- Gov’t giving oil majors friendlier terms in production sharing contracts. (Speed Round)

- Holiday-gate intensifies in UK tabloids. (Speed Round)

- Industry association pushing protectionist “buy Egyptian” clause in gov’t contracts. (Speed Round)

- Bourse greenlights CIRA initial public offering on EGX. (Speed Round)

- FinMin to expand hedging to other commodities, including wheat. (Speed Round)

- Egypt and China sign agreements worth USD 18.3 bn, Ittihadiya confirms. (Speed Round)

- PMI and Euromoney tomorrow, EFG London conference a week from today. (Up Next)

- All quiet in Egypt’s stands as fans return to stadiums. (On Your Way Out)

- The Market Yesterday — Rise in M2 drives FCI down in July

Monday, 3 September 2018

Egypt’s news coma ends this week.

TL;DR

What We’re Tracking Today

Look for Egypt to emerge from its August news coma this week. Fall conference season will nudge things in that direction: Euromoney’s Egypt event starts tomorrow, and we have a week to go before the EFG Hermes London conference, the fall’s premier gathering of investors focusing on opportunities in frontier and emerging markets. The EFG conference kicks off a week from today at Emirates Arsenal Stadium — check out the gathering’s website here or EFG’s thoughts on the macro backdrop here.

PSA #1: Glory Hallelujah. The Cairo governorate is kicking heavy trucks off the Ring Road from 6am until midnight beginning from September 15, state-run Al Ahram reports. Trucks needing to move at those hours will be required to take the new, army-built Regional Ring Road. Madbouly Cabinet spokesperson Ashraf Sultan made the rounds on the talk shows last night to explain that the move would reduce traffic in the city by 30-40% (watch, runtime: 2:27). We’ve heard (and reported on) the banning of trucks from the Ring Road in the past, so here’s hoping the Traffic Police will step up enforcement this time around.

PSA #2: The national weather service is warning of torrential downpours later this morning. Starting from 22 September, there’s a fair chance of thunderstorms and heavy rains on the northern coasts of Alexandria, with torrents expected in Upper Egypt governorates, the Red Sea and Sinai, AMAY reports. It is unclear how long the rain will last, and we remind readers that in a nation that doesn’t, strictly speaking, have ‘weather,’ long-range forecasting is something of an imperfect art.

The Fragile Five are back. That’s lazy, sell-side shorthand for emerging market economies at risk because of their over-reliance on external debt, and the Financial Times says it includes Turkey, Argentina, India, South Africa and Indonesia. Breathe a sigh of relief that Egypt isn’t yet on the list — and expect that some bored analyst will soon put us there. The term, which had fallen out of disuse for a period, is back now in the FT’s “your holiday is over, welcome back to fall 2018” piece, set against a backdrop of a strengthening greenback, rising US interest rates and fears of contagion arising from the unmitigated disasters that are Turkey and Argentina at the moment. The FT expects Turkey’s meltdown to accelerate todayamid signs of rising corporate distress and the release of data expected to show runaway inflation. Meanwhile, the bloodbath Franklin Templeton has taken in Argentina is spooking fund managers near and far.

Want a bullet-by-bullet look at how this could shape up to be a really bad week for emerging markets? Bloomberg is happy to play to your angst.

ESG. Sustainability. Impact investing. Even the old-school “socially responsible.” It’s all the rage in certain circles these days — and incredibly squishy to define. The idea is simple: “The ethical-investment industry started as a do-gooder niche that excludes so called ‘sin’ stocks, like tobacco” — we’re looking at you, Eastern Company — “and weapons companies. But it is now mostly dominated by another idea: Companies that avoid crooked management, promote diversity or insulate themselves from environmental fines will outperform companies that don’t,” notes the Wall Street Journal. The catch is that while ratings agencies seem to be in cahoots (what’s new?) on what constitutes ESG, providers of ESG indexes including MSCI, Reuters and FTSE are far from being on the same page. Go read: Why it’s so hard to be an ‘ethical’ investor.

Repeat after us: You do *NOT* want to take venture capital. You do *NOT* want… That’s the takeaway from a very on-point piece from Recode, which points out that you can build a very large, very sellable consumer-focused business with some combination of internal cashflows, comparatively small equity raises, bank debt and pure moxie — you know, the way it once was before we fetishized the cult of VC? Read: The rise of giant consumer startups that said no to investor money.

The new school year is starting. Should you consider unschooling your kids? It’s not the same thing as homeschooling: It’s a “parallel universe … where kids don’t do homework, don’t take tests and don’t worry about grades. For acolytes of unschooling, kids call the shots and direct their own learning. There’s no rigid structure, no provincially prescribed curriculum and no bell at the end of the day. An unschooled kid with a preternatural interest in the Jurassic Period, for example, might spend a few weeks learning about every single dinosaur of that era.” The Globe and Mail has a rundown on the idea and profiles of four families making it work.

We’re geeks here at Enterprise. That’s well-established. So consider the fascination of the two biologists-turned-policy-geeks on staff when we read that microwave weapons are prime suspect in what appear to be deliberate attacks on U.S. embassy workers with a mystery weapon. The NYT’s William Broad takes you on a whodunnit at the intersection of spycraft, science fiction and geopolitics, concluding that a little-discussed class of weapons has probably been used against US diplomats.

Enterprise+: Last Night’s Talk Shows

The talking heads jawed about everything from pollution to China and Mo Salah last night.And we’re still puzzled as to when Lamees Al Hadidi will be returning to the airwaves.

Env’t ministry fuming over “most-polluted city in the world” designation: The Environment Ministry is fuming (no pun intended) about a recent study by a UK outfit called the Eco Experts that Cairo is the most polluted city in the world, which happened to be picked up by Forbes Middle East. Ministry spokesperson Abdel Gawad Abu Kab attacked the data on Masaa DMC, casting aspersions on Forbes’ “journalistic integrity” and claiming that this is the second year in a row the magazine picked up the study. While he did acknowledged that pollution in Cairo is high, he claims other international agencies say the situation is improving (insert canned sitcom laugh track here).

Well, the WHO says we’re the second worst: Rep. Sherine Farag was not having any of it, launching a biting attack on the Environment Ministry’s record. She noted that the World Health Organization placed Cairo second only to New Delhi in terms of ambient air pollution in a 2016 study aggregating data from 2011-2015 (pdf). She attacked the ministry for failing to respond or even address the report and called for the establishment of a fact-finding committee to determine where the problem lies and force the ministry to take action (watch, runtime: 10:14).

President Abdel Fattah El Sisi’s China trip continued to receive widespread coverage on the airwaves. Pundits and former officials flocked to the airwaves to repeat ad nauseum how we’re witnessing a new golden era in relations with Beijing. Among them was former Foreign Ministry official Mohamed Hegazy, who praised the USD 18 bn in agreements signed as well as El Sisi’s address to the Communist Party Congress on the dangers of radical Islam (watch, runtime: 9:07). Egyptian-Chinese Business Council Deputy Head Mostafa Ibrahim said business relations between both countries needs another shot in the arm (watch, runtime: 6:17). Hona Al Asema’s Reham Ibrahim delved deeper into the agreements with a panel of experts (watch, runtime: 37:09).

Trial runs on phase 4A of Cairo Metro Line 3 should start in mid-October, acting head of the National Authority for Tunnels (NAT) Amr Shaat told Hona Al Asema. The Transport Ministry is planning to have phase 4B of Cairo Metro Line 3 operational by December 2019, he said, noting that Phase 4, which is expected to be completed by the year’s end, is costing the state upwards of EGP 6 bn (watch, runtime: 7:23).

Hona Al Asema’s transportation discussion continued with Madbouly Cabinet spokesman Ashraf Sultan on the government meeting held yesterday to install signalling systems to develop a smart transportation network (watch, runtime: 4:41).

And finally, Mohamed Salah’s arrival to take part in next Sunday’s national team match against Niger and his “improved” treatment by the Egyptian Football Association received a mention on Hona Al Asema. The move indicates that the EFA has responded positively to Salah’s criticism, said sports critic Essam Shaltoot (watch, runtime: 7:46).

Speed Round

Gov’t giving oil majors friendlier terms in production sharing contracts: The Oil Ministry is looking to keep international oil companies happy, having recently rolled out new production sharing contracts with some IOCs that leave the companies larger shares of profits from concessions in a bid to cut the time it takes for the companies to hit profitability on any one concession, ministry sources tell Al Masdar. The changes include eliminating a clause in the model contract that required the companies cede a additional points in their concessions to the government every two years. The new agreements also apparently raise the cost-recovery ceiling to 40% of the oil or gas produced by a concession, up from 35%, the newspaper claims. Oil and gas companies were consulted during the drafting of the changes and their recommendations factored into the changes, the source said. Caveat lector: The single-source story doesn’t cite anyone from the private sector, so we’ll be looking into this in a bit more detail in the days ahead.

And while we’re on energy, Egypt plans to ramp up gas exports to Jordan to their pre-2009 levels, an Oil Ministry official tells Al Masdar. Egypt and Jordan plan to sign a new export agreement before the year is out that would see Egypt export around 250 mcf/d of gas that the kingdom would use to fire electricity generation stations, the source added. Egypt had committed to export 250 mcf/d to Jordan under a 2004 agreement. Export levels started falling in 2009 before being stopped after the events of 25 January 2011, causing losses to the Jordanian government of around JOD 5 bn (USD 7 bn), according to previous statements by Jordan’s Energy Minister Hala Zawati. Cairo and Amman signed an amendment to the 2004 agreement last month under which Cairo will supply c. 10% of Amman’s natural gas needs.

Holiday-gate intensified on Sunday in the UK tabloids, with new reports that a British mother died in Hurghada when a banana boat in which she was riding flipped over. The incident allegedly took place last week and came a week after tourists John and Susan Cooper died suddenly at the five-star Steigenberger Aqua Magic hotel. Thomas Cook have now suspended all affiliated boat tours in Hurghada, according to the Daily Mail.

Meanwhile, reports have emerged that the room adjacent to the Coopers’ was being fumigated in the hours before the couple died, UK tabloid the Sun reports, citing “sources.” The couple’s family had reported a strange smell emanating from the room prior to their death. The UK press is presenting the Aqua Magic as a longtime problem for Thomas Cook, which BBC reports paid GBP 2,000 in compensation to a British man who contracted salmonella last year during his stay at the Aqua Magic. Thomas Cook has reportedly had to pay GBP 26k to tourists who fell ill in the past at the resort. The Daily Mail is also now showcasing a video of dirty accommodations at the hotel.

Let’s all get two things straight: First, nobody in Egypt (ourselves included) is setting out to torpedo the domestic tourism industry by reporting that we are facing a public relations crisis in one of our most important inbound markets. If you believe that, allow us, please, to help you dig a deeper hole for your ostrich head. If the issue is important enough to draw in the tourism minister herself, it’s important enough to cover. Second, the deaths of the Coopers is a tragedy, but we need to keep in mind — as we’ve written on multiple past occasions — that “English tourist goes to Egypt, gets upset tummy, vacation ruined, wants compensation” is a trope in the UK tabloid press. Beating up on non-English-speaking holiday destinations is as much mother’s milk to the British tabloid press as are the antics of D-list UK reality television stars and speculation about the [redacted] lives of the royal family.

CORRECTION: In our pickup of a Daily Mail story yesterday on another tourist death in Egypt on a Thomas Cook Holiday, we erred in writing that the death was the day before yesterday. The woman died in April after having become “violently ill after she and her husband noticed a ‘strong smell’ in their room.” The UK media outlet is drawing a direct line between that death and the recent deaths of Susan and John Cooper.

Industry association pushing protectionist “buy Egyptian” clause in gov’t contracts: The Federation of Egypt Industries has renewed calls to the government to enforce a 2015 law that would grant Egyptian goods and services preference in government contracts and tenders. The demand is part of a series of recommendations the lobby group presented to the Madbouly Cabinet on improving the investment climate. These include setting a stable tax system for industry (which, frankly, we thought we already had), eliminating a requirement that gives the government of Egypt seniority on any loan it extends or guarantees, and expanding the development of logistics zones, according to Al Mal.

IPO WATCH- Bourse greenlights CIRA IPO: The EGX board signed off yesterday on plans by leading education provider Cairo Investment and Real Estate Development’s (CIRA) to go public. The company will be added to the bourse’s database as of 4 September. Sources had previously said that CIRA was kicking off its international roadshow this week and that the private-sector education outfit was eyeing eventual expansion into markets in the Gulf, Europe, and South Africa. CIRA announced last week plans to offer up a 37.48% stake on the EGX, with the transaction set to include both an international private placement and a retail offering here in Egypt.

Advisers: EFG Hermes is sole global coordinator and bookrunner for the transaction. Al Tamimi & Co. is acting as the issuer’s local counsel, while Zulficar & Partners is domestic counsel to the underwriter. White & Case is international counsel to the issuer, while Gide Loyrette Nouel is doing duty for the global coordinator and bookrunner. Inktank Communications is serving as investor relations advisor to CIRA.

NI Capital to announce in October who’s running Eastern Co, AMOC stake sales: State-owned investment bank NI Capital will reportedly select in October the manager for the sale of additional stakes from Eastern Company and Alexandria Minerals and Oils Company (AMOC) on the EGX, sources close to the matter told Amwal Al Ghad. The deadline for financial and technical offers for the job was yesterday, the source adds.

Background: EFG Hermes is among other several investment banks invited to take part in the tender to manage the additional stake sales from the already-listed companies, which are expected to pilot the state privatization program before the end of 2018, alongside Heliopolis for Housing and Development, Alexandria Container and Cargo Handling, and Abu Qir Fertilizers. Among those invited to tender were EFG Hermes, Pharos Holding, Beltone, HSBC, and CI Capital, among others.

INVESTMENT WATCH- Etisalat Egypt to invest an extra EGP 1 bn in network upgrade upgrades: Etisalat Egypt is investing EGP 3.5 bn in network infrastructure upgrades this year, o about EGP 1 bn more than originally forecast to keep pace with demand for mobile data services, Chief Corporate Affairs Officer Khaled Hegazy tells Al Mal. The decision was driven by an uptick in the number of mobile internet users, especially after Telecom Egypt’s WE broke into the mobile market late last year, Hegazy explained, adding that upgrades are necessary to sustain the growing number of subscribers. The story provides no further background or color.

EXCLUSIVE- FinMin to expand hedging to other commodities, including wheat: It appears that the Finance Ministry is indeed to looking to initiate a program to hedge against volatility in the global price of wheat in manner similar to its fuel hedging program, a ministry source told Enterprise. The move is part of a series of initiatives announced by minister Mohamed Maait over the weekend to keep fiscal spending under control. Both Maait and the source implied that the hedging program would be expanded to include other goods Egypt imports.

Could the fuel hedging program be dead if oil prices stabilize? “There may not be a need to sign a fuel hedging agreement if global oil prices continue to stabilize,” the source told us. Oil prices have been stabilizing of late as Saudi Arabia and other leading producers adopted production cuts after oil surged beyond the USD 80/bbl mark earlier this year. That said: Crude has shot up about about 9% in the past two weeks to just under USD 78 / bbl.

Background: The government had selected last month a derivatives trading outfit to help hedge against rising oil prices, its primary strategy to counter rising oil prices.

INVESTMENT WATCH- Get ready to learn a bunch of hard-to-pronounce names as Egypt and China sign agreements worth USD 18.3 bn: The picture of is becoming clearer on the agreements signed in Beijing, as the State Information Service (SIS) announced that President Abdel Fattah El Sisi and Chinese Premier Xi Jinping have witnessed the signing of agreements worth a total of USD 18.3 bn. The projects we noted in yesterday’s edition account for the bulk of the agreements, including the second phase of the new administrative capital business district, a refinery at the Suez Canal Economic Zone, the Hamrawein “clean coal” power plant, and the the pumped-storage hydroelectric plant in Attaqa. China’s Shandong Ruyi Technology Group signed an agreement yesterday with the Suez Canal Economic Zone to develop a textiles factory there, according to SIS. Shandong Ruyi will be investing USD 6.2 bn on the new factory, according to Amwal Al Ghad. Tai Shan Gypsum Co. signed an agreement for the development of a gypsum board factory, while Xiamen Yanjan New Material Co. signed an agreement for a building materials factory.

The signing took place following a meeting between President El Sisi and China’s top business leaders on Sunday during which El Sisi pitched them on investing in infrastructure, petrochemicals, ICT, energy and logistics.

El Sisi also talked about investment with Chinese Prime Minister Li Keqiang, according to the SIS. The two leaders agreed on taking additional steps to promote Egyptian exports to China as well as boosting Chinese tourism to Egypt. El Sisi also visited the Central Party School of the Communist Party of China, the country’s top academy specializes in training government and communist party officials, according to an Ittihadiya statement.

Engagement with Ethiopia, East Africa tops Egypt’s agenda at China-Africa Forum: As we’ve previously reported, El Sisi is in Beijing for the China-Africa Cooperation Forum. The president met yesterday with a number of African heads of state yesterday. He agreed in a sit-down with Ethiopian Prime Minister Abiy Ahmed to push forward with talks to reach a final settlement on the issue of the Grand Ethiopia Renaissance Dam, Ittihadiya spokesperson Bassam Rady said. El Sisi also met with Sudanese President Omar Al Bashir, Ittihadiya said. El Sisi also discussed cooperation with Somalia’s President Mohamed Abdullahi Mohamed, says the SIS.

Education Ministry to pay Samsung USD 240 mn for tablets: The Education Ministry has contracted Samsung to supply 1 mn educational tables for the 2018-19 academic year at a cost of USD 240 mn, Al Shorouk reports, citing informed sources. The ministry had awarded Samsung with the contract, which 50 other local and international companies had been vying for. Samsung is expected to begin delivering the tablets within the coming days, according to the sources. Tablets and electronic exams were a crucial component of Education Minister Tarek Shawky’s plan to overhaul Egypt’s K-12 education system that would. Shawky had previously said the first batch of tablets would be produced locally by the ICT and military production ministries at a cost of around EGP 2.5-3 bn. Naturally, dedicated iSheep will see this as a massive waste of money that will need to be spent again in a year.

EIB plans to sign loan agreements with Egypt worth EUR 589 mn by end-2018: The European Investment Bank’s (EIB) board of directors has signed off on extending new loans to Egypt worth a combined EUR 589 mn, EIB’s North Africa and Middle East Director Flavia Palanza tells Al Mal. The loans include a EUR 214 mn facility for the Kafr El Sheikh Kitchener drainage project and another EUR 375 mn to support the country’s private sector. Palanza did not disclose further details on the latter. The bank expects to sign the agreements with Egypt before the end of 2018, according to Palanza.

Also coming from the department of large (but long term) loans: The Transport Ministry signed a EUR 243 mn loan agreement with the Export-Import Bank of Korea to finance the purchase of 32 metro cars from Hyundai Rotem, Transport Minister Hisham Arafat said, according to Al Shorouk. The loan carries a 1% interest rate and is payable over 33 years after a 20-year grace period. Egypt had signed last month an agreement with South Korea to manufacture and supply the metro cars, which will be used in the Cairo Metro Lines 3 and 4. The order makes up the second half of the 64 cars the government had planned to lock down for the new line. Hyundai Rotem was contracted last year to supply the first 32 cars under a EUR 350 mn contract. The Ministry is expected to sign soon a EUR 50 mn loan agreement with the French Development Agency (AFD) to upgrade the aging electric transmission lines and generators of the Cairo Metro Line 1, according to Amwal Al Ghad. The AFD’s board reportedly signed off on the loan, a ministry official said.

Libya declared yesterday a state of emergency in Tripoli as the death toll from fighting in recent days reached 39, Deutsche Welle reports. The fighting broke out last week between armed groups from Tripoli against others from the country’s southern suburbs, leaving around 96 wounded. Libya’s UN backed government urged rival militias to stop the fighting and abide by a UN-brokered ceasefire.

Up Next

It’s the start of fall conference season tomorrow. Euromoney starts tomorrow and the EFG Hermes London conference, the fall’s top gathering of frontier and emerging markets fund managers, starts a week from today.

It’s purchasing managers’ index day tomorrow. The Emirates NBD PMIs for Egypt, the UAE and Saudi Arabia will be out and posted here at around 6:15am CLT.

Egyptian and US military personnel will running Bright Star wargames for the second year in a row from 8-20 September.

A delegation of more than two dozen Indian business leaders and government officials will be in Egypt from 8 to 12 September for trade and investment talks.

Government to receive report on shorter work weeks before the end of September: Prime Minister Mostafa Madbouly expects to receive by the end of the month a state study on the impact of shortening civil servants’ work week to four days.

Orange Egypt shareholders will vote on 25 September to delist the company’s shares from the EGX.

The Central Bank of Egypt meets on Friday, 27 September to review interest rates.

Image of the Day

Egyptian women invested pregnancy tests more than 3,000 years ago? Papyrus texts from 3,500 years ago shows that Ancient Egyptian women followed a similar approach to modern days pregnancy tests by urinating on bags of wheat and barley and waiting on for a chemical reaction to indicate pregnancy, CNN reports.

Egypt in the News

Discovery of neolithic village tops coverage of Egypt: Topping coverage of Egypt in the foreign press this morning is the discovery of a Neolithic period village that predates the pharaohs in Tal Samara near Cairo, the Associated Press reports. Reuters also has the story.

On Deadline

The state needs to be more transparent when it comes time to shuffle governors and ministers, Mohamed Amin writes for Al Masry Al Youm. To do otherwise is to encourage the rumor mill, he argues. (Because as our friends in the West can tell us, there’s never rumors about who’s in or who’s out in a cabinet shuffle or presidential administration, right?) In a piece penned for Al Shorouk, opinion writer Emad El Din Hussein questions the ability of incoming governors drive make a difference when centralization of power in Cairo and the national government gives them few levers to pull.

Worth Reading

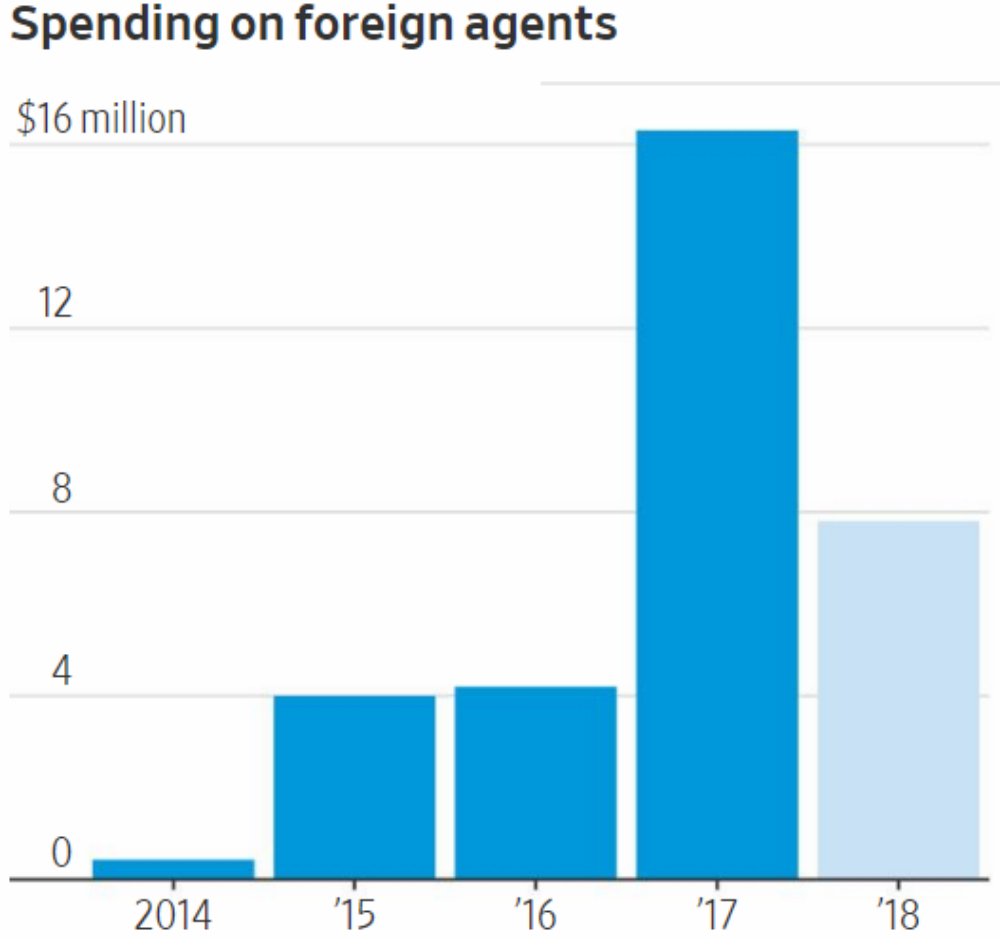

Our next shady lobbyists investigative feature: How Qatar seized the lobbying initiative away from its blockaders: No one can deny that Qatar has remained very functional throughout the continuing blockade enforced by the GCC and Egypt. It now appears to have seized the diplomatic initiative with the US away from the GCC, thanks to a lobbying strategy targeting associates of US President Donald Trump that is being spearheaded by New York restaurateur Joey Allaham and a guy named Nick Muzin, a former deputy chief of staff to Republican Senator Ted Cruz.

The strategy: Basically, the campaign would rely on what the pickup artist industry would call love bombing. The lobbyists would entice a list of “Trump influencers” — people associated with the president politically or otherwise — and people he follows. They would be invited by the Emir to come visit Doha and wow and dazzle them. Among those targeted: Former Arkansas Governor Mike Huckabee, Zionist Organization of America director Morton Klein, and lawyer (and Israel booster) Alan Dershowitz. The campaign goes so far as to run advertisements on shows Trump watches, according to an investigative piece by Julie Bykowicz of the Wall Street Journal. The campaign is widely considered to be unconventional for breaking with traditional channels of lobbying — and tailor-made for an unconventional president who “has changed the rules of the game in the influence industry.”

Not to mention the spending:” Qatar spent USD 16.3 mn on lobbying in 2017 in the US, up from USD 4.2 mn in 2016. Qatar was reportedly directly employing 23 lobbying firms as of June 2018.

The strategy appears to have been successful with the Trump administration changing its tone on Qatar drastically. “Mr. Trump reversed his stance and in April welcomed its emir, Sheikh Tamim Bin Hamad al-Thani, into the White House, patting him on the knee and calling Qatar ‘a valued partner and longtime friend.’ A congressional bill to label Qatar a terrorist-supporting nation due to its alleged ties to Hamas stalled,” writes Bykowicz. Dershowitz even praised the country in a newspaper column as “quickly becoming the Israel of the Gulf states, surrounded by enemies, subject to boycotts and unrealistic demands, and struggling for its survival.”

Further reading: You can also read this thrilling AP piece on how the shadiest lobbyist ever helped engineer the Qatar blockade, which we picked up in May.

Worth Watching

Spike Lee’s new movie BlacKkKlansman tells the true story of an African-American who infiltrated the Ku Klux Klan. The film is based on retired Colorado Springs police detective Ron Stallworth’s 2014 memoir, where he details how he infiltrated the group in 1979 using a white surrogate, who rises up through the KKK’s ranks to eventually lead the local branch. If that’s not incentive enough, the movie has a 7.9 rating on IMDB. Check out the trailer here (runtime: 2:26).

Energy

Companies with better WtE projects could be paid a higher FiT

Waste-to-energy (WtE) projects can be paid a premium above the minimum feed-in-tariff (FiT) rate set by the government, depending on how the waste or recycling center produces the energy,Electricity Minister Mohamed Shaker tells Al Shorouk. The more advanced the technology used by the company, the higher it will be paid for the energy used Shakr said. The Ismail Cabinet had agreed in May to set a minimum WtE feed-in tariff of EGP 1.40 per kWh, with the Electricity Ministry covering EGP 1.03 per kWh.

Basic Materials + Commodities

Aton begins drilling at Rodruin gold mine prospect

Canada’s Aton Resources began last Monday drilling at the Rodruin gold mine prospect in Egypt’s Arabian-Nubian Shield, the company announced last week. The first phase of the program will see the company drilling 4,000-6,000 meters deep for preliminary tests on gold mineralization, and is expected to take two months to complete. “The start of our Phase 1 exploration drilling programme at Rodruin is a milestone for the Company as I believe Rodruin to be one of the most prospective undrilled gold targets in Egypt. This drilling programme will be the first test of our belief that Rodruin can become a high grade and bulk mineable gold project,” said Aton CEO Mark Campbell.

Real Estate + Housing

Samcrete to launch three new projects on 200 feddans in Cairo and North Coast

Construction firm Samcrete’s real estate development arm announced plans to develop three new residential and administrative projects in East Cairo, West Cairo, and the North Coast, Managing Director Hisham El Kheshen said, according to Al Masry Al Youm. The company plans to launch at least one of the projects before year-end.

Tourism

TPA allocates USD 40 mn for tourism promotion campaigns, exhibitions

The Tourism Promotion Authority (TPA) has allocated USD 40 mn for tourism promotion campaigns abroad and for international tourism exhibitions this fiscal year, Al Shorouk reports.

Taba land port crossing open after EGP 49 mn renovation

Transport Minister Hisham Arafat inaugurated on Saturday the Taba land port crossing with Israel following the completion of its EGP 49 mn renovation work, according to state-owned Al Ahram.

Automotive + Transportation

Passenger car sales register 41% increase y-o-y during 7M2018

Passenger car sales rose 41% y-o-y in the first seven months of 2018 to 69,901 cars, up from 49,617 during the same period last year, according to figures from the Automotive Information Council (AMIC) picked up by Al Mal. Hyundai captured a 24.4% market share, followed by Nissan (20%), Renault (11.1%), Chevrolet (8.7%), and Toyota (7.1%).

Banking + Finance

HDBK to launch mobile and internet banking services by year’s end

The Housing and Development Bank (HDBK) is planning to launch internet and mobile banking platforms by this year-end, Chairman Fathy El Sebai said, according to Al Shorouk. The move is part of HDBK’s plan to expand in the retail banking sector.

Egypt Politics + Economics

House Rep. drafts law to punish anyone insulting Egypt’s historical figures

A draft law proposal seeking to impose heavy fines and prison sentences for anyone insulting Egypt’s historical figures has been tabled for discussion by the House of Representatives’ Religious Affairs Committee, committee head Rep. Amr Hamrouch tells Masrawy. The bill looks to impose jail sentences of at least three years and fines of between EGP 100k-500k, according to Hamroch.

On Your Way Out

All quiet in Egypt’s stands as fans return to stadiums: Saturday saw the long awaited return of fans to stadiums, for the Egyptian premier league, and the event was thankfully very peaceful. It is hard to get a clear figure of how many fans attended the the Zamalek-Enppi game (which ended 4-1 in Zamalek’s favor) at Cairo’s Petro Sport Stadium, but accounts from the local and foreign press indicated that the 16,000 seater facility was not quite full — and neither was it empty.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.94

EGP / USD at CIB: Buy 17.84 | Sell 17.94

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 15,852 (-1.0%)

Turnover: EGP 669 mn (20% below the 90-day average)

EGX 30 year-to-date: +5.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 1.0%. CIB, the index heaviest constituent ended down 0.9% . EGX30’s top performing constituents were Emaar Misr up 3.2%, Heliopolis Housing up 3.1%, and Madinet Nasr Housing up 3.0%. Yesterday’s worst performing stocks were Global Telecom down 11.2%, Pioneers Holding down 4.3%, and Palm Hills down 2.2%. The market turnover was EGP 669 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +26.0 mn

Regional: Net Short | EGP -27.0 mn

Domestic: Net Long | EGP +1.0 mn

Retail: 66.4% of total trades | 71.0% of buyers | 61.9% of sellers

Institutions: 33.6% of total trades | 29.0% of buyers | 38.1% of sellers

Foreign: 11.1% of total | 13.0% of buyers | 9.1% of sellers

Regional: 7.5% of total | 5.5% of buyers | 9.5% of sellers

Domestic: 81.4% of total | 81.5% of buyers | 81.3% of sellers

***

PHAROS VIEW

Rise in M2 drives FCI down in July: The Pharos Financial Conditions Index (FCI) dropped in July, driven by growing broad money supply, which rose by 17.84% y-o-y and 0.24% m-o-m. Factoring in inflation, M2 rose by 3.8% y-o-y, up from 3.5% y-o-y in June. Higher banking sector liquidity, and a flatter inverted yield curve also drove the index down, after it rose last month as the result of tightening monetary policy. You can read the full report here (pdf).

***

WTI: USD 69.90 (+0.14%)

Brent: USD 77.72 (+0.10%)

Natural Gas (Nymex, futures prices) USD 2.90 MMBtu, (-0.69%, October 2018 contract)

Gold: USD 1,205.00/ troy ounce (-0.14%)

TASI: 7,915.07 (-0.42%) (YTD: +9.53%)

ADX: 4,939.94 (-0.94%) (YTD: +12.31%)

DFM: 2,841.79 (+0.06%) (YTD: -15.68%)

KSE Premier Market: 5,273.80 (+0.23%)

QE: 9,864.02 (-0.23%) (YTD: +15.73%)

MSM: 4,435.53 (+0.37%) (YTD: -13.34%)

BB: 1,336.74 (-0.10%) (YTD: +1.14%)

Calendar

04 September (Tuesday): Egypt’s Emirates NBD PMI for August released.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

17-19 September (Monday-Wednesday): INTERCEM Cairo to Cape Town cement industry conference, Dusit-Thani LakeView, Cairo.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies” under a directive from President Abdel Fattah El Sisi.

03 October (Wednesday): Egypt’s Emirates NBD PMI for September released.

06 October (Saturday): Armed Forces Day, national holiday.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.