- Auto dealers beware: The Consumer Protection Act has you in its sights. (Speed Round)

- Eurobond issuance coming any day now, no glitches in state IPO program -El Garhy. (Speed Round)

- Net FX reserves see biggest m-o-m jump since July. (Speed Round)

- Global equities selloff continues this morning in Asia. (Speed Round)

- Enara plans 300 MW renewable energy projects over the next five years. (Speed Round)

- HC advising on M&As worth a combined EGP 3 bn, looks to enter leasing market. (Speed Round)

- Military denies working with Israel in the Sinai to stop Daesh. (Speed Round)

- Documentary of the week: Dirty Money—tales of corporate greed and misdeeds. (Worth Watching)

- The Market Yesterday

Monday, 5 February 2018

Car dealers could face CPA regulation

TL;DR

What We’re Tracking Today

The rout in global markets continues this morning: The EGX followed the Friday lead of global markets, with the EGX30 closing down 1.4% yesterday in light trading. Just about every regional exchange, from the UAE and Saudi Arabia to Kuwait and Qatar, also closed in the red yesterday. Just about every Asian market was (rather steeply) following suit as we dispatched today, with the lone market showing green on our dashboard at dispatch time: Pakistan, up 0.1%.

Bloomberg has proclaimed it the “biggest selloff for global stocks in two years” and quotes one strategist as suggesting the “pullback has farther to go … [but] is likely to be just an overdue correction, with say a 10% or so fall, rather than a severe bear market.”

It’s PMI day: The Emirates NBD Egypt purchasing managers’ index for January will be announced today and based on last month’s results, we’re reasonably optimistic. Gauges for the UAE and Saudi Arabia are also due out today.

The House Local Administration Committee is expected to discuss today two draft laws regulating shops in public spaces and governing procedures for the operation and management of shops, Al Mal reports. Also on the committee’s agenda: Proposed amendments to the Public Roads Act that would impose a licensing fee of EGP 10,000 on food trucks and carts. The Ismail Cabinet signed off on the amendments in July 2016.

Hope springs eternal, huh? A Turkish trade delegation to Egypt will be attending the Egyptian-Turkish Business Forum today, according to Yenisafak. The forum is organized by Federation of Egyptian Chambers of Commerce and the delegation consists of “10 high-level entrepreneurs” including members of Turkey’s Union of Chambers. Trade and Industry Minister Tarek Kabil has invited Turkish businessmen to look into investing in auto assembly projects once the Automotive Directive is passed into law, Al Shorouk reports.

The Abraaj Group is out with a strong statement on the deployment of funds called from limited partners in its Abraaj Growth Markets Health Fund in answer to a Wall Street Journal report over the weekend that four top LPs had demanded an external investigation into where the money went if it hadn’t been deployed in investments. The firm dismissed the media reports as “inaccurate and misleading” and, as we suggested in this space yesterday was likely the case, noted that, “Given the lack of mature healthcare assets in growth markets and the need to develop greenfield as well as brownfield projects, capital deployment is less predictable than that of a standard private equity fund. …Some capital was not used as quickly as anticipated due to unforeseen political and regulatory developments” in several markets. Investors were told about these delays “through quarterly general partner reports and other investor communications,” the statement added.Bloomberg has coverage, and you can read Abraaj’s statement in full (pdf) here.

Look for policy stability in our northern neighbor: Cyprus, a key ally in Egypt’s quest to become a regional energy hub, re-elected 71-year old president Nicos Anastasiades, who comfortably won yesterday’s runoff election with 56% of the vote. He faced an independent rival backed by the Communist Party. Deutsche Welle and the WSJ have coverage.

In miscellany worthy of your attention this morning:

Saudi Arabia and the UAE are the hardest places in the world to collect unpaid debts, according to research from insurer Euler Hermes in its annual survey on debt collection. The FT has more.

European bankers are leading the global charge against tech firms from the US and China set on eating the industry’s lunch. “Big Tech’s move into banking is threatening financial stability and the biggest US and Chinese technology groups should be subject to some of the same regulation as big banks, according to top European finance chiefs,” the FT reports.

Speaking of the salmon-colored paper, the “Hillbilly elegist” who explained why Trump got elected has lunch with the FT.

Egyptians may like Kenya right now as a natural export market, but the same can’t be said of the New York Times, which reports that just months after being hailed as a democracy, “the most widely watched television stations in Kenya are shuttered, and the government has defied a court order to return them to the air. Opposition politicians are under arrest, and journalists have also been threatened with jail.”

Forgive the bleary-eyed Americans in your lives this morning. They were likely awake until 5:20am-ish watching the Super Bowl, which saw the Philadelphia Eagles defeat the New England Patriots 41-33. It is Philadelphia’s first-ever Super Bowl win.

Today was a good day: A poem, written last year by an eleventh grader in Brooklyn, NY, has gone viral after being posted in a London bar. Read it backward—image below.

Finally, look the mercury to peak at 28°C today in Cairo before rising to north of 30°C on Wednesday as we look ahead to an unseasonably warm weekend.

What We’re Tracking This Week

Egypt is hosting the fintech and digital economy conference “Seamless North Africa” (pdf) tomorrow. The two-day conference, which the CBE is hosting, will allow local and global fintech companies to showcase their offerings in the region’s largest potential market.

Sudan and Egypt’s foreign ministers and intelligence service chiefs will meet in Cairo on Thursday, according to a Foreign Ministry statement. The meeting comes after the two countries’ presidents agreed last month to set up a joint ministerial committee mandated with resolving “outstanding issues” between Cairo and Khartoum. The shift in tone between Egypt and Sudan during President Abdel Fattah El Sisi and President Omar Al Bashir came a week after Al Bashir instructed his ambassador to Cairo to resolve pending issues with Egypt. Al Bashir had recalled the ambassador earlier last month for “consultations.”

On The Horizon

The central bank’s Monetary Policy Committee will meet on 15 February to decide on interest rates.

A delegation of 22 British companies led by UK trade envoy Jeffrey Donaldson is visiting Egypt on 10 February to discuss a tripartite trade agreement between the UK, Egypt, and China centered on exports to African markets.

The Housing Ministry will announce its 2018 land auction timetable next month, Minister Mostafa Madbouly said yesterday, Al Shorouk reports. Thirteen plots of land worth a combined EGP 550 bn have already been tendered this year to residential and commercial developers, he said.

Enterprise+: Last Night’s Talk Shows

With the nation’s talking heads still preoccupied by politics and poultry, Lamees Al Hadidi was the only one of the bunch to take note of the surge in FX reserves during January. (We have the full story in Speed Round).

The Hona Al Asema host asked the central bank to provide a breakdown of the reserves, explaining the record m-o-m rise (watch, runtime: 1:28) before she moved on to a video recording of IMF boss Christine Lagarde giving Egypt props for surpassing the regional average for economic growth (watch, runtime: 3:56).

She then briefly turned to the presidential election to tip her hat to former MP Mohamed Anwar Al Sadat for calling on President Abdel Fattah El Sisi to open a channel for dialogue with the opposition (watch, runtime: 41:18).

Over on Kol Youm, Amr Adib was up in arms over Religious Endowments Minister Mohamed Mokhtar’s statement that voting in the upcoming elections is a religious duty, saying that there is no need to bring religion into political issues (watch, runtime 3:16). Mokhtar phoned in to defend his stance, saying he meant to promote positive participation (watch, runtime: 6:33).

Still obsessing over the drop in poultry prices, Adib called up Health Ministry spokesman Khaled Megahed to confirm that the discounted chicken has not expired and is safe for human consumption (watch, runtime: 5:13). That was naturally his cue to bring out his inner Jack-of-all-trades, advising local producers to lower their prices in order to compete with the government, and claiming that red meat will soon see a similar drop in prices (watch, runtime 3:44)

Egyptian Poultry Association deputy head Tharwat El Zeny brought Adib back to planet earth, pointing out that selling prices can’t be lower than the cost of production. Many of them are now being forced to retail their products at EGP 20 per kg, which is still higher than the government’s price (watch, runtime: 14:39).

Over on Masaa DMC, Eman El Hosary discussed President Abdel Fattah El Sisi’s visit to Oman with Egypt’s ambassador in Muscat, Mohamed Ghoneim, who said that the president is scheduled to meet with other Omani officials and some 40 businessmen over the next two days (we have details on his meeting with Sultan Qaboos bin Said in Diplomacy, below) (watch, runtime: 5:06).

Back on Hona Al Asema, Lamees spoke to Omani researcher Salem El Gahoury for an analytical take on El Sisi and Sultan Qaboos’ sit-down (watch, runtime: 5:21).

Yahduth fi Masr’s Sherif Amer discussed the upcoming meeting between Egypt and Sudan’s foreign ministers and intelligence bosses with Foreign Ministry spokesperson Ahmed Abu Zeid. Meetings of this sort are expected to be regular to sort out the two countries’ disagreements, according to Abu Zeid (watch, runtime: 5:37).

Finally, on Al Hayah Al Youm, Public Enterprises Minister Khaled Badawi filled host Tamer Amin in on the details of Al Ghurair Group’s USD 1 bn sugar project in Minya (watch, runtime: 5:04). (We have more in the Speed Round.) Amin also spoke with New Egyptian Countryside Development head Atter Hannoura, who said that under an agreement with his company, Al Ghurair will hire local farmers to plant sugar beets for the new plant (watch, runtime: 26:28).

Speed Round

LEGISLATION WATCH- Auto dealers beware: The Consumer Protection Act has you in its sights: The Consumer Protection Act, which is currently being discussed in a plenary session at the House of Representatives, could impose new regulations on the sale of cars, Al Borsa reports. The law starts off by classifying cars as a “strategic good,” which places its sale in the purview of the Consumer Protection Authority (CPA) and its crusader-head, Atef Yakoub. Key features of the act that impact the auto industry include:

- Price controls: It appears as a “strategic good,” the CPA can be authorized to set price controls on vehicles if it receives approval from the cabinet. It is not yet clear under which circumstances the CPA would have a mandate to regulate prices.

- Dealers will have to clearly display sticker prices and clearly. Break down service fees.

- New penalties: The law sets penalties of up to EGP 500k for cars not meeting Egyptian or international standards. A penalty of up to EGP 2 mn is set for cars which are classified as unsafe; dealers who sell an unsafe vehicle that later results in bodily harm to a driver or passenger could face life in prison.

- Recall guidelines: The Consumer Protection Act sets a deadline of seven days for a company to recall cars which have been deemed faulty.

- Eliminating waitlists: The act outlaws the practice of waitlists on models, and the premium pricing on cars. The act bans hoarding of cars to artificially inflate the price.

Eurobond issuance coming any day now: Egypt will be issuing USD 4-5 bn in eurobonds “within days,” said Finance Minister Amr El Garhy on Sunday, according to Reuters. The timing was chosen to coincide with climbing yields in the international bond market, El Garhy said at a presser yesterday following a meeting with Prime Minister Sherif Ismail, according to Youm7. El Garhy has previously said that the bonds will be issued on the London and Luxembourg stock exchanges. HSBC, Citigroup, JPMorgan Chase & Co, Morgan Stanley, and National Bank of Abu Dhabi will be managing the issuance. Al Tamimi & Co. and Dechert LLP were chosen as legal advisors to the government and Linklater LLP and Zaki Hashem & Partners are advising the banking consortium.

El Garhy says there are no issues with the state IPO program: El Garhy also dismissed rumors that there were issues concerning the state IPO program, as the schedule and the timeline had not been announced yet. El Garhy said that procedures for the program had been ironed out, adding that the ball is rolling on the IPO of energy firm Enppi, though a timeline for the transaction has yet to be made clear. El Garhy also dismissed previous statements attributed to government officials that the state is expecting to net EGP 10 bn from the IPO of state assets over the coming three year, Al Masry Al Youm reports. He added that the government will list 8-10 companies over the next 18 months.

Egypt’s net FX reserves see biggest m-o-m jump since July: Egypt’s net FX reserves rose to USD 38.2 bn as at the end of January, up from USD 37.02 bn at the end of December, making their biggest m-o-m jump since July last year, according to CBE figures released yesterday. The rise came on the back of a USD 1.5 bn increase in inflows into the banking system, which recorded total flows of USD 5.6 bn, CBE Governor Tarek Amer said statements to the press last night. He noted that Egypt’s debt service obligations to the Paris Club were down by half at the start of 2018, with the state having had to repay only USD 290 mn. “The data is the latest sign that Egypt has turned the page on a USD shortage that squeezed the economy before authorities abandoned most currency restrictions and cut subsidies,” says Bloomberg. It is also a “strong sign the economy is able to accumulate excess USD, even if it is funded to a large extent by external borrowing,” said CI Capital senior economist Hany Farahat.

CBE Sub-governor Rami Aboul Naga had said last week that Egypt’s foreign reserves are sufficient to cover eight-months’ worth of imports — a very positive development, according to Allen Sandeep, head of research at Naeem Brokerage. “It will be even more positive if this was a result of real improvements in the trading account — for example, higher exports and drop in imports,” Sandeep told Reuters.

INVESTMENT WATCH- Enara Capital is planning to invest USD 300 mn in developing renewable energy projects in Egypt over the next five years, CEO Sherif El Gabaly tells Al Borsa. The projects, which will include solar, wind and waste-to-energy projects, will have a combined capacity of 300 MW. The company had announced in December that it would partner up with a Chinese consortium to invest USD 1 bn in renewable energy projects in Africa over the next three years. The projects will be funded under the World Bank’s financing framework for renewable energy projects in the region, under which Egypt has received c. USD 1.8 bn in funding.

INVESTMENT WATCH- Jamal Al Ghurair’s planned USD 1 bn sugar plant plant in Egypt will help the country reach self-sufficiency, Investment Minister Sahar Nasr said, according to Reuters. The agro-industrial project, Al Canal Sugar, will be funded in part by Ghurair’s Al Khaleej Sugar Refinery, which will put in around USD 333 mn of the total cost. The Minya plant should begin production in 2020 and put out an annual 900k tonnes of sugar once its fully operational by February 2021. The plant will be located 200 KMs away from its market and use mostly beets as a raw material, according to Ghurair. Land for the project was allocated under a 60 year-contract, the newswire says. Bloomberg also has the story.

INVESTMENT WATCH- Kandil Steel plans to invest USD 40 mn to increase by 50% capacity to produce galvanized steel, chairman Amr Kandil tells Al Borsa in an interview. The company hopes to boost production to 900k tonnes from a current 600k by 2019, he added.

M&A WATCH- HC Securities & Investment is advising on M&A transactions in Egypt and internationally worth a combined EGP 3 bn, company chairman Hussein Shoukry tells Reuters in an interview on Sunday. The investment bank is concluding four transactions at the moment, he added. HC is the buy-side adviser for unnamed investors from the Far East, Europe and MENA on two transactions to acquire a petrochemicals company and a medical equipment manufacturer, said Shoukry, without naming the target companies. The firm is also advising on a USD 50 mn acquisition of 30% of an unnamed Kuwaiti petroleum company by a Saudi investor. HC is also working on restructuring an Egyptian company her referred to as “one of the largest food and beverage producers in the country.”

HC has also signed on as buy-side adviser to three GCC companies looking at regional food and education opportunities. It has also been tapped to act as the sell-side adviser on an Egyptian manufacturing company, said Shoukry.

HC won’t move into the increasingly crowded leasing space until interest rates drop, he added. Shoukry expects interest rates to drop 500-600 bps in 2018, “a move which would help us launch leasing operations with our partners.”

Investors not too worried about the elections: When asked on the impact of the presidential elections on the investment community, Shoukry said that he does not expect them to pose any particular risk to investor-appetite. Investors see a victory by President Abdel Fattah El Sisi as a foregone conclusion, he added.

Is the Oil Ministry backtracking on ending LNG imports in July? “Egypt will stop importing LNG by the end of the year,” Oil Minister Tarek El Molla said at a press conference yesterday, according to Reuters. El Molla had announced last week that Egypt will end LNG shipments by mid-2018, which in retrospect, appears to have been a target estimate.

He also noted that one Floating Storage Regasification Unit (FSRU) could remain commissioned to accommodate LNG imports by the private sector or in case there is a shift towards supplying more power plants with natural gas instead of diesel or heavy fuel oil, Al Masry Al Youm reported.

Egypt’s natural gas production will exceed 6 bcf/d before the end of 2018, the minister added. Natural gas production increased by 1.6 bcf/d in 2017 to reach an output rate of 5.5 bcf/d currently, El Molla says.

The Egyptian government is looking to launch an electricity interconnection project with Ethiopia and Sudan through a 1,600 km transmission network, government sources tell Daily News Egypt. The Electricity Ministry had already conducted a feasibility study for the project, but it was halted due to the troubled talks over the construction of the Grand Ethiopian Renaissance Dam, sources added. The presidents of the three countries agreed at a trilateral meeting last month to set up a joint investment fund to finance infrastructure projects, including renewable energy power plants and constructing road and railway lines linking the three countries. Electricity Minister Mohamed Shaker had announced last month that Egypt would begin exporting excess electricity to the region in 2018. Egypt is already engaged in an interconnection project with Saudi Arabia that should see the two countries exchange up to 3 GW of electricity once it launches in 2021, as well as two others with Jordan and Libya. Cyprus and Greece are also potential markets for power exports.

Remember that SAR 60 bn investment fund announced during King Salman’s visit in 2016? It’s apparently still in the works and came up during the Egyptian-Saudi Business Council talks last week. Both sides of the council agreed that investments under the fund will primarily come from the Saudi government, deputy council head Abdullah Bin Mahfouz said, according to Al Mal. Mahfouz blamed the general malaise in the GCC economy resulting from weak oil prices for the delay in executing investment pledges made during King Salman’s visit.

As for what Saudi investors are looking for in Egypt, Mahfouz said that most investors are eyeing projects in neighborhood of EGP 50-100 mn, with the pharma, healthcare and education sector being particularly attractive.

Also coming from the Egyptian-Saudi Business Council talks: Saudi is apparently trying to piggyback off of Egypt’s plans to help with the reconstruction of Libya and Iraq. The council is looking to form partnerships between Egyptian and Saudi investors to take part in reconstruction projects in Libya and Iraq, Mahfouz tells Al Borsa. Saudi companies are looking to get their toes wet in Libya through such partnerships, he said, adding that they will participate in an international investment conference for projects in Benghazi in March.

Service revenues from Vodafone Group’s Egyptian operations rose 18.8% y-o-y in 3Q2017, “with successful segmented campaigns and rising data penetration supporting higher [average revenue per user], combined with strong customer base growth,” according to a company statement (pdf). Vodafone Group’s total revenue dropped 3.6% y-o-y to EUR 11.8 bn during the quarter, down from EUR 12.2 bn in 3Q2016.

Image of the Day

Ballerina wearing a headscarf showcases the beauty of dance and Alexandria: Holding a graceful passé position, 20-year-old Aya Magdy posed for a picture on Alexandria’s Stanley Bridge in a headscarf and long-sleeved dress in a bid to promote tourism in her city, Shounaz Mekky writes for Arab News.

Egypt in the News

It is a blessedly quiet news day for Egypt in the international press, with coverage largely confined to pickups of the recent discovery of a 4,400 year-old tomb and outlets like the Daily Mail playing “me, too” with David Kirkpatrick’s piece on military cooperation with Israel. The top spokesman for the Egyptian Armed Forces denied the Times report yesterday.

On Deadline

What’s really behind the sudden drop in poultry prices? El Watan’s Mahmoud Khalil wonders if the government pushed the discounted poultry into the market during the run-up to this year’s presidential elections as a means to assuage public discontent about the rising cost of living—and whether the drop in prices will therefore be short-lived. The price drop also begs the question of why the state didn’t move to increase its poultry supply (and therefore push down the price) at any point during the past few years, when citizens were consistently complaining about inflation, he writes.

Worth Reading

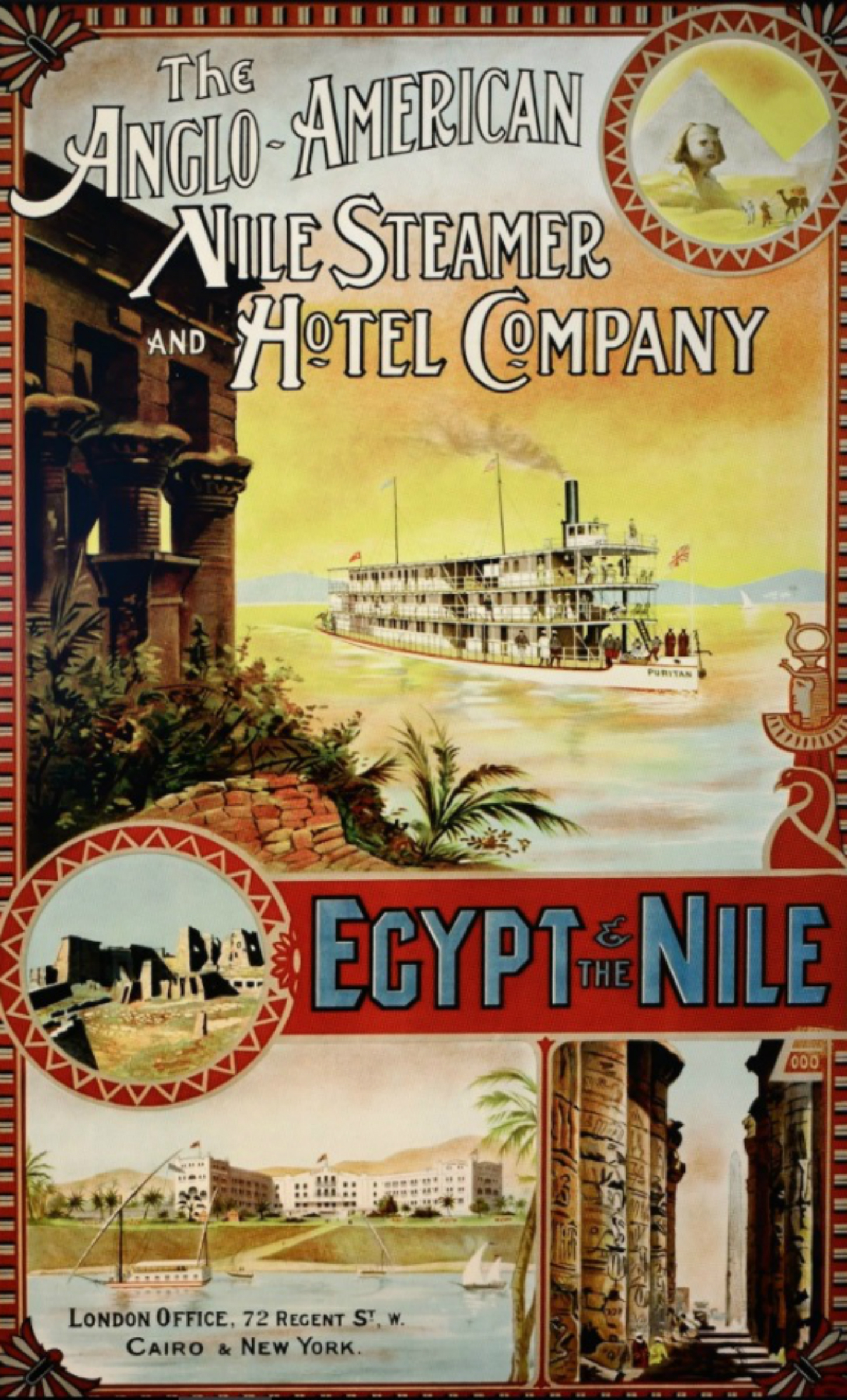

The doomed Nile expeditions of Edwardian aristocrats: Orientalists and amateur Egyptologists among Edwardian aristocrats drawn to Egypt in the turn of the 20th century did not exactly find the glamorous voyage they romanticized, Robert Leigh-Pemberton writes for The Telegraph. Reviewing a book titled Aristocrats and Archaeologists — based on the accounts of the Duke of Devonshire on his recreational cruise down the Nile in the winter of 1907 — Leigh-Pemberton traces how the reality of a seemingly glamorous trip was rather less appealing, ending with the illness and death. This certainly would not be a glowing tourism promotional campaign if you had lived in the early 1900s and seems to lend credence to Sherine’s joke about drinking from the waters of the Nile.

Worth Watching

DOCUMENTARY OF THE WEEK: Be prepared to kiss your families goodbye this week when you start binge-watching Dirty Money, Netflix’s new docu-series on some of the most prominent recent cases of financial crimes and shady practices committed by the biggest corporation. This series, which is produced by Alex Gibney — the creative genius behind such documentaries such as Enron: the Smartest Guys in the Room and Going Clear: Scientology and the Prison of Belief — runs the range of corporate scandals, including the Volkswagen emissions fraud case, HSBC laundering money for Mexican narcos, and Big Pharma’s price gouging on life-saving meds. As entertaining as these are, once cannot help but feel dejected at the central theme of the series: That the natural instinct of large corporations, emboldened by leniency of the justice system in dealing with them, appears to be to test the boundaries of what’s legal to drive up revenues. Check out the trailer here (watch, runtime 2:25) or you can just start watching it on Netflix here. You’re welcome.

Diplomacy + Foreign Trade

Military denies working with Israel in the Sinai to stop Daesh: Egypt’s Armed Forces issued a statement yesterday denying claims made in a New York Times’ piece suggesting that Israel has been launching covert airstrikes against Islamic militants in the Sinai with President Abdel Fattah El Sisi’s permission. The statement maintained that Egyptian security forces “are fighting terrorism in North SInai on their own,” according to Ahram Online.

Airstrikes alone are not enough to stop Daesh operatives in northern Sinai, whether or not Israel is helping Egypt, Anshel Pfeffer writes for Haaretz. He says that “it took a ground force to finally rout [Daesh] from its main strongholds“ in Iraq and Syria, arguing that Egyptian security forces will not be able to neutralize the threat otherwise. Meanwhile, Israeli Transport Minister Yisrael Katz tells Ynet News that while he can’t confirm or deny the claims, “Israel and Egypt share a deep interest to prevent a [Daesh] entrenchment in Sinai,” especially after flocks of fighters fled to Egypt following their defeat in Iraq and Syria.

President Abdel Fattah El Sisi met with Oman’s Sultan Qaboos bin Said in Muscat yesterday on his first official visit to the Sultanate, according to an Ittihadiya statement (pdf). El Sisi and Qaboos discussed ways to improve bilateral relations “across various fields,” including trade and economic cooperation, as well as counterterrorism. The two leaders also exchanged views about the crises in Yemen, Syria, and Iraq, as well as political developments in Lebanon.

Energy

EBRD to loan SOPC USD 200 mn

The European Bank for Reconstruction and Development (EBRD) is provisioning a USD 200 mn loan to the Suez Oil Processing Company (SOPC) “to finance a package of energy efficiency investments and other refurbishments and installations at the Suez refinery,” according to the EBRD project website. The loan is classified as a sovereign loan to Egypt and will be brought before the board for a vote on 28 March. A technical cooperation fund will allocate EUR 83k to environmental and feasibility studies.

Infrastructure

Transportation Ministry to tender 10 logistics zones, four river transport projects

The Transport Ministry is issuing tenders this year for the development of 10 logistical zones across the country, Minister Hisham Arafat said yesterday, Al Mal reports. These include the USD 2 bn 6 October logistics zone, whose feasibility study was conducted and funded by the European Investment Bank. The ministry will also issue tenders soon for four river ports in Qena, Sohag, Assiut, and Mit Ghamr, Arafat added.

SCZone in talks to develop 600-meter multipurpose facility in East Port Said Port

The UAE’s AOC has been awarded a contract to develop a handling facility, a pier, and a logistical zone at the East Port Said port, as well as a sugar factory in the Suez Canal Economic Zone, for a total investment cost of USD 1.6 bn, Suez Canal Authority head Mohab Mamish said yesterday. Mamish is also in talks with an unnamed Egyptian company to develop a 600-meter multipurpose facility at East Port Said, Al Mal reports.

13 companies bid for contract to supply ENR with 1,300 locomotives

The Egyptian National Railways (ENR) has received bids from 13 international companies to supply 1,300 railway cars, Al Borsa reports. The Transport Ministry is expected to select the best offer and sign the contracts within two-three months. Minister Hisham Arafat had said in November that the ministry was choosing between three rival bids from Italy, China, and a Hungarian-Russian consortium, and would announce the winning offer by December. The tender had initially been for 800 locomotives.

Basic Materials + Commodities

Ezz Steel exports grow 112% y-o-y in 11M2017 to USD 465 mn

Ezz Steel’s exports grew 112% y-o-y in the first 11 months of 2017 to USD 465 mn, up from USD 219 mn in the same period a year before, CMO George Matta tells Al Borsa.

Health + Education

Teachers with Ikhwani relatives banned from Thanaweya Amma examination process

Teachers who are in any way affiliated with the Ikhwan, including through relatives, will be banned from taking part in the Thanaweya Amma examination process, an Education Ministry source tells Al Shorouk. Security authorities imposing the ban argue that said teachers’ “extremist ideology” would be passed on to students, the source adds.

Real Estate + Housing

Catalyst to start work on EGP 5 bn Al Galala project this year

Real estate developerCatalyst Real Estate is planning to start work on a new EGP 5 bn development this year, Chairman Osama Shalaby told Al Masry Al Youm yesterday. He said that licenses and paperwork for the 360k sqm, 3600-housing unit project in Al Galala are almost at hand.

MG Developments to spend EGP 800 mn on office space project

MG Developments is investing EGP 800 mn to establish a commercial administrative complex in New Cairo, the company said in a statement picked up by Al Shorouk. MG has already broken ground on the new project, Headquarters Business.

Tourism

Alexandria launches first charter flight to Arab capital with Beirut route

Tour operators agreed to launch charter flight routes between Alexandria and other Arab capitals, with the Beirut line set to be the first to launch, according to Al Shorouk. Tishoury Tours boss George Boulos also told the newspaper that his company received authorization from security to allow Lebanese citizens to enter the country through Alexandria International Airport without a visa.

Telecoms + ICT

Vodafone, TE renew agreement over use of infrastructure

Vodafone Egypt and Telecom Egypt have renewed an agreement that allows Vodafone to use TE’s network infrastructure to offer its mobile services, according to Al Shorouk. Under the three-year agreement, TE will collect at least EGP 2.370 bn from Vodafone and offer new commercial and technical services in exchange. VFE officials had said last month that it was looking to increase its investments in Egypt in order to meet rising demand. The operator had also said that it was willing to restart talks with TE over a domestic roaming agreement after they had been stalled for months.

Automotive + Transportation

Transport Ministry to test third metro line in June

The Transport Ministry will run trial operations on phase four of the Cairo Metro’s Line 3 in June, before it opens it to the public in November,ministry sources told Youm7.Minister Hisham Arafat is in talks with the French Development Agency over an additional funding package for the Cairo Metro and the Alex Tram.

Other Business News of Note

IDA has issued over 3,500 licenses since Industrial Permits Act

The Industrial Development Authority (IDA) issued more than 3,500 temporary and permanent licenses since the Industrial Permits Act passed last year, Chairman Ahmed Abdel Razek told Al Borsa. The act simplifies licensing procedures by cutting the way time for approval and is a key part of the government’s economic reform program.

Egypt Politics + Economics

UEIA supports Sisi’s reelection

The Union of Egyptian Investors Associations (UEIA) threw their weight behind President Abdel Fattah El Sisi’s reelection bid yesterday, Ahram Gate reports, citing a statement.

National Security

Roadside bomb kills two in North Sinai

A roadside bomb targeting security forces in North Sinai killed two yesterday, The Associated Press reports. “The officials say the Sunday blast took place on a road just south of the coastal city of el-Arish. Five other members of the security forces and a civilian were wounded in the attack.”

Sports

Mohamed Salah breaks record for highest-scoring Egyptian player in the Premier League

Football star Mohamed Salah broke the record for the highest scoring Egyptian player in the Premier League, netting 23 goals in 25 games, Egypt Today reports. Salah surpassed the previous record of 22 goals set by now-retired Ahmed Hossam (Mido). This comes as Goal Arabia’s editors voted for Salah as the Best Arab Player of 2017, giving him a score of 299 out of a possible 300.

On Your Way Out

Police have arrested two men and a woman in connection with the fatal shooting of 28-year-old Egyptian pharmacist Andrew Samir Kolta in Maryland, CBS reports. The armed robbery took place last week outside Kolta’s home in Gambrills. He was taken to Baltimore-Washington Medical Center, where he died. The Egyptian Embassy in Washington is making arrangements with US authorities to return his remains for burial in Egypt, according to a statement from the embassy.

Kiwi tennis champ Erin Routliffe won the ITF Futures tournament in Sharm El Sheikh, according to Stuff. The 22-year old still has a long way to go in the WTA rankings, but the victory is expected to see her jump 100 spots to 650. The dual-national was brought up in Canada but started playing under the New Zealand flag last year.

The Market Yesterday

EGP / USD CBE market average: Buy 17.6214 | Sell 17.7214

EGP / USD at CIB: Buy 17.60 | Sell 17.70

EGP / USD at NBE: Buy 17.62 | Sell 17.72

EGX30 (Sunday): 14,875 (-1.4%)

Turnover: EGP 850 mn (24% below the 90-day average)

EGX 30 year-to-date: -1.0%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 1.4%. CIB, the index heaviest constituent closed down 2.1%. EGX30’s top performing constituents were Eastern Co up 2.1%; Global Telecom up 0.2%; and ACC closed flat. Yesterday’s worst performing stocks were Domty down 4.6%; Sodic down 4.2%; and Sidi Kerir Petrochemicals down 4.1%. The market turnover was EGP 850 mn, and foreigner investors were the sole net sellers.

Foreigners: Net Short | EGP -89.7 mn

Regional: Net Long | EGP +3.7 mn

Domestic: Net Long | EGP +86.0 mn

Retail: 59.1% of total trades | 60.4% of buyers | 57.8% of sellers

Institutions: 40.9% of total trades | 39.6% of buyers | 42.2% of sellers

Foreign: 17.6% of total | 12.4% of buyers | 22.9% of sellers

Regional: 10.5% of total | 10.7% of buyers | 10.3% of sellers

Domestic: 71.8% of total | 76.9% of buyers | 66.8% of sellers

WTI: USD 65.45 (-0.53%)

Brent: USD 68.58 (-1.54%)

Natural Gas (Nymex, futures prices) USD 2.85 MMBtu, (-0.35%, March 2018 contract)

Gold: USD 1,337.3 / troy ounce (-0.79%)

TASI: 7,608.33 (-0.62%) (YTD: +5.29%)

ADX: 4,584.56 (-0.6%) (YTD: +4.23%)

DFM: 3,385.75 (-0.78%) (YTD: +0.47%)

KSE Weighted Index: 411.54 (-0.31%) (YTD: +2.52%)

QE: 8,959.3 (-2.69%) (YTD: +5.11%)

MSM: 5,057.55 (+0.44%) (YTD: -0.82%)

BB: 1,354.86 (-0.21%) (YTD: +1.74%)

Calendar

05 February (Monday): Egypt’s Emirates NBI PMI reading for January announced.

08-11 February (Thursday-Sunday): Furnex & the Home international trade fair, Cairo International Convention Center.

10-12 February 2018 (Saturday-Monday): Third Africa STI Forum, Cairo.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s “World of Possibilities” Conference, Cairo/Luxor.

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday. (Look for possible Monday off given the first day falls on a Friday.)

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC)

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC)

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.