- House committee looks to legislate role for private sector in key ‘national projects.’ (What We’re Tracking Today)

- Annual headline inflation accelerates for the first time in almost a year. (Speed Round)

- Orange Egypt’s capital increase was largest in MENA in 2Q2018, regional M&A activity reaches eight-year high. (Speed Round)

- Sarwa Capital to sell up to 30% of shares in 4Q2018 –report. (Speed Round)

- Revised Banking Act won’t be ready for public debate before 4Q2018. (Speed Round)

- House Budget committee approves sovereign wealth fund act. (Speed Round)

- Must read for folks in renewables: IFC, EBRD commitments made the sector possible in Egypt –report. (Speed Round)

- Artificial intelligence could be really bad for emerging markets

- The cure for the common cold is … the national anthem? (Last Night’s Talk Shows)

- The Market Yesterday

Wednesday, 11 July 2018

Crowding out the private sector: A legislative solution?

TL;DR

What We’re Tracking Today

Could the House legislate a role for the private sector in key ‘national projects’? Amid continual concern in some quarters that the private sector is being crowded out of certain sub-sectors of the economy by expanding state activity, MPs are looking for a legislative solution. Rep. Amr El Gohary tells us that the House Economic Committee is set to recommend that three-quarters of national projects outlined in the Madbouly cabinet’s policy program be undertaken by the private sector. The committee will also specifically recommend that projects in transportation (including railways) and logistics, as well as others having to do with strategic goods, be open to private investors and operators. The committee has been meeting all week to draft its contribution to a report on the economic components of the Madbouly cabinet’s agenda, which it plans to introduce to the House tomorrow ahead of a general assembly vote on Sunday.

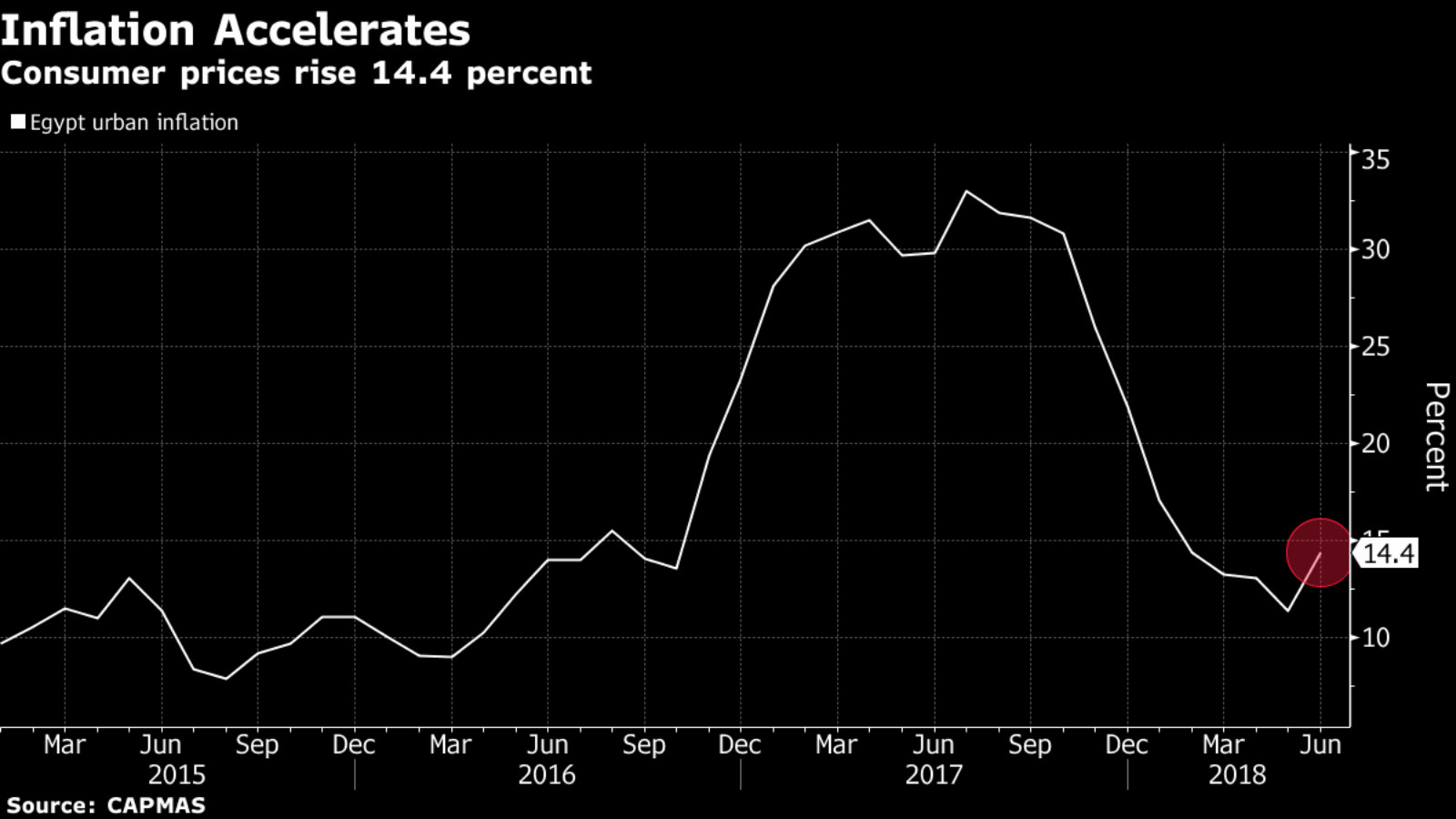

Inflation is up, as expected, and it’s not the end of the world: Initial data released yesterday showed annual headline inflation rising for the first time in almost a year to 14.4% in June, from a low of 11.6% in May, reflecting the ripple effects of last month’s hike in energy prices, which have hit commodities and services across the board. We have more in today’s Speed Round, below.

Foreign Minister Sameh Shoukry is in Brussels today for a mini-summit on Syria with his American, French, German, Jordanian and Saudi counterparts, according to a ministry statement.

A high-ranking Hamas delegation will reportedly be in Cairo today to resume talks with Egyptian officials about “reconciliation” with rival faction Fatah.

Customs Authority chief Gamal Abdel Azim is still in the clink this morning, according to state-owned Al Ahram. Abdel Azim was ordered detained for four days amid an ongoing investigation by prosecutors and the Administrative Control Authority into whether he accepted bribes. He has denied the allegations.

Speaking of customs: The global trade war between the US and just about everyone else is starting to get interesting. The Trump administration signaled yesterday it wants to slap a 10% tariff on an extra USD 200 bn worth of Chinese imports ranging from food products to car tires, baseball gloves, bicycles and dog food. The move comes a week after The Donald hit Beijing with a 25% elvy on USD 34 bn worth of Chinese imports; China responded immediately with matching tariffs on US goods. The Wall Street Journal has plenty more, as does the Financial Times — it’s the lead story in the global business press this morning. To put things in context: If the new tariffs go through, they would hit about a third of America’s imports (by value) from China, which the US Trade Representative’s Office estimated at about USD 580 bn in 2016.

New offers for Abraaj funds, Naqvi in court today: Colony Capital’s acquisition of key Abraaj funds — including the embattled private equity firm’s MENA fund — isn’t a sure thing. Both Colony and Cerberus have reportedly made new offers as Abraaj goes through court-supervised restructuring. “Cerberus made a bid for all of Abraaj’s funds, but hasn’t offered to buy the limited-partnership stakes in the underlying funds. … Colony made a revised offer for some of the funds, as well as its limited-partnership interests in the underlying funds,” Bloomberg reports, noting the offers “are being reviewed by provisional liquidators Deloitte and PricewaterhouseCoopers.” Any agreement needs investor approval. Readers will recall that Cerberus had been in talks with Abraaj before Colony reached an agreement with Abraaj last month. The news comes as a criminal case against Abraaj founder Arif Naqvi is due to come back up in court today.

Morgan Stanley has “streamlined” its line of succession for CEO James Gorman, the Financial Times says, preparing Ted Pick as heir apparent with his promotion to run the bank’s trading and investment banking businesses yesterday.

Rescue of Thai football team complete, all kids safe: All 12 members of the Thai’s boy soccer team and their coach have been rescued after being trapped in a flooded cave in Thailand for 18 days. “We are not sure if this is a miracle, a science, or what. All the thirteen Wild Boars are now out of the cave,” the Thai Navy SEALs posted on their Facebook page.

France heads to the World Cup final after beating Belgium 1-0 last night. Samuel Umtiti’s header at the 51st minute sent Belgium packing, but whether you love him or hate him, the Wall Street Journal says it was Kylian Mbappé who was the breakout star of the night — and probably of the World Cup. England faces Croatia tonight at 8:00pm in the other semifinal. The winner faces France on Sunday in the final.

And speaking of the World Cup: We apparently want to bid for the 2030 World Cup and the 2032 Olympics, FFT sports reports, picking up a Sputnik piece quoting Sports Minister Ashraf Sobhi. If you, like us, lived through our last bid for the World Cup — the infamous “0” we won back in 2004 in our bid for the 2010 cup — you may now start biting your tongue.

Enterprise+: Last Night’s Talk Shows

It was a very mixed and dreary night on the airwaves, folks, with topics ranging from sports, to further coverage of the arrest of the Customs Authority. Surprisingly enough, the least discussed topic was the inflation report. Not even Hona Al Asema touched on it.

Annual headline inflation on track to rise next month: Former Banque Misr deputy chairman Sahar El Damaty said annual headline inflation, which crept up on the back of the subsidy cuts, is expected to increase again next month as new electricity prices kicked in the beginning of the month. She was optimistic, however, telling Yahduth fi Masr that she expects the rate to taper off in the medium term, before declining towards the end of the year (watch, runtime: 4:09).

On the arrest of Customs Authority head Gamal Abdel Azim, Masaa DMC’s Osama Kamal held a roundtable discussion with former deputy interior minister for public funds Mohsen El Yamani, House Economics Committee member Rep. Amr El Gohary and Bawabet El Fagr editor Mostafa Thabet to discuss corruption. El Yamani said corruption in Egypt has always been significant, but now anti-corruption efforts are exposing what had long been kept under wraps. He also believes that what has been exposed so far is only the tip of the iceberg (watch, runtime: 5:47). El Gohary said corruption has been a hurdle in attracting foreign direct investors whose interest had been piqued by the economic reform program (watch, runtime: 4:09).

President Abdel Fattah El Sisi’s televised ceremony honoring Egypt’s medal winners at the 2018 Mediterranean Games preoccupied the talking heads last night.Hisham Nasr, who headed Egypt’s delegation to the games, hailed the ceremony, saying it demonstrates an interest to develop sports other than football. He urged the Sports Ministry and the Olympic Committee to work on providing better support and attention to these athletes ahead of 2020 Olympics in Tokyo (watch, runtime: 6:51). Masaa DMC’s Osama Kamal said Egypt deserves better than fifth place in Mediterranean games and called on policymakers to push for better results in international competitions (watch, runtime: 2:22). Al Hayah fi Masr’s Kamal Mady and Yahduth fi Masr’s Sherif Amer also covered the event (watch, runtime: 2:17 and watch, runtime: 2:34 ).

The cure for the common cold is … the national anthem? Lamees El Hadidi’s stand-in on Hona El Asema, Dina Zahra, focused her episode on Health Minister Hala Zayed’s order to broadcast the national anthem and hippocratic oath in public hospitals every morning. Zahra lambasted the move, which Zayed said would foster a sense of national identity, saying if the ministry has enough money to set up speakers for the national anthem to be played, then “there is a problem with its priorities.” She also dismissed the notion that the patients’ national identity would be stimulated by a daily dose of the national anthem (watch, runtime: 2:04).

Zahra got into a heated argument with Health Ministry spokesman Khaled Megahed,who vehemently defended the decision, saying it is part of a drive to improve staff morale and the work environment. He also noted that the decision is among several others designed to improve the conditions for public hospital doctors, including ensuring they are protected against assault (watch, runtime: 7:40). The real story here is that it took this long for us to protect state doctors from assault.

Elsewhere: The bodies of three murdered children in the Mariotiya district got some attention by Yahtuth fi Masr (watch, runtime: 5:00).

Speed Round

Annual headline inflation accelerated for the first time in almost a year to 14.4% in June, up from a low of 11.4% in May, according to data from CAPMAS released by the central bank yesterday. Monthly headline inflation rose to 3.5%, up from 0.2% in May. Meanwhile, annual core inflation — the CBE’s preferred gauge, which strips away volatile items such as food — fell to 10.9% in June, compared to 11.1% in May. Inflation in May had cooled to its lowest level in two years, but recent increases to the cost of fuel and power as well as transportation had widely been expected to push inflation up slightly during the summer months.

The spike, however, was a little too much, too soon, various analysts tell Reuters. “We had expected the 3.5% m-om increase in CPI to hit the July numbers, rather than June, which means that the spike in cost had reflected on prices faster than estimated,” said Pharos’ Head of Research Radwa El Swaify. “Consequently, we expect July monthly inflation to hit 2.5-3.5%, and annual inflation to score 14.5-15.0%, but level off gradually to 13-13.5% by December 2018.”

What does this mean for interest rates? Expectations are for the central bank to maintain key overnight deposit and lending rates until the end of the year, El Swaify and Naeem Brokerages’ Alan Sandeep tell the newswire. The central bank’s Monetary Policy Committee (MPC) had kept overnight deposit and lending rates unchanged at 16.75% and 17.75%, respectively, when it met last month, describing the move as a necessary measure to counter the expected rise in inflation. The CBE had said then that it sees inflation falling to single digits once the “temporary effect of supply shock dissipates.” The MPC next meets on Thursday, 16 August to decide on interest rates. Bloomberg also has the story.

FinMin calls off bond sale, says offer prices were too expensive: The Finance Ministry decided yesterday to cancel two local bond offerings worth a combined EGP 3.5 bnwith three- and eight-year maturities after investors and banks asked for returns as high as 18.5%, Reuters’ Arabic service reports. “The prices offered were not adequate,” the Finance Ministry’s Khaled Abdel Rahman told the newswire. He notes that the government is hoping to see average yields on government borrowing instruments drop to an average 14% in FY2018-19 from highs of 18.5% in the fiscal year just ended. The move comes as the Finance Ministry looks to phase out short and medium term borrowing in favor of less costly, long-term borrowing.

Orange Egypt’s capital increase was the largest in MENA in 2Q2018, M&A activity reached eight-year high: Orange Egypt’s USD 866 mn capital increase was the MENA region’s largest equity capital markets transaction in 1H2018, according to data released yesterday by Thomson Reuters. Total M&A transactions in the region reached an eight-year high during the quarter, growing by 74% y-o-y to USD 33.9 bn, driven largely by energy and power projects, which accounted for 32.8% of total M&As for the quarter. Transactions in the financial sector were the second-largest component with a 30.2% share.

Meanwhile, our friends at EFG Hermes were ranked the region’s top investment bank in terms of equity capital market underwriting fees, with a 24.4% market share. JP Morgan and Goldman Sachs followed in second and third place, respectively.

Debt capital market activity in the region slowed by 2% y-o-y in 1H2018 but remains at its second-highest level ever. Qatar had the largest share of debt issuances with 28.5% of the region’s total, followed by Saudi Arabia with 21.8%. Shariah-compliant transactions were down 44% yo-y in the second quarter of the year to USD 19.3 bn.

IPO WATCH- Sarwa Capital is planning to sell up to 30% of its shares on the EGX sometime in 4Q2018, sources reportedly told Al Mal on Tuesday. Our friends at Sarwa have reportedly hired Beltone Financial to lead the transaction, the newspaper reports, suggesting the offering will have a substantial international component. A financial adviser will be hired sometime this week to begin the fair value report, and Matouk Bassiouny is reportedly on board as legal counsel. Proceeds from the IPO are likely to go towards funding growth, the newspaper said, as the firm looks to launch insurance and factoring operations.

Our friends at Pharos have a pipeline of 15 transactions worth a combined EGP 7 bn on which they’re advising, Pharos’ head of investment banking Noha El Ghazaly said in a wide-ranging interview with Amwal Al Ghad. Most of these are M&A transactions, while three are IPOs or strategic stake sales, El Ghazaly added. The transactions run the gamut from retail and food to health and education, she noted.

Eying privatization program: El Gazaly hopes Pharos, which now has a presence in the GCC through Dubai-based Pharos Gulf, aims to take a share of the state privatization program, which she feels will have a positive impact on financial markets here. Earlier reports had indicated that Pharos was bidding to advise on the 4% stake sale of Eastern Tobacco Company, which is widely expected to pilot the program.

HC Securities & Investment has three M&As worth a combined EGP 2 bn in its pipeline for execution this year, the firm’s head of investment banking, Mahmoud Selim, tells Amwal Al Ghad. HC is also advising on an IPO in the manufacturing sector that Selim says will be worth EGP 800 mn. The firm is also a financial adviser on three transactions in the GCC and Jordan worth a combined USD 200 mn.

LEGISLATION WATCH- A revised Banking Act won’t be ready for public discussion before 4Q2018: The central bank will not be ready to present its long-planned overhaul of the bill to the Madbouly Cabinet until 4Q2018, a source familiar with the matter said. CBE Governor Tarek Amer had said back in May that the law would be ready to present to the government by 1 June. The delay comes as the CBE is still engaged in consultations with international institutions to help shape the law, according to reports in the domestic press. The final draft of the act will be much more expansive than the first draft of the law that came out last year and caused a stir in the banking sector. Industry players objected at the time to term limits for bank MDs, a proposed tithe on industry profits to endow an industry development fund, and provisions that would give the central bank more power to get involved in each bank’s daily affairs.

LEGISLATION WATCH- The House of Representatives’ Budget Committee approved on Tuesday legislation establishing Egypt’s EGP 200 bn sovereign wealth fund, Al Mal reports. The committee will submit its report on the legislation to the House general assembly next week. Planning Minister Hala El Saeed had said last month that the fund would launch at the end the year, with a roadshow to draw in private investment set to take off in 1H2019. The private sector will be allowed to buy stakes of over 50% in sub-funds and affiliated companies, she had also said.

Meanwhile, President Abdel Fattah El Sisi issued an order outlining the roles and responsibilities of his adviser for national projects, former Prime Minister Sherif Ismail, AMAY reports. Under the new directive, which was published on the Official Gazette, Ismail’s roles include heading up seizure of unlawfully occupied state land, manage development projects in North Sinai, and studying reasons behind failed or underperforming government projects.

Egypt, World Bank ink healthcare loan: Speaking of long-term borrowing, Egypt and the World Bank signed a USD 530 mn loan agreement to support Egypt’s healthcare system on Tuesday, according to a statement from the Madbouly cabinet. The loan will fund a series of ambitious healthcare programs, including the survey and free treatment of Hepatitis C victims, upgrading hospitals in the first phase of the roll out of the new universal healthcare system, and some help with family planning initiatives. The World Bank had pledged the funding earlier this month.

This comes as the government is close to closing USD 2 bn in new financing from the World Bank that Egypt requested during an ongoing visit by a WB team, sources told us earlier this week. While nothing official has been released by the government, state-owned Al Ahram has picked up our story, citing their own sources as saying the funding would run through 2022. They added that some USD 1 bn of he funding would be used for Sinai Development.

Meanwhile, Investment Minister Sahar Nasr sat down with the WB team for follow up talks on a USD 500 mn loan request to fund social housing development, according to a ministry statement. Prime Minister Mostafa Madbouly made the request at a meeting on Monday. The local press is also speculating that Nasr is planning further talks with the IMF on additional assistance at the (rather far away) IMF and World Bank spring meetings. It would surprise us if she wasn’t planning to do so — don’t read to much into this last bit.

The Social Solidarity Ministry wants to fine-tune and expand its cash subsidy programs, sources close to the matter said yesterday. The committee drafting the new measures — which brings together the ministers of social solidarity, finance, supply, and military production — recently expressed willingness to expand the scope of the government’s cash subsidy programs to include more segments of society, in addition to increasing the allowance paid out through the Takaful and Karama initiatives, according to the sources. This will be made possible through the ongoing purge of the subsidy rolls, they add. The move comes as part of government efforts to shore up the social safety net as inflation rises and is a key item on the Madbouly Cabinet’s four-year policy program. Other measures included new income tax breaks as well as raises to the wages and pensions of state bureaucrats and military and police personnel. No details were provided on the expected timeline for the new measures.

MUST READ for renewable energy folks: IFC, EBRD commitment to renewables in Egypt has attracted investors, funds to the sector -Report: The commitment that lending institutions such as the International Finance Corporation and European Bank for Reconstruction and Development have shown to Egypt’s renewable energy projects has helped attract much needed funds into the sector, according to a report by Arab Petroleum Investments Corporation (APICORP). The report says that a shortage is the reason why “solar projects have been slow to progress in Egypt,” but notes that the pace should pick up with the development of the 1.8 GW solar power complex in Benban, Aswan. APICORP expects international lenders to “continue to support the deployment of renewables in the region as they prioritise green energy in an effort to address climate concerns.” You can read the full report here (pdf).

MOVES- Radisson Hotel Group has appointed Frédéric Feijs (LinkedIn) as its regional director for Africa and Egypt, according to Hospitality Net. Feijs was most recently HNA Hospitality’s Regional General Manager for French Polynesia.

Up Next

Items that should be on your corporate and risk calendars:

You have an opportunity to sneak in a long weekend: Monday, 23 July is a national holiday in observance of Revolution Day. Expect half the nation’s workforce to try to “bridge” the Sunday and get a three-day weekend.

Also:

- President Abdel Fattah El Sisi will reportedly unveil a new education program this month. It is unclear whether the program is K-12 or post-secondary.

- The Cairo Court of Appeals is expected to rule on 16 July on Ibnsina Pharma’s appeal of antitrust sanctions imposed in a case brought by the Egyptian Competition Authority.

Image of the Day

Japan’s exit from the World Cup came with some childhood nostalgia: A massive banner of Captain Tsubasa — known to every Arab born in the 1970s and 80s as Captain Majed — was unfurled during its last game of the tournament. We couldn’t help but feel some kinship — and a little bit of the pain of their exit. H/t KN

Egypt in the News

It’s an extremely slow day for Egypt in the foreign press, with the sentencing of a Lebanese tourist who insulted Egypt in a Facebook post continuing to preoccupy international media attention.

On Deadline

Opinion writers take on corruption: With the arrest of Customs Authority head Gamal Abdel Azim, corruption is once again a topic for opinion writers. In a piece for Al Shorouk, Medhat Nafea offers his suggestions for cracking institutional corruption: Apparently, we need new laws to ensure the enforcement of existing laws.

Worth Reading

Artificial intelligence could be really bad for emerging markets: The way developed economies adapt to the rise of automatiion won’t work for emerging markets, according to a study from the Center for Global Development. The crux of the issue is that artificial intelligence (robots) are mostly being used to take over jobs in unskilled sectors such as agriculture and industry, but these sectors house big pools of labor in developing countries, Jamie Condliffe writes for the New York Times. Some governments are looking to “de-incentivize” automation by reducing minimum wages for human labor, but wages are already low in many countries. “Another [solution] might be for developing countries to build out labor-intensive sectors that look set to be resistant to automation over the coming decades — such as social care, education, health care, tourism or infrastructure construction. But this is a risky approach, requiring large upfront investment without [an assurance] of protection from automation in the long-term.”

Worth Watching

Women in Saudi Arabia have begun driving for ride-hailing app Careem just weeks after the kingdom began issuing driving licenses to women, according to the Wall Street Journal. The benefits of incorporating women into Careem’s workforce is not lost on the company or its clientele — Careem anticipates a surge in demand for its service as Saudi women’s employment levels continue to rise, while women commuters say they feel safer and more comfortable riding a stranger’s car when another woman is behind the wheel. However, Uber — Careem’s global rival — has yet to see any women drivers join its fleet, which some attribute to Careem understanding the cultural nuances of the region better. “To help overcome the stigma attached to driving, Careem bans the use of the word driver and brands them as ‘captains’ — or ‘captainahs’ for women now” (watch, runtime: 5:28).

Diplomacy + Foreign Trade

Italian Foreign Minister Enzo Moavero Milanesi is expected to visit Egypt some time soon, state-owned Al Ahram reports. Milanesi’s visit will be his first by a sitting Italian Prime Minister to Egypt since the death of Italian student Giulio Regeni in Cairo back in 2016.

The German development bank KfW is planning to provide EUR 30 mn in funding to construct small scale hydroelectric plants at seven different sites in Egypt’s Al Delta and Al Qanater, according to an unnamed source at the Electricity Ministry.

Energy

EEHC receives 5 offers for USD 250 mn worth of waste-to-energy projects

Five foreign power distribution companies have presented offers to the Egyptian Electricity Holding Company (EEHC) for USD 250 mn worth of waste-to-energy (WtE) projects, unidentified government sources tell the local press. The proposals came from Emirati, Chinese, Indian, and Canadian companies looking to construct WtE power plants using biogas and burnable agricultural waste with production capacities ranging between 10 and 20 MW. According to the sources, the Egyptian Electric Utility and Consumer Protection Agency (Egyptera) has already approved setting the feed-in tariff for WtE projects at EGP 1.03 per kWh.

KIMA denies seeking EUR 20 mn loan to finance Aswan fertilizer facility expansion

The Egyptian Chemical Industry Company (KIMA) is not in talks with the Indian International Cooperation Agency for a EUR 20 mn loan, the company said in a statement to the EGX (pdf). The local press had reported earlier this week that the company was seeking the funding to add a new production unit to the second phase of its fertilizer production facility in Aswan.

Basic Materials + Commodities

GASC purchases 175k tonnes of Russian wheat

The General Authority for Supply Commodities (GASC) purchased 175k tonnes of Russian wheat in an international tender yesterday, according to Reuters’ Arabic service. The wheat is scheduled for delivery between 21-31 August.

Health + Education

Education services outfit in talks with local banks for EGP 600 mn loan to construct a new university

Newly-established education outfit the Egyptian International Company for Education Services (EICES) is in talks with several local banks to borrow EGP 600 mn to finance the construction of Akhnaton University, which the company plans to set up in Wadi El Natroun, Al Mal reports. The university is expected to cost EGP 1 bn to construct, EGP 400 mn of which the founders will contribute. Construction will take two years and will be completed over three phases.

Tourism

Colliers International forecasts 13% rise in Hurghada’s hotel occupancy rates in 3Q2018

Hotel occupancy rates in Hurghada are expected to rise 13% y-o-y from June-August 2018 to reach 61%, Colliers International said in a report on MENA hotels (pdf). The report highlights Hurghada as one of the season’s hot spots, saying that “the Red Sea resort continues to benefit from positive security perception and chartered flights from traditional source markets.” Hotel occupancy in Sharm El Sheikh and Alexandria is forecasted at 51% and 81%, respectively.

Automotive + Transportation

Organization for Standardization sets 42 new standards for the vehicles

The Trade Ministry’s Organization for Standardization (EOS) has apparently issued a decision on Tuesday enforcing some 42 new standards for both imported and locally assembled cars, Al Mal reports. The EOS had been trying to implement these standards since 2016, which, according to the Federation of Egyptian Industries (FEI), were the first new quality control standards on the auto industry since 2010. The move appears to have garnered the approval of the FEI, according to the newspaper.

Transport Ministry issued terms and conditions for electrical rail, monorail projects

The Transport Ministry issued yesterday the terms and conditions for the tenders for the Alamein-Ain Sokhna electric rail and the new capital-6 October City monorail projects, Youm7 reports. The tender will be open to 10 global consortiums that prequalified for the first project and seven consortiums that qualified for the second. The combined investment value of both projects stands at c. EGP 130 bn, according to the newspaper.

Transport Ministry wants a lower price supply railway cars

The Transport Ministry is negotiating to the lower price offered by a Russian-Hungarian consortium to supply the Egyptian National Railways with 1,300 railway cars, according to unnamed government sources. The ministry reportedly wants to drop the consortium’s price from EUR 1 bn to EUR 950 mn, the source says.

Banking + Finance

Lebanon’s Blom Bank sees “significant growth” from Egypt arm

Lebanon’s Blom Bank is seeing “significant growth” from its arm in Egypt this year, Chairman Saad Azhari said yesterday, according to Reuters’ Arabic service. As a whole, the bank expects to see a minor increase in its profits, according to the chairman. Azhari had previously given props to Egypt’s improving economic climate, which he said has been driving the bank to open new branches and offer more services.

Other Business News of Note

HOTAC decides to re-do financial studies on Shepherd Hotel renovations

The Holding Company for Tourism and Hotels (HOTAC) has decided to re-conduct the financial and feasibility studies on plans to renovate the Shepherd Hotel, HOTAC Chairman Mervat Hatba said. No details were provided on the initial expected cost of renovations. Cabinet had signed off on looking into partnering with an international firm on the hotel’s renovation back in May.

Sports

Sports Ministry plans to build EGP 3.2 bn in projects in next four years

The Youth and Sports Ministry is planning to implement EGP 3.2 bn worth of projects between 2018-2022, Sports Minister Ashraf Sobhi said. The plan includes building a sports club in 6 October City, renovating the Cairo Stadium, and upgrading the sports development center in Shubra. The ministry is looking to develop these projects under a public private partnership framework, Sobhi says, adding that the ministry has started preparing to launch a global tender for investors for them without mentioning dates.

On Your Way Out

Three Egyptian entrepreneurs have launched Flareinn, an e-commerce platform designed to become an online marketplace for art, according to WeeTracker. The platform “targets young artists and provides artworks to customers at decent bargains” and allows artists to create accounts for themselves that act as a virtual gallery for their pieces. One of the co-founders, Abdalla Amin, is an artist himself and came up with the idea when he came face-to-face with the all too familiar difficulties of finding a local buying market for their work.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.94

EGP / USD at CIB: Buy 17.85 | Sell 17.95

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Tuesday): 15,921 (+0.9%)

Turnover: EGP 1.1 bn (11% above the 90-day average)

EGX 30 year-to-date: +6.0%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 0.9%. CIB, the index heaviest constituent ended down 0.2%. EGX30’s top performing constituents were Qalaa Holdings up 6.0%, Egyptian Iron & Steel up 5.2%, and GB Auto up 4.4%. Yesterday’s worst performing stocks were Juhayna down 2.0%, Eastern Co down 1.0%, and CIB down 0.2%. The market turnover was EGP 1.1 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -134.4 mn

Regional: Net Short | EGP -19.7 mn

Domestic: Net Long | EGP +154.1 mn

Retail: 61.1% of total trades | 56.1% of buyers | 66.1% of sellers

Institutions: 38.9% of total trades | 43.9% of buyers | 33.9% of sellers

Foreign: 18.9% of total | 12.5% of buyers | 25.3% of sellers

Regional: 9.2% of total | 8.3% of buyers | 10.1% of sellers

Domestic: 71.9% of total | 79.2% of buyers | 64.6% of sellers

WTI: USD 73.94 (-0.23%)

Brent: USD 78.59 (-0.34%)

Natural Gas (Nymex, futures prices) USD 2.79 MMBtu, (-0.04%, August 2018 contract)

Gold: USD 1,255.70/ troy ounce (+0.02%)

TASI: 8,417.91 (+1.10%) (YTD: +16.49%)

ADX: 4,668.55 (+1.12%) (YTD: +6.14%)

DFM: 2,895.64 (+0.71%) (YTD: -14.08%)

KSE Premier Market: 5,302.31 (+1.09%)

QE: 9,395.81 (+1.41%) (YTD: +10.24%)

MSM: 4,498.34 (-0.42%) (YTD: -11.78%)

BB: 1,334.80 (+0.03%) (YTD: +0.23%)

Calendar

16 July (Monday): Cairo Court of Appeals to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

23 July (Monday): Revolution Day, national holiday.

26-28 July (Thursday-Saturday): Green Banking: The Road to Sustainable Development, Baron Palace, Sahl Hasheesh, Hurghada.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

November (unspecified date): IMF delegation to visit Egypt for fourth review of the economic reform program ahead of disbursing the next tranche of a USD 12 bn extended fund facility.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.