How Egypt is positioning itself as an educational hub for international students

How Egypt is positioning itself as an educational hub for international students: Attracting more international students is a key priority for both private universities and the Egyptian government, opening up important avenues for investment as well as increased revenue generation thanks to higher fees being paid in foreign currency. Now a comprehensive strategy — including the internationalization of private and public universities, ministry-led reform and partnerships with a host of overseas entities — is driving an influx of international degree-seekers.

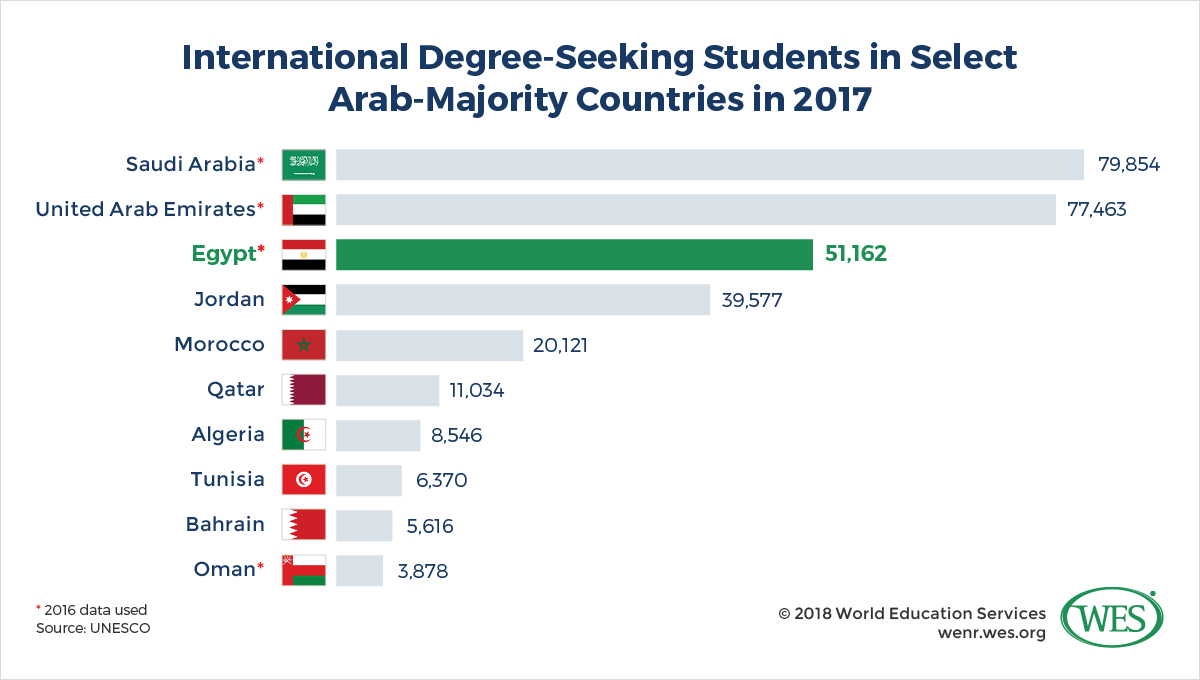

In 2016, Egypt was the third-largest destination for international degree-seeking students within the MENA region, behind Saudi Arabia and the UAE, with inbound mobility having shot up to some 51k students from an estimated 27k international students in 2003, according to the World Education Service (WES).

That figure is even higher today: A current listing by Rasha Kamal, the Head of the Central Administration for International Students at the Higher Education Ministry, puts the number of international students studying in Egypt at around 87k (the figure excludes international students studying at private universities in 2019-20). She hopes to increase the number of incoming first year international students attending Egyptian universities to 20k for 2020-21. The Supreme Council of Universities announced in 2017 a strategy to increase the total number of foreign students in Egypt to 200k, according to a statement by the council cited by Al Fanar.

Where are the international students coming from? Perhaps surprisingly, many students come from Southeast Asia, with Malaysia sending the vast majority (just over 4.5k in 2016, according to UNESCO data), but other countries in MENA (notably Syria) and Africa (notably Nigeria) are also important markets. Some 70% are male, and most study at public universities, according to WES. 18.8% of the country’s international undergraduates coming to Egypt’s public universities in 2018 came from Kuwait, making it the country with the largest representation that year — while in 2019, the greatest number of international undergraduates entering public universities were from Jordan, says Kamal.

Each international student will generate significantly more revenue for private universities than their Egyptian counterparts. At the American University in Cairo, international undergraduate students pay USD 735 per credit hour, while Egyptians pay USD 583 per credit hour. Egyptians pay USD 522 per credit hour for a graduate program, whereas international graduate students will pay USD 735. We see this discrepancy in other universities, such as the British University in Egypt (BUE), where annual fees for an undergraduate international student can range from USD 10,193-11,193, while Egyptian students can expect to pay annual tuition of USD 1,242-5,277. The same pattern holds at the German University in Cairo and Modern Sciences and Arts Academy (MSA).

What’s also significant is that international students must pay in FX, while their Egyptian counterparts are allowed to pay in EGP. This makes international students one of a university’s leading sources of hard currency.

These universities are pulling out all the stops to attract more international students. AUC has employed several strategic approaches to attracting international students, after its numbers fell dramatically between 2011 and 2015, says Ahmed Tolba, AUC’s Associate Provost for Strategic Enrollment Management (SEM). The university now has a recruitment team that attends high school study fairs in target countries, has contracted a market study to help inform its targeted outreach and messaging, engages in digital marketing campaigns, and offers scholarships. It has also set up some 202 study abroad partnerships all over the world, most of which are in North America and Europe. Meanwhile, BUE subscribed to a digital marketing platform back in 2018 that saw its website translated into 46 languages, resulting in a fivefold increase of roughly 1,900 international applicants this year, says BUE’s Mohamed Eid.

Gov’t looks to raise revenue generated by international students in Egypt: International students studying in Egypt generated some USD 186 mn for the Egyptian economy in 2017, according to University World News. The government is reportedly aiming to increase this contribution by as much as USD 700 mn by 2021.

The government is leveraging partnerships to attract students from overseas. The ratification of the International Branch Campus Law (pdf) in July 2018 has allowed international universities to set up branch campuses in Egypt by: building their own campus, like the German International University; partnering with an Egyptian company that can build an educational hub, like the Knowledge Hub, which hosts Britain’s Coventry University campus; and by partnering with existing Egyptian public or governmental universities, which Arizona State University is reportedly interested in doing.

Having big-name global universities set up shop in Egypt is attractive to international students, says Mohamed El Shinnawi, advisor to the Higher Education Minister. This strategy forms part of what Thomas Hale in the Financial Times calls a “model for indirect international study,” developing all over the world. “[Establishing] campuses in intermediary countries avoids requiring fee-paying international students to have the kind of wealth usually needed to study directly in the UK or US,” Hale writes. So for students who want to obtain a degree from a UK, US, or European university, but face the constraints of the high cost of living or indeed the difficulty of procuring a visa, this offers a viable alternative.

Egypt’s international student recruitment is in the same boat as tourism: “In 2010, international students — both degree-seeking and study abroad — made up about 17% of our student body. This number dropped as low as 3% in subsequent years, because of the situation in the country,” said AUC’s Tolba. Between 2011 and 2015, the US State Department issued security warnings against traveling to Egypt. Reclassifications in 2015 and then in 2018 is reversing the falling trend of international student recruitment. “International students made up about 6% of AUCs student body this year,” adds Tolba. These, however, still fall short of the 15% quota for 2019 set by AUC Provost Sherif Sedky back in 2016.

We should be thinking of attracting international students in the same way we think of foreign direct investment. Internationalization has significant direct and indirect economic benefits, enhancing economic competitiveness and boosting Egypt’s global reputation, argues Associate Professor Jason E. Lane, of State University of New York at Albany in a University World News opinion piece. It is a means of “importing academic capital” that is similar to FDI, he adds, and could allow Egypt to “leapfrog educational development that would likely be slower by only investing in domestic institutions.”

Your top 5 education stories for the past week

Your top education news stories in Egypt this week:

- Sphinx Private Equity Management will launch a USD 100-120 mn private equity fund with an eye on education and health.

- Spain’s Mediterrania Capital Partners is looking to raise USD 100 mn for its MC III fund. The fund will focus on education, health and other B2C services.

- CIRA will invest more than EGP 2 bn to develop several ongoing and future education projects and will turn to a securitized bond issuance as part of its financing plans, CEO Mohamed El Kalla said last week.

- King Salman University in Sinai is expected to open its doors in March 2020, Higher Education Minister Khaled Abdel Ghaffar said, according to Ahram Gate.

- MOVES- Reda Hegazi was appointed as Assistant Education Minister for Public Schools yesterday, according to Youm7. He had headed the ministry’s public education department since 2015.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.