Towards cost-effective, safe offshore oil platform decommissioning

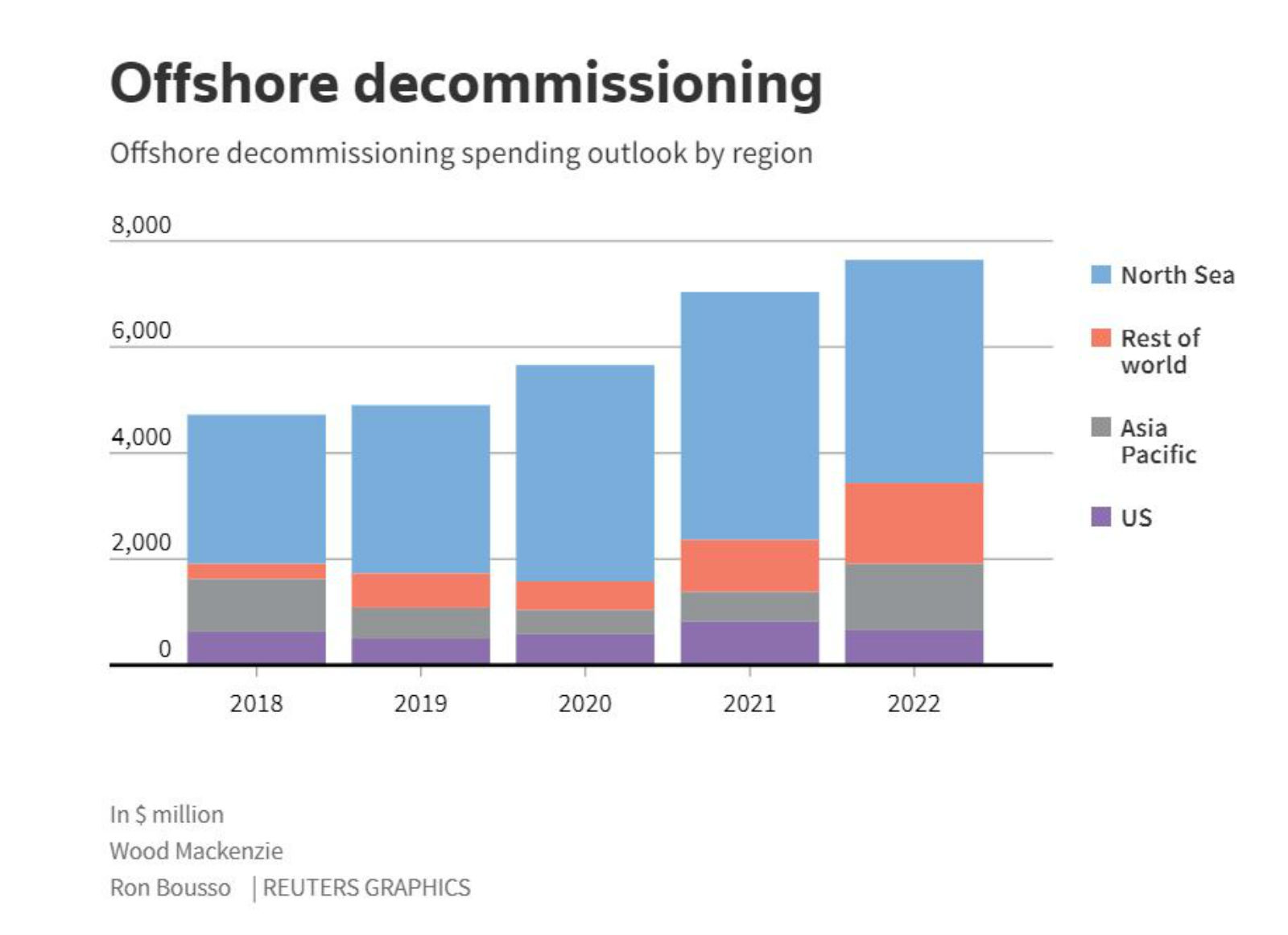

Dismantling the oil industry: The market for offshore decommissioning, which involves stripping down disused oil platforms, is expected to grow at unprecedented levels as the world moves away from fossils towards cleaner energy sources, writes Reuters’ Shadia Nasralla. Oil companies are now spending more than ever to take down their maturing platforms around the world: Energy research company Wood Mackenzie estimated 2018 global spending to reach USD 4.7 bn, and is expecting the figure to stand at USD 7.6 bn in 2022.

The market prospects and environmental gains are tremendous — but so are the costs and risks: The North Sea is expected to grow by 50% in the next five years, with USD 21.85 bn-worth of value to extract before 2025 off the UK coast alone, while there are some 1,500 platforms and 7,000 underwater wells in Southeast Asia that will need decommissioning by 2038. However, these platforms are dismantled piece-by-piece and then carried to shore on board heavy-duty vessels, making the process costly. This process also poses high risks to the service providers’ personnel and assets.

These flaws mostly serve as a great window for innovation, however, which could set the stage for a far safer and more economical practice for future projects.