- Pipeline sale unlocks Israeli imports — Egypt is now the East Med’s premier energy hub. (Speed Round)

- Egypt ends natural gas imports. (Speed Round)

- House is back in session on Monday + other stories we’re tracking this week. (What We’re Tracking Today)

- Central bank leaves interest rates unchanged. (Speed Round)

- Sarwa prices IPO at EGP 7.04-8.00 per share, trading to start on 15 October. (Speed Round)

- Sawiris criticizes crowding out of the private sector + gov’t is now biggest importer of live cattle and frozen beef. (Speed Round)

- CBE looks to introduce nano credit. (Speed Round)

- 220 people want to run our SWF; exec regs should be in front of PM by mid-October. (Speed Round)

- Egypt’s rights and freedoms take another beating in the foreign press. (Egypt in the News)

- New Balmain collection inspired by Ancient Egypt. (On Your Way Out)

- The Market Yesterday

Sunday, 30 September 2018

Gas dream comes true.

(A headline we never thought we’d write … on so many levels)

TL;DR

What We’re Tracking Today

It’s the last day of September — and of Q3 while we’re at it. Happy start of earnings season, ladies and gentlemen. We also hope you’re already working on your 2019 plans and budgets — an exercise that is always equal parts agony and ecstasy around here. Musical accompaniment for today’s issue? That could only be Green Day.

It’s shaping up to be a big week in this part of the world, though we expect media attention will be focused squarely on the US of A given the ongoing saga that is the nomination of Brett Kavanaugh to sit on the US Supreme Court, where the first day of business is tomorrow (the court always starts its new session on the first Monday in October).

Stories we’re watching this week:

We have won our bid become the East Med’s premier energy hub. Call us pie-in-the-sky optimists, but that’s our takeaway from the EMG pipeline agreement announced on Thursday. Expect a wave of follow-on news and plenty of pundits weighing in. We have chapter and verse in Speed Round, below. (It’s a story we have, immodestly, owned since the second month we began publishing, so we’re rather happy to see this one through.)

The House is back in session on Tuesday at 10am.Avoid Downtown at all costs. We’ll have a special preview for you of what lawmakers have in store for us.

What FX and interest rates are you using for your new budget? With budget season slamming into the EM Zombie Apocalypse and the CBE’s consequent decision on Thursday to leave rates on hold, we’re all going to be hearing a lot about that — and debating when / whether capex spending should be back on your agenda.

Also: What’s your average wage rise going to be in your 2019 budget? For blue-collar workers? For white-collar staff? Inflation is cooling, but wages haven’t quite caught up to pre-float levels. If you care about the long-term health of your company, it’s a question you’re going to be asking.

Promoting industry in the boonies: Trade and Industry Minister Amr Nassar is set to unveil on Monday a new national initiative aimed at developing local industry. Details are still fuzzy, but it looks set to target supply-chain integration, if a ministry statement (pdf) is anything to go by.

It’s PMI week: The purchasing managers’ index for Egypt (as well as the UAE and Saudi) is due out on Wednesday, 3 October. Look for it here when it arrives a bit after 6am CLT.

We’re probably going to get a kick or two from the American press given that US First Lady Melania Trump is due in town this week as part of an African tour to “promote child welfare and education.” Her visit will also take her to Kenya, Ghana and Malawi.

Is El Sisi heading to Russia? President Abdel Fattah El Sisi will visit Moscow “soon,” Russia Today cited Russian Deputy Foreign Minister Mikhail Bogdanov as saying, according to Extra News. Bogdanov offered no further details on timing, but the groundwork is likely in place: Foreign Minister Sameh Shoukry met with his Russian counterpart, Sergey Lavrov, on the sidelines of the UN General Assembly in New York on Friday to discuss strengthening relations and cooperation, according to a Foreign Ministry statement.

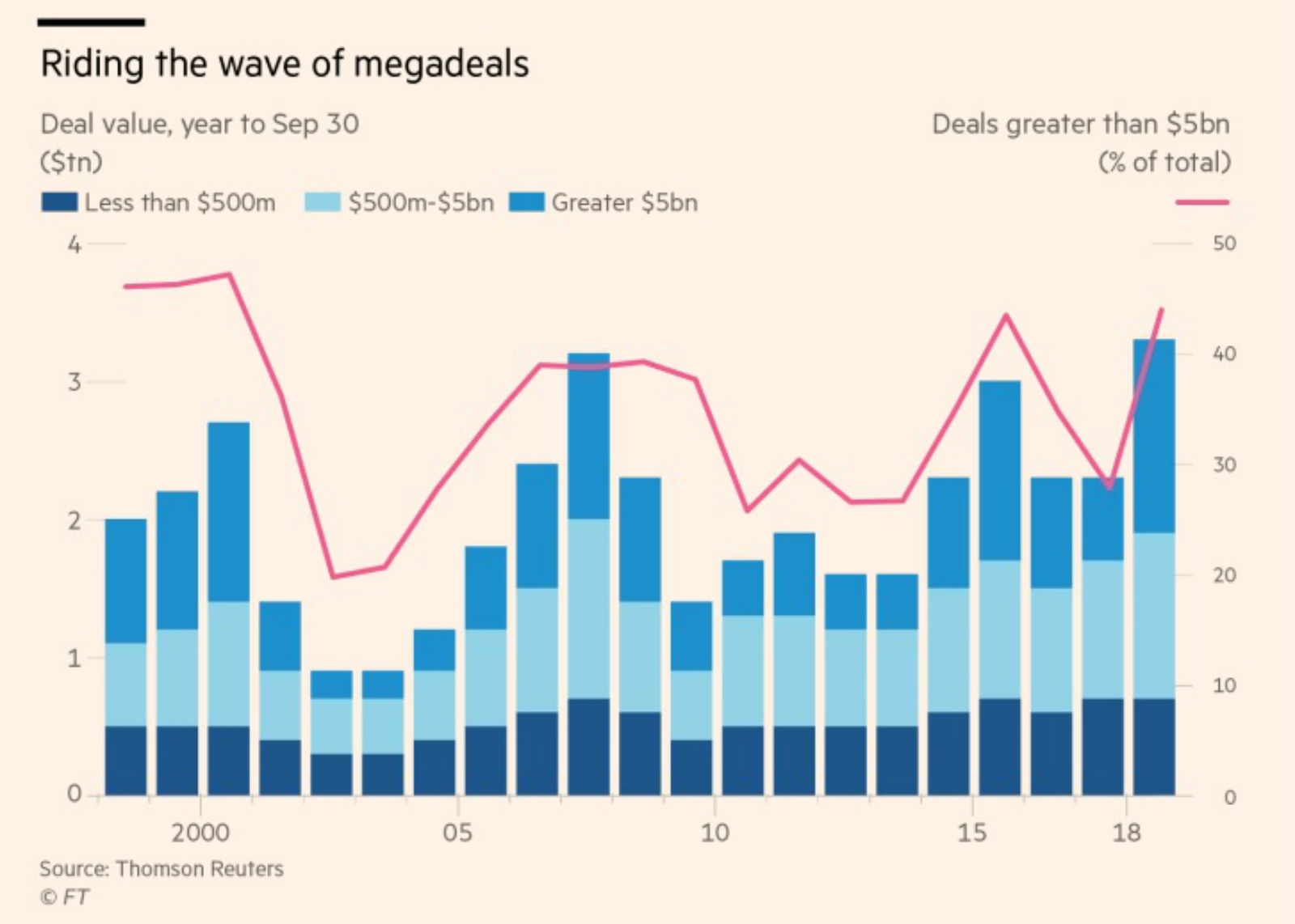

Global M&A in 9M2018 beats pre-financial crisis record: Global M&A activity during the first nine months of 2018 has crossed the USD 3.3 tn mark, “eclipsing a previous high reached on the eve of the financial crisis more than a decade ago,” according to the Financial Times. Energy, healthcare, and technology transactions have led the way. If M&A continues at the same pace through year’s end, total M&A activity could reach USD 4.3 tn, the salmon-colored paper notes. Announced transactions during the period were up 39% y-o-y, propelled by “a string of mega [transactions], defined as takeovers worth more than USD 5 bn.”

Pity the investment bankers: Investment bankers’ cuts, however, have taken a 4% dip, partially as a result of lower IPO fees and those generated by M&A advising.

The grass is always greener: Investment bankers want to be commercial bankers. And now commercial bankers want to run investment banks, according to this Bloomberg piece on Barclays boss Jes Staley, arguing that he has “staked Barclays’ future on investment banking.” Best line? Staley “plucks out his Barclays credit card and holds it up: ‘This card is the biggest risk in the bank.’”

In miscellany this morning:

- The latest from the EM Zombie Apocalypse: We’re all going to take it in the teeth on USD 80+ oil. (Wall Street Journal)

- Elon Musk will resign as Tesla chairman but remain CEO in a settlement with the SEC that will see him stay in the public-markets game. (Reuters)

- Canada and the US are expected to reach accord on the terms of a new North American Freetrade Agreement as early as today. (Bloomberg)

It’s Nobel week, but the best prize of them all — for the dismal science — won’t be unveiled until next week. You can expect:

- Physiology or medicine: Monday

- Physics: Tuesday

- Chemistry: Wednesday

- Peace: Friday

- Economics: A week from tomorrow

You can follow the announcements on the Nobel website as they roll out.

Enterprise+: Last Night’s Talk Shows

Gas dominates airwaves: News that natural gas imports are officially a thing of the past dominated discussion on the airwaves on what was an otherwise bland night (We have more in the Speed Round, below). But the EMG pipeline agreement that paves the way for imports from Israel? Not so big a topic.

Egypt will save around USD 1.5 bn a year by cutting LNG imports, Oil Minister Tarek El Molla told Amr Adib on El Hekaya, adding that domestic production is more than enough to cover domestic demand for LNG (watch, runtime: 5:14). El Molla said the move brings Egypt one step closer to its goal of becoming a regional energy hub, particularly with its existing liquefaction facilities that could potentially see it establish an underwater pipeline with Cyprus and export gas to Europe (watch, runtime: 5:37). An extensive interview with the minister on the subject is also set to air on Masaa DMC today (watch a preview, runtime: 7:34).

Plugging the gap between production and consumption is a target the government has worked longed to achieve, Oil Ministry spokesperson Hamdy Abdel Aziz told Hona Al Asema. The ministry plans to use its added capacities in value-adding industries, such as petrochemicals, and also continue to expand and connect more homes to the national grid. Ongoing exploration work in the Mediterranean is bound to reveal new gas fields, Abdel Aziz added (watch, runtime: 5:42).

Former EGPC deputy head Medhat Youssef called both Al Hayah fi Misr and Hona Al Asema to express just excited he is that Egypt achieved natural gas self-sufficiency (watch here, runtime: 8:59 and here, runtime: 2:51).

The UAE’s Emaar Properties is a big believer in the future of real estate in Egypt, founder and Chairman Mohammed Alabbar told Amr Adib in a pre-recorded interview. The company is in talks to acquire land in the new capital and other areas around Egypt (watch, runtime: 1:28) and is also taking part in various government tenders, he said (watch, runtime: 0:46). Emaar is also spending some EGP 1.5 bn on the marina it’s building in its North Coast development Marassi, which it intends to put on the global map (watch, runtime: 2:11).

Another Facebook breach? Tech expert Mostafa Abu Ghamra appeared on Hona Al Asema to discuss a hack that saw Facebook leak the personal information of some 50 mn users. His advice: Change your password as soon as possible and turn on two-step verification (watch, runtime: 26:15). Adib also urged viewers to do the same (watch, runtime: 1:12).

Are railway drivers dodging random drug tests? Recent reports from the National Railway Authority’s HR department indicate that many drivers and staff members have been avoiding random tests, which were instituted last year after a deadly train collision near Alexandria. according to Masaa DMC’s Eman El Hosary. Staff members who refuse to take the test are suspended for six months, according to authority boss Ashraf Raslan, who claims that only 1.5-2% of the samples test positive (watch, runtime: 13:00).

Meanwhile, water conservation and consumption were the topic of the night on Al Hayah Fi Misr, where Irrigation Ministry spokesperson Yousry Khafagy appeared to discuss measures the government has taken in that regard as well as cooperation with Nile Basin countries (watch, runtime: 30: 48).

Speed Round

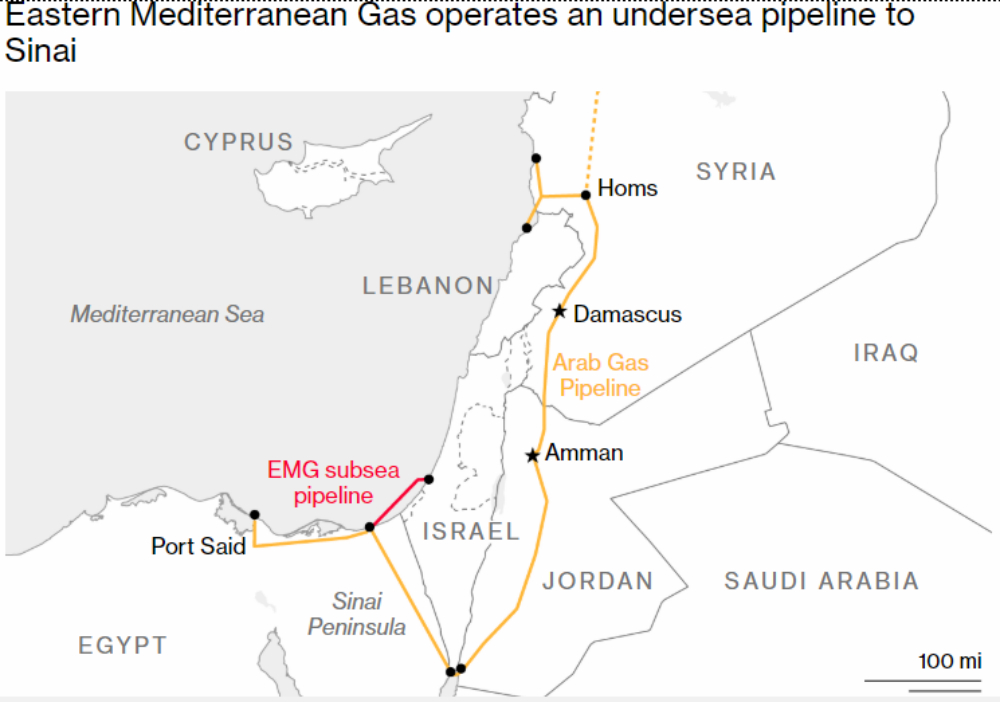

We just became the East Med’s premier energy hub: The operators of Israel’s Leviathan and Tamar gas fields, Noble Energy and Delek, along with their Egyptian partner East Gas, have signed agreements to acquire a 39% stake in pipeline operator East Mediterranean Gas (EMG). This paves the way for the gas field operators to export natural gas to Egypt under a USD 15 bn agreement signed in February with Alaa Arafa’s Dolphinus Holdings. “[The agreements] represent another major milestone toward Egypt’s goal to become a regional energy hub, providing access to both growing domestic markets and existing LNG export facilities,” Noble Energy said in a press release on Thursday morning. “With these agreements, we are securing the capacity to deliver on our firm gas sales agreement with Dolphinus for Leviathan while also allowing for interruptible sales from Tamar into Egypt,” the statement read.

The mechanics of the agreement: The agreement grants the three companies access to EMG’s 90 km pipeline connecting Israel’s grid to Egypt’s at El Arish, according to the statement. The partnership will pay USD 518 mn for the stake, with Noble and Delek each paying USD 185 mn, while East Gas will pay USD 148 mn, Reuters reports. Noble Energy will own an indirect and effective 10% stake in the pipeline.

Agreement opens up private sector natural gas import licenses… The Oil Ministry is ready to consider permit requests from the private sector to help Egypt become a regional hub for gas trading, Oil Ministry spokesperson Hamdi Abdel Aziz said in a statement (pdf). “The ministry welcomes this new step by the private companies responsible for the commercial project’s implementation,” he said of the agreement. The Natural Gas Regulatory Authority postponed earlier this month the issuance of natural gas import licenses to private sector companies, ostensibly because the private sector was “unprepared.” EGAS has renewed preliminary approvals giving Qalaa’s TAQA Arabia, BB Energy and Fleet Energy the import licenses.

…and clears arbitration cases: “The [agreement] will also entail the settlement and waiver by the sellers, their shareholders and affiliates of any claims, actions or awards related to arbitrations against the Government of Egypt and state owned companies,” according to an emailed statement by Alliance Law Firm (pdf), which was buy-side legal counsel on the transaction. Sources had told Bloomberg last month that the Egyptian government has reached an agreement to reduce the USD 1.76 bn international arbitration ruling against EGAS, EGPC and East Mediterranean Gas (EMG) to around USD 470 mn and would be amortized over a period of around 15 years. Negotiations are with banks for financing to cover it.

Gas exports to begin in early 2019: “The partnership intends to act to close the transaction and begin piping natural gas from Israel to Egypt as early as the beginning of 2019,” Delek said in a statement. By the end of 2019, 350 mcf/d is expected to be pumped to Egypt from the gas fields, supplying around 64 bn cbm of gas over a 10-year period. Delek and its partners will begin working on reversing the flow of the EMG pipeline, which used to carry Egyptian gas to Israel. The companies still need to test the state of the pipeline, according to Bloomberg.

Delek has a short investor presentation (pdf)and a long statement (pdf) breaking down the transaction.

It’s all coming together nicely: Inking the 10-year agreement with Dolphinus is only the most recent step in Egypt’s march to become the premier export hub of East Mediterranean gas to Europe and other markets. Egypt signed an agreement with Cyprus last week that would see the two sides build a USD 1 bn pipeline connecting gas from Cyprus’ Aphrodite field to Egypt’s liquefaction plants. Production at the supergiant Zohr field is ramping up, breaking the 2 bcf/d mark earlier this month, bringing the country’s total production up to 6.6 bcf/d.

More yet to come: Eni and Tharwa Petroleum were also said to have kicked off drilling at the Noor gas field in North Sinai last week. Market expectations are high: Eni, which holds an 85% stake in the field, denied in recent months reports claiming that it had discovered 90 tcf of reserves there, or 3x as much as Zohr. The Oil Ministry had also signed in the past month new exploration agreements that are together worth more than USD 1 bn with Shell and Malaysia’s Petronas, as well as Rockhopper, Kuwait Energy and Canada’s Dover Corporation.

The story topped coverage of Egypt in the foreign press on Thursday, with all stating how historic it was. Bloomberg noted that Israeli energy stocks soared on Thursday, while some, including Haaretz, are playing up how the agreement has brought the former enemies together.

Additional reading: Last month, Bloomberg uncovered the web of offshore companies that established the partnership, with a company based in Cyprus and another in the Netherlands. It also revealed that a 37% stake in EMG was bought by Sam Zell and Yosef Maiman, who won arbitration cases against Egypt.

Egypt has pulled the plug on natural gas imports. The pipeline news came as Egypt received its final shipment of imported liquefied natural gas last week, Oil Minister Tarek El Molla told the press yesterday, Reuters reports. El Molla — who did not specify the size of the most recent shipment or total volume of LNG received this year — had previously said that Egypt that LNG imports would come to an end as of October and that Egypt was due to begin exports by January 2019, as more output from gas fields is connected to the national grid. Capacity from the supergiant Zohr gas field had reached 2 bcf/d earlier this month, bringing the country’s total production up to 6.6 bcf/d. Zohr is expected to hit peak production at 2.7 bcf/d next year.

The Central Bank of Egypt left key interest rates unchanged on Thursday, as was widely expected. The CBE’s monetary policy committee left overnight deposit and lending rates on hold at 16.75% and 17.75%, respectively, while the main operation and discount rates were also maintained at 17.25%, the CBE said in a statement. Despite the challenging climate as a result of the emerging markets sell-off, the CBE sees that “the pass-through to domestic inflation from developments in emerging market economies remained contained due to stabilization and structural policies that support improving macroeconomic fundamentals.” Most analysts held the view that the MPC would need to keep rates high to preserve Egypt’s competitiveness in the battle for hot money fleeing EM for higher rates (and more stability) in the United States.

CBE says inflation moving as expected: The central bank’s statement said it expects inflation to come in at c.13% in 4Q2018 before dropping to the single digits “after the temporary effect of fiscal supply shock dissipates.” Annual headline inflation climbed to 14.2% in August, up from 13.5% in July, while monthly inflation eased to 1.8% from 2.4%.

IPO WATCH- Sarwa prices IPO at EGP 7.04 to EGP 8.00 per share, trading to start on 15 October: Consumer and structured finance player Sarwa Capital announced yesterday that it expects to price its initial public offering at EGP 7.04 to EGP 8.0 per share. Our friends at Sarwa are hoping to raise EGP 2.1-2.4 bn from the sale of c. 295 mn ordinary shares on the EGX, which make up 47.2% of the company, after receiving the green light from the FRA. Some 90% of the shares on offer are earmarked for global institutional investors in countries including the US, UK, South Africa and the Gulf. Another 29.5 mn shares have been set aside for retail investors, according to a company statement (pdf). The subscription period for the retail offering will run from 3-10 October, with the final share price set to be announced on 4 October, once the book building process is complete. Selling shareholders will use a portion of proceeds from the transaction to buy up EGP 700 mn’s worth of shares at the offer price in a closed subscription. Trading in Sarwa’s shares should start on 15 October.

Advisers: Beltone Investment Banking is acting as sole global coordinator and bookrunner for the transaction, and Matouk Bassiouny has been tapped as legal counsel.

IPO WATCH- EGX confirms CIRA shares to start trading on 1 October: The first day of trading on shares of private sector education outfit CIRA’s IPO will be Monday, 1 October, according to a bulletin by the EGX on Thursday. Appetite for the company’s shares was strong, with the retail tranche having been 18.9x oversubscribed, while the institutional offering was 10.4x oversubscribed.

Advisers: EFG Hermes is sole global coordinator and bookrunner for the transaction. Al Tamimi & Co. is acting as the issuer’s local counsel, while Zulficar & Partners is domestic counsel to the underwriter. White & Case is international counsel to the issuer, while Gide Loyrette Nouel is doing duty for the global coordinator and bookrunner. Inktank Communications is serving as investor relations advisor to CIRA.

M&A WATCH- OIH hires BDO to conduct FV report on Nile Sugar: Orascom Investment Holdings (OIH) has hired BDO Corporate Finance to do a fair value report on Nile Sugar Company before a possible acquisition, OIH said on Thursday, according to an EGX filing (pdf). Naguib Sawiris had said last week that the company was expected to complete the transaction by year’s end. Reuters also has the story.

Sawiris criticizes crowding-out of the private sector: Naguib Sawiris criticized the involvement of state- and military-owned firms in a number of key economic projects. Sawiris reportedly made the remarks in an interview with DPA picked up by Gulf Times. “We need to reduce the government’s interference in business and we need to encourage the private sector. We still have a lot of problems,” Sawiris said. He was particularly critical of the involvement of state firms in construction and housing, saying that “there are private construction companies for [these projects].”

Private livestock importers have also been pushed out of the market since the EGP float, making the ministries of supply, agriculture and defense now “Egypt’s largest importers of live cattle and frozen beef,” according to a report from the US Agriculture Department’s foreign service (pdf). The report expects local beef production to rise moderately next year as the expanding population generates increased demand.

Egypt received the third and final USD 500 mn tranche of a USD 1.5 bn African Development Bank loan on Thursday, according to an Investment Ministry statement (pdf). Authorities will use the funds to finance development projects and provide services to citizens in under-developed regions, Minister Sahar Nasr said. The bank is expected to dole out further financing to support Egypt’s private sector and development in the Sinai Peninsula during the coming period, the statement says, without providing further details. Nasr had met with a delegation from AfDB earlier this month to discuss its 2015-2019 cooperation strategy with Egypt.

CBE looks to introduce nano credit: The central bank is looking at introducing nano lending — providing mobile-based cash loans — as part of the third phase of its mobile banking strategy, CBE Sub-Governor for Payment Systems and Business Technology Ayman Hussein said on Thursday, according to Al Mal. The new nano credit system will also allow users to deposit savings. Under the system, credit scorer iScore will be allowed to monitor transactions to provide credit ratings for users.

220 people want to run our SWF: Egypt has received some 220 applications from potential managers for its new EGP 200 bn sovereign wealth fund, according to Planning Minister Hala El Said. The applicant pool for the CEO post is a mix of local and global talent, a source close to the search tells us. In all, some 400 individuals applied for the manager’s position or other posts. A shortlist for the manager’s gig is will be in Prime Minister Mostafa Madbouly’s hands by mid-October, with our source telling us that the independent committee includes reps from the financial, law and business communities as well as economic exports.

The executive regulations for the law governing the SWF should be with Cabinet for review by mid-October, our source tells us.The Ministry of Planning is working on the regs together with a team including PricewaterhouseCoopers, Baker McKenzie and Sarie-Eldin & Partners.

Madbouly is now reviewing nominations for the SWF’s board of directors and the general assembly and will present names to President Abdel Fattah El Sisi, who has final signoff on appointments to both bodies. The SWF CEO’s position was advertised in the Financial Times, the Economist and the domestic press earlier this month. The deadline for applications was last Thursday.

MOVES- AXA Egypt Health Insurance has tapped Ayman Kandeel as CEO, effective tomorrow, says Amwal Al Ghad. Kandeel moved over from sister firm AXA Egypt Investments.

CORRECTION- We garbled an S&P statement on the revision of its outlook on NBE and Banque Misr. We had said that the ratings agency revised it to ‘positive’ from ‘stable,’ when it was the other way around: From ‘stable’ to ‘positive.’ The story has since been corrected on our website. We regret the error.

The Macro Picture

There’s something rotten in the state of global trade, says UNCTAD: The United Nations Conference on Trade and Development (UNCTAD) has issued a grim warning on what the state of global trade, corporate power and debt mean for emerging market economies.

The current system of multilateral and hyperglobalized trade is making the world less equal and fueling an economic malaise, whose symptoms include trade wars. “While the economy has picked up since early 2017, growth remains spasmodic, and many countries are operating below potential,” UNCTAD says in its Trade and Development Report 2018. “This year is unlikely to see a change of gear,” the report says. “The immediate pressures are building around escalating tariffs and volatile financial flows but behind these threats to global stability is a wider failure – since 2008 – to address the inequities and imbalances of our hyperglobalized world,” said UNCTAD Secretary-General Mukhisa Kituyi.

The report names two main culprits: Growing global debt, particularly among emerging economies, and concentration of corporate power. “Private debt has exploded, especially in emerging markets and developing countries, whose share of global debt stock increased from 7% in 2007 to 26% in 2017,” it said. Over the same period, the ratio of debts racked up by non-financial businesses in emerging markets increased from 56% in 2008 to 105%. On corporate domination, the report had this to say: “Recent evidence from non-oil exports shows that, within the restricted circle of exporting firms, the top 1% accounted for 57% of country exports on average in 2014. The distribution of exports is thus highly skewed in favor of the largest firms.”

Oh, and and UNCAD also writes that infrastructure investments typically fail to result in sustained economic growth. It blames the influence of finance and the increased reliance on the private sector for funding.

You can catch the landing page for the report here or read the full report here (pdf).

Image of the Day

Is Egypt’s calligraphy scene seeing a resurgence? It would appear so, when looking at some of the modern uses of the ancient art form, Nick Leech writes for the National. Cairo’s urban landscape and art scene appear to be providing the fuel for this resurgence, according to Khatt: Egypt’s Calligraphic Landscape, a new book by photographer Noha Zayed. Along with some stunning photos, the book surveys the continued popular use of hand-painted typography and calligraphy throughout Egypt in a series of essays and interviews.

Egypt in the News

Egypt’s rights and freedoms records took yet another beating in the foreign press over the weekend, with the case of Amal Fathy — an activist who was penalized after posting a video on social media speaking against [redacted] harassment — at center stage. Amnesty International called on authorities to “immediately and unconditionally release Fathy,” who received a suspended two-year sentence on charges of “spreading false news,” says Reuters. The story was widely picked up by news outlets including the AP, AFP, Wall Street Journal, and Washington Post.

Fathy’s sentencing came one day after a group of UN human rights experts issued a statement criticizing Egypt for using its anti-terrorism law as a “pretext” for detaining rights defenders. Also on Friday, the Committee to Protect Journalists (CPJ) held a panel discussion at the UN General Assembly where they singled out countries, including Egypt, for imprisoning journalists. All of that comes as the Economist cited the recent arrests of retired diplomat Masoum Marzouk and a geology professor, as signs that authorities have grown “even more intolerant of dissent.”

In policy shift, military said to be arming Bedouins: The Armed Forces appear to be arming Bedouin tribes in Sinai for Operation Sinai, in a shift of a longstanding policy of solely relying on them for intelligence, writes Brian Rohan for the AP. The change in tactic signals a positive shift in the relationship between Bedouins and the army. “At the very least, the cooperation shows local residents expect the army to win eventually,” blogger Greenfly told the newswire. At the same time, the shift also highlights the success of the operation, which has driven Daesh out of coastal cities and into the interior of the Peninsula, requiring a greater role for the Bedouin.

Other headlines worth noting in brief include:

- Governor kicks Mickey Mouse out of school: The governor of Qaliubiya apparently ordered replacing paintings of Disney figures in Egyptian pre-schools with images of martyrs killed fighting militants, the Associated Press reports. The idea has (of course) caused a ruckus on social media.

- Theology wars claim another monk? An autopsy on a Coptic monk revealed signs of poisoning, the AP reports. The monk had been posted to a monastery at which an abbot was killed over ecclesiastical disputes.

- Trans rights in Egypt: Many Egyptian women believe transgender women should have the same rights, despite trans women having a difficult time living openly in Cairo, according to a Thomson Reuters Foundation poll carried by Reuters. “A significant number” of the respondents initially did not know what a transgender woman is.

- Giza Plateau overhaul back on the menu: Egypt’s Giza Plateau development project was revived when tourism began its recovery from its post-2011 slump, Los Angeles Times says.

- Another Brit gets food poisoning: Another British tourist was hospitalized in Egypt after allegedly contracting food poisoning at a Hurghada resort, Daily Mirror says.

- Israeli tourism: Biblical vistas meet modern-day security as Israelis visit Sinai for the Sukkot holiday celebrations, Reuters.

Worth Watching

New film about gay men in the Middle East to debut in secret screening: Egyptian filmmaker Sam Abbas attempts to portray the “reality” of gay men living in the Middle East in his new movie ‘The Wedding.’ The film, whose events center around the story of a secretly gay man as he prepares to marry a woman, “will show in secret, invitation-only screenings in the Middle East in November to protect viewers,” according to Reuters (watch the trailer, runtime: 2:23).

Diplomacy + Foreign Trade

US begins talks with Arab officials over NATO-style regional alliance: US State Secretary Mike Pompeo met with the foreign ministers of Egypt, Saudi Arabia, UAE, Bahrain, Kuwait, Jordan, and Qatar in New York on Friday to further discussions on the creation of a NATO-style Arab military alliance to promote regional security. Talks on the establishment of the Middle East Strategic Alliance (MESA), which would combine forces from all eight countries, were “productive” and are set to continue over the coming period, the State Department said in a press release. Little was added in the way of detail, apart from the fact that “all participants agreed on the need to confront threats from Iran directed at the region and the United States.” Sources had said in July that US President Donald Trump was planning an October summit to discuss the MESA with Arab leaders. US Deputy Assistant State Secretary for Persian Gulf Affairs Tim Lenderking has been on a tour of the region trying to win support for the alliance, according to PressTV.

Resolving the dispute between Doha and its neighbors is a necessary prerequisite to the MESA’s establishment, Qatari Foreign Minister Sheikh Mohammed bin Abdulrahman Al Thani said, the Associated Press reports. He said that the situation was still at a deadlock. Egypt had joined Saudi, Bahrain, and the UAE in boycotting Qatar in mid-2017, demanding that the statelet sever ties with Iran, stop funding known terrorist organizations, and shut down news network Al Jazeera.

Energy

ANRPC launches trial operations at USD 219 mn fuel production unit

The Alexandria National Refining and Petrochemicals Company (ANRPC) has launched trial operations at its new USD 219 mn octane production unit, according to an Oil Ministry statement (pdf). The project will produce an annual 700k tonnes of 92-95 octane fuel, bringing the country’s total output to 1.5 mn tonnes a year. The facility — which will direct its output toward the local market — will also produce an annual 38k tonnes of butane, as well as hydrogen. Oil Minister Tarek El Molla had previously said that ANRPC’s new project is set to go live next month. The minister said to expect more refining capacities to come online over the coming two years as the government steps up efforts to boost local production in order to reduce its fuel import bill.

ENOC to distribute and market jet fuel in Egypt

Abu Dhabi’s Emirates National Oil Company (ENOC) signed an agreement with the EGPC on Thursday that would allow it to market and distribute jet fuel, according to an Oil Ministry statement.

Infrastructure

Bolloré, Toyota and NYK to build car-trade center in Port Said

The Suez Canal Authority signed on Friday a USD 220 mn initial agreement with France’s Bolloré Transport & Logistics, Japan’s Toyota Alliance, and NYK to build a car trade terminal at the East Port Said Port, according to a statement. The 240k sqm terminal will be constructed under a build-operate-transfer framework. The final contract will be inked within a month.

Basic Materials + Commodities

India offers to sell Egypt rice at EGP 6,600 per tonne

India has offered to sell Egypt rice at EGP 6,600 per tonne, the head of the Federation of Egyptian Industries’ rice division, Ragab Shehata, told Al Shorouk. Shehata did not clarify how much rice Egypt is looking to buy from India. A report from the US Agriculture Department’s foreign service expected Egypt to import 300k tonnes of rice in FY2018-19 as production drops due to restrictions on the cultivation of water-intensive crops such as rice.

Tourism

Gov’t plans to make use of Oyoun Moussa’s therapeutic tourism potential

The Madbouly government is looking to potentially collaborate with the Austrian and Hungarian governments to build a healing center in the city of El Tor in Sinai, as part of a plan to turn the area around Mount Sinai into a hotspot for medical tourism, Al Mal reports

Banking + Finance

EBRD to provide Banque Misr with additional USD 50 mn in funding

The European Bank for Reconstruction and Development (EBRD) is providing Banque Misr with a new USD 50 mn trade facility its Trade Facilitation Program (TFP), the lender said in a press release on Thursday.

Other Business News of Note

Kazyon looks to open 310 new retail outlets by 2019-end

Discount supermarket chain Kazyon is planning to increase the number of stores it operates by 310 stores by the end of 2019, Marketing Head Ismail Hafez told Amwal Al Ghad. The company presently owns 420 outlets across 17 governorates and is planning to add an average of 20 stores a month. Hafez made no mention of how much Kazyon plans to spend on expansions.

Egypt Politics + Economics

SCZone settles EGP 3.4 bn worth of investor disputes

The Suez Canal Economic Zone (SCZone) has collected some EGP 3.4 bn from settling investor disputes dating back to 1998, SCZone boss Mohab Mamish said. The SCZone had decided last month to withdraw 41 mn sqm of land from companies for failing to complete projects on time.

Turkey releases Egyptian fishermen detained in Northern Cyprus

Turkey released yesterday the five Egyptian fishermen detained by the Turkish coast guard last week for trespassing over the waters of Northern Cyprus, according to a Foreign Ministry statement. The men paid EUR 500 in fines each.

Sports

Egypt to host U-23 AFCON from 8-22 November 2019

Egypt will host the upcoming U-23 African Cup of Nations football championship scheduled for 8-22 November 2019, according to the Confederation of African Football (CAF).

CAF sanctions Mortada, fines him USD 40k

The Confederation of African Football (CAF) has banned Zamalek football club chairman Mortada Mansour from football-related activities for one year and fined him USD 40,000 after he made derogatory comments about CAF officials, the organization announced (pdf).

On Your Way Out

New Balmain collection inspired by Ancient Egypt: French luxury fashion house Balmain featured pyramids, hieroglyphics, and even Nefertiti’s face in its Spring 2019 collection, Business of Fashion reports.

Two Egyptian-Swedish tech startups launched this year, Sweden’s ambassador to Cairo Jan Thesleff said yesterday. One company specializes in online retail and another in video games.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Thursday): 14,632 (+0.1%)

Turnover: EGP 1.9 bn (151% ABOVE the 90-day average)

EGX 30 year-to-date: -2.6%

THE MARKET ON Thursday: The EGX30 index ended Thursday’s session up 0.1%. CIB, the index heaviest constituent ended up 0.7%. EGX30’s top performing constituents were Egyptian Resorts up 5.8%, Eastern Co. up 5.0%, and Egyptian Iron and Steel up 2.4%. Thursday’s worst performing stocks were Edita down 9.1%, SODIC down 4.4%, and Orascom Investment Holding down 2.6%. The market turnover was EGP 1.9 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -514.7 mn

Regional: Net Long | EGP +250.4 mn

Domestic: Net Long | EGP +264.2 mn

Retail: 27.9% of total trades | 34.9% of buyers | 21.0% of sellers

Institutions: 72.1% of total trades | 65.1% of buyers | 79.0% of sellers

Foreign: 59.5% of total | 46.0% of buyers | 73.0% of sellers

Regional: 10.0% of total | 16.6% of buyers | 3.4% of sellers

Domestic: 30.5% of total | 37.4% of buyers | 23.6% of sellers

WTI: USD 73.25 (+1.57%)

Brent: USD 82.73 (+1.66%)

Natural Gas (Nymex, futures prices) USD 3.01 MMBtu, (-1.57%, Nov 2018 contract)

Gold: USD 1,196.20 / troy ounce (+0.74%)

TASI: 7,898.68 (+0.06%) (YTD: +9.30%)

ADX: 4,947.92 (+0.36%) (YTD: +12.49%)

DFM: 2,825.76 (+1.81%) (YTD: -16.15%)

KSE Premier Market: 5,345.74 (+0.17%)

QE: 9,784.31 (+0.57%) (YTD: +14.79%)

MSM: 4,523.82 (+0.50%) (YTD: -11.29%)

BB: 1,348.60 (-0.12%) (YTD: +1.27%)

Calendar

26-30 September (Wednesday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies under a directive from President Abdel Fattah El Sisi.

01 October (Monday): First day of trading on shares in CIRA’s IPO.

02 October (Tuesday): House of Representatives due back in session for its fourth term.

03 October (Wednesday): Egypt’s Emirates NBD PMI for September released.

03-10 October (Wednesday-Wednesday): Subscription period for Sarwa Capital’s IPO.

06 October (Saturday): Armed Forces Day, national holiday.

12-14 October (Friday-Sunday): 2018 annual meetings of the World Bank and International Monetary Fund, Bali, Indonesia.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.