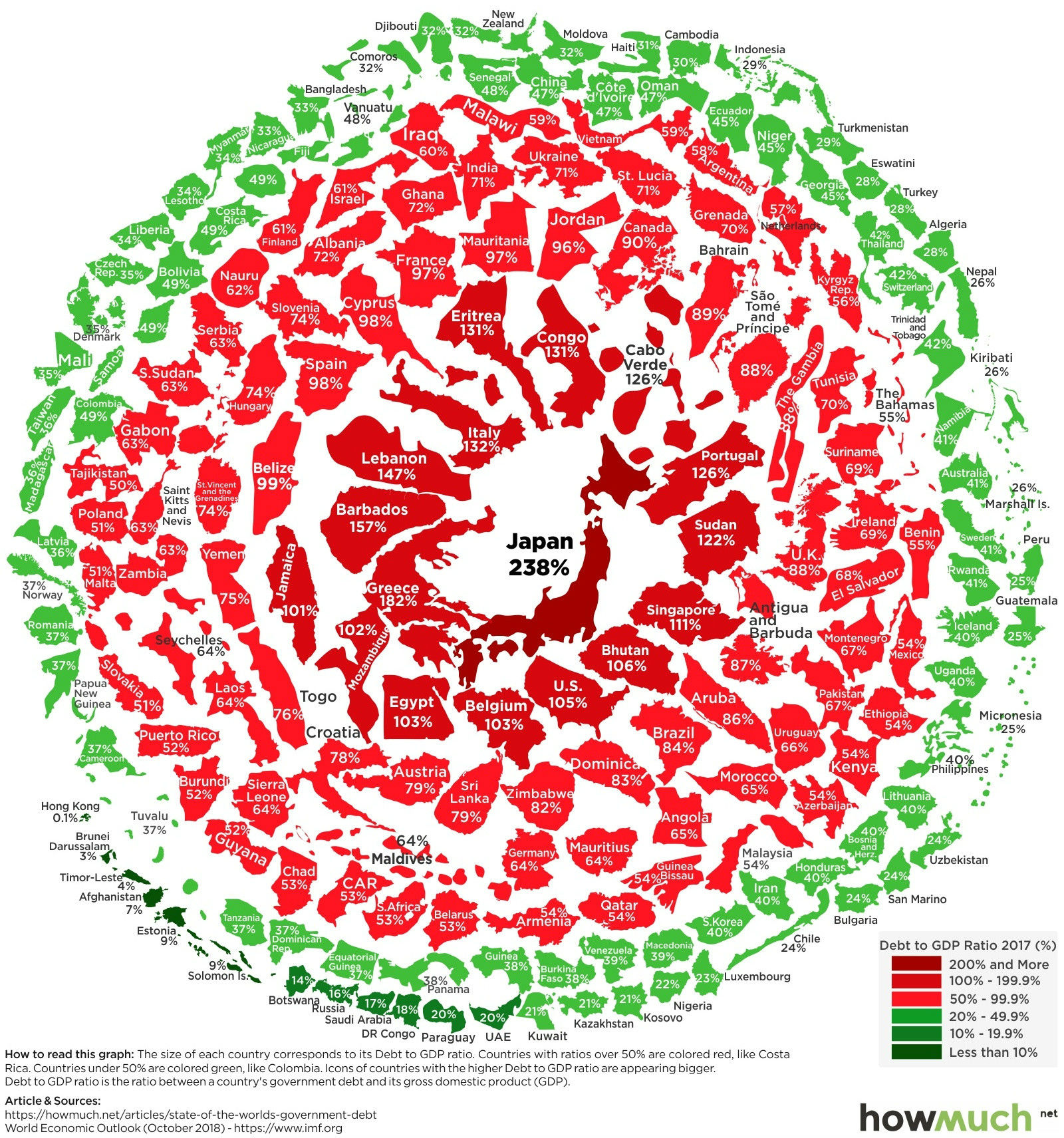

Egypt is in the hot zone of countries with the highest ratio of government debt to GDP, ranking us 15th out of 221 countries on a chart by HowMuch.net that is getting wide play after being picked up by the World Economic Forum. The chart uses data that puts Egypt’s government debt-to-GDP ratio at 103% as of October 2018, while senior government sources told us last December that the figure is closer to 98%.

Among the countries with the highest debt to GDP levels: Japan (238%), followed by Greece (182%), Barbados (157%) and Lebanon (147%). The US is also high on the list, with a ratio of 105%.

Egypt in the News

It’s a quiet morning for Egypt in the international press. The only story likely to have legs beyond today is a report by France’s AFP that a misdemeanor court in Six October has sentenced talk show host Mohamed El Gheity a year in jail and a fine of EGP 3k for hosting a homo[redacted] man on the airwaves in August 2018. The case was brought to court by Cairo’s wannabe Harvey Dent, otherwise known as lawyer Samir Sabry, who single-handedly leads a war against his definition of public indecency. El Gheity, accused of promoting homo[redacted] and contempt of religion, can appeal the verdict.

It’s an otherwise insipid morning with stories making the rounds including:

- Blather about startups: Cairo-based transportation app Swvl tops Arab News’ list of promoting startups in MENA.

- Blather about football: The African Cup of Nations is chance for Egypt to shine, the Arab Weekly says.

- Blather about corruption: The prosecutor general has ordered the confiscation of Cyprus-based funds belonging to Alaa and Gamal Mubarak, Asharq Al Awsat reported.

On The Front Pages

Two separate econ-focused meetings held by President Abdel Fattah El Sisi yesterday, one with French Finance Minister Bruno Le Maire and the other with Prime Minister Mostafa Madbouly and Finance Minister Mohamed Maait, dominated the front pages of the country’s three main state-owned dailies (Al Ahram | Al Akhbar | Al Gomhuria) this morning. El Sisi highlighted the noticeable improvement in the budget deficit figure and urged the government to continue pushing forward with the economic reform program, Al Ahram reports. The president also said on the sidelines of his meeting with Le Maire that Egypt could be a hub for French exports, Al Akhbar reports. He also called for an end to tax disputes, Al Gomhuria reports.

Worth Reading

How Qalaa’s ERC is the right way to do PPP: The Egyptian Refining Company (ERC)— a major public private partnership (PPP) megaproject led by Qalaa Holdings — is scheduled to come online later this year. The USD 4.3 bn facility, which is capable of producing 4.7 mn tonnes of refined oil products and derivatives per year, is also Africa’s largest public-private infrastructure project. When Qalaa Holdings closed financing on the plant in 2012, it set a record for equity raised in MENA. The project presents a prime example of how PPP projects can work and be effective. Our friend Ahmed Heikal, chairman and founder of Qalaa, explains why in a piece for the World Economic Forum’s blog ahead of the forum’s annual meeting tomorrow in Davos.

From the ground up with the right financing and tech: One of the fundamental aspects of ERC successfully getting off the ground was the broad network of financers. Qalaa called on a spectrum of private and public stakeholders and crafted an innovative PPP agreement: “a blended financing solution that includes direct foreign investment, export credit agencies and sovereign wealth funds, in addition to government and private-sector support.” This innovation extends to the technology involved in the project and the creative solutions that engineers, workers, and managers have responded with. Getting a Korean 1,280 tonne hydrocracker unit (HCU), the largest piece of equipment ever to enter an Egyptian port, installed was just one such solution.

Sustainability was also a key concern of ERC’s designers: With a PPP, writes Heikal, “no element of an impact assessment is minimized.” ERC delivers on an array of sustainability points. By bringing together local staff with foreign engineers, managers, and designers of many nationalities, ERC produces a transfer of industry knowledge into the local market, ensuring its own continued development, Heikal says.

Worth Watching

With only about 10 weeks left until Brexit, the UK has to make some tough decisions to end a political crisis unlike any other the country has ever experienced. The UK, in recent decades known for making sensible decisions, has always had a functioning democracy through which people would elect representatives to make decisions on their behalf. What happened, then?

Direct democracy vs. elected representatives: It all started with the 2016 referendum, Britain Editor for The Economist Tom Wainwright says (watch, runtime: 03:33). “What’s happening now is that those two different kinds of democracy are kind of jamming up against each other, you’ve got the instructions of the people in the referendum that says the leave has to happen, but then you’ve got their elected representatives, who they elected only in 2017, saying actually the terms of the withdrawal are not acceptable to their constituency,” Wainwright says.

Blame Theresa May? A compromise could have been possible if Prime Minister Theresa May had focused on bridging the gap between the two sides after the referendum instead of adopting a hardcore EU-exit approach, Wainwright says. A postponement of Brexit won’t work either unless May eliminates her no-deal exit proposal — which seems unlikely. Wainwright suggests that the only way out of this political mess is to “put the question back to the people and to have a second vote.”

Diplomacy + Foreign Trade

A ministerial delegation is currently in Germany to discuss ways of improving the country’s waste recycling facilities, Ahram Online reports. The delegation, which includes Local Development Minister Mahmoud Shaarawy and Environment Minister Yasmine Fouad, will meet German officials to study cutting-edge waste recycling technologies.

The UK’s Cultural Protection Fund is providing GBP 3 mn for six Egyptian cultural heritage projects across the country, which gather international experts from world renowned universities, foundations and international bodies, according to a statement. The fund, delivered in partnership with the British Council, brought together a delegation of experts in Cairo last week, to observe the restoration of Mamlouk Minbars in Cairo, a traditional rock-salt mosque in Siwa, and other projects.

Energy

Agiba Petroleum drills two new wells

Agiba Petroleum has drilled two new wells with an initial production capacity of 7,500 bbl/d, company head Mohamed Al Kaffas said in a press statement, without disclosing their location. Al Kaffas also said that production at the Ashrafi field in the Gulf of Suez has been increased to 3,500 bbl/d, from 2,200 bbl/d.

JW Marriott becomes Egypt’s first solar-powered hotel

Cairo’s JW Marriott had 150 MW-worth of solar panels installed on its roof, making it the country’s first solar-powered facility in the hospitality sector, according to a statement by the United Nations Information Centre in Cairo. The project was funded by Global Environment Facility (GEF), and is part of the UNDP, GEF, and Trade Ministry’s joint Sustainable Development Goals program, “Grid-connected Photovoltaic Power Systems – Egypt PV.”

Egypt studying improving 80 octane gasoline in 2H2019

The Oil Ministry expects to complete in 2H2019 a study to swap out 80-octane fuel to 87-octane grade, a ministry official tells Al Mal. No further details were provided on the study, which comes as part of a wider national strategy to upgrade refineries nationwide to improve the quality of locally produced fuel. State-owned Assiut Oil Refining Company (ASORC) signed a USD 100 mn loan agreement with the China Development Bank (CBD) last year to help fund these upgrades to its refinery.

Infrastructure

EETC signs agreements for EGP 317 mn-worth of industrial cables

The Egyptian Electricity Transmission Company (EETC) signed a purchase and installation contract for EGP 295 mn-worth of industrial power cables with Elsewedy Electric subsidiary EgyTech Cables, EETC's newly appointed chairman Sabah Mashaly said. The cables will be used to connect two substations in East Cairo. The state-owned company also signed a separate EGP 22 mn agreement with an Energya Power and Telecom Solutions–Energya Cables-Elsewedy–Giza Cables ElSewedy consortium for a connection project in Sharm El Sheikh.

Basic Materials + Commodities

HyperOne, Seoudi, and Carrefour win tenders for new retail complexes

Supermarket chains HyperOne, Seoudi, and Carrefour won tenders issued by the Supply Ministry to develop 7 retail complexes in Cairo, Alexandria, Giza, and Qena, reports Al Mal. The three companies beat out Metro, Kheir Zaman, and Lulu Market, with contracts expected to be signed in February or March of this year.

Manufacturing

Chinese investors to build EGP 100 mn fodder factory in Egypt’s Luxor this year

Unnamed Chinese investors are planning to invest EGP 100 mn this year in a new animal fodder production facility in Luxor, director of the governorate’s investment authority Nora Ahmed said. The investors are due to submit a financial feasibility study to the governorate in 45 days. Governor Mohamed Badr had met with the investors earlier this year to discuss their plans and other potential investments in agriculture, renewable energy, and tourism projects.

Tourism

Seti First to renovate and establish floating hotels in Luxor, Aswan, Abu Simbel

Seti First Travel is investing as much as EGP 132 mn in setting up and renovating four floating hotels, Chairman Magdy Henein told reporters, according to Al Shorouk. The investments will cover the renovation of two hotels, one between Cairo and Aswan and the other between Aswan and Luxor, at EGP 16 min apiece, in addition to two new boats between Abu Simbel and Sudan, which would require investments of EGP 80-100 mn. Work on the boats is pending official approval from the River Transport Authority and are expected to be operational by 2020.

Automotive + Transportation

Egypt’s NAT reportedly calls of tender for phase on of Cairo Metro Line 4

The National Authority for Tunnels has reportedly called off its tender for construction works on the phase one of Cairo Metro Line 4, local news said. The authority received an expensive offer from a Taisei Corporation-Orascom Construction consortium, which appears to be the only qualified bidder. The planned line will run from 6 October City and end at the Giza metro station.

Banking + Finance

Emirates NBD Egypt named best bank in 2018 by The Banker Africa

Emirates NBD Egypt has received The Banker Africa’s “Best Bank in Egypt in 2018” award for the second consecutive year, according to Al Mal. The bank was recognized for its recent innovations and its distinguished online banking services.

10k CIB corporate clients using online platforms to access GTS services

10,000 corporate clients of CIB’s global transaction services (GTS) department are using online platforms to access its services, Chief Digital Officer Mohamed Farag tells Al Mal. The companies use the platforms for supply chain finance, electronic government payments, ecommerce, and automated clearing house (ACH) transfers.

Legislation + Policy

Transport Ministry to hire adviser to review maritime transport legislations

The Transport Ministry will issue within days a tender for an adviser to review all maritime transport legislation, head of the ministry’s maritime sector Reda Ismail tells Al Mal. Most existing laws are unable to cope with new changes in the industry and need to be reviewed, he said.

Sports

Crowd trouble cuts short African Champions League match in Egypt

“Crowd trouble” resulted in a Group C African Champions League match held at the Ismailia Stadium to be abandoned on Friday, the BBC reports. Supporters of host team Ismaily, angered at decisions taken in the match with Tunisia’s Club Africain, threw objects onto the field, causing the referee to call off the match in extra time. The stadium will likely be one of the venues for the 2019 African Cup of Nations, which Egypt is hosting this summer, BBC notes.

On Your Way Out

Two Egyptian oil companies are bucking the industry trend of flaring associated gas by using it for power generation instead, an Oil Ministry source said, according to Youm7. Dana Petroleum-EGPC JV Petro Kareem and Vegas-EGPC JV Petro Amir began a project last March to process gas produced at oil fields either for on-site electricity or for the national grid. Fields operated by the companies produce 55 tonnes of gas and 112 tonnes of condensates, along with 10 mcf/d of gas worth around USD 27 mn. Egypt, which is the 11th biggest gas-flaring country in the world, is a signatory to a global initiative aimed at ending routine gas flaring by 2030.

The Market Yesterday

EGP / USD CBE market average: Buy 17.88 | Sell 17.96

EGP / USD at CIB: Buy 17.88 | Sell 17.96

EGP / USD at NBE: Buy 17.79 | Sell 17.89

EGX30 (Sunday): 13,444 (-0.3%)

Turnover: EGP 396 mn (51% below the 90-day average)

EGX 30 year-to-date: +3.1%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 0.3%. CIB, the index heaviest constituent ended up 0.2%. EGX30’s top performing constituents were QNB Alahli up 6.8%, Egypt Aluminum up 2.2%, and Orascom Investment Holding up 1.4%. Yesterday’s worst performing stocks were Global Telecom Holding down 3.6%, Porto Group down 2.4% and Ezz Steel down 2.1%. The market turnover was EGP 396 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -48.8 mn

Regional: Net Short | EGP -3.8 mn

Domestic: Net Long | EGP +52.6 mn

Retail: 70.4% of total trades | 71.2% of buyers | 69.6% of sellers

Institutions: 29.6% of total trades | 28.8% of buyers | 30.4% of sellers

WTI: USD 53.80 (+3.32%)

Brent: USD 62.70 (+2.48%)

Natural Gas (Nymex, futures prices) USD 3.48 MMBtu, (+2.02%, Feb 2019 contract)

Gold: USD 1,282.60 / troy ounce (-0.75%)

TASI: 8,383.52 (-0.76%) (YTD: +7.11%)

ADX: 4,975.31 (-0.20%) (YTD: +1.23%)

DFM: 2,512.83 (-0.16%) (YTD: -0.67%)

KSE Premier Market: 5,494.22 (+0.25%)

QE: 10,760.23 (-0.26%) (YTD: +4.48%)

MSM: 4,202.68 (-0.80%) (YTD: -2.80%)

BB: 1,347.62 (+0.48%) (YTD: +0.77%)

Calendar

21-22 January (Monday-Tuesday): EPEA and IFC’s SME Governance Workshop at the Fairmont Nile City Hotel.

22-23 January (Tuesday-Wednesday): CI Capital’s third annual MENA Investor Conference, The Plaza, New York City, USA.

22-25 January (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January (Wednesday) 50th Cairo International Book Fair.

25 January (Friday): Police Day, national holiday.

26 January (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

03 February (Sunday): Cairo court to hear lawsuit against Peugeot Citroen.

05 February (Tuesday): Egypt’s Emirates NBD PMI for January released.

07 February (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

14 February (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

24-25 February (Sunday-Monday): The Arab-European Summit, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg)

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna (Bloomberg)

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

23 July (Tuesday): 23 July revolution, national holiday.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Cairo, Egypt.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.