- El Garhy: No backing away from subsidy reform, IMF visiting in April, stamp tax is coming. (Speed Round)

- Profit repatriation window opens a bit wider for foreign companies in Egypt. (Speed Round)

- House strips ‘opposition’ MP Sadat of his seat. (What We’re Tracking Today)

- Egyptian food exporters blanket world’s largest food expo. (What We’re Tracking Today)

- Colliers International’s latest report on Egypt sees good things ahead for Egypt’s hospitality sector. (Speed Round)

- We Cairenes are officially out-breeding the Chinese. (Speed Round)

- Plight of Sinai’s Christians continues to dominate headlines on Egypt. (Speed Round)

- The Markets Yesterday

Tuesday, 28 February 2017

No backing away from subsidy reform –El Garhy

TL;DR

What We’re Tracking Today

Sameh Shoukry in DC: Foreign Minister Sameh Shoukry met with US Secretary of State Rex Tillerson in Washington, DC, on Monday. The two talked about a re-set of US-Egyptian relations, with Tillerson reportedly saying the US will increase aid to Egypt to support its ongoing war against terror, Youm7 reports. The two also discussed Egypt’s economic reform program, in addition to regional security issues including Syria and Libya. So far as we can tell, neither the State Department nor the US embassy in Cairo have released readouts of the meeting, and State did not hold a press briefing yesterday.

MPs (minus one) are also having a hectic week with the State Contractors Act due for a vote before the House (the construction business is reportedly impatient), and the Industry Committee set to resume discussions of a law that would offer tax incentives to domestic automobile manufacturers.

Why minus one MP? The House has stripped Rep. Anwar Sadat of his membership. The nephew of President Anwar Sadat, he was accused of leaking a draft of the controversial NGO law to foreign embassies and of faking signatures on a private member’s bill. Sadat was booted from the House by a vote of 468-8; four MPs abstained from the vote, implying 116 others were absent when the vote was held. The House Constitutional and Legislative Affairs Committee had voted on Sunday to boot expel Sadat based on the recommendation of the Ethics Committee. The story isn’t yet big news in the international press, but is rather likely to get the attention of foreign editors unless Donald Trump commits a significant outrage today. The Associated Press has the story and Declan Walsh has already filed for the New York Times, writing that the expulsion of one of Egypt’s “few dissenting lawmakers, the scion of a storied political family … had the practical effect of further enfeebling the opposition to President Abdel Fattah el-Sisi in Parliament.”

131 Egyptian food producers are participating in this year’s Gulfood expo in Dubai’s World Trade Centre. The event, generally considered the world’s largest annual food event, runs from this past Sunday through next Sunday. Edita boss Hani Berzi, wearing his hat as chairman of the Food Export Council (FEC), said 106 food manufacturers and 25 agrifood producers from Egypt are participating in the event. He added that the FEC has partnered with the Egyptian Commercial Service to promote the Egyptian section of the expo. Egypt’s ambassador to the UAE, Wael Gad, told Al Mal that having more than 130 Egyptian companies participate in the exhibition shows how developed and competitive the sector is becoming, explaining that the UAE market in particular continues to be a very attractive one for Egyptian producers.

Do you own a shop, mall or restaurant in Cairo? You’re going to be installing security cameras inside and outside your property under a decree handed down by the Cairo Governorate. The decision applies only to businesses in Cairo (not Giza or the GCA, just Cairo governorate). The nice folks at Sharkawy & Sarhan have a great explainer on what this means for business owners — and for your expectation of privacy when you’re visiting and shop. Want to read the decree for yourself in Arabic? Tap here for a look (pdf).

It’s a big day today for: US President Donald Trump, who is going to try to re-set the narrative on his presidency in an address to both houses of Congress. The Donald is also going to propose a 10% increase in defense spending — and pay for it by stripping bns from the budgets of the State Department and the Environmental Protection Agency, among others. There are no words.

On a rather lighter note: The “new” Nokia 3310 is out. The re-imagining of the classic early 2000s feature phone does include a web browser. Meanwhile, the latest Samsung Galaxy S8 leaks are here, and the folks at Google have outed Microsoft for failing to patch a significant vulnerability in its Edge and Internet Exploder browsers.

What We’re Tracking This Week

Finance Minister Amr El Garhy is due to brief the House of Representatives on all things fiscal.

German Chancellor Angela Merkel is due in Cairo on Thursday for talks with President Abdel Fattah El Sisi and other senior government officials.

On The Horizon

Russian flights to Egypt could “in principle” resume in March, Russia’s Transport Minister Maksim Sokolov told Sputnik. Even if flights resume next month, tourism expert Essam Aly tells the Russian news agency he expects Russian tourists would only start returning to Egypt by 15-20 April, in time for the Easter Holidays. Sokolov had also added that he expects Russian carrier Aeroflot to be the first Russian airline to resume flying to Egypt and would start with direct flights to Cairo first. We love Sokolov’s optimism, but we’ll believe this is happening when the first sandal-clad Russian foot touches down in Sharm.

UK Prime Minister Theresa May will visit Egypt sometime in May, Ian Gray, Chairman of the Egyptian British Business Council, told Al Borsa. He says the visit focus on supporting bilateral relations and exploring lifting restrictions on British tourists visiting Sharm El Sheikh. Gray added that a number of British companies are looking into investment opportunities in Egypt’s chemicals, petrochemicals, real estate, and construction sectors.

Enterprise+: Last Night’s Talk Shows

Our roundup of last night’s talk shows is off today — even the wicked need a day of rest every now and again — and will return tomorrow.

Speed Round

El Garhy: No backing away from subsidy reform, IMF visiting in April, stamp tax is coming. Fresh off the successful float of the EGP and the closing of a USD 4 bn eurobond, the finance minister and his team are now in the trenches on the 2017-18 budget — and looking at how to push the reform program forward. El Garhy spoke on Sunday at an American Chamber of Commerce in Egypt luncheon headlined “Egypt’s Financial Reform Agenda: The Way Forward.” The minister said Egypt has “passed through a very difficult phase that can be described as a tsunami of adverse circumstances.” Today, the float of the national currency has “resolved something like more than 60% of the issues that we face … leaving the market to determine the right level for the currency.” What remains, he says, is “what the government can do in terms of really paving the way for the private sector to operate more, because we need the entire economy to move at full speed.” El Garhy also noted the government is targeting reducing the budget deficit to a mid-single-digit percentage of GDP by 2021, telling attendees that this was a function of “long-term sustainable growth.” He expects GDP growth rates to be hitting 6% by 2021 and inflation to fall to 7-8% by that time.

Our key takeaways from the luncheon include:

- There’s no backing away on subsidy reform: Subsidies have to be designed differently to reach the neediest, El Garhy says. “We don’t want to live with energy subsidies that killed this country from 2002-2003 through 2014,” but the timing for lifting fuel subsidies has not been set yet.

- Egypt is fortunate oil prices have fallen from their peak north of USD 100 per barrel, the minister noted. That said: The effective devaluation of the EGP and a rally in oil prices to the USD 50s sees the ministry working now to figure out what to price oil at in next year’s budget.

- The stamp duty on stock market transactions has to be finalized before May and suggested the EGX’s doldrums in recent days has a lot more to do with the strengthening of the EGP against the greenback than it does with traders bucking the prospect of a stamp tax on buyers and sellers.

- We also spoke with Deputy Finance Minister Amr El Monayer, who said a 0.2% rate for the stamp tax is only one scenario the Ministry is considering, not necessarily the final rate that will be in the draft legislation. El Monayer says it’s not likely the stamp tax will be shelved.

- The IMF delegation visit originally set for March has indeed been postponed, as the Finance Ministry needs to finish the budget for FY2017-18 by 31 March. “So we will do it sometime in April. That will happen in line with the agenda before and after the Spring Meetings” of the IMF and World Bank, which are due to happen 21-23 April in Washington, El Garhy said.

- There is no fixed date for the disbursement of the USD 1.25 bn second tranche of the IMF loan to Egypt, Deputy Finance Minister Ahmed Kouchouk explained to Al Mal. The agreement with the IMF only sets a “proposed schedule of purchases.” Kouchouk adds that people are confusing the regular semiannual visit by the Fund’s delegation to conduct its mandated reviews and the actual disbursement of the funds.

- El Garhy says the IMF loan document, and an Arabic translation of it, were sent to the House and will be discussed in a plenary session on 7 March.

El Garhy also discussed about the successful eurobond issuance, saying “when we started the eurobond roadshow, we were thinking of [raising] USD 2.5 bn. Then we started receiving the order book. We were at a level USD 7-8 bn before the US market opened, and before 6 a.m. LA time we reached over USD 14 bn … We eventually decided to take USD 4 bn and we’ve tightened the price. Even more importantly, the secondary market performance is very strong. We’ve seen a rally.” He also added that foreign holdings of local T-bills jumped to EGP 53 bn within three weeks following the eurobond issuance as well.

The one clear thing on economic policy in Egypt now: “There is determination, resolve, and very strong attention from the political leadership on economic reform, and very clear desire to move the agenda forward,” El Garhy said.

Profit repatriation window opens a bit wider for foreign companies in Egypt: The Central Bank of Egypt has amended regulations on how banks can use their excess foreign currency balances, Al Mal reports. Banks can now use 50% of their excess currency to finance non-essential demand, 25% can be reinjected into the interbank market, and the remaining 25% can now be used to support the repatriation of profits by foreign companies. Prior to the directive, the central bank was allowing banks to use 50% of their excess currency to finance non-essential imports and inject the other half into the interbank market. A banker told Al Mal that banks never blocked profit repatriation, but the new directive allows for a larger percentage of a bank’s funds to be used for that purpose.

Tax Authority suggests 0.175% is an ideal stamp tax on the EGX: Tax Authority head Emad Samy says his agency’s studies suggest that a 0.175% stamp tax on the buy- and sell-side of stock market transactions would not hurt the EGX and should reel in an additional EGP 1-1.5 bn in annual revenues, according to Al Borsa. Samy said that he sent the proposal to top ministry officials to review before presenting it to the Ismail cabinet for approval.

Brokers still aren’t warming to the tax, despite it being likely to come in lower than the initial suggestion of a 0.2-0.4% levy. The Egyptian Capital Market Association, an industry lobby group, says it will is advising the Finance Ministry that anything higher than the 0.1% rate that was temporarily imposed in 2013 would reflect negatively on the EGX, the newspaper adds. Some are on the fence, with HC Securities’ Shawkat El Maraghy noting that a 0.175% stamp tax duty on transactions might be marginal for foreign investors and institutions, but would be an issue for the retail investors who account for the majority of the EGX’s turnover. Egyptian Financial Supervisory Authority head Sherif Samy had previously argued against the tax for the same reason.

The House of Representatives’ Economic Committee gave a preliminary nod to theInvestment Act on Monday during its first session debating the bill, Al Mal reports. Committee members expect to finalize their discussions in two weeks’ time before the bill comes up for a vote by the House as a whole by the end of March. The committee plans to bring business and investor associations into the discussions starting next week and also wants to consult the Finance Ministry, the Central Bank of Egypt, and the Egyptian Financial Supervisory Authority, Al Borsa says. Investment and International Cooperation Minister Sahar Nasr is also expected to join the meetings and had promised representatives that the executive regulations for the act would be ready in time for the vote.

Shockingly, European car makers and local importers of their wares are not in love with the so-called “automotive directive,” which would give tax breaks to local manufacturers and protect them against unfair advantages now enjoyed by EU, Turkish and Moroccan imports. The automotive directive will not only harm European exports to Egypt but also violates the terms of free trade agreements with the EU, the companies complained in a letter to the European Commission picked up by Al Borsa.

Trying to keep the Masry gravy train rolling, EU-based manufacturers argue that the bill offers tax breaks and incentives to local manufacturers that could prove harmful to exporters in the long run. Then came the not-so-veiled threat: The directive — which grants incentives along the value chain to encourage local manufacturing — will affect future European investments in Egypt’s auto industry. Members of the Federation of Egyptian Industries said it was unlikely that the government would take the European concerns into account, maintaining that the directive does not violate trade agreements. The bill is presently before the House Industry Committee.

Colliers International’s latest report on Egypt sees good things ahead for Egypt’shospitality sector. Resort towns of Sharm El Sheikh and Hurghada are both expected to see an upswing in occupancy in 2017 as Colliers anticipates travel bans by the UK and Russia will be lifted this year. The report sees occupancy levels reaching 41% in Sharm in FY 2017, up 22% year-on-year, while Hurghada’s is set to grow 33% to 45% this year. Cairo occupancy will also rise in 2017 to 64%, an increase of 7%, as a new airport in Sixth of October and new developments come online in the west of the city.

Paper, filing, and binding company Mintra is establishing a new USD 40 mn furniture factory by the end of the year, CEO Hany Cassis told Al Borsa. The company already secured a number of supply agreements from the new factory with US-based companies, including Amazon. The new plant is part of Mintra’s bid to expand beyond its traditional market, he said, noting that Mintra wants to double its plastic production to 20,000 tonnes annually in two years’ time.

Our breeding skills have beat out the Chinese. Internal migration might have something to do with it too. Either way: Cairo is expected to be the fastest growing city in the world by population, according to Euromonitor International’s Global Economies and Consumers in 2017 report (pdf). Cairo’s population is expected to grow by another 500K people this year alone. The capital city’s population reached 22.9 mn as of June 2016, according to CAPMAS. The population growth rate has beat out Shanghai, which is expected to see 400K new inhabitants this year. Alex should see another 100K people in 2017, according to the report.

** Earnings watch: ‘Tis the season, though we note that many companies plan to take advantage of the extension until mid-April to file 4Q/FY2016 results. Among those reporting earnings yesterday:

- Global Telecom Holding announced that its net profit attributable to shareholders increased to USD 7.3 mn in 4Q2016 from a net loss of USD 12 mn a year earlier. This came as revenues grew y-o-y to USD 768 mn from USD 710 mn. Net profit attributable to shareholders for 2016 came at USD 61 mn, up from a net a loss of USD 142.7 mn in 2015.

- National Bank of Kuwait-Egypt recorded a net profit of EGP 848.9 mn in 2016, up from EGP 575.6 mn in 2015. The bank says the EGP flotation has had a positive impact of EGP 37.7 mn on its financials. NBK’s board also approved a EGP 1.5 bn capital increase to EGP 2.5 bn, according to a regulatory filing.

- Al Baraka Bank Egypt registered a net profit of EGP 512.5 mn in 2016 compared to EGP 265.1 mn last year.

Development Partners International (DPI), the African private equity specialist, has signed onto the United Nations Principles for Responsible Investment (UNPRI), the firm said in an emailed statement yesterday. “The UNPRI association works to understand the investment implications of environmental, social and governance factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions.” DPI says this “reflects the firm’s continued dedication to responsible investing and its drive to support its portfolio companies in making a positive, long-lasting impact on the organisation, societies and economies they operate in.” DPI is a USD 1.1 bn Africa-focused private equity firm; it acquired one third of Egyptian electronics retailer B-Tech’s in July 2016 for USD 35 mn.

The Macro Picture

Oil is expected to stay in a tight range of USD 50-60 per bbl in 2017 as a recovery in US shale output “counterbalances the OPEC supply cut deal to reduce the global glut,” Litasco Chief Executive Tim Bullock told Reuters. He says “it’s difficult to see Brent going much below [USD 50] per barrel and with shale and everything lining up on the other side, it’s difficult to see it going much above [USD 60] per barrel.” Bullock adds that “a lack of volatility means trading houses will no longer have the extra boost as in the last two years following the 2014 oil price crash.” He says it became more difficult for traders to “make money” by the end of 2016 as “there was less volatility and less structure … 2017 looks like an extension of that.”

Global sovereign debt is expected to jump to a record high of USD 44 tn in 2017, according to a report by Standards & Poor’s which came out over the weekend (watch, runtime: 2:09). Absolute debt will rise almost USD 1 tn, up 2.5% year-on-year, despite a slight reduction in annual government borrowing. The US and Japan will be the “most prolific borrowers" in 2017, accounting for 60% of total borrowing, followed by China, Italy and France. S&P forecasts that gross borrowing from commercial sources in 2017 will increase to USD 1.1 tn in 20 major emerging market countries, with Brazil and India coming in second and third after China.

Egypt will again face the highest debt rollover ratio (including short-term debt), reaching29% of GDP. The country has an “unusual dependence” on short-term debt, which accounts for 34% of total debt, S&P say. MENA region sovereign borrowing will decline 20% this year to USD 136 bn, after increasing sharply in 2016, on the back of fiscal consolidation implemented by the GCC.

Egypt in the News

The plight of Sinai’s Christians continues to dominate headlines on Egypt in the international press this morning, with the Associated Press interviewing and tallying the victims of Daesh’s attacks on the population. The newswire sees this as evidence that Daesh is trying to assert some measure of control as it faces a heavy crackdown by Egyptian security forces and reversals elsewhere in the world.

Another day of praise for the Egyptian economy in the foreign press. FT’s Dan Pogler feels that Egypt’s economy is indeed turning a corner, showing signs for the first time since 2011 that it is moving towards an upward trajectory. These signs include both the fast appreciation of the EGP and the interest in Egypt’s debt instruments by foreign investors, not to mention rising tourism receipts and remittances. And it’s all thanks to the reform agenda, centered on the EGP float. The budget deficit, inflation, public debt, and higher energy prices leave question marks on whether this recovery can be sustained, but Pogler views these as fleeting.

Meanwhile, Linda S. Heard of Arab News takes it a step further pairing economic successes of the El Sisi administration with the positive turns on the diplomatic front, namely the improved relations with the US after Trump. She does not mince words on the UK and its flight ban, saying that the move to suspend flights was an unprecedented decision to punish a victim of terrorism Meanwhile, Geopolitical Monitor also feels that Egypt may have turned the corner, but says more needs to be done by way of dismantling corruption and cronyism. Either way the recovery has bought the government more time to maneuver.

Researchers at Egypt’s National Research Centre (NRC) have produced a biofuel suitable for aeroplanes using jatropha plants grown in desert with sewage water, SciDev reported. The NRC was commissioned officially by the Civil Aviation Ministry to find a local biofuel to power planes as part of the International Air Transport Association plan to halve carbon dioxide emissions by 2050. “Khaled Fouad, a researcher Zagazig University in Egypt, sees a fundamental advantage in the production of biofuels from jatropha seed oil,” according to SciDev. He says: “it is a non-edible tree for humans and animals, which grows in sandy desert soil and gets irrigated by sewage water.”

The challenge is the fuel’s high cost of production, Fouad explains, but researches are already working to reduce the fuel’s production cost. However, we still need to temper our expectations as this is not a novel discovery: Air New Zealand has already conducted a flight test successfully using a 50-50 blend of oil from jatropha plants and standard A1 jet fuel in 2008. By 2012, NPR had published a report claiming the dreams of biofuel from jatropha had come “crashing down.”

Egypt’s tourism sector is “on its knees,” so why is it doubling the cost of tourist visas, Natalie Paris asks in The Telegraph. Philip Breckner, director at the British tour operator Discover Egypt, tells Paris he understood the motives behind the move, but believes it is “not good.” He says “a family of four will be paying [GBP 200] for visas and they might only be paying [GBP 2,000] for the holiday … so that’s 10 per cent of the whole holiday cost.” He adds that tourism is still being affected by the government’s restrictions on travel to Egypt, which Paris describes as staying the same “despite a British cross-party taskforce suggesting last September that security at Sharm el-Sheikh had sufficiently improved for the Government to lift its ban on flights.”

Other international coverage of Egypt worth noting in brief:

- Travel industry mainstay Skift has picked up on Reuters’ coverage of Egypt’s frustration at the UK for not restoring flights.

- Stat News (paywall) is running a story on the Tour N’ Cure hepatitis C medical tourism program.

- Former footballer Abutrika has elected not to come back to Egypt for his father’s funeral, saying he fears arrest, according to Al Arabiya.

- ANSAmed reviewed the Egyptian film Akhdar Yabes (Withered Green), shown at the first-ever Aswan International Women’s Film Festival, which ended on Sunday. The film will be screened in Italy as part of the Middle East Now film festival in Florence in April.

- Pakistan Tribe took note of the opening of a “five star dog hotel” near Cairo that aims to “take care of dogs, examining their psychological and physical conditions.”

- Waste not, want not: Apparently, India wastes food at volumes sufficient to meet Egyptians’ total yearly intake.

- Unintended consequences: A former senior minister in Israel tells the Jerusalem Post that President El Sisi’s rise to power in 2013, and his clampdown of Hamas, drove the group to help instigate the 2014 Gaza war with Israel.

- We still kick [redacted] at squash: This time it’s coverage of the Windy City PSA Open in Chicago, where women’s world number one Nour El Sherbini will face off against Nicol David and world number four Nouran Gohar made it to the final eight.

Worth Watching

Accountants ruin the announcement of the best picture winner at the Oscars: Global accounting firm PricewaterhouseCoopers (PwC) has taken responsibility and apologised for the mix-up that caused the film La La Land to be (for a few moments) named best picture at the Oscars early yesterday morning instead of the real winner, Moonlight. “It’s still not clear exactly how PwC, which has administered the Oscars balloting process for more than 80 years, allowed the wrong red envelope to be carried on stage in a snafu that spoiled Hollywood’s biggest moment of the year,” CNN says. The process gives PwC “sole custody of all votes, and is responsible for keeping the results confidential. Once the ballots have been tabulated, two senior accountants memorize every winner, and then prepare two briefcases with the envelopes used by presenters on the big night.” The heads likely to roll over this are PwC accountants Martha Ruiz’s and Brian Cullinan’s. They were tasked with carrying the briefcases to the ceremony via "separate, secret routes” and stood backstage handing envelopes to award presenters before they walk onstage. You can watch the whole, messy announcement here (runtime 02:36).

First Muslim to win an Academy Award? Mahershala Ali won an Oscar for best supporting actor, recognizing his performance in Moonlight. Meanwhile, the Netflix documentary on Syrian heroes the White Helmets bagged best short documentary.

Diplomacy + Foreign Trade

Security officers at Cairo International Airport denied entry yesterday to Jibril al-Rajoub, “a confidant of Palestinian President Mahmoud Abbas and a high-ranking member of the central committee of Abbas’s Fatah movement,” Reuters reports, explaining that the reason for al-Rajoub being sent back to Palestine were unclear, as Egypt typically has better relations with Fatah than Hamas. Al-Rajoub was traveling to Cairo to attend a conference on terrorism at the invitation of the Arab League; the Palestinian delegation pulled out of the gathering in protest.

The “secret summit,” leaked by Haaretz, that convened in Aqaba between President Abdel Fattah El Sisi, Jordan’s King Abdullah, Israeli Prime Minister Benjamin Netanyahu, and former US Secretary of State John Kerry “not only presented a detailed road map which would seat the Israeli and Palestinian leaders in front of each other,” but also “took care of the division of labor,” Smadar Perry writes for YNet. Perry’s analysis suggests that El Sisi role would have been to pressure Netanyahu, Abdullah’s to pressure Palestinian President Mahmoud Abbas, and Saudi Arabia would support the initiative. The initiative, which was rejected by Netanyahu, included a proposed two-state solution.

Ethiopia has reportedly raised the production capacity of the Grand EthiopianRenaissance Dam by an additional 450 MW without notifying Egypt or Sudan, according to Egyptian sources from the Tripartite Technical Committee, Al Shorouk reports.

International funding for energy projects: The House of Representatives’ Energy Committee signed off on a USD 364.5 mn facility from the Japan International Cooperation Agency meant for the development of the national electrical power grid, Youm7 reports. This comes as the European Bank for Reconstruction and Development is set to provide a five-year EUR 22 mn grant to support creative industrial solutions using clean technology, Egyptian National Cleaner Production Center (ENCPC) director Ali Abo Sena tells Al Shorouk.

Energy

A strategic partnership to extend pipelines from Iraq to Egypt in the works

A strategic partnership between Egypt, Iraq, and Jordan could extend oil and gas pipelines from Iraq’s Al-Basra Oil Terminal to Jordan, through the Port of Aqaba port and on to Egypt, said Iraq’s ambassador to Egypt Habib Al Sadr on Monday. The proposal is part of a string of agreements which include Iraq sending its first shipment of oil to Egypt in March. Al Sadr said a third project is in the works where Iraq would supply Cairo with crude oil for refining before it is delivered back to Iraq as oil products, Ahram Online reports.

Egypt can produce 90 GW of electricity from renewable sources -Shaker

Egypt has the capacity to produce 90 GW of electricity from renewable sources, Electricity Minister Mohamed Shaker said, according Al Borsa reported. Egypt has the largest capacity in the MENA region in wind energy, Shaker says, that generate an output of 30 GW. He also added that Egypt can produce 60 GW from solar energy.

Chile’s ENAP Sipetrol looking to expand investments in Egypt

Chile’s state-owned ENAP Sipetrol is looking to expand its investments in Egypt, company board member Marcelo Tokman said after meeting with Oil Minister Tarek El Molla yesterday, Al Ahram reports. Tokman did not provide any details or figures on ENAP Sipetrol’s plans.

Qalaa’s ERC in talks with Aramco, Shell over fuel imports

Qalaa Holdings subsidiary Egyptian Refining Company (ERC) is in talks with Saudi Aramco, Kuwait National Petroleum Company and Shell to import an additional 1.2 mn tonnes of feedstock needed for its operations at USD 3.7 bn refinery in Mostorod, ERC’s Managing Director Mohamed Saad tells Youm7.

Basic Materials + Commodities

Increasing cotton area under cultivation on Agriculture Ministry’s agenda

The Agriculture Ministry is looking to increase the areas where cotton is grown to 250K feddans this season from 131K feddans last season, Cotton Research Institute chairman Adel Abdel Azim told Al Borsa. The ministry’s policies had reportedly resulted in reducing the area of land producing cotton last year following a ban on all but the highest quality cotton. The ministry is coordinating with the House of Representatives’ Agriculture and Irrigation Committee to amend the laws governing the growing and trading of cotton ahead of the cotton planting season, Al Borsa reports. No details were provided on the nature of the amendments.

Tourism

Sherif Ismail approves establishing High Council for Tourism Promotion

Prime Minister Sherif Ismail approved yesterday establishing the High Council for Tourism Promotion, which will be handling the government’s tourism promotions strategy. The council will be comprised of the ministers of tourism and civil aviation, as well as the governors of the Red Sea, Luxor, and South Sinai, Al Borsa reports. The council’s first order of business: reviewing the repercussions of increasing tourist visa prices — which would have been an excellent idea had it been formed before the decision to nearly double prices of entry visas was made.

Telecoms + ICT

TE to receive 4G spectrum by mid-year, will sign domestic roaming agreement within days -Gadalla

Telecom Egypt (TE) expects to receive its 4G spectrum from the National Telecom Regulatory Authority (NTRA) by the end of 2Q17, CEO Tamer Gadalla told Al Shorouk. Once TE receives the spectrum, he says, the company will begin testing its 4G services. Gadalla added that TE is in “advanced stages” of negotiations with one of the MNOs, which he refused to name, over an agreement for domestic roaming. He says an agreement could be signed “within days” and says a similar agreement could be signed with the other two “without having to resort to NTRA.

Automotive + Transportation

Uber partners with Rawaj, Altibbi for car financial lease, health

Uber has partnered with Rawaj Auto Loan and Altibbi to provide car leasing and health services, respectively, to its drivers, the companies announced at a press conference. The partnership with Rawaj aims at covering 30% of Uber drivers by end of 2017 with a five-year payment plan and the lowest down payment in the market, said Uber Egypt’s general manager Abdellatif Waked. Rawaj has already provided financing for a number of drivers, Rawaj’s managing director Mahmoud Ezzat said. As for the partnership with Altibbi, it provides free access to the health app for three months. “[Altibbi] application allows partner-drivers to connect with a selection of certified doctors, and get round-the-clock affordable medical consultations over the phone,” an Uber press release read.

Agreement signed allowing Sudan to import cars from Libya via Egypt

Sudan will be allowed to import cars (presumably used) via Egypt after the three countries signed an agreement allowing for the trade, All Africa reports, citing a Libyan news agency. The cars will be allowed to pass through Egypt after paying a crossing fee of EGP 12,000. The vehicles previously used to go through “Masaad Libyan port that links the road between Libya and Egypt without paying any customs fees.”

Other Business News of Note

AIG to suspend retail insurance activities in Egypt

American International Group (AIG) decided on Sunday to suspend sales of its auto, personal property, and home insurance products in Egypt effective from the beginning of April and will “restructure its operations” in the coming period, Al Borsa reports. Current policies will not be impacted by the decision.

Sports

COMESA launches antitrust investigation into CAF, Lagardère Sports

The Common Market for Eastern and Southern Africa’s (COMESA) competition commission launched an investigation into how Confederation of African Football (CAF) and Lagardère Sports marketed right to broadcast African football tournaments, according to an Egyptian Competition Authority (ECA) statement. “The Commission has reason to believe that business conduct that restrains competition in the Common Market has been committed by the parties.”

On Your Way Out

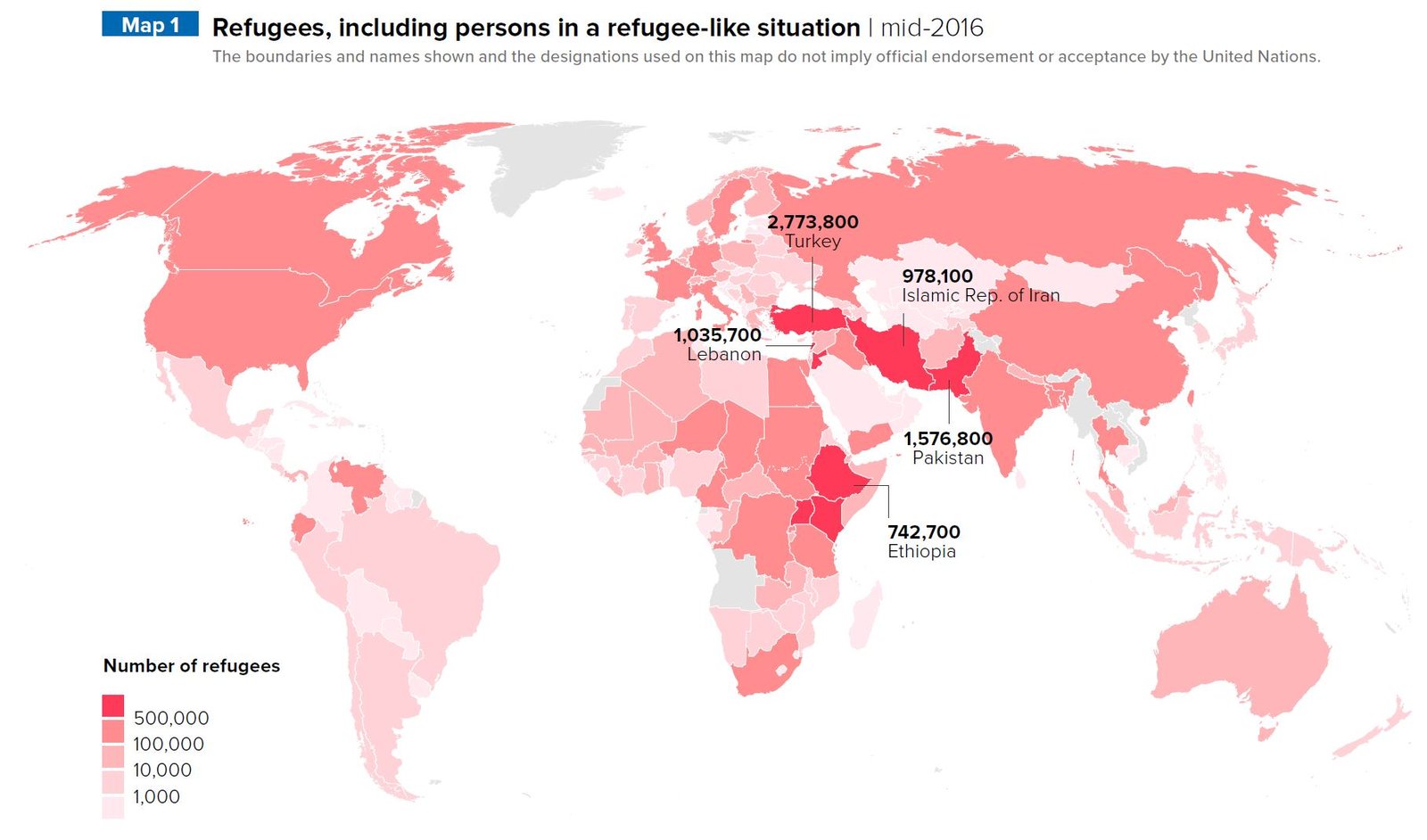

1.7 mn people were newly displaced within their own country in 1H2016, while 1.5 mn were forced to flee internationally, according to UNHCR’s Mid-Year Trends 2016 report. In total, there were 16.5 mn refugees in the world in 1H2016, slightly lower than the highs of 17.8 mn seen in 1992. More than half the new refugees in that period fled the war in Syria and most stayed in neighbouring Turkey, Jordan, Lebanon, and Egypt. Egypt was home to 210,865 documented refugees by the end of 1H2016. The full report is available here.

The markets yesterday

EGP / USD CBE market average: Buy 15.7594 | Sell 15.8624

EGP / USD at CIB: Buy 15.7 | Sell 15.8

EGP / USD at NBE: Buy 15.7 | Sell 15.75

EGX30 (Monday): 12,024 (-2.0%)

Turnover: EGP 933.3 mn (114% ABOVE the 90-day average)

EGX 30 year-to-date: -2.6%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 2.0%. CIB, the index heaviest constituent plunged 2.5%. The EGX30’s top performing constituents were: Cairo Oils and Soap up 2.5%, Credit Agricole up 1.1%, and Egyptian Iron and Steel down 0.2%. Yesterday’s worst performing stocks included GB Auto, Arab Cotton Ginning both declined by 8.6%, and ACC down 8.5%. The market turnover was EGP933.3 million, and local investors were the sole net buyers.

Foreigners: Net Short | EGP – 52.0 mn

Regional: Net Short | EGP – 12.5 mn

Domestic: Net Long | EGP + 70.5 mn

Retail: 63.1% of total trades | 66.4% of buyers | 59.8% of sellers

Institutions: 36.9% of total trades | 33.6% of buyers | 40.2% of sellers

Foreign: 18.8% of total | 16.0% of buyers | 21.6% of sellers

Regional: 12.5% of total | 11.6% of buyers | 13.4% of sellers

Domestic: 68.7% of total | 72.5% of buyers | 65.0% of sellers

WTI: USD 54.07 (+0.04%)

Brent: USD 55.93 (-0.11%)

Natural Gas (Nymex, futures prices) USD 2.69 MMBtu, (-0.19%, April 2017 contract)

Gold: USD 1,253.90 / troy ounce (-0.39%)

TASI: 6,969.3 (-1.1%) (YTD: -3.3%)

ADX: 4,628.6 (-0.6%) (YTD: +1.8%)

DFM: 3,633.5 (-0.2%) (YTD: +2.9%)

KSE Weighted Index: 425.1 (-0.5%) (YTD: +11.8%)

QE: 10,938.8 (0.0%) (YTD: +4.8%)

MSM: 5,821.0 (-0.2%) (YTD: +0.7%)

BB: 1,349.8 (0.0%) (YTD: +10.6%)

Calendar

23 February – 16 March (Thursday-Thursday): ‘Glimpses of Upper Egypt’ exhibition at Accademia d’Egitto in Rome.

02-03 March (Thursday-Friday): German Chancellor Angela Merkel’s visit to Egypt.

06-08 March (Monday-Wednesday): 13th EFG Hermes One on One Conference, Dubai, United Arab Emirates.

08 March (Wednesday): Microfinance forum, Nile Ritz-Carlton, Cairo.

09-11 March (Thursday-Saturday): Egypt Projects Summit, Cairo International Convention Center, Cairo.

14-15 March (Tuesday-Wednesday): The third Builders of Egypt conference, Ritz Carlton Hotel, Cairo.

15 March (Wednesday): Arab Women Organization’s event: Investing in refugee women, UN General Assembly Building, New York City.

18-19 March (Saturday-Sunday): Delegation of Japanese food industries companies visits Egypt.

29-30 March (Wednesday-Thursday): Cityscape Egypt Conference, Nile Ritz-Carlton, Cairo.

29-31 March (Wednesday-Friday): Balanced Development of Siwa Oasis International Tourism Conference, Siwa Oasis.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

31 March – 03 April (Friday-Monday): Cityscape Egypt Exhibition, Cairo International Convention Center, Cairo. Register here.

03-06 April (Monday-Thursday): Agri & Foodex Africa, Khartoum International Fair Ground, Khartoum, Sudan.

08-10 April (Saturday-Monday): Pharmaconex, Cairo International Convention Center, Cairo.

16 April (Sunday): Coptic Easter Sunday.

17 April (Monday): Sham El Nessim, national holiday.

20 April (Thursday): Closing date for the Egyptian Mineral Resources Authority bid round number 1 for 2017 for gold and associated minerals.

24-25 April (Monday-Tuesday): Renaissance Capital’s Egypt Investor Conference, Cape Town, South Africa.

25 April (Tuesday): Sinai Liberation Day, national holiday.

30 April – 03 May (Sunday-Wednesday): Cement & Concrete 2017, Riyadh International Convention & Exhibition Center, Saudi Arabia.

01 May (Monday): Labor Day, national holiday.

08-09 May (Monday-Tuesday): Third Egypt CSR Forum, Intercontinental Citystars Hotel, Cairo.

16 May (Tuesday): Official expiry date for the decision to suspend capital gains taxes on stock market transactions.

22-23 May (Monday-Tuesday): North Africa Mobile Network Optimisation Conference, Cairo.

27 May (Saturday): First day of Ramadan (TBC).

26-28 June (Monday-Wednesday): Eid Al-Fitr (TBC).

30 June (Friday): 30 June, national holiday.

23 July (Sunday): Revolution Day, national holiday.

02-05 September (Saturday-Tuesday): Eid Al-Adha, national holiday (TBC).

17-19 September (Sunday-Tuesday): Pipeline-Pipe-Sewer-Technology Conference & Exhibition, Intercontinental Citystars Hotel, Cairo.

22 September (Friday): Islamic New Year, national holiday (TBC).

06 October (Friday): Armed Forces Day, national holiday.

01 December (Friday): Prophet’s Birthday, national holiday.

08-10 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.