- Preliminary government figures show Egypt’s GDP growth rose to 5.3% in FY2017-18. (Speed Round)

- US releases USD 195 mn in military aid to Egypt. (Speed Round)

- Madbouly Cabinet gives Oil Ministry the greenlight to hire banks to advise on fuel hedging. (Speed Round)

- Heliopolis for Housing and Development hires NI Capital to manage the sale of additional company shares on the EGX in October. (Speed Round)

- House of Representatives signs off Madbouly program and a string of laws before going to summer recess. (Last Night’s Talk Shows + Speed Round)

- Egypt makes its most expensive wheat purchase since 2015. (Speed Round)

- Saudi’s Rajhi Group plans to invest over EGP 2.5 bn to reclaim 17,000 feddans in the Toshka project. (Speed Round)

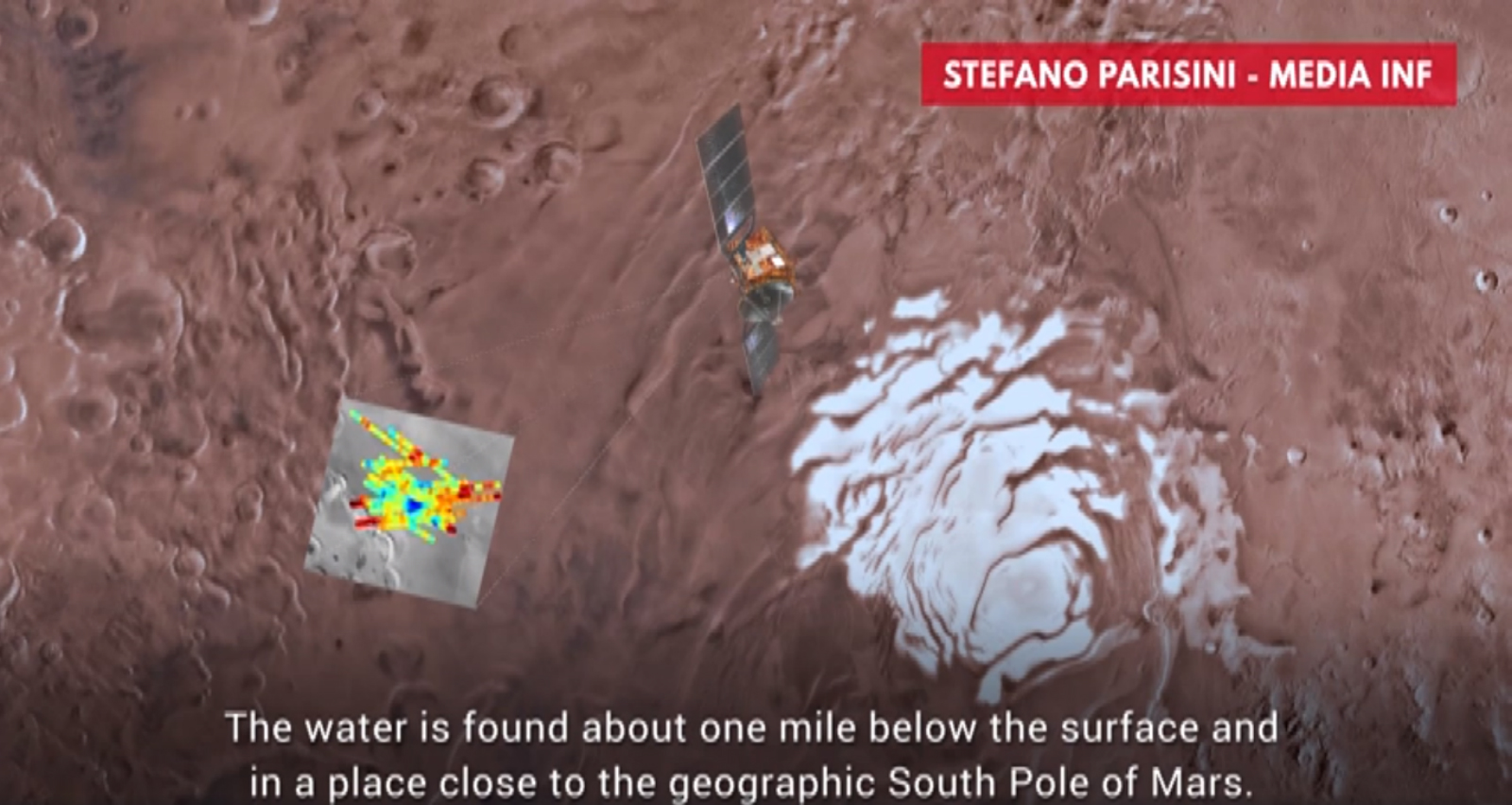

- We’ve found a lake of liquid water on Mars. But is there life? (Speed Round)

- The Market Yesterday —

Thursday, 26 July 2018

GDP growth reaches 5.3% last fiscal year

TL;DR

What We’re Tracking Today

While the slow news cycle continued again for the third straight day here in Egypt, it was peppered with important news. Preliminary figures from the government show Egypt’s GDP growth rising to 5.3% in FY2017-18, while economists polled by Reuters see GDP for the current fiscal hitting 5.2%. The US also unfroze USD 195 mn in military aid to Egypt it suspended last year, and the House of Representatives has finally given its sign off on the Madbouly Cabinet’s policy platform. All this and more coming up in the Speed Round below.

Speaking of our esteemed representatives, the House has ended its current legislative session and will recess for the summer — a break only us here at Enterprise will appreciate more than the MPs. By law, President Abdel Fattah El Sisi must call in the fall session of the House by the first Thursday of October, said House Speaker Ali Abdel Aal, according to Al Ahram. It is perhaps not surprising that the rush to the holidays saw a number of legislation having been passed by the House yesterday. We have more in the Speed Round.

Finance Minister Mohamed Maait had given us the rundown on some of the key laws the ministry plans to issue in the fall when the House reconvenes in an interview earlier this week. This includes major new amendments to the tax code, a new Customs Act, a new Pensions Act, and the executive regulations for recently passed laws.

UK’s FCO updates travel warning against publicizing negative political opinion in Egypt: The UK’s Foreign and Commonwealth Office (FCO) is warning British tourists against expressing “negative opinions” while in Egypt in the latest update to their travel advisory page. “Making political comments, including about the President or security forces, can cause trouble with the authorities. In some cases, derogatory comments on social media have led to custodial sentences.”

Oil appears to continue dominating international business headlines, as crude prices rose another 0.95% to USD 74.64/bbl. The price hike follows a report from the US Energy Information Agency which said that the country’s crude stockpiles dropped to the lowest since 2015 last week and gasoline supplies fell for a fourth week. Nationwide oil inventories fell by 6.15 mn bbls, according to the report which was picked up by Bloomberg.

Hedging against higher oil prices was front and center at yesterday’s Madbouly Cabinet meeting, where they signed off on hiring international banks to help the government hedge against rising crude prices, which is already straining the budget. We have more in the Speed Round.

EM zombie apocalypse respite? MSCI’s benchmark emerging equity index reached a one-month high, rising 0.4% for a second day of gains, boosted by a rise in Wall Street stocks which spilled over into tech-heavy Asian bourses, Reuters reports. Even Turkey’s bourse rose 1.3% after falling more than 3% on Tuesday after its central bank chose not to raise rates, defying analysts expectations. Analysts are crediting the respite to a slip in the USD amid uncertainty yesterday over how trade talks between the US and Europe are expected to go.

…a very short respite: The pendulum for today could very likely swing in favor of a strengthening USD today, after US President Donald Trump and European Commission President Jean-Claude Juncker announced they would hold discussions on eliminating the tariffs and subsidies, according to the Wall Street Journal (paywall).

As for that trade war with China, the Trump administration continued to double down by threatening to slap tariffs on all cars imported, Bloomberg reports.

Other emerging highlights this morning include the preliminary results from Pakistan’s elections, as former cricketer turned politician Imran Khan took an early lead, edging in front of jailed former premier Nawaz Sharif, according to Bloomberg. Results, however, hint that Khan’s Movement for Justice party is failing to capture a parliamentary majority, amid allegations by Sherif’s Pakistan Muslim League-Nawaz of election rigging.

We will be privy to the longest lunar eclipse of the 21st century tomorrow, and Cairo is apparently one of the best spots from which to view the blood moon, according to Ahram Online. The eclipse, which will begin at 6pm CLT tomorrow, will last about six hours, including nearly two hours of moon being entirely under Earth’s shadow.

PSA: temperatures are expected to drop 3-4°C today, head of the Egyptian Meteorological Authority Ahmed Abdel Aal tells Ahram Online. Cairo will see a daytime high of 37°C today, but humidity is expected to remain high.

Enterprise+: Last Night’s Talk Shows

As is usually the case on Wednesday evening, the talking heads covered a wide spectrum of topics on the airwaves last night.

The Reuters poll of economists (which we cover in Speed Round, below) undersells Egypt’s growth prospects, EGX Vice Chairman Mohsen Adel said on Masaa DMC. The economists polled did not account for several positive indicators, including the continuous decline in unemployment rates over the past two years and the stability of FX rates, and instead focused on concerns about inflations, he said. Adel sees Egypt’s economic growth coming in at 5.5-5.8% in FY2018-19 on the back of national mega projects and the reduction of debt levels as the government presses ahead with fiscal and monetary reforms (watch, runtime: 11:14).

After granting its vote of confidence to the Madbouly Cabinet, House reps. were intent on letting everyone know that they will be following up on the government’s “progress.” The House of Representatives will be receiving a progress report from Cabinet every three months, Parliamentary Spokesman Hassaballah told Yahduth fi Masr (watch, runtime: 2:48). Deputy Speaker Soliman Wahdan had similar things to say on Al Hayah fi Masr, and called on ministers to carving out some time from their schedules every month to appear in Parliament (watch, runtime: 4:26).

Support Egypt Coalition head Rep. Mohamed Elsewedy recapped parliament’s deliberation process of the Madbouly Cabinet’s policy program, which he said focused on the economic policies outlined, such as the integration of the informal economy and making commodities readily available and affordable for the population (watch, runtime: 5:02).

The government must prepare a legislative plan outlining the mechanics of how it will implement the promises made in its policy program, Hassaballah said on Hona Al Asema. He noted that parliament is ready to draft all the legislation necessary to support this process and ensure the government meets its objectives (watch, runtime: 4:20).

The proliferation of false news and rumors over the past several months is the Ikhwan’s doing, Supreme Council for Media Regulation head Makram Mohamed Ahmed told Masaa DMC’s Osama Kamal. Ahmed explained the council’s role and vehemently denied that it was responsible for the shuttering of several websites and news outlets, but defended the move as necessary, saying that all of the websites that have been blocked are owned or backed by the Ikhwan (watch, runtime: 4:43 and runtime: 7:43).

Residual commentary on the Siemens power plants also took up some time on Masaa DMC last night, with presidential advisor Hany El Nokrashy hailing the plants’ inauguration as a signal that Egypt is on the right track in terms of development (watch, runtime: 6:41). El Nokrashy also discussed Egypt’s energy mix, saying that relying on existing resources such as gas and solar power are optimal (watch, runtime: 4:00).

Speed Round

Preliminary gov’t figures show Egypt’s GDP growth rose to 5.3% in FY2017-18: Egypt’s GDP grew to 5.3% in FY2017-18, its highest rate in a decade, according to preliminary figures that Planning Minister Hala El Saeed announced yesterday during the Madbouly Cabinet’s weekly meeting. GDP grew to 5.4% in the third and fourth quarters of the fiscal year that ended on 30 June, thanks largely to a growth in both government and private sector investments and exports, which together make up 74% of total economic growth in FY2017-18, according to a cabinet statement (pdf). Non-oil exports were up 12.3% y-o-y for the year to USD 24.1 bn, led by increased exports from the chemical, textile, and engineering industries.

Finance Minister Mohamed Maait reaffirmed that Egypt achieved a primary surplus of 0.2% for the first time in 15 years in FY2017-18, according to a statement from the State Information Service. The overall budget deficit is also currently under 10% and the debt-to-GDP ratio had also dropped, he said, without mentioning figures. Maait had previously said that Egypt’s overall budget deficit is expected to have narrowed to 9.8% in the last fiscal year. The Madbouly Cabinet will be working to achieve a primary budget surplus of 2% for FY2018-19, in addition to a GDP growth rate of 5.8% and sovereign debt level of 93% of GDP.

Economists polled by Reuters aren’t as optimistic about this year’s GDP projections, seeing the economy growing at 5.2% in FY2018-19. The figure has even fallen short of the IMF’s projection of 5.5%. “The country has made significant progress under the IMF loan programme thus far and therefore Egypt’s medium-term economic growth prospects remain strong,” NKC African Economics’ Nadene Johnson tells the newswire, adding that pushing ahead “with the difficult reforms will be key to unlocking Egypt’s growth potential.”

As for next year’s projects, the median forecast of 12 respondents was for GDP to reach 5.5%.

US releases USD 195 mn in military aid to Egypt: The US government has released USD 195 mn in military aid to Egypt it froze last year, the State Department announced Wednesday, according to the AP. The decision to unfreeze the funds follows steps Egypt has taken in response to specific US concerns, and stronger ties between both countries in security and counterterrorism, the State Department said. “Secretary Pompeo determined that releasing these funds is important to supporting these needs and continuing to improve our partnership with Egypt,” said a State Department official. The move apparently came following a visit by an Armed Forces delegation to Washington, DC, sources with knowledge of the matter tell Ahram Online. The visiting delegation has been in week-long talks with various state officials trying to reverse the decision.

Background: Last August, the US had unceremoniously withheld USD 95.7 mn in aid and delayed the USD 195 mn in military assistance, citing human rights concerns. Analysts had seen at the time that move was aimed more at curbing Egypt’s alleged ties to North Korea, especially considering the improvement in US-Egypt ties following Donald Trump’s election.

Human rights is still an issue apparently: "We have serious concerns regarding human rights and governance in Egypt, and we will continue to use the many tools at our disposal to raise these concerns," a State Department official told Reuters.

The story has topped coverage of Egypt in the foreign press this morning, with the focus being on human rights. Most of the coverage, including from the Wall Street Journal, attribute the aid freeze to the Trump Administration’s frustration over the passing of the NGOs Act. “It’s a signal: Don’t pay attention to anything we say in the future,” said Michele Dunne, a former State Department official who is now director of the Middle East Program at the Carnegie Endowment for International Peace in Washington. Human rights groups and publications, including the US-based Human Rights First has denounced the move.

This came as Investment Minister Sahar Nasr signed USD 45 mn-worth of agreements with the USAID yesterday, according to a ministry statement.The five agreements include two grants worth USD 27 mn and USD 4 mn each for higher education initiatives; a USD 5.3 mn grant for governance programs; a USD 5 mn grant for the Health Ministry’s family planning program; and a USD 3.5 mn grant to support local farmers.

CABINET WATCH- The Madbouly Cabinet gave the Oil Ministry the greenlight to sign fuel hedging contracts with international banks at its weekly meeting yesterday. We had heard that seven offers were already on the table and under review from institutions looking to provide Egypt with fuel hedging solutions to prevent higher oil prices from further straining the state budget, which assumes an average price of USD 67/bbl. Brent crude prices had climbed to highs of over USD 80/bbl in May. OPEC and non-OPEC member states agreed last month to increase oil output as of July by 1 mn bpd, a move widely expected to ease upward pressure on prices, which have now retreated to around USD 68-70/bbl. Sources said the ministry was after 2-3 year contracts and that the government was also considering hedging against global wheat price fluctuations.

Also yesterday, the Madbouly Cabinet signed off on Egypt’s agreement with Russia to establish the USD 7 bn Russian Industrial Zone (RIZ). Contracts for the development of the RIZ were signed back in May and officials had said last month that they expect to announce progress soon, with talks already ongoing with companies including Volkswagen and Toyota to set up shop, in addition to a number of Russian investors who had come to Cairo earlier this year to explore available opportunities.

HHD hires NI Capital to manage October stake sale on EGX: Heliopolis for Housing and Development (HHD) chose state-owned investment bank NI Capital to manage the sale of additional company shares on the EGX in October under the state’s privatization program. HHD canceled plans for an international tender for banks to take part in the sale after it had begun talks with a number of them, the company said yesterday in a filing to the bourse (pdf). We had heard that Pharos and EFG Hermes, as well as Beltone Financial, CI Capital, Arqaam, Eagle, and Al Ahly Capital were among those being considered. The company is expected to pilot the privatization program alongside Eastern Company in October, with Alexandria Mineral Oils Company (AMOC) and Alexandria Container and Cargo Handling following in November, and Abu Qir Fertilizers in December. Finance Minister Mohamed Maait had said this week that the government plans to allow investors to buy up majority stakes of up to 33% in the company, with the state retaining 40%.

INVESTMENT WATCH- Saudi’s Rajhi Group plans to invest over EGP 2.5 bn to reclaim 17,000 feddans in the Toshka project, sources close to the matter tell Al Mal. Feasibility studies to determine the exact cost as well as the types of crops that will be grown should wrap up by 15 August, according to the sources, who add that the high price tag is due to the fact that the company intends to rely entirely on solar power for its work on the project. The group has already developed 13,000 feddans from a total 100k they have been allocated in Toshka.

M&A WATCH- Mondi to complete MTO of Suez Bags next week: Mondi Paper Sales plans to complete its mandatory tender offer to acquire a 70.1% stake in Suez Bags by 31 July as per the deadline set by the Financial Regulatory Authority, our friend and Pharos Holding Managing Director Essam Abdel Hafiz told the press on Wednesday. The company, a subsidiary of the London- and Johannesburg-listed Mondi Group, bought 7,666,435 shares in Suez Bags at EGP 26 per share in a transaction valued at EGP 199.4 mn. The FRA had signed off last month on the transaction. Our friends at Pharos had been tapped to act as the broker for the MTO, announced Abdel Hafiz. “The transaction represents the faith foreign investors have had in our economy,” he noted. Zaki Hashem & Partners acted as local counsel for Mondi in the transaction.

EARNINGS WATCH- Eastern Company reports record 42.5% jump in FY2017-18 net profit to EGP 4.2 bn: The state-owned Eastern Tobacco Company reported a record 42.5% y-o-y jump in net profit after tax to EGP 4.2 bn in FY2017-18, up from EGP 2.9 bn a year before, the company said in a filing to the EGX yesterday (pdf). The jump is attributable to a 27.2% y-o-y increase in revenues, which came in at EGP 13.4 bn, up from EGP 10.5 bn in FY2016-17.

These results come despite the company’s recent hike to cigarette prices in order “to accommodate the country’s new so-called sin tax, Bloomberg notes. They are, however, “a welcome development for Eastern,” which is slated to sell an additional 4.5% stake on the EGX in October under the state’s privatization program.

Orange Egypt reported a net loss after tax to EGP 252.5 mn in FY2017-18, up from a net loss of EGP 1.1 bn in the previous year, the company said in a statement to the EGX (pdf). Revenues were up 7.92% y-o-y for the year coming in at EGP 6.61 mn, up from EGP 6.12 mn a year earlier.

Meanwhile, Vodafone Group said service revenues from Egypt grew 16.7% y-o-y in the second quarter of 2018, “driven by rising data penetration and usage,” according to the company’s earnings release (pdf). Total group revenues dropped 4.9% y-o-y to GBP 10.9 bn, despite a 9.4% y-o-y growth in service revenues, thanks to “strong local currency growth in Turkey and Egypt.“

The Madbouly Cabinet received the House of Representatives’ official vote of confidence yesterday, Al Mal reports.The majority of reps. had signaled their approval of the cabinet’s policy program, which Prime Minister Mostafa Madbouly had unveiled early in July. The agenda is focused on the five main areas of economic development, improving living standards, human development, national security, and foreign policy; it also targets a GDP growth rate of 8% and a sovereign debt level of 80-85% of GDP by FY2021-2022. You can tap or click here for our spotlight on the cabinet’s agenda.

LEGISLATION WATCH- The Finance Ministry’s proposal to reduce the mandate of the Tax Dispute Resolution Act also received parliamentary sign-off yesterday. The ministry had signaled its intention to cut the law’s mandate short to speed up the resolution of the tax disputes currently on file. The Act will now expire on 31 December 2018, after its mandate had been renewed for two years in March.

House approves legislation to channel 5-15% of slush funds to state coffers: The House also approved yesterday legislation earmarking 5-15% of ministerial “private funds” for state coffers, Al Mal reports. The bill exempts funds used for educational research, charity, social housing, and university hospitals, as well as funds financed by international loans and grants. The legislation will also see state coffers laying claim to a one-time 15% cut of the annual surplus generated by these funds as of 30 June, 2018.

Parliament also gave its final approval to the Public Contracts Act (previously known as the Tenders and Auctions Act) after the Council of State (Maglis El Dawla) reviewed the legislation for a second time following the name change, Youm7 reports. The legislation aims to decentralize and streamline tender procedures.

Reps. also approved amendments to the Government Accounting Act that legally enshrine the transition towards a cashless economy, Al Masry Al Youm reports. The amendments make it mandatory for all government transactions to be electronic, and ban the use of paper cheques for transactions above a set threshold.

Also approved yesterday: A draft law allowing the Finance Ministry to act as guarantor to the National Company for Construction & Development’s settlement of the Omar Effendi Company’s USD 35 mn debt to the International Finance Corporation, according to Al Shorouk. The company is required to repay the debt by the end of the year.

Thank you, climate change — Egypt makes its most expensive wheat purchase since 2015: The General Authority for Supply Commodities (GASC) paid an average USD 235.65 per tonne in an international wheat tender which closed on Tuesday, traders told Bloomberg on Wednesday. This was the most expensive wheat purchase Egypt has made since February 2015, and comes amid a drought across Europe and the Black Sea region. "The major weather issues are actually in Europe and the Black Sea, and those are the major suppliers of wheat to Egypt," Michael McDougall, senior vice president at ED&F Man Capital Markets in New York, said. GASC bought 420,000 tonnes of wheat for delivery in 1-10 September. 240,000 tonnes came from Russia, while 120,000 tonnes were bought from Romania and 60,000 tonnes from Ukraine.

More pain ahead? Russian wheat production is expected to fall for the first time in six years, while crops in France, Germany and the Baltic countries are also expected to be smaller. Benchmark futures traded in the Chicago Mercantile Exchange surged 21% this year and Paris wheat for December delivery hit a record for the contract.

CORRECTION- We incorrectly referred to Humansoft Holding’s USD 226 mn secondary offering on the Kuwait Stock Exchange, which was successfully concluded in record time by sole sellside bookrunner and financial advisor EFG Hermes, as an IPO. We apologies for the mistake and the story has since been corrected on the website.

We’ve found an underground lake on Mars: Radar data from the European Space Agency’s Mars Express spacecraft appears to have found a sizable salt-laden lake under ice on the southern polar plain of Mars, Reuters reports. The reservoir they detected represents the first stable body of liquid water ever found on Mars, scientists said.

So, in the words of the late, great David Bowie: Is there life on Mars? The detection of liquid water, a fundamental ingredient for life, could raise the change there is native microbial life on the red planet, scientists said. There are similar environments on earth that harbor life, said planetary scientist Roberto Orosei of Istituto Nazionale di Astrofisica in Italy, who led the research. However, verifying whether something is actually living in this body of water could take years, and even a surface mission to drill under the ice.

Fiat Chrysler’s former CEO Sergio Marchionne passed away yesterday at age 66. Marchionne, who passed away from surgical complications just days after he was replaced, was the “architect of the automaker’s dramatic turnaround,” according to Bloomberg. “ [He] took the Italian manufacturer from the brink of bankruptcy to the New York Stock Exchange…to mark the debut of Fiat Chrysler Automobiles NV, the London company created when Fiat bought the Detroit carmaker.”

Up Next

Foreign Minister Sameh Shoukry is expected to land in Washington during the first week of August to meet with US Secretary of State Mike Pompeo over developments in the Middle East and US-Egypt relations.

Egypt is set to select the board of directors for its EGP 200 bn sovereign wealth fund “within days” by Prime Minister Mostafa Madbouly, according to Finance Minister Mohamed Maait.

Our friends at the American Chambers of Commerce (AmCham) are preparing to host Finance Minister Mohamed Maait for its monthly luncheon on Monday, 30 July. You can register for the event here.

President Abdel Fattah El Sisi is set to unveil a new education strategy during the sixth edition of the National Youth Conference scheduled for 28 and 29 July. Cairo University will be hosting the conference as university students are reportedly the focus of the edition.

El Sisi is also reportedly visiting Beijing in September to attend the Forum on China-Africa Cooperation.

Mo Salah fans have until 10 August to make him one of FIFA’s top three men’s footballers for 2018. Cast your ballots here.

Image of the Day

An Egyptian zoo didn’t have zebras, so it got creative: A zoo in Cairo has apparently been trying to pass off a few donkeys as zebras by painting them black and white, according to the Sun. An Egyptian student visiting the zoo noticed that “the creature had unusually long ears and lacked the distinctive mane usually present on the African beasts. A closer inspection revealed the equine creature was in fact a strategically painted [donkey].” The best part? The zoo has remained adamant that the animals in the exhibit are real zebras, not knockoff zonkeys.

Egypt in the News

Topping coverage of Egypt in the foreign press on a very slow news day this morning was the US unfreezing aid to Egypt. Other headlines worth noting in brief:

- Egypt should be clearing up conflicts arising in negotiations over the Grand Ethiopian Dam and establishing a long-term cooperation framework with Sudan and Ethiopia to guarantee its Nile water shares, Tareq Baconi writes for the European Council on Foreign Relations.

- A military court issued a suspended two-month prison sentence to six defendants “for their involvement in a play seen as insulting to security forces,” the New York Times reports.

- Founded by Huda Shaarawi in 1923, the Egyptian Feminist Movement is one of Africa’s strongest feminist groups today, Pulse says.

On Deadline

Tuesday’s inauguration of the three combined-cycle power plants opened the floodgates of columns about the state of Egypt’s energy sector. Social Solidarity Minister Ghada Wali penned a piece for state-owned Al Ahram lauding Electricity Minister Mohamed Shaker for leading the transformation of the energy sector in Egypt and for being a manifestation of the leadership’s political will and determination. Al Masry Al Youm’s Abbas El Tarabily zones in specifically on the three 14.4 GW power plants, which he hails as an “unprecedented miracle” that, alongside the planned Dabaa nuclear facility, has placed Egypt on the global energy map. Meanwhile, Mohamed Amin seems to be confused as to how citizens are paying more for electricity at the same time that these large-scale energy projects are fulfilling the country’s energy needs.

Worth Reading

Property rights for women grow with education and employment: Expanding women’s access to education and employment in the Middle East are the key to advancing women’s rights and gender equality, Benjamin G. Bishin and Feryal M. Cherif write for the Washington Post. “Examining women’s property rights in 41 Muslim-majority countries, we find that women are likely to enjoy more secure property rights in countries where, first, women have greater access to education and second, where there are dense networks of women’s-rights activists.” Statistics show that women outperform their male peers in school and have a higher rate of university enrolment, and are not increasingly joining the labor force, suggesting that the region is on its way to significantly advancing women’s rights.

Religion is too simple of an explanation for gender inequality: Explanations that dismiss gender equality as nothing more than the application of religious teachings, particularly those of Islam, are “too simplistic” and fail to account for the incomplete application of religious rules. “Countries tend to discriminate against women by applying religious norms in inheritance rights — but for property rights where Islam enjoins equality, the practice is more mixed. This inconsistency suggests that religion-based explanations fall short.” The real issue, therefore, is not religion, but rather the patriarchal culture that nitpicks at the parts of religion that cater to the sustenance of this status quo.

Diplomacy + Foreign Trade

Gov’t inks contracts with EIB for its EUR 172 mn contribution to Fayoum wastewater project: Investment and International Cooperation Minister Sahar Nasr signed yesterday a EUR 172 mn loan agreement with the European Investment Bank (EIB) to help upgrade sewage and wastewater systems in Fayoum, Al Mal reports. The loan is part of a EUR 448 mn package from the EIB, EU, and European Bank for Reconstruction and Development (EBRD). The government had already signed a contract with the EBRD for its EUR 186 mn portion of the facility last year. The funding will support the construction of eight new wastewater treatment plants, the expansion and rehabilitation of 19 units, and the procurement of 350 sewage removal trucks to serve remote rural communities. The project will also reduce pollution levels at Lake Qarun.

Egypt’s Trade and Industry Ministry is in talks with its Russian counterpart to begin exports of Hepatitis C treatment Sovaldi to Moscow, unnamed government sources told Al Mal. Egypt has been producing the treatment Sovaldi since 2015 under a government-sponsored initiative that is said to have lowered the price of a full course of

treatment to around USD 83 from around USD 84,000,

Energy

Energy Recovery awarded USD 3.3 mn contracts

The California-based Energy Recovery Inc. was awarded a contract to supply desalination projects in Egypt with USD 3.3 mn-worth of its PX Pressure Changer technology, the company announced. The orders are expected to ship in 4Q2018.

Manufacturing

Bechtel is sole bidder in Egyptalum tender to upgrade production line

The US’ Bechtel Corporation is the sole bidder in a tender issued by Egyptalum to upgrade its seventh production line, Al Mal reports. The company had postponed the tender to 24 July from June in the hopes of drumming up more interest. Egyptalum is currently studying Bechtel’s offer. No additional details were provided.

IDA promises SME manufacturers a 50% reduction in licensing fees

The Industrial Development Authority (IDA) has reportedly promised small factory owners a 50% reduction in licensing fees and permits, which will take effect at the end of the month, Ahram Gate reports. The IDA had raised licensing fees to EGP 6,042 from EGP 2,907. The authority had recently raised the registration fee for the Industrial Registry to EGP 4,332 from EGP 1,150.

Tourism

Taba Heights looking to double its visitors by end-2018

Taba Heights is looking to double the number of tourists visiting its hotels and resorts to reach 150k visitors by the end of 2018, General Manager Emad El Tarabishy tells Reuters’ Arabic service. The company is working on diversifying its sources of tourism by focusing on new markets such as Iraq and Poland. Occupancy rates at Taba Heights are currently at 60-0%, according to El Tarabishy.

Telecoms + ICT

MNOs to operate fixed line services before end of 2018

Egypt’s three private mobile network operators will reportedly launch fixed line services before the end of 2018, unnamed sources tell Al Mal. MNOs finished testing fixed line services with state-owned landline monopoly Telecom Egypt and are currently negotiating final terms, they add. Vodafone Egypt began testing its fixed line services last week but the company said it was uncertain about moving ahead with the launch, since the service is not particularly lucrative. The national telecom regulator is currently investigating why the nation’s three private mobile network operators are facing delays in offering fixed line services since they received their operating licenses two years ago. Orange Egypt had said in December last year that it would begin offering fixed line services as of 2018.

Banking + Finance

NI Capital’s Tamweely receives final microfinance license

NI Capital’s Tamweely announced yesterday that it received its final microfinance license on 8 July, which will allow the company to officially launch its operations, the company said in a press release (pdf). Tamweely was established in August by state-owned investment bank NI Capital with an initial investment of EGP 50 mn. The company had said in May that it was looking to expand its number of branches to 15 across the country by 2019.

Other Business News of Note

MAM to buy stake in Al Canal Sugar from Al Ahly Capital for EGP 100 mn

Misr Asset Management (MAM) reportedly plans to invest EGP 100 mn to buy into Al Ghurair Group’s Al Canal Sugar refinery, company sources told Al Mal yesterday. The company expects to finalize the terms of the transaction within a month with Al Ahly Capital, which holds a 27% stake in the project through its EGP 1.5 bn investment, for which the National Bank of Egypt is said to be arranging a USD 1 bn syndicated loan.

Sports

EFA shortlists four coaches to replace Cuper

The Egyptian Football Association (EFA) has shortlisted four coaches to replace Hector Cuper as the national football team coach, BBC reports. The list includes “Colombian Jorge Luis Pinto, Spaniard Quique Sanchez Flores, Mexican Javier Aguirre and Bosnian Vahid Halilhodzic.”. The association hopes a new coach will be appointed before the Africa Cup of Nations qualifier against Niger scheduled for 8 September.

On Your Way Out

Alexandria has ordered the closure of Agamy’s Al Nakheel beach following a spike in the number of drowning incidents at the beach in recent months, according to Egypt Today. The beach reportedly sees strong waves and a large number of whirlpools, making it a dangerous spot for swimmers.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.85 | Sell 17.95

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Wednesday): 15,186 (-1.9%)

Turnover: EGP 621 mn (33% below the 90-day average)

EGX 30 year-to-date: +1.1%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 1.9%. CIB, the index heaviest constituent ended down 1.3%. EGX30’s top performing constituents were Arab Cotton Ginning up 0.9%, Eastern Co up 0.6%, and Abu Dhabi Islamic Bank flat. Yesterday’s worst performing stocks were Egyptian Resorts down 7.7%, Kima down 7.6%, and Qalaa Holdings down 6.4%. The market turnover was EGP 621 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -1.1 mn

Regional: Net Short | EGP -11.1 mn

Domestic: Net Long | EGP +12.2 mn

Retail: 67.5% of total trades | 67.2% of buyers | 67.7% of sellers

Institutions: 32.5% of total trades | 32.8% of buyers | 32.3% of sellers

Foreign: 17.7% of total | 17.8% of buyers | 17.9% of sellers

Regional: 7.0% of total | 6.2% of buyers | 7.9% of sellers

Domestic: 75.2% of total | 76.2% of buyers | 74.2% of sellers

WTI: USD 69.7 (+0.25%)

Brent: USD 74.56 (+0.85%)

Natural Gas (Nymex, futures prices) USD 2.79 MMBtu, (+0.40%, August 2018 contract)

Gold: USD 1,242.40 / troy ounce (+0.11%)

TASI: 8,399.83 (-0.07%) (YTD: +16.24%)

ADX: 4,830.42 (+1.12%) (YTD: +9.82%)

DFM: 2,944.67 (+0.65%) (YTD: -12.62%)

KSE Premier Market: 5,355.28 (-0.19%)

QE: 9,613.78 (-0.05%) (YTD: +12.79%)

MSM: 4,405.34 (0.00%) (YTD: -13.61%)

BB: 1,362.87 (-0.35%) (YTD: +2.34%)

Calendar

26-28 July (Thursday-Saturday): Green Banking: The Road to Sustainable Development, Baron Palace, Sahl Hasheesh, Hurghada.

30 July (Monday): Finance Minister Mohamed Maait will address the American Chambers of Commerce on Egypt’s financial reform agenda.

05 August (Sunday): Egypt’s PMI reading for July released.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.