Hedge funds adopt hipsterism to compete with tech for talent

Hedge funds adopt hipsterism to compete for talent with tech: As the reign of the quants in the hedge fund industry continues, the sector is increasingly seeing computer science, IT and artificial intelligence graduates more appealing. The upside is that the hedgies are also finding tech talent difficult to land, as the majority of them (at least in the US) are moving towards Silicon Valley. With the lure of once lucrative jobs at hedge funds lacking in luster for these graduates compared to the more “purposeful” employment of tech, hedge funds are changing up their cultural norms to attract them, writes Lindsay Fortado for the FT.

So don’t be surprised if you see a lot of jeans, sandals and ripped shirts when you visit hedge funds on the East Coast, as an industry of suits and ties adapts to attract the hipsters. Expect to also see a lot of open office plans as they switch from cubicles to the Silicon Valley decor and services such as such as free dry-cleaning. The sales pitch to graduates also include the challenge of solving complex data problems and the promise of a well-resourced tech department, said Matthew Granade, the chief market intelligence officer at Steve Cohen’s USD 13 bn Point72 hedge fund.

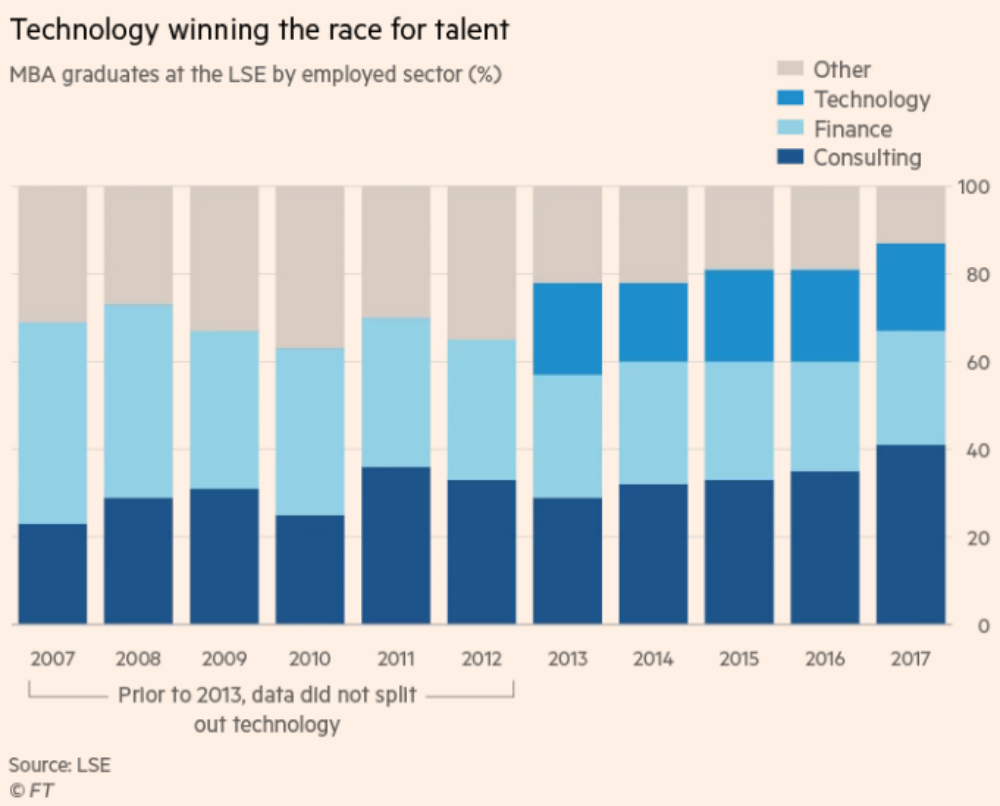

The competition is brutal: Tech appears to be winning the hearts and minds of the grads, with their propensity for grandiose visions of solving societal problems through code (because world peace will happen by building the next Candy Crush, right?), and more importantly, salaries that are the equivalent of those offered by hedge funds. At the London Business School, the percentage of graduates going to work in tech has jumped from 6% to 20% over the past decade, says Fortado. Those entering finance fell from 46% in 2007 to 26% last year.