- A long weekend in which to mourn a miserable, bone-crushingly disappointing end to Egypt’s first World Cup run in a generation. (What We’re Tracking Today, Last Night’s Talk Shows)

- Gov’t plans to issue “clear and simplified” guidelines for tax assessment of real estate. (Speed Round)

- EGX raises daily limit on intraday trading. (Speed Round)

- Abraaj founder Naqvi faces arrest warrant after allegedly bouncing cheques. (What We’re Tracking Today)

- Ebtikar, the joint venture between B Investments and MM Group, acquires 33.7% stake in payments outfit Masary. (Speed Round)

- MM Group backs out of acquiring Alturki Holding subsidiaries. (Speed Round)

- ODH aims to turn Gouna into year-round business destination, inks business park contract with German tenant. (Speed Round)

- Top Egyptian lawyers among appointments to the ICC’s International Court of Arbitration. (Speed Round)

- The Market Yesterday

Tuesday, 26 June 2018

Pharaohs’ World Cup run comes to miserable end

TL;DR

What We’re Tracking Today

The bad: The Pharaohs lost 2-1. To *Saudi Arabia*. In stoppage time. We shall never again speak of the events of the 2018 FIFA World Cup. Ever. Even Twitter feels sorry for us: “Hug an Egyptian today. An absolutely brutal World Cup for them,” wrote Washington Post foreign affairs reporter (and football aficionado) Ishaan Tharoor.

The good: We’re getting a surprise long weekend during which to lick our wounds: PM Mostafa Madbouly declared this Sunday a national holiday substituting for 30 June, which is falling on a Saturday, according to Al Masry Al Youm, citing the Official Gazette. We’ll be back in your inboxes on Monday morning.

A suggestion for legislators: Let’s pass a law, shall we? One that says there is a rule: “Thou shalt always have a replacement day off if a national holiday should fall on a weekend, and an Eid shall always last ‘x’ working days.” Or (take your pick, we don’t care): “Thou shalt not have a replacement day, ever, in the event that a national holiday should call on a weekend day, and…” What we would give to have consistency and the ability to plan ahead.

Wall Street was “pummeled by escalating trade threats” yesterday, Reuters reports, as the increasingly complex showdown between the US and other leading economies “handed the S&P 500 and Nasdaq their steepest losses in more than two months.” The benchmark EGX 30 bucked the trend yesterday (closing up 0.4%), but the wider EGX 50 and 70 indexes each closed down. Asian shares are extending the global selloff this morning and investors continue to “steer away from riskier assets, lifting safe-haven US treasuries and keeping the USD on the defensive.” Oil prices are edging lower (pressuring energy stocks), the yen is strengthening, and the CBOE’s VIX equity volatility index is edging back up to nearly 20, its long-term average, the Financial Times adds.

Arrest warrant issued for Abraaj founder over bounced checks allegedly worth at least USD 48 mn: UAE prosecutors issued an arrest warrant for Abraaj founder Arif Naqvi, who stands accused of issuing checks with insufficient funds, the Wall Street Journal and Financial Times are reporting. “[The] bounced check was used as partial security for loans estimated at USD 300 mn made to Abraaj by Hamid Jafar, founder of Sharjah’s Crescent Group,” the Financial Times quotes a source as saying. “Without this loan, Abraaj would have collapsed six months ago.”

A Sharjah judge will decide on Thursday whether Naqvi will face a custodial sentence. Sources said the Karachi-born businessman was in the UK would not return to face the charges. The FT notes that the arrest order is fairly standard in the UAE in cases of bounced cheques, and Naqvi’s lawyer said he was optimistic that a settlement on the cheques could be reached (though he sounded a sharply confrontational note in his remarks to the Wall Street Journal).

T minus two days to MPC day: As we approach the central bank Monetary Policy Committee meeting on Thursday, Economists continue to take the view that the CBE will keep interest rates on hold, largely to absorb the shock of the recent subsidy cuts. HC Securities Chief Economist Sara Saada is the latest to join the fray, joining what seems to be a consensus that monthly inflation is unlikely to accelerate beyond 3.5% in June. HC sees annual inflation reaching 14.5%, adding that, “while our numbers also point to monthly inflation of c. 1.5% in July on the rise of electricity prices and second round effect, we believe annual inflation will decelerate to c12.5% in July on favorable base year effect.”

Is the US headed for recession? At least one leading indicator is heading in a direction that suggests it could: The yield curve is flattening in the US of A, threatening to go negative — and every recession of the past 60 years has been preceded by an inverted yield curve. The limit, of course, is that the time between the inverted yield curve and the onset of recession is entirely unpredictable. Confused by it all? Eyeballs rolling into the back of your skull? The New York Times has the backs of all the non-bond-traders among us with a really straightforward explainer: What’s the yield curve? ‘A powerful signal of recessions’ has Wall Street’s attention.

Please don’t tell the House about this: Kenya is considering a “Robin Hood” tax in the form of an excise tax of 0.05 percent on financial transactions of more than USD 5k, the Financial Times reports. That includes “money transferred by banks, money transfer agencies and other financial services providers.” Surprising no one, Kenyan bankers are against the proposed levy.

What We’re Tracking This Week

The Finance Ministry will present the House with a report on the government’s ‘private accounts’ (or slush funds, as we prefer to see them) in two days’ time, Minister Mohamed Maait said yesterday, Al Masry Al Youm reports. The ministry is currently putting together a list of all private accounts and details on their cashflows to present to House representatives, who renewed their calls for greater oversight of the unpopular funds after it was revealed that a private fund belonging to the Cairo Governorate recorded a surplus of EGP 140 mn. Former finance minister Amr El Garhy had said that provisions to regulate private accounts could be included in a bill that is currently being reviewed by the House Budgeting Committee.

A shuffle of governors could be announced by the end of this week, Al Shorouk reports. Prime Minister Mostafa Madbouly has given a preliminary outline of the shuffle to President Abdel Fattah El-Sisi and Local Development Minister Mahmoud Shaarawy.

Next tranche of IMF loan in July? The IMF’s executive board will meet on 29 June to decide on the fourth USD 2 bn tranche of Egypt’s USD 12 bn extended fund facility. The disbursement, which is expected to arrive in July, would bring the total amount Egypt has received under the facility to USD 8 bn.

On The Horizon

Appeals Court to rule on Ibnsina antitrust case on 16 July: The Cairo Court of Appeals is expected to rule on 16 July on Ibnsina Pharma’s appeal of antitrust sanctions imposed in a case brought by the Egyptian Competition Authority. A Cairo Economic Court had ruled in March that Ibnsina, United Pharma, Ramco Pharm and Multipharma had colluded to cut credit periods and slash discounts to small and medium sized pharmacies. The companies were fined a total of EGP 5.6 bn.

Enterprise+: Last Night’s Talk Shows

Everyone and his / her semi-literate brother-in-law took to the airwaves last night to bemoan Egypt’s miserable 2-1 loss against Saudi yesterday at the 2018 Fifa World Cup. Among them: a host of sports critics including Yasser Ayoub (watch, runtime: 40:25) and Hassan El Mestikawy (watch, runtime: 3:51), as well as former football stars Wael El Kabani (watch, runtime: 23:22) and Hossam Hassan (watch, runtime: 1:49).

Is Cuper getting axed? Yahduth fi Misr’s Sherif Amer claimed that the Egyptian Football Association (EFA) made a formal statement announcing its intention to terminate national team coach Hector Cuper’s contract, though we’ve seen no evidence of that statement anywhere else. Amer also said that Cuper would hold a press conference once he arrives from Russia at which he will respond to criticism of the team’s performance (watch, runtime: 1:40).

But is he really to blame? Former footballer Hany El Okaby told Al Hayah fi Misr’s Kamel Madi that Egypt lost every game it played in the World Cup due to bad planning (watch, runtime: 5:30), while EFA member Khalid Latif pinned a share of the responsibility on the association, adding that he believes that Cuper’s contract would be dropped once it expires. He jumped to the team’s defense, however, telling Masaa DMC’s Eman El Hosary that they at least managed to qualify for the tournament (watch, runtime: 6:18).

The EFA was unable to shield team players from the strain of public pressure and expectation, sports critic Ihab El Khatib told El Hosary. He said that Mo Salah especially was under an immense amount of pressure (watch, runtime: 8:31). El Khatib also phoned into Hona Al Asema (watch, runtime: 6:17).

The sports community also mourned the death of former Zamalek club star Abdel Rehim Mohamed yesterday, who succumbed to a heart attack just before he was due on air to analyze the match (watch, runtime: 4:06).

Liverpool University is coming to Egypt: Higher Education Minister Khaled Abdel Ghaffar signed and MoU with Liverpool University yesterday that should see the school establish a local campus, he told Riham Ibrahim, who’s filling on for Lamees Al Hadidi on Hona Al Asema while she vacations until September (watch, runtime: 7:07). Elsewedy Electric CEO Ahmed El Sewedy phoned in to stress the need for private sector investment in education, adding he is working on a new education-geared project in the new administrative capital (watch, runtime: 4:16).

Meanwhile, Consumer Protection Agency (CPA) boss Rady Abdel Moty made his second on-screen appearance this week, this time on Hona Al Asema, as the government continues to reassure consumers it won’t let prices get out of control after recent fuel price hikes. Abdel Moty discussed ways customers can report violations such as price gouging and reassured viewers that the CPA is keeping a close eye on the market (watch, runtime: 17:17).

Speed Round

LEGISLATION WATCH- The Madbouly government is gearing up for a major overhaul of how real estate taxes are calculated, sources with knowledge of the matter told Enterprise yesterday. The government has reportedly decided to leave the tax regime unchanged for now as it as it works on a new formula that would set “clear and simplified” guidelines for the tax assessment of industrial properties, hotels, ports and airports, our sources told us. The aim of the changes, which would apparently require the assent of the House of Representatives, is to boost the state’s haul from real estate taxes on industrial and commercial properties. The government is on track to collect as much as EGP 5.3 bn from real estate taxes in the next fiscal year, up from EGP 3.5 bn this year.

REGULATION WATCH- EGX raises daily limit on intraday trading: The EGX has begun raising the daily limit on the percentage of shares that can be traded intraday, the bourse said in a statement on Monday. The daily limit was doubled to 0.01% of a company’s total shares, from 0.005%. The new regulations also allow brokers to trade on the same stock multiple times in the same day. The change, on which the Financial Regulatory Authority signed off last month, was published in the Official Gazette, the statement noted.

M&A WATCH- Ebtikar acquires 33.7% stake in payments outfit Masary: Ebtikar for Financial Investment, a joint venture between B Investments and MM Group, acquired a 33.7% stake in e-payments firm Masary in a transaction worth EGP 130 mn, Ebtikar said in a statement on Monday (pdf). The transaction on Masary, which now has some 60k points of sale in its network, marks the fourth significant acquisition by Ebtikar this year, the company said, noting it had earlier bought stakes in TBE Egypt for Payment Solutions and Services (Bee), Vitas Misr for Microfinance and Tamweel Group. “The acquisition of Masary positions Ebtikar as one of the leading investors in the electronic payments sector in Egypt,” said Ebtikar Chairman Aladdin Saba. Advisors: Zaki Hashem & Partners was buy-side legal counsel.

More from the e-payments scene: The people behind payments firm PayMob have launched Accept Payments, which plans to offer a single platform for companies to handle a variety of transactions, the company said in a statement (pdf) on Monday. This single platform, the company says, will provide businesses with a reduction of fixed costs stemming from cash and card on delivery, cash collection, mobile wallet payments, kiosk payments and online card payments, the company added.

M&A WATCH- MM Group backs out of acquiring Alturki Holding subsidiaries: MM Group has decided not to move forward with a planned acquisition of 100% of three subsidiaries of Alturki Holding, MM said in a regulatory filing with the EGX on Monday (pdf). MM Group had signed a letter of intent back in March with Alturki to acquire 100% of Itisalat International Egypt (i2), United Retail Company (URC), and DTR Trading. MM Group and Alturki scrapped the transaction by “mutual agreement,” according to the statement.

ODH aims to turn Gouna into year-round business destination, inks business park contract with German tenant: Orascom Development Holding announced yesterday it had signed a USD 6.7 mn, nine-year lease agreement with a German company for the first business park the developer is building in El Gouna. “ODH will build the office building for the German company at Al-Bustan area South of El Gouna with a total land area of 7,955 sqm,” the company said. The project, which should be complete in June 2019, will see the unnamed Germany company “move their business processes outsourced from Bavaria, Germany to El Gouna, Egypt with more than 400 employees of different nationalities.” The agreement is part of ODH’s plans to turn El Gouna into a regional business hub and year-round destination.

CIB is the first Mideast corporation to feature in a London Business School case study: Our good friends and sponsors at CIB have become the first Middle East corporation to feature in a case study by the London Business School. To mark the occasion, CIB Chairman Hisham Al Arab recently gave a talk on the future of finance and leadership in turbulent times to a London Business School audience at a joint event with LBS’s Leadership Institute and the Wheeler Institute for Business.

EMs have an innovation advantage: “Emerging markets are more innovative, because they are less regulated compared with the developed world. Look at the European market after the financial crash of 2008. Overregulation almost prohibited banks from lending money. As the market becomes less regulated, innovation will thrive,” Ezz Al Arab said.

The winning formula that could propel EM finance forward? It’s as easy as ABCD: A for artificial intelligence, B for blockchain, C for the cloud and D for data. “Those combined, honestly with a little deregulation, will be the real revolution in the financial services industry,” said Ezz Al Arab.

Walking the walk: Ezz Al Arab then spoke on how CIB adapted to the chaotic events of 2011 by investing further in Egypt. “We have taken transformational steps over the past years, moving from traditional banking to a service provider that fits with the requirements of the newer generation. Technology will play a critical role — it will pave the road for innovation,” said Ezz Al Arab. These steps include setting up a data hub outside the bank’s Cairo headquarters to provide cutting edge services. The choice to invest in tough times paid off, culminating in the bank being named the World’s Best Bank in the Emerging Markets by Euromoney.

Challenges facing Egypt’s finance sector are its biggest opportunity: High among the challenges named by Ezz Al Arab is a fragmented customer base. “People have savings with the post office, some people use cash, some have credit with microfinance — but to consolidate, this is the opportunity.” For example, Egypt’s low banking penetration and the high percentage of mobile phone users opened the door for the bank to push for a cashless society through e-payments using e-wallets and other mobile banking services.

CI Capital signs brokerage services agreement with Maybank Kim Eng: CI Capital has signed an agreement with Malaysia-based Maybank Kim Eng to provide the latter’s clients with brokerage services, according an emailed statement (pdf). “Under the agreement, CI Capital will provide Maybank Kim Eng’s clients streamlined solutions covering execution, research and corporate access for the MENA markets. CI Capital will offer investors strong reach and placement power through diverse channels, with a distinctive ability to manage and execute, large and complex transactions,” the firm said. The partnership is part of CI Capital’s drive to expand in regional and international markets, it added.

Deputy Justice Minister El Bahabety named as honorary member to the ICC’s International Court of Arbitration: Our friend Moustafa El Bahabety, the deputy justice minister for arbitration and international disputes, was named as an honorary member of the ICC. El Bahabety has been a judge on the ICC since 2005 and had reached his term limit as a member of court. El Bahabety’s induction sees him become the first Egyptian to be an honorary member of ICC. He continues to serve within the Egyptian government as the head of the technical committee of the Ministerial Committee for Settlement of Investment Disputes, building on his own track record of success of having reached settlement agreements last year in international arbitration cases with parties including Germany’s Utsch AG, National Gas Company in France, and a settlement in 2016 with ArcelorMittal.

Separately, there were also two lawyers appointed to the court: Two of Egypt’s top lawyers were appointed as members of the International Chamber of Commerce (ICC)’s International Court of Arbitration. Shahid Law Firm Managing Partner Girgis Abd El-Shahid and Samaa A. Haridi, a partner at Hogan Lovells in New York, joined the court as members. They join Zulficar & Partners Founding Partner Mohamed S. Abdel Wahab, who is a vice president at the ICC International Court of Arbitration.

MOVES- Amr El Bahey was named as the CEO and country head of Mashreq Bank-Egypt, according to Al Mal, replacing Mohamed Aly. Prior to the appointment, El Bahey was regional head of client network banking, business development and planning for MENA and Turkey at HSBC Middle East. Mashreq’s board approved the appointment was last month.

MOVES- Amani Mohamed Al Rafei has been appointed by presidential decree as head of the Administrative Prosecution Authority effective 1 July 2018, Ahram Gate says. She was most recently deputy chief of the Appeals Chamber Technical Bureau at the Administrative Prosecution Authority.

Major shake-up “coming soon” at the ICT ministry, an unnamed senior official tells Youm7. Egypt Post chief Essam El Saghir is reportedly exiting, the newspaper says, adding that its source claims the National Telecommunications Regulatory Authority (NTRA) will get a permanent boss. Moustafa Abdel Wahed has led the authority on an acting basis since July 2015. Also in line for a permanent boss is the Information Technology Industry Development Agency (ITIDA), which Maha Rashad has led on an acting basis since this past March.

Egypt in the News

Topping the foreign press’ coverage of Egypt this morning is the Pharaohs’ last-minute loss to Saudi Arabia, which scored a “last-gasp” 2-1 win over Egypt and gave KSA its first World Cup win since 1994. Egypt’s last-place finish in its group is likely to “heap pressure” on the national team’s coach Hector Cuper, Reuters reports.

Cuper defended his team, saying the Pharaohs were “unlucky” at the end. “Our strategy has not been a failure. We created at least five good chances on the counter attack and we had a very good first half in which we took the lead,” Cuper said, praising the record-breaking performance of 45-year-old goalkeeper Essam El-Hadary, who became the oldest competitor in World Cup history. The team’s only goal at yesterday’s match was scored by the usual, Mohamed Salah, who “put aside his highly publicized troubles,” according to the Associated Press, and scored his second World Cup goal. Salah later apologized to his fans for an “inexperienced” exit from the World Cup. “I just want to say that Egypt reached the World Cup after 28 years, some players here do not have the required experience,” the Independent quotes him as saying.

The Egyptian Football Association is still “emphatically” denying rumors that Salah wants to leave the national team: Reports claiming that national star Mohamed Salah is on the verge of quitting international football continue to dominate headlines in the foreign press. These “rumors” are not true and Salah has “made no complaints” to officials, the national team’s head of PR Osama Ismail tells RT. CNN had reported on Sunday that Salah was giving serious thought to leaving the national team after he “unwittingly became a publicity pawn” for Chechen dictator Ramzan Kadyrov and was upset for getting “special attention” during the team’s stay in Grozny, according to Reuters. “Salah is believed to be upset because he believes he has not been offered suitable protection by the Egyptian Football Association” from the backlash he faced over being photographed with Kadyrov, the New York Times reports.

To cap it all off, the EFA could face “harsh fines” from FIFA after Qatari sports network beIN reportedly complained to the global football governing body about the EFA refusing its request to interview the Egyptian national team during the World Cup. FIFA should be sending word to the EFA within the next few days, according to an unnamed EFA official.

The World Cup has done nothing to raise national morale: The political mess surrounding Salah, compounded by the national team’s disappointing and short-lived run in the World Cup, has only served to worsen the population’s simmering discontent with the country’s conditions, Khaled Diab writes in an opinion piece for Washington Post.

Other headlines this morning:

- Airbnb should consider investing in Egypt, as the service has grown exponentially in the country in just a few short years, Brennan Cusack writes on Forbes’ contributor network.

- Female preachers? Egyptian clerics are allowing women to act as preachers in mosques as part of the country’s fight against religious extremism, according to the Baptist Standard.

- Coptic hunger strike in Hong Kong: A Coptic Christian couple fleeing what they claim is persecution in Egypt went on hunger strike to protest alleged mistreatment at the hands of immigration officials in Hong Kong, South China Morning Post reports.

- Archaeologists uncovered six cases of cancer while studying the bodies of Ancient Egyptians buried 3,000 years ago at the Dakhleh Oasis, according to LiveScience.

On Deadline

The government’s efforts to keep prices in check are not sustainable in the long run, Ziad Bahaa El Din argues in a piece to Al Shorouk. Rather than trying to impose greater oversight on the market to regulate prices — which has proved inefficient for a number of reasons that include the large size of the country’s informal sector — the state should focus on making basic services, such as healthcare, education, and infrastructure, more readily available, he writes. The government should also promote entrepreneurship and reconsider its policies on NGOs, which used to compose a parallel social security net.

Worth Reading

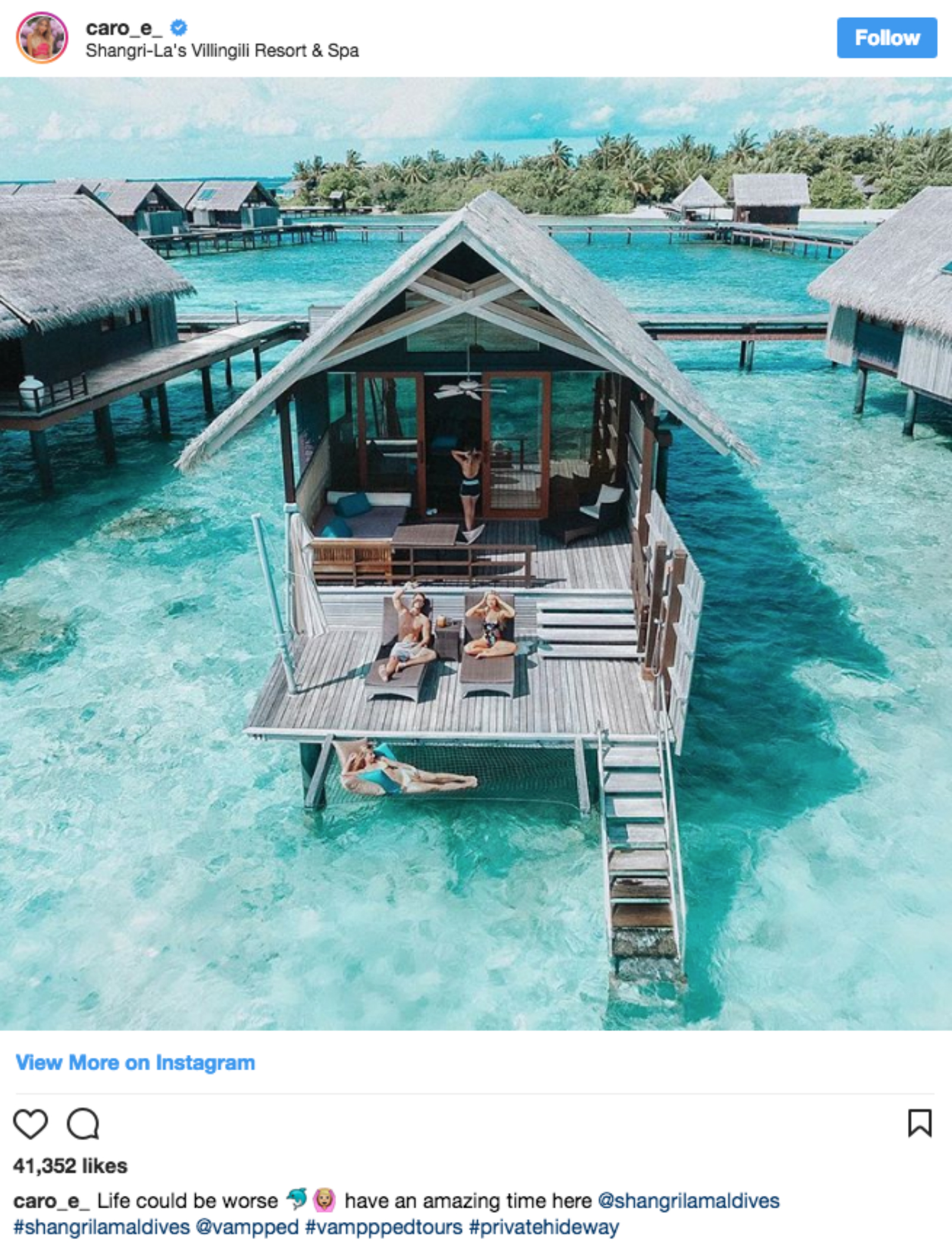

Hoteliers finally said it — posting a picture to a few thousand Instagram followers doesn’t make you a real ‘influencer’: (And yes, we absolutely despite the term “influencer.”) Hotel brands are fed up with normal people with a minor social media following touting themselves as “influencers,” according to the Atlantic. “People say, I want to come to the Maldives for 10 days and will do two posts on Instagram to like 2,000 followers,” says the marketing manager at Dusit Thani Maldives. Influencers are meant to operate just as a business professional in any other industry, one influencer says. That means having a proper business pitch, presenting a well-thought out strategy with numbers, and actually offering real services in exchange for a stay at the hotel. Based on these standards, it’s safe to say that 98% of unemployed millennials who claim they’re “influencers” don’t measure up.

Worth Watching

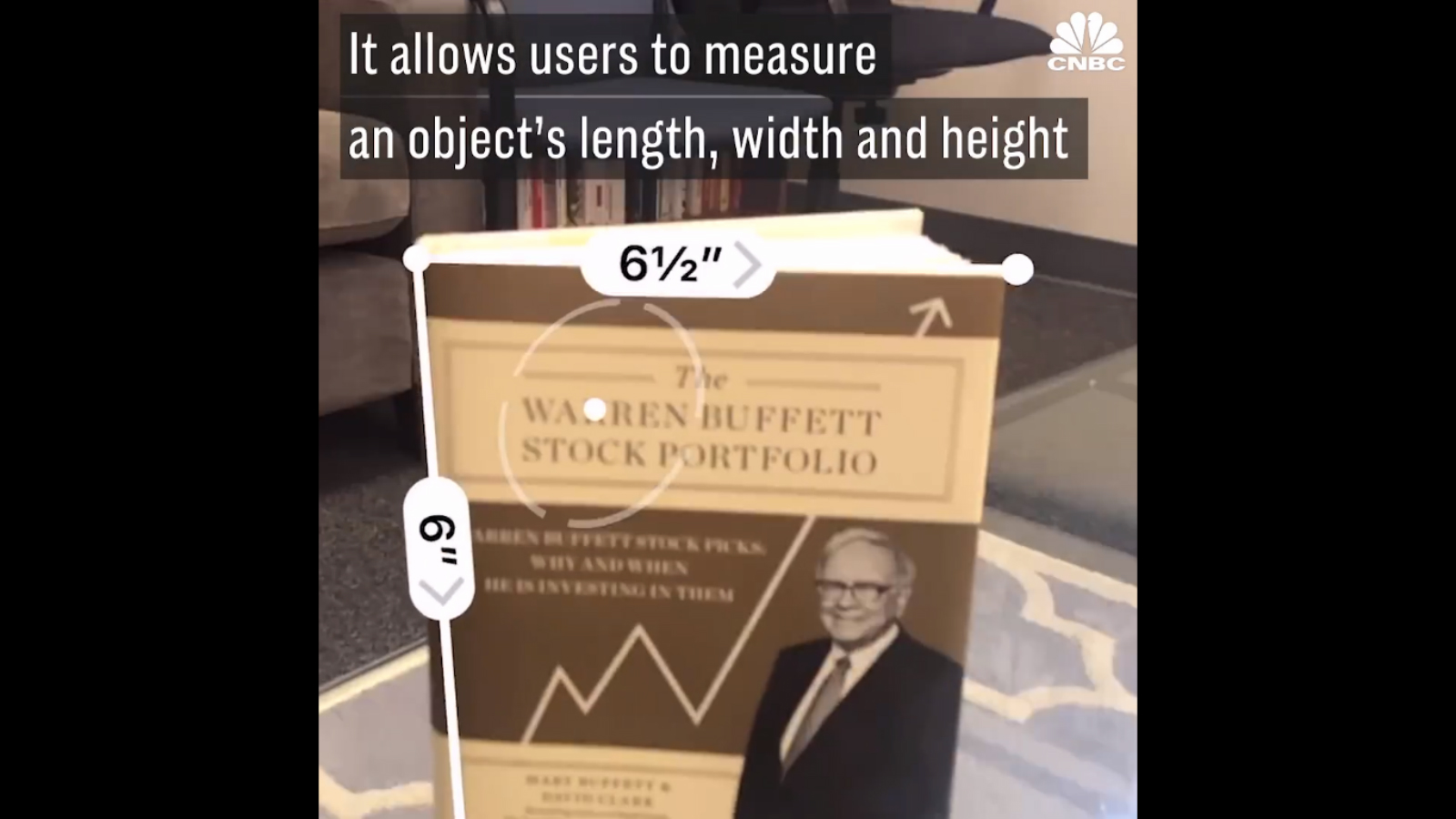

The latest thing to disappear into your iPhone (after following your TV, music and DVD collection, calculator, et cetera): The humble tape measure: Apple is preparing to roll out a new app this fall that “will make the tape measure go the way of the dinosaur,” according to CNBC. The app, simply named Measure, allows users to measure the height, width, and length of an object by tracing the object’s edge through your iPhone (watch, runtime: 1:00).

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi met yesterday with Iraqi Vice President Ayad Allawi to discuss political developments in Iraq, including the formation of a new government to complete the country’s political transition, according to an Ittihadiya statement. The two leaders also discussed work on reconstructing Iraqi cities after three years of war with Daesh. Prime Minister Mostafa Madbouly had a similar chat with Allawi to discuss potential collaboration on petrochemicals projects and infrastructure development.

Energy

EuroAfrica Interconnector presents feasibility studies on linking Egypt, Cyprus’ electricity grids

EuroAfrica Interconnector presented Electricity Minister Mohamed Shaker with feasibility studies yesterday on linking Egypt and Cyprus’ electricity grids, Al Mal reports. The ministry will review the studies before entering final talks with Cyprus on the details of the connection, Shaker said, without providing details on the expected timeline. EuroAfrica will install the 1,707 km, 2,000 MW subsea power cable between Egypt and Cyprus that’s at the heart of the USD 4 bn project to connect the power grids of Egypt, Cyprus, and Greece. The power linkage is expected to become part of a larger connection project between Europe and Africa.

Basic Materials + Commodities

GASC issues wheat tender for August delivery

The General Authority for Supply Commodities (GASC) issued a tender yesterday for an unspecified amount of wheat that’s expected to be delivered sometime between 11-20 August, Vice Chairman Ahmed Yousuf tells Reuters’ Arabic service. GASC is looking to purchase soft wheat and wheat flour from countries including US, Canada, Australia, Germany, Romania and Argentina.

Health + Education

House Education Committee approves USD 168 mn Egyptian-Japanese partnership agreement

The House of Representatives’ Education committee approved on Monday a USD 168 mn loan from the Japan International Cooperation Agency (JICA) to finance the construction of 45 new Japanese-style schools, Deputy Education Minister for Teaching Affairs Mohamed Omar tells Al Ahram. Egypt is chipping in with USD 200 mn for the project. The Cabinet had signed off on the loan back in April.

Tourism

Air Arabia launches two weekly flights to Sharm from Beirut

Low cost carrier Air Arabia has launched two weekly flights to Sharm El Sheikh from Beirut, according to the company’s website. The move comes as part of efforts to meet the growing demand for travel between both destinations, company CEO Adel El Ali tells Al Mal.

Automotive + Transportation

Cairo Metro Line 3 Phase 4A to be inaugurated in December, says Arafat

Phase 4A of the Cairo Metro’s Line 3 is expected to be operational by December 2018, Transport Minister Hisham Arafat said yesterday, Al Masry Al Youm reports. Construction work on the phase is 85% complete, while the establishment of the line’s rails is around 55% complete, according to the minister.

Banking + Finance

Five local banks to sign contracts with Al Canal Sugar for EGP 2.3 bn short-term loan

A consortium of five local banks is expected to sign contracts with Al Ghurair Group’s Al Canal Sugar for a EGP 2.3 bn short-term loan this week to fund its USD 1 bn sugar plant, unidentified sources tell Al Mal. The banks include Qatar National Bank Ahli, AlexBank, National Bank of Egypt, NBK Egypt, and one bank that has yet to be announced, according to the sources. The loan will be disbursed in tranches over the course of nine months.

Alta Semper Capital honored with Private Equity Africa award for Macro Group investment

Alta Semper Capital was honored with Private Equity Africa’s “Specialist [transaction] in Healthcare” for its 2016 investment in healthcare products outfit Macro Pharma, according to an emailed statement (pdf). Matouk Bassiouny had acted as legal advisor to Alta Semper on the transaction.

EIB, Alexbank sign EUR20 mn loan to support SMEs

The European Investment Bank (EIB) and Bank of Alexandria (Alexbank) signed yesterday a EUR 20 mn financing agreement to support SMEs in Egypt, according to an EIB statement picked up by Youm7. The agreement, which is part of the EIB’s Economic Resilience Initiative (ERI) and strategy to foster financial inclusion, marks EIB’s first credit line for SMEs through Alexbank.

Law

Zaki Hashem served as legal advisor to CSCEC on new capital business district development

Zaki Hashem & Partners served as legal advisor to China State Construction Engineering Company (CSCEC) on the company’s USD 3 bn contract to develop the business district of the new administrative capital, Al Masry Al Youm reports. CSCEC had signed the contracts for the project last October.

On Your Way Out

Egyptian Olympian swimmer Farida Osman clinched the gold medal for the 50m freestyle race yesterday and another for the 50m butterfly event the day before at the 2018 Mediterranean Games, Youm7 reports. Farida’s latest win brings the total number of medals under Egypt’s belt at the championship to 19. Osman also won a silver medal for the 100m butterfly event, while Marwan El Kammash won the bronze in the 200m freestyle, according to Youm7. Egyptian weightlifter Mohamed Ehab also snagged the gold medal in the men’s 77 kg class, while Ibrahim Moustafa won a silver medal in the men’s 69 kg category. Ahmed El Asfar and Ahmed El Masry are also bringing home silver and bronze medals for karate.

The Market Yesterday

EGP / USD CBE market average: Buy 17.83 | Sell 17.93

EGP / USD at CIB: Buy 17.82 | Sell 17.92

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Monday): 16,458 (+0.4%)

Turnover: EGP 1 bn (90% below the 90-day average)

EGX 30 year-to-date: +9.6%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.4%. CIB, the index heaviest constituent ended up 0.5%. EGX30’s top performing constituents were Eastern Co up 5.8%, Abu Qir Fertilizers up 3.9% and AMOC up 3.7%. Yesterday’s worst performing stocks were Porto Group down 3.7%, Arab Cotton Ginning down 3.3%, and Qalaa Holding down 2.9%. The market turnover was EGP 1 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +47.9 mn

Regional: Net Long | EGP +30.6 mn

Domestic: Net Short | EGP -78.4 mn

Retail: 60.6% of total trades | 60.2% of buyers | 61.0% of sellers

Institutions: 39.4% of total trades | 39.8% of buyers | 39.0% of sellers

Foreign: 20.2% of total | 22.5% of buyers | 17.8% of sellers

Regional: 9.9% of total | 11.4% of buyers | 8.4% of sellers

Domestic: 69.9% of total | 66.1% of buyers | 73.7% of sellers

WTI: USD 68.15 (+0.10%)

Brent: USD 75.00 (+0.36%)

Natural Gas (Nymex, futures prices) USD 2.93 MMBtu, (+0.21%, July 2018 contract)

Gold: USD 1,267.90 / troy ounce (-0.08%)

TASI: 8,342.35 (-0.10%) (YTD: +15.44%)

ADX: 4,537.30 (-0.29%) (YTD: +3.16%)

DFM: 2,867.85 (-2.09%) (YTD: -14.90%)

KSE Premier Market: 4,866.21 (+1.11%)

QE: 8,936.78 (-0.76%) (YTD: +4.85%)

MSM: 4,583.27 (-0.22%) (YTD: -10.12%)

BB: 1,301.57 (-0.40%) (YTD: -2.26%)

Calendar

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

29 June (Friday): IMF’s executive board meeting to review progress on Egypt’s reform program.

1 July (Sunday): Application deadline for the DigitalAG4Egypt Challenge.

16 July (Monday): Cairo Court of Appeals to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

23 July (Monday): Revolution Day, national holiday.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.