- Car prices are up, interest rate cuts could be postponed: Digesting the change in how customs are calculated on non-essential goods. (Speed Round)

- FinMin’s debt control strategy looks to reduce public debt to 72-75% of GDP by 2021-22. (Speed Round)

- Trade minister downplays ‘automotive directive,’ says talks are ongoing with unnamed global car manufacturers on Egypt investments. (Speed Round)

- Travco spending EGP 4 bn on eight new Jaz-brand hotels in resort towns. (Speed Round)

- Edita is planning to invest EGP 300-350 mn in new production capacity, overseas growth in 2019. (Speed Round)

- CIRA reports FY2018 results in maiden earnings post-IPO. (Speed Round)

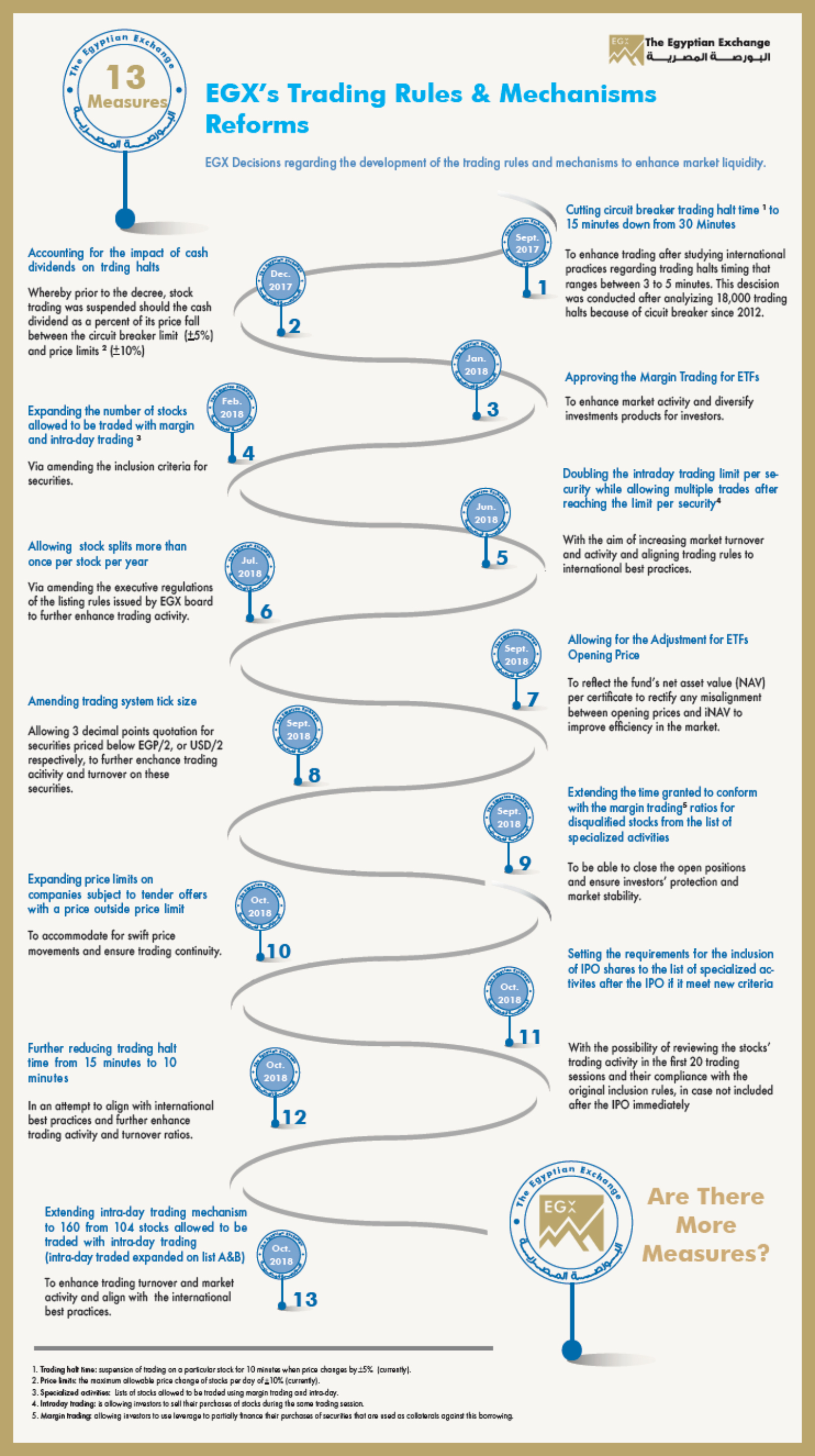

- EGX touts a year of regulatory reform. (Image of the Day)

- Halan raises multi-mn Series A round from Algebra Ventures and Battery Road Digital. (Automotive + Transport)

- The Market Yesterday

Monday, 3 December 2018

Car prices are up, interest rate cuts could be postponed: What customs changes mean for the economy

TL;DR

What We’re Tracking Today

Who do you have to know to get fast internet around these parts? Serious question. We went, with our checkbook wide open, to one of the three big mobile network operators — one that claims to be corporate friendly and that says it offers bundles including WiMax and microwave solutions. One with whom we have been a customer in good standing for more than a decade.

“Please, Big Telecom, get our soon-to-be new office online. Give us microwave internet, so that we may surf speedily and without worry. So that those who work for our parent company may back-up their large files to their hearts’ content.”

Days later: “No,” sayeth the telecom, mumbling something incoherent about bandwidth allocations at the Telecom Egypt-run central.

“Tayyeb, what about WiMax?”

“Sure,” sayeth Big Telecom. “That’s a great idea. We’ll get back to you.”

Days later: “Actually, no.”

“But why?”

“Because.”

Full-stop.

There are few experiences less satisfying than dealing with a corporation that no longer cares about being good, let alone great.

Careem is launching today a pilot run of its new, USD 100 mn fixed-route bus service, a company executive said, according to Masrawy. The service, a competitor to hot startup Swvl, will kick off in Cairo today and roll out to Alexandria and other parts of the country in the near future, the exec claims. The ride-hailing company had announced its plans to pilot the service in August, saying it will start with at least four Egyptian cities before tapping the broader MENA market.

This comes as Uber CEO Dara Khosrowshahi will be in Cairo tomorrow for “an important announcement” (pdf).

EDEX 2018 opens today in Cairo. The nation’s first defense expo runs through Wednesday at the Egypt International Exhibition Center and will feature international pavilions from 20 countries. Among those attending: The Brits, who have sent trade envoy (and frequent visitor to Cairo) Sir Jeffrey Donaldson and Lt. Gen. Sir John Lorimer, the UK government’s senior defense advisor for the Middle East, to visit, according to a statement.

A delegation of 11 major French companies is in town today, says Ludovic Prévost, director of the Business France office in Cairo. Execs from companies including Veolia and Systra are along for the visit.

Events you can attend today:

- AUC’s knowledge portal, Business Forward, marks its one-year anniversary today;

- The French Chamber of Commerce is hosting a seminar on consumer finance this evening.

Asian shares opened up this morning, oil prices surged and the USD got a bit cheaper after the so-called Trump-Xi trade “armistice,” suggesting a good start to the week for equities when western markets open later this morning.

Moscow and Riyadh will extend their OPEC+ pact for another year, Russian President Vladimir Putin said after meeting with Saudi Crown Prince Mohammed bin Salman over the weekend, Bloomberg reported. OPEC and other oil producers are scheduled to meet in Vienna on 6 December to possible output cuts to prop up prices.

If you’ve made a reservation at a Starwood hotel in the past four years, your personal information may have been hacked. The personal data of as many as 500 mn people has been exposed, including passport details, phone numbers, email addresses and, for some, encrypted credit card information. You should worry if you’ve stayed at hotels including the Sheraton, the Ritz Carlton or the Autograph Collection. Reuters and the New York Times have the story. New Starwood parent company Marriott has put up an entirely unsatisfying website, and you can take Wired’s advice on how to protect yourself from this hack and others going forward.

In miscellany this morning:

Do you run a family business? Thinking about succession? Brown Brothers Harriman, where the late US President George H.W. Bush’s father was a partner, has got you covered with their surprisingly good Owner to Owner quarterly magazine. Highlights include a profile of a family that sold their department store chain to private equity, a look at family business governance, and a discussion of how buy-sell agreements help succession plans. You can read it online in pdf form here.

Jeffrey Talpins may be the hottest investor on Wall Street — and odds are good you’ve never heard of him despite his hedge fund, Element Capital Management, posting a gain of 26.8% in 10M2018 against a loss of nearly 1.9% for the average hedge fund. Read: Jeffrey Talpins is the hedge-fund king you’ve never heard of (WSJ).

Element Capital’s website? We call that an “F.U.” site. As in “Oh, you want more information? F.U.” Click though and you’ll understand. (Though by hedgie standards, it’s actually rather generous with the run of text down the right-hand side.)

The head of the world’s largest sovereign wealth fund says he doesn’t have a personal assistant, arranges his own meetings and makes his own travel arrangements. An FT columnist asks him if he’s for real — and, while cheering him on, admits to having enjoyed being pampered herself.

For those who dream of the iPad Only Lifestyle, but still need to work on their Mac: Tld YouTuber Jonathan Morrison (who recently made waves with a video of him editing a video on his 2018 iPad Pro) shows how to ‘transform’ your iPad Pro into a Mac using a 2018 Mac Mini and a little dongle (watch, runtime: 4:24).

Enterprise+: Last Night’s Talk Shows

The new FX rate to calculate customs on non-essential finished imports dominated the conversation on last night’s talk shows, with Finance Minister Mohamed Maait blanketing the airwaves to discuss the issue with the talking heads. The minister had held a presser earlier in the day. We have the full story in Speed Round, below.

Using the market FX rate for luxury goods is in local industry’s best interest, as it will allow investors to import raw materials and semi-finished products at the discounted customs rate and complete the manufacturing process domestically, Maait told El Hekaya’s Amr Adib. This would also help create jobs for Egyptians, the minister said. Maait deflected Adib’s questioning on whether the decision is related to the cut to 0% of customs duties on European cars, saying only that it is only natural for the government to want to protect local industry (watch, runtime 9:01).

Prices of non-essential imports are expected to rise by 3-10%, former IMF consultant Fakhry Elfiky said on Al Hayah Al Youm (watch, runtime 6:48). Customs Authority official Shahat Ghatwary also phoned Hona Al Asema’s Reham Ibrahim to weigh in on the topic (watch, runtime 5:44).

Military Production Minister Mohamed El Assar phoned Al Hayah Al Youm to talk about Egypt’s first defense expo, EDEX 2018. Assar said the event will give Egypt the chance to market its military products as well as gain access to the latest technology in the industry and create space for potential future cooperation (watch, runtime 10:44).

Defending the suspension of new tuk-tuk licenses: The government’s decision to temporarily suspend issuing licenses for tuk-tuks is meant to curb child labor and encourage the country’s youth toward other jobs that would be more beneficial for the country, Cabinet spokesman Nader Saad said on Hona Al Asema (watch, runtime: 4:12). Development Ministry spokesman Khaled Kassem also said much of the same, and noted that there are currently some 222k licensed tuk-tuks in the country (watch, runtime: 6:14).

Supply Minister Ali El Moselhy gave an update on the ongoing purge of the country’s subsidy rolls, which he told Masaa DMC’s Eman El Hosary included 16k repeated names (watch, runtime: 9:47).

Actress Rania Youssef phoned DMC’s Eman El Hosary to apologize for offending the public by her choice of clothing at the Cairo Film Festival, which has caused a ruckus over the past few days after three ‘lawyers’ filed third-party lawsuits that could see her subject to a criminal trial for reasons that baffle the imagination (watch runtime, 18:17).

Speed Round

Car prices are up and analysts suggest interest rate cuts could be postponed as nation digests the change in how customs on non-essential goods are calculated: The exchange rate used to calculate customs on non-essential imports has been currently set at EGP 17.90 to the greenback and will be reviewed monthly to gauge the impact of inflation, said Finance Minister Mohamed Maait in a statement (pdf). It is unlikely that amending the customs FX rate will have an adverse impact on inflation, said Maait, noting that if inflation were to rise, the ministry may reverse the decision and bring the rate back down to EGP 16. Maait reiterated that the purpose of the decision was to encourage local production over imports. The statement came a day after the ministry scrapped its discount rate of EGP 16 per USD for “luxury” imports including pet foot, computers and mobile phones.

Analysts split on inflation impact: Shuaa Capital disputes Maait’s claim that the decision would have a minimal impact on inflation, saying the rate hike will hit goods that make up around 19% of the basket used to calculate the consumer price index (CPI). Beltone Financial predicts the impact will be minimal, arguing those hardest-hit are true non-essentials such as tobacco and alcohol, which only make up 2.2% of the CPI.

Does this mean a delay to interest rate cuts? We’ve already seen inflation rates jump in recent months, and the downside risk here is that it ticks up to a rate that prompts the central bank to either hike interest rates or delay its long-awaited rate cut. The central bank will next meet to review interest rates on 27 December — too early for the inflationary impact of this decision to be clear.

The House is worried: The House of Representatives, which plans to summon the head of the Customs Authority next week,is concerned about the decision, local news outlets report. House Economic Committee member Amr El Gohary predicts the move could see prices rise as much as 10%, arguing that the market is in no position to absorb further hikes, even if they are on non-essential goods. El Gohary fears retailers will use the change in customs FX rate as cover to justify across-the-board price hikes.

Car prices are already going up, as expected: Privately held Mansour Group (Chevrolet) and EGX-listed GB Auto (Hyundai, Geely), the country’s largest automotive distributors, were reportedly the first to raise prices in lock step with the new customs rate, according to reports in the domestic press (here and here) that suggest:

- Chevrolet’s Optra and Aveo passenger cars are now going for EGP 2-5k more per unit;

- Hyundai vehicles including the Creta, Accent and Elantra are running EGP 3-6k more expensive.

Expect the price of imported cars to rise 2-5% by the time the dust settles, industry association AMIC has suggested.

Rejoice if you’re a smoker though: Eastern Company has said the decision does not apply to its products as they are locally produced, local news reported. It explained that the decision also doesn’t apply to the tobacco it uses in production because it doesn’t fall under the “finished goods” category.

Complain all you want, but ask yourselves: How is it in the nation’s best interest to subsidize the import of non-essential commodities? Quick answer: It ain’t. The discount rate on customs was a temporary distortion necessary at the time, and it has run its course.

EXCLUSIVE- FinMin’s debt control strategy looks to reduce public debt to 72-75% of GDP by 2021-22: The Finance Ministry’s comprehensive debt control strategy, which has been in the works since August, will aim to reduce Egypt’s public debt to 72-75% of GDP by 2021-22 from 98% today, a senior government official told Enterprise. State budget guidelines for FY2019-20 released last month had set a public debt target of 79.3% of GDP by that time. The rollout of the strategy comes as government has reportedly set a foreign borrowing cap of USD 16.733 bn for FY2018-19, Reuters had reported in October, and is aiming for a limit of USD 14.3 bn in the next fiscal year. The ministry is expected to officially unveil the strategy by the end of the month. Diversification is the name of the game.

Diversification through new instruments: The diversification will see the government look at issuing green bonds and sovereign sukuk (a form of Islamic bonds) as two new-to-Egypt debt instruments. The government is also studying returning to issuing zero-coupon bonds with a tenor of 1.5 years, the official tells us. Finance Minister Mohamed Maait had previously said he expects Egypt’s maiden green bond issuance to take place before the end of the current fiscal year, and sukuk in the fiscal year thereafter.

Diversification of currencies in which we borrow: Egypt is preparing to issue USD 4-7 bn worth of yen-, yuan-, USD-, and EUR-denominated bonds in 1Q2019, and is currently waiting on global markets to stabilize before moving ahead with the issuances, our source says. Maait had said Egypt will next tap the bond market in February or April. The ministry sees Egypt issuing a total of USD 20 bn worth of bonds until 2022, according to our source.

Diversification in sources of funding: Under the strategy, Egypt will look to secure loans from a variety of international institutions to reduce its reliance on treasury issuances. Yields on Egyptian debt soared to an average of 19% this fiscal year, according to the Finance Ministry.

EGP-denominated int’l bonds aren’t happening — at least not right now. The Finance Ministry is not planning to issue EGP-denominated international bonds for the time being, but could do so when and if the time is right, our source said. (Separately, Egypt is close to signing an agreement with Belgium-based clearing house Euroclear to allow foreign investors to trade Egyptian bonds directly instead of through local banks.)

The strategy will see Egypt relying as much as possible on long-term financing to alleviate the burden of repayment. To that end, the Finance Ministry is currently working with the central bank to extend the tenors of its debt to an average of 2.2 years, rather than relying on instruments with three- and nine-month tenors. The ministry is also looking to bring debt service levels down to 20% of GDP from a current 40%.

Trade Minister: Please stop asking about the “automotive directive.” Trade and Industry Minister Amr Nassar threw cold water on years spent crafting the “automotive directive” that would have given incentives to local assemblers to move further up the value chain into manufacturing in return for a measure of protection against EU, Moroccan and Turkish imports.

“There’s nothing called the automotive directive in most countries,” Masrawy quoted Nassar as saying. “What we are working on is simply a strategy to promote investment in the sector, just as any ministry would do,” he added. Nassar gave no details of his ministry’s policy for the auto industry beyond suggesting that it would “attract foreign investment” and encourage the development of the market for electric vehicles. Nassar’s comments on the automotive directive came before he attended the opening of a new assembly line by Kia.

Background: The minister’s statement confirms our reporting this summer that the ministry was planning to scrap to the automotive directive in favor of a more limited approach. Local assemblers and international car manufacturers have been pushing for clarity on the ministry’s policy for the industry.

Nassar says all is well with the auto sector: Nassar’s remarks came as the ministry said it was in talks with unnamed global automotive manufacturers to set up car assembly facilities in Egypt. The ministry expects to be able to say more in about two months’ time, it suggested in a statement on Sunday (pdf). Foreign manufacturers have said they have placed on hold new investment in Egypt until the ministry strategy for the sector is clear. Japanese outfits have been particularly vocal on the issue since spring. Japan’s ambassador to Egypt raised the issue as recently as last week.

There are 28 days left before customs on EU-assembled cars fall to 0%.

IPO WATCH- Qalaa looking at early 2020 listing of TAQA, ERC: Qalaa Holdings could IPO subsidiaries TAQA Arabia and the parent company of Egyptian Refining Company by early 2020, Managing Director Hisham El Khazindar said, according to Amwal Al Ghad. El Khazindar’s remarks come as the outlook for equity offerings in EM stabilizes after a meltdown earlier this year that prompted Egyptian companies planning fall equity offerings to move to the sidelines.

Background: We had quoted Qalaa Holdings Chairman Ahmed Heikal as having said in October a reasonable date for the listings should be around 4Q2019. ERC’s USD 4.3 bn refinery in Mostorod is slated to begin operating in May 2019 and hit its stride in revenue and profitability in the second half of the year.

INVESTMENT WATCH- Travco subsidiary to invest EGP 4 bn in new Egypt hotels: Travco subsidiary Jaz Hotel Group is investing EGP 4 bn in eight new hotelsin Marsa Alam and Hurghada, Jaz CEO Alaa Akel tells Al Mal. Construction of the hotels is underway and should wrap up in 1H2019. The company is also planning to develop another eight hotels in the next five years in Marsa Alam, said Akel without revealing how much the company has earmarked for that phase of growth. The investment drive was prompted by the recovery of the tourism market in the past year, he said.

Edita is planning to invest EGP 300-350 mn next year to increase production capacity and finance overseas expansion, CEO and Chairman Hani Berzi said, according to Al Mal. We had noted yesterday that market-leading producer of packaged snack foods is targeting a 10% growth in exports over the next two years.

EARNINGS WATCH- Cairo for Real Estate and Investment (CIRA) reported a 95% y-o-y increase in net profit to EGP 126.4 mn in its 2018 fiscal year, which ended 31 August, according to the company’s maiden earnings release (pdf). Revenues rose 48% y-o-y during, coming in at EGP 517.5 mn, with growth being driven by higher enrollment rates in its K-12 schools and Badr University, the company said. CIRA also “made progress in strengthening our financial position through the repayment of outstanding long-term loan amounts and by simplifying our group’s legal structure.” 2018 was a “transformational year that served as a launchpad for CIRA’s ambitious growth strategy and culminated into a successful IPO” of the company on the EGX in October, said CEO Mahmoud El Kalla.

Looking ahead: CIRA is looking to both “organic and inorganic growth avenues that will see it deploy approximately EGP 1.1 bn over the coming three to five years across projects in primary education, tertiary education, and healthcare,” El Kalla said. The company plans to deploy part of the proceeds from its successful IPO to finance growth and will also rely on “bank financing, internally generated cash as well as proceeds from the disposal of non-core assets.”

LEGISLATION WATCH- House working group signs off on bill that regulates Federation of Egyptian Industries. A working group at the House of Representatives with members from the industry, budget and legislative committees has signed off on legislation regulating the Federation of Egyptian Industries (FEI), local news reported. The commission had held 15 meetings to discuss the bill, which was sent to the State Council for review last month. The bill sets four-year terms of the FEI’s board of directors and limits members to two consecutive terms in office. The bill also proposes scrapping fines for factories that don’t become members of the federation.

Egypt sold EGP 18.2 bn in treasury bills on Sunday, according to the central bank’s website. The sale included EGP 9.75 bn worth of 91-day T-bills at an average yield of 19.475% EGP 8.5 bn worth of 266-day T-bills at an average yield of 19.971%.

***

WE’RE HIRING: We’re looking for smart, talented, and seasoned journalists and editors to join our team at Enterprise, which produces the newsletter you’re reading right now. We’re looking for people who can work on this product and help us launch exciting new stuff. Applicants should have serious English-language writing chops, a strong interest — and preferably some professional experience — in business journalism, and solid analytical skills. The ideal candidate for us is a native-level-writer of English with the ability to read and understand Arabic. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. If you’re interested, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Please direct your applications to jobs@enterprisemea.com.

***

Up Next

Irish business delegation in town Tuesday: Irish Minister of State for Trade, Employment, Business, EU Digital Single Market and Data Protection Pat Breen will be in town between Tuesday and Wednesday, heading a delegation of 12 companies to explore investment prospects, our friends at the Irish Embassy in Cairo said in a statement (pdf).

The RiseUp Summit startup fest kicks off on Friday and will run until Sunday at the Greek Campus in downtown Cairo. This year’s event is themed “aim high, but stay grounded.” Click here for the full speaker lineup.

Food Africa Expo takes place as Egypt looks forward to a record citrus season. The gathering takes place 8-11 December at the Cairo International Convention & Exhibition Centre.

Pitch for a spot in Fintech Cairo: Pharos’ Pride Capital has launched Fintech Cairo in partnership with global seed program organizer Startup Bootcamp. The six-month accelerator program will select 10 companies from a pool of applicants. Our friends at Pharos Holding, along with Bank of Alexandria and the German development agency GiZ, are proud supporters and sponsors of the program. You can submit applications here. The deadline for submissions is the 31 December.

Image of the Day

EGX touts regulatory reforms: The EGX released an infographic listing the 13 measures and reforms (pdf) enacted since September 2017 to improve market efficiency. Among the highlights: Less-sensitive circuit breakers, shorter time-outs when you trip circuit breakers, and a much longer list of securities eligible for same-day (T+0) trading.

Egypt in the News

Still topping coverage of Egypt in the foreign press is the fallout following the charges brought up against Actress Rania Youssef for “indecent exposure.” Pickups of Youssef’s apology is in most major outlets, including NYT. Most are noting that she faces a sentence of up to six years. Youssef is due in court in January.

Also worth noting in brief:

- Tanzanian Prime Minister Kassim Majaliwa has called for the revival of the Nile Basin Commission to speed up development initiatives among the Nile Basin member states, according to the East African. Egypt has agreed with Tanzania to revive the Commission following its 20-year dormancy.

On The Front Pages

Finance Minister Mohamed Maait’s presser on the adjustment of the customs FX rate is the top headline on the front pages of state-owned Al Ahram and Al Gomhuria, with both focusing on the minister’s statements that next year will see an improvement in Egypt’s economic conditions. Al Akhbar, meanwhile, continued to focus on EDEX, which kicks off today.

Worth Reading

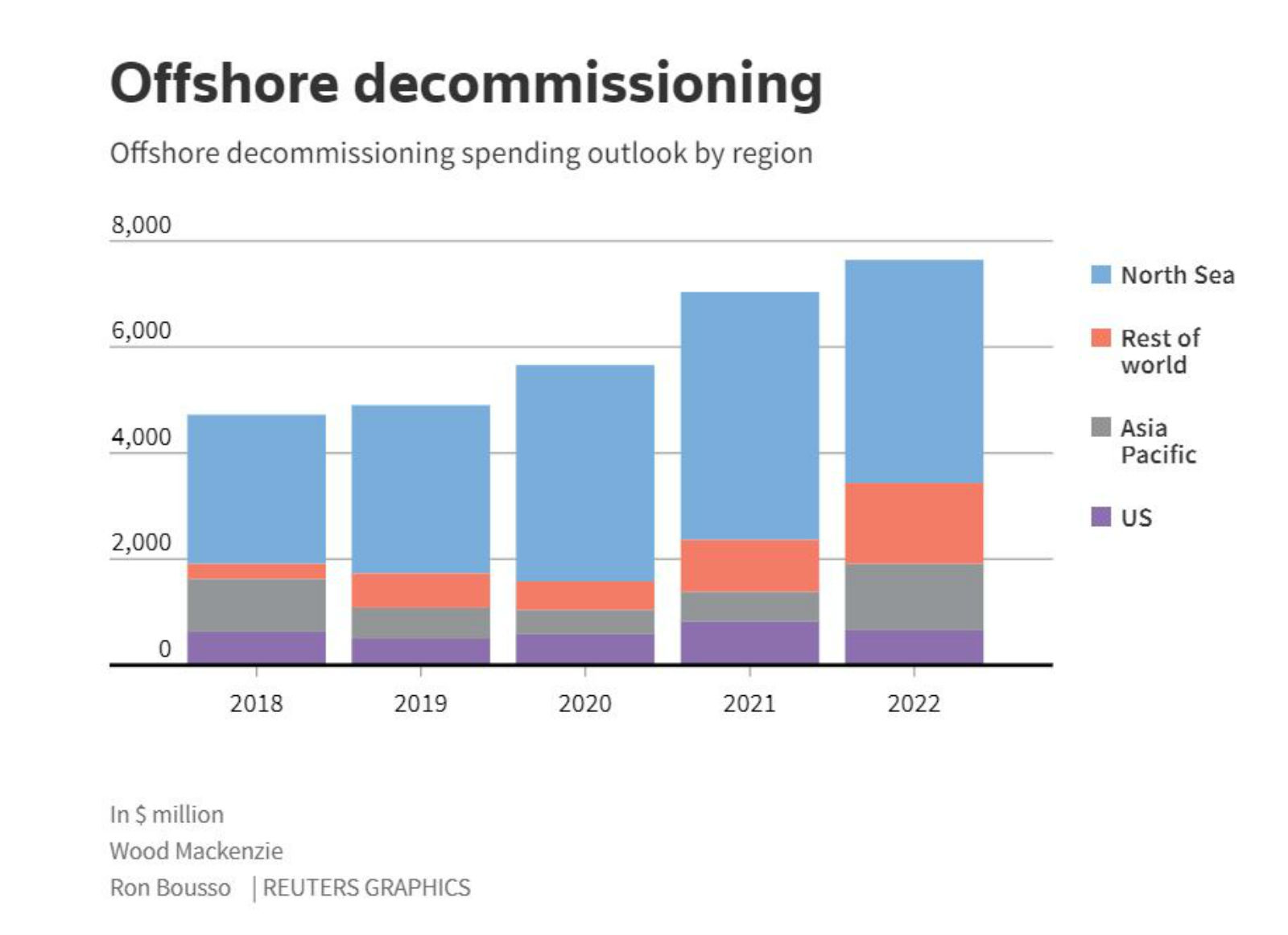

Dismantling the oil industry: The market for offshore decommissioning, which involves stripping down disused oil platforms, is expected to grow at unprecedented levels as the world moves away from fossils towards cleaner energy sources, writes Reuters’ Shadia Nasralla. Oil companies are now spending more than ever to take down their maturing platforms around the world: Energy research company Wood Mackenzie estimated 2018 global spending to reach USD 4.7 bn, and is expecting the figure to stand at USD 7.6 bn in 2022.

The market prospects and environmental gains are tremendous — but so are the costs and risks: The North Sea is expected to grow by 50% in the next five years, with USD 21.85 bn-worth of value to extract before 2025 off the UK coast alone, while there are some 1,500 platforms and 7,000 underwater wells in Southeast Asia that will need decommissioning by 2038. However, these platforms are dismantled piece-by-piece and then carried to shore on board heavy-duty vessels, making the process costly. This process also poses high risks to the service providers’ personnel and assets.

These flaws mostly serve as a great window for innovation, however, which could set the stage for a far safer and more economical practice for future projects.

Energy

Eni to drill tenth well in Egypt’s Zohr field next January

Italy’s Eni will begin drilling its tenth well in the Zohr gas field in January 2019 at a cost of USD 300 mn. The addition of the tenth well is expected to boost output production by 200 mcf/, and is predicted to take two months to complete. Production from the tenth well remains dependent on Eni’s sixth treatment plant, which is currently under construction and expected to be completed by 1Q2019. The company recently had to close the ninth well in Zohr after drilling due to lack of capacity at its treatment plants.

Health + Education

Nahdet Misr Publishing to establish two education subsidiaries

Nahdet Misr Publishing is planning to establish two new education-focused companies within two months, Al Mal reports. No further details were provided on the expected investment value or the mandate of the companies.

Real Estate + Housing

Government sets compensation mechanisms for El Warraq island residents

The government is preparing to offer compensation to citizens affected by the demolitions made in Warraq Island, where residents who refused to be evicted clashed last year with security forces, Prime Minister Moustafa Madbouly announced yesterday, according to a Cabinet statement. Residents can opt for financial compensation, alternative housing in a new city, or resettlement once the development of the island is complete. The government followed a similar compensation structure for the residents of the Maspero Triangle.

Tourism

Germany’s Bundestag agrees to allot EUR 10 mn co-finance Egypt’s Minya Museum

The German parliament has agreed to allocate EUR 10 mn to help finance the Akhenaten Museum in Minya, Egypt’s Ambassador to Germany, Badr Abdel Aati, announced on Friday, according to Ahram Online.

Automotive + Transportation

Halan raises multi-mn Series A round from Algebra Ventures and Battery Road Digital

Tuk-tuk and motorcycle ride-hailing app Halan raised mns in a series ‘A’ round from a group of investors, including our friends at Algebra Ventures as well as Battery Road Digital, according to MENAbytes. The company did not disclose the size of the round. Halan had previously said it was closing in on a USD 2 mn pre-series ‘A’ round.

Banking + Finance

Hermes’ valU starts Red Sea pilot run

EFG Hermes’ valU, which offers payment-on-instalment services via a mobile app, has begun operating in Hurghada on a trial basis, EFG Finance CEO Walid Hassouna said, according to Al Mal. valU is currently available in 1000 stores across three governorates in Egypt.

Egypt Politics + Economics

Egypt approves legalization of 168 new churches

A Cabinet committee approved the legalization of 168 churches on Friday, 17 of which are pending the completion of documents to be fully legalized, according to an official statement. Back in 2016, the government passed a new law on the construction of churches in an effort to ease the process of obtaining a license to build a church.

National Security

Egypt, France conduct naval drill in Red Sea

Egyptian and French naval forces carried out joint naval drills in the Red Sea, the Egyptian Armed Forces said in a statement. The training exercises included sailing formations and realistic scenarios of maritime security situations. Xinhua also has the story.

Sports

Egypt misses out on Basketball World Cup after Cameroon loss

Egypt’s national basketball team failed to qualify for the 2019 FIBA Basketball World Cup in China after losing to Cameroon in the African qualifiers on Sunday, Ahram Online reported. The Pharaohs finished fourth in Group A with 19 points.

Google’s parent company wants to eradicate mosquitoes through sterilization

Silicon Valley is coming after bloodsuckers: Google parent company Alphabet Inc. has a plan to eliminate mosquitoes around the world through sterilization technology, according to Bloomberg. The company has begun sterilizing male mosquitoes in its labs and releasing them into the wild, where they can mate with females — but their offspring will never hatch. Through its unit Verily Life Sciences, Alphabet is foraying into healthcare and life sciences (watch, runtime: 1:43).

What does this mean for the planet? Nobody likes getting a mosquito bite, and these insects are known to play a key role in transferring deadly diseases, including malaria, between humans. That said: Mosquitoes are food for a number of species — and we as a species have done a particularly poor job when we’ve decided we could re-design nature. Expect some measure of ecological disruption.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 13,150 (-1.3%)

Turnover: EGP 509 mn (36% above the 90-day average)

EGX 30 year-to-date: -12.4%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 1.3%. CIB, the index heaviest constituent ended down 1.5%. EGX30’s top performing constituents were Egyptian Resorts up 0.3%, and Pioneers Holding up 0.3%, and Heliopolis Holding up 0.3%. Yesterday’s worst performing stocks were Global Telecom down 9.9%, Telecom Egypt down 2.5% and Arab Cotton Ginning down 2.2%. The market turnover was EGP 509 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +4.2 mn

Regional: Net Short | EGP -25.4 mn

Domestic: Net Long | EGP +21.1 mn

Retail: 72.2% of total trades | 76.4% of buyers | 67.9% of sellers

Institutions: 27.8% of total trades | 23.6% of buyers | 32.1% of sellers

WTI: USD 52.31 (+2.71%)

Brent: USD 60.94 (+2.49%)

Natural Gas (Nymex, futures prices) USD 4.48 MMBtu, (-2.78%, January 2019 contract)

Gold: USD 1,227.00 / troy ounce (+0.08%)

TASI: 7,845.02 (+1.84%) (YTD: +8.56%)

ADX: 4,770.08 (-2.29%) (YTD: +8.45%)

DFM: 2,668.66 (-0.61%) (YTD: -20.81%)

KSE Premier Market: 5,317.76 (0%)

QE: 10,316.96 (-0.46%) (YTD: +21.04%)

MSM: 4,417.92 (+0.13%) (YTD: -13.36%)

BB: 1,332.07 (+0.25%) (YTD: +0.03%)

Calendar

03 December (Monday) Consumer Finance Landscape-New Law in the Making, Fairmont Hotel Nile City, Magenta ballroom, Cairo, Egypt

03-05 December (Monday-Wednesday): First Egypt Defense Expo “EDEX 2018”, Egypt International Exhibition Center, Nasr City Cairo.

04 December (Tuesday): The Central Bank of Egypt will terminate the foreign exchange repatriation mechanism, according to a CBE statement (pdf).

04 December (Tuesday): Uber CEO Dara Khosrowshahi will be in Cairo for “an important announcement, according to an emailed statement (pdf).

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

04-05 December (Tuesday-Wednesday) Irish Minister of State for Trade, Employment, Business, EU Digital Single Market and Data Protection Pat Breen will be in town heading a delegation of 12 companies to explore investment prospects, according to an Irish Embassy in Cairo statement (pdf).

07-09 December (Friday-Sunday): RiseUp Summit, The Greek Campus, Downtown Cairo (location).

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

08-10 December (Saturday-Monday): Fourth Food Africa 2018 expo, Cairo International Exhibition and Convention Centre, Nasr City, Cairo.

09-10 December (Sunday-Monday): Cairo Regional Centre for International Commercial Arbitration’s Sharm El Sheikh VII conference, Egypt Hall, SOHO Square, Sharm El Sheikh

10 December (Monday): The Financial Regulatory Authority will hear a grievance appeal by Beltone against a six-month suspension handed to its investment banking arm over “irregularities” the authority says it found in Sarwa’s IPO, Al Mal reported.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “ The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheikh, venue TBD.

14-16 December (Friday-Sunday): AutoTech 2018, Cairo International Exhibition and Convention Centre, Nasr City, Cairo.

18-19 December (Tuesday-Wednesday): Federation of Egyptian Chambers of Commerce leaders are scheduled to meet with their Saudi counterparts in Aswan to launch a collaboration project to support SME development in Egypt and Saudi Arabia, head Ahmed El Wakeel said.

19 December (Wednesday): Cairo Economic Court to rule into an appeal by pharma companies

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

January 2019: Flat6Labs will launch their 12th startup accelerator cycle.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

19 January 2019 (Saturday) Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

26 January 2019 (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January 2019 (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

7 February 2019 (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

11-13 February 2019 (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19-20 February 2019 (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

26-28 February 2019 (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March 2019 (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

June 2019: International Forum for small and medium enterprises (SMEs).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.