- Egypt, Cyprus reach agreement on key gas pipeline + EGX and oil ministry looking at natural gas futures exchange. (Speed Round)

- Gov’t to allow private sector to own just under 50% of public sector holding companies. (Speed Round)

- New guidelines would split regulatory authority over holding companies between GAFI and FRA. (Speed Round)

- Foreign debt up, debt service costs down. (Speed Round)

- World Bank agency to increase financing to Egypt’s private sector over the next three years. (Speed Round)

- The expected return of football fans to stadiums is the talk of the town. (Last Night’s Talk Shows)

- Canada-Saudi row deepens as some in GCC side with Riyadh. (What We’re Tracking Today)

- Hedge funds adopt hipsterism to compete with tech for talent. (Worth Reading)

- The Market Yesterday

Tuesday, 7 August 2018

Egypt reaches key natural gas pipeline agreement with Cyprus

TL;DR

What We’re Tracking Today

It’s earnings season and the start of Peak Sahel at the same time, so news today is largely dominated by talk of regulatory policies and the government’s release of macroeconomic data.

Foreign Minister Sameh Shoukry is in Washington today for day two of a two-day visit that will see him meet US Secretary of State Mike Pompeo and White House National Security Advisor John Bolton.

In other foreign policy news of interest to many of our readers: The Saudi spat with Canada deepened yesterday as the UAE and Bahrain came out in support of Riyadh’s move to curb diplomatic and investment ties with a longtime ally. “We stand with Saudi Arabia in taking steps to defend its sovereignty and laws … The belief of some countries that their model or experience allows them to interfere in our affairs is rejected,” UAE Minister of State for Foreign Affairs Anwar Gargash wrote on Twitter. The secretaries general of both the Gulf Cooperation Council and of the Organization of Islamic Cooperation also said they support Riyadh’s move.

Among other recent developments:

- Saudi is moving some 20k scholarship students out of Canada to the US, UK, Australia and New Zealand.

- State airline Saudia is suspending flights to and from Toronto on 13 August, Reuters adds.

- Canada has refused to back down, saying that while it is “seriously concerned … and seeking greater clarity on the recent statement from the Kingdom of Saudi Arabia … Canada will always stand up for the protection of human rights.”

What sparked this? Canada’s foreign minister tweeted about the detention of Samar Badawi, a rights activist whose brother Raif had already been detained back in 2012. Raif’s wife and children live in Canada, and his wife was recently made a citizen.

Still in question: The fate of a CAD 15 bn contract with a Canadian unit of General Dynamics to supply armored vehicles to KSA. Plus: Neither side has yet made clear what any of this means for visa regimes or other policies.

This isn’t the first time Canada has squabbled with a GCC nation: Canada and the UAE rowed from 2010 until 2013 over landing rights for Emirati airlines in Canada and Canada’s use of military logistics facilities in the UAE. The spat ended when then-Foreign Affairs Minister John Baird buried the hatchet over a cup of Tim Horton’s coffee in the UAE with Sheikh Abdullah bin Zayed Al Nahyan.

Nor is it the first time the Saudis have taken a swipe at an ally. Riyadh recalled its ambassador to Stockholm in 2015 after Sweden’s foreign minister criticized KSA over the Raif Badawi case. The tiff ended “after the Swedish king sent a message to his Saudi counterpart,” the FT said. Saudi recalled its ambassador to Berlin in November of last year after Germany’s foreign minister alleged Saudi had coerced Saad Hariri to resign as prime minister of Lebanon.

The story is front page in the global business press. See more in the Financial Times, Wall Street Journal, Reuters, Bloomberg (here and here) and New York Times (including an editorial).

US re-imposes economic sanctions on Iran: The US re-imposed on Monday a series of sanctions on Iran that had been waived following the Iran Nuclear Pact in 2015, according to a White House statement. “These actions include re-imposing sanctions on Iran’s automotive sector and on its trade in gold and precious metals, as well as sanctions related to the Iranian rial.” The measures will take effect today. Naturally, Iran was not happy with the move. The decision had stoked fears of the impact it would have on global prices, which has in part prompted Washington to pressure OPEC members to raise production.

It’s one of those rare weeks in which we’ll admit the weekend cannot come soon enough, even if it does kick off the countdown to a rather lengthy trans-Atlantic trek.

And because we’re in one of those moods this morning, we’re reflecting on The mystery of end-of-life rallies (New York Times) and the fact that The call to care of aging parents now comes sooner(Wall Street Journal).

Enterprise+: Last Night’s Talk Shows

The expected return of football fans to Egypt’s stadiums next month after a years-long hiatus was the talk of the town on the airwaves last night.

The Egyptian Football Association (EFA) is drafting a plan to gradually allow fans to attend football matches again without jeopardizing their safety, Sports Ministry Spokesman Mohamed Fawzy told Masaa DMC. According to Fawzy, the EFA and representatives from premier league clubs held a meeting yesterday to discuss the timeline, which will still require security authorities’ approval (watch, runtime: 6:44). The number of fans that will initially be allowed back into stadiums has yet to be determined, Fawzy said on Hona Al Asema (watch, runtime: 6:29).

The meeting came after President Abdel Fattah El Sisi gave the green light for the return of football fans, EFA member and former goalkeeper Magdy Abdel Ghany told Yahduth fi Masr’s Sherif Amer. Abdel Ghany also said that Interior Ministry officials sat in on yesterday’s meeting, suggesting that the plans will not face any resistance (watch, runtime: 5:15). Sports critic Ihab El Khatib phoned into Hona Al Asema to laud Sports Minister Ashraf Sobhy for seeing the issue through (watch, runtime: 5:29).

The rise in Egypt’s debt in 3Q2017-18 is a result of several loans the government took on to finance projects in different sectors, former Banque Misr deputy chairman Sahar El Damaty said on Yahduth fi Masr. She shrugged off concerns that Egypt will struggle to meet its debt obligations down the line, saying that the vast majority of the country’s debt is long-term facilities and FX revenues from the Suez Canal and tourism should be enough (watch, runtime: 5:37).

US-Egypt 2+2 meetings in the works? Foreign Minister Sameh Shoukry’s visit to the US, which began yesterday, will lay the groundwork for an upcoming meeting between the Egypt and America’s foreign and defense ministers, political science professor Atef Abdel Gawad told Al Hayah fi Masr’s Kamal Mady (watch, runtime: 5:58).

Another day, another abomination against art: Restoration work is underway on a statue of Khedive Ismail in Ismailia, which was recently the victim of a botched paint job, according to National Organization for Urban Harmony (NOUH) head Mohamed Abu Saada. He urged local authorities to seek approval from NOUH before undertaking these little arts and crafts projects (watch, runtime: 7:15). Apparently, people haven’t learned to stop painting over statues since the Om Kalthoum statue snafu back in 2016.

Other miscellaneous tidbits on the airwaves last night: Real Estate Tax Authority Samia Hussein phoned into Masaa DMC to apologize for the long wait-times outside the authority’s offices over the past few days (watch, runtime: 7:51); Hona Al Asema’s Dina Zahraa discussed the anti-terrorism operations in Sinai with General Nagy Shahoud (watch, runtime: 25:01); economic expert Fakhry El Fekky and logistics professor Hamdy Barghout piled on the praise for the new Suez Canal (watch, runtime: 4:28).

Speed Round

Egypt, Cyprus reach agreement on key gas pipeline: Cairo and Nicosia have reached an agreement to connect the Aphrodite gas field liquefaction plants in Egypt, Cyprus state television CyBC said, according to the Cyprus Mail. The agreement will be inked sometime in the fall, CyBC said, citing diplomatic sources. “The agreement has already been given the green light by the EU and it is being scrutinised for the final touches,” sources added. The pipeline, which is expected to cost between USD 800 mn and USD 1 bn, is a crucial stepping stone towards Egypt’s strategy to become the natural gas export hub for the Eastern Mediterranean as it plans to re-export a portion of the LNG to Europe after satisfying local demand. Egypt is hoping to reach natural gas self-sufficiency before the end of 2018, as more production units from the Zohr gas field come online.

EGX, Oil Ministry officials begin deliberations over setting up natural gas futures exchange: Bourse officials have reportedly started talks with the Oil Ministry to set up a futures exchange for natural gas, banking sources tell Al Mal. Officials met last week to begin discussing their vision for the establishment of energy-oriented futures exchanges, beginning with natural gas, according to the sources, who add that the gas exchange market will be the main platform used for striking gas sale and purchase agreements and determining prices, quantities, and delivery dates. The framework is still in the early drafting stages, the sources said, hinting that we’re still a long way from seeing the market turn into a reality.

Background: The recently-amended Capital Markets Act and its executive regulations included provisions that allow for the establishment of futures exchanges and the introduction of other financial instruments, such as green bonds, sukuk, and margin trading. We had heard in May that Financial Regulatory Authority boss Mohamed Omran had tasked a committee with drafting the rules and regulations that would govern futures exchanges, which are part of a four-year strategy to develop Egypt’s non-banking financial sector. New regulations to govern short-selling are also in the works and expected to be complete by 3Q2018.

LEGISLATION WATCH- Gov’t to allow private sector to own just under 50% of a public-sector holding companies: The Public Enterprises Ministry has finished drafting amendments to the Public Enterprises Act that, if passed, would allow private-sector companies to own stakes of just under 50% in the ministry’s holding companies, according to a copy of the proposed amendments published by Al Mal yesterday. Under the current law, all ministry holding companies must be fully owned by the government. The draft amendments have been sent to the Madbouly Cabinet for review and would only become law after being passed by the House of Representatives and then signed into law by President Abdel Fattah El Sisi.

Is this a prelude to a holding company privatization program? As the government looks set to kick off the state privatization program this fall, the news adds interesting spice to an already much-anticipated program, suggesting the government could widen the scope of its privatization drive to include massive state holding companies.

The amendments also introduce private-sector-friendly board regulations, according to the draft. This would limit government seats on the boards of state holding companies to seven seats at most. It would also set a three-year term limit for the boards.

REGULATION WATCH- Speaking of holding companies, new guidelines would make FRA split regulatory authority over private sector holding companies between GAFI and FRA: The Investment Ministry is reportedly drafting amendments to existing regulations that would transfer jurisdiction over the affairs of some private sector holding companies to the General Authority for Freezone and Investments (GAFI) from the Financial Regulatory Authority (FRA). Under new guidelines, the FRA’s jurisdiction will only extend to holding companies with half or more of their assets invested in the non-banking financial sector, with GAFI assuming regulatory responsibility over the rest, unnamed officials tell Al Mal. The amendments are meant to help the FRA focus its efforts and resources on non-banking financial companies, the officials also said, adding that they expect 70% of all registered holding companies in Egypt to be moved to GAFI’s domain. Expect a significant bureaucratic tussle over this one if the report is true.

Egypt’s foreign debt stood at USD 88.2 bn in 3Q2017-18, up from USD 73.9 bn during the same period last year and up from USD 82.9 bn in December 2017, central bank data showed on Monday (pdf). Despite the 19.3% y-o-y increase, the CBE says the debt-to-GDP ratio is still within safe limits at 36.8%. Debt from international bond issuances rose to USD 12.2 bn in 3Q2017-18, up from USD 8.9 bn in the same period last year, thanks to a USD 4 bn eurobond issuance in February. Total public debt for the period grew EGP 3.5 tn, or 86% of GDP.

CBE data also showed that foreign holdings of Egyptian debt fell in May for the second straight month this year, dropping 17.2% m-o-m to EGP 310.6 bn. We expect this figure to continue to drop for the following month as the CBE continues to record the impact of the emerging markets selloff on Egyptian debt instruments. According to Goldman Sachs the wider EM selloff reached its peak in June. Finance Minister Mohamed Maait said last week that foreign portfolio investors had sold off USD 3-4 bn of Egyptian debt.

On the flipside, debt service costs fell to USD 2.4 bn in 3Q2017-18, down from USD 6.8 bn in December 2017.

This comes as Egypt is expecting to receive around USD 450 mn in new loans from Europe to support the economic reform program, Vice Minister of Finance Ahmed Kouchouk said yesterday, Al Mal reports. We’ll be receiving USD 250 mn from Germany and another USD 200 mn from France, he added, without elaborating. As for the fate of any upcoming eurobond issuance, Maait had told us that the decision will be taken in the fall whether to go ahead with an issuance or seek alternative financing. Turbulence in emerging markets and global political tensions had left any potential issuance to the fate of market conditions.

Egypt will reportedly repay USD 6.3 bn of its foreign debt obligations in 2H2018, includes some USD 850 mn owed to international oil companies, according to previous reports from the newspaper. UAE government reportedly agreed to roll over two deposits at the CBE worth USD 2 bn each, with the CBE working on similar moves from other GCC depositors.

The story is gaining traction in the foreign press, with an Associated Press story now getting traction trying to paint the uptick in debt as a dent in the Sisi administration’s economic reform program.

The right kind of debt is a good thing, so we’re going to cheer this: More debt is in the works as World Bank agency plans to increase financing to Egypt’s private sector over the next three years. The World Bank Group’s (WBG) Multilateral Investment Guarantee Agency (MIGA) expects to expand its financing of private sector projects in Egypt over the next three years, Executive Vice President and CEO Keiko Honda told Investment Minister Sahar Nasr in a meeting yesterday. Keiko did not provide details on the size of the funding packages or types of projects the agency would target. MIGA has already provided projects in the Benban solar power complex with some USD 210 mn in funding and extended oil producer Apache around USD 150 mn to support exploration and production activity, according to an Investment Ministry statement.

Nasr also met with International Finance Corporation MEA Vice President Sérgio Pimenta yesterday on the sidelines of the WBG and IMF’s 2018 African Caucus meetings. Pimenta said the IFC, which has pledged USD 2 bn in funding to Egypt’s private sector until 2019, was interested in extending further support to the renewable energy industry. The commitment that lending institutions such as the IFC have shown to Egypt’s renewable energy projects has helped attract much needed funds into the sector.

IMF / World Bank Africa summit issue “Sharm El Sheikh Declaration”: The end of the African Caucus meetings in Sharm El Sheikh yesterday saw officials from the continent issuing the “Sharm El Sheikh declaration” calling for further lending from the World Bank and IMF to support infrastructure development in Africa. They also agreed to increase cooperation in fields including infrastructure development, agriculture, energy, fintech and mobile payments and exports.

For their part, IMF and World Bank officials promised to extend further credit to the continent, according to a statement from the Investment and International Cooperation Ministry. World Bank Vice President of the World Bank for Africa Hafez Ghanem noted that the WB plans to provide USD 18 bn in new financing to African countries in 2018, according to Al Shorouk.

Fitch affirms Egypt’s long-term credit rating at ‘B’ with a positive outlook: Fitch Ratings reaffirmed Egypt’s long-term foreign-currency issuer default rating at ‘B’ and maintained its outlook as positive. The agency said that Egypt’s rating is supported by the implementation of necessary reforms, which have yielded positive results across a range of areas, such as FX reserves rising, inflation levels dropping, and foreign investments picking up. Despite the fiscal deficit and high debt, Fitch sees economic growth accelerating to 5.5% next fiscal year. It notes, however, that “public finances will remain a key weakness of Egypt’s credit profile.” Tap or click here for the full report.

EXCLUSIVE- CBE / FinMin committee sets mechanism for selling gov’t bonds on the EGX: A joint central bank-finance ministry committee has decided on a new framework for selling government bonds on the EGX, a government source told Enterprise. This mechanism will allow the select banks and financial institutions who take part in government bond auctions to resell the bonds to companies and private investors on the EGX, the source said. A limit will be set for how many bonds investors can buy, the source noted. The move comes as part of a plan to sell government bonds on the EGX revealed to us exclusively by Finance Minister Maait last month. The committee is currently drafting the policy, said the source, adding that bonds will likely go on sale in the EGX next year.

IPO WATCH- Al-Babtain Power & Telecom taps Premiere Securities to lead IPO: Al-Babtain Power & Telecommunication Co. Egypt reportedly contracted Premiere Securities to lead the company’s planned IPO on the EGX, the company said in a disclosure to Tadawul. Al-Babtain is a subsidiary of Saudi’s Al-Babtain Group, which manufactures power transmission and cellular network broadcast towers. Premiere is expected to finish drawing up plans for the transaction by the beginning of September.

Up Next

EFIA to meet with FinMin next week to discuss Customs Act: The Egyptian Federation of Investors Associations (EFIA) will meet with Finance Minister Mohamed Maait next week to discuss their remarks on the latest draft of the Customs Act, deputy EFIA head Mohamed El Morshedy said yesterday. The federation’s reservations on the act are similar to those the Federation of Egyptian Industries’ had come up with and was expected to discuss with the ministry this week. Among their concerns are that penalties for customs evasion are too severe.

The Emirates NBD purchasing managers’ index for Egypt will be released on Sunday, 12 August, covering July 2018.

The central bank will next consider interest rates on Thursday, 16 August.

Orange Egypt’s board of directors is meeting on 27 August to look into the company’s proposal for a voluntary delisting.

A delegation of 60 unnamed US companies is set to visit Egypt in October to explore potential investments across a variety of sectors. A Japanese trade delegation is also due to visit the new capital and Suez Canal by the end 2018.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning are continued pickups of Italy praising Egypt’s handling of the murder investigation of PhD student Giulio Regeni during Italian Foreign Minister Enzo Moavero Milanesi’s visit to Cairo.

Prime Minister Mostafa Madbouly met yesterday with Milanesi to discuss potential cooperation and investments in several sectors in Egypt, including energy, agriculture, and healthcare, according to a Cabinet statement. Milanesi, whose visit to Cairo is the first from a high-ranking Italian official since 2016, had met on Sunday with President Abdel Fattah El Sisi and Foreign Minister Sameh Shoukry.

In a close second: Egypt and Israel have reportedly been coordinating a ceasefire agreement with Hamas without involving the Palestinian Authority (PA), according to Haaretz (paywall). The ceasefire will likely take precedence over a Hamas-Fatah reconciliation if it would improve conditions in the Gaza strip, a Hamas official says. This comes as Israeli Cabinet member Zeev Elkin says that Egypt should bear equal responsibility for Gaza’s internal economic and governance problems, and that these issues should not be solely Israel’s responsibility, according to Reuters.

Also today: Poet Galal El Beheiri’s imprisonment comes as part of “regular crackdowns on political dissidents and artistic expression,” Jennifer Hijazi writes for PBS. El Beheiri was sentenced to three years in prison over poems seen as insulting to security forces.

On Deadline

Columnists aren’t too happy with how the government has responded to hysteria over real estate taxes: Amr Hashem Rabie takes to the pages of Al Masry Al Youm to lambast the government for “scaring” people into quickly paying off their real estate taxes, while leaving rumors about the levy to circulate without trying to dispel them. This response (or lack thereof) is reflective of the government’s lack of concern over how much panic these policies can create, particularly when they are not explained thoroughly enough.

Worth Reading

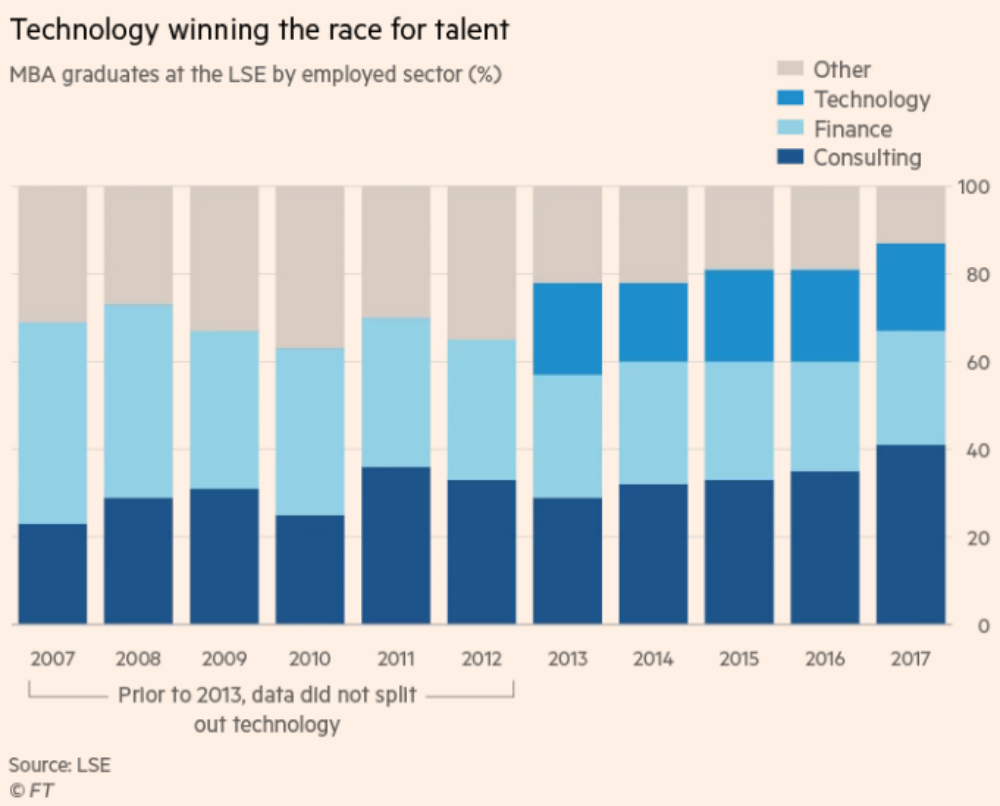

Hedge funds adopt hipsterism to compete for talent with tech: As the reign of the quants in the hedge fund industry continues, the sector is increasingly seeing computer science, IT and artificial intelligence graduates more appealing. The upside is that the hedgies are also finding tech talent difficult to land, as the majority of them (at least in the US) are moving towards Silicon Valley. With the lure of once lucrative jobs at hedge funds lacking in luster for these graduates compared to the more “purposeful” employment of tech, hedge funds are changing up their cultural norms to attract them, writes Lindsay Fortado for the FT.

So don’t be surprised if you see a lot of jeans, sandals and ripped shirts when you visit hedge funds on the East Coast, as an industry of suits and ties adapts to attract the hipsters. Expect to also see a lot of open office plans as they switch from cubicles to the Silicon Valley decor and services such as such as free dry-cleaning. The sales pitch to graduates also include the challenge of solving complex data problems and the promise of a well-resourced tech department, said Matthew Granade, the chief market intelligence officer at Steve Cohen’s USD 13 bn Point72 hedge fund.

The competition is brutal: Tech appears to be winning the hearts and minds of the grads, with their propensity for grandiose visions of solving societal problems through code (because world peace will happen by building the next Candy Crush, right?), and more importantly, salaries that are the equivalent of those offered by hedge funds. At the London Business School, the percentage of graduates going to work in tech has jumped from 6% to 20% over the past decade, says Fortado. Those entering finance fell from 46% in 2007 to 26% last year.

Worth Watching

Uber Horse Cart? Timothy Hochstedler, an Amish man in Indiana, did not just sit by and let his religion’s aversion to technology get in the way of his entrepreneurial spirit: He started his very own ride-hailing service — only this one is with a horse and buggy. He calls it Amish Uber. We certainly see this taking off here with all these unemployed donkeys who can’t get gigs as zebras.

Energy

Al Kharafi, NHVS win EGP 471 mn contract for West Damietta transformer station

An Al Kharafi-NHVS consortium was awarded an EGP 471 mn contract to construct a 500 kV power transformer station in West Damietta, according to unnamed Electricity Ministry sources. Other consortia that had competed in the tender include a General Electric-Larsen & Toubro consortium; another made up of Hyosung and China Energy Engineering Corporation; a third with Energia, Orascom and Hyundai; and NCC and Axion Energy.

Infrastructure

Finance Ministry in talks with EBRD to launch grain terminal at Dekheila Port

The Finance Ministry is in talks with the European Bank for Reconstruction and Development (EBRD) to launch a tender to establish a grain terminal at the Dekheila Port, PPP Central Unit Director Ater Hanoura tells Al Mal. The Arab Academy for Science Technology and Maritime Transport has conducted studies on the project, he said, without disclosing the expected timeline for the tender. Separately, the General Authority for Lands & Dry Ports will issue the terms and conditions for 6 October dry port next week, Hanoura said. The project, which will be developed under a PPP framework, will require an initial investment of around USD 100 mn, Transport Minister Hisham Arafat had said.

El Sisi meets with chairman of Germany’s Herrenknecht

President Abdel Fattah El Sisi met yesterday with Herrenknecht Tunnelling Systems Chairman Martin Herrenknecht to discuss a potential agreement to purchase drilling equipment for several projects, including the expansion of the Cairo Metro, according to an Ittihadiya statement.

Four companies work on developing 7.2 mn sqm in SCZone

Four local and Arab companies and consortia are currently working on developing 7.2 mn sqm in the Suez Canal Economic Zone, Amwal Al Ghad reports. The developers include Elsewedy Group subsidiary SDM, a subsidiary of ASEC Capital, a Polaris-Ardic consortium, and a CPC Egypt for Industrial Development Company-Ayady for Investment and Development consortium.

Manufacturing

KIMA 2 project in Aswan set to launch in January

The Egyptian Chemical Industries Company’s (KIMA) fertilizer production facility in Aswan (KIMA 2 project) is set to officially launch in January, according to unnamed KIMA sources. Trial runs are scheduled to start immediately after the facility’s inauguration, whose construction is currently 88% complete, sources said. Italian engineering and construction firm Tecnimont was granted a five-month extension and an extra EGP 4.3 bn to complete the facility’s development. The Italian company was originally scheduled to complete the facility by November of this year.

SCA in talks with unnamed int’l petrochemical company over USD 980 mn project

The Suez Canal Authority (SCA) is in talks with an unnamed international petrochemicals company to establish a USD 980 mn refinery in the Suez Canal Economic Zone, SCA boss Mohab Mamish tells Amwal Al Ghad. The authority is also in talks with four unnamed Chinese companies to work on textile, garments, construction, and logistics projects, as well as Indian and Egyptian companies to develop a 20 sqkm area “in the upcoming period.”

Telecoms + ICT

Telecom Egypt signs agreement with Bharti Airtel to use MENA Cables fiber pairs

Telecom Egypt (TE) signed yesterday an agreement with Indian telecom company Bharti Airtel that will grant the latter the right to use fiber pairs from TE’s recently-acquired MENA Cables, according to a TE statement to the EGX (pdf). The agreement will allow Airtel to use MENA Cables’ fiber pairs running from Egypt to India through Saudi Arabia and Oman, fiber pairs running from Egypt towards Italy, and another from Egypt to France. TE had acquired MENA Cables from Orascom Telecom Media and Technology in May.

Banking + Finance

Misr Travel receives EGP 250 mn loan from India to finance fleet upgrade

Holding Company for Tourism and Hotels subsidiary Misr Travel has received a EGP 250 mn loan from India’s Investment Ministry to purchase new vehicles to upgrade its fleet, Chairman Rashad Refai tells Al Mal. The loan has a five-year tenor and a repayment period of 20 years with 1.5% interest, in addition to a 1% administrative tax, he said. The new vehicles are expected to be delivered by the end of the year.

Law

Shalakany Law tapped as legal advisor for int’l financiers on wind, solar projects

Shalakany Law Office has been selected as legal advisor to international institutions financing the development of three wind and solar power projects valued at USD 400 mn each, El Shalakany Partner Mariam Fahmy tells Amwal Al Ghad. The 200-250 MW renewable power plants are being developed by unnamed international and local companies, Fahmy says. The companies expect to reach financial close on the projects by 1H2019.

National Security

Egyptian navy holds military exercises with British and French counterparts

Egypt’s naval forces held separate bilateral military exercises with the British and French navies off the Red Sea and Mediterranean coasts, respectively, according to an Armed Forces statement. Both exercises featured a series of field exercises and military maneuvers.

On Your Way Out

Veteran goalkeeper Essam El Hadary announced yesterday he is finally retiring from international football, saying in a statement that he sees it is “the right time” to end his international career after 22 years. El Hadary, 45, broke the Guinness World Record for the oldest player to ever participate in the World Cup during this year’s championship.

A car exploded near the 6th of October Bridge ramp in Dokki yesterday after colliding with a microbus, injuring 13 people, the Health Ministry said yesterday, Reuters reports. The explosion appears to be due to an electrical fault which spread to the car’s fuel tank, according to explosive experts.

The Market Yesterday

EGP / USD CBE market average: Buy 17.82 | Sell 17.92

EGP / USD at CIB: Buy 17.83 | Sell 17.93

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Monday): 15,645 (-0.6%)

Turnover: EGP 530 mn (40% below the 90-day average)

EGX 30 year-to-date: +4.2%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.6%. CIB, the index heaviest constituent ended down 0.5%. EGX30’s top performing constituents were Egyptian Iron & Steel up 2.9%, Juhayna up 2.0%, and Global Telecom up 1.5%. Yesterday’s worst performing stocks were Egyptian Resorts down 3.0%, SODIC down 2.9%, and Ibnsina Pharma down 2.5%. The market turnover was EGP 530 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +30.0 mn

Regional: Net Short | EGP -17.6 mn

Domestic: Net Short | EGP -12.4 mn

Retail: 62.7% of total trades | 60.1% of buyers | 65.3% of sellers

Institutions: 37.3% of total trades | 39.9% of buyers | 34.7% of sellers

Foreign: 20.5% of total | 23.3% of buyers | 17.7% of sellers

Regional: 7.6% of total | 5.9% of buyers | 9.3% of sellers

Domestic: 71.9% of total | 70.7% of buyers | 73.0% of sellers

WTI: USD 69.02 (+0.01%)

Brent: USD 73.92 (+0.23%)

Natural Gas (Nymex, futures prices) USD 2.87 MMBtu, (+0.24%, September 2018 contract)

Gold: USD 1,217.00 / troy ounce (-0.06%)

TASI: 8,230.13 (-0.15%) (YTD: +13.89%)

ADX: 4,883.54 (+1.61%) (YTD: +11.03%)

DFM: 2,977.78 (0.00%) (YTD: -11.64%)

KSE Premier Market: 5,437.56 (+0.51%)

QE: 9,933.22 (+0.37%) (YTD: +16.54%)

MSM: 4,420.34 (+1.14%) (YTD: -13.31%)

BB: 1,352.39 (-0.10%) (YTD: +1.55%)

Calendar

05-09 August (Sunday-Thursday): CBE hosts 41st annual meeting of the Association of African central banks, Sharm El Sheikh, Egypt.

12 August (Sunday): Egypt’s Emirates NBD PMI reading for July released.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.