- CBE keeps interest rates on hold at Thursday meeting. (Speed Round)

- Gov’t preparing to tweak budget for higher oil prices? (Speed Round)

- IPO WATCH- GB Auto could list GB Capital by 2020. (Speed Round)

- Beltone to launch acquisition bid for West African consumer finance provider Oragroup. (Speed Round)

- ExxonMobil eyes Africa expansion, Egypt tops the list. (Speed Round)

- Banque Misr reportedly taps Citigroup to arrange USD 500 mn loan from int’l lenders. (Speed Round)

- SODIC’s 1Q2018 sales growth driven by launch of “cornerstone of future recurring income portfolio.” (Speed Round)

- These middle aged guys have been playing one long game of “Tag” since graduating high school. (What We’re Tracking Today)

- So, when do we eat? At 6:45 pm CLT today.

- The Market Yesterday

Sunday, 20 May 2018

CBE leaves interest rates on hold

TL;DR

What We’re Tracking Today

The Financial Regulatory Authority (FRA) is expected to launch today a comprehensive electronic database for the insurance industry, which will include information on both providers and customers, Al Masry Al Youm reports. The piece does not explain who will have access to the database or otherwise outline its purpose, so the options here range from “iScore for the insurance industry” to this becoming the feedstock for a monthly league table as the FRA presently does with the leasing industry. The move will help keep insurance prices fair and transparent while helping curb market manipulation, according to the newspaper, citing a FRA statement that we have yet to see. FRA is planning sweeping overhauls of the insurance industry, primarily through amendments to the Insurance Act. These include making the market more open to SMEs.

The latest in emerging markets doom and gloom, which has become both generic and overdone, if you ask us:

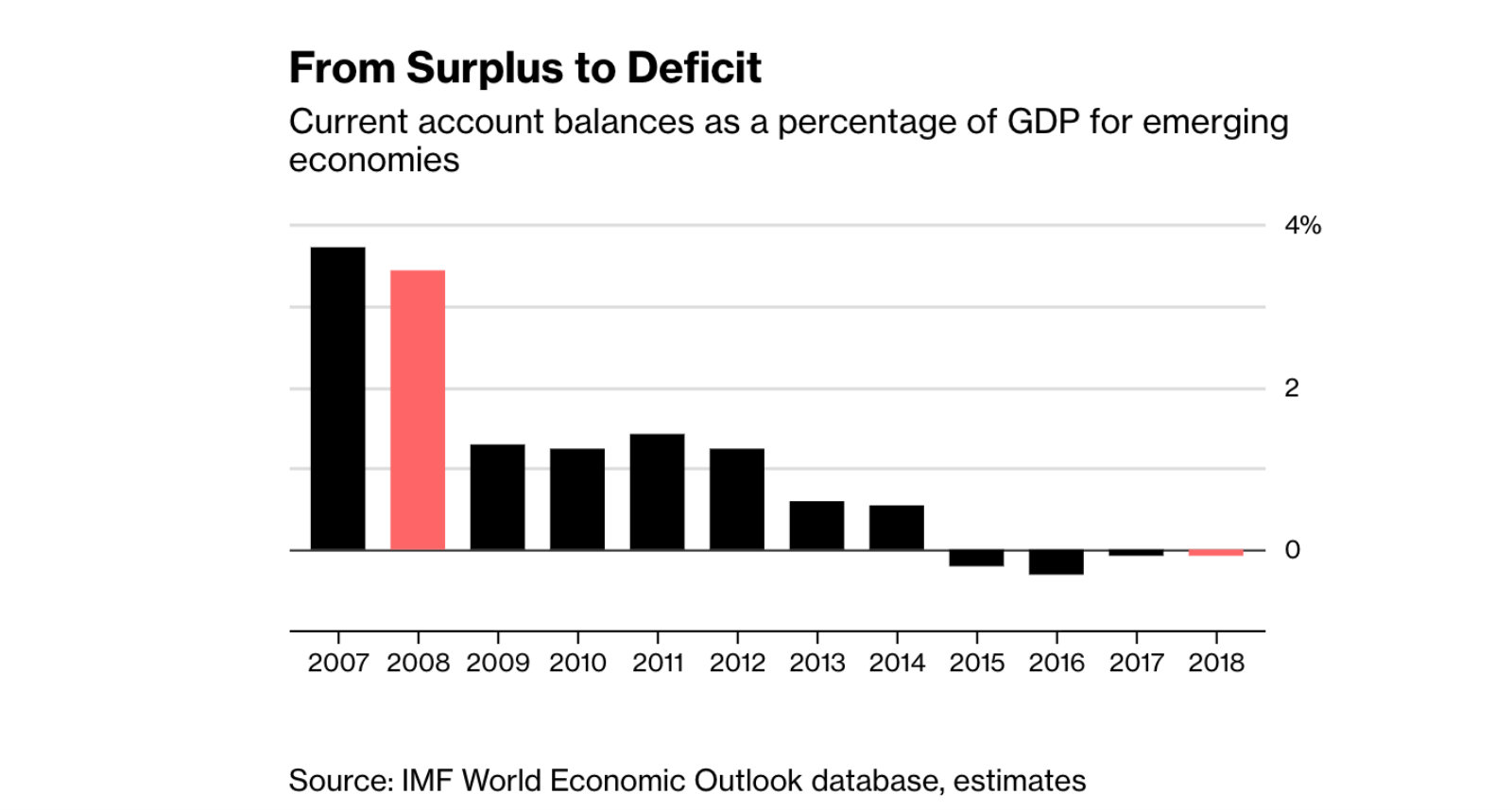

Are emerging markets worse off now than they were during the 2008 global financial crisis? Yes, according to Harvard economist Carmen Reinhart. Bloomberg delves into the details, taking a look at a number of EM indicators between 2008 now, including current accounts (which went from surplus to deficit), economic growth (which has been on an uptrend since 2011), debt levels (which increased steadily in the last few years), as well as bond markets (where yields on EM USD bonds are below average). Other indicators such as equity valuations, foreign exchange reserves, and currency volatility also play a huge factor, but vary widely (shocker) from one EM to another. Take a look here.

Also: EM export growth could fall to 1% in the third quarter of this year from 6% in three months ending 31 March, Capital Economics forecasts. (Financial Times)

Worth a moment of your time this morning:

Did KSA, UAE offer to try to swing the 2016 election for The Donald? Donald Trump Jr. reportedly met with an emissary from Saudi Arabia and the UAE who offered to help get Trump‘s father elected, the New York Times reported this weekend. The meeting was reportedly set up by former Blackwater boss Erik Prince and included an Israeli who founded a social media manipulation firm.

Minutes of the US Federal Reserve’s May monetary policy meeting will be released on Wednesday. Also, Fed chairman Jay Powell is expected to speak this week, so expect plenty of hand-wringing about a strong USD and rising US interest rates mean for emerging markets.

Are investors finally catching on to Erdogan’s shenanigans? “For the better part of 16 years, Turkish leader Recep Tayyip Erdogan, a self-styled economic reformer and the world’s great hope for Muslim democracy, had a compelling story—and for most of that time, everyone bought it. Everyone, that is, except Turkey’s old guard—the secular establishment, the bn’aires, generals, and educated elites who stood to lose their monopoly on power, wealth, and influence.” Bloomberg’s deep dive is worth a read if you, like us, love Turkey, but not the guy running the show over there.

Trade war averted? China pledged to increase US imports by at least USD 200 bn by 2020, in a bid to reduce the trade deficit. The move is being hailed by the Trump Administration as a victory. (New York Times)

Shia cleric and one-time militia leader Moqtada Al Sadr saw his coalition’s bloc win in Iraq’s parliamentary elections. He will not be prime minister as he had not put his name up. (BBC)

Ebola is back as the deadly virus has spread for the first time to a major city in the Democratic Republic of Congo, “raising the threat of a far larger contagion.” (New York Times)

Some obsess over the Academy Awards. We’re the same with the Pulitzers and the Loeb Awards, with the latter celebrating the best in business and financial journalism. This year’s Loeb nominations are out.

Your Ramadan rundown for today:

Bank hours run 09:30 am to 01:30 pm for customers and from 09:00 am to 02:00 pm for employees, CBE announced.

The EGX is running shorter trading hours. The trading session will kicks off at 10:00 am, but closes at 1:30 pm. Tap or click here for the full schedule.

We’re going to be putting up with this heat until Wednesday: The heat wave that kicked off on Thursday should continue today and tomorrow with a daytime high of 41ºC, the Meteorological Authority announced yesterday, Ahram Online reports. Temps will drop to around 37ºC on Wednesday.

So, when do we eat? Maghrib is at 6:45 pm CLT today. You’ll have until 3:18 am tomorrow to finish your sohour.

Today’s recommended Ramadan reading:

Whether you’re about to graduate high school or deep into midlife, you’ll want to read “It takes planning, caution to avoid being ‘It’,” the story of ten guys who have spent the last 28 years since graduating high school playing one long game of “Tag” every February. The story, which originally ran in the WSJ back in 2013, has been turned into a summer film starring Jon Hamm of Mad Men fame. You can catch the trailer for the film, due out 15 June, here (watch, runtime: 2:14).

What We’re Tracking This Week

Russian industrial zone contracts will be signed on Wednesday? Egypt and Russia will sign contracts for a 5.23 mn sqm Russian Industrial Zone on Wednesday, 23 May, during a joint committee meeting, according to a Russian trade ministry statement (Russian) issued on Friday. Foreign Minister Sameh Shoukry hinted at the possibility in an announcement last week. Work on the RIZ, for which talks started in 2014, is set to start this year and span 13 years.

A delegation from Russia’sRosatom Overseasis expected in Cairo next month to look into the possibility of upgrading the experimental nuclear reactor in Inshas in Sharqiya, Egyptian Atomic Energy Agency Atef Abdel Hamid tells Al Shorouk. This comes after the EAEA signed a follow-up contract to import fuel for the USD 21.37 mn reactor at the Atomexpo 2018 in Moscow.

On The Horizon

The IMF should issue its progress report on Egypt’s economic reform program in two weeks’ time, Deputy Chief of Media Relations Alistair Thomson has said.

Want to sell stuff to the rest of Africa? If hawking more of your wares in Africa is on your list of things to do, pencil in the Afreximbank-backed Intra-African Trade Fair, set to run in Cairo from 11-18 December. Lots of detail on the conference’s website here.

Regional electricity hub: May and June could see multiple milestones in our steady march to become an export hub for electricity.

Enterprise+: Last Night’s Talk Shows

Nothing to see here, ladies and gentlemen. Literally. The talking heads are on hiatus for the month of Ramadan. We’re intensely grateful for the break, but we’ll still keep one eye on the airwaves just in case anything should appear that you need to know.

Speed Round

The Central Bank of Egypt left key interest rates unchanged when it met on Thursday, according to a CBE statement (pdf). Overnight deposit and lending rates remain at 16.75% and 17.75%, respectively, with the discount rate also unchanged at 17.25%. The MPC said it still sees Egypt hitting its inflation target of c. 13% in 4Q2018 and single digits thereafter, but signaled downside risk from expected cuts to energy subsidies this summer as well as surging global oil prices and “the pace of tightening financial conditions” globally (read: US interest rate hikes). The move came days after preliminary data showed core inflation basically flat at 11.62% in April from 11.59% in March.

Look for a transient spike in Inflation as the government cuts fuel and energy subsidies further in July. “The measures have the potential to undercut progress the central bank has made in lowering annual inflation that had surged to more than 33% following the 2016 decision to float the currency,” Bloomberg notes. This forces the central bank to adopt a more cautious approach, especially as “the recent rise in US yields could complicate the timing of cuts further,” said Standard Chartered Bank’s Bilal Khan.

IMF, Egypt reach staff-level agreement to disburse USD 2 bn loan tranche: The IMF delegation that was in town reviewing Egypt’s economic reform program has reached a staff-level agreement with the government to disburse the next USD 2 bn tranche of a USD 12 bn extended fund facility. The announcement followed a positive third review of progress on economic and structural reform, which concluded that “Egypt has begun to reap the benefits of its ambitious and politically difficult economic reform program,” said Egypt Mission Chief Subir Lall.

Leading indicators: Inflation is cooling, GDP growth is accelerating, FX reserves are up, and social safety remains a priority for the government, according to Lall, who added that the country is “on track to achieve a primary budget surplus [of 2% of GDP] … with general government debt as a share of GDP expected to decline for the first time in a decade.” Finance Minister Amr El Garhy had said he expects the tranche to be disbursed by the end of June. The IMF’s executive board will still sign off on the agreement, which should bring Egypt’s total disbursements to USD 8 bn. You can read the full announcement here.

EXCLUSIVE- Gov’t preparing to tweak budget for higher oil prices? The Ismail Cabinet will decide in the coming two weeks whether to raise the overdraft limit in the FY2017-18 budget to give itself breathing room in the context of climbing oil prices, Vice Minister of Finance Mohamed Maait tells Enterprise. The budget was originally drafted with oil at USD 60-64 / bbl and assumed an average cost of USD 67 per bbl — but the black stuff has since hit USD 80 in trading on Thursday. Every USD 1 increase in the price of a barrel of oil raises government energy spending EGP 3-4 bn, Maait added. The government had budgeted EGP 110 bn for energy subsidy spending at an average oil price of USD 55/bbl.

Tightening consumption of petroleum products will help mitigate the impact of rising oil prices on the next budget, Finance Minister Amr El Garhy told the press on Thursday, Al Shorouk reports.

Here’s how (in part): An downstream energy industry insider pointed out to us recently that the USD 1.2 bn the government is spending to accelerate household connections to the natural gas grid will be key. A typical Egyptian low-to-middle income household preparing three meals daily consumes roughly two LPG cylinders a month at a subsidized cost of EGP 60 per month against a market rate north of EGP 100. The same household connected to the national distribution grid would consume gas worth EGP 30-40 per month, a savings of about 60%. Toss in the natural impact on consumption of higher gasoline, diesel and electricity prices — all expected to rise starting 1 July — and you start to get the picture.

The House of Representatives’ Budget and Planning Committee, meanwhile, has recommended that spending on health, education, railways, and the State Information Service be increased in the FY2018-19 budget, Rep. Yasser Omar tells Al Mal. The committee seeks to increase spending on health, specifically university hospitals, by EGP 10 bn, according to Omar. Health Minister Ahmed Rady reportedly said last week that the Ismail Cabinet agreed to give the health ministry an additional EGP 2.6 bn next year. The Budget Committee is expected to conclude its review at the start of June.

IPO WATCH- GB Auto could list GB Capital by 2020: GB Auto could list its financing subsidiary GB Capital on the EGX by 2020, GB Auto Chairman and CEO Raouf Ghabbour said, without disclosing further details on the expected size or value of the offering. GB Auto has no plans to list any of its other subsidiaries, according to Ghabbour.

M&A WATCH- Beltone to launch acquisition bid for West African consumer finance provider Oragroup: Beltone Financial’s board approved in principle on Saturday launching a bid to acquire a significant interest in African banking and financial holding company Oragroup, which serves 400k customers in 12 countries, mostly in West Africa. (You can check out the company’s 2016 annual report here in pdf.) Beltone intends to sign a non-binding offer and intends to conduct a preliminary feasibility study for the transaction before commencing due diligence. The board also signed off on hiring advisers for the transaction. The move is part of Beltone’s plan to expand in African financial markets, according to a company statement (pdf).

INVESTMENT WATCH- Saudi Arabia’s Zadna is planning to invest EGP 2 bn to produce and sell Egyptian dates and olives, Trade and Industry Minister Tarek Kabil said in a statement. The company has already begun planting palm trees on a 1,000 feddan plot in the Bahariya Oasis and will soon begin building a facility to process and store the cultivated dates. The UAE is also helping fund the establishment of refrigerated units with a storage capacity of 4,000 tonnes in the Bahariya Oasis to help the area improve the quality of its produce and ready it for export. Egypt is already the world’s largest producer and exporter of dates, with 18% of the total global production.

INVESTMENT WATCH- ExxonMobil is eyeing expansion opportunities in Africa, now that oil prices are on the rise again, according to the Africa Report. “The company wants to reinvest in Africa, partly to compete against Eni and Total and to not leave them to dominate the continent,” says OCP Policy Center research associate Francis Perrin. “ExxonMobil looks at everything and everywhere, from Egypt to Mauritania through South Africa, but that doesn’t mean it will buy all the blocks it is studying or start producing from all the fields it is exploring.”

Egypt may be a good choice for Exxon, where it’s already eyeing opportunities in the East Mediterranean. “The foray into Egypt’s offshore oil and gas it is currently considering can be linked to a desire to combine recent gas discoveries in Cyprus with new Egyptian fields and also to find business opportunities for its gas in the highly populated – close to 100 mn people – and top energy-consuming country in the region,” Wood Mackenzie’s upstream Egypt analyst Stephen Fullerton. Egypt is close to finalizing an agreement with Cyprus to build a USD 800 mn to USD 1 bn gas pipeline that should see Egypt begin exporting LNG to Europe, moving one step closer to achieving its goal of becoming a regional hub.

State-owned Banque Misr has reportedly tapped Citigroup to arrange a USD 500 mn syndicated loan, sources close to the matter tell Reuters. Banque Misr Chairman Mohamed El Etreby said earlier this month that the bank had hired an international institution to manage a USD 500 mn facility it was looking to secure by 3Q2018 to finance planned expansion. Neither Citigroup of Banque Misr could be reached for comment, says the newswire, which describes the chatter as “the latest sign of a pick-up in interest among international banks in lending to Egyptian borrowers,” noting a USD 600 mn loan being arranged for the National Bank of Egypt, around USD 700 mn in loans for the Egyptian Electricity Holding Company, as well as Telecom Egypt’s USD 900 mn in total recent facilities. “Such loans are being seen as a sign of returning confidence among international lenders in the Egyptian economy.”

EARNINGS WATCH- SODIC reported a net profit after tax and minority interest of EGP 212 mn in 1Q2018, with a net profit margin of 41%, the company said in its earnings release (pdf). Net contracted sales grew 9% y-o-y to EGP 1.2 bn, largely driven by a pickup in sales of non-residential developments, as the quarter witnessed the launch of the Eastown District New Cairo, which “is expected to be the cornerstone of SODIC’s recurring income portfolio in the future,” once it’s complete in 2021. Deliveries also remained on track in 1Q2018, with 167 units handed over on time or ahead of schedule, and the company expects it will meet its targets for the year, according to Managing Director Magued Sherif. “We begin the year with exciting developments on our land bank as we continue to deliver on our expansion and diversification strategy,” he said, noting that new land acquisitions — including 1.3 mn sqm of land in the North Coast, that should drive as much as EGP 15 bn in sales, and a 500-acre plot in West Cairo —brought the company’s total “land bank to 8 mn sqm, putting over 10 years of inventory visibility in all our markets.”

A potential merger with Madinet Nasr Housing and Development (MNHD) could almost double that figure, as the agreement “would leverage on the strengths of the two companies in their respective target markets and accelerate the monetization of a consolidated land bank of 14 mn sqm,” he said. SODIC and MNHD had reportedly started talks about a potential merger back in April.

OC’s US arm wins contract for Arizona airport Sky Train: Orascom Construction announced on Thursday that its US subsidiary, the Weitz Company, won a tender from Bombardier to design and build the second phase of the expansion of the PHX Sky Train guideway and maintenance facility at Arizona’s Phoenix Sky Harbor International Airport. “The scope of work associated with Stage 2 covers a 2.5-mile extension to the airport’s rental car center, two new stations and an expansion of the system’s maintenance facility to accommodate Stage 2 operations and train maintenance,” OC said in release (pdf). The company should wrap up the design phase, which began in April, by February 2019, “when construction is scheduled to start.” The project should be operational by 2022. The Weitz Company had worked with Bombardier on the first phase of the Sky Train. The value of the award was not disclosed.

CABINET WATCH- Egypt’s trade deficit narrowed by 11% y-o-y to EGP 26.8 bn in 9M2017-18, from EGP 30 bn in the same period last year, said Planning Minister Hala El Said during Thursday’s Cabinet meeting, according to an official statement. Non-oil exports for the nine-month period rose 12% y-o-y to EGP 17.5 bn, up from EGP 15.6 bn in the comparable period last fiscal year. Non-oil imports also dropped 3% y-o-y to EGP 44.4 bn.

Latest in state drive to make it easier to formalize land ownership: The Ismail Cabinet approved on Thursday lowering government inspection fees of EGP 2,000-10,000 on requests to legalize land ownership status, the deadline for which expires on 14 June.

Cabinet also signed off on proposed amendments to the national building code and has passed the bill on to parliament. The amendments give the the Local Development Authority power to award building and operating licenses for commercial and logistical projects, which is meant to facilitate processes and expand the agency’s role. Other decisions from Thursday include:

- Review plans to partner with an international firm on the renovation of the Shepherd Hotel in downtown Cairo;

- A new law proposal to establish and govern tech universities that would be built first in New Cairo, Beni Suef, and Quesna.

LEGISLATION WATCH- “Community dialogue” on rent control coming soon: The House Housing Committee will start holding within days a series of “community dialogue” sessions on potential amendments to legislation governing rent control, MP Ismail Nasr El Din said, according to Ahram Gate. The committee will then open debate on the bill before deciding if and when to pass it on to the House general assembly. There’s no word on whether the intention is to make it easier for landlords to raise rents presently regulated by rent control provisions.

LEGISLATION WATCH- New Foreign Campuses Act widens Higher Education Ministry’s oversight: The draft of a new act, which sets the rules for foreign universities opening campuses in Egypt, appears to give the Higher Education Ministry sweeping oversight powers, according to a leaked copy of the act published by Al Ahram. Under the new law, the ministry will be represented on the boards of these campuses as well as have a say in selecting university presidents. The ministry’s permission must be sought before setting tuition hikes.

The law effectively turns local campuses into franchises. Under the law, a foreign university must partner with an Egyptian entity, which will handle both developing the property and the day-to-day administration of the campuses. The foreign universities themselves will be represented on the board of trustees. By law, half of the students attending the campus will be Egyptian, who may only be charged tuition in EGP. The law, which was approved by the Ismail Cabinet last month, has been sent to the House of Representatives for approval.

From the department of laws that will never be followed — Supreme Media Council bans use of anonymous sources: The Supreme Media Council issued a directive to all media outlets on Saturday banning the use of anonymous sources. The directive, which offered little explanation for the move beyond cutting down on fake news, claims that the use of anonymous sources made up 30% of all “media violations.”

Bookings to Egypt and long-haul destinations have increased Thomas Cook’s revenues by 5% to GBP 3.2 bn in the six-month period ending March 2018, according to tourism portal FVW. The holiday bookings giant also saw a 13% rise in bookings for this summer (as of 5 May) due to strong demand for Egypt, Turkey and Greece. CEO Peter Fankhauser had said in an interview last month that the increasing demand for Egypt and other Mideast countries was being driven by a perceived lower terror threat, combined with a jump in the cost of vacations in Spain.

Abraaj founder being asked to take a few steps back? Abraaj investors are asking founder Arif Naqvi to “scale back his involvement” in the private equity firm “amid a row over misuse of funds,” sources close to the matter tell Reuters. Some investors reportedly refuse to have Naqvi involved at all in running the business. The Dubai-based emerging markets private equity giant had announced in February that it would undergo a management restructuring and corporate reorganization that will see Omar Lodhi and Selcuk Yorgancioglu promoted to co-CEOs alongside Naqvi, after allegations of misuse of funds surfaced. Abraaj has denied wrongdoing.

Our friends at Carbon Holdings have added 17-year-old Alexandria squash phenom Rowan Elaraby to their sports sponsorship program after she secured her biggest win yet in the Irish Squash Open this year, ranking 31 globally. “Our investors and business partners know that national development is at the heart of what Carbon Holdings is all about — the idea that producing feedstock for manufacturers in a unique geographical location will make us a catalyst of industrialization and of exports,” CEO and Chairman Basil El-Baz said in a press release (pdf). “We take the same approach to our sponsorship of sports programs, investing in young Egyptians who carry our nation’s flag out into the world as they rise through global sports rankings.” Carbon Holdings had announced back in April that it would be sponsoring squash power couple Nour Al Tayeb and Ali Farag.

Meanwhile, Egyptian squash champions Nour El Sherbiny and Raneem El Welily will be competing against each other for the British Open women’s title today, Fil Goal reports. El Sherbiny previously won the championship in 2016, marking the first time for an Egyptian woman to walk away with the title. Meanwhile, world number one Mohamed El Shorbagy also made it to the championship’s final match, where he will be squaring off with Colombia’s Miguel Rodriguez, according to King Fut. Rodriguez edged out Farag in the quarter-final round.

Image of the Day

A pair of Mo Salah’s boots have been added to Ancient Egyptian artifacts on display at the British Museum, the Guardian reports. The boots were donated by Adidas after Salah won the Golden Boot award for being named the Premier League’s Player of the Season last week. “The boots tell a story of a modern Egyptian icon, performing in the UK, with a truly global impact,” said Neal Spencer, the museum’s keeper of ancient Egypt and Sudan. The unused X17 Deadly Strike boots, specially moulded to the shape of Salah’s feet, will be displayed near ancient Egyptian footwear starting 24 May.

Zahi, is, naturally enough, unhappy: One-time antiquities supremo and self-styled Indiana Jones Zahi Hawass, not content to be outshone at an antiquities exhibit by another Egyptian, is raising a stink, according to Egypt Independent.

Egypt in the News

President Abdel Fattah El Sisi’s decision to open the Rafah border crossing with Gaza for Ramadan topped international coverage of Egypt over the weekend. The humanitarian move is meant to "alleviate the burdens on the brothers in the Gaza Strip,” El Sisi tweeted on Thursday. If implemented, the gateway with Gaza would be open for the longest uninterrupted period in years, Reuters reports. Egypt had reached an agreement with Hamas last week to contain protests in Gaza against the opening of a US embassy in Jerusalem. Time Magazine, the Wall Street Journal, the Guardian, i24 News, and CBS News, among many others, have coverage.

Cairo and Doha are both still trying to push for a longer-term solution for the situation in Gaza, which involves a reconciliation between Fatah and Hamas, according to Haaretz. Egypt is trying to “expand the Palestinian Authority’s role in the Gaza Strip, initiate economic relief and arrange for the preliminary dismounting of the Hamas military wing.” Qatar is proposing a similar solution, but would hand over administration of the Gaza strip to “an unaffiliated council of experts,” diplomats tell the Israeli daily.

All of this comes as the UN Human Rights Council voted on Friday to launch an investigation into Israel’s excessive use of force against Palestinians after Israeli forces killed dozens of Palestinians last week, Reuters reports.

Other stories worth noting in brief:

- Some MPs are calling for a revival of the Shura Council, the pre-revolution upper house of parliament, according to Al Monitor.

- Amnesty International has expressed concerns over Egyptian rights activist Haitham Mohamedeen’s arrest, calling for his immediate release.

- French police foiled what they claim was a plan to launch a ricin attack by an Egyptian-born student after intercepting messages on the secure social media platform Telegram, Reuters reports.

- Underage girls from West Africa and war-torn countries are trafficked into Egypt to be sold as slaves, Nigeria’s The Nation claims.

- Preacher Amr Khaled sparked public outrage after claiming ‘chicken will increase spirituality’ in a new poultry ad, Al Arabiya reports.

- Egyptian football fans across the world are planning their trips to Russia to watch the national team play at the 2018 FIFA World Cup, Sputnik reports. You can also listen to Christophe Bongo tell the story of the national team’s road to Russia.

Worth Watching

High King of Wakanda? Or was it Zamunda? Someone got their fictional African countries mixed up in this hilarious mashup of Eddie Murphy’s classic Coming to America and Black Panther. The trailer sees Prince Akeem of Zamunda step in the shoes of Wakandan ruler T’Challa, merging the honorable goal of saving one’s people with the even more honorable mission to find a bride in New York. We salute you, Funny or Die (watch, runtime: 1:33).

Diplomacy + Foreign Trade

The Agriculture Ministry has imposed new regulations on exports of Egyptian grapes, including requiring exporters to receive quality certificates from ministry-approved packaging facilities, according to ministry sources. The new regulations also require exporters to include codes for the farm of origin and sorting station when presenting the paperwork for pre-shipment inspections, as well as listing the shipment’s net, not gross weight.

Energy

Schlumberger to complete Gulf of Suez seismic studies before end of 2018

Oilfield services company Schlumberger is set to complete seismic studies in the Gulf of Suez before the end of this year, a source tells Youm 7. Norway’s TGS also expects to deliver final data in December this year after completing a 10,000-km 2D seismic survey along Egypt’s Red Sea border with Saudi Arabia. Schlumberger and TGS-NOPEC are two of five firms that were awarded contracts for scans in the area last year.

KarmSolar signs PPA with private companies for 70 MW solar power plants

KarmSolar has signed 25-year power purchase agreements (PPA) with private companies, factories, and hotels in Minya and Marsa Alam. The company will supplying the power from the USD 80 mn worth of solar power plants it is constructing with a combined capacity of 70 MW, CEO Ahmed Zahran said.

Basic Commodities + Goods

Port Said governorate, Supply Ministry sign MoU for EGP 3.3 bn logistics zones

The Supply Ministry signed yesterday an MoU with the Port Said governorate to construct logistics zones and a trading center at a combined cost of EGP 3.3 bn, Youm7 reports. The ministry had also signed an agreement with Majid Al Futtaim and Elsewedy Electric last month to establish several logistics zones. The logistics zones are at the heart of the ministry’s internal trade strategy, which aims to cut down on spoilage from transporting goods and commodities.

Manufacturing

Gov’t wants foreign companies to bid on National Cement Company factory

The Public Enterprises Ministry plans to invite foreign companies to bid on the construction of a new National Cement Company factory in Minya once feasibility studies on the factory are complete, Ahram Gate reports.

Health + Education

Magdi Yacoub looking for funding for new USD 350 mn heart center in Aswan

Egyptian cardiothoracic surgeon Magdi Yacoub is looking to secure funding for a new USD 350 mn heart center in Aswan, Vice Chairman Magdy Ishak tells Al Mal.

Automotive + Transportation

Fawry outlets may begin selling metro tickets soon – sources

The Egyptian Company Metro Management and Operation (Cairo Metro) is expected to sign a contract with e-payments platform Fawry within the next few days that will see Fawry sell metro tickets, a Cairo Metro source tells Al Mal. The agreement could be signed in the next few days.

On Your Way Out

Al Ahly football club’s hardcore supporters group Ultras Ahlawy announced their permanent dissolution and posted a video (watch, runtime: 0:28) of the banner being burnt before deleting their Facebook page. Al Ahly and Zamalek Ultras groups have been charged by security authorities over the years with inciting violence, most notably for the 2012 Port Said massacre, which left 72 Al Ahly fans killed.

Wasla Egypt has secured contracts to provide e-payment services for students at International Canadian Institutes around Egypt, Al Mal reports. The new service, which comes into effect as of the new September semester, will allow thousands of students to pay their tuition fees online. The agreement comes in coordination with the National Bank of Egypt (NBE) as part of a wider financial inclusion strategy.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.94

EGP / USD at CIB: Buy 17.84 | Sell 17.94

EGP / USD at NBE: Buy 17.77 | Sell 17.87

EGX30 (Thursday): 16,878 (-0.7%)

Turnover: EGP 869 mn (25% BELOW the 90-day average)

EGX 30 year-to-date: +12.4%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.7%. CIB, the index heaviest constituent ended down 1.3%. EGX30’s top performing constituents were AMOC up 2.1%, Elsewedy Electric up 2.0%, and Abu Qir Fertilizers up 1.3%. Thursday’s worst performing stocks were Telecom Egypt down 3.7%, Porto Group down 3.2%, and Pioneers Holding down 2.9%. The market turnover was EGP 869 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -83.2 mn

Regional: Net Long | EGP +59.0 mn

Domestic: Net Long | EGP +24.2 mn

Retail: 46.1% of total trades | 45.4% of buyers | 46.8% of sellers

Institutions: 53.9% of total trades | 54.6% of buyers | 53.2% of sellers

Foreign: 24.9% of total | 20.2% of buyers | 29.7% of sellers

Regional: 24.1% of total | 27.5% of buyers | 20.7% of sellers

Domestic: 50.9% of total | 52.3% of buyers | 49.5% of sellers

WTI: USD 71.28 (-0.29%)

Brent: USD 78.51 (-1.00%)

Natural Gas (Nymex, futures prices) USD 2.85 MMBtu, (-0.42%, June 2018 contract)

Gold: USD 1,291.30 / troy ounce (+0.15%)

TASI: 8,016.85 (+0.73%) (YTD: +10.94%)

ADX: 4,431.71 (-0.80%) (YTD: +0.76%)

DFM: 2,912.62 (-0.65%) (YTD: -13.57%)

KSE Premier Market: 4,765.78 (-0.21%)

QE: 8,891.16 (-0.66%) (YTD: +4.31%)

MSM: 4,617.71 (-0.78%) (YTD: -9.44%)

BB: 1,272.78 (-0.01%) (YTD: -4.43%)

Calendar

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

7-18 December (Friday-Tuesday):

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.