- IMF board approves three-year, USD 12 bn extended fund facility (Speed Round)

- Bank of America Merrill Lynch tips the Egypt carry trade. (What We’re Tracking Today)

- IMF’s Chris Jarvis on Lamees El Hadidi last night. (Enterprise+: Last Night’s Talk Shows)

- CBE secures USD 2 bn financing agreement after treasury privately places USD 4 bn in bonds. (Speed Round)

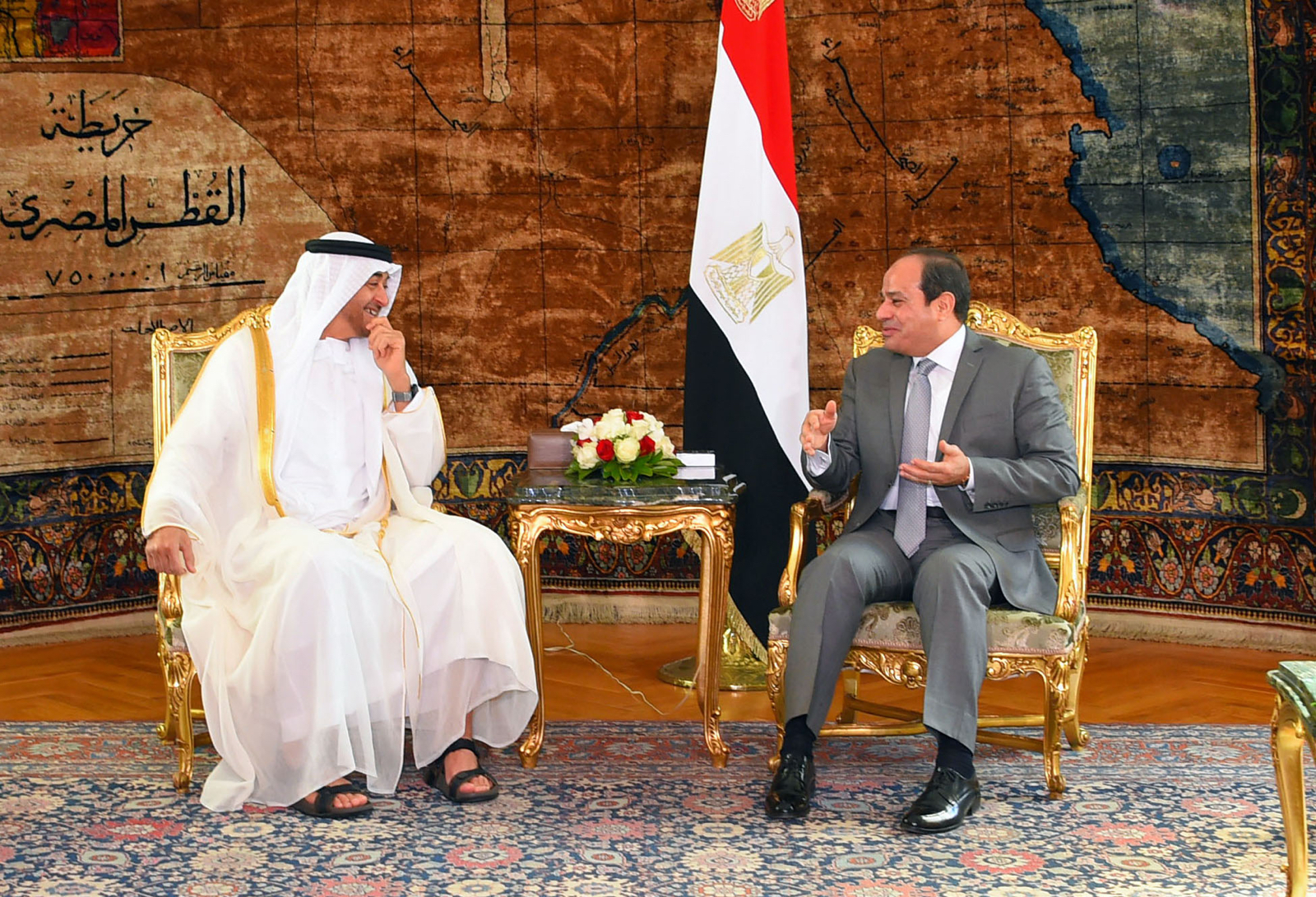

- Emirati crown prince made surprise visit for talks with President Abdel Fattah El Sisi. (Speed Round)

- Banking system has drawn in USD 1.4 bn since the float. (Speed Round)

- “Egypt’s economy will quickly begin roaring ahead at speeds we haven’t seen in a decade.” –Werr (Speed Round)

- Consumer Protection chief going after Pizza Hut, calls for one-day retail boycott. (Speed Round)

- By the Numbers — Egypt Equity Strategy: If Optimism is a Virtue, Reality Check is a Blessing

Sunday, 13 November 2016

IMF bailout is approved, carry trade gets bulge bracket nod

TL;DR

What We’re Tracking Today

Bank of America Merrill Lynch tips the Egypt carry trade: In a research note out on Thursday headlined “EM Alpha: Buy Egypt 6-month T-bills,” the bulge bracket bank recommends “buying Egyptian 6-month T-bills to benefit from an attractive carry and potential USD / EGP spot stabilization. EGP is cheap versus its history and could stabilize due to Fx inflows from multilateral sources and from the parallel market.” Risks, the bank notes, include “social unrest, reform slippage, inflation pick-up, Fx demand backlog, interbank Fx liquidity and Fx depreciation.” Egypt’s State Information Service likes the report enough that it’s carrying its own summary on its website. H/t Wael H.

The only caveat worth noting in this respect: The election of Donald Trump as president is curbing appetite for emerging markets equities, as we note in The Global Picture, below.

Central Bank of Egypt Governor Tarek Amer is due to meet today with bank chiefs and other members of the Federation of Egyptian Banks to discuss the FX market, Al Borsa reports. Sources speaking to Al Mal frame this as the first in a series of periodical touch-base session.

Finance Minister Amr El Garhy is expected to testify in front of the House Economics Committee today about the impact of the economic reform program on the state budget. Committee members are floating trial balloons on the possible implementation of a progressive tax bill to help close the budget deficit.

Aircraft landing at the Pyramids today? A flight of vintage biplanes from the 1920s and 1930s are due to land at the Pyramids sometime today — the first time in some 80 years that aircraft have been allowed to touch down there. (The official announcement from the state was a bit muddled, but it notes a flyby by one of the aircraft during a press conference scheduled for 13:30 today, so we’re assuming the full flight will land around that time.) The Pyramids event is part of a Crete to Cape Town charity air rally that began on Friday and will see a dozen vintage planes try to make the 12,800 km journey. The rally’s website is here, or you can tap here to see the group’s sketch of its Pyramids runway on a Google map. Reuters has coverage and a small photo gallery.

What We’re Tracking This Week

The executive regulations of the value-added tax will be revealed sometime this week and will be put out for “national dialogue,” said Deputy Finance Minister Amr El Monayer. You can check out some features to look out for here.

Bank of America Merrill Lynch’s MENA 2016 Conference will run from Monday, 14 November till Wednesday, 16 November in Dubai.

The Egypt Trade & Export Finance Conference will be held on Tuesday, 15 November. The Egypt Mega Projects Conference also runs on the same day.

The CBE’s Monetary Policy Committee will convene on Thursday, 17 November to review interest rates.

“Unstable weather” is set to sweep much of the nation starting Tuesday and peaking on Thursday and Friday, according to the Meteorological Authority. Cairo, Alexandria, the North Coast and Sinai could all see heavy rainfall, the authority warns. Our favourite weather apps are split, with one showing a 20-40% chance of rain each day starting Monday, and two others showing sun and clouds all week with 0% chance of precipitation.

Enterprise+: Last Night’s Talk Shows

The International Monetary Fund will disburse around USD 4 bn to Egypt each year in two payments, each of about USD 2 bn, said the IMF mission in Egypt Chris Jarvis in an interview with Lamees El Hadidy’s “Hona El Assema” on CBC. A second payment under year one of the facility should arrive next spring, around the same time the IMF reviews Egypt’s progress in implementing its economic reform program. Jarvis said that Egypt will not make further reductions in fuel subsidies before the first IMF review, indicating that this will not be a deciding factor in disbursing the next payment.

Saudi not on the list of countries providing third-party funding: Jarvis named the World Bank, the African Development Bank and the UAE as being among those who contributed to base of third-party funding the IMF required before approving the funding. The China currency swap is also part of the funding base. Conspicuously absent: Saudi Arabia.

Jarvis also said the new FX regime will promote exports, bringing in more FX to the country and reducing borrowing from the banking system. Jarvis expects economic growth to rise to 6-7% within the coming years. You can view the full episode in Arabic here (runtime: 1:54: 21). Jarvis appears here at c. 17:43 and speaks in English.

The EGP has strengthened significantly, said Mohamed El-Etreby, Chairman of Banque Misr in an interview on Al Assema TV’s Lo’met Eish. He said USD exchange rate in Banque Misr, CIB and the National Bank of Egypt is now almost the same, hinting that this as a sign that the exchange rate is stabilizing. “It doesn’t matter where the customer exchanges his foreign currency, the most important thing is that FX has entered the Egyptian banking system,” he said. As of Saturday night, both NBE and CIB are quoting a selling rate of EGP 16.05 to the USD 1. The full interview with El-Etreby is here (runtime: 48:45)

Speed Round

The IMF board approved a three-year, USD 12 bn extended fund facility for Egypt on Friday, according to an IMF statement, and the Central Bank of Egypt confirmed that it has received the first USD 2.75 bn tranche of the loan the same day. CBE Governor Tarek Amer told Ahram Online that the loan will help raise the country’s foreign reserves to more than USD 23 bn from the current USD 19.04 bn recorded in October. Deputy Finance Minister Mohamed Maait confirmed that the CBE received the payment and that it will be transferred to the Finance Ministry in EGP, Al Borsa reports. The balance of the facility will be disbursed in phases over the duration of the program, subject to five reviews, according to the IMF statement. Finance Minister Amr El Garhy told Al Mal that the first review will take place in March 2017, while the second will take place next September of that year.

Managing Director Christine Lagarde said the homegrown economic reform program will address longstanding challenges including “a balance of payments problem manifested in an overvalued exchange rate, and foreign exchange shortages; large budget deficits that led to rising public debt; and low growth with high unemployment. Resolute implementation of the policy package under the economic program is essential to restore investor confidence, reduce inflation to single digits, rebuild international reserves, strengthen public finances, and encourage private sector-led growth.”

The statement, which also includes a summary of the reform program’s pillars and a snapshot of current and projected macro indicators, quotes Lagarde at considerable length on foreign exchange policy, public finances and social protection, structural reforms and risks.

Lagarde’s release notes the Ismail government’s reform program is based on four pillars, namely:

- A significant policy adjustment including (1) liberalization of the foreign exchange system to eliminate forex exchange shortages and encourage investment and exports; (2) monetary policy aimed at containing inflation; (3) strong fiscal consolidation to ensure public debt sustainability;

- strengthening social safety nets by increasing spending on food subsidies and cash transfers;

- far-reaching structural reforms to promote higher and inclusive growth, increasing employment opportunities for youth and women;

- Fresh external financing to close the financing gaps.

“With sound implementation of the program, growth could rebound to 6 percent by 2021—similar to the levels in 2005-2010,” the IMF said in a separate ‘news article’ released on Saturday and picked up by local media. The fund is also anticipating that foreign direct investment will reach USD 9.4 bn this fiscal year, up from USD 6.7 bn last year, Al Borsa reports, picking up on an entry in the table accompanying Lagarde’s statement. The prediction is line with the Investment Ministry’s goals of attracting USD 8-10 bn this year. The IMF is projecting inflation will hit 16.6% this year from 14% last year, Al Mal reports.

S&P revised Egypt’s sovereign credit outlook to Stable on Friday on the support from IMF, with the current rating at B-, Reuters reported. Ratings on Egypt remain constrained by "wide fiscal deficits, high public debt, low income levels, and institutional and social fragility." S&P anticipates that Egypt’s economic growth will start recovering in 2018-2019, fueled by domestic consumption and investments, and expects the country’s real GDP growth will exceed 4% by 2019.

Does the House get a say? The loan agreement is expected to be with the House of Representatives in ten days’ time, said Hussein Eissa, chair of the House Budget Committee, Al Borsa reports. The move is part of the House’s duties to ratify foreign agreements, he added. Some political parties have come out strongly against the loan. Farid Zahran, head of the Egyptian Social Democratic Party, said the need for an international bailout proves the Ismail government hasn’t got a grip on the economy. The National Progressive Unionist Party issued a statement condemning the agreement, AMAY reports. Members of the House Economics Committee and the Country’s Future Party have come out publically in support and praise of the agreement.

The IMF bailout is the dominant story on Egypt in the international press this morning. Coverage includes:

- With shock reform, Egypt throws out rules it long lived by (Associated Press) (widely picked up by US, Canadian, UK press)

- IMF Approves USD 12 bn Loan to Egypt (Wall Street Journal)

- Painful Steps Help Egypt Secure USD 12 bn IMF Loan (New York Times)

- IMF board approves Egypt’s USD 12 bn loan agreement, USD 2.75 bn disbursed (Reuters)

- IMF Approves Biggest-Ever Mideast Loan to Revive Egypt’s Economy (Bloomberg)

- IMF approves $12 billion Egypt loan agreement (Germany’s DW, relying primarily on wires)

- Egypt optimistic about economy after IMF loan approval: PM (China’s Xinhua)

The central bank announced on Thursday it has “initiated a repurchase transaction with a consortium of international banks for a total amount of funding of USD 2bn with a maturity of 1 year.” The funding was provided against the USD-denominated sovereign bonds issued with maturities of December 2017, November 2024, and November 2028, held by the CBE, which are listed on the Irish Stock Exchange, the CBE says. The CBE says, explicitly, that the funds will bolster “the liquidity and size of the international reserves” and represent “a strong vote of confidence from the financial markets” in Egypt’s ability to implement its reform agenda.

You’ve never heard of those sovereign bonds the CBE is talking about? The Finance Ministry issued a statement on the same day explaining that it had issued USD 4 bn in international bonds in a private placement. The issue included a USD 1.36 bn bill carrying 4.62% interest maturing on December 2017, a further USD 1.32 bn carrying 6.75% interest and maturing on November 2024, and a USD1.32 bn bond with 7% interest maturing on November 2028. Finance Minister Amr El Garhy said the issuance is aimed at diversifying the sources of financing the budget deficit, especially as the cost of borrowing remains high, and boosting foreign reserves.

Issuance isn’t part of the eurobond offering, which appears to have slipped a bit given global volatility right now: The Ministry’s statement notes that the placement is not part of the planned eurobond issuance, which Reuters says is likely to be postponed, citing El Garhy’s comments on Al Arabiya. The finance minister said “we had plans to start [the roadshow] in the last week of this month, but some changes and volatility happened in the markets … We are watching closely in order to be sure if we can start in the last week of November or if we will have to — and this is possible — delay." El Garhy reportedly announced a probable date of the second week of January if the November issue does not take place, Al Borsa says. The Ministry also issued a separate statement reiterating its commitment to moving forward with issuing the eurobonds before year-end, but it is still assessing the impact on the US presidential elections’ results on financial markets. A source told Al Mal that the eurobond issuance has been delayed by one month.

Think of the bond as a “structured sovereign loan in a way, whereby the Ministry of Finance held a private placement solely for the CBE for USD 2 bn worth of bonds of varying maturities, which the latter used as a collateral to borrow an equivalent amount from international banks for one year,” says EFG Hermes economist Mohamed Abu Basha. This leaves USD 2 bn that would go straight to the CBE’s reserves piggy bank, Bloomberg says, citing Deputy Finance Minister Ahmed Kouchouk.

We’re going to go out on a limb here and say the bond is what closed the IMF facility for us on Friday. We’re finalizing the USD 2.7 bn currency swap with China, and the USD 4 bn in bonds puts us at above the USD 5-6 bn in third-party funding the IMF had required for the extended fund facility. This also signals that Saudi funds have dried up entirely, with Egypt actively and effectively being able to secure funding internationally, albeit at less favourable terms. The office of Iran’s charge d’affaires in Heliopolis might also be getting a tad busier now.

The drying up of the Saudi tap makes a visit to Egypt this weekend by the crown prince of Abu Dhabi all the more interesting. Mohammed bin Zayed Al Nahyan was in Cairo on Friday for one-on-one talks with President Abdel Fattah El Sisi, after which the two sat down with a wider group of government officials from both sides. An emailed readout from Ittihadiya includes the standard / customary reciprocal recitation of pledges of Egyptian support for the UAE, of Emirati support for Egypt, and of the importance of working together for the common good of the Arab world. We’ll be paying close attention to comment on Egypt coming out of the UAE in the days ahead given earlier reports that the Emiratis had largely lost patience with Egypt this past summer. Word on the diplomatic circuit is that the visit aimed to mediate between Cairo and Riyadh.

The banking system has pulled in USD 1.4 bn in one week following the float of the EGP, 15 times what it was raking in before the liberalization of the currency, said CBE Governor Tarek Amer, according to Al Mal. Amer noted that all of the USD 1.4 bn has been dispersed to cover import backlogs and the issuance of letters of credit, denying reports that banks have not been channeling these funds back into the economy. As we noted last week, importers have taken to the press to complain about not being able to access USD from banks, with reports emerging that some in the auto industry continue to rely on the parallel market. Amer is set to meet with banking heads today to talk FX strategy.

How popular were the NBE’s 20%- and 16%-interest CDs? National Bank of Egypt (NBE) attracted some EGP 30 bn in deposits with its new high-yield certificates of deposit, Yehia Aboul Fotouh, NBE’s deputy chairman, told Ahram Gate. NBE also said it extended USD 65 mn to importers on Wednesday and increased that amount to USD 70 mn on Thursday. This was probably helped by the Egyptian Foreign Exchange Company announcing it sold USD 2.5 mn to NBE at a rate of EGP 16.90 per USD 1. Al Masry Al Youm described the transaction as the largest of its kind since 2011.

In another sign that the baking system is beginning to replenish supply of FX, banks have apparently begun loosening up their caps on USD withdrawals abroad, with new cash withdrawals ranging from USD 250 to up to USD 3,000. Among them was HSBC which has raised purchasing limits on all of its cards outside Egypt, while maintaining a USD 300 monthly limit, Al Mal reported. Purchasing limits were increased to EGP 5k for standard debit cards, EGP 10k for Advance cards, and EGP 15k for Premier cards. Meanwhile, purchasing limits were raised to EGP 5k for standard credit cards, EGP 12k for MasterCard Advance and Visa Platinum cards, and EGP 25k for Premier cards. The newspaper has also published a chart tracking the new caps.

Gov’t signs settlement with ArcelorMittal: The Industrial Development Authority has signed a settlement agreement with Luxembourg-based steel producer ArcelorMittal in an arbitration case the company filed with the International Centre for Settlement of Investment Disputes (ICSID) in November 2015, according to an Investment Ministry statement picked up by Al Borsa. Under the settlement, the company will drop its USD 600 mn claim in damages in exchange for the government paying back the company the costs of licensing and land purchases. We broke the news that a settlement was imminent on 7 November and followed that up with an interview last Thursday with Judge Moustafa El Bahabety, Deputy Justice Minister and the man who led Egypt’s charge for a resolution.

4G looks very, very fast indeed: Orange Egypt chief Jean Marc Harion said the company’s 4G mobile network will be up to 10x faster than its existing 3G infrastructure — and it’s waiting only for the nod from the regulator to launch. In a press demo last week, Harion showed speeds as high as 27 Mbits / sec in Garden City and 90 Mbits / sec in Smart Village. Orange’s “is now ready to go with 4G but will wait for the clearance and blessings of the Egyptian Regulation body” Harion is quoted as saying in a company statement (pdf). Like all mobile operators, Orange is now offering to swap 3G SIM cards for 4G SIMs at no charge; the company is also rolling out an entry-level 4G smartphone

Consumer Protection chief going after Pizza Hut, calls for one-day retail boycott: The Consumer Protection Agency (CPA) has asked the Prosecutor General’s Office to open an investigation into its allegations that Americana Group has violated Consumer Protection Act in its pricing of “value meals” at Pizza Hut, Al Mal reports. The company had reportedly changed the price of the meal following the implementation of the value-added tax — but had continued to advertise the old price, according to an unnamed company source.

Meanwhile, CPA head Atef Yacoub, who fancies himself the Czar of Shopping, is calling for a one-day moratorium on shopping on 1 December to “pressure retailers” to lower prices. In an interview with Al Hayah Al Youm (run time 10:22), Yacoub welcomed the involvement of civil society, and emphasized that the consumer needs to take action. The first day of any month is ideal time to pressure retailers because it’s the peak spending day of the month, he claimed.

Hear, hear, Mr Werr: “Egypt’s economy will quickly begin roaring ahead at speeds we haven’t seen in a decade,” writes Patrick Werr in his weekly column in The National following the government’s reform measures. Werr says Egypt’s anticipated “J Curve” recovery never happened after 2011 “partly because of security concerns but mostly because the central bank … began pegging the currency at unrealistic levels.” He says a close parable to what we might expect is Egypt’s accelerated growth after 2004. One shorter term prediction he makes: October’s PMI decline should be “the last month we hear such painful news.”

Among the other national and international stories worth noting this morning:

- There no protests this weekend amid a heavy security presence. Reuters’ coverage is typical. The most evidence we could find were undated photos on the Freedom and Justice Party’s twitter feed of what it claimed was a Thursday, 10 November march in 10 Ramadan and a later call for revolution on the Ikhwan’s website. We’re not linking to either to save you the blood pressure points.

- Siemens revenue up on Egypt projects: “Revenue rose 3% [in the company’s fiscal fourth quarter], to EUR 21.95 bn, helped by strong growth at the power and gas division. Revenue growth in that business was mainly a result of the ‘strong execution’ of a large order backlog, including a EUR 8 bn power generation deal with Egypt, the company said,” the WSJ (paywall) reports. The company’s full earnings release is here (pdf).

The Global Picture

Donald Trump isn’t good for emerging markets. “Investors are dumping assets in emerging markets around the world, as Donald Trump’s election victory upends a long-profitable trade,” writes the Wall Street Journal (paywall) noting a broad sell-off of EM equities and currencies on Friday. Adds the paper: “Investors are expected to pour a net USD $157 bn into emerging markets by the end of the year, according to the Institute for International Finance, seeking relief from the rock-bottom yields prevailing elsewhere around the world. But Mr. Trump’s election has changed that calculus. His emphasis on infrastructure spending and tax cuts has sparked a rally in U.S. stocks and sent benchmark Treasury yields sharply higher. With better yields now available in developed markets and expectations that the Federal Reserve could have to raise key interest rates more aggressively, rather than the slow and gradual approach many analysts had been expecting, investors have a more compelling case to keep their money in the U.S.”

Worse news for those of us in EMEA: The money chasing EM opportunities is flowing eastward, writes the Financial Times (paywall), noting that, “Frontier equity fund managers have dramatically increased their holdings of Asian stocks, with the continent overtaking the Europe, Middle East and Africa region for the first time as the dominant bloc. The move underlines the rise of Asia as the pre-eminent domain of the emerging world, leaving Latin America and Emea floundering in its wake.”

And wonderfully enough, fund managers are overweight Egypt, according to a chart accompanying the FT piece provided by Copley Fund Research. A larger version of the chart is available on our website, while the full FT piece is accessible from the link above.

Spotlight

** SPECIAL COVERAGE: The Ismail cabinet turned out in force for the Akhbar Al Youm economic conference yesterday. Tap here for our wrap-up of remarks from the Prime Minister Sherif Ismail, Finance Minister Amr El Garhy, Planning Minister Ashraf Al Araby, Trade and Industry Minister Tarek Kabil Electricity Minister Mohamed Shaker and International Cooperation Minister Sahar Nasr.

On Deadline

Egypt is now pursuing a strategy of comprehensive economic development, International Cooperation Minister Sahar Nasr writes in El Watan. Nasr says that, unlike the expansion in the 00s, there is now a dual focus on achieving high growth rates as well as guaranteeing that there is a fair distribution of economic opportunity that works on reducing poverty and reducing the gaps in income inequality. There is a specific focus, she says, on education and healthcare programmes as well as cash transfer initiatives including the Takaful and Karama projects. Nasr also says the government is exerting more effort on supporting youth-led initiatives and SMEs.

Diplomacy + Foreign Trade

Azerbaijan plans to organize an export mission to Egypt, Rufat Mammadov, head of Azerbaijan Export and Investment Promotion Foundation, said. The mission will include proposals for cooperation in fields including food processing, food stuff, and production of non-alcoholic beverages. The timing of the visit was not announced.

Egypt’s Foreign Ministry condemned “irresponsible” statements made by Turkish President Recep Tayyip Erdogan about Egypt, Ahram Online reported. Erdogan accused “the Egyptian regime of providing support to the Gulen movement,” whom he earlier accused of masterminding the failed coup attempt in Turkey in July. FM spokesperson Ahmed Abu Zeid said the statement comes as a “continuation to the blundering and double standards approach that the Turkish policies have been characterised by throughout the past years.” During the crackdown on alleged coup participants and rivals and Erdogan’s push to have Gulen extradited from the US, Egyptian MPs had called for Gulen to be granted asylum in Egypt, demands which the government has never publicly stated it would support.

Elsewhere: Egypt and regional competitors / allies will have fewer worries about the US criticizing domestic policy, will be better able to pursue their own agendas, and could have more freedom to cozy up to Mother Russia under a Trump presidency, the WSJ’s Yaroslav Trofimov argues in “Trump Election Pushes U.S. Mideast Allies to Ponder Alternatives” (paywall). The Associated Press had a similar piece out this weekend that’s worth a look.

Energy

IOCs agree to speed up developments of new discoveries

International oil companies have agreed to speed up development of new discoveries, Oil Minister Tarek El Molla told Al Borsa. Additionally, IOCs have agreed to build new refineries, and add production lines at existing refineries, he added. The ministry is targeting expansions in the petrochemicals sector, considering it a valued-added market.

Basic Materials + Commodities

FEI denies previous reports that gov’t will issue advisory price guide this week

The Federation of Egyptian Industries (FEI) denied previous news reports where its head, Mohamed El Sewedy, had allegedly stated that the Trade and Industry Ministry will issue a price guide sometime this week, Al Mal reports.

Manufacturing

Industrial Development Authority issues 750k sqm in Badr City this month

The Industrial Development Authority is issuing 750k sqm in infrastructure-ready land plots in Badr City targeting engineering, textiles, and weaving industries, Al Borsa reported. The IDA has so far issued six out of 10 mn sqm as part of its strategy, and is planning to build 22 industrial complexes in different governorates by 2020, sources at the authority said.

Health + Education

Government works with AUC to cancel tuition increases

The Ministry of Higher Education says on its Facebook page that the American University in Cairo has agreed not to raise tuition this semester. The Ministry claims it is working with AUC to sort out a tuition rise that is “not outside the financial reach of its students.” In related news, the Cabinet Information and Decision Support Center notes that international schools may only collect tuition in Egyptian pounds.

Real Estate + Housing

MNHD to increase Taj City prices by a third

Madinet Nasr Housing & Development (MNHD) announced on Thursday it is going to increase the prices of its Taj City projects to EGP 12,000 per sqm from EGP 9,000 per sqm. MNHD says it is raising its prices in response to increases in building materials’ as well as the exchange rate. The company had issued a release a day earlier announcing that reservations in its Sarai project have reached EGP 1.06 bn and that it was borrowing EGP 600 mn to fund the Taj City project.

Tourism

House Foreign Affairs Committee meets with Chinese delegation to discuss tourism

The House of Representatives’ Foreign Affairs Committee met with a high-level Chinese delegation to discuss promoting Egyptian tourism in China, with MPs asserting that Egypt is safe for tourists, Al Shorouk reports. Potential investments in technology and SMEs was among the other topics on the agenda. Cabinet spokesperson Hossam El Qawish puts the size of Chinese investments and projects currently underway in Egypt at USD 7.5 bn, according to the newspaper.

Thomas cook will convert 21 charter flights to the new tourism initiative

Thomas Cook will convert 21 charter flights to low-cost budget flights in order to meet the requirements Tourism Ministry’s new flight incentives, according to Al Borsa. Under the new program, flights to Hurghada and Sharm El Sheikh with an 80% seat occupancy rate will receive incentives of USD 6,000 per flight. The ministry was reported last month to have reduced incentives offered to charter airlines although it simultaneously diminished the minimum capacity incoming flights to flights to Al Alamein, Marsa Matrouh, Luxor and Aswan had to reach to qualify for the subsidy.

Automotive + Transportation

Cairo Metro to issue tender for 13 trains in early-2017

The Cairo Metro company is set to issue a tender at the beginning of 2017 with the National Authority to import 13 trains for the second line at a total cost of USD 1.5 bn, Cairo Metro Chairman Ali Fadali told Amwal Al Ghad. Cairo Metro is pursuing to receive a joint loan from the European Bank for Reconstruction and Development and the European Investment Bank, he added, but the value of the loan has not been determined yet. Additionally, the company is looking for a USD 1 bn loan to finance upgrading the first line, he added.

Banking + Finance

QNB Al Ahli, CIB, United Bank offering high-interest rate CDs

Private banks are following the lead of state-owned ones in offering high-yield savings products. QNB Al Ahli has started offering 18-month certificates of deposit carrying an interest rate of 20% and three-year ones carrying 16%, Al Mal reports. CIB also announced its own line of high-interest products with an 18-month certificate that could pay up to 19% and a three-year one paying up to 16.5%. United Bank of Egypt issued variable-interest three-year CDs paying 20% in the first year and 16% in the second and third years, payable quarterly.

Other Business News of Note

Abou Hashima’s Egyptian Media buys 50% stake in Synergy Art Production

Ahmed Abou Hashima’s Egyptian Media company bought a 50% stake in film producer Synergy Art Production, Al Borsa reported. A source at Egyptian Media says more capital will be injected in film and television series production. The source also added that Synergy will resume focusing on film production following Abu Hashima’s acquisition.

Darwish announces that SCZone will tender 20 projects in December

The Suez Canal Economic Zone will tender 20 logistical services projects in December, SCZone chief Ahmed Darwish said, according to Al Mal. He added that it takes as little as a mere three days for companies to receive licences to operate in SCZone.

Egypt Politics + Economics

El Sisi committee looking into releasing detainees to release 80 young people

The committee recently formed by President Abdel Fattah El Sisi to look into releasing young detainees will announce the first group of 80 individuals (most youth and students) to receive parole or pardons within 48 hours, sources told Al Ahram.

On Your Way Out

Mahmoud Abdel Aziz dies at age 70

Prolific actor and star in a number of all-time Egyptian classics Mahmoud Abdel Aziz passed away yesterday, AMAY reports. An Alexandrian native, Abdel Aziz is best known for his role as a spy in the series Raafat al-Haggan, playing a blind man in the film Kit Kat, starring in crime thriller Al-Keif, and more recently, in the action film Ibrahim Al Abyad. He died in a coma after battling jaw cancer.

The markets yesterday

EGP / USD CBE market average: CBE website down at dispatch time

EGP / USD at CIB: Buy 15.90 | Sell 16.05

EGP / USD at NBE: Buy 15.90 | Sell 16.05

EGX30 (Thursday): 10,688.16 (+4.52%)

Turnover: EGP 2.174 bn (399% above the 90-day average)

EGX 30 year-to-date: +52.55%

THE MARKET ON THURSDAY: EGX30 ended Thursday’s session on its highest intraday level up 4.52%. None of the EGX30 constituents ended in negative territory. The day’s top gainers were Porto Group, Eastern Co, and TMG Holding. Market turnover was high at EGP 2.2 bn, while local investors were the sole net sellers.

Foreigners: Net long | EGP + 194.5 mn

Regional: Net long | EGP + 23.8 mn

Domestic: Net short | EGP – 218.3 mn

Retail: 69.1% of total trades | 63.6% of buyers | 74.7% of sellers

Institutions: 30.9% of total trades | 36.4% of buyers | 25.3% of sellers

Foreign: 13.4% of total | 17.9% of buyers | 8.9% of sellers

Regional: 12.4% of total | 13.0% of buyers | 11.9% of sellers

Domestic: 74.2% of total | 69.1% of buyers | 79.2% of sellers

***

PHAROS VIEW

If Optimism is a Virtue, Reality Check is a Blessing

In a research note out this morning, Pharos Head of Research Radwa El-Swaify writes that after long-awaited reform measures, foreign participation in the market has spiked, affecting trading volumes and share price movements. El-Swaify’s report looks at how “stocks in focus” are positioned within their respective sectors and how far optimism can stretch fair values given the spike witnessed in prices over the last six sessions. To further put things into perspective, the note goes through a reality check of the several opportunities and challenges that corporations in Egypt would have to deal with over the next 6-18 months.

DCF valuations are close to being “stretched” at this point. When we have examined the current assumptions underlying our and consensus DCF valuation and strongly believe that the implied assumptions do capture the turnaround in macroeconomic conditions, which takes us to the next question. Why is the market showing extremely strong momentum that seems to surpass cash flow assumptions? The short answer is Replacement Cost.

Tap here to read the full research report, which includes Pharos’ fundamental strategic view per sector and per key players in each sector. A detailed Egypt valuation table is presented at the end of the report to show valuations and multiples, the stocks Pharos favors and dividend plays.

***

WTI: USD 43.41 (-2.80%)

Brent: USD 44.75 (-2.38%)

Natural Gas (Nymex, futures prices) USD 2.63 MMBtu, +0.27%, December 2016 contract)

Gold: USD 1,224.30 / troy ounce (-3.32%)

TASI: 6,528.1 (+2.3%) (YTD: -5.6%)

ADX: 4,282.5 (-0.9%) (YTD: -0.6%)

DFM: 3,274.1 (-0.1%) (YTD: +3.9%)

KSE Weighted Index: 363.1 (+0.9%) (YTD: -4.9%)

QE: 9,961.0 (-0.1%) (YTD: -4.5%)

MSM: 5,417.7 (+0.2%) (YTD: +0.2%)

BB: 1,160.9 (+1.3%) (YTD: -4.5%)

Calendar

14-16 November (Monday-Wednesday): Bank of America Merrill Lynch MENA 2016 Conference, The Ritz Carlton, Dubai International Financial Centre, Dubai.

15 November (Tuesday): Egypt Trade & Export Finance Conference 2016, Fairmont Nile City, Cairo

15 November (Tuesday): Egypt Mega Projects Conference, Four Seasons, Cairo

17 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

18-20 November (Friday-Sunday): 4th Africa-Arab Summit in Malabo, Equatorial Guinea.

21-22 November (Monday-Tuesday): President Abdel Fattah El Sisi visits Portugal.

22 November (Tuesday): Industrial Development Authority cement auction (unconfirmed report)

25-26 November (Friday-Saturday): 27th Energy Charter Conference, Tokyo, Japan.

27 November (Sunday): 2016 Cairo ICT, Cairo International Convention Centre.

29-30 November (Tuesday-Wednesday): Citi’s Global Consumer Conference, London, UK.

30 November (Wednesday): OPEC’s 171st ordinary meeting, Vienna, Austria.

November (TBD): Delegation of German companies in the renewable energy sector due to visit to discuss investment opportunities.

04-06 December (Sunday-Tuesday): Solar-Tec exhibition, Cairo International Convention Centre.

04-06 December (Sunday-Tuesday): Electricx exhibition, Cairo International Convention Centre.

07-08 December: Citi’s 2016 Global Healthcare Conference, London, UK.

09-11 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

10-13 December (Saturday-Tuesday): Projex Africa and MS Marmomacc + Samoter Africa, Cairo International Convention Centre.

11 December (Sunday): Prophet Muhammad’s Birthday (national holiday; date to be confirmed).

11-13 December (Sunday-Tuesday): The Middle East Fire, Security & Safety Exhibition and Conference (MEFSEC), Cairo International Convention Centre, Cairo.

13 December (Tuesday): Amwal Al Ghad’s top 50 most influential women in Egypt women forum, Four Seasons Nile Plaza Hotel, Cairo.

29 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

14-16 February 2017 (Tuesday-Thursday): Egypt Petroleum Show 2017 (EGYPS), CIEC, Cairo

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.