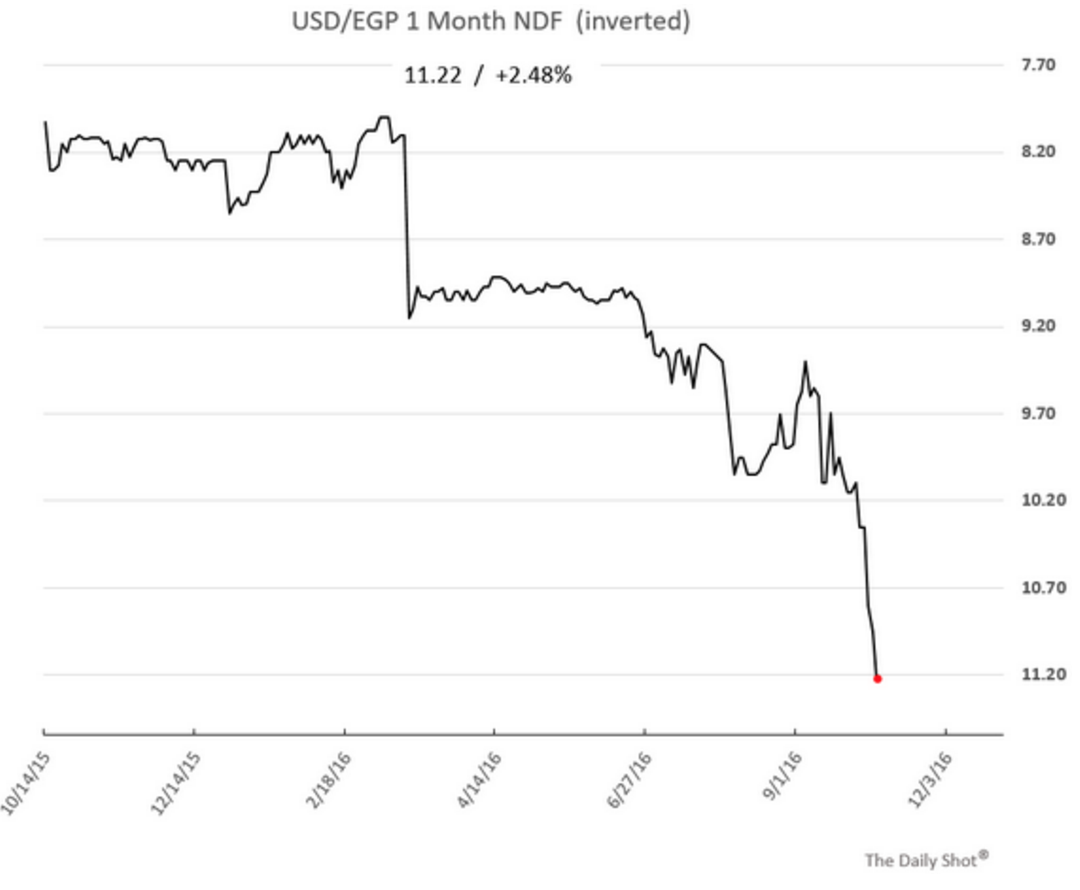

- Industry pushing 21-day boycott on the parallel market; one-month NDFs put fair value for EGP at 11.22 (What We’re Tracking Today)

- Tiff between Cairo and Riyadh gets international attention; USD 2 bn KSA deposit actually arrived in September. (Speed Round)

- Gov’t to raise fuel prices 20-25% before the IMF board meetings –Report. (Speed Round)

- Is Egypt delaying USD 3 bn eurobond because we’ve been crowded out by KSA’s USD 15 bn offering? (Speed Round)

- Cabinet approves market share cap for brokerage mergers. (Speed Round)

- Orange Egypt signs 4G licence agreement; Vodafone Egypt and Etisalat Misr open talks. (Speed Round)

- China Harbor to build second container terminal at Port of Damietta. (Speed Round)

- El Sisi interviews with state-owned newspapers focus on foreign policy, economy. (Speed Round)

- Viral Tuktuk Man video and self-immolating cab driver in Alex seen by local press as warning signs for cabinet. (Worth Watching)

- By the Numbers

Sunday, 16 October 2016

Industry mulls 21-day boycott of parallel market for USD

TL;DR

What We’re Tracking Today

Are we, or are we not? Unless you pulled a Rip van Winkle or were in the High Arctic, you know by now the Central Bank of Egypt did not devalue the EGP on Thursday as its board meeting came and went without a public announcement. Hesitation is the order of the day across the government, Al Masry Al Youm cites government sources as saying, as officials struggle to stem inflation in key commodities. Fear of inflation is reportedly driving the cabinet and the CBE away from a full float and toward a gradual devaluation sometime in November or December, despite statements by IMF managing director Christine Lagarde that a devaluation will need to happen before the IMF board approves a USD 12 bn facility. This dilemma has driven a near-paralysis in decision-making over the devaluation, an unnamed government source tells the newspaper.

The EGP has been gaining strength as major buyers have reportedly sat on the sidelines to send a message that rampant speculation has gone too far. The EGP strengthened to EGP 15.30 on Thursday (from close to EGP 16.00 the day before) and rallied to 15.05-15.20 yesterday, Al Mal reports.

Industry is looking to send a message: Industry associations plan to announce they will stop sourcing FX on the parallel market for 21 days, according to Adel Al Shenwany, a member of the food industries division at the Federation of Egyptian Chambers of Commerce speaking with Ahram Gate. initiative is expected to be widely adopted by industry this week, said Walid Helal, member of the 10th of Ramadan investors association.

What’s the EGP really worth? Remember our grumbling last week that 16.00 for the EGP is nonsense given what are being quoted in the market are asks and asks alone? Non-deliverable forwards projected on Thursday that the EGP would be at 11.22 a month from now, according the Wall Street Journal’s newly-acquired charts newsletter. That compares with about 10.80 a week earlier.

Meanwhile, the EGX is whipsawing back and forth, and we’re going to play amateur stock picker and suggest rumors (and what little news there is) about devaluation will continue to drive volatility in the days ahead. The EGX rallied 3.9% — its biggest gain in more than two months — on Thursday after the Ismail government announced it had received a USD 2 bn deposit from Saudi Arabia, snapping three-day losing streak.

Talk of a nationwide sugar shortage prompted the government to announce it has a four-month reserve of the sweet stuff in addition to six months of edible oils and 4.5 months of wheat on hand, according to a brief in Reuters. Our exceptionally unscientific survey this weekend found no processed domestic white sugar on shelves in four supermarkets, including two national chains, one ‘upscale’ market and one middle-income outlet.

Random fact of the morning: Velvet was first manufactured in Egypt in roughly 2000 BC, the Financial Times tells us as it notes the fabric is becoming a daytime staple this season. For ladies, that is. Gents: Doesn’t seem to be much in the way of daytime velvet for you, so it’s vintage (if you can pull it off) or leave it to evening (cf: merlot Shelton velvet tuxedo jacket by Tom Ford) and pick up a textured navy wool blazer.

What We’re Tracking This Week

Three stories look set to dominate the domestic agenda this week: The boxed-set of devaluation, subsidy cuts and inflation; what seems like a clash between Egypt and Saudi Arabia; and the ongoing 4G license saga. More on all three in Speed Round.

Also: If you’re a white-goods manufacturer, you’ll want to read-up on yesterday’s decision by nearly 200 countries to ban the use of factory-made hydrofluorocarbon (HFC) gases in refrigerators and air conditioners as part of the global battle against climate change.

Across the pond, Hillary Clinton and Donald Trump square-off in the third and final debate of the 2016 US presidential election. They’re set to clash starting 9pm Eastern on Wednesday, 19 October (that’s 3am CLT on Thursday, 20 October). Same format as the first debate: podiums, six 15-minute segments.

Meanwhile, nerds like us are looking to heavenward for a sign that we may get New MacBook Pros (or is it MacBooks Pro?) soon. Apple moved its earnings call to Tuesday, 25 October because of an undisclosed “scheduling conflict.” It was originally scheduled for Thursday, 27 October, prompting speculation that the long-awaited MacBook Pro with an OLED touchbar replacing the function key row may be announced on the 27th.

Speed Round

Saudi Arabia’s deposit at the Central Bank of Egypt actually arrived in September, Prime Minister Sherif Ismail told Reuters. This means that the USD 2 bn deposit showed up in the announced USD 19.6 bn September reserve figure and prior to Aramco’s suspension of fuel shipments in October — and before Egypt’s vote for the Russian-backed resolution on Syria at the UN Security Council. “Egypt is also in talks with China. An IMF official said during its annual meeting last week that the IMF and Egypt had made ‘good progress’ on securing the funding but did not specify how much might still be needed,” Reuters adds. Banking sources speaking to AMAY suggested that CBE Governor Tarek Amer was the unnamed senior government official who made it public the deposit had arrived without saying when, aiming to downplay the significance of the rift between Saudi Arabia and Egypt in the media.

Aramco’s suspension of fuel shipments to Egypt has nothing to do with Egypt’s votes in the UN Security Council, President Abdel Fattah El Sisi said in a speech on Thursday. Egypt’s decision to vote for rival resolutions was simply part of Cairo’s bit to work toward a ceasefire in Syria, Al Shorouk reported. El Sisi did not say why the shipments were suspended, but noted they were part of a commercial agreement. The President also said Egypt has the steps necessary to ensure an uninterrupted flow.

Whatever is going on, El Sisi isn’t backing down, calmly declaring:“There are attempts to pressure Egypt but it won’t kneel before anyone but God.” Watch the section in question (run time: 2:15), or catch the speech in full (run time: 28:48).

No rift with Saudi on flights: Meanwhile, the Civil Aviation Authority is at pains trying to hammer that there is no “problem” with Saudi aviation authorities approving the private Egyptian airline flight schedules, according to its chief Hany El Adawy, Al Mal reports. Coordination between the two sides is ongoing and companies will be notified when schedules are approved, he added. The news follows reports last week claiming Saudi had delayed approving Egyptian schedules as part of the ongoing dispute.

Flap getting international attention: The global business press has taken note of the brewing flap. The Financial Times is out with a single piece, but the WSJ has given it blanket coverage with no less than three pieces as of this morning. The announcement on Wednesday of USD 2 bn from Saudi anchored the first Wall Street Journal piece on the subject, setting up a much deeper dive by Yaroslav Trofimov for the paper headlined “Egypt Juggles Its Friendships as Russian Influence Surges: A United Nations Security Council vote shows the new regional calculus at play for Cairo.”

Saudi mouthpiece Jamal Khashoggi is all over the WSJ piece: “The government of Egypt is failing. People are seeing Egypt as a black hole, and we aren’t getting a return on investment,” Trofimov quotes him as saying. “Egypt sees Syria in a very simplistic manner—a military regime just like they have in Egypt that is also refusing democracy and Islamists.” Subtle, dude.

“Egypt Presses Oil Companies for More Time to Pay for Fuel,” the Wall Street Journal declares in its third piece, reporting that EGPC called a meeting on Wednesday to ask energy suppliers to give it six months instead of the usual three to pay for LNG, crude and petroleum product orders now in the pipeline. The Journal says its unnamed source did not specify which suppliers attended the meeting; the paper notes BP, Vitol and Trafigura as among Egypt’s top suppliers. Wood Mackenzie LNG analyst Lucas Schmitt says concerns about credit risk could see Egypt could pay a premium compared to regional countries for upcoming orders. “Egypt hasn’t yet procured LNG to meet its needs in 2017 and is expected to seek offers to deliver 120 cargoes, the largest-ever short-term tender, traders said.”

Where do we go from here? The endgame is entirely political, we believe. A delegation from Egypt is reportedly heading to Saudi this week to work on language for a UN resolution that both countries can back (among other issues). Talks on Syria in Lausanne, Switzerland, last night convened by US Secretary of State ended in deadlock. The talks — which included the foreign ministers of Russia, Egypt, Saudi Arabia, Iran, Iraq, Turkey, Qatar and Jordan — ended in deadlock, Reuters reports.

The Ismail government is mulling whether to raise fuel prices by 20-25% in advance of the IMF’s executive board meeting, a government source tells Al Borsa. The story suggests cabinet is worried about the impact of a fuel price hike on inflation — we see the USD at c. EGP 13.00 is already priced-in; a fuel price hike is not — and suggests there isn’t enough time to implement the long-delayed smart card system for fuel before the price hike.

Has Saudi’s first international bond issuance pushed back ours? The Ismail government will likely delay its USD 3 bn eurobond issuance until after Egypt receives approval from the IMF board for a USD 12 bn extended fund facility, the local press reports this weekend, noting that IMF approval on the EFF would reduce borrowing costs. There’s also the suggestion out there that Saudi Arabia’s first international bond — now expected to be in the USD 15 bn range — is a factor in the delay. Unnamed sources speaking to Al Mal say the Saudi issue is crowding the market, while others speaking to Al Masry Al Youm see little competition between the two offerings. Either way, the Egyptian Finance Ministry has reportedly delayed the roadshow for the offering, which was set to begin this month.

Finance Minister Amr El Garhy struck an optimistic note on the issue, telling cabinet that investors he spoke with in DC and New York expressed keen interest. El Garhy successfully sold Egypt’s recovery plan to these investors, lenders and finance ministers, according to a statement that ran in AMAY.

We’re getting fast mobile internet after all: Orange Egypt has acquired a 4G license; Vodafone Egypt and Etisalat Misr look to follow suit. Orange has reportedly signed a USD 484 mn agreement with the National Telecommunications Regulatory Authority that will see it acquire a 4G license. Orange also agreed to pay USD 11.26 mn to offer virtual fixed-line services. On the mobile side, the operator will get 10 MHz of spectrum instead of the 7.5 MHz previously on offer, which it had rejected as insufficient to offer 4G, Al Borsa reports. Meanwhile, Reuters quotes an unnamed NTRA official as saying “Meetings are ongoing between [Vodafone and Etisalat] and the regulator.”

The NTRA has reportedly approved “new terms” for the licenses: The licence will be priced in USD, with half of the fees payable in USD and the balance in EGP-equivalent at the CBE rate at the time of payment, Al Mal reported. The same method will be used to price the fixed-line licence, while international gateway licenses will be payable entirely in USD. Telecom operators acquiring 4G licenses will have priority access to the gateway licenses.

Orange Egypt’s acquisition of a 4G license will be financed by the mother company and will be paid for in USD or EUR, said CEO Jean-Marc Harion. The company will soon announce its 4G launch date, reports Al Mal. Existing clients can apparently stop by an Orange branches starting Monday to pick up a 4G-compatible SIM card.

Vodafone and Etisalat have until 23 October to acquire a 4G license, NTRA CEO Mostafa Abdel Wahed told Al Mal.

Cabinet approves market share cap for brokerage mergers: The acquisition a stake greater than 33% of any brokerage with a market share of 10% or more will require approval from the board of the Egyptian Financial Supervisory Authority under amendments to the executive regulations of the Capital Markets Law. Cabinet signed-off on the regulatory change at its meeting last week, Al Borsa reports. The move, which the Council of State (Maglis El Dowla) reviewed back in May, was previously positioned as a bid to “protect minority shareholder rights.” The new rules also give existing shareholders first right of refusal to subscribe to a new capital increase and give heirs up to two years to acquire EFSA sign-off on the inheritance of a one-third interest in any brokerage. The regulatory changes were proposed during Beltone Financial’s failed bid to acquire CI Capital from CIB at a cost of nearly EGP 1 bn; CI Capital had an 11.1% market share in September against Beltone’s 6.2%.

Meanwhile: “The new Investment Law” will be a top legislative priority for cabinet during the current session of the House of Representatives, said Prime Minister Sherif Ismail. The measures, which past statements by Investment Minister Dalia Khorshid suggest include bringing back tax breaks and free zones, will be reviewed during cabinet’s next meeting, said Ismail. The statement, which ran in Al Shorouk, does not clarify whether this means a whole new law or amendments to the existing act, a question on which the Investment Ministry had sought the input of investors in a poll which closed earlier this month. Poll results have not yet been released.

AfDB to vote on second tranche of USD 1.5 bn facility at the end of November: The board of the African Development Bank (AfDB) will vote at the end of November on releasing the USD 500 mn second tranche of its USD 1.5 bn development loan, said the bank’s Resident Representative in Egypt, Leila Mokaddem. The date for the vote could come sooner, she added, contingent on the House of Representatives ratifying the agreement.

As for energy funding, the AfDB will not be financing companies that signed up for phase one of the feed-in tariff program, joining the European Bank for Reconstruction and Development, which pulled out in protest of the domestic arbitration requirement, a source from the bank tells Al Borsa. The AfDB is exploring funding phase two as soon as the New and Renewable Energy Authority clarifies its reasoning behind some of the terms, particularly reducing the tariff from USD 0.14/kWh to USD 0.084/kWh, the source added. As we noted last week, the Electricity Ministry is ready to sign with 10 companies which have secured funding under phase one terms.

“The Prosecutor General not looking into charges of monopoly against Oriental Weavers does not imply its exoneration,” read a statement from the Egyptian Competition Authority quoted in Al Borsa. The prosecutor’s decision not to go forward with charges at this time could be due to procedural concerns, the ECA said. Oriental Weavers declined to comment for Al Borsa’s story beyond noting the prosecutor had dropped the case. The ECA had alleged the carpet manufacturer had engaged in anti-competitive behaviour by reportedly requiring its distributors carry only its good.

China Harbor to build second container terminal at Damietta Port: China Harbor Engineering gets an “A” for persistence, closing an MOU to build a second container terminal at Damietta Port despite having weathered more than 18 months of turbulence over its bid to build a multipurpose platform in Alexandria. China Harbor has closed a memorandum of understanding with the Damietta Port Authority to build “2,225 metres of berths, with a water depth of 17 metres and stacking space of 700,000 square metres” over a two-year period, according to industry publication Port Technology. Fully 85% of the project financing will come from China, with the port authority retaining full ownership.

Television channels donned mourning stripes again this weekend after 12 soldiers were killed in an attack on a checkpoint in Sinai by heavily armed militants affiliated with Daesh. The Armed Forces report having killed 15 attackers. The Friday attack “may indicate an escalation in tactics after a relatively long period of relying mainly on [improvised explosive devices] and sniper attacks,” the Wall Street Journal quoted George Washington University’s Mokhtar Awad (Twitter) as saying. The Armed Forces launched a retaliatory operation with a three-hour airstrike yesterday, according to a televised statement by the Armed Forces (runtime: 3:47)

El Sisi interviews with state press hit on foreign policy, economy: In a sit-down with state-owned newspapers this weekend, President Abdel Fattah El Sisi discussed relations with Saudi Arabia and Russia and the economy and the Army’s role in it, among other topics.

On the economy, the president sought to reassure the public that the IMF loan is a fundamentally good thing, reiterating that it was a testament to the strength of the economic reform program that Egypt was able to line up the USD 12 bn extended fund facility. El Sisi promised the Investment Law will be out by year’s end and that the national project to upgrade infrastructure, which he considers pivotal for investment, will be completed by 2018, four years ahead of schedule. El Sisi also outlined seven measures to tackle rising prices including: 1) reviewing ration card databases and eliminating those not eligible for support; 2) reviewing the social welfare and Takafol and Karama programs; 3) expanding the state’s network of subsidized food retailers, particularly in Upper Egypt; 4) curbing smuggling through stricter customs enforcement; 5) launching initiatives to curb electricity, natural gas and water consumption; 6) building up to six months’ worth of strategic reserves, and 7) ensuring domestically produced staples are widely available. Notably absent from the discussions was talk of devaluation.

The president noted that Egypt takes a balanced approach on foreign policy and is adamant of not interfering in the domestic affairs of other nations. The president discussed Egypt’s votes on UN resolutions on Syria and insisted that Egypt is not supporting the opposition in Ethiopia. El Sisi said Cairo’s relationship with Riyadh remains important and strategic and will not be impacted by recent events. Egypt has taken measures to ensure it is not wholly reliant on the Aramco fuel product shipments. Similarly, relations with Russia remain strong: The final Dabaa nuclear contracts are expected to be signed soon and we should expect direct flights to Egypt to also resume in the near term, El Sisi added.

El Sisi said the Armed Forces’ role in development projects will ease in the coming years as it completes the national project to upgrade infrastructure.

On security, El Sisi said he is more worried about domestic threats than international ones, noting that while the situation in Sinai is improving, “the war on terror is long” and that "the terrorists are evolving, but we are improving our operations.”

Read the full interview in Arabic in two parts: Part 1 and Part 2

Prime Minister Sherif Ismail chaired a meeting of his cabinet yesterday. Among other decisions, Cabinet:

- Approved laws allowing for investors to build, operate, and maintain projects for the National Authority for Tunnels, in addition to specialized and public ports, or piers at existing ports, under 15-year right-to-use contracts, after which ownership of all facilities returns to the state;

- Approved establishing a committee to implement environmental standards at coal mills;

- Reallocated 528 feddans to the Alexandria Governorate for development projects;

- Approved amending an existing MoU to accept EUR 125 mn in new funding from Spain;

- Approved a USD 40 mn loan from the OPEC Fund for International Development for the SDF’s SME strategy;

- Approved the creation of the “Aswan quarries project,” which includes the issuance of licenses for 175 quarries;

- Reallocated 800 feddans in Giza to NUCA for its greenhouses project;

- Expanded the role of the Deputy Health Minister to include being in charge of motherhood and childcare policy.

Egypt in the News

The economy is driving coverage of Egypt in the international press this morning. The brewing spat between Cairo and Riyadh (see above) dominates the wires and newspapers alike. Reuters’ “Fuel aid halt suggests deeper Saudi-Egyptian rift” is typical. But the Associated Press owned the weekend with Brian Rohan’s “Egypt inches toward IMF bailout as shortages, prices enrage,” over-the-top verbiage and all.

Compared to the difficulty of balancing Saudi with Russia, our other foreign policy challenge of the moment *looks* like a tempest in a teapot. But when you consider Ethiopia is building a dam that could have massive impact on water use and soil quality in Egypt, you’ll be glad the wires are giving plenty of attention to President Abdel Fattah El Sisi’s statement that Egypt is not supporting rebels in Ethiopia. (Al Ahram’s breaking news website has more here: “We chose cooperation and peace,” adding that he is personally responsible for peace and cooperation with Ethiopia.)

(And on a somewhat tangential note: Three friends and family members accosted us this weekend, convinced that war between Russia and the US is imminent. It’s not. This story gets to the heart of the fuss: Russia envoy: Tensions with US are probably worst since 1973. The money quote: “even though we have serious frictions, differences like Syria, we continue to work on other issues … and sometimes quite well.”)

The military’s expansion of its economic activities also broadens the potential jurisdiction of military courts, Sahar Aziz writes for the Carnegie Endowment for International Peace. The piece also appeared in the Cairo Review of Global Affairs.

SDX Energy gets some love from the Financial Timesin the salmon-colored paper’s look at small-cap drillers. The piece quotes CEO Paul Welch — whose company recently announced positive seismic data — as noting that the company’s strong balance sheet has helped make its shares attractive: “If you went into the downturn with a bunch of debt, you had to scramble to avoid a crisis. We didn’t have that. Our operating costs are also relatively low; we can generate cash flow with crude prices as low as USD 30.”

Bloomberg Businessweek’s Devin Leonard profiled Egypt-born Haim Saban, the American-Israeli chairman of Spanish-language US television network Univision (and co-creator of the Power Rangers). Saban has donated over USD 10 mn to Hillary Clinton’s campaign and tells Leonard he plans to take Univision Communications public.

Worth Watching

Tuktuk preacherman: Cabinet is feeling the heat from the street over prices as it mulls when to devalue and by how much to cut subsidies. A three-minute video by a Distinguished Professor of Economics at Tuktuk University in Cairo went viral over the weekend, garnering more than 20 mn views. The driver, Mustafa Abdel Azim El Leithy, who was interviewed by Al Hayat TV’s Amr El Leithy (no relation) for his program “Wahed Men Al Nas,” gave an impassioned speech on the spike in prices and the government’s “neglect” of the average Egyptian, criticizing its focus on pomp and ceremony. Al Hayat’s pulled the video from its Youtube page with the limp excuse that the server managing its channel was overloaded. Amr El Leithy also appears to have suddenly felt the need to take a vacation, with sources at the channel speculating that the clip might have something to do with his need for a break.

The controversy comes as a taxi driver self-immolated in Alexandria, reportedly in protest of rising prices, according to AMAY, which posted a video of the act that’s simply too gruesome for even us to show.

“Tuktuk man” is being positioned by the domestic press as a warning sign that popular discontent is rising ahead of protests called for 11 November. This piece by El Watan’s Mahmoud Khalil is typical.

Diplomacy + Foreign Trade

USD 785 mn in loans from JICA? The International Cooperation Ministry expects to sign final agreements with the Japanese International Cooperation Agency for a USD 450 mn loan to finance the second phase of the Grand Egyptian Museum by the end of the month, Al Mal reported. The ministry is also looking to close a USD 335 mn facility with JICA to fund power stations upgrades around Cairo.

Belgian, Australian business delegations to visit in early 2017: A delegation from Belgium is visiting Egypt in early-2017 to study investment opportunities and boost bilateral trade, Trade and Industry Minister Tarek Kabil told Al Mal. Kabil met with Belgian Ambassador Sibille de Cartier d’Yves, who said investors were interested in the Suez Canal Axis development projects. An Australian business delegation interested in the mining, new and renewable energy industries is scheduled to visit Egypt in 1Q2017, according to an e-mailed statement from GAFI.

Energy

Total to invest USD 200 mn in Egypt, up from an initial report of USD 100 mn

Total is set to invest USD 200 mn in Egypt over the next five years, the cabinet announced, according to Reuters’ Arabic service. Al Mal had pegged the investment value at USD 100 mn on Wednesday, but noted that the company had plans to operate 10 new fuel stations annually over the five years.

Infrastructure

Alexandria Port Authority to issue tender to build dry, liquid bulk terminals

The Alexandria Port Authority is set to issue tenders to build dry and liquid bulk terminals at the Dekheila Port within the coming two months, authority deputy chief Mohamed El Dakak told Al Borsa. The project aims to increase the port’s dry bulk capacity to 35 mn tonnes annually from 22 mn tonnes today.

Basic Materials + Commodities

GASC excludes Egyptian trading houses from tender

The General Authority for Supply Commodities (GASC) has excluded Egyptian buyers from participating in its wheat tenders, Reuters’ Arabic service reported. This would exclude companies including trading house Venus, which had presented GASC wheat offers during its zero-ergot tolerance policy, from participating in future tenders. Traders told the newswire the reasons behind the restrictions are unclear. Separately, traders said the lowest offer presented to GASC for its tender on Thursday came from Russia, after a bid for US wheat was rejected as it contained durum wheat instead of soft wheat. GASC was looking for wheat for delivery from 11 to 20 November. This comes as GASC has purchased 120k tonnes of Romanian wheat and 60,000 tonnes of Russian wheat at a price of c USD 187 per tonne for both shipments, Al Masry Al Youm reports.

Welspun in Egypt, pledges to preserve reputation of Egyptian cotton

Representatives from India’s Welspun met with ministers Tarek Kabil and Ashraf El Sharkawy to improve relations with Egypt and pledge to preserve the reputation of Egyptian cotton globally, Al Masry Al Youm reported. Welspun is embroiled in a scandal after having supplied cotton mislabelled as Egypt to retailers in the US. Group Managing director Rajesh Mandawewala said the company has begun internal investigations to ensure proper quality control. Welspun is also looking to partner with the Public Enterprise Ministry’s programme to redevelop Egypt’s textiles sector, Ahram Gate says.

Spinneys opens three branches in three months

Spinneys is opening three branches within the coming three months, CEO Mohanad Adly told Al Mal. The branches are located in New Cairo, Sheikh Zayed, and Maadi. Spinneys has allocated EGP 500 mn towards the expansions, separate from EGP 100 mn allocated towards expanding into Upper Egypt on which we had earlier reported.

Manufacturing

China’s Megan group completes designs for Borg El Arab electronics factory

China’s Megan group has completed the architectural designs for its planned electronics factory with Egypt’s SICO in the Borg El Arab industrial city in Alexandria, Al Mal reported. SICO’s Chairman says the partners are currently just awaiting regulatory approvals and building permits to begin constructing the USD 15 mn plant. The planned factory will reportedly produce smartphones and Internet of Things products in Egypt, targeting to export 65% of its output and was announced last May.

Cement companies bidding on new cement licenses have until this month to submit letters of guarantee

The Industrial Development Authority (IDA) is giving cement companies bidding on new cement licenses until the end of the month to complete and submit their letters of guarantee, Al Borsa reports. Six companies that applied for eight new cement licenses earlier this year have received extensions, IDA head Ismail Gaber told the newspaper.

Health + Education

Health, Military Production Ministries sign cooperation protocol to build IV solutions factory

ACDIMA and Vacsera signed a cooperation protocol with the National Organization For Military Production to build an IV solution factory, Al Shorouk reported. The factory will produce IV solutions for domestic consumption and export. The military production organization will provide financing for the building and production lines, supervise construction, and provide regular maintenance. Meanwhile, ACDIMA will provide the building, machinery, raw materials, and licensing at the Health Ministry. This comes as the House of Representatives’ health committee is set to hold a meeting on finding an “urgent solution” to the IV solution shortage, Al Borsa reports.

Automotive + Transportation

White taxis hit the appspace today

After all the nagging and crying, white-taxi drivers finally get their own hailing app which launches today, Al Masry Al Youm reports. If you are inclined to go back to the dark ages, rest assured the app will run in three languages, said Taxi Drivers’ Union head Mahmoud Abdelhamid. As we noted in late September, the initiative is reportedly in partnership with El Araby Car.

Banking + Finance

CBE asks banks to survey non-performing industrial, tourism projects

The CBE has requested banks survey non-performing industrial and tourism projects, and assess the possibility of a float, sources told Al Borsa. The CBE wants to estimate how much financing would be required to revitalize the projects, the source added.

National Bank of Abu Dhabi SME portfolio hits EGP 800 mn in August

The National Bank of Abu Dhabi (NBAD)’s SME portfolio reached EGP 800 mn in August, Al Borsa reported. The SME portfolio represents 8% of the bank’s total loans, sources said. The bank aims to grow the SME portfolio to EGP 1 bn by the end of the year, and hit 20% of the total loan portfolio by mid-2018 in compliance with the CBE SME initiative, the source added. The merger between Gulf Bank and NBAD will strengthen the bank’s presence in Egypt, the source said.

Other Business News of Note

Raya to buy Egyptian food company

Raya Holding’s board of directors approved in principle entering into negotiations to acquire a food manufacturer that “operates in the domestic market and exports,” according to an EGX disclosure. The company will complete its due diligence contingent on which it will formulate an agreement. Raya has already bought a 19.39% stake in a Polish pasta producer and was looking to build a food production plant in Ain Sokhna.

Law

Manpower Ministry presents Labor Law to Cabinet

The Manpower Ministry has completed drafting a new Labor Law and is presenting it to the Cabinet today for review and approval ahead of introducing the bill to the House of Representatives, Manpower Minister Mohamed Saafan told Al Shorouk.

On Your Way Out

Like a rolling stone: Folk singer / songwriter Bob Dylan was awarded the 2016 Nobel Prize in Literature “for having created new poetic expressions within the great American song tradition.” We guess we weren’t took mistaken when we prematurely called the Nobel Season off after the economics award announcement last week.

Three men in the US have been arrested for plotting to bomb a housing complex dominated by Muslims. The three “were key members of a militia group that referred to itself as the Crusaders,” the US Department of Justice said in a statement, noting, “The complaint alleges that since February the FBI has been investigating the defendants’ activities, including their plans to carry out a violent attack against Muslims in southwestern Kansas.”

UNICEF, EU want more Egyptian kids in preschool: UNICEF and the European Union “will work together on a humanitarian project to help children attend pre-school, to provide more education opportunities and a safer environment for refugee and Egyptian children.” UNICEF says 37k children, families, and caregivers will benefit from the project which runs until March 2017, providing 30 new kindergartens in six governorates.

The markets yesterday

USD CBE auction (Thursday, 13 Oct): 8.78 (unchanged since 16 March 2016)

USD parallel market (Saturday, 15 Oct): 15.05-15.20 (from 15.20-15.68 on Thursday, 13 Oct, Reuters)

EGX30 (Thursday): 8,505.12 (+3.9%)

Turnover: EGP 1,184.84 mn (172% above the 90-day average)

EGX 30 year-to-date: +21.39%

THE MARKET ON THURSDAY: EGX30 closed the day up 3.9%, breaking the 8,500 mark driven by news of a USD 2 bn Saudi deposit. The index’s top performers were TMG Holding, CIB, and EFG Hermes. On the flip side, today’s worst performers were Egypt Kuwait Holding, Edita, and Ezz Steel. At a market turnover of EGP 1,184.8 mn foreign investors were the sole net buyers.

Foreigners: Net long | EGP +61.5 mn

Regional: Net short | EGP -58.5 mn

Domestic: Net short | EGP -3.0 mn

Retail: 54.9% of total trades | 50.4% of buyers | 59.4% of sellers

Institutions: 45.1% of total trades | 49.6% of buyers | 40.6% of sellers

Foreign: 21.2% of total | 23.8% of buyers | 18.6% of sellers

Regional: 8.0% of total | 5.5% of buyers | 10.5% of sellers

Domestic: 70.8% of total | 70.7% of buyers | 70.9% of sellers

WTI: USD 50.35 (-0.18%)

Brent: USD 51.95 (-0.15%)

Natural Gas (Nymex, futures prices) USD 3.28 MMBtu, (-0.3%, Nov 2016 contract)

Gold: USD 1,255.50 / troy ounce (-0.17%)

TASI: 5,694.0 (0.0%) (YTD: -17.6%)

ADX: 4,347.2 (-0.4%) (YTD: +0.9%)

DFM: 3,334.9 (-0.6%) (YTD: +5.8%)

KSE Weighted Index: 346.6 (-0.1%) (YTD: -9.2%)

QE: 10,390.0 (-0.1%) (YTD: -0.4%)

MSM: 5,660.2 (-0.4%) (YTD: +4.7%)

BB: 1,144.6 (+1.3%) (YTD: -5.9%)

Calendar

19 October (Wednesday): Digital Media Forum Cairo, Four Seasons Nile Plaza Hotel, Cairo.

24 October (Monday) EBRD executive meeting in Egypt on sustainable development strategy.

24-29 October (Monday-Saturday): The 2016 Dubai Design Week Iconic City exhibition Cairo NOW City Incomplete, Dubai Design District (d3), Dubai

26-27 October (Wednesday-Thursday): The Marketing Kingdom Cairo 2 event, Cairo.

31 October (Monday): Deadline for Telecom Egypt to reach an agreement with MNOs over using their 2G and 3G network infrastructure

November (TBD): Delegation of German companies in the renewable energy sector due to visit to discuss investment opportunities.

2-6 November (Wednesday-Sunday): Petroleum Housing Conference, Petrosport Club, New Cairo, Cairo

3 November (Thursday): The Emirates NBD PMI for Egypt, Saudi Arabia and the UAE compiled by Markit comes out here.

14-16 November (Monday-Wednesday): Bank of America Merrill Lynch MENA 2016 Conference, The Ritz Carlton, Dubai International Financial Centre, Dubai.

17 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

27 November (Sunday): 2016 Cairo ICT, Cairo International Convention Centre.

29-30 November (Tuesday-Wednesday): Citi’s Global Consumer Conference, London, UK.

04-06 December (Sunday-Tuesday): Solar-Tec exhibition, Cairo International Convention Centre.

04-06 December (Sunday-Tuesday): Electricx exhibition, Cairo International Convention Centre.

07-08 December: Citi’s 2016 Global Healthcare Conference, London, UK.

10-13 December (Saturday-Tuesday): Projex Africa and MS Marmomacc + Samoter Africa, Cairo International Convention Centre.

11 December (Sunday): Prophet Muhammad’s Birthday (national holiday; date to be confirmed).

11-13 December (Sunday-Tuesday): The Middle East Fire, Security & Safety Exhibition and Conference (MEFSEC), Cairo International Convention Centre, Cairo.

13 December (Tuesday): Amwal Al Ghad’s top 50 most influential women in Egypt women forum, Four Seasons Nile Plaza Hotel, Cairo.

29 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meets to review rates.

14-16 February 2017 (Tuesday-Thursday): Egyptian Petroleum Show, Cairo International Convention and Exhibition Centre.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.