Are emerging markets worse off now than they were during the 2008 global financial crisis?

The latest in emerging markets doom and gloom, which has become both generic and overdone, if you ask us:

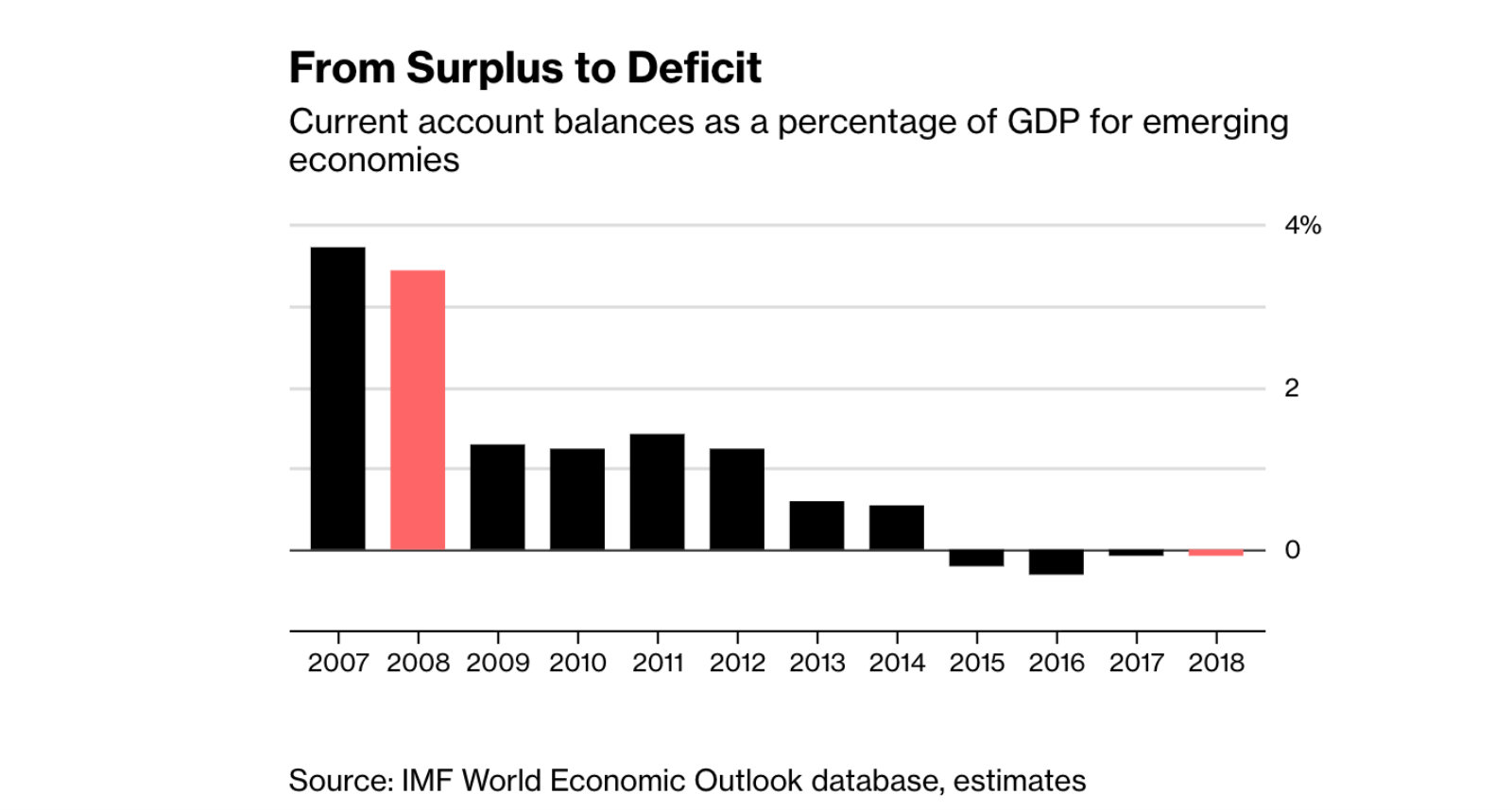

Are emerging markets worse off now than they were during the 2008 global financial crisis? Yes, according to Harvard economist Carmen Reinhart. Bloomberg delves into the details, taking a look at a number of EM indicators between 2008 now, including current accounts (which went from surplus to deficit), economic growth (which has been on an uptrend since 2011), debt levels (which increased steadily in the last few years), as well as bond markets (where yields on EM USD bonds are below average). Other indicators such as equity valuations, foreign exchange reserves, and currency volatility also play a huge factor, but vary widely (shocker) from one EM to another. Take a look here.

Also: EM export growth could fall to 1% in the third quarter of this year from 6% in three months ending 31 March, Capital Economics forecasts. (Financial Times)

Worth a moment of your time this morning:

Did KSA, UAE offer to try to swing the 2016 election for The Donald? Donald Trump Jr. reportedly met with an emissary from Saudi Arabia and the UAE who offered to help get Trump‘s father elected, the New York Times reported this weekend. The meeting was reportedly set up by former Blackwater boss Erik Prince and included an Israeli who founded a social media manipulation firm.

Minutes of the US Federal Reserve’s May monetary policy meeting will be released on Wednesday. Also, Fed chairman Jay Powell is expected to speak this week, so expect plenty of hand-wringing about a strong USD and rising US interest rates mean for emerging markets.

Are investors finally catching on to Erdogan’s shenanigans? “For the better part of 16 years, Turkish leader Recep Tayyip Erdogan, a self-styled economic reformer and the world’s great hope for Muslim democracy, had a compelling story—and for most of that time, everyone bought it. Everyone, that is, except Turkey’s old guard—the secular establishment, the bn’aires, generals, and educated elites who stood to lose their monopoly on power, wealth, and influence.” Bloomberg’s deep dive is worth a read if you, like us, love Turkey, but not the guy running the show over there.

Trade war averted? China pledged to increase US imports by at least USD 200 bn by 2020, in a bid to reduce the trade deficit. The move is being hailed by the Trump Administration as a victory. (New York Times)

Shia cleric and one-time militia leader Moqtada Al Sadr saw his coalition’s bloc win in Iraq’s parliamentary elections. He will not be prime minister as he had not put his name up. (BBC)

Ebola is back as the deadly virus has spread for the first time to a major city in the Democratic Republic of Congo, “raising the threat of a far larger contagion.” (New York Times)

Some obsess over the Academy Awards. We’re the same with the Pulitzers and the Loeb Awards, with the latter celebrating the best in business and financial journalism. This year’s Loeb nominations are out.