- El Sisi, Trump have meeting of the minds in the Oval Office, hit ‘reset’ on relations. (What We’re Tracking Today)

- Ministers hit talk shows to talk up Washington trip. (Last Night’ Talk Shows)

- Egypt and the US: the Reboot. (Speed Round)

- International media coverage of El Sisi’s trip to DC: The good, the bad and the ugly. (Egypt in the News)

- ADES International Holding files intention to float on LSE. (Speed Round)

- Raya Contact Center guides on EGP 16.00-17.91 per share for IPO pricing. (Speed Round)

- MTI prices IPO EGP 5.96 per share, institutional offering is more than 9x oversubscribed. (Speed Round)

- Ian Grey retires from Vodafone Egypt after 17 years, Hany Mahmoud named new chairman. (What We’re Tracking Today

- The Markets Yesterday

Tuesday, 4 April 2017

Egypt, US hit reset button on relations with Oval Office meeting

TL;DR

What We’re Tracking Today

The only thing anyone is talking about this morning: President Abdel Fattah El Sisi’s visit to Washington, DC, which included a sit-down in the Oval Office yesterday.

The only thing you need to know about that: It went very, very well from the point of view of both leaders. According to a readout from the White House, Trump told reporters before their sit-down: “I just want to let everybody know, in case there was any doubt, that we are very much behind President al-Sisi. He’s done a fantastic job in a very difficult situation. We are very much behind Egypt and the people of Egypt. And the United States has, believe me, backing, and we have strong backing. … I just want to say to you, Mr. President, that you have a great friend and ally in the United States and in me.”

El Sisi’s obligatory Fox News sit-down will air on Wednesday at 6pm Eastern (that’s midnight CLT) in the form of an interview with anchor Bret Baier. Fox’s take: “President Trump has made it clear that there is going to be a new dawn in relations between the United States and Egypt.” (Watch the teaser, run time: 0:45)

The one story about the trip that everyone in the business community seemed to be sharing yesterday is a piece by former US Ambassador to Cairo Frank Wisner for the National Interest headlined simply: “America and Egypt need each other.” We couldn’t agree more. H/t Hisham E.

The story policy wonks are circulating: “What Trump Should Ask Sisi” by Mokhtar Awad, Daniel Benaim and Brian Katulis for Politico Magazine.

We have full coverage of the president’s visit to Washington in Speed Round and Egypt in the News.

What everyone will be talking about later this morning: We now officially have four IPOs in the market following ADES International Holding’s announcement yesterday of its intention to float. ADES joins offshoring outfit Raya Contact Center (which has a price range announcement out this morning), retail and distribution play MTI (which announced overnight final pricing on its IPO) and real estate developer Misr Italia in the market.

One of Egypt’s best friends has retired: Vodafone Egypt Chairman Ian Gray marked his last day on the job yesterday after a 17-year run with a farewell reception at the UK embassy in Cairo. We’ve known and admired Ian, now the CEO of Vodafone Qatar, since he arrived in Egypt for his 2002-2007 stint at chief executive and have admired not just his vision and passion for the job, but the way he developed Egyptian talent that has since spread across the industry. He plans to remain involved with Egypt through the UK-Egypt bilateral business councils. Ian was replaced yesterday by Hany Mahmoud, the former minister of communications and IT (2012) and one-time minister of local development (2013), an 11-year veteran of Vodafone Egypt.

On The Horizon

Habemus papal visit date: Pope Francis is set to arrive in Cairo on 28 April for a two-day visit, according to an Ittihadiya statement cited by Ahram Online. During the visit, Pope Francis will meet with President Abdel Fattah El Sisi, Coptic Orthodox Pope Tawadros II, and has plans to visit Al Azhar. The full program of the Pope’s visit is available through the Holy See.

The parents of murdered Italian graduate student Giulio Regeni have asked Pope Francis to broach the topic of Regeni’s murder and help them uncover the truth during his visit to Cairo this month, ANSAmed reports. The Regenis’ lawyer, Alessandra Ballerini, told the Italian Senate yesterday that she knows that members of Egypt’s police force are responsible for kidnapping, torturing, and murdering Regeni, according to La Repubblica.

Enterprise+: Last Night’s Talk Shows

As expected, the talking heads last night discussed nothing but Monday’s Trump-Sisi meeting in the Oval Office.

Economic ties were at the top of yesterday’s agenda, as both presidents stressed their eagerness to deepen ties, Investment Minister Sahar Nasr told Hona Al Asema’s Lamees El Hadidi from DC. Trump reassured the delegation that the US will continue to provide Egypt with economic support, Nasr added, whether through its voting power in international funding institutions or through “major” direct investments (watch, runtime 7:20).

Finance Minister Amr El Garhy also told Lamees that the Egyptian delegation promised to make it easier for US companies to invest in Egypt, particularly in the fields of energy and petrochemicals (watch, runtime 4:16).

On the international relations front, Foreign Minister Sameh Shoukry told El Hadidi that Trump and Sisi are of the same mind over security and regional issues, as well as the need to be “practical” in the face of challenges. The minister stressed that the day marked an important step forward in Egyptian-US relations and told Lamees that El Sisi is set to also meet with the US secretaries of defense, state, and trade during his visit to delve deeper into cooperation talks. (watch, runtime 11:08).

The minister also told Kol Youm’s Amr Adib that Trump’s statements about the US intending to invest in its military were in reference to combined regional efforts to combat terrorism. Shoukry also said that Trump acknowledged the importance of supporting Egypt to allow it to play its strategic role in achieving stability in the region (watch, runtime: 12:27).

Adib criticized an attempt to assault talk show host Youssef El Hosseiny in Washington. The alleged attacker, an Egyptian, is shown in the footage wearing a t-shirt with a picture of El Sisi, which he used to blend with the crowd before making his move and quickly getting neutralized by nearby police (watch, runtime: 3:52). It seems Egyptians beating up on talk show hosts in Amreeka is a thing, if you’ll recall events in New York a couple of years back.

Over on MBC, Yahduth Fi Misr’s Sherif Amer spoke to former Trump advisor Walid Phares, who said that the new US administration supports Egypt’s drive to label the Ikhwan a terrorist group, but added that the time was not yet right to make the decision. He told Amer that other Arab countries had also made the same request.

(The Ikhwan appear to be feeling the heat and reacting in kind: The Ikhwan’s Shura Council is planning to vote this weekend on whether or not it should pursue conciliation with the Sisi administration and seek a way back into the political arena, AMAY reports. The proposal is being met with some opposition from within the group and preacher Magdy Ghoneim has reportedly suspended his membership in protest. Exiled preacher Youssef Al Qaradawi has also threatened to follow suit, the newspaper adds.)

Speed Round

Egypt and the US: the Reboot: President Abdel Fattah El Sisi and US President Donald Trump had a busy day of closed door meetings on Monday that was preceded by a brief joint press conference (watch, runtime 7:32) in which the US president declared that Egypt “have a great friend and ally in the United States and in me.” Trump commended El Sisi for doing a great job at a difficult time. El Sisi returned the compliments.

It remains unclear whether Egypt will see new military or economic assistance. Both leaders expressed their desire for further cooperation on security, with Trump promising to remain supportive of the other’s counter-terrorism efforts and attempts to achieve regional stability. However, Trump did say that the United States and Egypt "have a few things" they do not agree on, which we’re taking this as a suggestion (at least) that the White House isn’t in a rush to designate the Ikhwan as a terror group. A US official speaking to Reuters said that Egypt is going to be disappointed because El Sisi wants more assistance and he’s not going to get it, adding it is not yet clear whether US assistance to Egypt would be cut under Trump’s proposed cuts to foreign aid spending. Foreign Minister Sameh Shoukry told Youm7 that continued military aid is in the interest of both countries.

Don’t expect the White House to say much more than it already has: White House Press Secretary Sean Spicer was adamant on keeping the meeting private. (Watch Spicer’s full briefing, which is always entertaining, or skip straight to this part here where questions are asked about why human rights issues are being pressed less publicly than during the Obama era.) What Spicer did say, at the beginning of the briefing: “With respect to today, the President, as you know, welcomed President Al-Sisi of Egypt to the White House this morning. The two Presidents had an honest discussion focused on areas of cooperation. The President made clear that this is a new day in the relationship between Egypt and the United States, and the President affirmed his strong support of the Egyptian people. It was a candid dialogue during which they discussed both areas of cooperation and of concern.

Behind closed doors: Beyond the expected talk of terrorism, El Sisi, Trump and US Secretary of State Rex Tillerson discussed a number of key regional issues. El Sisi pressed hard on his doctrine of “sovereignty and non-interference” and advanced the Arab plan for the resolution of the Israeli-Palestinian conflict, which centers on a two-state solution, according to an official statement from Ittihadiya picked up by Al Mal. Expect to see more talks on these fronts in the coming months, the statement added.

Will investment and not aid be used to build stronger economic ties? Investment Minister Sahar Nasr pushed the investment file forward, promised to encourage investment in energy, agriculture, and telecoms. Nasr also said that Egypt told Trump that it is interested in seeing more US investment in the Suez Canal Economic Zone. El Sisi and his delegation held a roundtable discussion with representatives from over 60 major US corporations to discuss progress in Egypt’s economic reform agenda and invite them to explore potential investment opportunities, Al Borsa says. The Egyptian President also sat down with the CEO of the US Chambers of Commerce Thomas Donohue, according to Youm7.

…On a related note, Trade and Industry Minister Tarek Kabil is reportedly in talks with US officials to add areas of Upper Egypt to the Qualifying Industrial Zones agreement after having recently included Minya and Beni Suef, Al Shorouk reports. The agreement gives Egyptian products preferential access to the US market provided they have a specified minimum Israeli component.

Prime minister pens piece for The Hill on what Egypt and the US can do together to clamp down on curb terrorism, promote regional stability: Successful anti-terror policies and peace in the Arab world demand the US and Egypt engage on four fronts, Prime Minister Sherif Ismail writes for The Hill. The first is to “support counterterrorism efforts in moderate Arab states under siege by extremists within their own borders,” which will require the right mix of equipment, intelligence-sharing and logistics support” as well as “the right alignment of strategies, tactics and shared responsibilities.” Ismail also says sources of funding and weapons to terrorist organizations should be stopped. Third: “Expand trade and investment and share technologies to shore up the economies of the Arab world and enable them to provide a living standard that discourages citizens from being attracted to extreme ideologies.” The fourth element, according to Ismail, is the need to “promote a serious and genuine reform of religious discourse.” He says the effort has to be led by moderate Arabs “to advance a culture of peace by discouraging hate speech and supporting the coexistence of all peoples.” Ismail says “progress will not always be smooth, and there will inevitably be disagreements and setbacks … But progress can be made, and my government is prepared to play a more active diplomatic role.”

“We’ve certainly seen a lot of foreign money coming in,” Emirates NBD Chief Investment Officer Gary Dugan told Bloomberg TV, commenting on the expectation that central bank reserves are expected to have surpassed USD 28.5 bn in March. A lot of foreign money came in and it has been looking to pick up those relatively high yields on the expectation that currency remains stable, Dugan says. He says most of the access points now are in the money market and the “juice” in trade over the past three months has been in three-month and twelve-month deposits. Dugan suggests that economists expect the impact of devaluation to subside in about “eight months from now” and this will usher a marked improvement in the headline rate of inflation and confidence will prompt more fund inflows (runtime 04:18).

IPO Watch- Oil and gas drilling and production services provider ADES International Holding announced its intention to proceed with a global offer of its existing shares on the London Stock Exchange yesterday. The Dubai International Financial Centre-based company is planning to raise up to USD 170 mn through the issue of new shares. The selling shareholder is also offering for sale a block of existing shares. ADES offers offshore and onshore contract drilling as well as workover and production services in Egypt, Algeria and Saudi Arabia with clients including Aramco, Sonatrach, BP, Eni. ADES will use the net proceeds of the global offer received by it to fund capital expenditures related to its scale-up in Egypt, Saudi Arabia and Algeria and to fund ventures into new markets including Gulf Cooperation Council countries “in the belief that this will create substantial risk-adjusted returns for shareholders.”

Why it’s so interesting: The company, which has deep roots in Egypt (the market accounts for about 44% of its backlog) has consistently grown its top line and EBITDA through the oil price slump by focusing on recurring revenues. “Oil has fallen from a high of USD 126 per barrel in 2012 to c. USD 57 per barrel at the end of last year, dipping below USD 30 per barrel in the interim. Our annual revenues have expanded at a compound annual growth rate of 34% in the period 2014-16 as we have cost-effectively serviced a number of profitable contracts with a strong track record of renewals. Our backlog has grown at a CAGR of 107% in the period 2014-16,” CEO Mohamed Farouk said. The company, which has 100% USD-denominated revenues and a majority EGP cost base, posted an EBITDA CAGR of 46% in 2014-16.

EFG Hermes is sole global coordinator and joint bookrunner for the offering. Citigroup Global Markets Limited is joint bookrunner. White & Case LLP is counsel to ADES, while Baker McKenzie is counsel to the sole global coordinator and joint bookrunners. Inktank Communications is investor relations advisor to the company.

Meanwhile, Raya Contact Center announced indicative pricing for its initial public offering of some 49 mn shares, saying it would price the offering in the range of EGP 16.00 and EGP 17.91 per share. At the top end of the range, the company could raise as much as EGP 877 mn, by our calculations. Shares will be offered to institutional and retail investors at the same price. The selling shareholder plans to subscribe to an EGP 100 mn capital increase to inject some of the proceeds from the sale back into the company, which CEO Ahmed Imam says is “in the midst of [a] transformation [into a] multinational BPO service provider.” Read the price range announcement here. EFG Hermes is sole global coordinator and bookrunner for the IPO. Dechert LLP is international counsel to the issuer, Zaki Hashem and Partners is local counsel to the issuer, Matouk Bassiouny is local counsel to the sole global coordinator and bookrunner.

Finally, consumer electronics, retail and luxury car player MM Group for Industry and Trade has concluded its institutional offering and priced its IPO at EGP 5.96 per share. Total demand generated by the institutional offering was in excess of EGP 5.5 bn, making it about 9.2x oversubscribed. At that price, MTI’s market cap on the first day of trading will be EGP 2.4 bn. The subscription period for the retail offering will end on Thursday and trading in the company’s shares is due to begin on 11 April. Beltone Investment Banking is the sole global coordinator and bookrunner, while Zaki Hashem and Partners is serving as local counsel.

Edita will not be channelling new investment into Egypt in 2017, Chairman and CEO Hani Berzi reportedly told Al Mal. We’re taking Al Mal’s report with a teaspoon of salt: The company has consistently telegraphed (as recently as the end of February) that it is on the lookout for either M&A or greenfield expansion opportunities, saying in its 4Q2016 earnings press release, “our strategy this year may also include direct expansion both in Egypt and in new markets.” Either way, the newspaper says, Edita does plan to continue investing in Egypt in the future. Berzi told Al Borsa Edita has no plans to increase its product prices in the near future. He expects Edita’s business to grow 15-20% y-o-y in 2017 as it targets a 10% increase in exports. The company had said in March it plans to begin operating two new production lines for wafer and cake products at its new factory in the Polaris Al Zamil Industrial Park in 2H2017.

A Mediterranean gas pipeline carrying natural gas from Israel to Europe could be built by 2025, and it looks like Egypt is being cut out, Reuters reports. European and Israeli governments gave their support to moving forward with the agreement on a 2,000 km-long pipeline that aims to link gas fields off the coasts of Israel and Cyprus with Greece, and possibly Italy, for EUR 6 bn. The plan, as laid out, does not mention any connections from Egypt or to Turkey. The agreement followed a meeting between the energy ministers from Israel, Cyprus, Greece, and Italy, with European Climate and Energy Commissioner Miguel Arias Canete saying “he believed the project would ‘meet all relevant requirements’ to make financial commitment possible.” One energy executive was skeptical, telling the Financial Times, “I think the industry doesn’t believe in it … The government would be better served growing the domestic market and finding solutions to make gas flow to Egypt, Jordan and Turkey.”

And while we’re on gas, Qatar Petroleum has ended a 12-year moratorium on new gas projects, announcing plans to start a new development in the 2 bcf/d offshore North Field, Bloomberg reports. The moratorium allowed the company to assess how its current rate of extraction affects the giant reservoir it shares with Iran. Production should start in five to seven years, CEO Saad Sherida Al Kaabi said on Monday.

Cabinet approved yesterday a draft of the Universal Healthcare Act and referred it to the State Council, Ahram Gate reports. The Health Ministry will receive the actuarial studies on its implementation within three weeks, Health Minister Ahmed Rady said, Al Shorouk reports. Once approved, the act will be implemented in Canal governorates as a first stage as soon as it the House of Representatives approves it prior to a nationwide implementation by 4Q2017, Prime Minister Sherif Ismail previously said. Under the act, the state will finance health insurance for those who cannot afford it, which the government currently estimates to be 30-40% of the population, Rady says. State hospitals will be the main healthcare providers under the program with private hospitals participating if they meet specific accreditation and quality control authority requirements. You can read more about the act in our Spotlight from last month.

Talk of price controls postponed to next week: Cabinet was also expected to discuss the Consumer Protection Act and “price controls frameworks” at its meeting yesterday, but postponed the discussion until its next meeting, Al Masry Al Youm reports.

Mandatory smart cards, fuel prices hikes expected next fiscal year: The government is planning to raise fuel prices next fiscal year in effort to keep subsidies spending on budget, unnamed government sources tells Al Shorouk. Separately, the government is also planning to make using fuel smartcards mandatory next fiscal year as part of its plan to cut back on fuel subsidies, Al Borsa reports, citing unnamed government sources. The move is part of an effort to ensure that the fuel subsidy spending meets the target laid out in FY2017-18 budget of EGP 110.148 bn. The Finance Ministry had initially estimated that fuel subsidies would cost state coffers somewhere between EGP 140-150 bn, but the planned steps to reduce subsidy expenditures will free up the EGP 30-40 bn.

Separately, the Finance Ministry will maintain export subsidies at their current levels of USD 2.6 bn next fiscal year, Deputy Finance Minister Ahmed Kouchouk said, according to Daily News Egypt.

The central bank allocated USD 23 bn to finance foreign trade since the EGP float last November, according to a statement from the Ismail cabinet following a meeting between CBE Governor Tarek Amer and Prime Minister Sherif Ismail on monetary policy. The statement and an official notice from the CBE confirmed CBE Assistant Sub-Governor Rami Aboul Naga’s comments on Sunday that FX reserves have hit USD 28.5 bn — the highest they have ever been since March 2011 — and that the banking sector drew in USD 17 bn since the float.

Terrorism in Russia? Eleven people were killed and 20 were injured in an explosion in St. Petersburg. The blast in a train carriage was carried out by a suicide bomber, Reuters suggests. The Foreign Ministry issued a statement condemning the incident, stressing that Egypt stands against terrorism in all its forms.

Image of the Day

Save the turtles: The Environment Ministry and Alexandria Turtle Rescue Team (ATRT) are helping save endangered turtles in the Mediterranean. Walaa Hussein writes for Al Monitor that the good people at ATRT buy the endangered marine animals on the market and release them into the sea. They are also cooperating with the Environmental Affairs Ministry, which is preparing to launch the National Plan for the Protection of Turtles in mid-summer. The plan includes “awareness campaigns for beachgoers and distribution of leaflets on how to handle turtle nests and eggs and how to conserve them.”

Egypt in the News

As expected, almost all coverage on Egypt in the foreign press centered on the state visit and its significance as the barometer for the break between the Trump and Obama administrations on the issue of human rights. Perhaps the most interesting (albeit quite antagonistic) commentary on the issue came from The Atlantic, which posits that there was no real difference between Obama and Trump on the issue of human rights beyond paying it lip service. Obama, contrary to popular perceptions in both Egypt and the US, maintained and never cut over 90% of the aid DC sanctions to Egypt and he never made human rights a condition for receiving it, writes Shadi Hamid. This interpretation was partially supported by co-chairs of the bipartisan Working Group on Egypt Peter Keagan and Michelle Dunne who penned an op-ed for the Washington Post that also asserts that it is standard protocol not to make aid conditional on human rights issues.

Dunne, in a separate interview with NPR, joined the New York Times’ Peter Baker and Declan Walsh in casting the trip as a meeting of the minds of two authoritarian leaders. Baker and Walsh assert that this is in keeping with Trump’s pattern of admiring men like Vladimir Putin.

Would that this were in the WSJ: USA Today carries a nice piece from Jacob Wirtschafter on how Egypt’s economy is “like a phoenix … rising from ashes.”

One thing almost all major outlets can agree on, is the Financial Times’ conclusion that the trip was a victory for El Sisi regardless of whether Trump doles out the aid. The trip has validated him is both domestic and on the international stage. That big hug was just what Mr. Sisi’s government sought, said Eric Trager, a scholar on Egypt at the Washington Institute for Near East Policy. “It wants to see the White House legitimate it, and set it on a new course.”

Coverage was more varied before the meeting, with The Times of Israel speculating that El Sisi and Jordan’s King Abdullah are pushing on the two-state solution and Middle Eastern studies professor Josef Olmert generalized in his The Huffington Post piece that El Sisi deserves “much credit for saving Egypt from another internal implosion similar to that which is existing in Libya, Yemen, Iraq and Syria, with the exception, that as important as all these countries are, especially the latter two, Egypt IS THE most important Arab country.”

CNN says “Trump seems to be banking heavily on the Sunni states to play a major role in achieving his administration’s objectives in the region. But the Trump administration’s vision of a new US strategic partnership with Sunni states is flawed.” Elsewhere, Tom Porteus wrote in a piece for The Hill that “Trump should tell Sisi that if he wants the continued support of the U.S. government, he needs to implement a program of genuine political reform, end torture, release political prisoners, relax the restrictions on civil society, end the harassment of human rights defenders and adhere to international standards in his fight against ISIS in the Sinai.” Al Jazeera highlights that activists were still asking Trump to bring up the issues prisoners in Egypt. Bel Trew was even more dismissive of the meeting, writing in The Daily Beast that Trump would be making a “bad bet” on El Sisi if he is “looking for a Mideast winner.”

Worth Watching

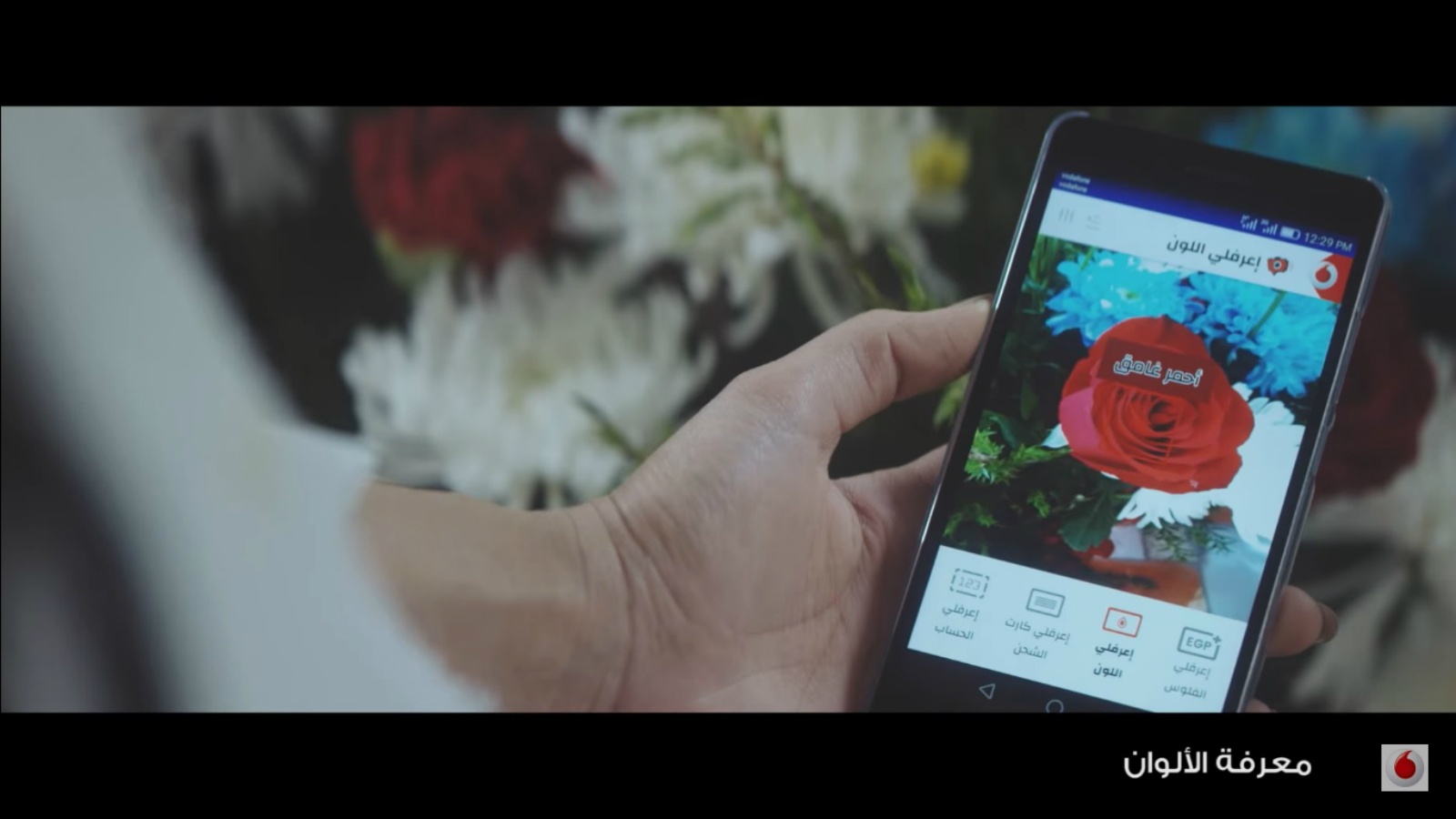

Vodafone Egypt launched an app on Friday to help blind people get around with their smart phones. The app uses mobile phone cameras and microphones to help identify and read out numbers and colors. The app also can read taxi meters, Vodafone scratch cards and slew of other items. The app is getting widespread attention on social media and in the local press. The accompanying ad (watch, runtime: 1:32) is also pretty neat, showing a seemingly average woman going about her day, followed by the big reveal of her blindness. Props Vodafone.

Diplomacy + Foreign Trade

A delegation from the House Energy Committee is in Russia for several days to discuss bilateral cooperation, Ahram Gate reports. Rosatom had invited the MPs to visit the company’s headquarters in Russia.

Five UAE companies presented plans for new investments in Egypt to General Authority for Investment and Free Zones (GAFI) officials at Dubai’s Annual Investment Meeting, Al Masry Al Youm. Potential investors include Al Fahim Group, which wants to invest in car assembly and real estate development at the New Administrative Capital. Khodeir also met with Dubai Investment Development Agency officials to follow up on a signed MoU for training and expertise exchange to improve the investment climate.

TEDA Egypt signed two cooperation agreements yesterday with the Egyptian Businessmen’s Association and El Nasr for Housing & Development to increase investments in the Chinese industrial zone in Egypt, Al Borsa reports. The company is also in talks with Shandong Ruyi Group for a USD 500 mn textiles project in its industrial zone in Ain Sokhna, CEO Wei Jianqing said, according to the newspaper. China-Africa TEDA Investment Company signed a USD 30 mn agreement with Dayun Group to set up a motorcycle factory in the Ain Sokhna Industrial Zone, Al Mal reports.

This comes as Chinese investors will potentially invest in a USD 200 mn project in Rashid, Beheira, Ahram Gate reports. They are reportedly looking into building a shipyard and a petroleum product supply services area in partnership with Egyptian investors, Governor Nadia Abdo says. Abdo says the Egyptian partners are preparing feasibility studies as well as their land requirements for the projects. Abdo’s statement did not name the Chinese investors.

Energy

Rosneft in strategic push for Middle East markets

Russia’s Rosneft is expanding a strategic push into Middle East energy markets and its attempts to expand trading after trumpeting agreements in Egypt and Libya, Henry Foy writes for The FT. Foy suggests Rosneft is buying more oil from the region, to replace supplies lost in the dissolution of a joint venture with BP at the start of this year. Rosneft recently bought a 30% stake in Eni’s Zohr field, bought cargoes of Egyptian crude, and signed agreements to supply LNG to Egypt. There is also speculation that “it could be seeking to build a substantial presence on the ground, especially in Libya.”

South Korea in talks to fund USD 35 mn solar power plant in Hurghada

South Korea is in talks to fund a 20 MW solar power plant in Hurghada, The New and Renewable Energy Authority’s Chairman Mohamed Omran tells Al Mal. If approved, the plant would cost USD 35 mn and the project is set to be operational in 2018.

Basic Materials + Commodities

France’s VICAT Group expresses interest in expanding investments in Egypt

French cement manufacturing company VICAT Group is interested in expanding its projects and investments in Egypt, VICAT chairman and CEO Guy Sidos told Prime Minister Sherif Ismail yesterday, Ahram Gate reports. The company currently owns two cement manufacturing facilities in Egypt.

Egypt imported 5.5 mn tonnes of wheat from Ukraine in 2016

Egypt bought a total of 5.5 mn tonnes of wheat and 841k tonnes of oilseeds from Ukraine in 2016, UkrAgroConsult reports. An Egyptian delegation visiting Ukraine expressed interest in further grain trade cooperation, provided “permissible levels of ergot and ambrosia seeds in cereal and pulse grains” are satisfied.

Egypt wastes 2 tonnes of wheat per year -Agriculture Research Center

Egypt wastes around two tonnes of wheat each year as a result of not following correct agricultural procedures, vice president of the Agriculture Research Center Mohamed Soliman said, Al Mal reports.

Health + Education

Education Ministry, Orascom Construction, Sawiris Development Foundation discuss establishing 15 community schools

Education Minister Tarek Shawki met with officials from Orascom Construction and the Sawiris Foundation for Social Development to discuss cooperating in establishing 15 community schools in Assiut, Al Borsa reports.

Vezeeta to expand operations to Jordan and Lebanon

Automatic clinic and physician booking platform Vezeeta is set to expand its operations to Jordan this month, and will later expand to Lebanon, Al Borsa reports. Vezeeta had raised USD 5 mn in its series B funding, led by the UAE’s Beco Capital, in January.

Tourism

Tourism Minister discusses increasing Italian tourism with Italy’s tour operators at BIT Milano

Tourism Minister Yehia Rashed met with Italian tour operators at the BIT Milano tourism expo to discuss ways to increase Italian tourism to Egypt, Al Shorouk reports. The tourism companies requested Rashed to look into launching direct flights from Italian cities to Luxor and Aswan and encouraged Egypt to continue its tourism promotion campaigns.

JWT to launch tourism campaign in Gulf countries during Ramadan

Advertising agency JWT is planning to launch a tourism promotion campaign in Saudi Arabia, UAE, Kuwait, and Bahrain during Ramadan, Egypt CEO Hany Shoukry said, Al Shorouk reports. JWT is also set to launch a separate digital media campaign in Lebanon and Morocco “within weeks,” after finding success in a similar campaign in China and India. Shoukry had previously said that launching new campaigns would not be financially feasible for JWT due to the Tourism Development Authority’s debts to the ad agency.

Amadeus IT Group looks to expand investments in Egypt

Europe’s Amadeus IT Group, which provides IT solutions for the global travel industry, is looking to expand its activities and investments in Egypt, the company announced during a joint workshop with EgyptAir in Alexandria on Monday, Al Mal says.

TSA agents inspect Cairo Airport’s security procedures

A delegation of United States Transportation Safety Administration agents arrived in Cairo yesterday to inspect Cairo Airport’s security procedures, particularly for New York-bound flights, Ahram Gate reports.

Banking + Finance

Four electricity production companies in talks with six banks to borrow USD 400 mn

The West Delta, East Delta, Middle Delta, and Cairo electricity production companies are in talks with six banks to borrow USD 400 mn to repay international contractors for their maintenance work on the electricity production companies’ power stations, Al Borsa reports. The companies are currently negotiating with the National Bank of Egypt, Banque Misr, CIB, QNB, Banque du Caire and the Arab African International Bank, and are hoping to reach an agreement this month.

MasterCard to implement government e-payment solutions

MasterCard will expand electronic payment solutions in partnership with the Egyptian government by year-end, Al Mal reports. This will include allowing for electronic payments for government services as well as cash transfers. The expansion will include disbursing the cash subsidies through the Takaful and Karama programs electronically through cards.

Egypt Politics + Economics

Alex Port Authority mulling new 400-feddan logistical zone in Nubareya

The Alexandria Port Authority is looking to establish a new 400-feddan logistical zone in Nubareya to provide strategic services to existing factories in the area such as food packaging and the storage of grains and petroleum products, port chief Medhat Attiya told Al Borsa on Monday.

National Security

Egypt begins receiving order of MiG-29 fighters

It appears that Egypt has begun receiving the first of its Mikoyan MiG-29 order from Russian arms exporter Rosonboronexport, with images of the aircraft being used by the Egyptian Air Force emerging, according to Quwa Defense News & Analysis Group. Delivery of the 50 planes is expected to be completed by 2020.

On Your Way Out

Egyptian archeologists discovered the remains of what is believed to be a 3,700-year old pyramid, The Associated Press reports. The remains were found north of King Sneferu’s bent pyramid in the Dahshur royal necropolis, Ancient Egyptian Antiquities Sector head Mahmoud Afifi said in a statement. “Due to the bent slope of its sides, the pyramid is believed to have been ancient Egypt’s first attempt to build a smooth-sided pyramid.”

The markets yesterday

EGP / USD CBE market average: Buy 18.0638 | Sell 18.1659

EGP / USD at CIB: Buy 18.10 | Sell 18.20

EGP / USD at NBE: Buy 17.95 | Sell 18.05

EGX30 (Monday): 13,061 (+1.1%)

Turnover: EGP 1.3 bn (21% above the 90-day average)

EGX 30 year-to-date: +5.8%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 1.1%. CIB, the index heaviest constituent ended 2.1% up. EGX30’s top performing constituents were: ACC up 8.4%, Pioneers up 4.7%, and Qalaa Holdings up 2.7%. Yesterday’s worst performing stocks included Domty down 1.2%, Elsewedy Electric down 1.0%, and Egyptian Iron & Steel down 0.9%. The market turnover was EGP1.3 billion, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +70.0 mn

Regional: Net Short | EGP -3.5 mn

Domestic: Net Short | EGP -66.5 mn

Retail: 54.3% of total trades | 52.4% of buyers | 56.1% of sellers

Institutions: 45.7% of total trades | 47.6% of buyers | 43.9% of sellers

Foreign: 33.4% of total | 36.0% of buyers | 30.9% of sellers

Regional: 5.0% of total | 4.8% of buyers | 5.1% of sellers

Domestic: 61.6% of total | 59.2% of buyers | 64.0% of sellers

WTI: USD 50.29 (+0.10%)

Brent: USD 53.17 (+0.09%)

Natural Gas (Nymex, futures prices) USD 3.15 MMBtu, (+0.58%, May 2017 contract)

Gold: USD 1,258.50 / troy ounce (+0.36%)

TASI: 6,968.0 (-0.3%) (YTD: -3.4%)

ADX: 4,466.6 (+0.4%) (YTD: -1.8%)

DFM: 3,539.3 (+1.4%) (YTD: +0.2%)

KSE Weighted Index: 414.7 (-0.2%) (YTD: +9.1%)

QE: 10,344.1 (-0.5%) (YTD: -0.9%)

MSM: 5,596.7 (+1.1%) (YTD: -3.2%)

BB: 1,347.8 (+0.1%) (YTD: +10.4%)

Calendar

03-06 April (Monday-Thursday): Agri & Foodex Africa, Khartoum International Fair Ground, Khartoum, Sudan.

04 April (Tuesday): Emirates NBD Egypt PMI reading for March announced. The report will be available here.

08-10 April (Saturday-Monday): Pharmaconex, Cairo International Convention Center, Cairo.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

20 April (Thursday): Closing date for the Egyptian Mineral Resources Authority bid round number 1 for 2017 for gold and associated minerals.

22-24 April (Wednesday-Friday): Food Africa, Cairo International Convention Center, Cairo.

24-25 April (Monday-Tuesday): Renaissance Capital’s Egypt Investor Conference, Cape Town, South Africa.

25 April (Tuesday): Sinai Liberation Day, national holiday.

25-26 April (Tuesday-Wednesday): MENA New Energy conference, Hyatt Regency, Dubai.

26-27 April (Wednesday-Thursday): Corporate Governance Case Study Workshops by the Egyptian Private Equity Association and IFC.

28-29 April (Friday-Saturday): Pope Francis visits Cairo.

28 April – 08 May (Friday-Monday): IMF delegation visit to Egypt to assess economic reforms.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

05-07 May (Friday-Sunday): Egypt Property Show, DWTC, Dubai.

08-09 May (Monday-Tuesday): Third Egypt CSR Forum, Intercontinental Citystars Hotel, Cairo.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

20-23 September (Wednesday-Saturday): 2017 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.