- Global FDI slumped in 1H2018, but Egypt remains Africa’s top destination. (Speed Round)

- World Bank pledges USD 3 bn loan for infrastructure projects, Sinai development. (Speed Round)

- Are Russian planes about to return to Sharm and Hurghada? (Speed Round)

- FinMin looking at regulatory changes to allow sovereign sukuk issuances; eyes 2019 for maiden issuance. (Speed Round)

- Freezone companies are trying to wiggle out of paying into Universal Healthcare scheme. (Speed Round)

- Three questions lurking behind the headlines. (What We’re Tracking Today)

- It’s easy to hate tuktuks when you’re not forced to rely on them to get to work. (Last Night’s Talk Shows)

- Egyptian is co-founder of the Middle East’s first fully licensed digital currency exchange. (What We’re Tracking Today)

- Is modern pentathlon Egypt’s new squash? (On Your Way Out)

- The Market Yesterday

Wednesday, 17 October 2018

Egypt #1 destination in Africa as global FDI slumps

TL;DR

What We’re Tracking Today

** #6 – Three questions lurk behind the headlines on an otherwise quiet-but-steady newsday:

- Will the beating handed to the shares of consumer and structured finance player Sarwa earlier this week prompt companies with IPOs now in the market to delay their offerings to 1Q2019 or beyond?

- Will the Madbouly government postpone the scheduled 21-25 October sale of 4.5% of cigarette maker Eastern Tobacco, which is piloting the latest of the state’s privatization drives? Government officials were reportedly meeting yesterday with the investment bankers quarterbacking to sale, but no word on timing had emerged by dispatch time today.

- Does SODIC’s blockbuster bid for MNHD — by all accounts Egypt’s largest-ever M&A — presage a scramble for scale among players of all sizes in the domestic real estate market?

** #8 – Making us proud this morning is Yehia Badawy, one of four co-founders behind theregion’s first fully licensed digital currency exchange. Based in Bahrain, “Rain is a digital currency exchange and custodian in the Middle East that allows people to buy, sell, and store digital currency in a regulated, secure, and compliant way,” according to an emailed statement (pdf). Rain received its sandbox license from the Central Bank of Bahrain in 2017 and has been running trial operations for nine months with an eye on becoming fully operational in 2019. The exchange will be held to strict international standards on security, regulation, and pricing, which the co-founders understand is integral to building trust with customers — which they note is “the biggest issue in this industry.”

Rain’s launch comes as someone is clearly playing with crypto in Egypt: Domestic bitcoin volumes surged in the first week of October to the local-currency equivalent of EGP 1.1 mn, almost as much as in all of September, according to data from Coin Dance (below).

Must-read of the morning: “The world’s largest insolvent private equity firm.” The Wall Street Journal has an insanely good (and detailed) drill-down into the flow of money as Abraaj allegedly used investor funds to pay its own operating expenses. “At least USD 660 mn of investor money was moved without the knowledge of most investors into bank accounts that forensic accountants call the Abraaj treasury, according to documents and people familiar with the situation. More than USD 200 mn flowed from those accounts to Mr. Naqvi and people close to him, according to company documents and people familiar with the situation.” Among the alleged beneficiaries: One of Naqvi’s sons, an online luxury-clothing retailer started by Naqvi’s former personal assistant, and a Pakistani influence peddler who was offered USD 20 mn to get a former prime minister to clear a transaction. Read Private-equity firm Abraaj raised bns pledging to do good — then it fell apart.

The Khashoggi affair is still front page news around the world, preoccupying the international business as top global banking execs drop out of a high-profile investment conference in the kingdom and US President Donald Trump appears to give cover to Riyadh’s trial balloon suggesting the dissident journalist was killed in an interrogation gone wrong. Blaming KSA for Khashoggi’s disappearance is another instance of “guilty until proven innocent,” Trump told the Associated Press overnight. The Donald’s remarks came as former New York Times Cairo bureau chief David Kirkpatrick led a team of reporters in an investigation that alleges suspects in the Khashoggi case have direct ties to Crown Prince Mohamed bin Salman.

Uber valued at USD 120 bn in potential IPO, rival Lyft also looking at 2019 offering: Goldman Sachs and Morgan Stanley presented Uber with proposals valuing the company at USD 120 bn in a potential IPO that could materialize in 2H2019, according to the Wall Street Journal. The proposed valuation is nearly 2x what Uber was valued at around two months ago, the Journal notes. However, there is no certainty “Uber will go public on the time frame or with the valuation envisioned by investment bankers hungry for fees,” particularly as the conditions of the IPO market are fickle. The Financial Times also has the story, and elsewhere the Journal notes that Uber rival Lyft has tapped JPMorgan Chase, Credit Suisse and Jefferies as underwriters for its USD 15 bn IPO, also scheduled for 2019.

Pot is legal in Canada today. Toronto’s Globe & Mail has the rundown on everything from where to buy it to how to invest in it and whether you can get high at work.

In miscellany this morning:

- How millennials and savings apps are making asset managers wake up and smell the coffee. (Financial Times)

- Older workers primed for a comeback: ‘Modern elders’ use life experience to offer advice and intergenerational expertise. (Financial Times)

- Why you have (probably) already bought your last car. (BBC)

- When your boss is an algorithm. (New York Times)

PSA- The PR blitz for this year’s Cairo International Film Festival has begun. The annual gathering runs this year 20-20 November, according to the breaking-news website of state-owned daily Al Ahram, which has declared it front-page news. Film buffs can visit the festival’s website here and check out the tally of submissions here.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s visit to Moscow dominated the airwaves last night. We have chapter and verse in this morning’s Speed Round, below. In other news:

Egypt qualified for the 2019 Africa Cup of Nations following a 2-0 win against Swaziland yesterday and a favorable result for Tunisia against Niger, sports critic Ihab El Khatib told Hona Al Asema. El Khatib hailed new team manager Javier Aguirre. The national team’s win comes despite Mo Salah’s absence from the roster following a minor injury during an earlier match. The pharaohs earned their first point from a header by Ahmed Hegazy and doubled their lead with Marwan Mohsen’s goal in the second half (watch, runtime: 6:57)

Spotlight on industrial development: In the absence of any detail as to the substance of the Trade Ministry’s new industrial development strategy, Egyptian Federation of Industries boss Tarek Tawfik flew the flag for manufacturers as he discussed bureaucracy and the parallel economy with Masaa DMC’s Osama Kamal (watch, runtime: 8:32 and runtime: 6:12).

** #7 – Class warfare: It’s easy to hate tuktuks when you’re not forced to rely on them to get to work, the doctor’s office, etc: The three-wheeled menaces (which dislike almost as much as the otherwise very smart talkshow host who famously described them as “cockroaches” a few years back) are once again in the spotlight. Sharqiyah Governor Mamdouh Ghorab told Hona Al Asema estimates that he has more than 14,500 of the three-wheeled vehicles plying his streets and explained that unlicensed tuktuks are again being impounded and their owners slapped with EGP 1,000 fines (watch, runtime: 6:17). A top aide to the minister of local development also made an appearance to discuss efforts to figure out how many tuktuks are operating nationally. Daqahliyah is apparently home to the largest number of licensed vehicles (watch, runtime: 6:07). Reality check, friends: They’re a natural outgrowth of the lack of transport infrastructure serving low-income earners, particularly those living in shantytowns and other informal and / or peri-urban areas.

More than 450 terrorists have been killed since a large-scale counter-terrorism offensive got underway earlier this year, Masaa DMC’s Kamal said, citing an armed forces statement. Kamal believes that the terrorist insurgency is losing steam in North Sinai (watch, runtime: 1:11).

Universal healthcare: Prime Minister Mostafa Madbouly visited Port Said to tour hospitals that will provide services under the Universal Healthcare Act, House deputy spokesman Wahdan Soliman told Al Hayah Al Youm (watch, runtime: 5:09).

Speed Round

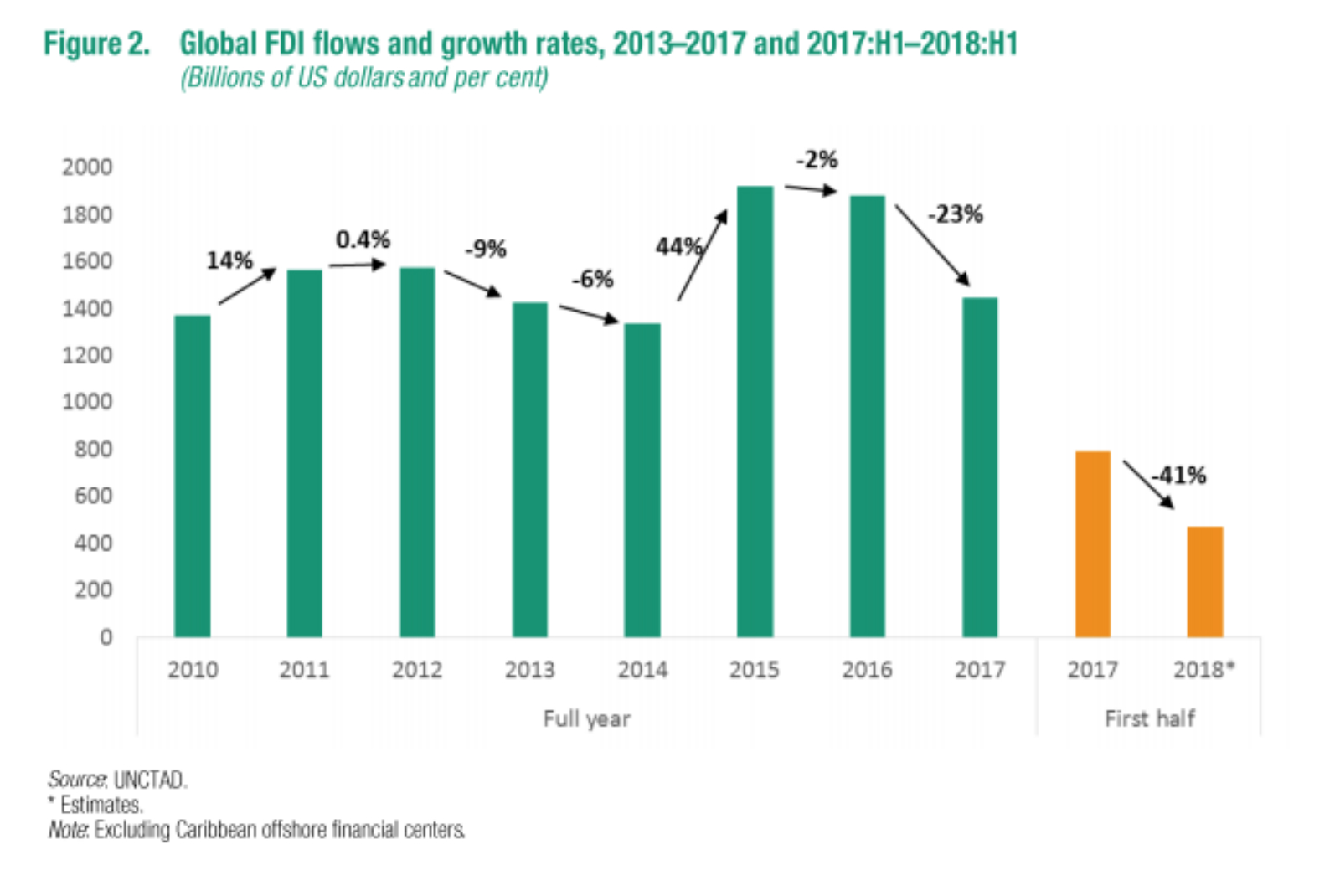

** #1 – Global FDI slumped in 1H2018, but Egypt remains Africa’s top destination: Global FDI fell 41% y-o-y in 1H2018 to USD 470 bn, according to UNCTAD’s latest investment trends monitor report (pdf). The slump was driven mostly by “large repatriations by United States parent companies of accumulated foreign earnings from their affiliates abroad following tax reforms.” Developed countries such as the US, Switzerland, and Ireland also saw the sharpest decline in FDI, while developing regions, including Africa and Latin America saw their FDI inflows dip only slightly.

Egypt remained the most attractive destination for FDI in Africa in the first half of this calendar year, with the total inflow up 24% compared to 1H2017, according to UNCTAD. Egypt’s net FDI inflows had dipped in the state’s 1 July-30 June 2017-18 fiscal year to USD 7.7 bn, down from USD 7.9 bn the previous year.

FDI into Africa as a whole was down slightly at 3% as inflows to Egypt and South Africa were offset in large part by a 17% slump in allocations to “resource-dominant Western Africa.” “The volatile global economic environment and mixed commodity price trends are important factors behind weakened FDI in Africa. Also, the expected growth in FDI inflows to Africa due to advances in regional integration has yet to materialize; the African Continental Freetrade Agreement, once in operation, may trigger new investor interest in the continent.”

Developing economies accounted for two-thirds of global FDI inflows, with emerging markets accounting for five of the world’s top 10 “host economies” for FDI in the first half of this year. Among top FDI earners at all stages of development, China was the world’s largest recipient of FDI, followed by the UK, the US, and the Netherlands.

** #2 – World Bank pledges USD 3 bn loan for infrastructure projects, Sinai development: Investment and International Cooperation Minister Sahar Nasr reached a final agreement with the World Bank to extend a USD 3 bn loan “over the coming months,” according to a ministry statement (pdf). The funding will be directed towards supporting the government’s development drive in the Sinai Peninsula, as well as financing infrastructure, transport and agriculture projects elsewhere in the country and general backing for Egypt’s economic reform program, the statement says. Talks for the funding had been ongoing since April. We had reported in an exclusive back in July that Cairo was seeking USD 2 bn in World Bank funding. It remains unclear whether the USD 3 bn in funding package includes a USD 500 mn loan Prime Minister Mostafa Madbouly had requested from the bank for social housing development.

The news comes as Investment Minister Sahar Nasr is courting European investors on a roadshow that has taken her to Luxembourg, according to a ministry statement (pdf). In addition to sit-downs with government and Luxembourg stock exchange officials, Nasr is meeting with execs in industries including banking, materials, and chemicals. Look for a return visit by a Luxembourg trade delegation in the not-so-distant future.

Nasr is meeting today with the EU’s top “neighborhood policy” boss, according to a European Commission statement picked up by Al Masry Al Youm.

** #3 – Are the Ruskies finally restoring flights to Sharm and Hurghada? President Abdel Fattah El Sisi and Russian President Vladimir Putin are reportedly set to reach an agreement that would allow the resumption of direct flights between Russia and Red Sea destinations including Sharm El Sheikh and Hurghada when they meet in Moscow today, according to a State Information Service (SIS) statement (pdf). The statement provides few further details, but suggests that the two countries have already reached common ground and that El Sisi and Putin will be dotting the i’s and crossing the t’s.

A long time in the making: We’ve had our fingers crossed since August that the Russians could be making a comeback to Hurghada and Sharm after Russian tour companies began kicking the tires on travel packages to offer once flights resume. Direct air travel between Cairo and Moscow resumed last April, following protracted negotiations over security concerns after the 2015 Metrojet crash.

Putin and El Sisi are also expected to discuss military cooperation, according to Russia’s TASS. Trade ties and the latest developments at Egypt’s Dabaa nuclear plant (being built by Rosatom) and the Russian Industrial Zone will also be on the agenda.

El Sisi and Russian Prime Minister Dmitry Medvedev touched on some of these issues when they met yesterday, according to an Ittihadiya statement. The president also visited the Federation Council, where he delivered a speech on a wide range of topics, from bilateral ties to ideological and religious extremism and the political course in Libya and Syria, according to a readout of the speech.

The Moscow trip is getting end-to-end coverage in the domestic press. It is front-page news Al Ahram, the government-controlled newspaper of record, and dominated the airwaves on talk shows last night. Masaa DMC’s Osama Kamal zeroed in on the potential resumption of direct air service to Sharm and Hurghada (watch, runtime: 9:10), while Cairo University Political Science Professor Moataz Abdel Fattah spoke with Hona Al Asema about what he said was Russia’s increasingly important regional role (watch, runtime: 8:14). Yahduth fi Masr’s Sherif Amer noted that El Sisi’s address to the Russian Federation Council was the first ever to that body by a visiting head of state (watch, runtime: 5:25).

** #4 – EXCLUSIVE- FinMin looking at regulatory changes to allow sovereign sukuk issuances; eyes 2019 for maiden issuance: The Finance Ministry plans to introduce legislative amendments that could pave the way for the issuance of a sovereign sukuk offering as early as 2019, a senior government official tells us. The framework would explicitly make possible the issuance of sharia-compliant bonds in USD or EUR, a plan shelved since 2013. The ministry reportedly believes sukuk could be a cornerstone of its long-term debt-management strategy, which sees the government borrowing USD 20 bn over the course of the next four years.

Background: Finance Minister Maait had told us back in September that the government was unlikely to issue sukuks this fiscal year as there was no legislative framework in place allowing it. Recent legislative and regulatory changes allowed sukuk for corporates, but did not explicitly authority sovereign issues.

Ministry eyeing two-year local currency bonds? The same official tells us the Finance Ministry could introduce a two-year local-currency bond as it adjusts the tenor and local- / foreign-currency mix of its borrowing.

EXCLUSIVE- Gov’t looks to keep Korean companies happy as it drums up Asian interest in eurobond issuance: The Finance Ministry is forming a working group with the Korean embassy to resolve any outstanding concerns of Korean companies operating here, a senior government official tells us. The move comes as the Finance Ministry looks to address any lingering hiccups in a key trade and investment relationship as it tests Asian appetite for an upcoming USD 5 bn eurobond issuance, the source said. Finance Minister Mohamed Maait has reportedly met with Seoul’s ambassador to Cairo multiple times over the past few weeks to get a tally of some of the issues South Korean companies face.

The move highlights the pressure the government is feeling to ensure successful bond and stock issuances over the coming months in the midst of the emerging markets selloff. Some analysts are seeing the 11% drop in Sarwa Capital’s shares on its opening day of trading and the ever-rising yields on government bond issuances as a sign that Egyptian capital markets are feeling the strain of the selloff.

INVESTMENT WATCH- Infinity Solar plans to invest USD 400 mn in solar and wind power projects through 20201, a company official told Al Mal. The company aims to develop as much as 400 MW of capacity in Cairo, the Red Sea and Aswan, the official said, all under the Independent Power Producer (IPP) framework. In the works are three solar power facilities with a combined capacity of 130 MW, the first of which is slated to come online in April 2019 in the world-scale Benban solar complex, where Infinity was the first company to complete a solar plant earlier this year. The company had also recently obtained licenses for two wind-powered stations with a combined capacity of 100 MW.

Gas import era ends as Höegh Gallant FSRU leaves Egypt this week: The Höegh Gallant floating storage regasification unit (FSRU), until recently the final critical link in Egypt’s natural gas import chain, is set to leave Egypt before the week is out, Oil Minister Tarek El Molla told Reuters, marking another milestone in Egypt’s cessation of gas imports. Höegh has agreed with Egypt to amend the terms of a five-year contract for the FSRU that will see the Norwegian company hired as an LNG carrier to a third party, Höegh said in a statement on Monday.

Egypt to make Höegh whole: The amendments also stipulate that the state’s EGAS will compensate Höegh for the rate difference between the original FSRU contract and the new LNG carrier agreement. Egypt will also compensate Höegh for equipment installed on the Ain Sokhna jetty for 3Q2018. “The amended contract is expected to become effective in October 2018 and will run to April 2020, the termination date of the original five-year FSRU contract.”

Background: El Molla officially pulled the plug on Egypt’s natural gas imports in September. That’s when the country received its final shipment of imported liquefied natural gas as we switch from being a net importer to a net exporter thanks to recent world-scale natural gas finds. Egypt’s total gas production output reached 6.6 bcf/d in September after capacity from the Zohr gas field hit 2 bcf/d.

REGULATION WATCH- FRA to introduce regs next year on credit scores for margin traders: The FRA is planning to implement next year recently-passed regulations that allow brokers to unilaterally sell shares belonging to clients trading on margin if their credit score falls below a certain threshold, Al Mal reports. Earlier this year, the FRA approved allowing brokers to sell a client’s shares in a margin trade, without their consent, if a client’s iScore falls below 400 points. The regulations stipulate, however, that the client be given a grace period to bring up their credit rating.

LEGISLATION WATCH- Parliament’s housing, econ committees to discuss amendments to Real Estate Tax Act this month: The House of Representatives’ economics and housing committees are expected to meet sometime this month to discuss proposed amendments to the Real Estate Tax Act, housing committee chair Rep. Alaa Waly tells Al Masry Al Youm. The proposed changes cover everything from the new real estate tax formula to how rented properties would be taxed, how properties would be appraised, and avenues for appeals. Waly stressed that parliament will not be scrapping the tax, but noted that President Abdel Fattah El Sisi has called for the amendments to be “revisited” to be more considerate of low-income citizens. According to Waly, his committee will be done with the proposed amendments before the end of 2018. He made no mention of the fate of the Returns Act — the rival legislation drafted by some MPs who are unhappy about the proposed changes to the Real Estate Tax Act.

The House Industrial Committee will meet on 21 October to discuss proposed amendments to the law governing the Federation for Egyptian Industries, Industry Committee chair Farag Amer said, according to Al Masry Al Youm. The proposed changes include tweaking the fee paid by new manufacturers for their membership in the federation as well as regulating the procedures for dissolving the federation’s board of directors. Manufacturers are required as part of their licensing and incorporation procedures to pay dues to the federation.

** #5 – Freezone companies are trying to wiggle out of paying into Universal Healthcare scheme: A number of freezone companies are objecting to paying the 0.25% tax on sales revenue to fund the new universal healthcare scheme, as stipulated under the Universal Healthcare Act, unnamed company representatives said. By their logic, freezone companies are exempt from paying taxes and fees under the Investment Act, which means that they should also be exempt from paying the 0.25% tithe. A government source noted, however, that the levy is not a tax that can be waived — it applies to all companies operating in Egypt, regardless of whether they’re onshore or offshore for customs purposes. The act — part of the Sisi administration’s EGP 600 bn health coverage plan — also sets premiums for employers of 4% of each employee’s monthly salary, while employees are required to pay premiums of 1% of their salary into the system. The El Sisi administration began rolling out the first phase of the act in July.

** WE’RE HIRING: We’re looking for smart, talented, and seasoned journalists and editors to join our team at Enterprise, which produces the newsletter you’re reading right now. We’re looking for people who can work on this product and help us launch exciting new stuff. Applicants should have serious English-language writing chops, a strong interest — and preferably some professional experience — in business journalism, and solid analytical skills. The ideal candidate for us is a native-level-writer of English with the ability to read and understand Arabic. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. If you’re interested, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Please direct your applications to jobs@enterprisemea.com.

Up Next

Egypt has still not selected a CEO for its new sovereign wealth fund despite reports earlier this month that it would do so “within days.” The executive regulations for the law governing the SWF are also pending.

An IMF delegation is due in town mid-October for a review of Egypt’s progress on its reform program ahead of the disbursal of the fifth USD 2 bn tranche of the country’s extended fund facility.

The House will convene for its first general assembly of the new session on 21 October.

The 2018 Narrative PR Summit will take place at the Four Seasons Nile Plaza on Sunday, 28 October.

Egypt in the News

On a slow day for Egypt in the foreign press, coverage centered mostly on pickups of areport by Amnesty Internationalon Egypt’s use of French weapons. The report alleges that these weapons were deployed against protesters in Egypt during political unrest in 2013. The Washington Post and New York Times, for example, have both picked up AP stories on the report.

Coming in at a close second is President Abdel Fattah El Sisi extending the nationwidestate of emergency for an additional three months. The House of Representatives is expected to rubber-stamp the presidential decree — which was published in the Official Gazette yesterday — within seven days, according to the Associated Press.

Meanwhile, Egypt features heavily in a piece by Jared Malsin for the Wall Street Journal on how the disappearance and likely murder of Saudi journalist Jamal Khashoggi has “darkened the outlook for Arab dissidents,” including Egyptian Islamists in exile.

Thank the English for all of their help sending tourists our way: The tabloid press in the UK has moved on from “horror hotel” and “imprisoned UK drug trafficker” stories. Witness the Daily Mail’s clickbait-optimized headline: Horrific images capture the brutality of Egypt’s dog cull which sees strays poisoned and thrown into rivers or shot dead and left to rot in the streets.

Worth Reading

The latest report on climate change is an unmitigated disaster. This is why you should care. The UN Intergovernmental Panel on Climate Change report warned last week that we only have 12 years to avoid climate change disasters by keeping global warming to a maximum rise of 1.5 °C. The report has been rattling cages since its release as scientists had previously thought a temperature increase of 2 degrees was enough for all hell to break loose. Boiled down to its essence: we have a lot more to do in a shorter period of time before disaster strikes. For many pessimists, the scale of the change needed for the global economy are simply too large to be met, and official inaction (including by the sitting president of the United States) is just making it worse. In short, we’ve probably already failed as a species and geoengineering may our only (very bad) option.

The UN report holds special significance for Egypt: It claims we’re among the countries most at risk from rising sea levels. Some 50 mn people in Egypt, the US, Bangladesh, China, India, Indonesia, Japan, the Philippines and Vietnam face the prospect of being displaced by 2040 if global warming hits 2.7°C. It argues that transforming the world economy, including imposing hefty taxes on carbon dioxide emissions, at an estimated cost of USD 54 tn (and fast) is one key way to meet the 1.5°C limit.

Africa is already feeling the heat: “Today at only 1.1 degrees of warming globally, crops and livestock across the region are being hit and hunger is rising, with poor small-scale women farmers, living in rural areas suffering the most. It only gets worse from here,” Pan Africa Director of Oxfam International Appolos Nwafor said on the IPCC report. He urged governments to take action to rely on clean energy to protect vulnerable communities. Oxfam notes that If global temperature rises by more than 2 degrees by the end of the century, by 2050 daytime temperatures in North Africa (and the Middle East) could rise to 46 degrees on the hottest days, “which can be deadly.”

Nobel Prize in Economics highlights the scale of the dangers: The 2018 Nobel Prize in economics was awarded jointly to Yale’s William Nordhaus and NYU’s Paul Romer. The Royal Swedish Academy awarded Nordhaus the prize for “integrating climate change into long-run macroeconomic analysis” and Romer for “integrating technological innovations into long-run macroeconomic analysis.”

This year’s prize carries a particular significance as it is a testament to the ever-expanding domain of economics as it overlaps with other social sciences. “Romer saw the frontiers of knowledge as also having central economic determinants. Similarly, Nordhaus recognized that the global climate – broadly speaking, nature – is not just an important determinant of human activity, but is simultaneously affecting society and affected by its economic activity. Thus, the two laureates have brought knowledge and nature into the realm of economic analysis and made them an integral part of the endeavour.”

Politically, the award could be seen as one that takes a swipe at free-market purists by picking winners who show that market economy can generate inefficient future outcomes at the global level. The award also recognizes the real threat of climate change and nudges observers towards seeing how technological improvements could help combat it.

Worth Watching

Could we have been born with memories encoded in our DNA? Experiments with rodents revealed that the animals were able to tap into their parents’ prior experiences to find ways around mazes — suggesting that parental memories were somehow imprinted in their genes. Scientists are now exploring whether traumas have an impact on DNA and could be passed down through the generations. The findings could help explain (and potentially treat) anxiety, phobias, post-traumatic stress disorders, and various other conditions (watch, runtime: 4:03).

Diplomacy + Foreign Trade

It is a slow morning on the diplomacy and trade front as all eyes shift to President Abdel Fattah El Sisi’s visit to Moscow, where he is set to meet today with Vladimir Putin. In other headlines:

- Some 57 countries have reportedly reserved plots of land in the new administrative capital to which they intend to move their embassies, according to Al Ahram.

- The Federation of Egyptian Chambers of Commerce signed a protocol with its Chinese counterpart to step up trade and investment cooperation, Amwal Al Ghad reports;

- Cairo-backed Libyan National Army commander Khalifa Haftar and rival Libyan Presidential Council boss Fayez Al Serraj have been invited for separate peace talks, sources told Asharq Al Awsat.

- Moving Australia’s embassy in Israel to Jerusalem could damage ties with Arab countries, Egypt’s ambassador to Australia Mohamed Khairat told Reuters.

Energy

ANOPC seeks EGP 1.2 bn in financing for refinery

Assiut National Oil Processing Company (ANOPC) is in talks with local banks for a EGP 1.2 bn loan as part of the financing package for a USD 1.9 bn hydrocracking facility being built by subsidiary Assiut Oil Refining Company (ASORC), sources told Al Mal. ANOPC has approached the National Bank of Egypt, Banque Misr, CIB, Arab African Bank, QNB Egypt, HSBC, Credit Agricole, and Egyptian Gulf Bank, among others. The ASORC facility would refine product received from another Assiut plant and produce Euro V-grade diesel and gasoline, among other products. ANOPC signed earlier this week contracts with Italy’s Technip and Eni for pre-construction services.

Egypt’s monthly payments to IOCs rising

Egypt’s monthly payments to international oil companies for the state’s share of output from oil and gas fields has risen more than 7% from USD 700 mn in July to USD 750 mn monthly in September thanks to the rising price of oil and a ramp up in production, an unnamed Oil Ministry source is quoted by the domestic press as saying. Egypt receives a portion of oil and gas produced by international companies and pays the companies at global prices.

El Sisi signs off on EGPC, Apache Western Desert exploration rights changes

President Abdel Fattah El Sisi has signed off on a bill that will allow the oil ministry to amend an agreement between EGPC and Apache on exploration rights in the Western Desert, according to local media.

Five qualify to bid for EUR 50 mn Zaafarana solar plant

Five international bidders have qualified to submit financial offers for an EUR 50 mn, 50 MW solar power plant in Zaafarana, sources from the New and Renewable Energy Authority (NREA) said on Monday. The companies — reportedly Spain-based Elecnor, Germany’s B Electric, Australia-based TCK Solar, India’s Vikram Solar and Chinese player NARI Group — should submit financial offers by year-end. Some 18 companies applied for prequalification in the tender.

Basic Materials + Commodities

New regulations on citrus exports to China

The Agricultural Quarantine Authority (AQA) is imposing new regulations on citrus producers selling to China as Egypt looks to grow its market share in the key export destination, according to a report in the domestic press citing unnamed sources at the authority. The new requirements address pesticide revenues and pest-control systems, among other changes.

Manufacturing

Raya, Samsung mull EGP 300 mn washing machine plant

A subsidiary of Raya Holding is studying a EGP 300 mn investment in a plant that would manufacture washing machines in partnership with Samsung, CEO Medhat Khalil tells Al Mal. Construction would begin within a year. Raya and Samsung had signed a separate USD 3.5 mn agreement earlier this year to manufacture top-loading washing machines.

Suez Methanol signs USD 35-40 mn MoU with APICORP to finance methanol facility

Suez Company for Methanol Derivatives signed on Tuesday an MoU with the Arab Petroleum Investments Corporation (APICORP) on financing its USD 35-40 mn methanol derivatives plant, according to an Oil Ministry statement. The facility, which will be built in Damietta, will target sales on the domestic market.

Alfa Masr to build EGP 50 mn paints factory in Sadat City

Alfa Masr for Coatings is looking to build an EGP 50 mn paint factory in Sadat City, CEO Osama El Zanaty said. The plant will be operational by the end of 2019. The company will seek financing under the central bank’s SME financing program, which provides subsidized funds to banks to lend on to small and medium-sized businesses.

Ahram Plastics to bring EGP 30 mn factory online in March 2019

Al Ahram Plastics expects to complete construction of its new EGP 30 mn plastics factory in Sadat City by the end of the month will begin commercial operations by March 2019, CEO Samir Sarhan told the local press.

Tourism

Seven bidders eye Downtown’s storied Shepheard Hotel

Seven unnamed Egyptian and international bidders are interested acquiring a 51% stake in a joint venture with the state-owned Egyptian General Company for Tourism and Hotels (EGOTH) to redevelop Downtown Cairo’s storied Shepheard Hotel, EGOTH head Mervat Hataba said, according to a report in Al Mal. EGOTH invited last month hotel operators and investors to bid on the project.

Telecoms + ICT

Etisalat launches trials of virtual fixed landlines

Mobile network operator Etisalat Misr has launched trial operations for its virtual fixed landline service, CEO Hazem Metwally said earlier this week. Commercial operations for the service will launch “soon” under an agreement that will allow it to use infrastructure owned by fixed-line monopoly Telecom Egypt.

Banking + Finance

Gov’t’s see leasing industry worth EGP 80 bn by 2022

Egypt’s four-year strategy to drive growth in the non-bank financial sector sees the leasing market worth EGP 80 per year bn by 2022, up from EGP 28.6 bn in 2017, Financial Regulatory Authority Chairman Mohamed Omran said, according to Al Masry Al Youm.

EDB in talks for USD 500 mn facility for trade finance?

The Export Development Bank (EDB) is starting a fresh round of talks with international lenders for USD 500 mn to finance trade between Egypt and African countries, sources told Masrawy.

On Your Way Out

** #9 – Is modern pentathlon Egypt’s new squash? Not content with dominating the world squash rankings, Egyptian athletes are now turning their attention to modern pentathlon. Ahmed El Gendy won gold for Egypt in the modern pentathlon on Sunday at the Buenos Aires 2018 Youth Olympic Games. El Gendy’s win marks Egypt’s third gold in the sport: Salma Abdel Maksoud landed our first-ever Olympic pentathlon medal the day before. Between them, Abdel Maksoud and El Gendy have taken home three gold and one silver in modern pentathlon at the games — winning three of the four gold medals on offer. Modern pentathlon includes fencing, freestyle swimming, equestrian show jumping, and a combined pistol shoot and cross-country run.

The publisher of EgyptAir’s in-flight magazine has agreed to stop printing copies of an issue that included an article on actress Drew Barrymore that sparked controversy for its content in recent weeks, the AP reports. The national flag carrier is also pulling existing issue of the magazine, Horus, from its planes.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Tuesday): 13,689 (+1.2%)

Turnover: EGP 898 mn (27% above the 90-day average)

EGX 30 year-to-date: -8.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.2%. CIB, the index heaviest constituent ended up 1.3%. EGX30’s top performing constituents were Juhayna up 5.9%, Ibnsina Pharma up 4.6% and Elsewedy Electric up 3.4%. Yesterday’s worst performing stocks were SODIC down 5.7%, Egypt Aluminum down 0.6%, and Edita ended flat. The market turnover was EGP 898 mn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +84.6 mn

Regional: Net Long | EGP +17.4 mn

Domestic: Net Short | EGP -101.9 mn

Retail: 44.8% of total trades | 42.3% of buyers | 47.3% of sellers

Institutions: 55.2% of total trades | 57.7% of buyers | 52.7% of sellers

Foreign: 36.0% of total | 40.7% of buyers | 31.3% of sellers

Regional: 11.6% of total | 12.6% of buyers | 10.6% of sellers

Domestic: 52.4% of total | 46.7% of buyers | 58.1% of sellers

WTI: USD 72.22 (+0.42%)

Brent: USD 81.70 (+0.36%)

Natural Gas (Nymex, futures prices) USD 3.25 MMBtu, (+0.37%, November 2018 contract)

Gold: USD 1,228.70 / troy ounce (-0.19%)

TASI: 7,666.80 (+1.31%) (YTD: +6.10%)

ADX: 4,930.90 (-0.04%) (YTD: +12.11%)

DFM: 2,727.87 (+0.55%) (YTD: -19.06%)

KSE Premier Market: 5,171.67 (-0.65%)

QE: 10,031.59 (+2.01%) (YTD: +17.69%)

MSM: 4,451.65 (-0.20%) (YTD: -12.70%)

BB: 1,311.64 (-0.33%) (YTD: -1.51%)

Calendar

Second week of October: NI Capital expected to select winning bid in its tender for the management of Alexandria Containers & Cargo Handling’s stake sale.

Mid-October: IMF delegation due in town for its fourth review of Egypt’s economic reform program.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

28 October (Sunday): 2018 Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

01-02 November (Thursday-Friday): Annual Middle East Conference on Business Angel Investment, El Gouna, Egypt

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

17-19 November (Saturday-Monday) ElectricX-Energizing The Industry, Egypt International Exhibition Center, Cairo, Egypt

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “ The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.