- Inside the web of companies that will see us importing gas from Israel — and thus emerge as the region’s energy powerhouse. (Speed Round)

- Private-sector bankers, lawyers aren’t being crowded out of the privatization program, Maait says. (Speed Round)

- Did the IMF just call out Egyptian tax dodgers? (Speed Round)

- Mining regulator accepts Aton’s declaration of commerciality. (Speed Round)

- ECA to conclude investigation into Uber antitrust complaints soon. (Speed Round)

- Talking heads chew over the rising price of newspapers and population growth. (Last Night’s Talk Shows)

- Human rights top coverage of Egypt in the foreign press. (Egypt in the News)

- The Market Yesterday

Thursday, 9 August 2018

Bankers, lawyers not being crowded out of privatization program, Maait says.

TL;DR

What We’re Tracking Today

Do you need the weekend as much as we do? Odd that we feel that way on such a quiet news day, but it is what it is…

What little Egypt news is out there is interesting:

- The nation has edged even closer to a natural gas import agreement with Israel (a key to our bid to become the region’s premier energy hub);

- Private sector investment bankers and lawyers aren’t being crowded out of the privatization program, Finance Minister Mohamed Maait assures us;

- And mining industry regulator EMRA has accepted Aton Resources’ declaration of commerciality, potentially giving Egypt its second major gold producer after Centamin.

Iran sanctions hitting us at home? The US re-imposing sanctions on Iran will negatively impact state-owned Misr Iran Development Bank’s (MIDB) foreign transactions and shareholder’s activities, MD Amr Tantawi claims, Al Mal reports. The US will reinstate on 5 November sanctions targeting transactions by foreign financial institutions with the Central Bank of Iran, according to a White House Statement. The US re-imposed on Monday sanctions on the Iranian rial.

The big news out of the region, though, remains the tiff between Saudi Arabia and Canada, where the Financial Times broke the news yesterday that Riyadh has “instructed [its] overseas asset managers to dispose of [its] Canadian equities, bonds and cash holdings ‘no matter the cost.’” Bloomberg does a good job of tracking down what those holdings may be, and the Wall Street Journal underscores how limited investment ties are between… the two erstwhile allies by saying the selloff is worth “hundreds of mns.” Canada’s Globe and Mail, though, quotes the Royal Bank of Canada as estimating Saudi’s central bank holds about USD 10 bn in Canadian stocks, bonds and other instruments, or less than 1% of foreign holdings of Canadian securities.

So as of now, KSA has:

- Recalled its envoy to Ottawa and PNG’ed the Canadian ambassador to Riyadh;

- Promised to pull more than 10k scholarship students out of Canada and to recall some 800 physicians doing internships, residencies and fellowships in the Great White North;

- Frozen new trade and investment, including informing brokers it will buy no Canadian wheat or other commodities;

- Suspended flights to Canada from Saudi;

- Made clear there will be no mediation until there’s an apology of some form.

Business is taking stock: Some big Canadian businesses say they’re unfazed, and Canada’s most influential newspaper (generally a mild-mannered outlet) is running with an editorial declaring that “Justin Trudeau shouldn’t go grovelling to Saudi Arabia.” Omar Allam, a diplomat turned consultant to companies doing business in the GCC, makes the case for why Canadian businesses should care about KSA — and offers three ideas on how to prevent the dispute from turning into “a visa standoff and full-blown trade war.”

Don’t expect it to end anytime soon: KSA Foreign Minister Adel Al-Jubeir has declared that there’s nothing to mediate until Canada apologizes for interfering in Saudi affairs. Canadian Prime Minister Justin Trudeau made it clear yesterday that he’s not backing down. (That said, Trudeau offered something of an olive branch, telling reporters yesterday that Saudi “is a country that has great significance in the world, that is making progress in the area of human rights.”)

All of this over a couple of tweets? There’s a missing link here — and nothing has leaked out of Riyadh yet that would make it clear.

Need funding for, say, an infrastructure project with commercial and developmental cred? Meet “OPIC on steroids.” America is looking to get back into the development finance institution (DFI) game, ratcheting-up its approach to “commercial diplomacy” by taking over “the current US government development finance institution, the Overseas Private Investment Corporation (Opic), as well as several USAID credit facilities and the agency that provides financing for feasibility studies in emerging markets,” the Financial Times notes in an op-ed carried by its Beyond Brics blog. OPIC has previously backed or proposed backing Qalaa Holdings (back in 2011), oil and gas player Apache, CIB, Carbon Holdings’ Tahrir Petrochemicals Corporation and microfinance players, among others.

Other international news worth a skim this morning, time permitting:

- The FT’s John Authers argues there is “value in emerging markets after an unwelcomed decoupling” as EM shares look well-priced relative to US equities.

- China is looking to slap additional tariffs of as much as 25% on some USD 16 bn worth of imports from the United States including fuel, steel, automobiles and medical equipment, Reuters reports.

- The US securities regulator is probing whether Elon Musk was telling the truth or trolling critics with his suggestion he could take Tesla private at USD 420 a share, according to the Wall Street Journal. The offer, if made real, would be a 20% premium to Tesla’s share price at the time of the tweet. 4/20 is also shorthand for 20 April, an international day for cannabis-related protests and events, as the dweebs of Tweeter pointed out.

PSA- Chinese gov’t recalls rabies vaccines in China and abroad, including Egypt: Chinese authorities have issued a recall for defective rabies vaccines produced by Changchun Changsheng Bio-tech Company after a an investigation found the company guilty of violating regulatory standards since 2014, according to the State Council’s website. Overseas sales made up 2.3% of Changsheng’s revenue in 2017, with its vaccines being sold in Egypt, India, Cambodia, and Belarus, according to financial records obtained by Bloomberg.

Enterprise+: Last Night’s Talk Shows

A decision from the National Press Authority to hike state-owned newspaper prices was the topic du jour on the airwaves last night. The decision comes as a measure to offset the rising cost of paper, which Egypt imports.

The price hike would be “limited” and would be capped at EGP 1 or 2 per issue, which would help stymie newspapers’ significant financial losses, authority head Karam Gabr told Masaa DMC. The increase has become necessary after the cost of paper rose to USD 950 per tonne, up from USD 550 previously, Dar Al Tahrir Chairman Saad Selim said (watch, runtime: 9:14).

The authority and Press Syndicate are looking into alternative solutions, including having state and private newspapers team up to set up a paper factory, Press Syndicate head Abdel Mohsen Salama told Hona Al Asema’s Lama Gebril. They apparently also think that trying to get the Finance Ministry to subsidize paper when the government is trying to eliminate all other subsidies could be a good solution. Egypt’s journalism industry has been crippled by rising costs of materials, including paper and ink, but is also facing a bit of a crisis in terms of content and performance, Salama said (watch, runtime: 7:13).

Private newspapers might be forced to follow suit as they face the same financial squeeze, Al Shorouk’s Managing Director Ahmed Bedair said, noting that many newspapers have been in the red for a while, with many resorting to laying off employees (watch, runtime: 4:46).

Raising prices might actually make things worse for newspapers if the move backfires and reduces their readership, Al Masry Al Youm Editor-in-Chief Abdel Moneim Saeed told Yahduth fi Masr. Saeed stressed that all options are still on the table for private newspapers as they assess the situation to decide on the best path forward (watch, runtime: 6:10).

Egypt’s population growth remains the country’s biggest risk factor, IMF Executive Director Hazem Beblawi (who was once interim prime minister of Egypt) told Yahduth fi Masr’s Sherif Amer. Beblawi shrugged off Amer’s concerns about Egypt’s debt levels, saying that being able to borrow at all is actually an indicator of a strong economy and reflects confidence in the economy’s future. He also noted that debt in general is not bad as long as it is put to use correctly. Beblawi praised the strides Egypt has taken in its reform program, reminding viewers that the measures were all “tough but necessary” (watch, runtime: 10:10).

Shoukry wraps up two-day trip to Washington, DC: Foreign Minister Sameh Shoukry met with a wide range of American businessmen in Washington yesterday as he wrapped up his brief visit, Ministry Spokesman Ahmed Abu Zeid told Al Hayah fi Masr. Shoukry’s meeting with US Secretary of State Mike Pompeo (which we recap in detail in Speed Round, below) and Tuesday’s sit-down with National Security Advisor John Bolton come ahead of a planned 2+2 meeting with both countries’ foreign and defense ministers, Abu Zeid said (watch, runtime: 6:32).

On money laundering and investment: Former Banque Misr deputy chairman Sahar Damaty and former assistant interior minister for economic security Nagah Fawzy each gave their two cents on money laundering and how it ties into investments on Masaa DMC (watch, runtime: 15:52).

Education was the order of the day on Al Hayah fi Masr, where host Kamal Mady hosted Education Ministry Spokesman Ahmed Khairy to discuss the new public education system (watch, runtime: 21:04) and Deputy Education Minister for Technical Education Affairs Mohamed Megahed for a chat about developing technical education in Egypt (watch, runtime: 19:52).

Speed Round

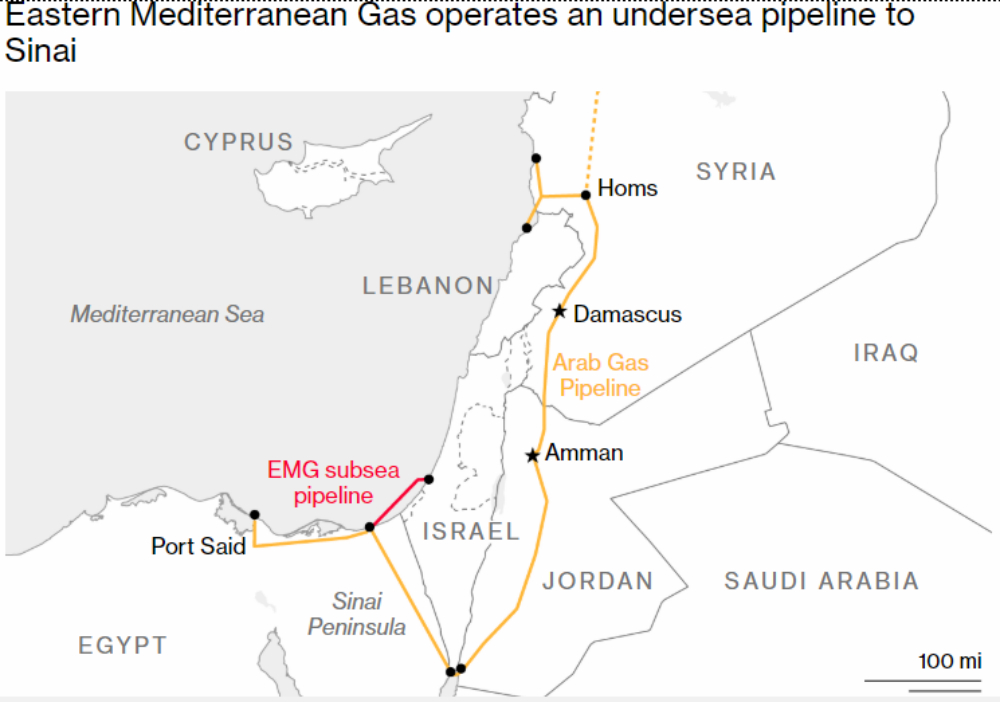

Go inside the web of private operators who are helping turn Egypt into the region’s premier energy hub: Operators of Israel’s Leviathan gas field are finalizing an agreement with their Egyptian partner that would bring Egypt closer to its goal of becoming the export hub for natural gas from the East Mediterranean. The agreement, which will come through setting up multiple offshore companies, will kill two birds with one stone: Securing a 10-year, USD 15 bn agreement signed in February with Alaa Arafa’s Dolphinus Holding to export gas from Tamar and Leviathan to Egypt early next year — and cutting and spacing out arbitration rulings that have long held up any gas import agreement between Egypt and Israel.

The transaction — enter East Gas: Israel’s Delek, Noble Energy (Delek’s Texas-based partner on the Leviathan gas field in Israel) and Egyptian partner East Gas will acquire a 37% stake in the East Mediterranean Gas Company (EMG). EMG is held by, among others, businessmen Sam Zell and Yosef Maiman, people familiar with the matter tell Bloomberg. Delek and Noble are in the process of setting up a Cyprus-based joint venture, which would then partner with a Netherlands-based company set up by East Gas. This new partnership, also based in Holland, would buy the 37% stake in EMG.

The transaction would give the partners ownership of EMG’s pipeline, which links Israel to Egypt. Under terms of the agreement, Delek, Noble and East Gas, will finalize technical due diligence on the pipeline after the initial buyout agreement is signed. They would then transfer the money to the EMG shareholders involved, sources said, adding that the agreement would go through regardless of the condition of the pipeline. The companies are planning to start gas imports from Israel in the beginning of next year.

It is not yet clear who owns East Gas — their website appears to have been under construction since 2016 — but we wouldn’t be surprised to see Dolphinus in there somewhere.

Clearing arbitration cases: The buyout by the two companies and their Egyptian partner in effect settles three of the four arbitration cases that had blocked the gas-import agreement, sources told Bloomberg. The Egyptian government has reached an agreement to reduce the USD 1.76 bn international arbitration ruling against EGAS, EGPC and East Mediterranean Gas (EMG) for failure to supply Israel Electric Corporation (IEC) with gas in 2012.

The fine would be reduced to around USD 470 mn and would be amortized over a period of around 15 years, according to two of the people directly involved in the talks. Negotiations are ongoing over which which bank would issue a letter of credit, they added. IEC wants “a top-tier international lender,” while Egypt is pushing for the National Bank of Egypt. Either way, any resolution to the case clears the largest hurdle between a gas import agreement between Israel and Egypt. For years, the Ismail cabinet had made resolving this case a condition for the agreement.

What about the other arbitration cases? Maiman and other shareholders of EMG had also won USD 1.03 bn in damages from the state in a Cairo arbitration court back in February.The sources did not make clear how this case fators into the agreement. Also unclear so far is how the new partnership resolves a USD 270 mn arbitration case with Spanish Egyptian Gas Company (SEGAS), which runs the Damietta liquefaction plant and is 80% owned by Spain’s Union Fenosa. Union Fenosa Gas had filed a complaint with the ICC in 2013 alleging that “its state partner had failed to comply with contracts by halting gas supplies in 2012 and not making payments.”

EXCLUSIVE- Maait to private sector service providers: We have a piece of the IPO program for you. Finance Minister Mohamed Maait is reassuring private-sector bankers, lawyers and other advisers that they will have roles to play in the share sales of five companies piloting the state privatization program. The minister made the remarks in an exclusive interview with Enterprise. State-owned NI Capital will manage three of the five stake sales, he said, leaving the remaining two up for grabs by the private sector. The government will hold tenders for legal counsels and financial advisers for all five of the share sales, he noted. As we noted earlier this week, NI Capital had been tapped to manage share sales for Alexandria Container and Cargo Handling and Heliopolis for Housing and Development. We expect the third company in its roster will be Alexandria Mineral Oils Company (AMOC). Chemical Industries Holding Company (CIHC) Chairman Emad El Din Mostafa had said that NI Capital was organizing a limited tender for private sector banks to manage share sales for Eastern Company and Abu Qir Fertilizers.

Maait also noted that the government hopes this initial phase would bring in EGP 20 bn in new investment, with the treasury’s share of the stake sale looking to reach EGP 8-10 bn. The first of the offerings will take place in October, with Maait reiterating that shares in all five companies will be sold by December.

Did the IMF just call out Egyptian tax dodgers? IMF Executive Director Hazem El Beblawi scoffed at the notion that the IMF is against the Egyptian treasury increasing its annual tax haul. El Beblawi made the remarks in response to questions from Al Masry Al Youm at the annual meeting of the African caucuses for the World Bank and the IMF. The former prime minister pointed to what he sees as a large segment of society who evade taxes, particularly self-employed workers including doctors, lawyers, engineers, artists, and accountants.

IMF supports our strategy of long-term borrowing: El Beblawi also reassured the press that Egypt’s current external debt position isn’t anything to be worried about. The facilities are long-term and were necessary to achieve sustainable development goals.

Speaking of foreign debt, CBE Governor Tarek Amer said that Egypt will renew its USD 2.65 bn currency swap with China, which Egypt signed in 2016 as part of the USD 5.7 bn funding required to secure a USD 12 bn extended fund facility from the IMF. The move is part of a series of loans the CBE is looking to roll over, which include the USD 2 bn deposit from the UAE.

Foreign holdings of Egypt’s debt since the 2016 EGP float have reached USD 37-38 bn, Amer said at a conference of African central bankers in Egypt on Wednesday.

African central bankers renew hope in mythical single currency: The conference also appeared to revive the ludicrous (yet long-discussed) proposal to establish a single currency for the African Union. The AU commission is currently revisiting the proposal to establish a single “Africa zone” with its own central bank and a unified currency as part of the AU’s 2063 vision, AU Commissioner for Economic Affairs Victor Harrison told Enterprise. There are certain conditions that need to be met first, including requiring member countries to be guided by a single inflation target, and a single budget deficit target. Good luck: Our grandkids will be rooting for that.

One needs to only look at the West Africa single currency proposal to get an idea of why this knockoff of the EUR will not work. The implementation of that common currency for West Africa’s anglophone countries, which was supposed to merge with the a currency union of francophone West African states, was postponed four times before finally being jettisoned. The main reason? Setting unified criteria akin to the ones proposed by Harrison. Talk of a West African monetary union was revived last year and could take place by 2020, according to CNN. Again, one is not necessarily advised to hold one’s breath.

Aton Resources could be the second licensed major gold producer after Centamin: The Egyptian Mineral Resources Authority (EMRA) accepted a declaration of commerciality from Canada’s Aton Resources on its Hamama West gold concession, according to a company statement. The move could open the door for the company to be the second major gold producer in Egypt after Centamin. “This is very exciting news for Aton as it allows us to move forward not only in developing our Hamama West Project, but in progressing our Rodruin exploration target,” said Aton CEO Mark Campbell. “We will now move to begin our next steps in advancing Hamama West and the first pass drilling program at the Rodruin prospect is set to commence shortly,” he said, adding that Aton will be looking for partners with whom to develop the project. The firm had submitted in June a declaration of commerciality on its Hamama Project by Wardell Armstrong International to obtain a 20-year license.

Aton is pleased with the direction gov’t reforms of the mining sector appear to be taking: The statement from Aton was filled with color on what Aton believes is the state of discussion of the government’s reform of the mining sector. Among them are believed to be proposals to scrap the oil-and-gas-style production sharing agreement and move to a tax, rent and royalty model — and eliminate the requirement of a 50:50 JV with EMRA completely. Aton also expects the government to allow exploration companies to acquire exploration ground without first acquiring exploration licenses. The changes are yet to pass the House of Representatives. “With all the signs are pointing towards the long awaited reform of the Egyptian mining sector and the speed that the Government appear to be moving at to implement these changes, leads us to believe that major positive changes for exploration companies, mining companies and the Egyptian Minerals industry overall is at hand,” said Campbell.

ECA to conclude investigation into Uber antitrust complaints “soon”: The Egyptian Competition Authority (ECA) is still looking into complaints brought against Uber by ride-hailing rivals Careem and Ousta, but the investigation should wrap up soon, according to an ECA statement out on Wednesday (pdf). Ousta and Careem had filed a complaint in December 2016 alleging that Uber engaged in monopolistic practices when it did not raise fares and temporarily stopped charging its drivers a 20% service fee through the end of January 2017. Former ECA boss Mona El Garf said in April of last year that the agency had begun investigating the matter.

Did the ECA leave a Singaporean Easter egg for us to ponder? The ECA began the statement by referring to a ruling by the Competition Commission of Singapore against a merger between Uber and its South East Asian rival Grab. Uber and Grab had reached an agreement in March whereby the latter would buy Uber’s regional business in exchange for Uber acquiring a 27.5% of Grab and a board seat. The ECA said it was studying the Singapore authority’s ruling.

In related news, Uber and Nacita AutoCare today launched the Rent to Own vehicle solutions program in Egypt to facilitate car ownership for Uber drivers renting their cars, according to an Uber statement (pdf). The program, which comes in partnership with the Investment and International Cooperation Ministry and has received EGP 45 mn in funding from the Saudi Fund for Development, will see qualifying drivers paying 5% interest on cars they are renting to purchase the vehicle after 36 months provided they pay 30% of the car’s sticker price.

Further afield, New York City on Wednesday approved legislation that would cap the number of licenses given to ride-hailing apps Uber and Lyft in what Bloomberg calls a political blow to the industry. The legislation also gives the city the right to set minimum pay standards for drivers.

EARNINGS WATCH- GB Auto reported a consolidated net profit of EGP 148.1 mn in 2Q2018, up 340.0% q-o-q from EGP 33.5 mn in the last quarter, according to a the company’s earnings release (pdf). Top line for the quarter rose 45.8% y-o-y to EGP 6.1 bn, up from EGP 4.8 bn in 2Q2017. “Market demand has by every measure surpassed our most bullish expectations during 2Q18, and we are seeing a strong recovery in the Auto and Auto Related businesses that is indicative of strong consumer resilience,” said GB Auto CEO Raouf Ghabbour. “Macro and market indicators today show a healthy economy that has turned a corner toward sustainable growth,” he added. Looking ahead, the company sees further improvements heading into 2H2018 during which demand is seasonally higher. “As this momentum continues, GB Auto stands as a transformed group with a leaner, more efficient operation that is ideally positioned to capture the upside,” Ghabbour said.

In other GB Auto news, the company’s board of directors approved plans to sell a 20% stake in its Netherland-based subsidiary MNT Investments BV, GB Auto said in a regulatory filing (pdf). The value of the transaction was not disclosed.

IFC funding to Egypt hits new record of USD 1.2 bn in FY2017-18: Funding to Egypt from the International Finance Corporation (IFC) reached a new record with USD 1.2 bn in new financing doled out in the FY2017-18 fiscal year, which ended in June, according to a statement from the IFC (pdf). Among the landmark funding last FY was its USD 653 mn in financing to the Benban solar park and USD 15 mn in EGP to polymer and construction companies — the latter being its first local currency loan. The IFC also provided an Islamic financing package of USD 75 mn to Almarai, a USD 135 mn facility to the Egyptian Fertilizers Company, and USD 100 mn facility to our friends in CIB for SME funding. “Our investments have been geared towards addressing the challenges facing the private sector — like power shortages, burdensome regulations, gender inequality, and difficulty in accessing financing. By tackling those issues, we can help lay the foundation for long-term growth and prosperity,” said Walid Labadi, IFC Country Manager for Egypt, Libya, and Yemen.

The IFC is committed to extending as much as USD 2 bn in funding to Egypt’s private sector until 2019 under the country’s cooperation framework with the World Bank Group, according to previous statements by IFC CEO Philippe Le Houérou.

US commits to providing Egypt with aid: The Trump administration is keen to ensure that the US aid to Egypt continue to flow, US Secretary of State Mike Pompeo told Foreign Minister Sameh Shoukry during the latter’s visit to Washington DC. This includes military, economic and development aid, Pompeo said, according to a statement from Foreign Ministry spokesperson Ahmed Abu Zaid. His pledge comes a few weeks after the US unfroze USD 195 mn in military aid it had suspended last year, ostensibly on human rights grounds.

It would appear that much of the conversation centered around regional crises, particularly Egypt’s effort to secure a peace agreement on Gaza, efforts to stabilize Libya and the Syrian civil war.

Speaking of the Gaza talks, the situation appears to be swinging from reproachment to conflict between Hamas and Israel, all in the same day. A Hamas delegation arrived in Cairo yesterday and is set to hold talks with Egyptian authorities, according to Al Masry Al Youm. An unnamed senior member of Hamas and top Israeli lawmaker both told Reuters that since peace talks have reached advanced stages, an end to the confrontations and threats is likely to take place. Later in the day, however, Gaza militants fired rockets into Israel prompting a response from the Israeli military on Wednesday, according to Reuters. Separately, Egypt will host Fatah-Hamas reconciliation talks next week, according to Ahram Gate.

MOVES- Our good friend Ramez Farag is becoming L’Oreal’s corporate affairs director for the Middle East and Africa, based in Paris. Farag takes on the new role after three years with Mars Inc. As corporate affairs director for MEA and developing markets. His tenure saw a period of expansion for the company, which doubled its investments in Egypt to transform its local manufacturing facility into the regional sourcing hub for the entire MEA region. The EGP 750 mn facility will be fully operational next year. Farag will be replaced by Wanja Mwangi. Ghada Fouad will become Mars’ regional head of communications.

Up Next

The Egyptian Federation of Investors Associations (EFIA) is set to meet with Finance Minister Mohamed Maait next week to discuss the latest draft of the Customs Act.

The Emirates NBD purchasing managers’ index for Egypt will be out on Sunday, 12 August, covering July 2018.

The central bank will be reviewing interest rates on Thursday, 16 August.

Orange Egypt’s board of directors is meeting on 27 August to look into the company’s proposal for a voluntary delisting.

This year’s Euromoney conference begins on 4 September.

A delegation of 60 unnamed US companies is set to visit Egypt in October to explore potential investments across a variety of sectors. A Japanese trade delegation is also due to visit the new capital and Suez Canal by the end 2018.

Image of the Day

Egyptian students from Helwan University have designed a car that runs on air instead of fuel or electricity, according to Reuters. The prototype, which runs on compressed air, fits one person and can has a maximum speed of 40 km/h, but the designers are confident that future models will see higher speeds and more “fuel” efficiency. The students are now shopping around for funding to begin mass producing the cars, which cost around EGP 18k to produce.

Egypt in the News

Human rights top coverage of Egypt in the foreign press this morning. Rights advocates tell NPR that the US’ decision to resume military aid to Egypt “sends all of the wrong signals to [Egypt] that the rhetoric about human rights is merely lip service.” The disbursement of the aid, they say, might be the end of any leverage the US has to push the Egyptian government on improving its human rights track record and allowing civil society to operate freely. This comes as Amnesty International issued yesterday a statement decrying Egyptian activist Amal Fahmy’s arrest for speaking out against [redacted] harassment as a “shocking case of injustice.” Meanwhile, Chicago radio station WBEZ discusses David Kirkpatrick’s book on Egypt’s revolutions, Into the Hands of the Soldiers.

Other headlines worth noting in brief:

- A former diplomat of whom we’ve never heard in the past says he will hold some form of protest in Tahrir Square on 31 August if the Sisi administration does not call a referendum on its own performance, according to the Associated Press.

- Asharq Al-Awsat recaps the “series of dramatic events” at the monasteries of Wadi El Natroun, including the murder of a bishop and a monk’s suicide attempt.

On Deadline

Raising the price of state newspapers could be the kiss of death for Egypt’s print journalism, Salah Montasser writes for Al Ahram. As the cost of living in general has been on the rise, many citizens could rethink buying a newspaper at all if prices were to rise again, he says. Montasser notes that the slow uptake of digital technology in Egypt has kept print newspapers alive as part of most citizens’ daily routines, but that could be on its way out if the new, technology-based educational system is successful in raising a generation of tech-savvy Egyptians.

Worth Reading

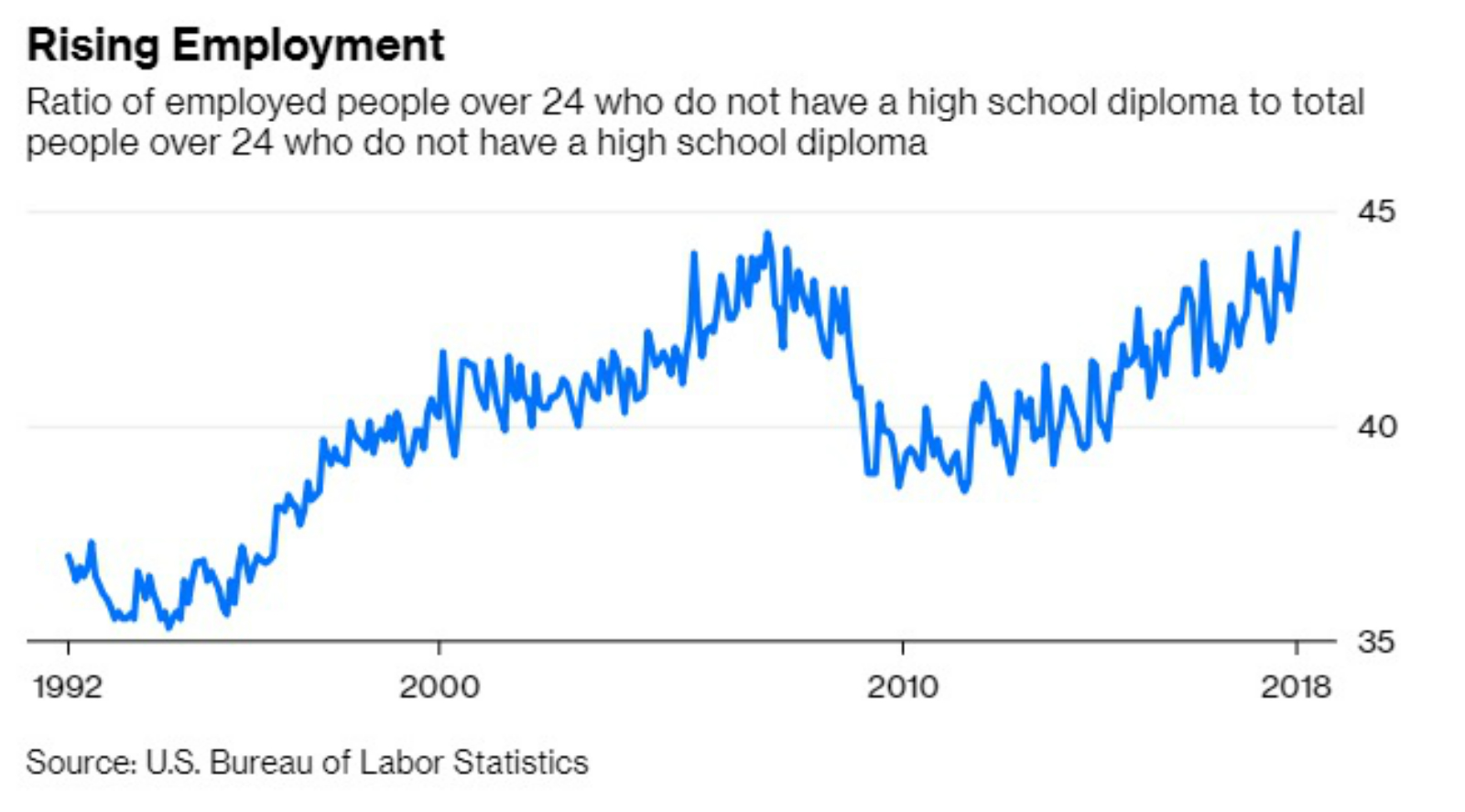

Could the US job market stop favoring college-educated workers? A surge in manufacturing jobs in the US could translate into a more balanced job prospects for college-educated and less-educated workers, Conor Sen writes for Bloomberg. “The unemployment rate for people over age 25 with less than a high school degree is 5.1 percent, the lowest on record going back to 1994. Perhaps more impressive, as economists point to the employment-population ratio still being below its highs of prior cycle peaks to argue there’s still more labor market slack, that is not the case for those with less than a high school degree.”

The wage gap between high- and low-income earners could also be getting narrower as the fastest rate of income growth is now concentrated among the low-income earners, suggesting that wage inequality is not something inevitable, Sen says. This comes as the economic environment in general is in their favor, with many key manufacturing industries bouncing back from temporary dips and minimum wage rising around the country. Put together, all of these factors mean “things are actually moving in the right direction” for America’s least-educated labor force.

Diplomacy + Foreign Trade

Another day, another possible Saudi ban on Egyptian agri goods: Saudi Arabia warned of a potential ban on pomegranate imports from Egypt this season if shipments show violations of its safey regulations, an unnamed source from the Trade Ministry tells Al Mal. This is the first time Saudi Arabia issues a warning before banning the entry of Egyptian agricultural products, the newspaper says (so let’s be grateful, we suppose).The kingdom had lifted its bans on Egyptian guava, strawberry, and pepper imports earlier this year after the government imposed new regulations on the inspection of cargo to be examined ahead of export. It’s worth noting that Australian fruit provider Creative Gourmet has recalled pomegranate imported from Egypt back in April over a link to a Hepatitis A outbreak in New South Wales.

Health + Education

Ranbaxy Labss to supply 10,000 packs of anti-Hepatitis C Harvoni in January

Indian Ranbaxy Laboratories is planning to supply 10,000 packs of the anti-Hepatitis C med Harvoni in January, General Manager Hany Meshaal tells Al Mal.

Tourism

Future projections see Turkish tourism recovering faster than Egypt, Tunisia

Future projections for air travel picked up by the UK’s Travel Weekly shows that while British tourists are returning to Egyptian, Turkish, and Tunisian holiday destinations, some are recovering better than others. Turkey is leading the pack, with a 66.4% y-o-y growth in UK leisure bookings last year, according to findings from ForwardKeys and Gfk. Egypt is up 50.9% y-o-y, while Tunisia is ahead 901.0% but still holds a 0.7% market share. The studies show that in 3Q2018, Egypt and Tunisia both have a long way to go to reach their 2015 levels in terms of scheduled airline capacity. Egypt is expected to have 46% of seats available three years ago, while Tunisia will only have 38%.

Tourism Ministry mulls using “mystery guests” to assess hotels’ performance

The Tourism Ministry is looking into a proposal to begin using mystery guest assessments to measure the standards of Egyptian hotels, Al Mal reports. Mystery guest assessments entail having an industry professional posing as a regular hotel guest to provide an unbiased evaluation of the hotel. The proposal comes as part of the ministry’s plans to overhaul the hotels sector by setting unified standards for ratings.

Telecoms + ICT

TE, Etisalat Misr sign first fixed line services MoU

Telecom Egypt signed yesterday the first agreement to provide Etisalat Misr with fixed line services through its infrastructure, according to a joint statement (pdf). The agreement “covers all the basic terms that shall allow both companies to formalize a commercial agreement in due course. No details were provided on the value of the agreement.

Orange Egypt’s new mobile phone line sales drop 30%

Orange Egypt’s sales of new mobile phone lines have dropped 30% after the the government’s decision to hike regulatory fees for new lines to EGP 70 from EGP 20 in June, CEO Yasser Shaker tells Tahrir News. Industry insiders had previously claimed that the fee hike would result in EGP 2 bn in losses to the industry.

Other Business News of Note

Economic court orders open auction on Al Hayat TV trademarks

The Cairo Economic Court has issued an order for an open auction on Al Hayat TV’s trademarks on 15 August, Al Mal reports. The court had issued a ruling in March sequestering the television network’s trademarks due to the network failing to repay USD 6 mn in debts owed to TV network MBC.

Law

Baker McKenzie was local legal council on Afreximbank’s USD 200 mn loan to EGPC

Helmy, Hamza & Partners, Baker McKenzie Cairo acted as the local legal counsel on the African Export-Import Bank’s (Afreximbank) USD 200 mn loan to the EGPC to to finance the expansion of state-owned MIDOR’s refinery, according to an email statement.

The Market Yesterday

EGP / USD CBE market average: Buy 17.82 | Sell 17.92

EGP / USD at CIB: Buy 17.83 | Sell 17.93

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Wednesday): 15,863 (+0.6%)

Turnover: EGP 860 mn (2% below the 90-day average)

EGX 30 year-to-date: +5.6%

THE MARKET ON WEDNESDAY: The EG30 ended Wednesday’s session up 0.6%. CIB, the index heaviest constituent ended up 1.1%. EGX30’s top performing constituents were Egyptian Resorts up 3.6%, Juhayna up 3.6%, and Arab Cotton Ginning up 3.0%. Yesterday’s worst performing stocks were Eastern Co. down 2.5%, SODIC down 1.1%, and Telecom Egypt down 0.9%. The market turnover was EGP 860 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +7.7 mn

Regional: Net Short | EGP -14.3 mn

Domestic: Net Long | EGP +6.6 mn

Retail: 58.7% of total trades | 55.1% of buyers | 62.3% of sellers

Institutions: 41.3% of total trades | 44.9% of buyers | 37.7% of sellers

Foreign: 19.9% of total | 20.3% of buyers | 19.4% of sellers

Regional: 7.8% of total | 7.0% of buyers | 8.7% of sellers

Domestic: 72.3% of total | 72.7% of buyers | 71.9% of sellers

WTI: USD 67.09 (+0.22%)

Brent: USD 72.54 (+0.36%)

Natural Gas (Nymex, futures prices) USD 2.95 MMBtu, (-0.10%, September 2018 contract)

Gold: USD 1,223.10 / troy ounce (+0.17%)

TASI: 8,210.29 (-0.39%) (YTD: +13.62%)

ADX: 4,925.61 (+0.29%) (YTD: +11.99%)

DFM: 2,948.65 (-0.08%) (YTD: -12.50%)

KSE Premier Market: 5,466.26 (+0.15%)

QE: 9,961.55 (-0.12%) (YTD: +16.87%)

MSM: 4,435.720 (-0.27%) (YTD: -13.01%)

BB: 1,346.06 (-0.16%) (YTD: +1.08%)

Calendar

05-09 August (Sunday-Thursday): CBE hosts 41st annual meeting of the Association of African central banks, Sharm El Sheikh, Egypt.

12 August (Sunday): Egypt’s Emirates NBD PMI reading for July released.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.