- It’s the last day of voting in the presidential elections — or is it? (What We’re Tracking Today)

- Fiat, VW exploring auto manufacturing opportunities in Egypt -FEI (Speed Round)

- Egypt’s first real estate fund begins trading on the EGX (Speed Round)

- EFG Hermes reports net profit of EGP 1.2 bn in FY2017 (Speed Round)

- Ride-hailing soap opera, ep 3: Uber, Careem appeal Administrative Court ruling ordering their closure (Speed Round)

- MEA, North American tourist arrivals to drive tourism growth going forward (Speed Round)

- Will Saudi be upgraded to FTSE emerging market status today? (What We’re Tracking Today)

- Why the f**k does swearing feel so f**king good? (Worth Watching)

Wednesday, 28 March 2018

Is it really the last day of the elections?

TL;DR

What We’re Tracking Today

We have very little non-election news of note for you this morning, ladies and gentlemen. ‘Tis simply one of those days.

It’s the third day of voting in the 2018 presidential election, and it’s still unclear if it will be the last. The National Elections Authority (NEA) continues to deny reports that it will announce an extension of balloting to Thursday, with spokesman Mahmoud El Sherif saying “we have not yet made up our minds,” State Information Service reports.

Turnout has been particularly strong in several governorates, including Cairo, Giza, Alexandria, Qalyubia, Asyut, and Aswan, El Sherif also said, adding that even North Sinai is seeing residents head to the polling stations, despite the ongoing military campaign in the area. There are 59 mn eligible voters in Egypt, and election results are set to be announced on Monday, 2 April.

Everyone from community leaders to government, security and religious leaders are pushing to drive turnout, the Associated Press reports, including incidents in which managers have ordered employees out to vote. And as is the case in every poll since 2011, we’re all being reminded by House Spokesman Salah Hassaballah that any of us who don’t vote face EGP 500 fines, according to Youm7. The NEA has also threatened the same thing, state-owned Ahram Online reports.

Some business leaders are trying a softer approach, and have given staff time off to go out and vote today. These included businesses associated with the the Investors Association of 6 October City, Ahram Gate reports.

AU says there have been no voting irregularities: “No violations or complaints were registered by the AU observers’ team,” said the head of the African Union observers mission Abdallah Diop, according to Ahram Online. “Voters cast their ballots in a very peaceful and organised environ

ment on the first and second day of elections,” he added. Similar praise came from the head of the COMESA’s observers mission there.

The international press is still still obsessing over turnoutand the rather unlikely notion of an upset victory for that guy who did the country a solid by allowing his name to be placed on the ballot. “Turnout appeared low on Tuesday as Egyptians voted on the second day of an election that President Abdel Fattah El Sisi is virtually certain to win,” says the Associated Press. Reuters notes that authorities continued to push “for a high turnout on Tuesday,” adding that Sisi voters with whom the wire service spoke said they were casting their ballots for stability.

The Washington Post’s editorial board, meanwhile, is sneering about Egypt’s “sham election” — and using it as a cudgel against the Trump administration. The paper’s editorial writers summon all the usual charges against Omm El Donia, adding that even “a number of innocent Americans” have been hurt and that “under Mr Sissi, Egypt is failing.” Heaven forbid that the US embassy say something nice about our electoral process in a tweet: That’s the Trump administration propagating false news on Egypt’s behalf, the newspaper says.

From the remainders bin: There are noticeably more female voters at the polling stations, Gulf News observes, quoting Egyptian women saying they feel safer and more empowered under the Sisi regime. Valdai Club does a “macro assessment” of Sisi’s first term in office, CNBC has a guide on all Egypt elections-related matters, and Asharq Al-Awsat also has coverage.

The seventh annual Cityscape Egypt conference runs today through Saturday at the Egypt International Exhibition Center. With over 17,000 participants and over 90 companies attending, the conference gives property developers a chance to showcase their upcoming projects and discuss industry issues. The conference will be kicked off by Housing Minister Mostafa Madbouly.

Will Saudi be upgraded to FTSE emerging market status today? FTSE Russell will announce today whether it will include Saudi Arabia on its list of emerging markets countries, Bloomberg reports. Tadawul chairwoman Sarah Al Suhaimi is very optimistic that the country will be promoted to EM status based on positive feedback from investors. After a series of market overhauls including a shift to a T+2 settlement system from T+0 last year, KSA’s next big step is “establishing our clearing house that will allow us to have derivatives in the kingdom,” Al Suhaimi tells Bloomberg. FTSE refrained from promoting the country to from unclassified status last September, saying that it would “soon" meet criteria to be included. Al Suhaimi expects a positive decision from FTSE could draw inflows of c. USD 3 bn. An upgrade to MSCI emerging market status would see about USD 15 bn inflows, EFG Hermes estimates.

Investors appear to biting, as the Tadawul index rose 1.08% on Tuesday, good for a 10% YTD gain so far this year, while the iShares MSCI Saudi Arabia exchange traded fund rose 10.5% in March, Bloomberg reports.

This comes as the chairwoman of the Tadawul says the bourse is “doing everything” to get ready for the Saudi Aramco IPO. Al Suhaimi was a guest on CNBC’s Power Lunch yesterday. She made her remarks as Crown Prince Mohammed bin Salman suggested the Aramco IPO may be kicked to 2019. In other KSA news yesterday, the Kingdom’s Public Investment Fund said it was looking at opening offices in the US, UK and Japan as it seeks to become a “global investment powerhouse.”

Saudi and Russia seem to be hashing out a long-term energy pact that could have far-reaching consequences for the global energy market. The agreement would extend the short-term oil pact they made to curb falling oil prices back in 2017. “We are working to shift from a year-to-year agreement to a 10 to 20 year agreement,” Saudi Crown Prince Mohammed Bin Salman told Reuters in an interview on Monday. “We have agreement on the big picture, but not yet on the detail.”

In other EM news, China’s government is relaxing capital controls for the first time in two year, the Financial Times reports. The government has revived a programme allowing global asset managers, including JPMorgan Chase, to raise funds from Chinese onshore clients for investment in offshore hedge funds.

Also in the headlines this morning:

- It’s the end of the world as we know it: Saxo Bank’s “often-bearish” chief economist fears a 30 percent stock market correction is possible in the US, citing “growing credit loans, a widening fiscal deficit, doubts over infrastructure spending plans and a potential trade war,” CNBC reports.

- Deutsche Bank is reportedly starting a process to find a replacement for CEO John Cryan “amid mounting boardroom unrest and shareholder discontent over the bank’s performance ahead of is annual meeting in May.” Execs from Goldman Sachs, Standard Chartered and UniCredit are said to have been approached for the job.

- FAANG shares fell 5.6% yesterday, their worst-ever one-day loss as a group “over fears of heightened regulation and setbacks for tech companies,” the Financial Times reports. The FAANGs include Facebook, Amazon, Apple, Netflix and Google parent company Alphabet.

- DPRK makes nice with the ChiComs: China’s Xi Jinping says he has secured a denuclearization pledge from North Korean leader Kim Jong Un ahead of a planned meeting between the DPRK strongman and US President Donald Trump.

PSA- After the sweet rain comes the sandstorm: After rain and thunder last night (an echo of a reminder that the short months we call “winter” existed), the Meteorological Authority says to expect strong, sandy winds both today and tomorrow. A sandstorm could be in the offing either day, according to Youm7.

What We’re Tracking This Week

It’s MPC day tomorrow: The central bank’s Monetary Policy Committee will meet on Thursday to decide on interest rates, amid a universal consensus among the business community that rates will be cut.

The Ismail Cabinet is expected to present its draft FY2018-19 budget to President Abdel Fattah El Sisi this week before shipping it to the House of Representatives at the end of the month.

On The Horizon

Pharos Holdings will be holding a two-day investor conference headlined In Search of Egypt Alpha on 2-3 April. The event, set to be attended by a number of senior government officials, is expected to host around 40 companies a range of industries to help explore the long-term prospects for investment in the EGX, Chairman and CEO Elwy Teymour said in a statement (pdf). “In Search for Egypt Alpha Conference aims to support the companies whose stories are not generally visible or known to the market,” said COO Angus Blair. The opening day will see panel discussions on the energy and petrochemicals sectors in light of Egypt’s emergence as an energy hub, while the second day will see meetings between fund managers and corporate representatives.

The Easter and Sham El Nessim long weekend is coming soon: The two holidays fall on 8 and 9 April, respectively.

Enterprise+: Last Night’s Talk Shows

The presidential election again dominated the airwaves last night as talk show hosts remained fixated on turnout on the second day of voting.

Unofficial indicators seem to suggest that yesterday more voters at the polls than on Monday. Initial figures show that around 910k Alexandrians out of a total 3.8 mn eligible voters voted over the past two days, Hona Al Asema’s Lamees Al Hadidi said (watch, runtime: 1:01), encouraging her to describe yesterday’s turnout as “good” — a cautious upgrade from the previous day’s “reasonable” (watch, runtime: 1:27:13).

Lamees took note that former presidential candidate Ahmed Shafik was seen voting yesterday. Al Wafd Party President Al Sayed Al Badawi also noted an improvement in yesterday’s turnout (watch, runtime: 2:54), while Kol Youm’s Amr Adib threw caution to the wind in claiming day two was significantly better (watch, runtime: 2:28). Adib also took the opportunity to lambast the foreign press for “jumping the gun” in claiming voter turnout would be low after just one day of the elections (watch, runtime: 25:17).

Some talking heads also obsessed over the Islamist Al Nour Party’s participation in the vote as examples of reformed reformed Islamists (watch, runtime: 1:04) and (watch, runtime: 1:29).

Observers say it’s been smooth sailing so far: Paul Okumu, head of the business and development group Africa Platform, and National Council of Human Rights Yasser Abdelaziz also sat down with Kol Youm’s Amr Adib to discuss the electoral process, which Abdelaziz said has thus far not drawn any complaints from international observers. Okumu noted that Africa Platform will issue a complete report on its observations later (watch, runtime: 2:03). Abdelaziz also reminded Adib that a total of 62 observers, including nine international organizations, are overseeing the elections (watch, runtime: 00:43).

Turnout to continue on an upwards trajectory? Council of State Club head Samir Al Bahy told Masaa DMC’s Osama Kamal that he expects today to see the highest voter turnout, adding that rural areas boasted higher participation numbers than cities (watch, runtime: 4:58). Daqahliya governor Ahmed Shaarawy voiced the same opinion on Al Hayah Al Youm (watch, runtime: 3:43).

People are already stressing about 2022. Al Wafd’s Badawi said that President Abdel Fattah El Sisi’s main political challenge during his (expected) second term would be to create an environment conducive to establishing of a multi-party system (watch, runtime: 4:44). Egyptian actor Mohamed Sobhi (who has, for reasons unbeknownst to us, become a regular political commentator) also said that it is El Sisi’s responsibility to make it possible—starting from now—for candidates to toss their hats into the ring for the 2022 election (watch, runtime: 5:12).

Speed Round

On a slow news morning, we start with a quickening drumbeat of stories suggesting that the automotive industry is attracting interest from global automotive industry players as people wait for news of the automotive directive, which would give local assemblers a competitive advantage against EU, Turkish and Moroccan imports provided the assemblers move further up the value chain into manufacturing.

European automakers Fiat and Volkswagen are said to be exploring manufacturing opportunities in Egypt, Federation of Egyptian Industries (FEI) Executive Director Khaled Abdel Azim said yesterday. FEI members have been meeting with FIAT executives, who are now deciding between Egypt, Morocco, and South Africa as possible locations to establish a manufacturing plant, he said, adding that both producers have inquired about the timeline and framework of the Automotive Directive, as well as the possibility for using locally-manufactured parts for their operations.

Automotive Directive driving the good news: Reports that the Automotive Directive would be issued some time in 2018 has been responsible for a recent wave of news for the industry. Last week we learned that Volkswagen has reportedly already tapped three Egyptian manufacturers — IDACO, MOBICA, and El Teriak Industrial Group — to become part of its global parts supply chain, serving demand at assembly facilities across the region. French multinational group Renault is also said to be in talks with potential local partners over a similar-style agreement, while Spanish automaker SEAT is expected to begin assembly operations in Egypt by 2020 through its local agent Kayan.

M&A WATCH- OTMT to complete acquisition of real estate developer Inertia in the next two weeks: Orascom Telecom Media and Technology Holdings is two weeks away from completing the acquisition of 51% of real estate outfit Inertia for Engineering and Trading’s shares, sources close to the matter said yesterday. The two sides are adding some final touches and concluding negotiations over the value of the transaction. OTMT is expected to acquire the 51% stake through a capital increase and share issuance. Inertia Managing Directors Ahmed El Adawy and Hussein Rifai — who together hold a controlling 60% stake in the company — are expected to retain their seats on the company’s board once the transaction is complete. Matouk Bassiouny is legal counsel for the sellside, while White & Case has been tapped as OTMT’s legal counsel. OTMT had announced in December that it signed an MoU with Inertia to acquire a controlling stake of at least 51%.

Egypt’s first real estate fund began trading on the EGX yesterday, according to Al Shorouk. The EGP 80 mn fund — a tie in between the Egyptians Abroad Investment and Development Company, Pioneers Holding, and Misr Iran Development Bank — will invest in four real estate projects worth a combined EGP 2.5 bn, including a hotel and a commercial project, the fund’s CEO says. Other projects in Asyut, Minya, and Gharbiya are also under study.

EARNINGS WATCH- EFG Hermes’ net profit after tax and minority interest stood at EGP 1.2 bn at the end of FY2017 on the back of EGP 3.6 bn in revenues, an increase of 186% y-o-y “after adjusting for FX gains of EGP 2.7 bn recorded in 2016,” the company announced yesterday (pdf). “EFG Hermes decisively completed its transformation from a MENA-focused investment bank into the premier provider of financial solutions for retail, high-net-worth and institutional clients across MENA and Frontier Emerging Markets,” said Group CEO Karim Awad. “2017 saw us execute on our expansion strategy, by adding Pakistan, Kenya, the United Kingdom and the United States to our geographic footprint in addition to diversifying our product base.” Looking ahead, EFG will focus “on the continued rollout of innovative products and services and the replication of our MENA success story in our newly-entered markets, where we hope market conditions will permit the execution of our first frontier IPO mandate this year.”

Uber, Careem appeal Administrative Court ruling ordering their closure: Ride-hailing apps Uber and Careem have filed an appeal with the Supreme Administrative Court against last week’s ruling suspending the companies’ licenses in Egypt, Al Mal reports. The appeal, which challenges charges by taxi drivers of the companies operating illegally, says that the apps are operating legally after receiving licenses from the Investment Ministry and the government. The companies say they are waiting for the passage of the Ride-Hailing Apps Act — currently with the House Transport Committee — to regulate their business. The appeal also points out that the companies themselves do not own any cars. Both companies have thus far been operating normally, despite a spokesperson for the plaintiffs claiming the ruling went into effect immediately. The State Lawsuits Authority had also filed a separate appeal against the ruling earlier this week.

Egypt has been named the second most attractive investment destination in Africa on Quantum Global’s 2018 Africa Investment Index. “In addition to being the second largest economy and the third most populous country in Africa, Egypt scores well on other factors such as liquidity, external debt, and current account — the latter two indicators both pertaining to the relative riskiness of the country for foreign investment.” Egypt is up from third place last year, preceded by Morocco and followed by Algeria. Tap or click here full the report (pdf).

Tourist arrivals from the Middle East, Africa, and North America are expected to drive growth in Egypt’s tourism industry going forward, according to data released ahead of the 2018 Arabian Travel Market carried by Breaking Travel News. A combination of a cheaper EGP and the government’s charter flight incentive program is expected to drive arrivals from North America up at a compound annual growth rate of 3.9% between 2018-2021 to 318,444, while African arrivals are seen growing at annual rate of 3.8% over the same period to more than 300,901 tourists. Middle East arrivals are also expected to grow by 3% a year to more than 1.34 mn, while European tourists — “who have traditionally been the key source market for Egypt” — will be growing in numbers at an annual rate of 1.6% in the next four years. The return of direct air travel between Cairo and Moscow after an over two-year halt is also expected to drive tourist numbers up.

Global players are sensing a turnaround in the making: A number of hotel chains, including Hilton, had announced ambitious plans to expand across the country, just as newly-appointed Tourism Minister Rania Al Mashat said she would be working on a strategy to develop the sector and diversify source markets for tourists.

LEGISLATION WATCH- Cabinet refers anti-terror council legislation to the House: The Ismail Cabinet referred yesterday draft legislation for the establishment of the Supreme Council to Combat Terrorism and Extremism to the House of Representatives. President Abdel Fattah El Sisi had ordered the formation of the council in April, following twin bombings targeting churches in Tanta and Alexandria. The council, which held its first meeting in August, will task every ministry and state institution with a role in the war on terror and will have the authority to issue binding decisions on counterterrorism measures. The council will also work to fast-track terror cases through the court system.

MOVES- Visa has tapped Marcello Baricordi as the company’s new General Manager for the MENA region, according to a statement. Baricordi, who has been with Visa since 2009, succeeds Ihab Ayoub, who left the company for “personal reasons.”

Ethiopia’s ruling coalition elected yesterday Abiy Ahmed as the country’s new prime minister and chairman of the coalition, according to the Ethiopian News Agency. Ahmed succeeds Hailemariam Desalegn, who resigned suddenly last month over anti-government violence, particularly in Ethiopia’s restive Oromia region. Ahmed is the chairman of the Oromo Peoples Democratic Organization, one of the ethnic-based parties in the country’s ruling coalition. Desalegn’s resignation had sparked concerns here in Egypt that Ethiopia’s stance on the Grand Ethiopian Renaissance Dam would shift once again when a new premier is sworn in. Egypt, Sudan, and Ethiopia are scheduled to hold the next round of trilateral talks on the dam next month.

***

SMART PEOPLE WANTED. We’re hiring at both Enterprise and at our parent company, Inktank. We’re looking for critical thinkers who have outstanding English-language writing skills. Don’t apply if you are not (at an absolute minimum) unafraid of numbers. We offer a great, casual work environment, the opportunity to work with smart people who care about what they do, and plenty of intellectual challenge. You’ll do your best work here, whatever your profession is. Check out our open positions, from creative director to reporter, from Enterprise editor to senior investor relations advisor at Inktank.

***

The Macro Picture

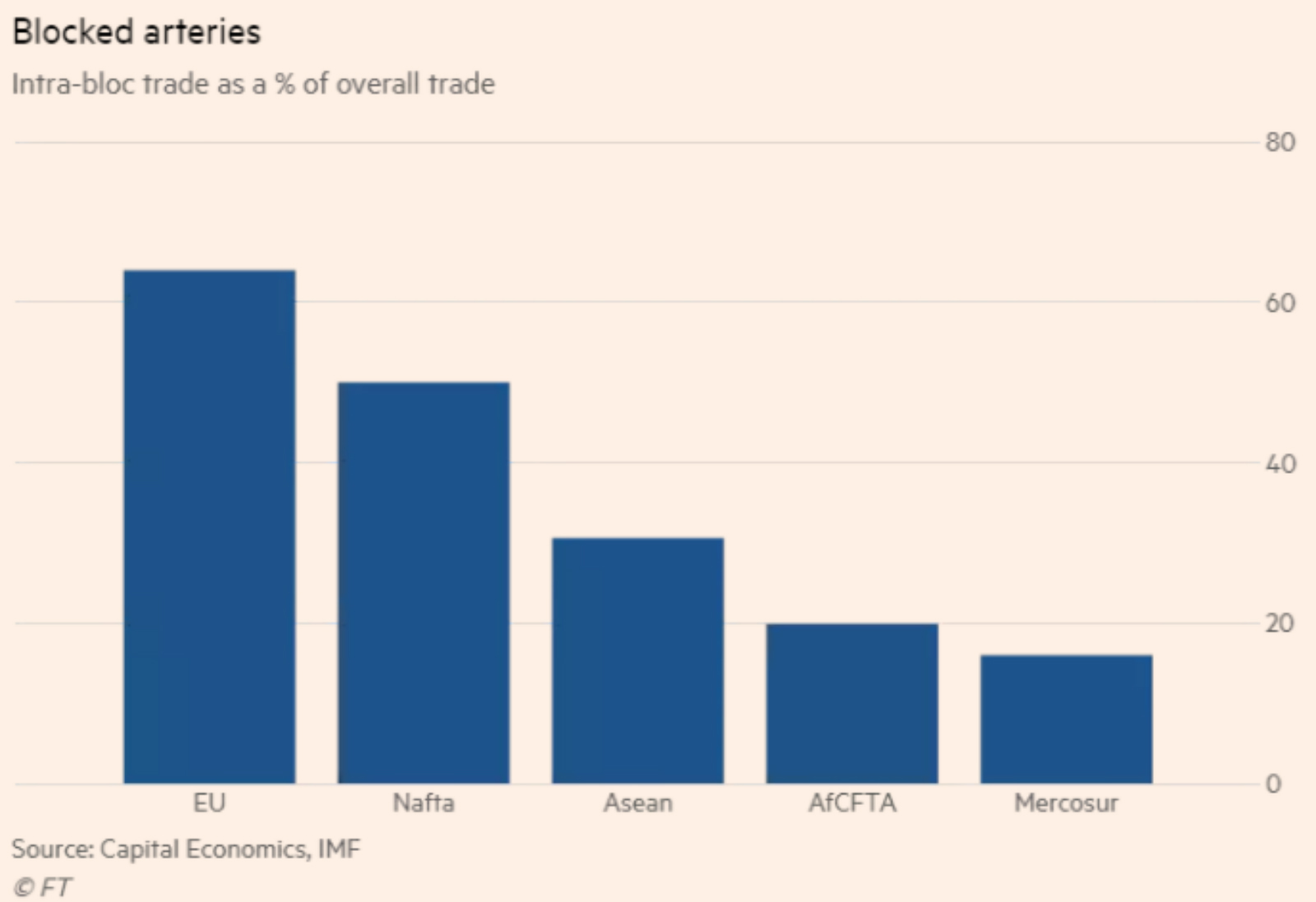

How beneficial can the African Continental Freetrade Area really be? The pan-African Continental Freetrade Zone (CFTZ) agreement — signed by 44 African countries including Egypt — is being heralded by the African Union as having the potential to increase intra-continental trade by 53% by eliminating import duties, which average 6.1%, and to more than double trade if non-tariff barriers are also reduced. Credit agency Moody’s has given its approval for the agreement, with its managing director for credit strategy saying that it would be credit positive and give regional trade greater stability.

Others, however, are finding flaws with the numbers. The United Nations Conference on Trade and Development (UNCTAD) estimates (pdf) the total annual gain would be USD 4.6 bn, or 0.2% of continental GDP, even if all tariffs were scrapped. The signatories have only committed to cut tariffs on 90% of goods, suggesting that some of the most onerous taxes may remain, writes Steve Johnson for the FT. The AU’s analysis is predicated on all of its 55 members signing up to the CFTZ, but 10 countries, including South Africa and Nigeria — the continent’s largest economies — have not signed it.

It may not be much compared to other regional treaties, but it’s a good start: By scope and size the agreement does not come close to its counterparts NAFTA, the EU and the Asian-Pacific regional freetrade zones. Analysts, including John Ashbourne, Africa economist at Capital Economics, see that the agreement provides a good jump off point by tackling two of the biggest problems in African trade. The first being, that at 19.9% of African exports going to other continental markets, intra-continental trade is low. The second, by boosting trade among African nations, countries will reduce their dependence on extractive commodities, which are volatile.

Meanwhile, Egyptian healthcare companies are looking to be among the first to take advantage of the agreement. Representatives from 30 local pharma companies will be meeting with 16 companies from Somalia to explore potential cooperation on trade, according to Medical Exports Council Chair Rasha Nasr. The companies are hoping to benefit from the CFTZ agreement, she added.

Image of the Day

The allure of the Sunken Cities of Egypt exhibition is about more than artifacts: The “Sunken Cities: Egypt’s Lost Worlds” exhibition in St. Louis, which has on display several artifacts from two Egyptian cities recovered from beneath the seabed, is “more than just a collection of artifacts,” Edward Rothstein writes for the WSJ (paywall). The display helps to piece together the fragments of information we know about Ancient Egyptian rites, some of which were only partially uncovered through temple drawings. It doesn’t hurt that the recovered artifacts are also eerily well preserved: “Yes, some surfaces eroded, but for millennia no robbers disturbed these watery graves.”

Egypt in the News

Among the handful of non-election stories out of Egypt that caught the eye of the international press:

- A lack of shipments to Egypt due to Russian competition has driven down Romanian wheat exports 9% y-o-y, UkrAgroConsult reports.

- World Finance takes note of Naguib Sawiris’ new USD 2 bn real estate venture in Pakistan, which caters to the “American dream for Pakistani citizens”, says Aisha Ahmad.

- Photographer Sandro Vannini publishes stunning images from the Valley of Kings in "King Tut: The Journey Through the Underworld,” CNN reports.

- Egypt needs new policies to make education more easily accessible to students with disabilities, Suhair Abdul-Hafeez writes for Al-Fanar Media.

- Italy’s anti-terror police have arrested a 58-year-old Egyptian-Italian man accused of ties to Daesh, The Local reports.

On Deadline

Has the state IPO program been studied thoroughly enough? Columnists seem to think not: The government doesn’t seem to have properly assessed the potential outcomes (both good and bad) of its IPO program, Safwat Kabel writes for Al Shorouk. The columnist sees the plan to list public companies on the EGX as a recycled version of the Mubarak-era strategy of privatization, except he believes that the current government did not learn from its predecessors’ mistakes. Being paid trolls writing for an old medium, Kabel and his peers offer no real evidence to back their Nasserist stance. Al Masry Al Youm’s Nadine Abdallah voices similar concerns over the strategy, saying it should have been discussed more thoroughly and transparently to ensure it does not hit any snags moving forward. Transparency is part and parcel of the whole process, but why bother explaining that when you have readership to rile up.

Worth Reading

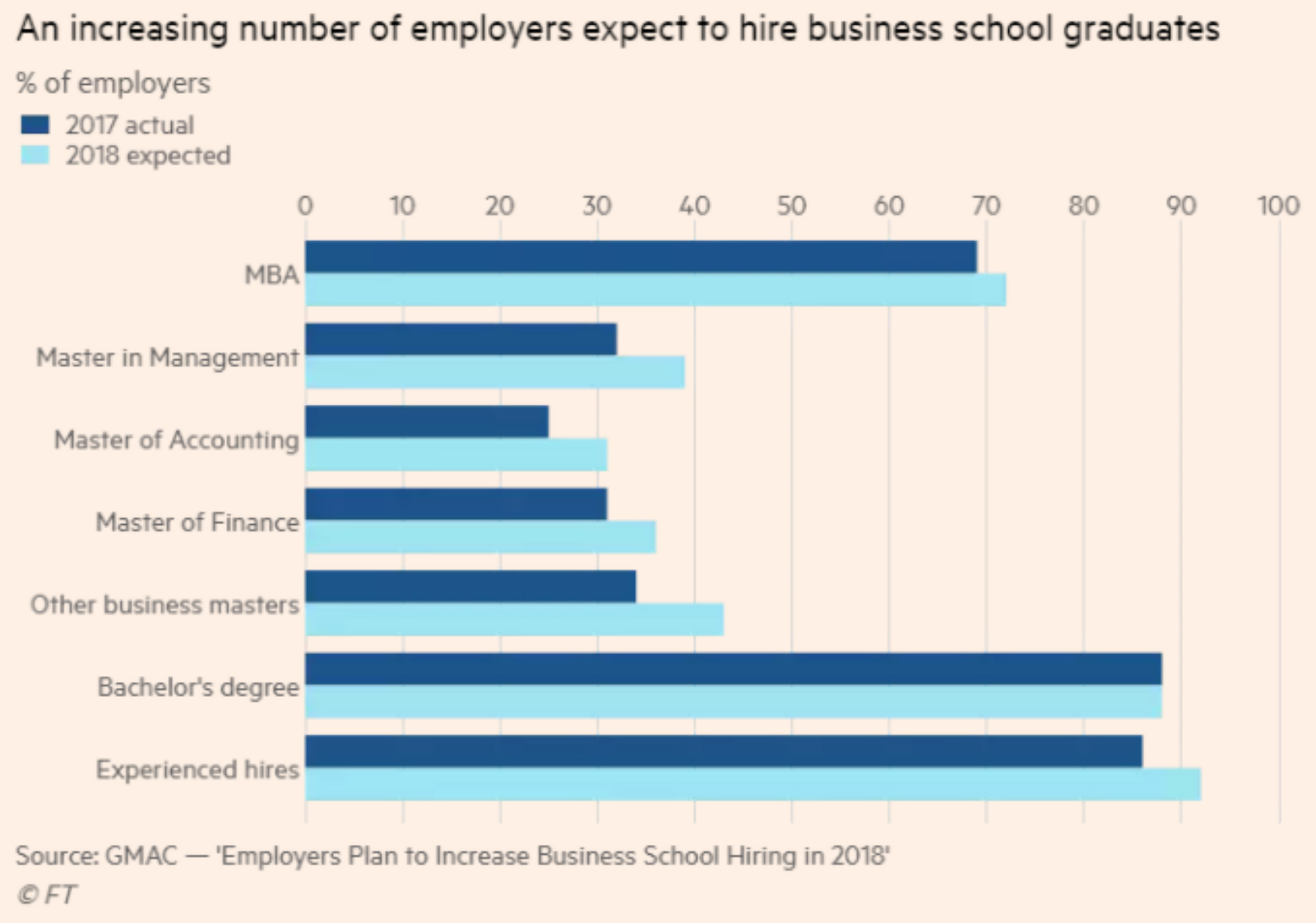

Why MBA programs must do more to make their grads more appealing to employers: As competition between MBA programs to get their graduates placed with top companies intensifies, so does the pressure on them to justify a strong return on investment, writes Jonathan Moules for the Financial Times. Business schools must do more to promote the return on investment of an MBA for companies, according to Scott DeRue, dean of Michigan’s Ross School of Business. For one thing, an MBA graduate is a hot commodity, with 72% of companies surveyed by business school entrance exam administrator the Graduate Management Admission Council saying they plan to recruit MBA graduates this year, up from 69% last year. Then there is competition from other degrees, as companies look for more specialized skills. “40% of employers surveyed said they expect to hire more people with specialist skills, such as those offered by master in management and master in finance degrees, compared with 28% who said they would hire more for the generalist teaching of an MBA.”

Beyond competition, there’s also the length of time a graduate needs to pan out for the company. As with any return on investment, the sooner it comes, the better. “An MBA hire is typically negative until the third year of employment, which puts an onus on the school to explain the rewards of hiring their students,” says DeRue. And if MBA selections do not pan out, companies, especially in tech, might opt to train employees in-house. “Amazon says, ‘If you can provide students with the right mix of business and data analytics skills, then we will have them,” he added.

Worth Watching

Why the f**k does swearing feel so f**king good? There’s a reason a lot of us pepper our speech with profanity — and it has a lot to do with how our brains are wired, according to The Economist. Swear words activate a different region of the brain than that used in regular speech — an area near the center that’s activated when we cry or scream, suggesting that swearing is closely connected to expressing “our most basic emotions.” The object of our swearing is also an important factor to look into, and varies across cultures and languages based on what people perceive as fair game or a red line (watch, runtime: 3:03).

Diplomacy + Foreign Trade

Sudan and Qatar will sign a USD 4 bn agreement to jointly develop and manage the Red Sea port of Suakin off Sudan’s coast, Sudan’s Transport Minister Makkawi Mohamed Awad and his Qatari counterpart Jassim Saif Ahmed Al Sulaiti announced in a joint press conference, Sudan Tribune reports. Qatari Transport Ministry officials visiting Sudan told Reuters that the cost and other details of the agreement had not been finalized yet. Sudan has been playing a dangerous regional game, mending ties with Egypt on the one hand, while flirting with the latter’s rivals on the other. Sudan’s new pact with Qatar follows an agreement with Turkey to redevelop the Suakin island for military use.

Energy

Elsewedy, EGEMAC, Xian signs c. EGP 1 bn in transmission projects

Elsewedy Electric subsidiary Egytech has signed an EGP 255 mn agreement with the Egyptian Electricity Holding Company (EEHC) to connect the New Imbaba transformer station to the one in Motamadiyah, the company said in a filing to the EGX (pdf). The 5km 220 kV connection project will be established on a turnkey basis, the company says. Meanwhile, the Egyptian Electricity Transmission Company signed yesterday a EGP 721 mn contract with an EGEMAC-XD EGEMAC-Xian consortium to develop a turnkey 500/220 kV gas insulated substation Naga Hammadi, Al Mal reports. The substation will take 12 months to develop.

SDX begins drilling new exploration well at South Disouq

SDX Energy has begun drilling at the Ibn Yunus-1X exploration well at South Disouq, Hydrocarbons Technology reports. Drilling is expected to last around 30 days. SDX had announced last month signing a rig contract with Sino-Tharwa Drilling Company for four firm wells and one contingent well in South Disouq. The company expects the field to have a plateau rate of 50 mcf/d of conventional natural gas.

Infrastructure

General Authority for Ports denies requiring USD 60 mn loan for 6 October dry port tender

The General Authority for Ports and Dry Land denied news reports that the authority was requiring investors to arrange a USD 60 mn loan in order to qualify for the 6 October dry port tender. The terms and conditions for the project have yet to be issued, the authority noted. The authority stressed that it has only issued an invitation to interested investors to apply for pre-qualification for the project, which the Transport Ministry announced in December. Transport Minister Hisham Arafat had previously said that the project, which will be developed under a PPP framework, will require an initial investment of around USD 100 mn. The bidding window for the project will close on 7 April.

Manufacturing

Fluor Corporation wins Enppi front-end engineering design contract

State-owned oil services outfit Enppi has awarded the Fluor Corporation, an American outfit, a contract for the design and management consultancy on the phosphoric acid production plant at Abu Tartour, according to a company press release. The contracts were signed in Cairo earlier this month. The Texas-based engineering firm did not give a timeline for its work but said it would fast-track designs for the USD 750 mn plant. The Ismail Cabinet said earlier this month that it was studying offers from Spanish, Chinese, German, and South Korean contractors who are looking to partner up with the state-owned Misr Phosphate’s El Wadi Phosphate Company on building the facility. The plant is expected to produce an annual 1 mn tonnes of phosphate-based fertilizers once it’s operating at full capacity, and will split its output evenly between local consumption and exports.

Health + Education

Arab Academy to open a new branch in Sharjah

The Arab Academy for Science, Technology, & Maritime Transport signed an MoU with Sharjah ruler Sultan bin Muhammad Al Qasimi to establish a new branch of the university in the emirate, Al Mal reports. No details were provided on the expected timeline or cost of the agreement.

Telecoms + ICT

Telecom Egypt wants data centers to bring in 25% of its revenues within five years

State-owned monopoly Telecom Egypt is looking to make data centers account for 25% of its revenues within five years’ time, Chief Business Officer Muhammad Sameh told reporters yesterday, Al Mal reports. He says that this is the “natural course” of development for the telecom company due to the rapid development of data. The company currently has four data centers and is in the process of constructing another two, according to Sameh. After allegations surfaced in the media that TE had been using user bandwidth to mine cryptocurrency (and all the other issues with TE), this recent news brings back Col. Walter E. Kurtz’ dying words: The Horror.

Automotive + Transportation

Alstom plans to bid on Alex tram project, new capital rail projects

France’s Alstom is planning to bid in the tenders for the EUR 360 mn Alexandria tram project and the construction of rail lines in the new administrative capital, among other transport projects, Middle East and Africa Senior Vice President Didier Pfleger tells MENA. Alstom is currently working on maintaining the infrastructure and signalling systems for the first and second phases of Cairo Metro Line 3, in addition to the electromechanical works for the third phase of the line.

SYSTRA and AECOM tapped as consultants for Alamein-Ain Sokhna train line

France’s SYSTRA and US-based outfit AECOM have been tapped by the ministries of housing and transport ministries to consult on the Alamein-Ain Sokhna high-speed railway project, sources tell Al Mal. The two companies, who are expected to sign the contracts “within days,” presented the best two (out of ten) offers for the project, the sources added. The two companies will be advising the ministries on the terms and conditions for the tender and helping evaluate offers for the railway line that will run through the new administrative capital, Six October City, and Alexandria.

Egypt Politics + Economics

Egypt retrieves EGP 596 mn from Ahmed Ezz’s Swiss bank accounts

Swiss authorities have handed Egypt EGP 596 mn from seized bank accounts belonging to steel tycoon Ahmed Ezz after he reached a EGP 1.7 bn settlement agreement with the government, claims Swiss Info.

Sports

Egypt loses 1-0 against Greece in pre-World Cup friendly match

Egypt’s national football team lost 1-0 against Greece in a World Cup warm-up match yesterday, Ahram Online reports. National team coach Hector Cuper put the team’s second string on the pitch to test out their performance without key players such as Liverpool winger Mohamed Salah. “Although Egypt could have grabbed an early lead, they were largely on the back foot in a dull first-half littered with mistakes, with heavy rain making things more difficult for both sides.”

On Your Way Out

Antiquities Ministry channels Indiana Jones and is on the trail of stolen artifacts: Egypt has retrieved three mummy parts that had been smuggled to the US in 1927, the Antiquities Ministry said in a statement yesterday. The mummy head and two hands, which had been stolen from the Valley of the Kings over 90 years ago, had recently been displayed for sale at an auction in Manhattan, according to the statement. The ministry also said it was investigating the origins of the 27 Ancient Egyptian artefacts set to go on auction at Christie’s New York this Friday, ministry official Shaaban Abdel Gawad tells Al Shorouk.

Meanwhile, Scientists in Australia could help reveal more secrets about ancient Egypt after discovering the remains of a mummy in a 2,500-year-old coffin that was previously thought to be empty, Reuters reports. The presumably empty sarcophagus had been sitting at a university museum in Sydney for over 150 years, until academics removed the lid last year and found the remains of human feet and bones that could have belonged to someone important.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5881 | Sell 17.6861

EGP / USD at CIB: Buy 17.58 | Sell 17.68

EGP / USD at NBE: Buy 17.55 | Sell 17.65

EGX30 (Tuesday): 17,270 (+1.0%)

Turnover: EGP 2.3 bn (99% ABOVE the 90-day average)

EGX 30 year-to-date: +15.0%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 1.0%. CIB, the index heaviest constituent ended up 0.4%. EGX30’s top performing constituents were Qalaa Holding up 8.4%, Orascom Telecom Media & Technology up 6.8%, and Egyptian Resorts up 6.4%. Yesterday’s worst performing stocks AMOC down 1.2%, Abu Dhabi Islamic Bank down 1.4%, and Kima down 1.0%. The market turnover was EGP 2.3 bn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +13.2 mn

Regional: Net Short | EGP -24.1 mn

Domestic: Net Long | EGP +10.9 mn

Retail: 63.5% of total trades | 62.6% of buyers | 64.4% of sellers

Institutions: 36.5% of total trades | 37.4% of buyers | 35.6% of sellers

Foreign: 18.4% of total | 18.7% of buyers | 18.1% of sellers

Regional: 12.3% of total | 11.8% of buyers | 12.9% of sellers

Domestic: 69.3% of total | 69.5% of buyers | 69.0% of sellers

WTI: USD 64.66 (-1.36%)

Brent: USD 69.61 (-0.73%)

Natural Gas (Nymex, futures prices) USD 2.69 MMBtu, (+2.79%, April 2018 contract)

Gold: USD 1,347.90 / troy ounce (-0.96%)

TASI: 7,942.54 (+1.08%) (YTD: +9.91%)

ADX: 4,611.75 (-0.84%) (YTD: +4.85%)

DFM: 3,092.85 (-0.35%) (YTD: -8.23%)

KSE Weighted Index: 406.52 (-1.05%) (YTD: +1.27%)

QE: 8,693.98 (-0.21%) (YTD: +2.00%)

MSM: 4,759.29 (+0.02%) (YTD: -6.67%)

BB: 1,327.33 (+0.13%) (YTD: -0.33%)

Calendar

28-31 March 2018 (Wednesday-Saturday): Cityscape Egypt, Cairo International Convention Centre, Cairo.

02-03 April (Monday-Tuesday): Pharos Holding’s investor conference: In Search for Egypt Alpha, Cairo.

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

11 April (Wednesday): The Game Sports Industry Conference, Nile Ritz-Carlton Hotel, Cairo.

17-18 April (Tuesday-Wednesday): Creative Industry Summit, Four Seasons Nile Plaza Hotel, Cairo.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

07 May (Monday): International Data Corporation’s CIO Summit, The Nile Ritz-Carlton Hotel, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.