- EFG investor survey sees Egypt as best-performing MENA market this year. (What We’re Tracking Today)

- Saudi robot utopia known as NEOM to get 1,000 sq km in Sinai. (Speed Round)

- Freedom of speech, MbS visit dominate airwaves as Khairy Ramadan released from custody. (Last Night’s Talk Shows)

- New orders grow, appetite from EU improving, but PMI reading still below below 50 in February. (Speed Round)

- B Investments to complete EGX listing this month, Farid sees as many as seven IPOs this year. (Speed Round)

- Ibnsina co-CEO confident antitrust fine will be overturned. (Speed Round)

- Deputy finance minister Amr Monayer resigns; was responsible for tax policy. (What We’re Tracking Today)

- Special report: The full rundown on yesterday’s EFG Hermes One on One in Dubai. (Spotlight)

- The Market Yesterday

Tuesday, 6 March 2018

Egypt equities to outperform in MENA, EFG investor survey finds

TL;DR

What We’re Tracking Today

Greetings from the second day of the EFG Hermes One on One in Dubai. The world’s largest frontier and emerging markets investor conference got off to a busy start yesterday with a packed morning of panels and interviews, the largest poll of frontier and emerging markets investors and executives, and an afternoon of company meetings. More than 500 fund and portfolio managers from 255 global institutions with aggregate AUM north of USD 8 tn will meet face-to-face today and tomorrow with C-suite execs from 173 companies spanning 26 countries.

The largest poll of frontier and emerging markets investors and companies was among yesterday’s highlights. More than 990 attendees voted, with highlights including:

- 75% of attendees expect the US Federal Reserve to hike rates 2-3 times this year. Some 42% expect just two rate increases, a bit behind consensus, says EFG Hermes strategy boss Simon Kitchen.

- Emerging markets will outperform the S&P this year, say 77% of respondents, who were almost evenly split on whether the S&P would close up or down by year’s end.

- Banks will see the best returns in Saudi Arabia, respondents said, in line with what Kitchen says is the consensus.

- Egypt will be the best-performing MENA market this year. Some 47% of voters tipped Omm El Donia, edging out Saudi Arabia as the second pick at 30%.

- Kuwait will outperform among frontier markets, placing ahead of Pakistan, Vietnam and Argentina.

- Pakistan is the country most likely to see a 10% of greater currency devaluation this year, respondents said. Devaluations in Pakistan and Kenya are persistent questions from investors, Kitchen notes.

- 65% of respondents see tech stocks outperforming global commodity names on a view year view, and 60% of attendees voting saw blockchain technology as “a mortal threat to the traditional banking industry.”

You can download the full survey results here as a pdf.

We have the full rundown on yesterday’s events in today’s special Spotlight section, after Speed Round, below.

Not a public markets person? You’ll still want to check out our report from Dubai: We have tech stuff for you, with the last panel yesterday having focused on “disruption” in frontier markets. Appearances by top execs from Careem; Mohamed Alabbar’s e-commerce platform Noon; the largest investor in education in Egypt, CIRA; and Vietnamese e-commerce platform Mobile World.

Saudi Crown Prince Mohammed bin Salman wraps up his three-day visit to Egypt today. MbS is off to London next, where he’s expected to sign agreements worth bns of USD. We have more in the Speed Round, below.

Amr El Monayer resigned yesterday as deputy finance minister in charge of tax policy. Prime Minister Sherif Ismail accepted El Monayer’s resignation, effective immediately, Al Masry Al Youm reports.

The House of Representatives will be going into recess at the end of today’s sessions until after the presidential elections later this month, Ahram Gate reports.

The 2018 international Sustainable Industrial Areas (SIA) International Conference gets underway today at the Nile Ritz Carlton. The gathering is being held under the auspices of the Trade and Industry Ministry in partnership between the East Port Said Development Company. More than 400 delegates are now registered to attend, c. 100 of whom will be arriving from outside Egypt.

Sudan’s ambassador to Egypt Abdel Mahmoud Abdel Halim arrived in Cairo yesterday to resume his official duties for the first time since January, sources tell Reuters’ Arabic service. Abdel Halim had been recalled “for consultations” in January amid souring ties between the two countries over disputes in sovereignty over the Halayeb Triangle and “Egyptian suspicions of a Sudan-Turkey naval agreement.

US President Donald Trump says he may visit Israel in May for the opening of the new US Embassy in Jerusalem, Reuters reports.

Enterprise+: Last Night’s Talk Shows

Saudi Crown Prince Mohammed bin Salman was the talk of the town yesterday after his roundtable with Egyptian media’s who’s-who, including our beloved talking heads.

That Egypt is “not selling land to Saudi Arabia” is something Kol Youm’s Amr Adib felt the need to clarify, as he proceeded to explain that Riyadh will simply funnel USD 10 bn in cash through its joint investment fund with Egypt to the development of 1,000 sq km in Sinai as part of its NEOM project (We have the full rundown in the Speed Round) (watch, runtime: 10:00).

MbS seems to have left quite the impression on Hona Al Asema’s Lamees Al Hadidi, who described him as “well-read” and “candid” in his answers to reporters’ questions (watch, runtime: 5:37). The Qatar rift, relations with Turkey, and Saudi Arabian politics were among the topics journalists floated, Al Shorouk Editor Emad el-Din Hussein said (watch, runtime: 6:58). Al Masry Al Youm Chairman Abdel Moneim El Said told Masaa DMC’s Eman El Hossary though that MbS shrugged off questions on Qatar (watch, runtime: 6:14).

The Saudi royal’s visit to the Abbasiya Cathedral marks the opening of “a new page in history,” Coptic Orthodox Church spokesperson Boules Halim told Lamees (watch, runtime: 4:00). He also told El Hossary that the visit conveys a message of “enlightenment” (watch, runtime: 2:28). Yahduth fi Misr’s Sherif Amer agreed (watch, runtime: 2:43).

Khairy Ramadan released on bail: The talking heads were happy to learn that fellow host Khairy Ramadan was released on EGP 10,000 bail yesterday, pending investigations into charges of spreading false news and insulting the police. Al Hayah Al Youm’s Tamer Amin saw Ramadan’s release as the end of his dispute with the Interior Ministry, which leveled the case against him after a segment about low police wages (watch, runtime: 2:18).

Columnists join forces to defend Ramadan: His case damages the government’s image abroad and sends a wrong message of instability, Al Shorouk’s Emad El Din Hussein argued. While Hamdy Rizk and Mohamed Amin independently urged the Interior Ministry to forgive Ramadan’s “well-intentioned mistake” and drop the case.

Meanwhile, four Press Syndicate board members called for an urgent board meeting to discuss Ramadan’s arrest and the unconstitutional detention of other journalists.

Lamees called for the release of the two journalists arrested while filming a documentary about the Alex tramway, as she thanked the Interior Ministry and other officials for intervening to resolve Ramadan’s conundrum (watch, runtime: 4:06).

People are growing fearful of speaking their mind in public, Adib warned on Kol Youm. He said, though, that the issue does not warrant calls to protest (watch, runtime: 7:06).

The new life-insurance certificates for private-sector workers also received significant airtime, as various bank bosses provided updates on demand since the policies were launched earlier this week. Watch here (runtime: 7:00), here (runtime: 3:04), here (runtime: 3:50), and here (runtime: 1:32).

Speed Round

NEOM is getting 1,000 sq km in Sinai: Egypt has committed more than 1,000 sq km of land in South Sinai to developing its side of the transnational robot utopia better known as NEOM, for USD 10 bn, a Saudi official told Reuters yesterday. “Saudi Arabia plans to build seven cities and tourism projects, while Egypt will focus on developing the existing resort cities of Sharm El Sheikh and Hurghada,” according to the Saudi official. “The kingdom will also work with Egypt and Jordan to attract European cruise companies to operate in the Red Sea during the winter season. Riyadh is negotiating with seven cruise companies and aims to build yacht marinas.”

Egypt’s stretch of NEOM will be financed through the USD 16 bn (SAR 60 bn) joint investment fund that Cairo and Riyadh agreed to establish on Sunday, the newswire says. The fund — which is originally part of a 2016 agreement — will also finance other projects in Egypt that will be picked from the Investment Ministry’s investment map, particularly tourism-related projects in Alamein and South Sinai, the ministry said in a statement (pdf). A board of directors comprised of officials from both countries will manage the fund, set its strategy, and follow up on ongoing ventures. The agreement will still have to pass a vote in Egypt’s House of Representatives.

Cairo and Riyadh had signed two other MoUs on Sunday: One on cooperation between the General Authority for Freezones and Investment and its Saudi counterpart, and another on the preservation of the Red Sea’s coral reefs and prevention of ‘visual pollution.’ (Does that apply to tourists of various forms?)

The agreements come as “Egypt seeks investment from oil-rich Saudi Arabia” as part of “a growing strategic partnership,” Brian Rohan writes for The Associated Press. President Abdel Fattah El Sisi gave Saudi Crown Prince Mohammed bin Salman a “warm welcome” upon his arrival in Cairo, where the Saudi royal also met with Coptic Pope Tawadros II and Al Azhar Grand Imam Sheikh Ahmed Al Tayeb. El Sisi also accompanied MbS to Ismailia, where they toured sites of several ongoing projects, Ittihadiya said yesterday.

The story is still getting a lot of ink in the foreign press, particularly from the GCC, with coverage from ANSAMed, Financial Times, The National, Saudi Gazette, Khaleej Times, Al Arabiya, and Arab News.

Total new orders for Egypt’s non-oil private sector returned to expansion and new export business witnessed an uptick in February, the Markit-compiled Emirates NBD PMI showed. The PMI reading for the month still remained below the 50.0 neutral mark at 49.7, but was over its long-run average. “Panelists noted stronger demand from both domestic and export markets. Despite the rate of growth being only marginal overall, the expansion was only the third recorded over the past two-and-a-half years… Some panel members noted higher demand from EU markets.” Even though the survey shows that output contracted during February, the overall level of confidence “was well above the historical average,” and anecdotal evidence showed higher business investment, an expected economic upturn, and new project wins underpinning confidence. “The data remains upbeat in comparison to recent annual averages. In particular, new orders, new export orders, and business optimism were all in positive territory, supporting our view of a strengthening Egyptian economy, and our expectation that the headline figure will begin to breach the 50.0 level more consistently in the coming quarters,” Emirates NBD MENA Economist Daniel Richards commented.

The Finance Ministry is targeting a budget deficit of between 8.5 and 8.8% of GDP in FY2018-19, according to an initial outline Minister Amr El Garhy presented to Prime Minister Sherif Ismail yesterday, Youm7 reports. The ministry is also hoping to achieve a primary surplus of 1.8-2%. El Garhy also said that Egypt’s GDP growth is projected to reach 5.5% in FY2018-19, Reuters reports. The ministry will present the draft budget to the House of Representatives on 31 March.

IPO WATCH- The EGX is looking forward to as many as seven IPOs in 2018, Chairman Mohamed Farid told Bloomberg TV. “An IPO this month is likely to be followed by another in April, and a further four or five share sales before year-end,” he said, without revealing any names. Farid had said last month that that eight companies have already begun listing procedures from sectors including petrochemicals, finance, real estate, and tourism.

IPO WATCH- B Investments to complete EGX listing this month: Our friends at BPE Holding for Financial Investments (better known as B Investments) announced yesterday (pdf) that it was taking the “final steps” in completing its listing on the EGX this month. The company intends to list a total of 43,131,554 shares on the EGX through private and public placement. Bookbuilding for the private placement of 38,131,554 shares will run from 6-25 March, while the public offering will take place from 13-25 March. Proceeds will be used to grow the company’s current portfolio through acquisitions and new investments. “We are very pleased to grow our shareholder base through this IPO and capital increase,” said B Investments Chairman and co-founder Hazem Barakat. “This allows us to further deploy capital and transact on new investments to build on our existing portfolio.” Sigma Capital is the sole coordinator and bookrunner, while Zaki Hashem & Partners are acting as legal counsel to the issuer.

Ibnsina Pharma’s sales practices did not break competition rules, the company’s Co-CEO Omar Abdel Gawad told Bloomberg. His comments followed the Cairo Court of Appeals agreeing to hear Ibnsina’s appeal on a ruling that fined the company, alongside three other pharma manufacturers, a combined EGP 5.6 bn for alleged antitrust violations. “The opinion of the lawyers we consulted is that our position is very strong and this is why we haven’t sought a reconciliation,” Abdel Gawad explained, adding that the company is confident the fine will be overturned. On the other hand, Head of the Egyptian Competition Authority, Mona El Garf, said, “We are 100 percent sure that there is a violation and we see this ruling as fair and necessary to deter pharmaceutical companies attempting to breach the law.”

CLARIFICATION- On a related note, sources had told us that Cairo Poultry was not among the 12 poultry companies indicted by the Prosecutor General and sentenced by the Economic Court in an antitrust case. Al Borsa had named the company as part of the Egyptian Competition Authority’s investigation into the case back in August 2017.

Egypt is going to move away from the carry trade and increasingly into equities, EFG Hermes Head of Macro Strategy Simon Kitchen told Bloomberg TV. As interest rates continue to fall through the year there will be a shift into equities and the firm likes the “consumer story … consumers were battered last year by high inflation, this year is going to be a bit of a year of recovery,” Kitchen says. FDI is generally picking up, he added, and decent private sector flows are expected, broadening beyond oil and gas. The money coming in might take a little while to have an impact on the economy, but right now “what we’re looking for is the base effect recovery from a difficult 2017,” Kitchen says (watch, runtime 03:03).

Elsewedy Electric lands EGP 3.6 bn power lines contract for Dabaa nuke plant? The Egyptian Electricity Holding Company (EEHC) has contracted Elsewedy Electric to build power transmission lines worth EGP 3.6 bn to connect the Dabaa nuclear power plant to the national electricity grid, an unnamed EEHC source tells Al Borsa. The news comes as the Electricity Ministry is reportedly operating from a list of 10 Egyptian companies — including Elsewedy Electric — it will recommend for some of the USD 4 bn contracts up for grabs for the USD 30 bn plant.

Qalaa Holdings’ Egyptian Refining Company (ERC) expects to recover the cost of its delayed launch in six-years’ time, Managing Director Mohamed Saad told the press yesterday, Reuters reports. The company is on track to begin trial operations at the Mostorod facility in 3Q2018 and launch operations by the end of 2018 or early next year, he said. The project’s cost had risen to USD 4.2 bn from from USD 3.7 bn on the back of a 22-month delay due to financing issues. Banks and international funding institutions are providing as much as USD 2.9 bn in financing to the project, with shareholders providing the remaining USD 1.3 bn. The company will begin repaying its debts as of June 2019 and running for a 17-year period, Saad also said. Qalaa had said last week that ERC took on new finance and equity commitments.

INVESTMENT WATCH- The Ismail Cabinet is studying offers from four global firms to develop the Abu Tartour USD 750 mn phosphoric acid and fertilizers plant, according to a statement. The government has received offers from companies in Spain, Germany, China, and South Korea. The plant, which will be developed in partnership with the state-owned Misr Phosphate’s El Wadi Phosphate Company, will aim to produce an annual 1 mn tonnes of phosphate-based fertilizers that will be split between local consumption and export, according to the statement.

INVESTMENT WATCH- Sumitomo Electric Wiring Systems Egypt is planning to invest EGP 100 mn to expand its automotive wiring harness factory in Port Said, the company’s Managing Director Ahmed Magdy said, Al Mal reports. The Japanese-British firm recently inaugurated a new EGP 1 bn production line at its 6 October City factory, bringing the company’s total investments in Egypt to EGP 6.5 bn, Magdy notes. The company also has an “ambitious” plan to add new production lines across its facilities in Egypt, Magdy said, without providing further details.

INVESTMENT WATCH- IDEMIA is planning to invest EUR 70 mn in Egypt after the March presidential election, the company’s government relations officer tells Al Mal. The company, a digital security and identification technologies developer formerly known as OT–Morpho, has created national identification databases in India, Kenya, and Dubai, the official said.

The UAE’s Dana Gas is set to start drilling operations on the first well in its Mediterranean concession in Egypt in 2H2018, EGAS sources tell Al Shorouk. The company has excess liquidity that it will deploy to new projects in Egypt, including the drilling of three wells in its Delta concession, especially as it continues to receive late payments from the Egyptian government through to 2019, they add. Dana Gas had announced on Sunday that it received USD 10.4 mn last month from the sale of Egyptian natural gas condensate as part of a plan to recover outstanding receivables.

Land tenders in new administrative capital coming in May, holding company could consider EGX listing: The New Administrative Capital Company for Urban Development (NACCUD) will issue tenders for 2,500 feddans for development in the new capital in May, company managing director Mohamed Abdel Latif tells Al Borsa. Separately, NACCUD is planning to become a holding company that incorporates several companies working on the new capital. The company is also looking into listing a portion of its shares on the EGX, Abdel Latif said, without providing further details.

The Trade and Industry Ministry has decided to lift anti-dumping tariffs on bus and truck tires imported from China and India, head of the ministry’s international trade policies department Ibrahim El Seginy tells Al Mal. The ministry has also lifted anti-dumping tariffs on Chinese porcelain products and home appliances.

The Alexandria Passenger Transportation Authority is planning to issue tenders for 30 new tram cars this year, General Manager Ali Abdel Moneim tells Al Mal. The Authority also signed a USD 17.5 mn contract with a Ukrainian company to provide 15 new tram cars for the city line. In addition, several bodies including the Public Transport Authority are studying an offer from an unnamed Chinese company to establish a sea-land monorail connecting the two ends of the city on a build-operate-transfer basis.

Foreign Minister Sameh Shoukry met with a US delegation headed by Special Envoy Anthony Zinni yesterday to discuss updates on the Qatar boycott, a ministry statement said. This came one day after US President Donald Trump called President Abdel Fattah El Sisi to discuss “the American-Egyptian partnership on a range of security and economic issues” and “Russia and Iran’s irresponsible support of the Assad regime’s brutal attacks against innocent civilians,” according to a US Embassy readout.

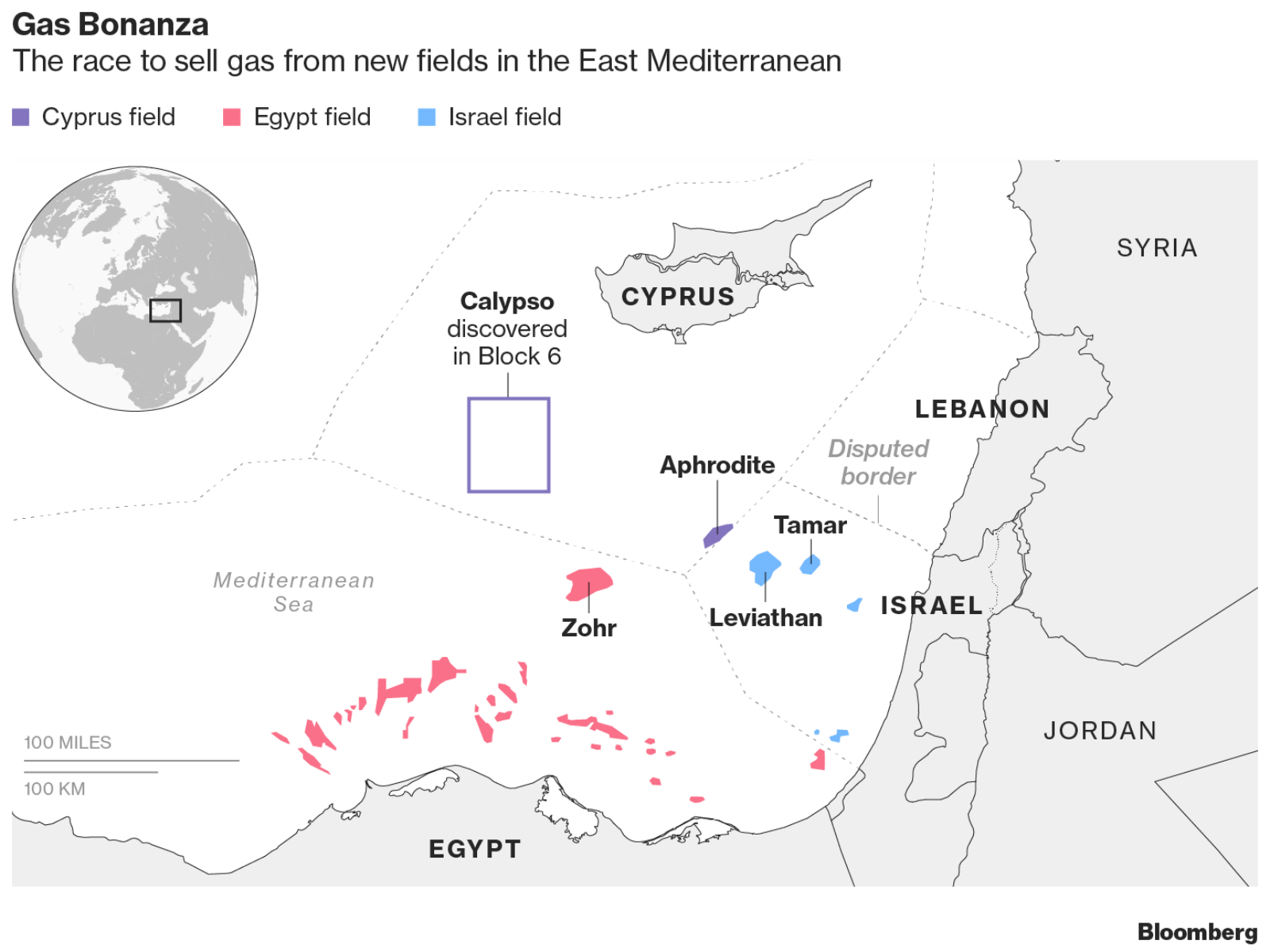

More feedstock for Egypt as natural gas export hub? Greek energy explorer and producer Energean has signed a USD 1.27 bn agreement with multiple banks to finance its development of Israel’s Karish and Tanin offshore natural gas fields, Bloomberg reports (paywall). The two fields hold a combined 2.5 tcf of contingent gas, and their development comes amid an acceleration in “the race to develop offshore energy resources in the eastern Mediterranean,” where several gas findings “position the region as a potential gas-producing hub on Europe’s doorstep.” Energean is expected to supply some 4.2 bn cubic meters of gas per year to Israeli companies and earmark any surplus output for export.

Spotlight: EFG Hermes One on One 2018 in Dubai

EFG Hermes Group Chief Executive Officer got things underway with opening remarks that highlighted transformation—of both the One on One and the firm. The One on One now stands as the largest frontier- and MENA-dedicated conference globally, a sharp change from its “very humble beginnings in Sharm El Sheikh in 2002 …back then, we must have had something like six Egyptian companies and around a dozen investors at best,” Awad noted.

The firm has undergone a similar transformation under his leadership, with Awad noting that, “Today, we look at our firm not as an investment bank, but as a provider of financial services to retail, HNW, institutional and corporate clients in the MENA and frontier region. To see this vision through, we have expanded our presence to Pakistan, Kenya, Bangladesh, the US and the UK providing our clients a wider reach than ever before.”

Key takeaways:

EFG Hermes’ transaction pipeline includes its first frontier markets IPO, slated for potential execution this year. That’s coming off a year in which the firm’s corporate advisory franchise executed 16 transactions and landed a number one ranking in the regional Thomson Reuters ECM league table

The firm is now the largest buy-side house in MENA following its investment last year in FIM and the finalization of its third renewable energy investment in Europe, bringing its total AUM to c. USD 5 bn. Expect new buy-side products from the firm this year, including one to be announced “in the coming weeks,” Awad said.

Investing responsibly: EFG Hermes has become the first Egyptian financial institution to sign the United Nations’ Principles for Responsible Investment.

A more private sector oriented Public Enterprise Ministry: The opening session of the conference was an interview with Public Enterprises Minister Khaled Badawy, who we are pleased to say is taking a much friendlier tone toward the private sector than we’ve heard from the 20-year-old ministry in … well, forever. The current central philosophy to the ministry, which comes off the back of the Egypt’s wider reform agenda, is the need to bring private capital into public enterprises. Badawy would also like to see more private sector management principles ingrained in state companies, by making them more profit-oriented and reliant on key business indicators and avoiding production for production’s sake.

The ultimate goal? To get state-owned companies outside the direct influence of bureaucrats and into the hands of investment professionals. He sees the long term plan for state managed assets to be placed under a sovereign wealth fund. Plans for an Egypt sovereign wealth fund are still down the road. Badawy named the bureaucratic old guard and its rigidity as a major challenge to reforming the sector. Egypt, however, has learned from the mistakes of privatization in the 1990s and is better equipped now to meet these challenges.

Key takeaways:

Raising the private sector’s involvement: Work on expanding the private sector’s role in the economy will, in the short term at least, be through the state IPO program. Badawy confirmed that 10 companies currently have slated for listing, though he did not detail which ones, saying the Finance Ministry would be responsible for the program and will make the announcement. He sees the government holding a controlling stake of at least 51% in each company brought to market—for the time being. Down the road, he expects all government owned shares in state-owned enterprises to be traded in the market through various investment vehicles, whether that’s the EGX or a sovereign wealth fund.

Restructuring before selling stakes: But before we can make these companies attractive to investors, they need to be reformed.

Which sectors? Badawy pointed several times to textiles, steel, automotive (specifically, the components industry), logistics and construction. He also sees petrochemicals as an attractive sector considering the boom in natural gas Egypt has seen of late. Badawy noted that out of 121 state companies, 48 are losing money. Some of these, particularly textiles, have substantial assets — with the public sector textile companies having assets totaling almost EGP 100 bn. Some of these would need to be sold to help bring companies much needed liquidity to fund their restructuring.

Legislative reform is also in the works. The current laws governing the Public Enterprises Ministry will need to be amended to bring it line with the goals of other legislation, such as the new Investment Act and the upcoming Automotive Directive.

What’s the status on a sovereign fund? Badawy told delegates that “The idea of the fund is being discussed internally and is in its early stages,” he said, but we had been under the impression from senior policymakers that it was far more advanced than that. His comments came a day after Planning Minister Hala El Said also said the government was interested in setting up a sovereign wealth fund, without providing more details.

Best quotes:

“Governments should not, in my personal opinion, manage profit-oriented companies. If the government wants to own an asset, it should be through a sovereign fund managed by professionals.” —in response to a question on which sectors the government should directly manage.

Speaking on the public’s aversion to privatization, Badawi said: “We had a problem approaching the IPO program, but we have passed that stage. The government has taken aggressive reforms over the past couple years. It had an impact on the mindset, and people took it well.”

Layoffs could be part of the privatization program, but they’re not they’re not the raison d’être of the program.

The first panel discussion of the conference looked at Structural developments in MENA equity markets, bringing together regional regulators and operators including:

- Khaled Abdul Razzaq AlKhaled, CEO Boursa Kuwait

- Khaled A. Alhomoud, member of the Board of Commissioners, Capital Market Authority of Saudi Arabia

- Mishaal Al_Usaimi, vice chairman of the Board of Commissioners and acting chairman / managing director, Capital Market Authority of Kuwait

- Mohamed Farid, chairman of the EGX

- Obaid Al Zaabi, CEO, Securities and Commodities Authority of the UAE

- Moderated by: Julian Bruce, head of UAE Securities Brokerage at EFG Hermes

Key takeaways:

Egypt: The emphasis has to be on deepening both the supply side (more IPOs) and the demand side, with the latter to include the introduction of new financial products and instruments (short-selling and derivatives), says Farid. Egypt already has a well-rounded regulatory framework, but look for changes that will make it faster to incorporate a fund and get it listed on EGX. Further changes could involve changes to how the closing price of equities is calculate.

UAE: The country is looking to bring larger family holding companies back to the market. The country introduced a self-regulating model in 2016 and changed listing regulations to accommodate family businesses and SMEs. The SCA will continue to look at how to encourage family companies to return to the market and is pushing to roll out blockchain and a sandbox for fintech.

Kuwait: Kuwait has had a poor IPO record, with only one company listing in the last six to seven years. The country is undergoing a four-phase reform process, said Al Usaimi. Regulators there have relaxed listing restrictions by removing the 30% free float and profitability requirement, introducing a new market segmentation mechanism, which goes live in April, and through plans to list the Kuwait Bourse by 1Q2019. The bourse also saw the introduction of T+3 settlement cycle. This could result in as many as IPOs this year or next. Future reform plans include introducing margin lending and short selling.

Saudi Arabia: The country’s reform priorities include updating rules and regulations on settlement cycle, IFRS, and reclassification of sectors in the market. New developments are coming, including the introduction of derivatives. While these need plenty of work and coordination with the commercial banks and authorized financial institutions, the country plans to have it up and running by the end of 2019.

Improving investability and expanding foreign ownership: The UAE hopes to open the door for 100% foreign ownership in some sectors through a new investment law currently being drafted, said Al Zaabi. The country has a vision of opening all sectors to allow for a minimum 49% foreign ownership once boards of companies have the confidence to be more exposed to foreign capital. As for Saudi Arabia, its Vision 2030 does call for greater foreign ownership, but it is too early for the country to allow foreign ownership levels to increase above 49%, said Alhomoud.

Challenges facing the reform cycle: The biggest challenge the UAE faces in terms of developing equity markets is attracting more institutional investors. Al Zaabi sees a need to develop investor confidence as a solution to the problem. He sees brokerages as playing a major role in this. EGX boss Mohamed Farid thinks the biggest mistake the country has made when expanding its equity markets has been the focus on institutional investors over retail investors. Fintech will play a role in bridging that gap, along with improving financial literacy.

The final session yesterday morning was headlined Entrepreneurial disruption across frontier and emerging markets and featured a panel discussion between:

- Ankur Shah, chief finance and development officer, Careem (the widely known ridesharing app)

- Faraz Khalid, chief executive officer, Noon (the e-commerce platform in which Emaar’s Mohamed Alabbar invested alongside Saudi’s Public Investment Fund)

- Mohamed El Kalla, founder and CEO, CIRA (Egypt’s largest investor in private education)

- Robert Willett, non_executive director, Mobile World Group (Vietnamese investor in everything from e-commerce to groceries and pharmacies)

- Moderator: Heather Henyon, founder, Women’s Angel Investor Network

The panel was heavy on Silicon Valley rhetoric transplanted to emerging markets, but featured a handful of ridiculously interesting facts.

Key takeaways:

The regional opportunity is staggering, even if it is fragmented. Consider that together, MENA, Iran, Turkey and Pakistan have:

- More than 650 mn people

- 1.5x the GDP of India

- Higher smartphone penetration than China

And yet only 2% of total consumer spending in this region via e-commerce, although 8.5% of the population has a credit card. That 2% figure? It’s better than Vietnam, where Willett says the comparable number is closer to 1%. In developed markets? Look for figures closer to 25-30% on the high end of the scale.

As that 2% moves closer to the 15% average in other markets, we’re looking at USD 400-500 bn annual sales opportunity in e-commerce and consumer internet.

Building an e-commerce platform will be expensive, with costs running as high as USD 60-70 to acquire a customer in the UAE and Saudi Arabia. “You need a 10-year horizon,” says Khalid.

E-commerce in MENA is less about convenience, but about access, says Khalid. It’s about connecting rural Saudi cities, for example, to global brands.

Cash-on-delivery is king in MENA. Consumers have moved from buying on desktops / laptops to mobile websites to via apps, but they still prefer to pay in cash rather than use their credit cards.

The standout performer of the panel was Egypt’s El Kalla, who proved himself articulate, engaging and passionate about his business, the largest private-sector investor in the nation’s education sector. (Yes, we’re Egyptian nationalists for saying this. But he was. Ask the Emirati guys sitting with us, who were captivated by his remarks.)

Careem is processing 1 mn transactions a day across 100 cities in 16 countries spanning from Morocco to Pakistan. Most of its (not)employees are ‘captains’ driving their own personal vehicles, though in some “more highly regulated countries, we worked with licensed [taxi] drivers.”

Mobile World now has more than 1,000 outlets, including 900 big box stores and some 300 stories selling fresh food. It’s now expanding into pharmacies. It has a 40% share of Vietnam’s phone market, 20% of its white goods market and its new food line already has a 5% market share.

Staff come for the mission, the challenge and the work environment — but they stay for the employee stock ownership program. Just about everyone on stage tipped their hat to the importance of ESOPs to keeping talented staff. Mobile World has 5% of shares set aside for an ESOP, while Careem has had a 15% option pool allocated to the ESOP “from the beginning,” Shah says, “to make sure everyone from the CEO to the call center agent is a shareholder…Having gone through one or two secondary sales when we’ve been able to provide liquidity to broader pool of colleagues has given it meaning.” 95% of candidates didn’t negotiation on it before, he says, but they do now.

Buy the companies that would ‘disrupt’ you, El Kalla says, noting that his company’s captive VC activity does that just.

Careem is still in talks with regulators and legislators in Egypt and Pakistan, says Shah — no news there, and no additional detail, either.

Tech types think something will have to change on the regulatory front for there to be technology IPOs in MENA when the time is right.

Egypt in the News

The crackdown on media continued to dominate headlines of Egypt in the foreign press this morning in the wake of pro-government talk show host Khairy Ramadan’s arrest on charges of insulting the police. The case of Ramadan, who was released on bail of EGP 10,000 yesterday, “comes amid a climate of increasing pressure on journalists with frequent accusations of ‘fake news’ leveled at individual reporters and outlets, even those reporting in favor of the state,” The Guardian’s Ruth Michaelson notes.

This came as US State Department Spokesperson Heather Nauert said the US is concerned about reports of journalists being detained in Egypt. The Hill also carried the story.

A crackdown on dissent in Egypt and other countries in the Middle East has partly averted large-scale unrest that could have followed subsidy cuts and austerity measures, Andrew England and Heba Saleh write for the Financial Times. They speak to people from Egypt, Tunisia, Saudi Arabia, and Jordan who believe the status quo will ultimately lead to a second Arab spring.

The Market Yesterday

EGP / USD CBE market average: Buy 17.5636 | Sell 17.6622 EGX30 (Monday): 15,709 (+1.2%) THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 1.2%. CIB, the index heaviest constituent ended up 1.5%. EGX30’s top performing constituents were SODIC up 6.0%, Heliopolis Housing up 4.4%, and Amer Group up 3.2%. Yesterday’s worst performing stocks GB Auto down 1.7%, Egyptian Aluminum down 1.3%, and EFG Hermes down 0.9%. The market turnover was EGP 1.4 bn, and foreign investors were the sole net sellers. Foreigners: Net Short | EGP -37.8 mn Retail: 47.2% of total trades | 42.2% of buyers | 52.2% of sellers Foreign: 25.9% of total | 24.6% of buyers | 27.1% of sellers WTI: USD 62.73 (+0.26%) TASI: 7,366.83 (-0.03%) (YTD: +1.94%)

EGP / USD at CIB: Buy 17.56 | Sell 17.66

EGP / USD at NBE: Buy 17.55 | Sell 17.65

Turnover: EGP 1.4 bn (24% ABOVE the 90-day average)

EGX 30 year-to-date: +4.6%

Regional: Net Long | EGP +11.5 mn

Domestic: Net Long | EGP +26.3 mn

Institutions: 52.8% of total trades | 57.8% of buyers | 47.8% of sellers

Regional: 15.4% of total | 15.8% of buyers | 15.0% of sellers

Domestic: 58.7% of total | 59.6% of buyers | 57.9% of sellers

Brent: USD 65.54 (+1.82%)

Natural Gas (Nymex, futures prices) USD 2.71 MMBtu, (+0.33%, April 2018 contract)

Gold: USD 1,323.30 / troy ounce (+0.26%)

ADX: 4,609.55 (+0.11%) (YTD: +4.80%)

DFM: 3,206.56 (-0.17%) (YTD: -4.85%)

KSE Weighted Index: 413.82 (-0.01%) (YTD: +3.09%)

QE: 8,454.18 (-3.16%) (YTD: -0.81%)

MSM: 4,988.00 (-0.30%) (YTD: -2.18%)

BB: 1,374.59 (-0.41%) (YTD: +3.22%)

Calendar

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

06-07 March (Tuesday-Wednesday): The Sustainable Industrial Areas International Conference 2018, The Nile Ritz Carlton hotel, Cairo.

07-11 March (Wednesday-Sunday): ITB Berlin Convention, Berlin, Germany.

12-16 March (Sunday-Saturday): AmCham’s 40th Doorknock mission, Washington D.C., USA.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo.

02-03 April (Monday-Tuesday): Pharos Holding’s investor conference: In Search for Egypt Alpha, Cairo.

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.