- CBE signals victory over inflation, cuts interest rates by 100 bps, carry trade still looks solid, 20% CDs are dead. (Speed Round)

- Resuming flights to Egyptian resorts “impossible” right now, Russian deputy PM says. (Speed Round)

- US threatening Egypt, 11 other countries with steel tariffs. (Speed Round)

- Ethiopia declares new state of emergency as Desalegn resigns. (What We’re Tracking Today, Last Night’s Talk Shows)

- EXCLUSIVE- Breaking down the three competing bids for the 6.6 GW Hamrawein power plant. (Speed Round)

- Hassan Allam Holding looking to acquire 60% of PGESCo -report. (Speed Round)

- Local component requirements for Automotive Directive are being revised -Kabil. (Speed Round)

- Egypt improves to fourth place on Bloomberg’s ‘Misery Index.’ (What We’re Tracking Today)

- The Market Yesterday

Sunday, 18 February 2018

And finally, a rate cut

TL;DR

What We’re Tracking Today

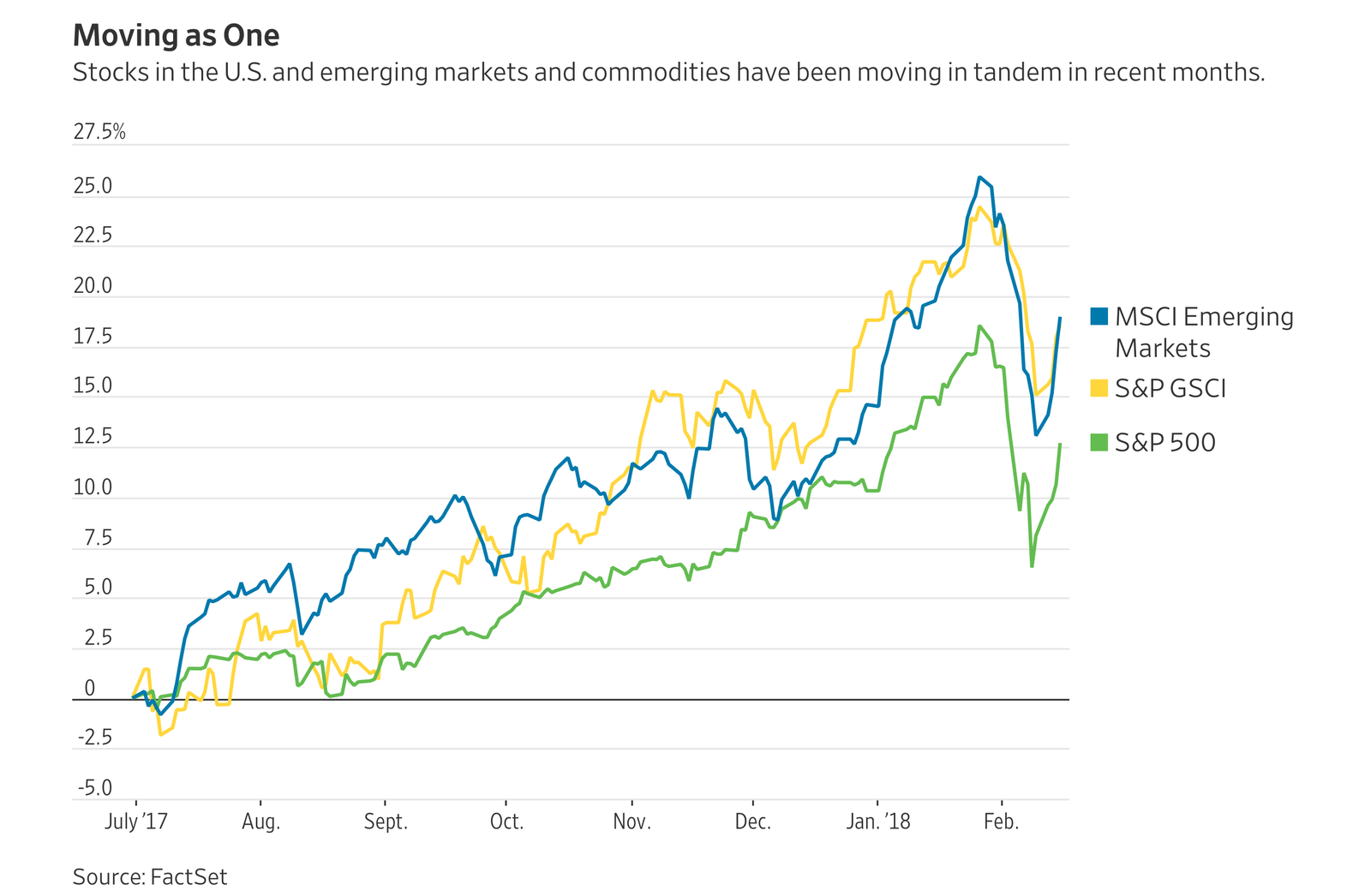

So, is the correction over? The EGX30 gained 1.1% on Thursday and Wall Street on Friday “finished its best week in years as stocks staged a recovery from a tumultuous period that pushed major indexes into correction territory, a sign that bullish sentiment remained intact,” the Wall Street Journal writes. The S&P500 and the Dow Jones each climbed 4.3% last week, and the MSCI Emerging Markets Index is up 5% from its recent low. Commodities are also on the rebound.

Throw in the central bank’s 100 bps rate cut late on Thursday and we’re relatively happy campers this morning. Relative being the key word, because we’re a little less pleased with developments up the Nile at one of our key neighbors:

Ethiopia has declared a six-month state of emergency following the surprise resignation on Thursday of Prime Minister Hailemariam Desalegn, effectively kicking talks with Egypt on the Grand Ethiopian Renaissance Dam far down the priority list for our upstream neighbor’s government. Desalegn said he was resigning over anti-government violence. The snap resignation came amid protests in Ethiopia’s restive Oromia region, PBS reports. Desalegn said his resignation was “vital in the bid to carry out reforms that would lead to sustainable peace and democracy” and that he would remain in office until parliament chooses a successor. The state of emergency will ban protests and publications that incite violence in one of the world’s fastest-growing economies, the Financial Times notes.

The background: The backdrop to the resignation is anti-government protests by the ethnic Oromo and Amharic people, who are calling for greater civil rights and political inclusion. Long time readers of Enterprise will remember that Ethiopia had accused Egypt back in 2016 of stoking Oromo protests. “The imposition of a new state of emergency may indicate that … Desalegn’s resignation on Thursday was the result of tensions among the four parties in the ruling coalition,” which has been in power since 1991, Reuters notes.

Where’s this going? One Ethiopian political analyst sees things spiraling. Events in Ethiopia, Hassan Hussein says, “feel like a revolution against a regime that will do whatever it can to stay in power. Things are changing very quickly…The country might just go into a prolonged period of chaos but I can see the scenario where the government itself is toppled,” according to the FT.

Desalegn’s resignation has prompted Sudan ask that the next tripartite meeting on GERD be postponed, Al Shorouk reports. It was originally slated for 24-25 February, and Cairo, Addis Ababa and Khartoum are yet to agree on a new date. The three countries’ presidents had set a one-month deadline in January to resolve the deadlock in negotiations over the dam.

This comes as we hear that the Sudanese government has reportedly asked members of the Ikhwan who had fled there from Egypt to leave the country, a source with close ties to the matter tells Al Shorouk. This comes less than a week after Sudanese and Egyptian intelligence officials met to set up a framework for improving ties, which have soured over failed GERD discussions and border disputes.

Thursday’s interest rate cut, Desalegn’s resignation and the developments in Sudan are the talk of the town, if last night’s talk shows (below) are anything to go by.

Egypt ranked fourth on Bloomberg’s Misery Index for 2018, coming down from second place last year, thanks largely to reform efforts and focus on private investment. Venezuela and South Africa are seen as the “world’s unhappiest countries,” coming in in first and second place, respectively. Argentina follows in third, while Greece and Turkey are tied in fifth place. The index, “which sums inflation and unemployment outlooks for 66 economies,” sees that “rising prices are more of a threat to the global economy this year than joblessness.” Still, the data points to a “a global economic outlook that remains bright overall.” Tap here for the full rundown.

SICO’s new Nile X smartphone goes on sale today: Our friends at Pharos Investment Banking are celebrating today the launch (pdf) of the first locally assembled smartphone. The Nile X, from the Egyptian Company for Silicon Products (SICO), was introduced during Cairo ICT last year. The Android-powered Nile X was produced through partnerships with Google and Qualcomm. The devices will be marketed locally and elsewhere in the MEA region. The six available models range in price from EGP 999-4,200, according to Al Mal. Pharos is SICO’s exclusive financial advisor.

In miscellany this morning:

- The Ritz detox: How Saudi Arabia’s business elite coped with being locked up in the Ritz-Carlton during the kingdom’s “anti-corruption” purge. (Financial Times)

- Charges in US election hacking: The US has formally charged more than a dozen Russians with interference in the 2016 elections. (Reuters)

- Delaying the spread of prostate cancer: Two meds, one of them already approved for other use, could delay the spread of aggressive prostate cancer by up to two years. (New York Times)

What We’re Tracking This Week

Pride Capital is hosting a workshop to talk over big topics in fintech, with the first installment covering insurance tech and how technology can deliver affordable, convenient health insurance. The event will be held tomorrow at the Greek Campus on Tahrir. Register here.

The T-20 is holding a fireside chat on blockchain. The gathering takes place on Tuesday, 20 February at 7:30pm and is open to T20 members and select invitees from the larger business community. Enterprise readers may register here to request an invite.

Enterprise+: Last Night’s Talk Shows

An interest rate cut and the resignation of Ethiopia’s prime minister kept the talking heads busy last night.

Hona Al Asema’s Lamees Al Hadidi spoke to National Bank of Egypt (NBE) Deputy Head Yehia Aboul Fotouh about the interest rate cuts, which he said would help banks lower the cost of borrowing. Aboul Fotouh said the bank will now offer 17% certificates of deposit in place of the infamous 20% predecessors, while its entry in the 16% CD space will now yield 15% (watch, runtime: 6:11)

Interest rates could drop by another 400 bps by the end of 2018, CI Capital economist Hany Farahat told Lamees (watch, runtime: 3:54).

The MPC’s decision is a step in the right direction, but its impact will be limited, our friend Hani Berzi phoned in to say. The Edita boss said the current lending rate is still unattractive to businesses and that a fair level would be around 12% (watch, runtime: 5:45).

Lamees then shifted over to regional politics, speaking to Hany Raslan from Al-Ahram Center for Strategic Studies to talk about the Ethiopian PM’s resignation. Raslan said Desalegn’s resignation could make Ethiopia more flexible where negotiations over its grand dam are concerned (watch, runtime: 5:11)

Over on Kol Youm, Amr Adib also zeroed in on the resignation, railing on and on about Egypt needing an action plan mapping out the future of talks over the Grand Ethiopian Renaissance Dam (watch, runtime: 12:44).

Back on Hona Al Asema, Lamees attempted to verify reports that Sudanese authorities have asked members of the Ikhwan to leave the country. The host commended the move, describing it as a “positive” development in Egyptian-Sudanese relations if true (watch, runtime: 3:24)

Adib was equally unsuccessful in confirming the report (watch, runtime: 1:46) and spent the rest of his time discussing regional tensions between Mediterranean countries (watch, runtime: 2:15) and following up on the latest in the arrests of ex-top auditor Hisham Genena (watch, runtime: 5:50) and ex-presidential candidate an Ikhwan member Abdel Moneim Aboul Fotouh (watch, runtime: 4:56).

Lamees also got in on a bit of that action, saying that Aboul Fotouh is still prominent within the brotherhood despite his resignation ahead of the 2012 presidential elections. She said that his political party Strong Egypt also carries Islamist undertones, which is illegal under the constitution. She said the Salafist Al Nour Party is also unconstitutional (watch, runtime: 1:49:46)

Meanwhile, Al Hayah Al Youm’s Nahawand Serry (watch, runtime: 20:00) and Masaa DMC’s Eman El Hossary (watch, runtime: 8:15) both spoke to Nasser Military Academy advisor, Gen. Mohamed El Ghobary for updates on the military’s ongoing anti-terror campaign in North Sinai.

Speed Round

CBE signals victory over inflation, cuts interest rates by 100 bps: The central bank’s Monetary Policy Committee cut interest rates by 100 bps at its meeting on Thursday, the first rate cut since the EGP float in late 2016. The MPC lowered its overnight deposit, overnight lending and main operations rates by 100 bps each to 17.75%, 18.75%, and 18.25%, respectively. The discount rate was also cut by 100 bps to 18.25%, the CBE said in a statement on Thursday (pdf). “[The cut] remains consistent with tight real monetary conditions; a necessary requirement to achieve the inflation target of 13% (±3 percent) in 4Q2018 and single digits thereafter.”

The base effect has kicked in: “Inflationary pressures have been contained, a consequence of tighter real monetary conditions. This has been evident by relatively tame monthly inflation figures, despite being affected by upward adjustments of regulated prices,” read the statement. Inflation had dropped for the sixth consecutive month in January, with annual inflation falling to 17.1% and core inflation easing to 14.35%. “Favorable base effects have been accelerating the decline of annual inflation rates since November 2017,” said the CBE.

GDP strength also factored in: The central bank noted that GDP continued to grow for the fifth consecutive quarter, culminating in a rate of 5.3% in 2Q2017-18, “the highest economic growth since 2010.” The CBE attributed this growth to higher foreign demand for Egyptian opportunities since the float.

The pick-up of economic activity coincided with the continued narrowing of the unemployment rate, said the CBE. The unemployment rate in 3Q2017 was 11.9%, according to CAPMAS. The unemployment rate dropped to 11.3% in 4Q2017 from 12.4% in 4Q2016,CAPMAS announced on Thursday, as per Reuters. The unemployment rate in 3Q2017 was 11.9%, according to CAPMAS.

Economists hail the beginning of Egypt’s easing cycle: “A 1% cut is a great signal for investors that the tightening of monetary policy has ended and also a conservative approach which is highly needed in order to test market activity moving forward,” CI Capital Asset Management economist Noaman Khalid told Reuters. He said he expected another cut of 100 basis points at the bank’s next policy meeting, scheduled for March 29. Capital Economics believes that the easing cycle is likely to result in sharper interest rate cuts than most anticipate. “We expect an additional 650 bp of rate cuts by the end of 2019,” the firm said in a research note on Friday (pdf).

The carry trade still looks attractive: Others are looking to the US Fed to see if Egypt’s debt will remain attractive in light of global market turbulence. “The main concern is whether Egypt will continue to be an attractive destination for portfolio investments, particularly if the Federal Reserves also raises rates in the coming months,” said Bloomberg’s Economics’ Ziad Daoud. Average yields on Egypt’s debt dropped to 15% prior to the rate cuts, which some argue is still very attractive. “The carry trade in Egypt remains very attractive,” said Brett Rowley, Managing Director at TCW Group, which currently holds Egyptian debt.

Industry is looking for further rate cuts to unlock capex spending, members of the Federation of Egyptian Industries (FEI) tell state-owned Ahram Gate.

Bye-bye, 20% CDs: The three largest state-owned banks announced yesterday that they would stop issuing their infamous 20% CDs. Banque Misr will be offering 17% CDs with one-year maturity, down from 18 months, Chairman Mohamed El Etreby tells Al Mal. The National Bank of Egypt and Banque du Caire also followed suit. The three also lowered yields on 16%-yielding Platinum CDs by 100 bps. Banque du Caire will begin issuing CDs offering 15% today, said the bank’s Vice Chairman Amr El Shafei.

CBE, Finance Ministry look to make it easier for foreigners to buy Egyptian paper: The CBE and the Finance Ministry are apparently working on a mechanism to allow foreign investors to directly buy government bonds and treasuries, Al Mal reports. The CBE is studying developing an online platform with clearing house Euroclear Bank, which would allow investors to log orders without having to go through banks licensed to buy them at auctions. The move is expected to help strengthen inflows to the secondary market, which currently stand at USD 21 bn, the newspaper says.

From the department of moving the goalposts: Resuming flights between Russia and and resort cities in Egypt is impossible at the moment, Russian Deputy Prime Minister Arkady Dvorkovich said, according to TASS. “I was approached by the Egyptian deputy foreign minister who asked when the resort cities will be open [for air traffic]. I said there is no such an opportunity now," Dvorkovich said. However, flights to Cairo are set to be restored this month.

Have flights with Cairo have been postponed to the end of the month? Cairo International Airport authorities received a memo on Friday from Russian national carrier Aeroflot requesting the postponement of a planned resumption of Russian flights to the airport for a week due to technical reasons, according to state-owned Al Ahram, which claims to have a copy of the memo. “Aeroflot is currently waiting on security approvals and necessary permits from Russian authorities to resume flights to Cairo,” the memo read. “Not all agreements between EgyptAir and Aeroflot have been signed,” said Russian Transportation Minister Maxim Sokolov on Thursday. These should be concluded in a matter days, he added, according to Russian news agency RIA Novosti (Russian). He said that both airlines can begin selling tickets.

Last we had heard from official Russian statements was that the resumption of flights between Cairo and Moscow had been delayed to this Tuesday from mid-month. The resumption of flights between the cities will very likely take place on 20 February, Dvorkovich said on Thursday, according to RIA Novosti (Russian). The resumption of flights was discussed between Foreign Minister Sameh Shoukry and his Russian counterpart Sergei Lavrov at a meeting in Munich on Friday, the Foreign Minister said in a statement.

US looks to impose heavy tariffs on steel imports from Egypt, 11 others: The US Commerce Department has put Egypt in a list of 12 countries that it recommends the Trump administration slap with import tariffs on steel. Egypt joins Brazil, China, Costa Rica, India, Malaysia, Russia, South Korea, South Africa, Thailand, Turkey and Vietnam, which the department recommends hitting with a tariff of least 53%. Other countries would be subject to a quota limiting their tariff-free access equal to their 2017 steel exports to the United States.The department’s Section 232 report purposes other alternatives: A global tariff of at least 24% on all steel imports from all countries or a quota on all steel products from all countries equal to 63% of each country’s 2017 exports to the US. The report claims that the move would be a measure to curb the US’ massive steel imports (most of which are produced in China), which have risen to four times their exports.

EXCLUSIVE- Details of three competing Hamrawein power plant bids revealed: Details on the offers presented for the 6.6 GW-capacity Hamrawein power plant — the largest tender ever held by the Egyptian Electricity Holding Company (EEHC) — began to emerge over the weekend. As we noted last week, three consortiums are bidding on the project. Sources also tell us that the EEHC will announce the final winners of the project in two weeks. Our sources tell us the breakdown of the offers is as follows:

- Orascom Construction, Elsewedy Electric, Mitsubishi Hitachi Power Systems consortium: The group is quoting USD 7 bn to build the plant and has generation costs at USD 0.045 per KWh.

- Shanghai Electric, Dong Fang, Hassan Allam Construction consortium: The consortium is quoting a price tag of USD 4.4 bn, with 27% of the costs to be paid in EGP to meet the EEHC’s domestic component requirements. They will charge USD 0.054 per KWh to generate power.

- GE: The company, which appears to be going at it alone, would charge USD 5.8 bn to develop the plan and is quoting a feed-in-tariff rate of USD 0.07 per KWh.

M&A WATCH- Hassan Allam Holding is looking to acquire 60% of the Power Generation Engineering and Services Company (PGESCo) for EGP 420 mn this month, sources from Hassan Allam told Al Borsa on Thursday. The company hopes to acquire the stake from existing shareholders, including CIB, Saud Consultants, and BPE Partners. Hassan Allam has also reportedly agreed that it would not be involved in the management of PGESCo once the acquisition is complete, sources added. The Electricity Ministry holds a 40% stake in PGESCo. Matouk Bassiouny is has been tapped to advise on the transaction, the story claims, without noting who the firm is reportedly advising.

LEGISLATION WATCH- Local component requirements for Automotive Directive are being revised: Trade and Industry Minister Tarek Kabil said yesterday that the minimum local component requirements that would make producers eligible for incentives under the Automotive Directive are being revised, according to a ministry statement (pdf). Kabil had said last November that auto manufacturers would be eligible for incentives if they are able to meet a minimum local component requirement of 45%, which over the course of eight years would rise to 60% for personal vehicles and smaller of group commercial vehicles. Local content requirements for light trucks would peak at 70%.

Timeline unclear: Kabil did not hint at a timeline for the bill to be introduced in the House or provide any other details. The Automotive Directive, which means to encourage local assemblers to move further up the value chain into manufacturing in return for incentives that would not be enjoyed by cheaper imports from the EU, Morocco and Turkey, has been stalled for months while a German consultancy firm advises on its redrafting. The latest from the rumor mill had claimed that the bill should be ready by 2Q2018.

The minister’s statements came during the inauguration of Belarusian state-run automotive manufacturer Minsk Automobile Plant’s (MAZ) new truck production line in Egypt, which has launched under a joint venture agreement with the Helwan Machinery and Equipment Manufacturing Company.

LEGISLATION WATCH- Cabinet to get executive regulations for the Universal Healthcare Act by week’s end: Health Minister Ahmed Rady is due to present the executive regulations to the newly-passed Universal Healthcare Act by the end of the week, the minister said yesterday, Al Masry Al Youm reports. Rady confirmed the law would be put into effect by 1 July, starting with 10 hospitals in Port Said. Sources tell Al Shorouk that the Finance Ministry will review the 67-article document before it’s passed over to the Cabinet. President Abdel Fattah El Sisi had signed the Universal Healthcare Act into law last month.

Background: The health coverage plan sets a 0.0025% tax on sales revenues for every company operating in Egypt to fund the system and imposes premiums for employers of 4% of each employee’s monthly salary, while employees would pay premiums of only 1% of their salary into the system.

IN OTHER LEGISLATIVE NEWS:

- A draft law on small and medium-sized industries that will include tax and non-tax incentives for SMEs to join the formal economy awaits cabinet’s touch before it ships it over to the House of Representatives, a government source tells Youm7.

- A new building code goes up for discussion at the Housing committee in the coming days, Al Shorouk says.

EGAS to hold exploration tender for nine blocks by June: EGAS plans to hold an international exploration tender for nine blocks “before the end of 1H2018,” EGAS Vice Chairman for Agreements and Exploration Ahmed Salah Abdel Wahed said on Thursday, Youm7 reports. The tender includes six offshore and three onshore blocks. Though he did not specify where these blocks will be, the offshore ones are expected to include areas in the Mediterranean as EGAS has put a plan to issue tenders for natural gas exploration annually, with a focus on the Mediterranean. Last week, Oil Minister Tarek El Molla said that the ministry plans to float tenders in the West Mediterranean once seismic mapping of the area is complete and a marketing strategy for the field has been developed. He added that the Red Sea and South Egypt areas will also see tenders — for the first time — once geological data has been collected.

Will the impact of the early launch of the Atoll gas field be minimal? Analysts speaking to chemical industry news firm ICIS appear to think so, adding that LNG imports are likely to continue to the end of the year. “The Atoll field is a reasonably significant addition to the trend of growing domestic gas production in Egypt, but on its own it would only have a limited impact,” said Andy Flower, an independent LNG consultant. BP had announced the launch of the Atoll gas field seven months early last week.

Meanwhile, Eni is doing well—and preparing to reap the rewards of Zohr, as its net profits more than doubled in the fourth quarter to c. EUR 1 bn and production in December reaching an all time high of 1.9 mn boe/d. Production from Zohr is expected to 70,000 boe/d for Eni this year, CEO Claudio Descalzi said in the company’s earnings release (pdf).

Gov’t launches sanitation services holding company, will offer stakes to investors: The Environment Ministry signed on Thursday an MoU with the National Bank of Egypt, Banque Misr, National Investment Bank, and the Maadi Company for Engineering Industries to establish a garbage collection holding company, Al Shorouk reports. The government is expected to hold a 51% stake in the company, with the remainder open to other stakeholders including investors, banks, garbage collectors unions, and civil society organizations, MP Mona Gaballah had said last year.

INVESTMENT WATCH- USD 350 mn medical city to be established in Matrouh: Two unnamed companies from the US and UAE have partnered up to build a world-class medical city in Matrouh at an investment cost of USD 350 mn, Matrouh Governor Alaa Abu Zeid tells Al Shorouk. The project, which will be run by the US company once completed, is expected to house a number of specialized state-of-the-art hospitals and medical care centers that will aim to make Egypt a hub for medical tourism, said the project’s Chief Executive Gary Lang. The 370-feddan medical city will open its doors with a capacity of 600 hospital beds that will gradually increase to 6,000, he added. Details on construction timeline were not disclosed.

MOVES- Gold miners Aton Resources announced it has appointed Ahmed Mehelmy to its Advisory Board. Mehelmy currently runs Fortune Financial Team, a corporate finance advisory firm that he founded in 1996.

MOVES- Mohamed Edris has arrived in New York to assume his duties as the new Permanent Representative of Egypt to the United Nations, succeeding Ambassador Amr Aboulatta, Al Shorouk reports. Edris previously served as Egypt’s Ambassador to Ethiopia and its permanent representative to the African Union.

Stocks in Dubai are showing the biggest discount when compared to the EGX 30 in almost three years, Filipe Pacheco writes for Bloomberg. “A rally in Egyptian stocks since the country’s 2016 currency float made its benchmark the best performer in the Middle East last year, while a lack of positive catalysts has weighed on shares in Dubai,” Pacheco writes. Naeem Holding director of research Allen Sandeep explains that “the undervaluation in Egypt shares was explained, to a certain extent, by the currency risk premium that was perceived by investors last year … With no more currency risks and repatriation challenges, there is a valuation discount adjustment that is bound to happen.” Equities in the UAE are more event driven, with people nervous about the outlook for oil, and are linked to weaker USD, Sandeep adds.

You’re welcome, Nigeria: Nigeria sold USD 2.5 bn in eurobonds on Thursday as it sought to lower funding costs by using the notes to refinance higher-yielding naira debt, Bloomberg reports. Nigeria issued USD 1.25 bn of 12-year bonds with a yield of 7.14 % and a separate 20-year tranche, also USD 1.25 bn, at 7.7%. Investors placed more than USD 11.5 bn of orders, according to the ministry. The sale completes a program of increasing foreign debt to help reduce the burden of double-digit yields on local-currency bonds. Nigeria went to market one day after Egypt’s successful USD 4 bn eurobond issuance demonstrated EM-debt appetite was still significant despite the global sell-off.

Egypt in the News

The real drama in Egypt’s presidential elections is not surrounding the candidates, but on the sidelines, Tarek El Tablawy writes for Bloomberg. El Tablawy was commenting on the arrest of former presidential candidate Abdel Moneim Aboul Fotouh, who, according to the Associated Press, has been referred to state security prosecutors for questioning. “Officials say prosecutors have documents and video recordings that allegedly show that Aboul Fotouh has been in contact with Brotherhood leaders in exile.” Bel Trew also uses the story to say “Egyptian authorities are widening a crackdown against opposition figures before next month’s elections” in The Times.

The military’s offensive in Sinai is still getting significant ink in the foreign press. Egypt’s military offensive in Sinai “has the whiff of an election-eve publicity stunt,”The Economist says. Meanwhile, the AFP is noting statements by the Armed Forces that the military is pressing on with the offensive after receiving intelligence that the Sinai peninsula could be global jihadists’ new home base after being pushed out of Syria and Iraq.

Also worth a listen this morning: The Financial Times released a podcast of Heba Saleh’s profile of Mada Masr as “one of the few Egyptian media outlets that dares to challenge the status quo.”

Worth Watching

Is Mohamed Salah the cure for Islamophobia? Liverpool fans have been belting a new chant vowing to become Muslim and go to the mosque if Salah keeps up his stellar performance with the Premier League team this season (watch, runtime 0:28). The song is a stark departure from British fans’ often discriminatory behavior, showing their appreciation for Salah’s performance and how it has made them “more apt to accept his ethnic and religious background,” the Washington Post reports. Salah has just netted his thirtieth goal for Liverpool this season, Reuters reports.

Diplomacy + Foreign Trade

Polish bn’aire Roman Karkosik will be heading a delegation to Egypt from 24-27 February to meet with the ministers of trade, transport, and military production, according to Youm7. Potential projects include an auto parts plant, a plastic recycling facility, and engine oil and superstructure materials plants.

US Central Command (CENTCOM) Commander Joseph L. Votel met on Thursday with Defense Minister Sedki Sobhy and military Chief of Staff Mohamed Farid to discuss joint military exercises, including Bright Star, according to an Armed Forces statement. Votel also sat down with President Abdel Fattah El Sisi (pdf).

The African Development Bank (AfDB) and Egypt are “championing a new push for African countries to work together towards building a new Africa driven by innovation and technology,” AfDB said in a release.

Qatar wants to see Middle Eastern countries resolve their differences and form a security pact “modeled on the EU,” Sheikh bin Hamad Al Thani said on Friday, Reuters reports.

Foreign Minister Sameh Shoukry met with F-16 manufacturer Lockheed Martin’s Chairperson Marillyn Hewson in Munich yesterday to discuss further aerospace cooperation. Shoukry also met with his Belarusian counterpart Vladimir Makei to discuss preparations for an MoU on ICT cooperation.

Shoukry discussed ways to revive Palestinian peace talks with UN Secretary General Antonio Guterres, according to a ministry statement. The minister also met with UN Special Representative for Libya, Ghassan Salamé, for talks on Libya and discussed efforts to curb terrorism and illegal migration with French Armed Forces Minister Florence Parly and Greek Defense Minister Panos Kammenos. Rounding off Shoukry’s busy diplomatic schedule was a meeting with Chairman of the European People’s Party Manfred Weber.

This comes as Egypt cuts off diesel shipments to Gaza on Wednesday, leading the strip’s only power station to stop working, according to Ynet News.

Energy

EETC to receive offers for 200 MW Kom Ombo solar power plant next month

The Egyptian Electricity Transmission Company (EETC) will begin receiving offers for the 200 MW solar power plant in Kom Ombo next month, sources tell Al Borsa. The bidding window was pushed several times to allow the Electricity Ministry time to agree on the feed-in tariff for the project, they add. Orascom Construction, ACWA Power, and Elsewedy Electric are among the qualifying companies.

Basic Materials + Commodities

Hero Foods looking to increase exports 20% in 2018

Hero Foods is looking to increase its exports 20% this year to EGP 420 mn, up from EGP 350 mn last year, Al Borsa reports. The company plans to tap into new export markets, including Nigeria, Côte d’Ivoire, and Libya throughout the year, export manager Wessam Samir says. Hero is also planning to add a new production line to begin manufacturing peanut butter.

Abu Auf to invest EGP 30 mn to increase packaged dates production

Samo Trading Company is planning to invest EGP 30 mn this year to increase the production of its packaged dates brand Abu Auf, Al Borsa reports. The company is looking to boost its packaged dates exports and tap into new markets, including Latin America and the EU.

Agriculture Ministry expects 16% y-o-y increase in this year’s wheat harvest

The Agriculture Ministry is forecasting a 16% y-o-y increase in this year’s wheat harvest to 9.8 mn tonnes, up from 8.4 mn tonnes last year, ministry sources tell Al Borsa.

Manufacturing

EBRD lends Angel Yeast Egypt USD 52 mn

The European Bank for Reconstruction and Development (EBRD) announced lending Angel Yeast Egypt USD 52 mn. The company, a global yeast manufacturer, is the Egyptian subsidiary of China’s Angel Yeast Co. “The loan will enable Angel Yeast Egypt to increase production of dry yeast, which is mainly exported, and to launch a yeast extract, a higher value-added product. The company is already working with local suppliers of molasses, a by-product of the sugar industry, and will increase its purchase of local raw materials,” EBRD says.

IDA signs contracts with Polaris Al Zamil, SDM for two industrial zones in Sadat City

The Industrial Development Authority (IDA) signed on Thursday contracts with Polaris Al Zamil and SDM to develop two 1.4 mn sqm industrial zones in Sadat City at an initial investment cost of EGP 500 mn, according to a Trade and Industry Ministry statement (pdf). Initial designs will be complete in three months’ time, while infrastructure and development work will take two years, group Deputy Manager Bassil Shuara tells Al Masry Al Youm.

Tourism

Mena House Hotel rebrands as Marriott Mena House

The Mena House Hotel has officially been rebranded as Marriott Mena House, Marriott International announced. Marriott had signed a hotel management contract with the Egyptian General Company for Tourism and Hotels (EGOTH) earlier this month to manage the property, which is split between an historic palace and an attached modern hotel building. Marriott International “continues to see a robust pipeline of over 1600 rooms under development over the next 3-5 years,” according to the hotel group statement.

Banking + Finance

NBE looking to secure USD 500 mn loan by June’s end

The National Bank of Egypt (NBE) is in talks with international financing institutions for a USD 500 mn loan by June’s end, chairman Yehia Aboul Fotouh told Bloomberg. NBE has already secured USD 1 bn in loans and is looking to add another loan package to improve its USD liquidity. Reports had emerged earlier this month that NBE would sign a EUR 500-750 mn loan agreement with the European Bank for Reconstruction and Development during 1H2018. Separately, NBE is planning to open its first branch in Saudi Arabia by the end of 2018, and is currently waiting on Saudi approval.

Egypt Politics + Economics

Hisham Genena released on bail, Aboul Fotouh’s family denies allegations against him

Former top auditor Hisham Genena was released on EGP 15,000 in bail following an investigation into his claim that he holds incriminating evidence against the Supreme Council of Armed Forces (SCAF), Genena’s lawyer told Al Masry Al Youm. Genena is facing charges of spreading false news, harming the Armed Forces, and defaming former SCAF chief Sami Anan’s military reputation. Anan is currently also being held in military detention over his presidential bid. Meanwhile, ex-presidential candidate Abdel Moneim Aboul Fotouh’s family issued a statement denying allegations against him that he is still in contact with the Ikhwan, while his lawyer dismissed reports that his clients’ assets were frozen.

National Security

Military foils infiltration attempt on Libyan border, Zawahri calls on Egyptians to topple “apostate” government

The Egyptian army announced foiling an infiltration attempt on the border with Libya. The army also announced that security forces have killed 53 militants since the beginning of its security operation in Sinai last week, according to The Associated Press. Meanwhile, Al Qaeda leader Ayman El Zawahiri released a video statement over the weekend calling on Egyptians to topple the “apostate” government, Reuters reports. Daesh had also released a video message last week urging violence during the presidential elections.

On Your Way Out

Egypt ranked 110 out of 113 countries in terms of rule of law in the World Justice Project’s (pdf) 2017-18 index, outperforming only Afghanistan, Cambodia, and Venezuela. Egypt’s performance is the lowest in the region, with the United Arab Emirates coming out on top in the MENA region. The report’s rankings are based on “constraints on government powers, absence of corruption, open government, fundamental rights, order and security, regulatory enforcement, civil justice, and criminal justice.”

Brazilian football legend Roberto Carlos is in Cairo as part of a medical tour of a hepatitis C campaign, according to Egypt Independent. The local campaign Carlos is participating in markets Egypt as a destination to cure hepatitis C, and raises awareness about the disease. Lionel Messi and Ronaldinho participated in similar programs last year.

The Market Yesterday

EGP / USD CBE market average: Buy 17.65 | Sell 17.75

EGP / USD at CIB: Buy 17.60 | Sell 17.70

EGP / USD at NBE: Buy 17.60 | Sell 17.70

EGX30 (Thursday): 14,966 (+1.1%)

Turnover: EGP 1.3 bn (15% ABOVE the 90-day average)

EGX 30 year-to-date: -0.4%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 1.1%. CIB, the index heaviest constituent closed up 0.9%. EGX30’s top performing constituents were Palm Hills up 5.3%; SODIC up 5.1%; and Emaar Misr up 4.2%. Thursday’s worst performing stocks were El Sewedy Electric down 1.7%; Eastern Co down 1.1%; and Qalaa down 0.8%. The market turnover was EGP 1.3 bn, and local investors were the sole net sellers.

Foreigners: Net Long | EGP +20.1 mn

Regional: Net Long | EGP +47.4 mn

Domestic: Net Short | EGP -67.5 mn

Retail: 60.5% of total trades | 56.5% of buyers | 64.6% of sellers

Institutions: 39.5% of total trades | 43.5% of buyers | 35.4% of sellers

Foreign: 18.6% of total | 19.4% of buyers | 17.8% of sellers

Regional: 19.7% of total | 21.5% of buyers | 17.9% of sellers

Domestic: 61.7% of total | 59.1% of buyers | 64.3% of sellers

WTI: USD 61.68 (+0.55%)

Brent: USD 64.84 (+0.79%)

Natural Gas (Nymex, futures prices) USD 2.56 MMBtu, (-0.85%, MAR 2018 contract)

Gold: USD 1,356.2 / troy ounce (+0.07%)

TASI: 7,51.47 (+1.22%) (YTD: +3.93%)

ADX: 4,577.42 (-0.25%) (YTD: +4.07%)

DFM: 3,330.44 (-0.17%) (YTD: -1.18%)

KSE Weighted Index: 410.66 (+0.25%) (YTD: +2.3%)

QE: 9,027.71 (-0.36%) (YTD: +5.92%)

MSM: 5,016.62 (+0.21%) (YTD: -1.62%)

BB: 1,339.72 (-0.2%) (YTD: +0.6%)

Calendar

19 February (Monday): Pride Capital’s talk on Insurtech, Greek Campus, Tahrir Square, Cairo.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s “World of Possibilities” Conference, Cairo/Luxor.

20 February (Tuesday): The Third Annual Capital Markets Summit, InterContinental Cairo Semiramis, Cairo.

05 March (Monday): Egypt’s PMI reading for February released.

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

07-11 March (Wednesday-Sunday): ITB Berlin Convention, Berlin, Germany.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday. (Look for possible Monday off given the first day falls on a Friday.)

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC)

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC)

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.