- Economists are warning of a bit too much reform, a bit too fast, but OPEC production hike should provide some breathing room. (Speed Round)

- El Sisi sets 7% economic growth target for Madbouly cabinet. (Speed Round)

- Colony Capital acquires key Abraaj funds, including North African pocket; outfit has ties to Trump administration, GCC leaders. (What We’re Tracking Today)

- Wealth tax is unlikely to make a comeback, says Kouchouk. (Speed Round)

- Middle East leads decline in global IPOs in 1H2018. (Speed Round)

- Rameda to offer up to 45% of its shares on EGX. (Speed Round)

- House approves Leasing and Factoring Act. (Speed Round)

- Did Eni pledge USD 3 bn in investments in Egypt? Plus: We could be exporting natural gas by year’s end, early 2019. (Speed Round)

- Koko the gorilla, who used sign language and was a friend of Mr. Rogers and Robin Williams, has died. (On Your Way Out)

- The Market Yesterday

Sunday, 24 June 2018

OPEC production cut gives breathing room as analysts warn on too much reform, too fast

TL;DR

What We’re Tracking Today

** Our apologies for being a few minutes later than usual this morning, but it was a particularly busy weekend on the news front.

Prime Minister Mostafa Madbouly has postponed the unveiling of his government’s policy and legislative agenda to an as-yet unspecified later date, unnamed sources in the House tell Ahram Gate. Madbouly had been expected to present his program to legislators yesterday, but reportedly wants his ministers (sworn in only on 14 June) to have more time. The big unveil could come on 30 June, according to House spokesman Salah Hasaballah.

The House will vote today on the government’s EGP 70 bn overdraft request for the FY2017-18 state budget, according to Youm7. The overdraft, in large part to cover higher-than-planned spending on fuel, was originally scheduled to come up for a vote yesterday.

The Tenders and Auctions Act had also been expected to go up for a vote during a plenary session yesterday, but we’ve seen no confirmation the vote took place. The bill aims to streamline the tender process and set quotas for domestic components and SME contractors in state tenders.

The House will vote today on a presidential decree to extend the state of emergency for an additional three months retroactive to 1am CLT yesterday, according to Youm7. The state of emergency has been renewed every three months since April 2017.

Egypt, Greece and Cyprus are holding joint, multi-day military exercises starting today in a span of the Mediterranean between Crete and Egypt, Greece’s Ekathimerini reports.

Abraaj’s key funds are now owned by Colony Capital, an outfit with strong ties to both the ruling elite in the GCC and the Trump administration. Colony acquired on Thursday four funds from the Dubai-based private equity firm, including its North Africa, Sub-Saharan Africa, Turkey and Latin America funds, reportedly paying about USD 250 mn and agreeing to oversee Abraaj’s other funds until they can be disposed of. A rival bid from Cerberus Capital Management had offered USD 125 mn for Abraaj’s asset management business, but not Abraaj’s underlying stakes in those funds. The news prompted blunt questions from the Financial Times’ Lex column and coverage from WSJ, Reuters and Bloomberg.

Background: You can read the announcement from Abraaj and Colony (pdf), explore Colony Capital’s website (it recently changed its name from Colony NorthStar, but that’s not reflected on the website yet), or learn more about Colony founder and Trump pal Tom Barrack in a recent New York Times piece.

The leaders of Ethiopia and Zimbabwe narrowly escaped separate assassination attempts yesterday, Bloomberg reports. An unidentified suspect threw a grenade at Ethiopian Prime Minister Abiy Ahmed “minutes after addressing tens of thousands of supporters at a rally in Addis Ababa.” The attack came just days after Ahmed said he was starting peace talks with Eritrea for the first time since 1998. Zimbabwean President Emmerson Mnangagwa survived an explosion at an election rally. The Egyptian Foreign Ministry issued statements strongly condemning both assassination attempts (here and here).

It’s a big day for Saudi Arabia as women get the legal right to drive for the first time. It’s front-page news just about everywhere this morning, with some including the Wall Street Journal and the New York Times carrying multiple pieces. Both the WSJ and NYT zero in on the notion that men (on the road and through the guardianship system in KSA) will face pressure to change.

Speaking of KSA: Saudi Arabia has won an upgrade to MSCI emerging markets status as of mid-2019, according to Reuters.The kingdom, whose stock market has recently outperformed others in the GCC, should have a c. 2.6% weighting in the index once the deed is done. Hopes are for “current privatization efforts,” which include the initial public offering of state energy company Aramco, to continue expanding the scope of available growth opportunities in the market and increase its weight on the index, said MSCI MD and Global Head of Equity Solutions Sebastien Lieblich. Analysts interviewed by Bloomberg seemed to agree.

Tadawul will be working to make sure capital inflows in the coming months “will not adversely affect the market,” Reuters also says. The news of Saudi’s inclusion on the MSCI could generate as much as USD 45 bn in new capital inflows, much of which could be from “passive” investors, rather than “active” ones, who are likely to be less impacted by market fluctuations (i.e. less likely to flee at the first sign of turbulence).

It’s also a big day for Turkey as opinion polls reportedly show that today’s elections for the presidency and the parliament are both too close to call after 16 years of rule by Erdogan and his Justice and Development (AKP) party. At stake: Another five years in power, threatened by an “unusual show of unity from four opposition parties and their voters as well as the energetic and combative performance of Muharrem Ince, a former physics teacher who is a presidential candidate for the secularist CHP,” the Financial Times suggests. The New York Times’ Carlotta Gall looks at “signs the public is weary of Mr. Erdogan’s building mania” and focus on megaprojects. Meanwhile, Patrick Kingsley, the Guardian’s former Egypt correspondent, and Iliana Magra have an overview, also for the Gray Lady.

Chanel has published its financials for the first time in 108 years despite not being a publicly traded company. The fashion house made the move to end persistent rumors that it was so small it needed to merge with a larger outfit. Its USD 9.6 bn in 2017 revenues make it larger than Gucci and about the same size as Louis Vuitton. It’s not a precursor to a stock market listing, Business of Fashion reports.

What We’re Tracking This Week

The central bank’s Monetary Policy Committee meets on Thursday, 28 June to decide on interest rates.

The IMF’s executive board will meet on 29 June to decide on the fourth USD 2 bn tranche of Egypt’s USD 12 bn extended fund facility. The disbursement, which is expected to arrive in July, would bring the total amount Egypt has received under the facility to USD 8 bn.

On The Horizon

Grand Egyptian Museum will open its doors by year’s end, ahead of schedule; Giza Plateau development to be complete in two weeks: The Giza Plateau development project will be complete within two weeks, with the “final touches” currently being made, Prime Minister Mostafa Madbouly said yesterday, according to a Cabinet statement. Madbouly also said the first phase of the Grand Egyptian Museum will be ready to open its doors to visitors by the end of 2018, rather than in 1Q2018 as was previously announced.

Enterprise+: Last Night’s Talk Shows

Talk shows are (mostly) back from their summer hiatus, with a few exceptions and changes. Lamees Al Hadidi is soaking up the sun until September, but has several others filling in for her on Hona Al Asema in the meantime, according to El Watan. Al Hayah Al Youm host Tamer Amin is also vacationing in (of course) Russia until next month, leaving a spot open for a new show, Al Hayah fi Masr, Al Shorouk reports. ONE also seems to still be mulling what to do with Kol Youm, which Amr Adib hosted prior to his sudden on-air resignation.

Now, onto the news: Fuel price hikes and “exceptional raises” and pensions for state bureaucrats were the topic du jour for the talking heads who managed to force themselves to get back to work.

Wage and pensions increases for state bureaucrats will cost state coffers more than EGP 50 bn collectively, Finance Minister Mohamed Maait told Masaa DMC’s Eman El Hosary. The increases, which President Abdel Fattah El Sisi ratified yesterday, came as part of Income Tax amendments that will result in an EGP 8 bn drop in tax collections next year, Maait said (watch, runtime: 14:33).

The government sanctioned an increase in cab fares in tandem with the recent hike in fuel prices to make it harder for cabbies to set their own tariffs, Consumer Protection Agency head Rady Abdel Moty told El Hosary. Abdel Moty also urged citizens to snitch on cab drivers who try to price gouge (watch, runtime: 3:43). Fares for informal buses and microbuses are proving more difficult to control, MP Ahmed El Segini said (watch, runtime: 6:03).

Egypt is unlikely to completely liberalize fuel prices — at least not anytime soon, former oil minister Osama Kamal said. Instead, the government is targeting lower consumption and reduced spending on fuel subsidies. Kamal suggested that the Finance Ministry encourage drivers to switch to CNG-powered motors from gasoline by offering to cover the cost of the switch (watch, runtime: 22:45).

Elsewhere on the airwaves, sports critics and journalists spent their evening dissecting the latest from the World Cup. Egypt’s defeat against Russia was “disappointing” but not surprising considering the Pharaohs’ less-than-stellar performance, Yalla Kora’s Editor-in-Chief Karim Saeed said. National star Mohamed Salah was also not physically ready for the match, Saeed claimed (watch, runtime: 1:34 and here runtime: 1:09). Our next and final match against KSA will be an opportunity to salvage our image, he said (watch, runtime: 1:16).

Hona Al Asema paid tribute to army general Youssef Baki, the man behind the idea of destroying the Bar Lev Line during the 1973 war against Israel, who passed away yesterday (watch, runtime: 5:29).

Speed Round

Economists are warning of a bit too much reform, a bit too fast: The prices of fuel, electricity, water and metro tickets have risen back-to-back over the past couple of months, prompting a number of economists speaking to Reuters to warn that the rapid pace of the reforms could lead to high inflation “that would crimp consumption, put off a quick recovery and deter potential investors.” Among them is our friend Mohamed Abu Basha, lead economist at EFG Hermes, who warned too many reforms at once might fail to quickly revive the ailing economy. “Typically in fiscal consolidation the risk is that you enter a period of stagnation,” Abu Basha said. “You do a lot of reforms but they weigh too much on the economy’s capacity to grow.”

Nonetheless, we’re headed in the right direction in the long run, especially when foreign direct investment is concerned. “In the grand scheme of things, whatever harsh austerity measures are being put in place today, they lay a very strong foundation for private-sector-led growth over the coming five years,” said Hany Farahat, senior economist at Egyptian investment bank CI Capital. “No investor will come to Egypt if there is a risk of overspending or over-borrowing, which risk pressure for devaluation of the currency and an outflow of capital,” he added.

Moody’s welcomed the cuts to fuel subsidies, but warms of potential for “reform fatigue”: The ratings agency said in a statement issued Thursday (paywall) that recent subsidy cuts are credit-positive for Egypt and should reduce the state fuel subsidy bill to 1.7% of GDP in FY2018-19 from 2.5% of GDP in the current fiscal year. The hikes will help reduce the overall subsidy bill to 6.5% of GDP in the fiscal year starting 1 July, from 7.5% this year. Without the decision, the government’s fiscal consolidation targets for next year would have been in jeopardy. “The authorities plan to eliminate all fuel subsidies (excluding liquefied natural gas) by the end of 2019 as per the government’s reform program agreed to with the IMF,” says the report. The fuel price hikes would help Egypt meet its target to reduce the budget deficit to 8.4% of GDP in FY 2018-19, from around 9.8% in FY 2017-18. The report warned that “reform fatigue” could set in and so signals political risk as one of the biggest risk factors in Egypt.

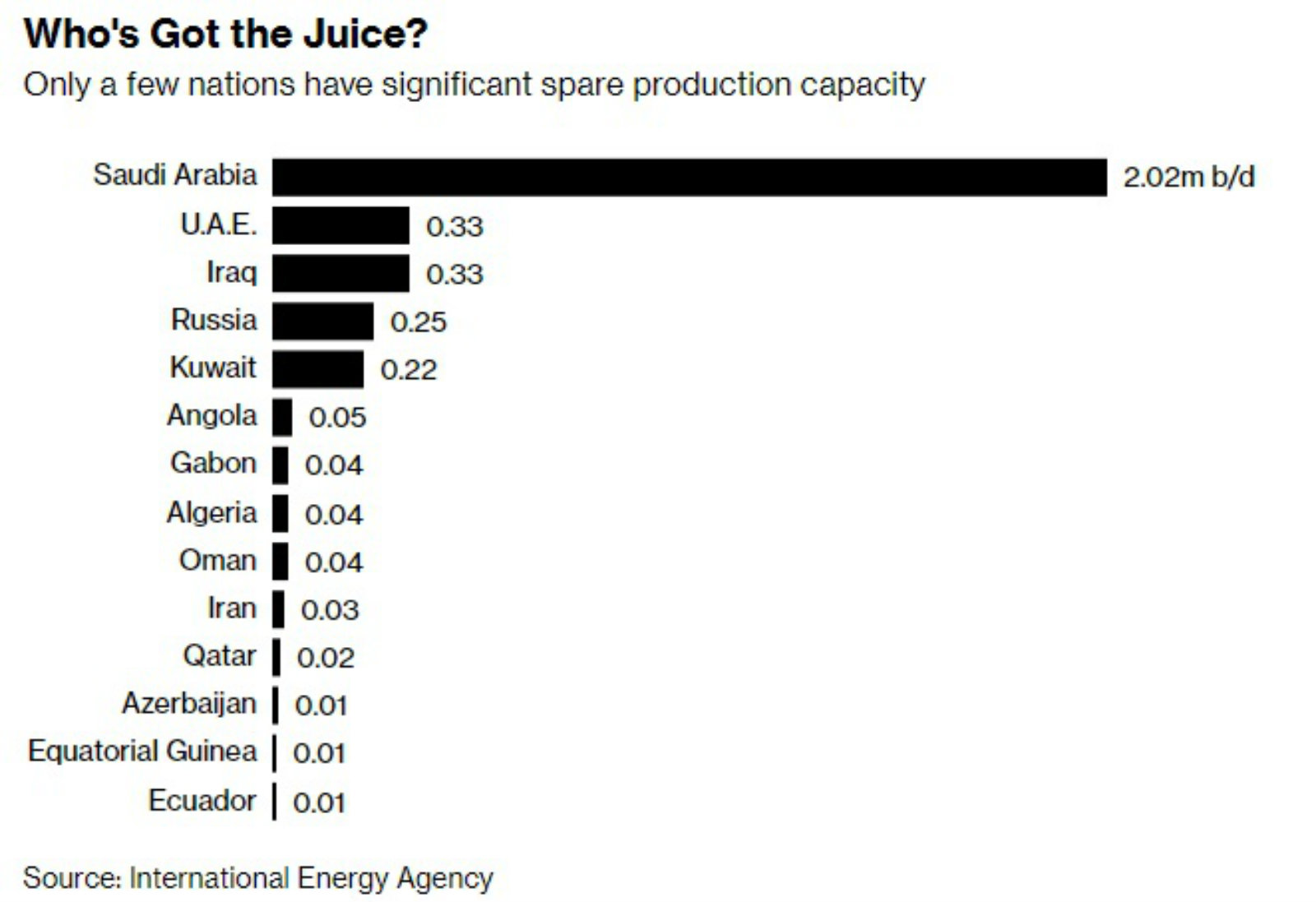

Egypt’s bid to tame its subsidy spending got a shot in the arm over the weekend after OPEC and other oil producers agreed to increase output starting next month, although the meeting in Vienna stopped short of outlining clear targets, Reuters reports. OPEC and other major producers said in a joint statement they intend to return to “100% compliance with previously agreed output cuts, after months of underproduction.” Saudi Arabian Energy Minister Khalid Al Falih said “OPEC and non-OPEC combined would pump roughly an extra 1 mn bpd in coming months equal to 1% of global supply,” with Saudi contributing “hundreds of thousands of barrels,” and Russia supplying an additional 200k bpd in 2H2018. “The only country that can increase production is Saudi Arabia, so its interpretation of the [pact] is the one that matters," Wood Mackenzie consultant and OPEC watcher Ann-Louise Hittle tells Bloomberg.

This is good news for Egypt, which has been hoping to see oil prices drop. Lower oil output had caused global Brent crude prices to surge above the USD 80/bbl mark. The strain of higher oil prices on the state’s FY2018-19 budget has been a growing concern for policymakers here and even saw the governmentconsider hedging strategies. Speaking at the OPEC gathering in Vienna, Oil Minister Tarek El Molla described the move on production as a “show of unprecedented global solidarity in order to achieve a balance in the oil market.”

Iran, however, was less pleased. Reuters says that the decision came “amid deep disagreements between OPEC arch-rivals Saudi Arabia and Iran,” noting that unlike Riyadh, Tehran has “little to gain” from increased oil production due to US sanctions passed down by President Donald Trump last month. The FT says Saudi had made a last-minute attempt to change Iran’s mind after Iranian Energy Minister Bijan Zanganeh threatened to derail the agreement .

Also from the reform files: Gov’t takes comatose fuel smart cards off life support: The Madbouly government has officially pulled the plug on the defunct ration card system for fuel, according to an announcement by the Oil Minister Tarek El Molla on Wednesday, according to Al Mal. The policy had been riddled with “holes” the government could not plug, he reportedly said. The smart card system would create another parallel market for fuel, which would be counterproductive, he added. The policy was also economically unfeasible, costing the state some EGP 2 bn, he said. Oil Ministry spokesperson Hamdy Abdel Aziz highlighted another glaring problem with the system: We have no tally of all the vehicles out there in Egypt. The system was supposed to include vehicles such as tuk-tuks and fishing boats, and without a proper tally of these vehicles the system would not be able to be implement, he said on Thursday, according to AMAY.

Background: The fuel smart cards system was meant to help reduce energy spending by limiting access to subsidized fuel and curbing the sale of this fuel on the black market. The issuance of smart cards began in May 2015, with an eye to fully implementing it by June of that year. President El-Sisi then postponed the system suddenly a day before its scheduled implementation “until all the sectors that don’t have these cards are covered.” New smart cards, however, continued to be issued for a period after.

What’s really going on: The system has been scrapped because subsidies are going out the window.

Fuel subsidies to be completely eliminated by next year, warns El Molla: “The [recent] increase [in petrol prices at the pumps] comes as a corrective measure for the pricing of petroleum products amid a level of consumption that does not reflect the country’s economic development,” he said, according to Ahram Online. He noted that last week’s 50% hike in fuel prices still leaves the government subsidizing 25% of the cost of fuel. El Molla then reiterated that fuel subsidies would be eliminated completely by next year, according to Al Shorouk.

CABINET WATCH- El Sisi sets growth target of 7% per annum for the Madbouly Cabinet: President Abdel Fattah El Sisi ordered the newly formed Madbouly Cabinet to work to bring average annual GDP growth to 7%, according to a statement from the cabinet. The also president urged ministers to continue cutting the budget deficit while cutting unemployment and inflation. The cabinet must also drive industrialization nationwide and expand aid to SMEs, particularly in Sinai, the statement quotes El Sisi as having said.

These economic targets are one of six objectives set out by El Sisi for the Madbouly Cabinet, which held its first meeting on Wednesday. Other priorities include (1) national security, (2) improving quality of life for citizens; (3) expanding protections for low-income earners; (4) improving education and (5) improving government services.

Re-engagement with Nile Basin tops foreign policy objectives: On the foreign policy front, El Sisi ordered cabinet to work on improving ties and “fostering trust” with African nations, particularly those of the Nile Basin Initiative (NBI) to drive “joint sustainable development.” As we noted in our 2016 year in review, re-engagement with Africa and the NBI would be a major priority for the El Sisi administration. The policy has begun to bear fruit as Ethiopia and Egypt appear to have reached a breakthrough in talks on the Grand Ethiopian Renaissance Dam during Ethiopian Prime Minister Abiy Ahmed’s visit to Cairo earlier this month.

Decisions taken by the cabinet at its inaugural meeting include:

- Approving a plan to restructure the Administrative Control Authority to bring it in line with the Vision 2030 goals;

- Approving a USD 200 mn loan from the European Bank for Reconstruction and Development as part of an energy efficiency project at Suez Oil Company;

- Approving a EUR 150k grant from the Spanish Agency for International Development to cooperate on judicial matters.

EXCLUSIVE- Wealth tax is unlikely to make a comeback, says Kouchouk: A proposal coming from the House of Representatives’ Budget committee to bring back a wealth tax is unlikely to pass, Vice Minister of Finance Ahmed Kouchouk told us last week. The proposal would see salaries of more than EGP 500k per year taxed at a 25% rate against today’s 22.5%. The plan would also cut taxes on lower income earners at the same time. The ministry has received the proposal from the committee, but is unlikely to go through as the ministry is emphasizing policy stability in the tax code, said Kouchouk, noting that the code in its current form is “conducive to private sector growth.”

Middle East leads decline in global IPOs in 1H2018: Global listings in 1H2018 fell 19% y-o-y to a total of 676 IPOs, coming largely on the back of political concerns and market volatility, according to a report from Baker McKenzie. The value of listings globally has also fallen 15% y-o-y to USD 90 bn. EMEA and Asia-Pacific led this decline, with capital raising in the Middle East falling 70% y-o-y in 1H2018 compared to the same period last year to only USD 263 mn. Total listings in the region for the period fell to six transactions from 13 last year, notes the report.

Privatization is the ray of hope? IPO activity in the Middle East is expected to start to pick up in 2H2018 as a result of the privatization drive in the region, said the report. “While the number of IPO transactions during the first half of this year was lower than expected, we still believe that appetite is there, particularly in Saudi Arabia and the UAE … The IPO pipeline includes a number of transactions that aim to hit the market later this year, although it is likely that some of these transactions will spill into 1Q2019,” the report says.

By our count, only two IPOs on the EGX took place in 1H2018 — CI Capital and B Investments in April, and we don’t see a significant number of new listings coming out of the state privatization program this year. Instead, we’re looking at stake sales by already-listed companies, with the first up likely to be Eastern Tobacco Company’s 4% sale. Former Public Enterprises Minister Khaled Badawi told us that the company would sell these additional shares before the end of the month. An investment bank was supposed to have been hired by now, according to Badawi.

IPO WATCH- Pharma manufacturer Rameda is planning to list up to 45% of the company’s shares on the EGX, sources close to the transaction tell us in the wake of a report in Al Mal on Thursday. Expect the EGP 1.9-2.3 bn transaction to include both primary and secondary sales that will see 35-45% of the company in free float. The transaction will include both a domestic retail offering and an international institutional offering, we’re told.

Advisers: CI Capital will be joint global coordinator and sole bookrunner, while Compass Capital will be joint global coordinator and lead manager. Zaki Hashem has been tapped to serve as counsel to the underwriters. Norton Rose Fulbright will be international counsel to the issuer, with Matouk Bassiouny doing domestic duties. E&Y is Rameda’s auditor, while the lead on Rameda’s IFA has yet to be appointed.

M&A WATCH- Mondi completes acquisition of NPP: London- and Johannesburg-listed Mondi Group has completed the acquisition of 100% of Egyptian industrial bags maker National Company for Paper Products (NPP) for EUR 24 mn (EGP 510 mn), Mondi said in a press release on Wednesday. “We are excited to have completed this acquisition, which complements our existing network in the growing Middle East region and allows us to grow our business and better serve our customers,” said Mondi’s Fibre Packaging CEO Erik Bouts. Mondi has been working to expand its presence in Egypt and is reportedly close to acquiring the remaining 70.1% stake in the Suez Bags company in a transaction valued at EGP 300-400 mn.

INVESTMENT WATCH- South Africa’s Tiger Brands is eyeing Egypt as one of several potential North African expansion markets, according to Bloomberg. The packaged-goods producer “makes products from energy drinks to peanut butter and porridge oats to shampoo” and is eyeing markets that have “have comparatively larger middle classes and more developed retail sectors than African nations below the Sahara,” says CEO Lawrence Mac Dougall. The products will initially be shipped over from South Africa, but could see the company move further up into the value chain into manufacturing as it follows an “on-the-ground, bottom-up” approach to expansion.

INVESTMENT WATCH- Did Eni pledge USD 3 bn in investments in Egypt? Eni plans to allocate USD 3 bn in new investments in Egypt over “the coming period,” Eni CEO Claudio Descalzi said, according to a purported statement from the Oil Ministry floating around in the local press on Thursday. The company’s investments in the fields of Nooros and Zohr now stood at USD 8.4 bn, Descalzi reportedly said during a sit down with Oil Minister Tarek El Molla.

Eni is also keen on exploring possible projects in renewable energy, Descalzi said in a meeting with President Abdel Fattah El Sisi, according to an Ittihadiya statement. While the statement gave no detail, it is likely that Descalzi is speaking of building a 50 MW solar power plant in the Red Sea’s Abu Redis to sell power directly to consumers under an independent power producer (IPP) framework. Eni was one of five companies that had submitted proposals back in April to build under the IPP framework.

Mubadala enters Egypt with Zohr acquisition: Descalzi’s statements come a day after Eni finalized a 10% stake sale in the Shorouk concession, which holds the Zohr gas field, to the UAE’s Mubadala Petroleum, according to a statement from the Oil Ministry. The USD 934 mn agreement, which was signed by Eni in March, now sees Eni’s share through its JV with the Oil Ministry IEOC fall to 50%, with Rosneft holding a 30% and BP taking 10% alongside Mubadala’s 10%. More reading: Eni statement’s (pdf) on the transaction.

Meanwhile, Zohr has apparently led to a cancellation of two LNG cargoes: EGAS bought six LNG cargoes in an international tender won by Switzerland-based traders Trafigura, Vitol and Gunvor, trade sources told Reuters on Wednesday. Sources said the government likely cancelled two planned LNG cargoes as the Zohr gas field ramps up production to 1.75 bcf/d by August. That means LNG imports are just about done: Domestic production will be enough to cover local demand in Q3 of this year, El Molla told the press yesterday, according to Bloomberg, and there are no imports planned for Q4. Natural gas imports by 4Q18 / 1Q19? When we have natural gas surplus to domestic demand, Egypt will begin “compensating companies that have rights to operate the country’s LNG export terminals, including Royal Dutch Shell Plc and Union Fenosa SA,” according to the minister.

Ibnsina Pharma lays out case in appeal of antitrust case: Ibnsina Pharma has filed documents countering antitrust allegations leveled against the company by the Egyptian Competition Authority (ECA), said company Chairman Mohsin Mahgoub. A Cairo Economic Court had found in March that Ibnsina, along with competitors United Co. for Pharmacists, Ramco Pharm and Multipharma, had colluded to cut credit periods and slash discounts to small and medium sized pharmacies, fining the companies a total of EGP 5.6 bn. Mahgoub said the ruling was excessive considering how the court failed to hear from experts. The Cairo Court of Appeals is expected to rule on the case on 16 July.

Did Egypt save EGP 5 bn in potential int’l arbitration disputes? The State Lawsuits Authority won international arbitration disputes in April and May that have together saved Egypt around EGP 5 bn, sources at the authority said. The authority mounted a successful defense of claims by French environmental services firm Veolia Propreté, said the authority’s Secretary General Mohamed Abdel Latif. The company had taken Egypt to international arbitration seeking a EGP 3.6 bn settlement over the breakdown of its six-year contract with Alexandria governorate for waste management services back in 2012. The story gives no details on the energy case.

On a related note, the government sources had said last month that there will amendments to the State Lawsuits Authority Act that would impact international arbitration cases. These sources said nothing by way of detail beyond stating that these amendments would help “improve procedures to reach quick resolutions on Egypt’s international and domestic cases.”

LEGISLATION WATCH- House approves Leasing and Factoring Act: The House of Representatives gave its final approval to the Leasing and Factoring Act during a plenary session yesterday, Al Masry Al Youm reports. The law, which regulates leasing and factoring as non-banking financing tools that are subject to oversight by the Financial Regulatory Authority (FRA), limits players in the field to leasing and factoring upon establishment, leaving further expansion to FRA approval. We have yet to see the full text of the law in its final form. Investment Minister Sahar Nasr said the law will be good for SMEs and entrepreneurs, according to a ministry statement (pdf).

House Speaker Ali Abdel Aal also referred the draft Anti-Terror Act to a subcommittee bringing together members of the constitution, defense and national security committees, according to the newspaper. The House also gave the green light to an extradition treaty with Belarus, which was signed in January, Ahram Gate reports.

Talks with Russia to resume charter flights back on after World Cup: “The talks on opening charter flights to Egyptian resort cities will be resumed after the 2018 FIFA World Cup,” Russia’s Transport Minister Yevgeny Ditrikh said on Thursday. Representatives of the Egypt’s Civil Aviation Ministry have visited Russia during the 2018 FIFA World Cup to discuss the timeline of the talks, said Ditrikh, according to TASS. Russia had restored direct flights between Cairo and Moscow in April following a ban instituted since the Metrojet crash in 2015.

UK flights to Sharm also in play? UK travel newspaper TTG had said back in March that the UK could reconsider its ban on flights to Sharm El Sheikh if Russia was to lift its restrictions, citing sources.

Egypt says it will file a formal complaint with FIFA about referee Enrique Caceres’ performance during the Pharaoh’s match against Russia last week. The national team went down to a 3-1 defeat that knocked Egypt out of the 2018 World Cup. “We want an investigation into the performance of the whole refereeing team,” Egyptian Football Association president Hany Abo Rida told Reuters. He said that among the violations that Caceres ignored were those that pushed fullback Ahmed Fathi into steering the ball into his own net. He also said that Egypt was due a penalty shot in the 78th minute of the game.

Our very slim chances of qualifying for the next round of the tournament died on Wednesday with Saudi’s Arabia’s predictable defeat by Uruguay.

Egypt meets Saudi on Monday at 4:00pm CLT in what the AP is calling “an inconsequential match between two teams already eliminated from the World Cup.” The match, however, still determines who ranks last in Group A. It is also “about pride, politics and maybe some score settling too,” after Saudi Sports Minister Turki Al Sheikh made some comments about Mo Salah that were deemed inappropriate.

Dissent among in the ranks? Rumors had surfaced that the team’s performance has caused a rift between players and coaching staff ahead of tomorrow’s final game for the Pharaohs, according to Goal.com. Mo Salah was quick to squash rumors in a tweet on Wednesday.

On the plus side, the tournament did bring some Egyptian players to the attention of the international transfer market. Salah was naturally in the limelight, this time for being named an honorary citizen of Chechnya by President Ramzan Kadyrov. Mahmoud “Trezeguet” Hassan has reportedly attracted a lot of interest, including that of English team Leicester City, according to Turkish Newspaper Milliyet. El Hadary was also featured, “[agonizing] over his personal World Cup Milestone,” while the AP noted that many of the big names in football, such as Lionel Messi and Neymar, have been axed from the tournament (Check who’s in and who’s out).

Meanwhile, Egypt’s Coptic Christians say they’re feeling left out of the game “with the composition of the team and the way the squad was perceived [highlighting] what they believe is a problem with the sport in Egypt,” Hamza Hendawi writes for the AP.

CORRECTION- In last week’s Worth Reading on the state of Egypt’s VCs by Wamda, it was incorrectly noted that Vezeeta’s 2016 Series B round held the record in Egypt at USD 5 mn. That record was broken last month with BasharSoft’s job recruitment platforms Wuzzuf and Forasna raising USD 6 mn in Series B funding last month. We’ve fixed the mistake on our web edition.

Egypt in the News

IMF weighs in on the military’s role in the economy debate: Although The Egyptian military’s economic activities “aren’t particularly in contradiction with the IMF policy,” it’s up to the state to establish a “fast-growing economy whose main pillar [ought to be] the private sector rather than the public sector or the state,” IMF mission chief to Egypt Subair Lall tells Al Monitor in an interview. The government should “reduce the state’s control in general, not specifically the military, over economic activities, in line with the agreed objectives of the economic reform plan,” Lall added. Lall’s statements underscore the middle ground the IMF is taking on the debate. A series of stories in the international press have drawn attention to what some claim is the military’s growing role in the economy. Most notable of these was a year-long Reuters investigation and, most recently, a long recap of the issue from the Wall Street Journal. Military Productions Minister Mohamed El Assar subsequently refuted the claims, noting that 75% of the ministry’s projects come in partnership with the private sector. “Economic reform experiences in many developing countries show that excessive state intervention in the economic sector doesn’t affect competition as [much as] some might claim,” said Lall.

More needs to be done to spur private sector growth: Lall urged for more measures to encourage private sector growth. “The state has to encourage competition and remove any obstacles facing investors in acquiring lands and investments. It has also to work on increasing economic transparency by passing legislation to this effect, eliminating bureaucracy and developing infrastructure, which will help the private sector increase investment, develop the economy and create the required job opportunities," he added.

Meanwhile: Egyptians are using dueling hashtags on Twitter, one side to call for President Abdel Fattah El Sisi to resign, the other to voice support, Menna Zaki writes for the AP. The hashtags — #Sissi_Leave and #MyLeaderIsSissiAndProud — have been gaining momentum since the government moved to raise fuel prices over the Eid break.

On Deadline

Egypt’s path towards growth after reforms will not be as successful without the full inclusion of the private sector, Magda Shahin writes for Al Shorouk. Shahin lauds the state for remaining steadfast in its drive to implement reforms, but notes that excluding the private sector would be a hindrance. Al Masry Al Youm’s Aly El Salmy chimes in to urge the government to focus on industrial growth, which would create a strong foundation for further development.

Diplomacy + Foreign Trade

Is the Trump administration looking to Sinai as the lynchpin of its Middle East peace plan? White House adviser Jared Kushner and special envoy Jason Greenblatt met with Egyptian President Abdel Fattah El Sisi on Thursday for the third leg of a Middle East tour to promote the Trump administration’s new peace plan for the region. The meeting looked at increasing cooperation between Washington and Cairo and the need to facilitate humanitarian relief to Gaza, a White House statement said. This appears to validate reports in the Israeli press that the plan, which is backed by Saudi Arabia, could see the GCC invest up to USD 1 bn in Gaza’s economy. The plan, which has yet to be announced, could establish a freetrade zone between the Gaza Strip and Al Arish in Sinai where five large industrial projects will be built, according to Haaretz.

Palestinian officials are not at all happy with the proposed plan, which they see as an “Israeli, American, Saudi and Egyptian conspiracy,” that ultimately aims to “[avoid] diplomatic negotiations over the future of Palestine,” a senior Palestinian Authority (PA) official tells Haaretz.

At the meeting with Kushner, Sisi reportedly continued to push for a two-state solution with East Jerusalem as Palestine’s capital,Ittihadiya said in a statement.

Trade and Industry Minister Amr Nassar spoke with his Sudanese counterpart on easing obstacles to trade and investment, the ministry said in a statement on Wednesday. The “obstacles” referenced here likely allude to the boycott of agriculture goods Sudan had imposed since in May 2017.

Energy

Chinese consortium lands Hamrawein coal plant tender

The Egyptian Electricity Holding Company (EEHC) awarded a Shanghai Electric-Dong Fang-Hassan Allam consortium the tender for the 6 GW Hamrawein “clean coal” power plant, Al Ahram reports. The consortium, which edged out an Orascom Construction-Elsewedy Electric-Mitsubishi Hitachi consortium and GE, had reportedly presented the lowest offer for the construction of the plant at USD 4.4 bn. The EEHC will begin procedures to sign the contracts with the consortium “within the coming period.” Construction is expected to take 6-7 years.

On Your Way Out

Koko the gorilla, who used sign language and was a friend of Mr. Rogers and Robin Williams, has died. The 46-year-old gorilla captured the imagination of children in the 1970s and 1980s and was twice on the cover of National Geographic (once in an image she took herself). Koko and her pet cat All Ball sparked a generation’s fascination with Western lowland gorillas, a highly endangered species. Obits are running in the New York Times and Canada’s CBC, among other places.

The Market Yesterday

EGP / USD CBE market average: Buy 17.82 | Sell 17.92

EGP / USD at CIB: Buy 17.81 | Sell 17.91

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Thursday): 16,346 (+1.3%)

Turnover: EGP 740 mn (30% BELOW the 90-day average)

EGX 30 year-to-date: +8.8%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 1.3%. CIB, the index heaviest constituent ended up 1.7%. EGX30’s top performing constituents were Arab Cotton Ginning up 4.7%, Egyptian Iron & Steel up 4.0% and Kima up 3.6%. Thursday’s worst performing stocks were TMG Holding down 0.4%, Orascom Construction down 0.2%, and Amer Group flat. The market turnover was EGP 740 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +64.4 mn

Regional: Net Short | EGP -3.2 mn

Domestic: Net Short | EGP -61.2 mn

Retail: 68.4% of total trades | 67.4% of buyers | 69.4% of sellers

Institutions: 31.6% of total trades | 32.6% of buyers | 30.6% of sellers

Foreign: 21.5% of total | 25.8% of buyers | 17.1% of sellers

Regional: 6.4% of total | 6.2% of buyers | 6.6% of sellers

Domestic: 72.1% of total | 68.0% of buyers | 76.2% of sellers

WTI: USD 68.58 (+4.64%)

Brent: USD 75.55 (+3.42%)

Natural Gas (Nymex, futures prices) USD 2.95 MMBtu, (-1.01%, July 2018 contract)

Gold: USD 1,270.70 / troy ounce (+0.02%)

TASI: 8,206.40 (+0.49%) (YTD: +13.56%)

ADX: 4,535.26 (-0.33%) (YTD: +3.11%)

DFM: 2,928.17 (+0.19%) (YTD: -13.11%)

KSE Premier Market: 4,803.52 (-0.24%)

QE: 8,922.52 (+0.46%) (YTD: +4.68%)

MSM: 4,609.87 (+0.36%) (YTD: -9.60%)

BB: 1,309.49 (+0.64%) (YTD: -1.67%)

Calendar

25 June (Monday): Egypt plays against Saudi Arabia at 2018 World Cup, Volgograd, Russia.

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

29 June (Friday): IMF’s executive board meeting to review progress on Egypt’s reform program.

1 July (Sunday): Application deadline for the DigitalAG4Egypt Challenge.

16 July (Monday): Cairo Court of Appeals to issue ruling on EGP 5.6 bn antitrust case against pharma companies.

23 July (Monday): Revolution Day, national holiday.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.