- Electricity Ministry to recommend power prices rise up to 55% in July; stay tuned for political theatre. (Speed Round)

- Military says it’s not crowding out the private sector. (Speed Round)

- Boeing looks at opening a regional office in Cairo. (Speed Round)

- House to extend legislative session by two weeks? (Wha we’re Tracking Today

- Eight law firms vying for gig as legal advisor on state privatization program. (Speed Round)

- SODIC plans to invest up to EGP 1 bn to grow its land bank this year. (Speed Round)

- Orascom Construction JV signs notice to proceed with USD 320 mn wastewater plant in Abu Rawash. (Speed Round)

- Global M&A hit USD 2 tn YTD in 2018, a new record. (What We’re Tracking Today)

- You may next eat at … 6:46pm CLT.

- By the Numbers

Wednesday, 23 May 2018

Electricity bills to rise as much as 55% in July?

TL;DR

What We’re Tracking Today

The House may choose extend its current legislative session by two weeks to get through a backlog of legislation, Rep. Osama Heikal tells Youm7. Among the bills waiting to receive House approval: The FY2018-19 state budget, part two of the Media Act, and amendments to the Criminal Procedures Act, Heikal says. Parliament is currently in recess until 3 June and will likely only have six plenary sessions before Eid Al-Fitr, at which point MPs will go on vacation again.

Russian industrial zone contracts to be signed today? Egypt and Russia look set to sign contracts for a 5.23 mn sqm Russian Industrial Zone today at a meeting of the Egyptian-Russian Economic Committee, according to a Russian trade ministry statement.

The Transportation Ministry will break ground today on the third phase of Cairo Metro Line 3, Al Ahram reports. Once completed, the 18-km, 15-stop line is set to run from Imbaba to Cairo International Airport. A EUR 900 mn loan is covering 60% of the cost of the project.

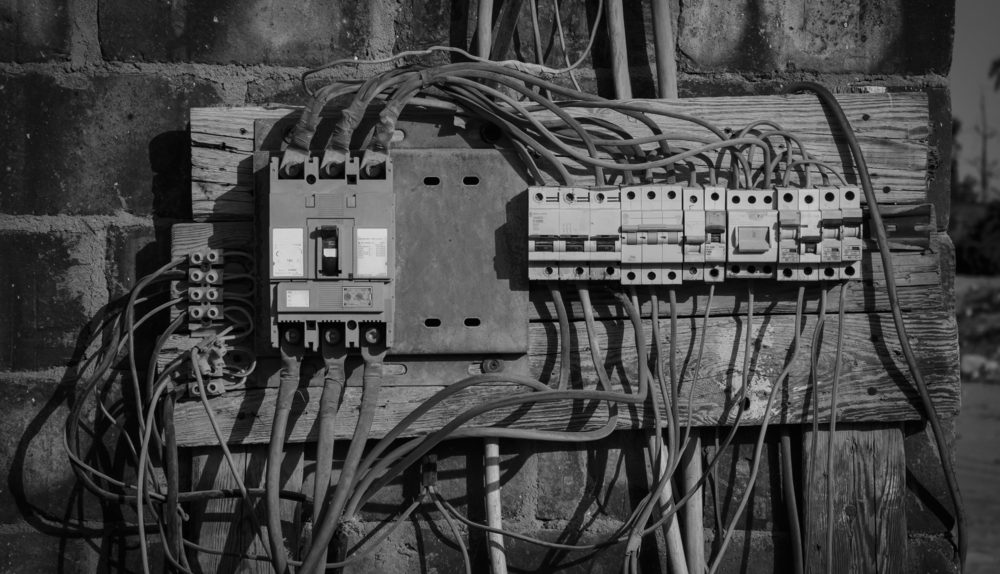

A harsh reminder that power prices will go up this summer: We hope you are all having a better time with the heat wave (and yesterday’s electricity outages in the capital city) than we have. We experienced long blackouts in both Maadi and Heliopolis yesterday. Even the metro saw a slowdown, according to AMAY. This all a stark reminder that electricity prices are going to go up. We have the latest on all of it in Speed Round below.

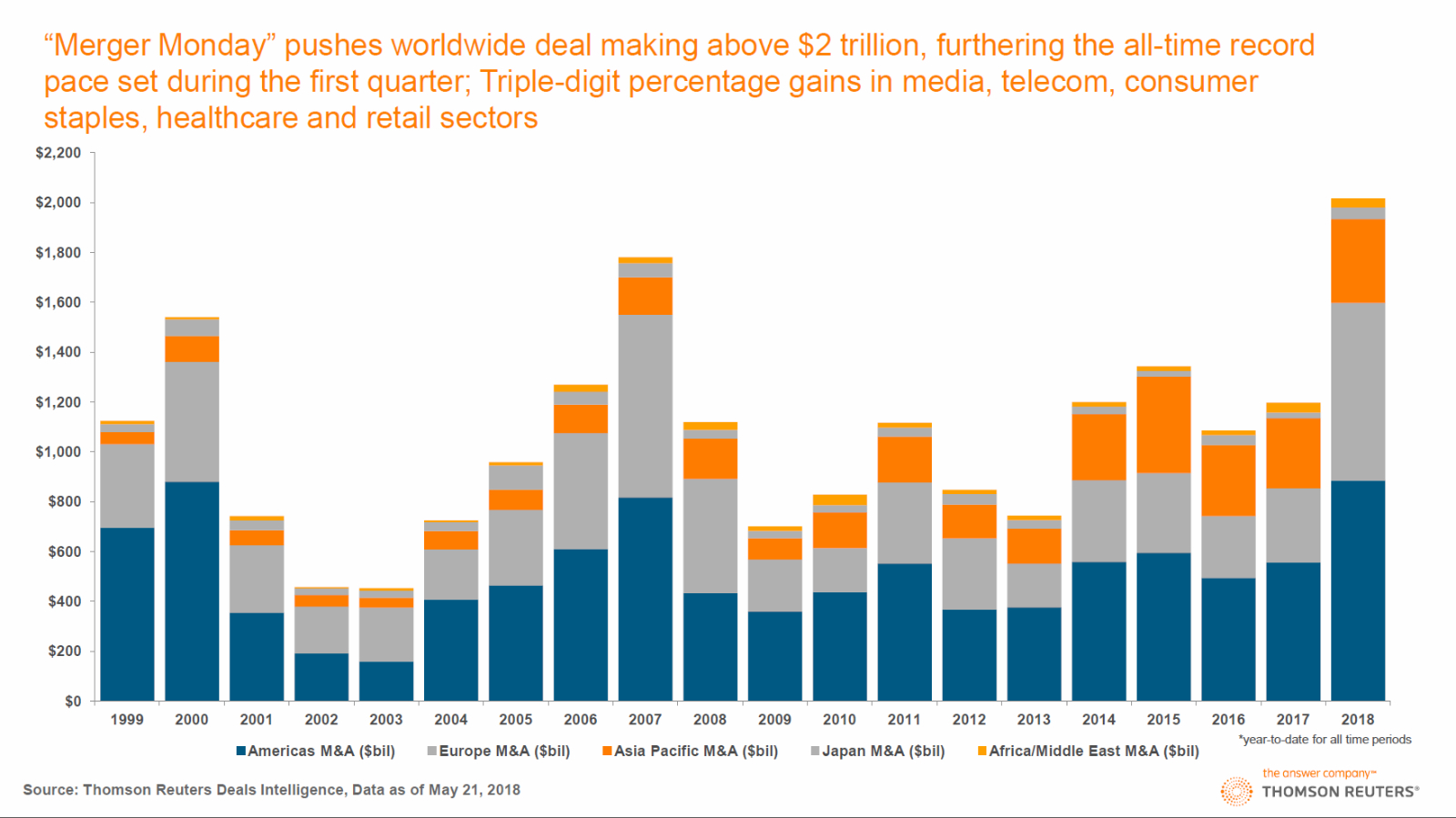

Global M&A hit USD 2 tn YTD in 2018, a new record according to data from Thomson Reuters. About USD 28 bn in US transactions were announced on Monday, with strong activity in power, financials, and real estate. The most notable among them was the USD 11.1 bn merger of GE’s transportation unit and rail equipment maker Wabtec.

The data comes with an ominous warning: Reuters notes that the last times global M&A hit this level was a year before the global financial crisis and right before the bursting of the dot com bubble.

This week alone saw MENA banking M&A hit USD 8 bn, according to Bloomberg. Leading the pack was Saudi British Bank’s USD 5 bn all-stock acquisition of Alawwal Bank. This was followed by Emirates NBD announcing that it has agreed to acquire Turkey’s Denizbank from Russia’s state-owned Sberbank for USD 3.2 bn. The acquisition of Turkey’s fifth largest bank is the biggest ever undertaken by Emirates NBD, and will add USD 37 bn of assets to its books.

From the dept of D’uh: The Institute for International Finance (IIF) is concerned about the vulnerability to rising interest rates of emerging market asset classes in its latest report (pdf). Contagion risk from the sharp depreciation in the Turkish lira and the Argentine peso this year are dampened, however, by the fact that portfolio inflows to EMs since 2016 were largely concentrated in a select few emerging markets, including Egypt, Colombia, South Africa and Argentina. Nonetheless, it warns that the extent of the impact of the Fed hikes on the lira and peso could be a sign for things to come.

The New York Stock Exchange has a female boss for the first time in its 226-year history. Stacey Cunningham (LinkedIn), the exchange’s COO, takes over as Thomas Farley steps down after a four-year run to launch an outfit that will invest in fintech, Axios reports. Cunningham started her career as an intern at NYSE back in 1994, worked at both Nasdaq and Bank of America, and went to culinary school during a hiatus from the trading floor. See wall-to-wall coverage from Reuters, the Financial Times and the Wall Street Journal.

The US Congress is rolling back some of the restraints put on banks after the global financial crisis, and the big winners aren’t the Bulge Bracket, but smaller US banks. Goldman Sachs, Morgan Stanley and JPMorgan Chase got elbowed out by smart lobbying from smaller US banks who convinced lawmakers that only banks with USD 250 bn or less in assets face reduced federal oversight and easier lending, capital and trading rules, Reuters reports. Political junkies will want to read the WSJ’s tick-tock on the lobbying effort to get the bill passed. The big Wall Street firms had pushed hard to water-down the 2010 Dodd-Frank act by raising the oversight threshold to USD 500 bn.

The new legislation is called the Crapo bill, and it’s not a scatological reference, but rather a sobriquet arising from the rather unfortunate family name of Senate Banking Committee Chair Mike Crapo. Business Insider has a good explainer (as does the Wall Street Journal), CNBC offers five buys after the legislative overhaul.

You’re in Egypt. Should you care? Only to the extent that you want to be vaguely aware of rising risk in the global financial system… The Dodd-Frank act was the source of the mandatory post-financial-crisis stress tests to which large lenders are subject. Banks with assets of less than USD 100 bn are now exempt from them and regulators are allowed to be more lax with lenders who have assets of USD 100-250 bn. If you’re geeky on risk, you’ll want to read Rana Foroohar’s column on the issue in the Financial Times.

In miscellany today:

The best (American) football columnist in the history of the game is retiring, and his farewell column is absolutely epic. Peter King has handled Sports Illustrated’s football column for 21 years and anchored its Monday Morning Quarterback (MMQB) site since 2013. If you, like us, are quiet fans of American football (as distinct from football football), it’s a massive must-read peppered with anecdotes, stats and quotes. It’s so long it’s never-ending. Until it does. We’ll miss you, Mr. King.

Random distraction: Play Pac-Man in your browser: Google “Pac-Man 30th anniversary” on the computing device of your choice (mobile included) to play one of our all-time favourite video games. Yesterday was the 38th anniversary of the iconic 8-bit game.

If you, like us, are still mopey that the third season of Stranger Things seems unlikely to debut until 2019, go have a look at Variety’s coverage of an appearance by director Shawn Levy and two of the show’s stars at a Netflix event.

Your Ramadan rundown for today:

Bank hours run 09:30 am to 01:30 pm for customers and from 09:00 am to 02:00 pm for employees, CBE announced.

The EGX is running shorter trading hours. The trading session kicks off at 10:00 am, but closes at 1:30 pm. Tap or click here for the full schedule.

It’s going to be hot all week: The ongoing heatwave is continuing through Thursday, with forecasts for a daytime high of 42°C today. Respite comes on Sunday (yeah, Sunday, not Saturday, according to the updated forecast), when you can expect a string of days at 33°C running through the end of next week.

So, when do we eat? For those of us, Maghrib is at 6:46 pm CLT today. You’ll have until 3:15 am tomorrow to finish your sohour.

Today’s recommended Ramadan reading:

Getting old is inevitable. Becoming crusty, grumpy and unable to cope with change isn’t. That’s the take-home from the Wall Street Journal’s Sue Shellenbarger, whose advice to the olds are words to live by: “Would your boss hire you again with the skills you have now? Being able to answer yes takes some smart moves to keep your skills fresh, your attitude upbeat and your personal style up-to-date.” Despite the headline, the story has little to do with tech. It doesn’t matter whether you’re on day one of your first job, in your 60s, or running your own business, read: In a digital era, how can older workers stay in the game.

What We’re Tracking This Week

The IMF should issue its progress report on Egypt’s economic reform program by the end of the week, Deputy Chief of Media Relations Alistair Thomson has said.

On The Horizon

Do you have an idea for a tech-enabled business idea that could make agriculture in Egypt more efficient? The World Bank may have seed funding for you. The World Bank’s “DigitalAG4Egypt” program is looking for business ideas built around logistics, value-added services, fintech relevant to agriculture, smart agriculture and natural resource management. There’s some seed funding on offer as well as access to mentorship and an accelerator / incubator program. The deadline for submissions is 1 July. Tap or click here for more information.

Upcoming milestones to watch on our march toward becoming a regional energy hub:

- We could sign the contracts for our USD 60-70 mn grid connection project with Sudan in two weeks’ time, according to Egyptian Electricity Head Gaber El Desouky. Eight local and global players have been invited to participate in the prospective tender to develop the project;

- Talks with Cyprus and Greece on a USD 4 bn interconnection project will kickstart within the coming month when a Cypriot delegation visits;

- Contracts for an interconnection with Saudi Arabia could be signed by the end of June, sources say.

Egypt’s national football team will make its first appearance at the World Cup in 20 years on Friday, 15 June, with our inaugural match against Uruguay at 2:00pm CLT. The championship will kick off one day earlier in Moscow, Russia. The Pharaohs kicked off their final training camp ahead of the World Cup yesterday, Ahram Online reports.

Enterprise+: Last Night’s Talk Shows

The nation’s talk show hosts are deep in the embrace of a food coma. Or whatever it is they do when they go on their annual Ramadan hiatus.

Speed Round

Electricity prices set to rise by as much as 55% come July? Speculation about how far electricity prices will rise in July has kicked into overdrive, with ministry sources telling Al Mal that its final recommendation to cabinet is for prices to rise 33-55%. Previous reports had suggested that the new system would divide residential consumers into four consumption tiers — 0-100 KW, 101-200 KW, 201-600 KW, and 601-1000 KW — with expected price increases ranging between 15 and 43%.

Watch for political theatre: The new scheme will see consumers at the lower end of the income / consumption spectrum pay more, too, the ministry source said. We’re taking this as a very standard piece of political theatre: The same source made a point of saying that only cabinet could exempt a group of consumers from a price hike. While it’s possible the state will sock it to low-income consumers, its interests align with those of the IMF / World Bank here in sheltering them from the cuts. We see this as likely setting it up for the Council of Minister to allow tension to build, then deflate the bubble just before (or when) the hikes are announced by declaring the poor (and possibly low-income earners) will be exempt from price hikes. Electricity Minister Mohamed Shaker previously rejected a bid by members of the House of Representatives to commit to no price hikes for the working poor.

Are we also looking at different prices for different times of the day? The Egyptian Electricity Utility and Consumer Protection Agency (Egyptera) reportedly also suggested setting two prices for electricity consumption at different times of the day, the ministry source told the newspaper. The proposal, which would only be applied to those in the uppermost consumption bracket, would set a higher price at peak consumption times. It remains unclear whether this proposal was incorporated into the ministry’s final scheme or scrapped.

Military says it’s not crowding out the private sector: The Military Production Ministry is not competing with the private sector, said minister Mohamed El Assar in a sit down with the press, Al Ahram reports. The ministry works alongside the private sector and compliments its role, he added, noting that 75% of the ministry’s projects come in partnership with the private sector. Some 41 major projects are being implemented in cooperation with private companies, he added. El Assar said the ministry’s top priority is to manufacture goods for use by the Egyptian military. His media availability came after a series of stories in the international press have drawn attention to what some claim is the the military’s expanding role in the economy. Most notable of these was a year-long Reuters investigation and, most recently, a long recap of the issue from the Wall Street Journal.

INVESTMENT WATCH- Boeing looks at opening regional office in Cairo: Speaking of cooperation with the private sector, Boeing is considering forming a JV with a “sovereign entity” which could see it open its first North Africa office in Cairo, says Boeing MENA President Bernard Dunn, according to Al Shorouk. President Abdel Fattah El Sisi had met with Boeing International President Marc Allen in Cairo last month to discuss potential plans to use Egypt as a regional hub for the company’s maintenance operations, as well as to upgrade national flag carrier EgyptAir’s fleet. Egypt has been a major customer for the company in recent years, with EgyptAir having bought nine 737-800 Next-Generation aircrafts last year for USD 864 mn.

INVESTMENT WATCH- SODIC plans to invest up to EGP 1 bn to grow its land bank this year: Our friends at SODIC are planning to invest between EGP 900 mn and 1 bn to expand their land bank this year, CEO Magued Sherif told reporters yesterday, according to Arabic Reuters. Sherif did not get into details on where the company hopes to acquire new land. His remarks came as SODIC continues to explore a potential merger with MNHD, talks on which reportedly began back in April. Advisors to the two companies met last week to discuss what a combination of the two businesses might look like and how could be structured. Sherif said earlier this month that a merger with MNHD could leverage “the strengths of the two companies in their respective target markets and accelerate the monetization of a consolidated land bank of 14 mn sqm.”

In other news from the real estate sector, Emaar Misr has awarded Dubai-based Arabtec Construction a USD 43 mn contract to develop two phases of Emaar’s Uptown Cairo Project, according to a statement from Arabtec (pdf). The agreement will see Arabtec build villas as well as develop “surrounding roadworks and infrastructure” in the two phases, which have a built-up area of around 61k sqm.

Meanwhile, Emaar Misr continues look for resolution of its dispute with state-owned El Nasr Housing and Reconstruction at the Uptown Cairo project, which centers on El Nasr’s claims that Emaar failed to develop 3 mn sqm of land allotted to it back in 2005 — and that there are 215k sqm of Uptown that are technically outside the project’s borders. Reports emerged on Sunday that El Nasr is planning to proceed with the arbitration suit it filed last July against Emaar, despite a statement two weeks earlier from a board member that El Nasr’s general assembly had voted to accept Emaar’s settlement offer. A source had told us last month that Emaar had offered EGP 100 mn to settle the dispute.

Ismail Cabinet on the case? The Ismail Cabinet held a meeting on Tuesday to discuss some of the major lingering cases of disputes between the state and investors, according to a cabinet statement. The statement did not specifically mention Emaar.

IPO WATCH- Eight Egyptian law firms are reportedly vying for the role of legal advisor to the government’s privatization program, government sources said. The list of suitors includes Zaki Hashem & Partners, Zulficar & Partners, Sarie Eldin & Partners, Matouk Bassiouny, Helmy, Hamza and Partners, Shahid Law Firm, El Tamimi & Co, and TMS Law Firm. The Public Enterprises Ministry is reviewing the offers and is expected to make a selection within two months’ time, according to the sources. The state privatization program includes 23 companies that will IPO or list additional shares on the EGX.

REGULATION WATCH- FRA looking to cut fees for listing, clearing: An advisory committee to the Financial Regulatory Authority (FRA) met yesterday to look into the possibility of lowering listing fees and fees at Misr Clearing, sources told Youm7. The regulator had requested that the EGX and Misr Clearing send their proposals for cutting fees, a move it hopes will help spur new listings and higher trading volumes. The EGX had sent back its proposal, which include reducing listing fees for IPOs and cutting them for SMEs, the source added. The board of the EGX had met last week to propose facilitating listings for SMEs, tightening governance rules and amending delisting regulations as part of its recommended amendments to the executive regulations of the Capital Markets Act.

M&A WATCH- Heliopolis-based Golf International Hospital (GIH) is closing in on a EGP 45 mn acquisition of Al Masah Hospital, GIH CFO Mohamed Abdelaaty tells Al Mal. The contract for the transaction should be signed by the end of Ramadan, according to Abdelaaty. The two hospitals began talks on the transaction a while ago, but had already reached a separate agreement several years back for GIH to take over management of Al Masah. The agreement would see GIH paying c. EGP 20-30 mn for Al Masah as well as obligations to suppliers worth some EGP 15 mn. GIH had been shut down earlier this month by the Health Ministry over allegations of “life threatening” violations, but that decision has since been reportedly revoked.

EBRD lends SOPC USD 200 mn to finance energy efficiency program: Egypt signed yesterday a USD 200 mn loan agreement with the European Bank for Reconstruction and Development (EBRD) for the Suez Oil Processing Company (SOPC) to finance the company’s energy efficiency investments, including its Green Economy Transition approach, according to an Investment Ministry statement. “In particular, the Project will focus on the installation of a New Vapour Recovery Unit (VRU), the refurbishment of the old coker unit and a number of energy efficiency investments identified to improve operational performance, environmental footprint and utilisation rate of the refinery,” according to the EBRD.

We’d also like some money to focus on CNG use, please: Oil Minister Tarek El Molla also met yesterday with the EBRD’s Director for Natural Resources Eric Rasmussen to discuss a potential separate financing package to help increase Egypt’s reliance on compressed natural gas for cars, Al Masry Al Youm reports. The move would help reduce our fuel consumption levels.

This comes as Egypt is planning to reach petroleum and diesel self-sufficiency within the coming three years, El Molla told reporters, according to the newspaper. El Molla provided no details on how we intend to reach that milestone. He did, however, make it a point to say that self-sufficiency will not mean ending crude oil imports, noting that Egypt would continue importing crude oil to be refined at local facilities and directed towards domestic consumption and exports.

Meanwhile, the Oil Ministry has set October deadlines for companies to submit their bids for the two upcoming oil and gas exploration tenders, Reuters’ Arabic service reports. Bids for the 11 concession areas offered by EGPC are due by October 1, while oil companies eyeing the 16 concession areas offered by EGAS must submit their bids by October 8. International oil companies, including Shell, Apache Corporation and UAE’s Mubadala are all looking at opportunities in the two bid rounds, as we noted yesterday.

FinMin to disburse late export subsidies over a period of years: The Finance Ministry plans to disburse overdue payments from the Export Subsidy Fund over a period of years, ministry sources said. The source did not state why they had been held up, but a number of industry-specific export associations have been lobbying for the tap to be turned back on. Even the fund’s MD, Amany El Wessal, had called for payments to start as soon as possible in a hearing at the House of Representatives. The ministry also plans to raise the fund’s budget to EGP 4 bn in FY2018-19 from EGP 2.6 bn this fiscal year, the sources noted.

OC JV signs notice to proceed with USD 320 mn wastewater plant in Abu Rawash: Orascom Construction’s joint venture with FCC Aqualia signed a notice to proceed with the construction of the USD 320 mn wastewater treatment plant in Abu Rawash, the company said in a press release on Tuesday (pdf). The 50:50 JV was awarded the EPC contract for the plant back in September 2017. “The joint venture will operate and maintain the 1.6 mcm/d facility for three years. Once complete, the facility will serve 6 mn people,” the company added. The project is getting USD 150 mn in funding from the African Development Bank.

EARNINGS WATCH- OC also reported a 13.9% y-o-y increase in net income attributed to shareholders in 1Q2018 to USD 31.9 mn, up from USD 28.0 mn during the comparable period last year. Revenues came in 29.0% lower at USD 756.8 mn, compared to USD 1,065.7 bn in 1Q2017. The company’s consolidated backlog as of 31 March 2018 stood at USD 4.3 bn, with new awards standing at USD 332.9 mn. “The current backlog mix and size provides the Group with sufficient revenue and profitability as it pursues an active bidding pipeline in MENA and USA.” Infrastructure and commercial work make up the bulk of the backlog, accounting for 96.5% of the total. In Egypt, OC “signed additional infrastructure and commercial work, strengthening its position as a leading player in all major construction segments … and positioning the Group for more projects in growing sectors such as water, transportation and renewable energy.”

The Tax Authority is looking into how best to impose the value-added tax (VAT) on ride-hailing companies once they officially register their business as mandated by the Ride-Hailing Apps Act, according to an authority source. The authority expects to complete its studies within two months.

EXCLUSIVE- Attention international school teachers. The Tax Authority has decided that it will exempt salaries for foreign international school teachers from taxes for a one-time period of two years, after which their salaries would be taxed, government sources tell Enterprise. The decision comes amid disagreements between the schools and the authority on the right to tax foreign school staff, which the schools — many of whom are incorporated abroad — say constitutes dual taxation. The compromise from the authority comes with a caveat: staff who hold a second job could see this tax exemption lifted. The authority has instructed international schools to send over their list of current foreign staff members who will benefit from the exemption, the sources added.

Image of the Day

Egypt in the News

It’s not a particularly pleasant day for Egypt in the international press this morning. A Human Rights Watch report accusing the Armed Forces of “widespread destruction of homes” in North Sinai is leading the conversation on Egypt in the foreign press this morning, with the Associated Press, Reuters and the Times of Israel among those taking note. In a report released yesterday, the New York-based organization claims that at least 3,000 homes and commercial buildings have been destroyed, in addition to “hundreds of hectares of farmland.”

HRW also published yesterday a letter two of its directors penned to FIFA imploring the latter to “use [its] leverage with the Egyptian authorities to push back against a vicious anti-gay campaign.” HRW is using as leverage the 2019 Africa U-23 Cup of Nations, which Egypt is hosting.

Meanwhile, Egyptian journalist and researcher Ismail Alexandrani, who reported on the Sinai insurgency, was sentenced yesterday by a military court to 10 years in prison on terror-related charges, the AP reports. Alexandrani was detained back in 2015.

Also taking a kick at the can yesterday: Brookings adds nothing new to the debate about Egypt’s population boom, and the Daily Beast is carrying a piece on [redacted] harassment by former Financial Times Cairo correspondent Borzu Daragahi.

(A note to new readers: We’re all big boys and girls and can handle the word that should be up there in place of [redacted] before “harassment,” but the algorithms that govern our deliverability to your inbox penalize us for mentioning large sums of capital, anything smacking of intimacy, et cetera.)

Worth Reading

Was the Qatar smackdown partly engineered by the shadiest creatures ever? The next investigative piece in our shady lobbyists selected features has to be The Princes, the President and the Fortune Seekers by Desmond Butler and Tom DiBianco for the AP. The piece details the dealings of an odd pair of seedy lobbyists now caught up in the Mueller federal investigation into the Trump 2016 campaign.

The Characters: One, a Lebanese American convicted of child molestation, who allegedly is an adviser to the crown princes of the UAE and Saudi Arabia (named Nader, a name his business partner sometimes typo’ed as “Vader”). He’s the handsome devil pictured above with none other than the president of the US of A. Two, a defense contractor who worked with Erik Prince’s BlackWater mercenary army in the Iraq War.

The plot: To lobby on behalf of the UAE and Saudi for the US to impose sanctions on Qatar and move its military base out of Doha in exchange for lucrative defense and security contracts in those countries worth bns.

Almost successful: By the time the Mueller investigation reeled around, the pair had allegedly managed to get leading congressional leaders on board and engineered anti-Qatar op-eds in leading media outlets by notable security figures. They helped push the pendulum towards Trump administration’s supportive rhetoric for the Qatar boycott — and landed themselves a defense contract with the UAE worth hundreds of mns in the process. The plan ultimately unravelled with new administration figures swinging the other way in the debate and one of the lobbyists being caught up with Trump lawyer Michael Cohen (he, too, was allegedly paying hush money to an adult entertainment model).

Best jab: Referring to Donald Trumps son in law as America’s “clown prince” in a piece peppered with references to the crown princes of the UAE and KSA.

Worth Watching

Promoters of Westworld spooked unsuspecting Londoners with a freakishly lifelike robot last month ahead of the American sci-fi Western thriller’s season two premiere, Syfy Wire reports. Fred, who is based on a real London resident, was seen sitting casually at a city pub, starting conversations and even making jokes. It was all a publicity stunt by the service streaming the show in Britain, with hidden cameras to capture the poor pub goers’ reactions. “Do you want to meet your maker?” Fred asks a frightened customer (watch, runtime: 01:42). Westworld is now airing in the Middle East on OSN.

Energy

Siemens, Doosan front runners to manage Siemens power plants

The Egyptian Electricity Holding Company (EEHC) has narrowed the contenders for the day-to-day management and maintenance of the three Siemens combined-cycle power plants down to Siemens and Korea’s Doosan, an EEHC source said. The EEHC expects to make a final decision in two weeks and sign the contracts within one month, according to the source. Doosan reportedly presented the cheapest offer, followed by Siemens. Other contenders — an Orascom-ADERA Energy consortium, an Elsewedy-EDF consortium, a STEAG GmbH-PGESCo consortium, a Triangle-GD France consortium, and Japan’s Mitsubishi — have been eliminated from the race, as they quoted prices that were too high.The three fully-commissioned plants are expected to be inaugurated next month with a combined production output of 14.4 GW.

SDX Energy to abandon Kelvin-1X well after it is deemed “not commercial”

SDX Energy announced yesterday that its Kelvin-1X exploration well at South Disouq, of which it holds a 55% working interest, had low gas saturation and was not deemed to be commercial. “The results of the Kelvin-1X well are not commercial and will not contribute to the initial production in this first phase of the development at South Disouq,” said CEO Paul Welch. The company will now plug and abandon the well, which it began drilling earlier this month. The rig will be moved to the SD-4X appraisal well, the site of the next drilling location at South Disouq.

Banking + Finance

TE signs USD 200 mn short-term loan agreement with AfreximBank

State-owned landline monopoly Telecom Egypt signed yesterday a USD 200 mn short-term loan agreement with the African Export-Import Bank (AfreximBank) “to finance working capital and investments in Telecom Egypt’s infrastructure,” according to a statement to the EGX (pdf). Abu Dhabi Islamic Bank acted as financial advisor.

Egypt Politics + Economics

51 Free Egyptians Party members join Nation’s Future

51 members of the Free Egyptians Party has signed on to join the Nation’s Future Party, sources tell Youm 7. El Khouly, who had lost Al Wafd’s elections to MP Bahaa Abu Shoka back in March, said that he was joining the Nation’s Future Party to avoid disputes with the new chief.

Suez Canal revenues jump to USD 479.3 mn in April

Suez Canal revenues increased to USD 479.3 mn last month, up from USD 463 mn in March, Reuters reports.

On Your Way Out

Pharmacy locator Chefaa is looking to secure EGP 5 mn in funding, says CEO Doaa Aref. One of 10 startups that recently graduated from Flat6Labs’ tenth cycle, the company is hoping to expand its activity and reach 1.6 mn prescriptions per month. Only nine weeks into business, the app has already teamed up with 250 pharmacies, says Aref. The on-demand smart medicine system allows users to scan their prescriptions, locate the nearest pharmacy, order medicine online, and schedule for monthly packages in case of chronic diseases.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.77 | Sell 17.87

EGX30 (Tuesday): 16,658 (-0.7%)

Turnover: EGP 1.1 bn (5% BELOW the 90-day average)

EGX 30 year-to-date: +10.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.7%. CIB, the index heaviest constituent ended down 0.4%. EGX30’s top performing constituents were Pioneers Holding up 2.5%, Qalaa Holdings up 1.0%, and Egyptian Aluminum up 0.8%. Yesterday’s worst performing stocks were EFG Hermes down 2.4%, Orascom Telecom Media & Technology down 2.4%, and Madinet Nasr Housing down 2.2%. The market turnover was EGP 1.1 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +30.7 mn

Regional: Net Long | EGP +10.7 mn

Domestic: Net Short | EGP -41.4 mn

Retail: 49.0% of total trades | 47.5% of buyers | 50.5% of sellers

Institutions: 51.0% of total trades | 52.5% of buyers | 49.5% of sellers

Foreign: 35.2% of total | 36.6% of buyers | 33.8% of sellers

Regional: 6.5% of total | 6.9% of buyers | 6.0% of sellers

Domestic: 58.4% of total | 56.5% of buyers | 60.3% of sellers

WTI: USD 72.13 (-0.15%)

Brent: USD 79.45 (+0.29%)

Natural Gas (Nymex, futures prices) USD 2.90 MMBtu, (+3.31%, June 2018 contract)

Gold: USD 1,290.50 / troy ounce (-0.03%)

TASI: 8,044.67 (+0.60%) (YTD: +11.32%)

ADX: 4,526.61 (+1.53%) (YTD: +2.91%)

DFM: 2,973.10 (+0.88%) (YTD: -11.78%)

KSE Premier Index: 4,752.83 ( -0.27%)

QE: 8,993.22 (+0.55%) (YTD: +5.51%)

MSM: 4,579.24 (-0.36%) (YTD: -10.20%)

BB: 1,265.48 (-0.19%) (YTD: -4.97%)

Calendar

14 June (Thursday): 2018 World Cup kickoff match between Russia and Saudi Arabia, Moscow, Russia.

15 June (Friday): Egypt’s first 2018 World Cup match against Uruguay, Yekaterinburg, Russia.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

19 June (Tuesday): Egypt plays against Russia at 2018 World Cup, St. Petersburg, Russia.

25 June (Monday): Egypt plays against Saudi Arabia at 2018 World Cup, Volgograd, Russia.

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

1 July (Sunday): Application deadline for the DigitalAG4Egypt Challenge.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.