- Putin says “Yes” to Dabaa, but only “soon” on sending tourists back. (Speed Round, Last Night’s Talk Shows)

- Can we really expect by next summer the IPOs of three so-far CEO-less companies set to run the new ‘Siemens power plants’? (Speed Round)

- WorldRemit raises USD 40 mn to expand in Egypt, has Western Union in it sight. (Speed Round)

- OTMT confirms it’s eyeing agribusiness investments in Africa. (Speed Round)

- Massive new market for Egyptian film industry as Saudi Arabia moves to re-open theaters after 35 years. (Speed Round)

- Did Egypt’s purchase of Rafale planes revive interest in an unpopular piece of military hardware? (Speed Round)

- Are emerging markets becoming Fed-proof? (The Macro Picture)

- Egyptian banks aren’t snapping up 36% Ethiopian dam bonds. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 12 December 2017

Dabaa nuclear plant? Yes. But tourists? Not yet.

TL;DR

What We’re Tracking Today

Let’s get one thing straight before we break out the early-morning Champagne: Russian President Vladimir Putin has not yet allowed direct flights to Egypt to resume. You’re going to be reading plenty in the domestic and international press alike about Putin agreeing to allow direct flights back into the air, but as is characteristic, the Russian leader left himself wide room to maneuver.

What did Putin really say on the flights? “Security agencies reported to me that we are generally ready to restore a direct air link between Moscow and Cairo.” An agreement, he said, could be signed “in the nearest time,” the Associated Press reports. The tourism industry is going to have to hold its collective breath before a market that once sent us up to 3 mn holidaymakers a year is back on the map. In the meantime, Russian tourists will have to keep sneaking in through Ukraine.

But it does seem as if the Daba’a nuclear power plants are going ahead. A statement from Rosatom said Putin and President Abdel Fattah El Sisi witnessed the signing of a “notice to proceed.” NTPs are issued to contractors to start work under a contract, implying that the final contract must have been signed. Communiques from both sides have been rather vague on that last bit, but its meshes with all that we’ve heard of late about hotels and rental stock on the North Coast being snapped up by Russians in the past months. We have more on yesterday’s developments in Speed Round, below.

Shares of Ibnsina Pharma begin trading today on the Egyptian Exchange under the symbol ISPH.CA. The company, Egypt’s fastest-growing and second-largest distributor of pharmaceutical products, will have a market cap of EGP 3.9 bn at the opening bell. The company will use some EGP 280 mn of its IPO proceeds towards a capital increase in 1Q2018 and the balance to cover exits by current shareholders. Beltone Investment Banking is sole global coordinator and bookrunner for the transaction, while Matouk Bassiouny is acting as counsel to the issuer. Inktank Financial is investor relations advisor. Read the full press release here (pdf).

Contrary to rumors spreading on social media in the past 36 hours, Egyptian banks have not bankrolled the construction of Ethiopia’s Grand Renaissance Ethiopian Dam by buying into bonds offering 36% interest. Central bank governor Tarek Amer described the notion as “hallucinations and myths” in a statement to state news agency MENA. (But really: 36%? I mean, if that offer was real, you’d be just about crazy not to take it.) The tempest in a teapot comes as Ethiopian Prime Minister Hailemariam Desalegn is expected to address Egypt’s House of Representatives sometime this month. Cairo and Addis Ababa are locked in a war of words over use of Nile water as Ethiopia continues to build out GERD.

***Take our end-of-year survey — get a bag of Enterprise-branded coffee and cool mugs from which to drink it: It’s that time of the year again — we want you to help us gauge how well business went during the year. What are the biggest challenges you faced during the year? Where will the exchange rate stabilise? How big do you expect your employer’s raises to be? Are you hiring? Help us find out. You’ll get the chance to become one of 25 people who’ll get our end of year giveaway package consisting of Enterprise swag and our first-ever Enterprise-branded batch of coffee, which we’ve put together with good friends in the coffee business. (More on that in a later issue.)

Adventurer and entrepreneur Omar Samra and triathlete Omar Nour will begin their epic 5,000 km journey across the Atlantic ocean on nothing but a rowboat tomorrow. We wish them all them best.

This morning’s miscellany:

- It turns out that building a robot-powered hedge fund is a heck of a lot more difficult than it seems on first glance, according to this feature in the Journal.

- A US analyst looks at a diminished geopolitical future for the Middle East thanks to the rise of the US fracking industry in a piece penned for the Wall Street Journal.

- “Hyundai Motor is facing [nearly USD 1 bn] in production losses this year as union members at the South Korean carmaker continue the spate of partial labour strikes,” the Financial Times notes.

- Donald Trump wants to see America head back to the moon — and onward to Mars, the salmon-colored paper notes elsewhere.

- Being obese or having diabetes could put you at higher risk of cancers including tumors of the colon, gallbladder, liver and pancreas, the New York Times notes in a pickup of a recent study.

The Golden Globe nominees are out, and we’re a bit miffed that the kids from Stranger Things got nary a nod. The series was nominated for best drama, while David Harbour, the actor who plays Chief Hopper, was nominated for best supporting actor in a TV drama. The Golden Globes website is here, and you can read their official list of nominees here.

Speaking of Stranger Things: You may have more than a year to wait for the next season of the show, according to the aforementioned David Harbour, who told an interviewer in Dubai: “You probably won’t get [Season 3] until sometime in 2019 … like any good thing, [the writers] need time. And those guys work so hard. I mean, they just sit in their apartment and write for 12, 14 hours a day,” reports Time magazine, picking up an interview for Variety. You can watch the Harbour interview here for yourself (runtime: 4:51).

Random (rude) thought: Yes, we know you think Stoicism is cool. We occasionally listen to Tim Ferriss’ podcast, too, and he’s been banging on about this since at least 2009. Now, would you shut up about it for five minutes, please?

What We’re Tracking This Week

Ahmed Shafik, the 2012 presidential candidate turned exiled Mr. McGoo, will announce his final decision on whether to run for office in 2018 sometime in the next few days, said Raouf Al Sayyed, deputy head of Shafiq’s Egyptian National Movement Party, AMAY reports. The former air force commander had turned the local press into a circus last week, when he announced out of the blue that he was running, before claiming that UAE authorities were not allowing him to leave, then disappearing and reappearing in Egypt. We plan to give his announcement the coverage as it deserves: lip service.

On The Horizon

The IMF’s Executive Board will meet on 20 December to review progress on Egypt’s economic reform program ahead of voting to disburse the third USD 2 bn tranche of the USD 12 bn Extended Fund Facility. Egypt has already received two tranches worth a combined USD 4 bn.

The Central Bank of Egypt will review interest rates at a meeting of its Monetary Policy Committee on 28 December.

Enterprise+: Last Night’s Talk Shows

The reality of the Dabaa nuclear power plant and its connection to the resumption of Russian tourism reigned supreme on the airwaves last night.

The Dabaa contracts that were signed last night officially kickstarted the project, which now enters the design phase, Electricity Minister Mohamed Shaker told Al Hayah Al Youm’s Tamer Amin. Egypt and Russia have been in prolonged discussions over the technical and financial details of the project for the past year and a half, Shaker noted, but Russian teams have already started studies of the project site (watch, runtime: 5:13).

Kol Youm’s Amr Adib was more concerned with the Russian Industrial Zone than the Dabaa facility, saying that the former is more beneficial to the Egyptian economy since it’s an industrial project that will create jobs, boost exports, and bring in foreign currency (watch, runtime: 3:45). He did take note, however, of some key points of the agreement over the nuclear plant, including that Russia is lending us USD 25 bn to cover the costs of the plant and that the loan carries a 3% yearly interest rate (watch, runtime: 7:24).

The resumption of Russian flights to Egypt seems more likely now, since Russian Transport Minister Maksim Sokolov gave an official statement that he expects direct trips between Moscow and Cairo to resume in February, House Tourism Committee President Sahar Talaat Mostafa told Masaa DMC’s Eman El Hosary. Mostafa had little information, but still said the two countries are expected to sign a protocol within a week to get the ball rolling on bringing back Russian holidaymakers (watch, runtime: 5:27).

Hona Al Asema’s Lamees Al Hadidi delved further into the potential return of Russian tourism with Blue Sky Chairman Hossam El Shaer, who said that resuming direct flights to Cairo is only a first step. The more important goal is to bring back flights to Sharm El Sheikh and Hurghada, which could reel in as many as 2 mn Russian tourists per year, especially if charter flights are back in the air.

Egypt’s tourism industry needs to awaken from its slumber and begin preparing as soon as possible for the potential influx of tourists, El Shaer stressed. Multiple hotels have either been shut down or require extensive upgrade work, but the CBE’s initiative to provide affordable financing for the tourism industry has flopped, according to El Shaer (watch, runtime: 7:14).

Lamees also spoke to Trade and Industry Minister Tarek Kabil about the World Trade Organization’s ministerial conference in Buenos Aires. The minister said developed and developing countries did not find common ground on their respective needs. Egypt has been rallying Arab and African countries to present a united front in that regard to give developing countries a significant voice in negotiations. One of the main points of contention between the two sides is implementing legislation to regulate storage of foodstuffs — countries like Egypt store large amounts of agricultural products for its local food security, while others store these products for exports that can impact global prices and trade volumes (watch, runtime: 5:46).

Speed Round

It seems we have signed contracts for the USD 20+ bn Dabaa nuclear power plant, but direct flights from Moscow to Cairo aren’t back yet: President Abdel Fattah El Sisi witnessed the signing of “the notices to proceed [with] the contracts” for the construction of the Dabaa nuclear power plant following his summit with Russian President Vladimir Putin, who arrived in Cairo on Monday, according to a statement from Russian nuclear power company Rosatom (pdf), which will be constructing and operating the plant. Electricity Minister Mohamed Shaker also signed contracts for the facility’s fuel at a ceremony following the summit (watch, runtime: 28:46). NTPs by definition imply that contracts are signed, so it seems we’re about to become a nukuler power.

Rosatom says the nuclear power plant in Dabaa would cost up to USD 21 bn and is expected to be completed by 2028-2029, according to Sputnik. Commercial operations on the first nuclear reactor, with a generation capacity of 1.2 GW, should begin in 2026, Electricity Minister Mohamed Shaker tells Al Borsa. The remaining three reactors will come online over the following two years. Egypt had approved an agreement for a loan from Russia to cover the cost of the project. The loan would cover 85% of the construction costs and the company would service the plant’s four reactors for 60 years, Rosatom Chairman Alexei Likhachyov says. Egypt will begin repaying the first instalment on the loan in 2029, according to Shaker.

No agreement on restoring flights yet, only some encouraging words of a possible February deadline: Russia is “ready in principle” to resume direct passenger flights to Egypt and an “agreement is expected to be signed in the near future,” Putin said after meeting with El Sisi, according to Russia’s Sputnik. Putin added at the Dabaa signing ceremony that Egypt had made “great efforts” to bolster security at its airports. His encouraging statements follow those by Russian Transport Minister Maxim Sokolov, who told reporters earlier yesterday that he expects Russia to resume flights to Egypt by February. According to Sokolov, the date by which the relevant intergovernmental protocol could be signed “depends primarily on the Egyptian party. We will be ready to do this already this week,” the minister said, according to TASS.

As for the Russian Industrial Zone (RIZ), Putin said he expects Russian investments there to reach USD 7 bn after generating the interest of some of Russia’s leading corporations. The zone will be Russia’s main conduit to export goods to the Middle East and Africa, according to Sputnik. There was no statement given on when an agreement on the zone will be signed.

Regional politics and security also featured prominently during Putin’s sit-down with El Sisi. The two agreed to expand cooperation and information sharing on security and terrorism, said El Sisi. He called on states to take further measures to halt the movement of suspected terrorists, who are looking for a home after their “Caliphate” had been extinguished in Iraq and Syria. As for the Trump administration’s peculiar Middle East strategy of sidelining the Palestinians from Jerusalem and then offering a peace plan, Putin said that any steps that pre-empt a possible agreement between Israel and the Palestinians are counter-productive and destabilizing. He welcomed the Egypt-mediated reconciliation talks between Hamas and Fatah.

There was no news of arms sales to Egypt that had been expected by defense analysts. Russia has grown to stand as Egypt’s leading supplier of military hardware after the United States. Russia and Egypt had signed an agreement back in November giving the countries access to the other’s airbases. Putin left Cairo for Turkey to discuss Syria’s future after he ordered a (partial) drawdown of Russian troops in Syria yesterday. Putin had made an announcement during a pit-stop to a Russian airbase in Syria before landing in Cairo, TASS reports.

IPO WATCH- From the Department of Unrealistic Deadlines, we have the notion that the IPOs of the three companies that will operate the Siemens power plants will take place in July 2018, Egyptian Electricity Holding Company (EEHC) head Gaber El Desoky told Al Borsa on Monday. The companies, which will manage combined cycle plants in Burullus, Beni Suef and the new capital, are currently in the process of being established and the IPO will take place after the three plants are up and running completely, he added. The EEHC, which will hold a 51% stake in the three companies, and state-owned NI Capital, which is setting up the management structure for the companies, have settled on candidates to become the CEOs of each of the plants, said El Desoky, without naming them. He noted that plans for a fourth company to manage future developments of the electricity grid have been scrapped, and those functions will be rolled into one of the companies.

El Desoky did not comment on when the Electricity Ministry plans to hold the open tender for the day-to-day management and maintenance of the three plants, which was set to take place this month. Ten companies, including Siemens, an Orascom-ADERA Energy consortium, an Elsewedy-EDF consortium, Germany’s STEAG GmbH, Hassan Allam, a Triangle-GD France consortium, Korea’s Doosan, and Japan’s Mitsubishi are reportedly taking part in the tender. An EEHC source had said last month that the company was planning to come to a final agreement with the winning company or consortium before the end of the year.

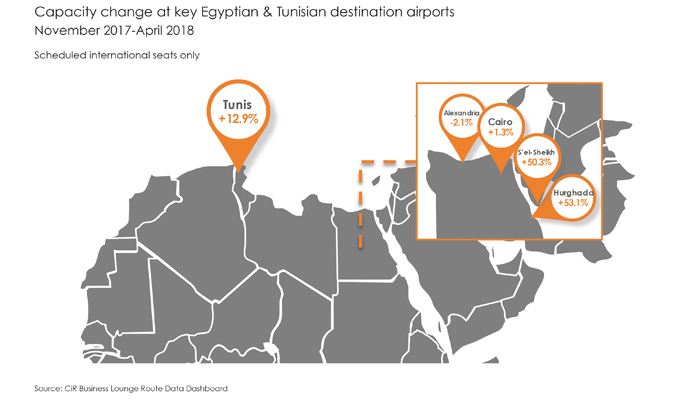

Tourism to Egypt and Tunisia is bouncing back, a report by Counter Intelligence Retail (CiR) shows, according to TRBusiness. “Egypt, for example, recorded strong growth of +20.1% passengers in August alone this year, followed by +13.4% increase in Q3 2017. Egypt’s top four airports also handled an additional 810,000 tourists in Q3, compared to the same period last year, states CiR.” CiR President Garry Stasiulevicius says “tourists are returning to the Red Sea, which is good news for dutyfree operators, as well as the entire resort industry.” CiR also expects the number of travelers to Egypt to increase by 8% y-o-y between November 2017 and April 2018.

INVESTMENT WATCH- Digital money transfer service WorldRemit has raised USD 40 mn in Series C funding to finance expansion of its Egypt operation, the company said in a statement on Monday. The move comes on the back of a surge in remittances by Egyptian expats following the EGP float, which jumped nearly 40% in 1Q2017-18 to USD 6.0 bn, from USD 4.3 bn last year. The new funding will be used to expand the company’s partner network in Egypt as well as appoint a country manager and head of North Africa to lead the growth of the business. WorldRemit allows migrants to send remittances through their phones, cutting out high-priced middlemen such as traditional operator Western Union.

Orascom Telecom Media and Technology Holding (OTMT) confirmed that it is considering plans to invest in several agribusiness projects in Africa, the company said in a statement to the EGX (pdf) on Monday. The company said it was looking into nut and grain production as well as a vegetable oil factory. Countries on its target list include Côte d’Ivoire, Sudan, and South Sudan. The statement follows announcements by Naguib Sawiris that the company is planning two agri-business projects in Côte d’Ivoire in 2018 worth about USD 30 mn each and it was looking at similar projects in Mali, Burkina Faso, Sudan and South Sudan. Sawiris had also said that the OTMT is studying mining projects in Niger and Mauritania. However, the company’s disclosure noted that announced mining projects were investments by Sawiris personally. It is unclear whether they are referencing the Niger and Mauritania projects or Sawiris’ upcoming gold mining investment vehicle.

MoU with Italy’s Danieli for a new steel factory scrapped: The Suez Canal Economic Zone (SCZone) has abandoned plans that would have seen a 1.2 MTPA steel plant built in the Ain Sokhna economic zone, SCZone head Mohab Mamish told Al Masry Al Youm on Monday. Mamish did not explain the reason behind the move, which effectively nullifies an MoU signed by the for the Suez Canal Iron and Steel Company with Italy’s Danieli Steel back in August. The move was a surprise to the company, especially as the agreement stipulated that Danieli would seek financing for the project through Italian and European banks, sources from Danieli tell the newspaper. Undeterred, the company is looking for a local partner to establish a steel manufacturing project, especially in light of the Trade and Industry Ministry imposing anti-dumping duties on steel rebar imports from China, Turkey and the Ukraine for a five-year period.

MOVES- Acting Prime Minister Mostafa Madbouly issued a decision yesterday appointing former ambassador Ahmed Shehab El Din as deputy CEO of the General Authority for Freezones and Investment, Al Masry Al Youm reports. Shehab El Din previously served as assistant foreign minister and was posted to Egypt’s permanent representative at the UN, in addition to service at the nation’s embassies in Holland and China.

A massive new market for Egypt’s film industry: Saudi Arabia announced yesterday it will allow movie theaters to open next year for the first time in more than 35 years. “It’s a stark reversal in a country where movie theaters were shut down in the 1980′s during a wave of ultraconservatism in the country. Many of Saudi Arabia’s clerics view Western movies and even Arabic films made in Egypt and Lebanon as sinful,” the Associated Press says. The first cinemas in Saudi Arabia are expected to open in March 2018. “The kingdom says there will be 300 cinemas with around 2,000 screens built in the country by 2030.” Our first of many questions: Will the cinemas be ‘mixed’ with men and women sitting in the same place?

Did Egypt’s purchase of Rafale fighter jets revive interest in an unpopular piece of military hardware? Egypt’s initial purchase of 14 Rafale planes back in 2015 for USD 6 bn helped spur further orders from other countries, according defense intelligence news outlet Strategy Page. “Until 2015 export buyers for the Rafale had been scarce. The Rafale was up against stiff competition for sales from aircraft such as the Eurofighter Typhoon, Swedish Gripen NG, American F-18E and Russian Su-30.” In 2013, Brazil passed on buying the Rafale and instead went with the cheaper Swedish Gripen NG. France had difficulties in finding customers for Rafale prior to the Egypt sale, and has had to reduce annual production to 11 planes from 14. However, Since 2015 production has increased. By late 2017 over 170 Rafales had been built and over a hundred more were on order. In 2016, India agreed to buy 36 Rafale fighters with an option to buy another 18, encouraged by speedy deliveries to Egypt. The UAE is reportedly still considering a purchase order for some 60 planes, Defense World reports.

Making the most efficient use of roads is more important to improving transportation than building new roads, Careem CEO Mudassir Sheikha tells Bloomberg. “We believe ride-hailing, or a version of it, is the best way to build public transport today … [There’s a Middle Eastern city] that’s building a metro bus system for [USD 700 mn] that will transport 200,000 people. If they invested the same amount in ride-hailing, it would have capacity for 1.5 mn people and create 100,000 jobs,” Sheikha says. He adds that investment in technology could also create alternatives to new public transport systems: “Autonomous vehicles are on the horizon. We’re looking at it and have partnered with a company out of the Bay Area making self-driving electric pods.”

On a related note, Careem announced that it has partnered with Sarwa Capital to help provide drivers with financing for new cars, Al Mal reports.

Also from the transport apps space, recently-launched courier and shipping services company Trukto is planning an expansion both in Egypt and abroad, company sources tell the newspaper. The app, which currently operates in Cairo and Alexandria, is eyeing further expansion and is looking to get a fleet of 15,000 trucks by 2019. The company is also looking to launch operations in Saudi Arabia in 1Q2018.

Former LafargeHolcim CEO Eric Olsen was charged with funding terrorist groups as part of a French probe into the cement maker’s operations in war-torn Syria, Bloomberg reports. Olsen, who resigned from the company in April, was also charged late Thursday with putting someone else’s life in danger and placed under judicial supervision, said an official at the Paris prosecutor’s office who declined to be named in line with policy. The case revolves around payments made to armed groups to keep a cement plant in Syria operating by Lafarge prior to its merger with Holcim.

Liverpool forward Mohamed Salah was voted BBC African Footballer of the Year on Monday, according to BBC Sport. Salah’s performance this year — both with the British club and Egypt’s national team — has been stellar. Aside from being on a tear with Liverpool, he was the driving force behind Egypt qualifying for the World Cup for the first time in 28 years. Salah beat out Gabon’s Pierre-Emerick Aubameyang, Guinea’s Naby Keita, Sadio Mane of Senegal and Nigeria’s Victor Moses for the award and becomes the third Egyptian to hold the honor, after Mohamed Barakat and Mohamed AbouTrika.

Police in New York authorities apprehended a 27-year-old man suspected of carrying out an attempted suicide bombing at the Port Authority Bus Terminal yesterday, Reuters reports. The attacker, Bangladeshi national Akayed Ullah, attempted to set off a homemade pipe bomb he had strapped to his body, but the device did not properly detonate. Three others were injured in the attack. The idiot apparently targeted the terminal because it had Christmas-themed posters up.

The Macro Picture

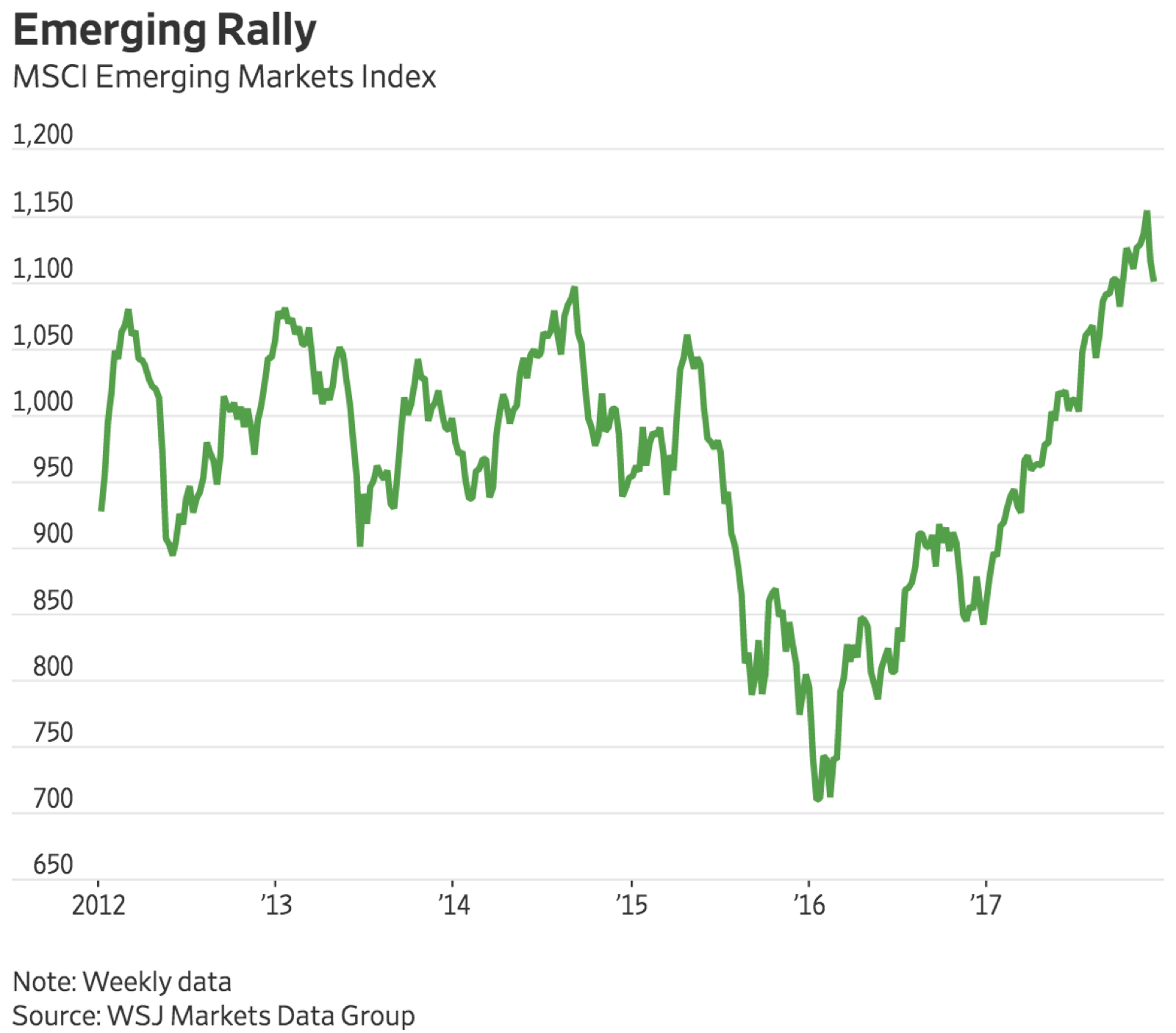

Are emerging markets becoming Fed-proof? That’s the argument explored in a piece this morning for the Wall Street Journal — a rare piece in a newspaper not known for its deep thinking on EM.

The team-written story argues that “strong global growth, stabilizing commodity prices and improving domestic fundamentals” are behind the ongoing emerging markets rally. That rally has so far seen key markets immune to the Fed flu: The propensity of capital to flee EM in search of lower-risk (and just plain lower) returns anytime the Fed raises interest rates.

“The MSCI Emerging Markets Index of stocks has risen around 28% this year, more than the 18% gained by the S&P 500, and is on pace for its best year since 2009,” they note, pointing out that investors will “pour USD 1.1 tn into emerging-market assets this year, the biggest flow of funds in three years.”

And there’s more to come, they argue: “Flows are expected to increase further next year, to USD 1.2 tn,” citing data from the Institute of International Finance.

Egypt in the News

The new Cold War: It’s a single-story news day for Egypt as the international press frames Russian President Vladimir Putin’s visit to Cairo in the context of a new Cold War with the US — a war in which Russia is largely presented as having an edge. Some outlets, including the Associated Press and Reuters, suggest that stronger bilateral ties with Egypt would come at America’s expense, noting that the signing of new agreements, especially on military cooperation, comes at a time when the US is withholding military aid to Egypt on humanitarian grounds.

In a rare over-reach, the Financial Times leads with the notion that Putin agreed to allow the resumption of Russian flights to Egypt, a theme also popular with Bloomberg. Both the AP and the Washington Post hit the nail on the head, with the latter noting that, “the question of resuming flights between Egypt and Russia remains unsolved after Putin’s visit, a significant setback for Egypt.” The New York Times also gets the flights angle wrong, but its piece by Neil MacFarquhar and Anne Barnard is otherwise one of the best on yesterday’s developments.

Also getting a little bit of ink this morning: Palestinian President Mahmoud Abbas’ stop in Cairo for coffee with President Abdel Fattah El Sisi; the upcoming Christmas Day trial of a UK woman charged with smuggling opioids into Egypt; and the Luxor tomb discovery we noted earlier this week.

On Deadline

The US and Russia are in a tug of war for power and influence over Egypt, Emad El Din Adib writes in a column penned for El Watan. Each country comes with its own set of carrots and sticks: The US uses its economic and military aid as leverage to mold Egypt’s policies on Israel, human rights, and our ties with Russia. Russia is taking advantage of its tourism market and the planned Russian Industrial Zone. Adib seems to think that Egypt has done a good job so far of balancing the two powers and benefiting from what each has to offer, but claims that the balance will be more difficult to maintain now as Moscow and Washington are upping their efforts to undermine Egypt’s sovereignty.

Worth Watching

This heart-wrenching video of an emaciated polar bear struggling to find food on Canada’s Baffin Island is all you need to see to understand the effects of climate change. Polar bears normally feed on seals, but they have lost access to their main dietary staple as global temperatures rise and sea ice continues to melt, disrupting the entire ecosystem. The footage, captured by National Geographic photographer Paul Nicklen, gives us a very harrowing and tangible image of what climate change is doing to the planet and its inhabitants (watch, runtime: 1:08).

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi and his Palestinian counterpart Mahmoud Abbas agreed yesterday to continue rallying international support against the Trump administration’s recognition of Jerusalem as Israel’s capital, Ittihadiya said in a statement. The two also agreed that the Palestinian reconciliation process must proceed to help the country’s position. Abbas also met with Arab League Secretary General Ahmed Aboul Gheit in Cairo, Reuters reports. His visit comes as students and professors in Egypt continued to hold protests on university campuses against US President Donald Trump’s declaration, according to Al Masry Al Youm. The Palestinian president should be in Istanbul today to attend an emergency meeting at the Organization of Islamic Cooperation. Foreign Minister Sameh Shoukry will also attend the summit in the Turkish capital, according to a statement.

Meanwhile, Israeli Prime Minister Benjamin Netanyahu “met a firm rebuff” from several EU countries who refused to follow America’s lead in moving their embassies in Israel to Jerusalem, Reuters reports.

Switzerland’s Economic Affairs Secretary will be in Cairo today to set USD 87 mn cooperation framework: Swiss State Secretary for Economic Affairs Marie-Gabrielle Ineichen-Fleisch will arrive in Cairo today to hammer out a cooperation framework with Egypt which could see us receive CHF 86 mn (USD 87 mn) in foreign development aid, Al Mal reports, citing a Swiss embassy statement. The framework and the aid package will be for the period of 2017-2020. Ineichen-Fleisch will also be following up and visiting a number of Swiss-funded development projects, including Badr University, which has received USD 10 mn in Swiss funding.

Egypt and the Libyan Government of National Accord have agreed to form a joint committee to cooperate on setting customs and financial policies and which will see Egypt help train Libyan custom officials. The committee will be headed by Vice Minister of Finance Mohamed Maait, Al Masry Al Youm reports. The move follows a meeting between Libyan Finance Minister Osama Hamad and Finance Minister Amr El Garhy on Sunday. Hamad had requested Egypt’s help to bolster its customs authority and to help aid it in curbing customs evasion, according to a Finance Ministry statement.

Energy

EETC issues first tender outside FiT program for 600 MW of solar energy

The Egyptian Electricity Transmission Company (EETC) issued its first tender outside the feed-in tariff program for 600 MW of solar power projects west of the Nile, PV Magazine reports. Under the new system, the EETC will issue competitive solar and renewable energy projects. Interested developers who have prior experience will be allowed to submit their technical and financial bids until 14 January, 2018. Winning offers will be awarded long-term power purchase agreements, and the projects will be established under a build-own-operate framework.

GE Power to help connect 120 MW of wind power to the national grid by 2018

GE Power and the Egyptian Electricity Transmission Company (EETC) have agreed to cooperate on connecting 120 MW of wind power to the national grid by the end of 2018, GE announced on Monday. This will be done by extending the Gabal El Zayt 22/220 kV Gas Insulated Substation through the use GE Power’s Grid Solutions’ medium- and low-voltage systems, control and protection systems and auxiliary services. GE will handle the project on a turnkey basis.

Alexandria Electricity Distribution launches 10 tenders to install cables, other equipment

The Alexandria Electricity Distribution Company launched 10 tenders to supply and install power distribution cables, control systems and other equipment, company sources told Al Mal on Monday. The company is expecting to receive bids from companies this week, sources added.

Afrises wins Ugandan contract to supply EGP 100 mn in PV solar systems

Egyptian solar company Afrises has been awarded EGP 100 mn in contracts by the Ugandan government to supply and install solar power systems, company CEO Ahmed Hamdy tells Al Mal. The PV systems, which will be used to power various small-scale development projects in Uganda, will be completed by the end of 2018.

Health + Education

Public Funds Prosecution investigates ACDIMA over penicillin shortage

A prosecutor’s office in charge of investigating the misuse of public funds is probing the Arab Company for Drug Industries and Medical Appliances (ACDIMA) amid allegations it engaged in monopolistic practices that resulted in a penicillin shortage in the local market, Al Masry Al Youm reports. The Health Ministry is reportedly accusing ACDIMA’s former president, Medhat Shaarawi, of halting an incoming shipment of penicillin and rerouting the shipment through a company owned by one of his family members. The ministry alleges that was behind the penicillin shortage citizens began complaining about earlier this month. Shaarawi has denied the allegations.

Banking + Finance

Al Ahly Capital to set up factoring arm in 1H2018

Al Ahly Capital is planning to set up a factoring arm in 1H2018 as part of its strategy to expand its non-bank financial services offering, CEO Khaled Badawi tells Reuters’ Arabic service. The company would have an initial capital of EGP 300 mn.

Egypt Politics + Economics

House Economics Committee plans to summon Sahar Nasr over delay in roll out of investor service center, map of industrial projects

The House Economics Committee may summon Investment Minister Sahar Nasr answer questions about what it says is a delay in setting up an investor service center, Ahram Gate reports. The committee will question Nasr over “conflicts” between different ministries, which has delayed the establishment of the center and the release of the ministry’s investment map of 600 projects, committee deputy head Medhat El Sherif says. He points to the Trade and Industry Ministry’s success in releasing its industrial investment map as evidence that the Investment Ministry is not prioritizing its own map.

Eight arrested for protesting Trump’s Jerusalem decision

Eight people were arrested in Cairo and accused of being connected to the Ikhwan for demonstrating against US President Donald Trump’s decision to recognize Jerusalem as Israel’s capital, presidential candidate Khaled Ali said yesterday, according to the AP. The demonstrators have also been charged with “inciting protests and violence” and will be detained for 15 days, pending investigation.

On Your Way Out

Endeavor Egypt held an event honoring mentors for their contributions in guiding Egyptian entrepreneurs, the organization said in an emailed statement (pdf). Transcendium founder and executive partner Alaa Hashim was celebrated as the group’s mentor of the year. Ten others, including Ezdehar Managing Partner Emad Barsoum, Orascom Development Holding CEO Khaled Bichara, and our friend PwC Country Senior Partner Tarek Mansour each received awards recognizing their 10-year commitment to mentorship with Endeavor Egypt. The ceremony brought together more than 100 entrepreneurs.

The Market Yesterday

EGP / USD CBE market average: Buy 17.7544 | Sell 17.8544

EGP / USD at CIB: Buy 17.75 | Sell 17.85

EGP / USD at NBE: Buy 17.69 | Sell 17.79

EGX30 (Monday): 14,427 (+0.1%)

Turnover: EGP 967 mn (7% below the 90-day average)

EGX 30 year-to-date: +16.9%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.1%. CIB, the index heaviest constituent closed down 1.0%. EGX30’s top performing constituents were Abu Dhabi Islamic Bank up 4.6%; Arab Cotton Ginning up 3.9%; and Kima up 3.0%. Yesterday’s worst performing stocks were Domty down 1.3%; Egyptian Iron & Steel down 1.2%; and CIB down 1.0%. The market turnover was EGP 967 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -65.3 mn

Regional: Net Long | EGP +16.2 mn

Domestic: Net Long | EGP +49.1 mn

Retail: 69.8% of total trades | 71.9% of buyers | 67.7% of sellers

Institutions: 30.2% of total trades | 28.1% of buyers | 32.3% of sellers

Foreign: 15.5% of total | 12.1% of buyers | 18.9% of sellers

Regional: 13.7% of total | 14.5% of buyers | 12.8% of sellers

Domestic: 70.8% of total | 73.4% of buyers | 68.3% of sellers

WTI: USD 57.95 (+1.03%)

Brent: USD 64.61 (+1.91%)

Natural Gas (Nymex, futures prices) USD 2.80 MMBtu, (+1.01%, January 2018 contract)

Gold: USD 1,244.0 / troy ounce (-0.35%)

ADX: 4,356.3 (+1.43%) (YTD: -4.18%)

DFM: 3,414.05 (+0.55%) (YTD: -3.31%)

KSE Weighted Index: 390.43 (-0.7%) (YTD: +2.72%)

QE: 7,923.07 (+1.22%) (YTD: -24.08%)

MSM: 5,041.06 (-0.43%) (YTD: -12.83%)

BB: 1,265.09 (-0.03%) (YTD: +3.66%)

Calendar

15 December (Friday): The Law Magazine’s Law Talks event, Zamalek palace, Cairo.

19 December (Tuesday): Village Capital’s Financial Health Competition: Middle East and Egypt (applications close 3 November)

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

29-30 January (Monday-Tuesday): Seamless North Africa, The Nile Ritz-Carlton, Cairo

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

29 April – 1 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.