- Cigarette prices rise today. Plus: The national anthem still won’t cure cancer, and 2 mn women don’t have access to birth control. (Last Night’s Talk Shows)

- Is the Egypt carry trade approaching a tipping point? (Speed Round)

- DBK Pharma resurrects zombie IPO, mulls dual-listing on Egypt and Saudi stock exchanges in 1H2019. (Speed Round)

- MPs set to give Madbouly’s policy platform a ringing endorsement as committee report due to House today ahead of Sunday vote. (Speed Round)

- Gov’t looking at how to fund higher spending on commodities for newborns; move is part of expansion of social safety net in El Sisi’s second term. (Speed Round)

- Oil Ministry signs three new oil and gas exploration agreements in Gulf of Suez and North Sinai. (Speed Round)

- Your next EGX trade could cost you an extra five piastres to fund a new NBFI federation. (Speed Round)

- The world is at 7.5 bn, with Egypt’s population coming in at 96.3 mn. (What We’re Tracking Today)

- The Market Yesterday —

Thursday, 12 July 2018

Smoke prices rise today. Now, let’s go to Sahel.

TL;DR

What We’re Tracking Today

It’s a slow news day in Cairo as many of us scurry to the coast to squeeze in a long weekend as we approach “peak summer.” For new readers, peak summer is our shorthand for the long weekend many take some time around the 23 July holiday, propelling us into August when Sahel booms. It’s among the quietest months of the year, particularly after the 2Q / 1H earnings season ends in mid-month.

Be prepared for grumbling: Cigarette prices go up today. The non-smokers among us are crowing. (Yes, there’s nothing more pious or self-righteous than reformed smokers.) We have the rundown in Last Night’s Talk Shows, below.

Happy World Population Day. We’re at 7.5 bn people and counting, according to the US Census Bureau. Projections see the world’s population growing to 9.9 bn individuals by 2050. Here at home, we hit 96.3 mn citizens at the start of 2018, according to a CAPMAS report. Cairo was still the country’s most populous city with 9.9 mn residents at the start of the year, followed by Giza with 8.8 mn, making the Greater Cairo Area some 18.7 mn. One-third of the population was under 15 years and only 3.9% were over 65 years of age, according to the report, which adds that life expectancy has improved for men (to 71.2 years from 66.5 in 2006) and women (to 73 years from 69.1 in 2006). We city dwellers represented 42.6% of the population as of January.

Are the two biggest economies in Africa joining the continent’s freetrade zone? Nigeria plans to sign up to the African Continental Freetrade Zone “soon,” Nigerian President Muhammadu Buhari said on Wednesday following a meeting with South African President Cyril Ramaphosa. The latter had also said that South Africa saw huge benefits from the continental free trade deal and that a draft agreement relating to the movement of people was being reviewed, Reuters said. The two biggest economies had refused to join the other 44 countries, including Egypt, who signed on to the agreement when it was inked in March.

The price of oil sank nearly 7% yesterday as the US-China trade war continued to unfold. The fall in Brent, coupled with a sell-off in metals from copper to zinc and agricultural commodities, underscores “widespread weakness” in commodities markets, the Financial Times writes.

Turkey is getting it behind the ear from global markets after Erdogan predicted interest rates would fall, prompting investors to “fret over the health of the economy,” the Financial Times reports. “Investors fear that Mr. Erdogan will have a greater say in monetary and economic policy” under the country’s new presidential system and after appointing his son-in-law in charge of the economy. Bloomberg Opinion takes it further, bluntly declaring “Erdogan’s new dynasty makes Turkey uninvestable. The president has given investors every reason to turn away.”

Worth a moment of your time if you’re looking for something to fill your commute or to read while you scarf down lunch at your desk:

- This PE boss has a secret list of 110 instructions on how to maximize value in a buyout. He claims the list is key to why he’s never lost money on a transaction, the WSJ writes in a profile.

- A list of the similarities between Silicon Valley and the USSR will make you smile.

- The “cruel truth” about what happens when startups raise too much money. (Business Insider)

- If you live in America, you’ll apparently be stuck with landlines forever. But don’t worry: Phone calls are dead and voice chat is the future, the WSJ promises (God help us all).

Go behind the scenes of one of the world’s most dramatic rescue operations ever. Published the same day as the first pictures of the Thai boys’ football team were made public, the Wall Street Journal has great look at how they were brought to safety from deep inside a flooded cave network. “One of the world’s most dramatic rescue missions appeared to take place like clockwork. It narrowly skirted disaster many times. Divers nearly missed finding the trapped soccer team. Thai Navy SEALs had no cave diving experience. A critical pump broke. ‘I didn’t think anyone would be so crazy as to do this.’” Replete with great color, detail and behind-the-scenes photos, the piece is a must-read if you were as transfixed by the rescue as we were. (And it was hard not to be, if you’re a parent and imagined for half an instant that yours was one of the kids.) Or check out the video of the boys carried by Reuters if you’re not up for a long read.

Looking for a series on which to binge on an upcoming flight? The starting point in your quest should be Vanity Fair’s “predictions for every major category” of the 2018 Emmy nominations.

It’s Croatia and France in the World Cup final. Croatia beat England 2–1 yesterday as Mario Mandzukic’s extra-time goal sent them into their first World Cup final ever, Reuters reports. The New York Times has great color commentary. England and Belgium’s third play place-off will be airing at 4pm on Saturday. France meets Croatia in the final at 5 pm on Sunday.

Enterprise+: Last Night’s Talk Shows

As a nation of smokers wakes up to news that their smokes are more expensive, it is not surprising that the talking heads transfixed by it. In fact, today’s talk show report is all about healthcare: From cancer sticks and hospitals to access to birth control and the Health Ministry’s decision to play the national anthem at state hospitals to improve morale. Side effects may include nausea.

Eastern Tobacco Company is raising the price of the cigarettes it produces EGP 1.5-3 per pack today, which the company’s CEO said was due to the state’s EGP 0.75 rise in the sin tax to pay for the new healthcare system. Earlier this week, Eastern Tobacco had denied it was raising prices following reports that it increased prices on four local cigarette brands. Eastern CEO Mohamed Haroun told Yahduth fi Masr’s Sherif Amer that the decision has been on the books since January, but these would only come into effect after six months. The sin tax increase should net the state around EGP 3 bn in annual revenues.

The most frightful figure of the interview: Egypt consumes 83 bn cigarettes a year, Haroun said, with an average of 280 mn cigarette per day (we don’t get his math, either) (watch, runtime: 5:34). Haroun also spoke to Masaa DMC’s Osama Kamal to say that other tobacco companies may choose to raise prices more than Eastern has (watch, runtime: 5:17).

Health Minister Hala Zayed defended her decision to play the national anthem and Hippocratic oath in hospitals, telling Kamal (in an off-camera talk) that it would somehow result in doctors delivering better care to patients. Kamal was not convinced, and neither are we (watch, runtime: 3:52).

Hona Al Asema tackled women’s access to birth control. The show quoted former deputy Health Minister Maissa Shawki’s statements that some 2 mn women have no access to contraceptives. Lamees Al Hadidi’s current stand-in, Reham Ibrahim, spoke to the head of survey firm Baseera, Maged Othman, who said the figures she quoted were “stop-smoking-guru.com”. He noted that access to contraceptives is generally more limited in Upper Egypt. Othman said around a quarter of Sohag’s women do not have access to birth control. He called on authorities to make this a priority (watch, runtime: 9:29).

Supreme Media Council head Makram Mohamed Ahmed answered a summons by the Prosecutor General yesterday to explain his decision to impose a media gag on the corruption investigation of the 57357 Children’s Cancer Hospital. Press Syndicate official Hatem Zakaria told Hona Al Asema that the inquiry has not seen charges brought against Ahmed, but was limited to why he imposed the gag order in the first place (watch, runtime: 3:17).

The committee tasked with managing Ikhwan assets had so far seized funds belonging to 2,100 alleged members, Masaa DMC’s Osama Kamal said, citing sources. Accounts of some 350 companies, 105 hospitals and medical centers, 120 schools, 1,133 NGOs and 300 feddans have also been seized. On the media front, 16 news website, 16 TV channel, and two newspapers saw their assets sequestered by the committee (watch, runtime: 5:07).

Speed Round

Is the carry trade approaching a tipping point? CBE data on the balance of payments in April indicated that the foreign holdings of Egyptian debt fell 1.25% m-o-m to EGP 375.5 bn — the first drop in foreign portfolio investments in 2018, according to the local press. As our friend EFG Hermes lead economist Mohamed Abu Basha suggested to Al Mal earlier this week, “hot money” investors have curbed somewhat their appetite for Egyptian treasuries as the central bank’s started guiding interest rates down 1H2018. Early signs among rate watchers are that we’re looking at a slower pace of easing in the back half of the year — good news for the carry trade, not necessarily for the rest of us who were hoping lower rates might spark corporate borrowing for replacement capex, at least.

MPs set to give Madbouly’s policy platform a ringing endorsement; committee report due to House today ahead of Sunday vote. The ad hoc House of Representatives committee reviewing the Madbouly Cabinet’s policy program has given it a ringing endorsement, the committee’s deputy chair, Rep. Mahmoud El Sherif, said, according to Al Shorouk. The committee held a vote after its final hearing on the program, with 27 of 31 members in favour; it is due to present its report to the House general assembly today. The House Economic Committee, which is also looking into the program, is also finalizing its report. We’re tracking with interest the committee’s proposal to require that the private sector be involved in three-quarters of the national projects slated in the program.

EXCLUSIVE- DBK Pharma resurrects IPO, mulls dual-listing on Egypt and Saudi stock exchanges in 1H2019: DBK Pharma’s long-awaited initial public offering appears to be back on, but this time the company is planning a dual-listing in Egypt and Saudi Arabia, sources close to the transaction told Enterprise yesterday. DBK is planning to offer as much as 25% of the company on the EGX and Tadawul during 1H2019 in secondary sales that will see some anchor shareholders trim their positions. Selling shareholders are then expected to use the lion’s share of their proceeds to subscribe to a capital increase to fund the remaining work on its new manufacturing facility in Obour. Saudi Arabia’s Marei bin Mahfouz Group had acquired a 25% stake in DBK Pharma back in February for EGP 38.5 mn, after the company’s initial bids for an IPO in 2016 and 2017 failed to garner enough shareholder support.

REGULATION WATCH- Your next EGX trade could cost you an extra five piastres to fund a new NBFI federation. That’s the message from the Financial Regulatory Authority (FRA), which is mulling an EGP 0.05 tithe on any capital market transaction executed by a brokerage firm, with the proceeds being channeled to the operating budget of a new federation for non-bank financial companies that will soon be established, sources with knowledge of the matter tell Al Mal. The newly-issued Capital Markets Act includes provisions for the establishment of a federation for non-banking financial companies similar to the Federation of Egyptian Banks. The FRA’s policy consultation committee expects to present the list of regs for the establishment of the federation to the FRA board in a few weeks’ time, they add.

Siemens to sign management contracts for the three combined cycle plants next week: It appears that the Electricity Ministry had settled on having Siemens run the day-to-day operations and maintenance of the three combined-cycle power plants in the new capital, Burullus, and Beni Suef. The global giant built the plants with local partners including our friends Orascom Construction and Elsewedy Electric. Siemens and the state are expected to sign the EGP 6 bn, eight-year contracts next week, sources from the Egyptian Electricity Holding Company said. The EEHC had issued an open tender for the management and maintenance of the plants back in November.

You can get the latest information on the Siemens plants on the company’s landing page. It’s oddly good if you have a moment to check out their videos, and the geeks among you can follow our lead and download their white paper on the plants (pdf, registration required).

EXCLUSIVE- Gov’t looking at how to fund higher spending on commodities for newborns; move is part of expansion of social safety net in El Sisi’s second term. The Madbouly government is debating on how to fund increased commodity subsidies for 6 mn newborns, which the state defines as kids under the age of two, sources tell Enterprise. Three solutions are under consideration to fund an additional EGP 3.6 bn in spending: 1) covering it with a budget overdraft in FY2018-19, 2) re-allocating funds from other ministries or 3) classify the newborns as beneficiaries of programs under the Takaful and Karama social welfare programs. A meeting was held yesterday between the ministers of supply and social solidarity with President Abdel Fattah El Sisi to decide on the solution. Commodity subsidy spending in the FY2018-19 budget is up 36.6% y-o-y to EGP 86.18 bn.

Supply Ministry looking to add EGP 20 to subsidy beneficiaries’ monthly allowance? This comes as the Supply Ministry is reportedly planning to hike the monthly allowance for beneficiaries of various food subsidy programs to EGP 70, from a current EGP 50, unidentified government sources tell Al Mal. The supply and finance ministries are still discussing the feasibility of the increase, according to the sources.

Background: Overall spending on commodity subsidies is set to rise 36.6% this fiscal year to EGP 86.18 bn. With that in mind, the government is looking to cut off moochers and channel more funding to those who need it most. Reports earlier this week suggested the ministers of supply, finance and military production are also reconsidering eligibility conditions for the commodity subsidies system. The government had been expected to focus on reducing the number of beneficiaries that receive subsidized commodities and raising the number of those eligible for bread subsidies instead during FY2018-19. Almost two mn more citizens are expected to benefit from subsidized bread this year — 78.6 mn citizens, up from 76.8 mn last fiscal year. At the same time, only 69 mn people are likely to be made eligible for subsidized commodities, down from 71 mn last year.

Oil Ministry inks three new agreements for oil and gas exploration in North Sinai and the Gulf of Suez. The first agreement, between GHP Exploration Corp. and the South Valley Petroleum Holding Company, will see the company drill four new wells at a cost of about USD 6 mn at the West Gabal El Zeit concession in the Gulf of Suez, according to a ministry statement. The second agreement was signed between the EGPC and UK’s Perenco for exploration in the North Sinai offshore concession, while the third was with the EGPC for exploration in the Gulf of Suez’ Ras Fanar concession. The Oil Ministry is currently finalizing procedures for 18 other agreements that will be announced soon, according to Minister Tarek El Molla. The government had announced plans to step up exploration activities in FY2018-19 as the country marches toward natural gas self-sufficiency and bids to become a regional energy export hub.

On a related note, the EGPC is reportedly considering renewing a crude oil import agreement with Iraq for a third year, government sources tell Al Mal. The authority is planning to re-negotiate payment terms and request to increase its grace period to six months from three months, if it decides to commit to the agreement for another year, they add. Egypt had renewed its agreement with Iraq, to import 12 mn bbl of crude oil, back in January.

LEGISLATION WATCH- House committee approves amendments to Gov’t Accounting Act enshrining transition towards a cashless economy: The House of Representatives’ Planning and Budget Committee approved on Tuesday amendments to the Government Accounting Act that legally enshrine the transition towards a cashless economy, Al Mal reports. The amendments aim to bring the act up to speed with several ministry-level decisions adopted recently, such as the scrapping of paper cheques for transactions above a set threshold. The amendments make it mandatory for all government transactions — including collecting taxes and disbursing civil servants’ wages — to be electronic, according to Rep. Yasser Omar. Cabinet had signed off on the amendments last month. The proposed amendments still required asset from the House general assembly.

Background: Drafting a law on non-cash payments and transactions was one of several resolutions adopted during a National Payments Council meeting last year. The government has been taking steps to gradually decrease the rate of cash transactions as part of the state’s wider financial inclusion strategy. Planning Minister Hala El Said had said last week that her ministry has finished drafting legislation to encourage non-cash payments, but had not divulged the contents of the bill. The Finance Ministry and CBE had also been working on a law earlier this year to set limits on the amount of cash that government agencies can receive or pay in a single transaction. These laws and the Government Accounting Act appear to be separate, complementary initiatives.

Global Innovation Index: Egypt stands out among lower-middle income countries and is most improved in MENA. Egypt climbed 10 spots to rank at 95 on the Global Innovation Index (GII) for 2018, up from of 110 last year. The country witnessed the biggest improvement in overall ranking for the MENA region and was one of the lower-middle income economies that appeared to “stand out as performing better than would be expected by their income level,” according to a GII report, which measures innovation by factoring in data on institutions, human capital and research, infrastructure, business and market sophistication, creative outputs, and knowledge and tech outputs. Energy innovation is the theme for this year’s report. You can tap or click here to download the full version.

Up Next

Items that should be on your corporate and risk calendars:

LEGISLATION WATCH- The Public Contracts Act could be up for discussion before the House general assembly this coming Monday, House Rep. Sylvia Nabil tells Al Mal. The House’s Budget Committee expects to put its final touches on the bill on Saturday, she adds. The law, which aims to decentralize and streamline tender procedures, had been sent back to the committee to be revised after its name was changed from the Tenders and Auctions Act. Just don’t expect it to become law before later this fall: Once introduced to the general assembly, the bill will move to the Council of State for review before it can be ratified by the House, which we heard earlier this week could happen in four months’ time.

You have an opportunity to sneak in a long weekend: Monday, 23 July is a national holiday in observance of Revolution Day. Expect half the nation’s workforce to try to “bridge” the Sunday and get a four-day weekend.

The Cairo Court of Appeals is expected to rule on Monday, 16 July on Ibnsina Pharma’s appeal of bns worth of antitrust sanctions imposed in a case brought by the Egyptian Competition Authority.

The deadline for the World Bank’s “DigitalAG4Egypt” competition for business ideas built around logistics, value-added services, fintech relevant to agriculture was extended to 30 July.

President Abdel Fattah El Sisi will reportedly unveil a new education program this month. It is unclear whether the program is K-12 or post-secondary.

The Macro Picture

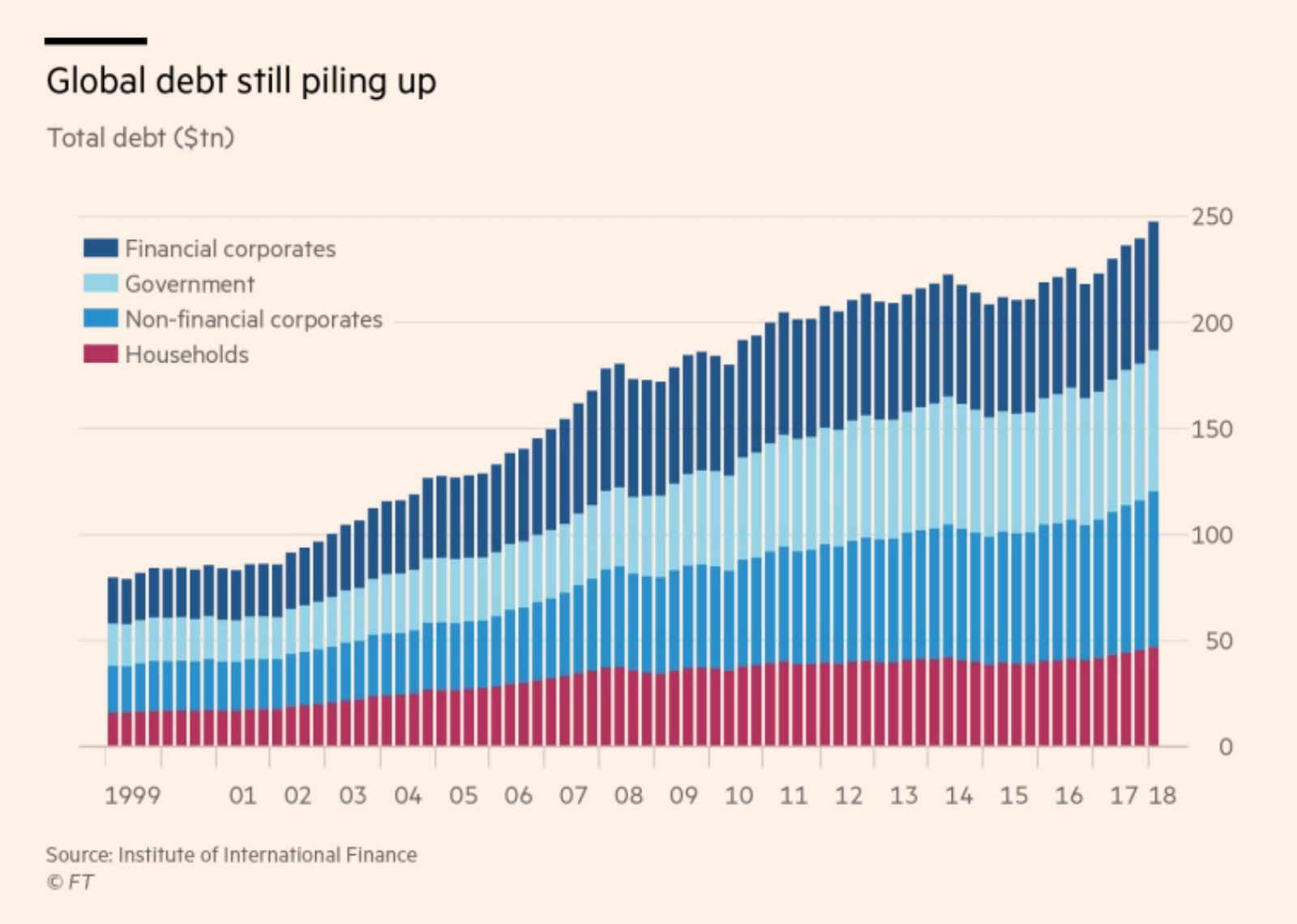

The rise of global debt to over USD 247 tn alongside tightening financial conditions is a “cause for concern” for EMs, Jonathan Wheatley writes for the Financial Times. According to the Institute of International Finance (IIF), appetite for currencies and bonds in EM including Argentina, Turkey, and Brazil has been on a downwards trend as “the vulnerability of countries with high inflation and large current account and budget deficits” become increasingly evident. “When you combine a rising rate environment, stronger [USD] and low levels of liquidity, you have a recipe for volatility and the exacerbation of any periods of market strain,” says IIF Senior Director Sonja Gibbs.

Egypt in the News

Topping coverage of Egypt in the foreign press on an unbearably slow news morning is the discovery of a sarcophagus in Alexandria from the Ptolemaic era. The black granite casket is apparently causing a ruckus because archaeologists don’t know who’s inside, according to Metro.

Coming in at a close second is wire coverage of security forces killing 11 militants in a North Sinai shootout.

Chinese newswire Xinhua put together a short photo essay on sand art bottles, a popular souvenir in Dahab.

Also worth a skim:

- Marriott International has launched a hospitality training program in Egypt, in partnership with Helwan university, CNBC Africa reports.

- National anthem stir: A decision by Egypt’s health minister to air the national anthem in state hospitals every morning has set off a storm on social media, the Associated Press reports.

- Islamist preachers are losing audience credibility as TV ratings in Ramadan have seen their popularity drop to its lowest point since 2011, Hany Ghoraba writes to Algemeiner.

- Rice farmers in Upper Egypt’s Minyat Al Said are having trouble tending to their crops: They fear snakes that appear to have taken refuge from the heat in their water-soaked rice fields, Gulf News reports.

- GERD in the news: Tech group Voith has set up a hub in Addis Ababa to help coordinate and advise on hydroelectric projects such as Ethiopia’s mega dam, taking into consideration the dispute with Egypt, according to Power Technology. African Business Magazine, meanwhile, highlights the tensions over the dam are easing.

On Deadline

A daily dose of the national anthem to instill “national identity and pride” is not enough to keep hospitals up and running, Ashraf El Berbery writes to Al Shorouk. He suggests that the state needs to focus on improving dire conditions in “negligent and overcrowded” hospitals lacking basic supplies. “Doctors do not need to renew their nationalism or commitment to their job, they need fair wages to compensate their long and stressful working hours.

Worth Reading

WhatsApp introduces new “forwarded message” feature in India to address fake news: WhatsApp has rolled out a new feature that notifies users in India — the biggest market for WhatsApp in the world — when a message they have received was forwarded and not originally composed by the sender in an attempt to curb the circulation of fake news, according to the Financial Times. “The Facebook-owned messaging service introduced the new feature for some users on Wednesday as part of a wider attempt to repair its reputation following a spate of lynchings in India that were alleged to have been sparked by false WhatsApp rumours.” However, while the messaging service is trying to address the “fake news” issue, it is wary of the fine line between controlling false content and infringing on users’ privacy and anonymity.

Worth Watching

The Giza Zoo has taken “additional measures” to help keep its animals comfortable in Egypt’s sweltering heat, according to WFLA. Zookeepers have been giving the animals a steady supply of cool treats — including frozen chunks of watermelon one bear is seen munching on —and altered their daily routines, while the zoo has installed water access in the animals’ housing areas (watch, runtime: 2:26)

Diplomacy + Foreign Trade

Trade Minister meets World Bank delegation to discuss current, future projects in Egypt: Trade and Industry Minister Amr Nassar met yesterday with a delegation from the World Bank to discuss ongoing and future projects the bank is funding in Egypt, according to a ministry statement. The two sides looked into potentially cooperating on “developing competition protection policies and promoting energy efficiency,” among others. Yesterday’s meeting comes as the government is closing in on USD 2 bn funding package from the bank, which Egypt requested during the delegation’s ongoing visit.

Foreign Minister Sameh Shoukry met yesterday with Vice President of the EU Commission Federica Mogherini to discuss regional developments, including illegal immigration, Israel-Palestine conflict and the Syrian, Libyan crisis, according to a ministry statement.

South Korea will end visa-free travel for Egyptians starting this October, following a “dramatic increase” in the number of Egyptians seeking asylum, S.Korean newspaper Donga reports. Apparently, many of the applicants present fabricated documents saying they belonged to the Ikhwan. The lengths we go to move out of here, seriously.

Energy

Indian company awarded USD 60-70 mn contracts for Sudan interconnection

An Indian company has reportedly been awarded the contract for the USD 60-70 mn power interconnection project with Sudan, Electricity Minister Mohamed Shaker said on Tuesday, according to the Sudan Tribune. Shaker reportedly said that the final contracts will be signed “soon” and that the first phase of the project will be complete within four months. The report conflicts with claims earlier this week that the Egyptian Electricity Transmission Company would re-issue the tender for the project, as the Indian company lacks the experience necessary for the project, despite putting forth the best offer.

NREA to tender 250 MW wind farm next week

The New and Renewable Energy Authority (NREA) is planning launch the tender to develop the 250 MW wind farm in the Gulf of Suez next week, according to sources from NREA. Siemens, Danish wind turbine manufacturer Vestas, and German wind energy solutions Senvion are the only three companies remaining in the running for the EUR 260 mn wind farm, funded by Germany’s KfW bank, European Investment Bank, the French Agency for Development, and the EU. The windfarm would be the first project in Egypt’s plan to develop a 2.2 GW in generation capacity. There had been reports that negotiations with Siemens stalled pending over the feed-in tariff rate, which the ministry wants to lower to USD 0.04/KW from a current EUR 0.053.

Elsewedy subsidiary signs EGP 430 mn contract to supply, install power cables

Elsewedy Electric subsidiary EgyTech Cables has signed a EGP 430 mn contract with the Egyptian Electricity Transmission Company (EETC) to supply and install ground and fiber optics cables to connect the Zahraa power transmission station to the national power grid, Al Mal reports.

Manufacturing

Local investors eye industrial projects worth EGP 500 mn in Sohag

Several local investors are looking into setting up food and heavy industry projects worth a combined EGP 500 mn in the industrial zone in Sohag’s Girga, Sohag Investors’ Union head Mahmoud El Shandaweely said. The union is set to meet with these investors by the end of next month to look into diversifying their investments into other sectors, including manufacturing medical equipment, automotive components, household appliances, and tiles, among others, according to El Shandaweely.

Real Estate + Housing

OUD breaks ground on EGP 350 mn Heliopolis Hills residential compound

Oriental Weavers subsidiary Orientals for Urban Development (OUD) has broken ground on its EGP 350 mn Heliopolis Hills residential compound in Obour City, Chairman Mohamed Farid Khamis said yesterday, Amwal Al Ghad reports. OUD expects to complete the 18-feddan project by 1Q2020.

Telecoms + ICT

GTH taps KAMCO, Fincorp as financial advisors for Veon acquisition offer

Global Telecom Holdings’ board of directors has tapped KAMCO Investment Company and Fincorp Investment Holding as financial advisors for Amsterdam-based Veon Holdings’ acquisition offer, the company said in a statement to the EGX (pdf). Veon had made an offer last week to acquire GTH’s Pakistan subsidiary Jazz and its associated operations, in addition to Bangladesh telco Banglalink, for USD 2.6 bn. The transaction has yet to be approved by GTH’s minority shareholders. Veon, which owns 57.7% of GTH, will abstain from voting. The firm had made a mandatory offer to purchase the remaining 42.3% of GTH for nearly EGP 15.5 bn back in November, but withdrew the offer in April, causing GTH’s shares to tank.

Sales of new mobile lines drop 50% after increase in regulatory fees

Sales of new mobile lines have dropped 50% following the government’s recent decision to hike regulatory fees for new mobile lines to EGP 70 from EGP 20, industry sources said, according to Amwal Al Ghad. The drop was an “expected reaction” to the price hike, sources say, predicting sales to hike back to normal after the new prices settle in with the consumer. Industry insiders had previously claimed that the fee hike will result in EGP 2 bn in losses to the industry.

Automotive + Transportation

Egypt receives EUR 100 mn from AFD to finance Cairo Metro Line 1 infrastructure

Egypt has received the first EUR 100 mn tranche from the French Development Agency (AFD) to finance the infrastructure development of Cairo Metro Line 1, National Authority for Tunnels head Tarek Gamal Al Din said, according to Amwal Al Ghad. It’s unclear whether this financing is part of a EUR 600 mn funding agreement that was expected to be signed with the EBRD, the European Investment Bank (EIB) and AFD to finance the project back in February. Egypt is expecting to receive an additional EUR 1 mn tranch by the end of the year, Gamal Al Din said, without disclosing more details. Total investments in developing the country’s rail network are expected to reach EGP 220 bn by 2030, according to a Cabinet statement.

EgyptAir Chairman discusses fleet expansion and development with Boeing delegation

EgyptAir Chairman Ahmed Adel met yesterday with a delegation from Boeing International to discuss the airline’s plans to expand and develop its fleet, Al Shorouk reports. The national flag carrier received late last year the ninth and final aircraft from Boeing under an EGP 864 mn agreement signed in 2016.

Banking + Finance

NBE to direct USD 150 mn of USD 750 mn loan towards SME financing

The National Bank of Egypt (NBE) is planning to direct USD 150 mn of a USD 750 mn syndicated loan it received towards SME financing, Al Mal reports. The bank will use the remaining USD 600 mn for corporate credit, according to an unidentified source. NBE had signed the USD 750 mn loan agreement last month with several institutions, including the European Bank for Reconstruction and Development, Standard Chartered, Citibank, HSBC, Emirates NBD, and the Commercial Bank of Dubai.

Other Business News of Note

Egyptian-Saudi company looks to establish EGP 10 bn-worth of projects, including medical city in new capital

An Egyptian-Saudi venture that goes by the name of Spine Medical (which appears to have no solid internet presence) is allegedly looking to invest EGP 10 bn in projects at the new administrative capital, New Administrative Capital Company (NACC) spokesperson Khaled El Hosseini said yesterday, Al Masry Al Youm reports. El Hosseini claimed that a delegation from the company met with NACC boss Ahmed Zaki Abdien yesterday to pitch their medical city and Dragon City mal projects, as well as other industrial ventures, including a facility — possibly in 10 Ramadan City — to manufacture surveillance and remote control equipment for smart buildings at the new capital and new urban communities around it.

Law

Zaki Hashem & Partners legal advisor on 20 M&As worth c.EGP 400 mn each

Zaki Hashem & Partners has been tapped as a legal advisor for 20 M&A transactions valued at around EGP 400 mn per transaction, Managing Partner Yasser Hashem tells Amwal Al Ghad. The acquisitions are across different sectors, including financial services, industrial and healthcare sector.

National Security

Egyptian-UK navy talk cooperation at HMS Argyll in Alexandria

Egyptian and UK naval officers discussed maritime security and counterterrorism cooperation at the Royal Navy’s HMS Argyll currently docking in Alexandria, CNBC Africa reports.

Sports

CIB sponsors Egyptian Junior Squash Team

Our friends at CIB are the proud sponsors of the Egyptian Squash Federation’s Junior Squash team.CIB is also sponsoring Junior Squash team athletes Mostafa Assal and Hania El Hammamy. The team will be representing Egypt at the WSF World Junior Squash Championships 2018 in Chennai, India, on 18 July. Last year saw the junior team make a clean sweep at the championships, with the women’s team winning its sixth consecutive World Junior Squash Championship in New Zealand.

Trezeguet set to join Czech football club SK Slavia Prague

Egyptian winger Mahmoud “Trezeguet” Hassan is reportedly set to join Czech football club SK Slavia Prague, Ahram Online reports. Slavia Prague has yet to make an official announcement, but has agreed to pay the EUR 5 mn required to release Trezeguet from his current contract, according to the vice president of Kasimpasa — the Turkish club Trezeguet currently plays for. The winger had previously said he hopes to join Turkish club Galatasaray.

Weightlifter Sara Samir wins three gold medals at Junior World Championships

Egyptian weightlifter Sara Samir won yesterday three gold medals at the International World Federation’s Junior World Championships in Uzbekistan in the women’s 69 kg class, El Watan Sport reports.

On Your Way Out

Egyptian film Akhdar Yabes (Withered Green) is set to screen at Tunisia’s first-ever Manarat film festival this week, Arab News reports. The film, directed by Mohamed Hammad, revolves around a woman grappling with cultural traditions as she “attempts to convince her uncles to attend her younger sister’s engagement.” The film previously won the Muhr Feature Award for Best Director at the Dubai International Film Festival.

UNICEF gives props to Egypt’s progress on children’s rights: Egypt has “made remarkable progress on children’s rights,” UNICEF MENA Regional Director Geert Cappelaere said, according to a UNICEF statement. The director took note of progress in reducing child mortality rates and education enrolment, as well as children’s health and nutrition.

The Tourism Ministry has launched an online television channel through Instagram’s IGTV to promote tourism in Egypt, Al Shorouk reports. The channel, named “Experience Egypt,” will be broadcast through the Tourism Promotion Authority’s page on the social media platform.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.94

EGP / USD at CIB: Buy 17.85 | Sell 17.95

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Wednesday): 15,952 (+0.2%)

Turnover: EGP 799 mn (19% below the 90-day average)

EGX 30 year-to-date: +6.2%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.2%. CIB, the index heaviest constituent ended up 0.1%. EGX30’s top performing constituents were Egyptian Iron & Steel up 7.5%, Kima up 5.5%, and Arab Cotton Ginning up 3.3%. Yesterday’s worst performing stocks were SODIC down 2.8%, Heliopolis Housing down 2.7%, and Madinet Nasr Housing down 1.2%. The market turnover was EGP 799 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -75.2 mn

Regional: Net Short | EGP -23.4 mn

Domestic: Net Long| EGP +98.6 mn

Retail: 65.2% of total trades | 66.3% of buyers | 64.1% of sellers

Institutions: 34.8% of total trades | 33.7% of buyers | 35.9% of sellers

Foreign: 15.1% of total | 10.4% of buyers | 19.8% of sellers

Regional: 9.3% of total | 7.8% of buyers | 10.8% of sellers

Domestic: 75.6% of total | 81.8% of buyers | 69.4% of sellers

WTI: USD 70.58 (+0.28%)

Brent: USD 74.37 (+1.32%)

Natural Gas (Nymex, futures prices) USD 2.82 MMBtu, (-0.18%, August 2018 contract)

Gold: USD 1,243.20/ troy ounce (-0.10%)

TASI: 8,388.66 (-0.35%) (YTD: +16.08%)

ADX: 4,691.80 (+0.50%) (YTD: +6.67%)

DFM: 2,892.43 (-0.11%) (YTD: -14.17%)

KSE Premier Market: 5,377.27 (+1.41%)

QE: 9,355.02 (-0.43%) (YTD: +9.76%)

MSM: 4,455.54 (-0.95%) (YTD: -12.62%)

BB: 1,344.89 (+0.76%) (YTD: +0.99%)

Calendar

16 July (Monday): Cairo Court of Appeals to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

23 July (Monday): Revolution Day, national holiday.

26-28 July (Thursday-Saturday): Green Banking: The Road to Sustainable Development, Baron Palace, Sahl Hasheesh, Hurghada.

30 July (Monday): Deadline for submitting ideas for the World Bank’s “DigitalAG4Egypt” competition.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.