- Egypt to sign a cooperation agreement with South Korea’s Myoung Shin to locally produce electric microbuses this week. (The Big Stories Today)

- Novax is officially out of the Australian Open after back and forth over vaccination. (The Big Stories Abroad)

- Make a killing on NFTs? The US government wants a slice of that pie. (For Your Commute)

- Netflix’s Archive 81 is “the horror series humanity needs right now.” (On The Tube Tonight)

- The newest trend in the music scene? Artists selling their own music rights. (For Your Commute)

- There’s a ton of football to watch today. (On The Tube Tonight)

- World Economic Forum has some dire warnings for the future. (Macro Picture)

- The Food District is your go-to for the start of any delicious meal. (Eat This Tonight)

Sunday, 16 January 2022

PM — There’s tons of football to binge today

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

It’s a relatively quiet start to this new workweek, ladies and gents. However, we don’t expect the slowdown to persist beyond today.

THE BIG STORIES TODAY-

#1- We’re getting closer to locally assembling EV microbuses: El Nasr Automotive subsidiary the Engineering Automotive Manufacturing Company is set to sign a cooperation agreement with South Korean auto parts maker Myoung Shin “by the end of the week,” to locally produce electric microbuses, Hapi Journal quotes Public Enterprise Minister Hisham Tawfik as saying.

#2- The Suez Canal Economic Zone (SCZone) is in talks with Hungary over a potential investment in a specialized industrial area in the zone, with a Hungarian delegation set to visit mid-February to continue talks, SCZone head Yehia Zaki told Bloomberg Asharq on the sidelines of the Suez Canal International Conference at Dubai’s Expo 2020 (watch, runtime: 3:47). The SCZone also plans to launch ship catering and marine services in the next few months during his speech at the conference, according to a Suez Canal Authority statement. Also in the pipeline: A target to complete work on widening and deepening the Suez Canal by July 2023, according to a separate statement.

HAPPENING NOW-

The Senate is currently discussing the bill that would create a new Labor Act to regulate employment for private sector companies. If passed, the bill would dictate how employees can be dismissed, making it harder for private sector employers to fire staff for illnesses but allowing workers to lose their jobs if convicted of a felony. The bill would also set a minimum annual raise requirement equal to 3% of the amount covered by social ins., according to the text of the bill (pdf).

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- The Grand Egyptian Museum could open its doors to the public in 2H2022 to coincide with the centennial of the discovery of King Tutankhamun’s tomb, Tourism Minister Khaled El Anany said.

- Orcas raises USD 2.1 mn pre-series A round: Egyptian edtech startup Orcas raised USD 2.1 mn in a pre-series A round co-led by our friends at CIRA’s NFX Ventures, and Access Bridge Ventures.

- Apicorp and IsDB launch USD 1 bn Infra Initiative: Arab Petroleum Investments Corporation and the Islamic Development Bank have launched a three-year, USD 1 bn initiative for private-sector focused infrastructure financing in countries including Egypt.

THE BIG STORY ABROAD-

DJOKOVIC WATCH- Novax is officially out of the Australian Open: World number one tennis champion Novak Djokovic was deported from Australia after its Federal Court upheld a decision to cancel his visa due to his being unvaccinated, Bloomberg reports. The ruling overrides a lower court ruling supporting Djokovic’s appeal against being deported from Australia, saying that he provided sufficient evidence to justify a medical exemption from getting the covid-19 vaccine, which rested on testing positive for covid-19 a few weeks ago and recovering since then. The final decision to deport Djokovic — over which he voiced his “extreme disappointment” — means he will be unable to defend his Australian Open championship title or land his 21st Grand Slam, which would set a new record and place him ahead of Rafael Nadal and Roger Federer, each of whom have 20 titles.

Also getting digital ink: Fresh threats from Russia in the ongoing face-off with Ukraine. Moscow could do more than invade Ukraine if President Vladimir Putin’s demands on ending Nato expansion and scaling down the US’ security presence in Europe are rejected. In “subtle threats,” Russia implied that it could move nuclear missiles closer to the US coast, “potentially igniting a confrontation with echoes of the 1962 Cuban Missile Crisis,” the New York Times says. Meanwhile, Ukraine’s military authority claims that Russian-backed militants have been gathering more weapons as border tensions continue to rise, according to Bloomberg.

|

???? CIRCLE YOUR CALENDAR-

Consoleya will kick off its Startup Meet-up series this Tuesday with a talk from Founder and Principal of Newton International Management Ayman S. Ashour. The talk, titled Exits and Reset Dilemmas, will see Ashour discuss how to plan for your startup’s exit and the connections you’ll need along the way. Hossam Allam, founder of Cairo Angels and managing director of maintenance services at Hassan Allam Construction, will moderate the discussion. The event will take place from 6-9pm — you can register using this link.

National flag carrier EgyptAir will operate a flight from Casablanca to Cairo this Wednesday, 19 January, to bring home Egyptian expats stranded in Morocco following border closures.

South Korean President Moon Jae-in is due in town this Thursday and Friday, 20-21 January on an official visit, during which he will meet President Abdel Fattah El Sisi.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- We’re in for moderate rainfall tomorrow, the Egyptian Meteorological Authority forecasts. Temperatures are also going to remain on the colder side, with a daytime high of 15°C and a nighttime low of 7°C, according to our favorite weather app.

???? FOR YOUR COMMUTE

Make a killing on NFTs? The US government wants a slice of that pie: Non-fungible token (NFT) investors in the US may be in for a surprise this tax season, as Internal Revenue Service (IRS) officials gear up for a crackdown on the newly-ballooning industry, Bloomberg reports. The market has exploded to 44 bn over the past year, and levy rates could be as high as 37%, according to tax experts, which means collectors would owe the IRS bns of USDs. However, the exact rules for taxing tokens remain unclear, leaving NFT collectors scrambling to try and figure out how much they owe — while others may not even realize they need to pay taxes on their tokens at all, increasing their chances of incurring future penalties.

Step away from the cookie jar: Sugar may be the “worst food ingredient” for your immune system, immunologist Heather Moday tells CNBC. Increasing your sugar intake raises your blood sugar, which launches a vicious cycle resulting in increased inflammation, insulin resistance and obesity. This cycle leads to a weakened immunity that paves the way for viruses to slip through our body’s defenses, explains Moday. A recent study found that people with obesity or type two diabetes (which, in Egypt, accounts for an estimated 15.6% of adults aged 20-79) are at higher risk for covid complications. The good news, however, is that scrapping the white stuff from our eating habits “can not only help end this cycle, but it can reverse it completely,” Moday says.

The newest trend in the music scene? Artists selling their own music rights: After the pandemic hit live touring — the most lucrative business for artists, musicians began to search for other revenue streams to make up for the loss. Copyright soon emerged as a more durable asset, luring big names — such as Shakira, Tina Turner, Bob Dylan, and Stevie Nicks — to jump on the bandwagon of selling the rights to their own work. Everyone from conglomerates and music labels to private equity groups and investment funds are swooping in to get in on the trend as they pocket earnings every time the songs they own are played on streaming platforms, in public including on the radio, or licensed for use in TV, film or advertising. Both the New Statesman and Rolling Stone have come out with pieces explaining the ongoing trend.

???? ENTERPRISE RECOMMENDS

Archive 81 is “the horror series humanity needs right now” + Get beef bacon jam at The Food District

???? ON THE TUBE TONIGHT-

(all times CLT)

If you’re into horror series, Archive 81 is one that boasts a good storyline: Based on a fictional podcast of the same name, the new Netflix horror thriller follows film archivist Dan Turner who is offered USD 100k to restore a set of fire-damaged tapes on the condition that he does so in an abandoned basement. With a paycheck that big in store, he takes the job and soon finds himself enveloped in an oral history project undertaken by grad student Melody Pendras in 1994. Pendras was attempting to talk to the inhabitants of an apartment building that burned down in the 1920s. However, as both she and viewer Turner soon find out, the building was home to a supernatural cult that ends up with a horrific demise for her and all the people she interviewed. The show is told through these tapes and through Turner’s digging into the topic in a show that ping pongs between two storylines. The Guardian calls it “the horror series humanity needs right now” but is quick to point out a number of plot holes that take away from the show, but don’t cancel it out as an interesting watching experience.

⚽ Afcon has four matches on today: The two Group F leaders, Gambia and Mali, will compete today at 3pm, while the other two countries in the group will try to catch up as Mauritania and Tunisia start a match at 6pm. Meanwhile, Group E will see Ivory coast go up against Sierra Leone at 6pm and Algeria play Equatorial Guinea at 8pm. Egypt’s next match is against Sudan at 9pm on Wednesday.

The Egyptian League Cup: Future and Pyramids are currently on the field as we dispatch, while at 5pm, Al Ittihad will play against Al Masry and Misr Lel Mekassa against Eastern Company.

There are two matches in the Premier League at 4pm today: Liverpool vs. Brentford and West Ham vs. Leeds United.

The Supercopa de España final is definitely a match to watch, with Athletic Club and Real Madrid fighting for the title at 8:30pm.

Serie A: Sassuolo and Verona are finishing up their match as we dispatch, while Venezia and Empoli will hit the field soon at 4pm. Later, Roma and Cagliari will compete at 7pm and Atalanta has a match against Inter at 9:45pm.

Elche and Villareal kicked off their match at 3pm in La Liga.

????EAT THIS TONIGHT-

The Food District is your go-to for the start of any delicious meal: Located in Galleria 40, The Food District is a market, a restaurant, a deli, and a bakery — each of which has high quality items to choose from — with a great indoor/outdoor design to boot. There’s the option of sitting outside and ordering from the restaurant menu which has breakfast plates, burgers, pastas, and a variety of main dishes (pro tip: try their ginger shrimp). Otherwise, you can grab a quick bite to go from a selection of salads, pastries, and sandwiches as well as a fruit bar that you can make a sweet fruit salad from. The market is also a great place to pick something up — we were drawn to their selection of meats and cheese. They have a beef bacon jam and a nut-filled cheese that caught our taste buds' attention.

???? OUT AND ABOUT-

(all times CLT)

Let out your inner art critic as a number of local galleries open new exhibitions:

The World Art Forum is ongoing at Cairo’s National Museum of Egyptian Civilization until Wednesday, 19 January. The inaugural edition of the forum, which kicked off yesterday, will see artists from around the world participating.

It’s opening night of Kodak Passageway’s newest exhibition Mastic & Musk organized by Art To Heart and featuring a lineup of artists from all corners of the country.

Almashrabia Gallery has on Abdelwahab Hawam’s new exhibit Rosy Dreams.

Some Art School and Gallery is hosting group exhibition Echoes of the Eye with works that “navigate the conditions of gain, loss and transformation that characterize identity-formation in the worlds they inhabit today.”

???? UNDER THE LAMPLIGHT-

Impress your friends with your quick maths knowledge, like the fact that 1 mn seconds is 12 days: Making Numbers Count by Chip Heath and Karla Starr offers dozens of these facts while also showing you how to incorporate numbers on a day to day basis. The book outlines the specific principles that reveal how to translate a number into our brain’s language such as simple perspective cues (using comparisons), vividness (visualize the size of an object), convert to a process (demonstrating time through daily processes), and emotional measuring stick (framing the number in something people care about). As consumers and producers of news content, we’ve seen all of these principles show up in well-written news articles to help with explaining a certain point. But even if you’re not a journalist, understanding the numbers that animate our world allows you to bring more data into your decision-making process in personal or professional spaces.

???? GO WITH THE FLOW

Market roundup on 16 January

The EGX30 fell 1.5% at today’s close on turnover of EGP 556 mn (53.4% below the 90-day average). Foreign investors were net buyers. The index is down 1.0% YTD.

In the green: MM Group (+2.3%), AMOC (+1.5%) and EFG Hermes (+0.2%).

In the red: Rameda (-4.9%), Fawry (-4.9%) and Raya Holding (-3.7%).

???? MACRO PICTURE

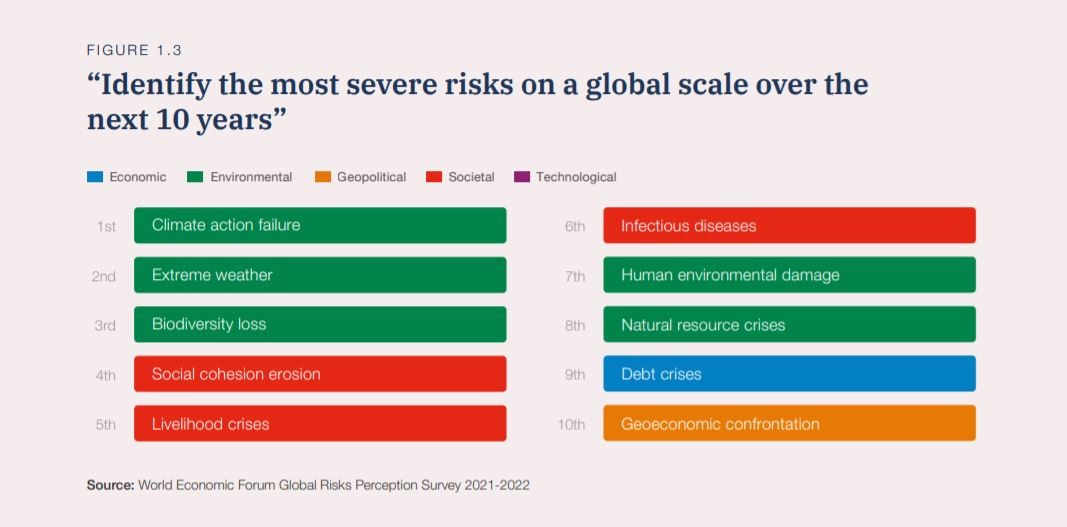

The sentiment for an accelerating global economic recovery is looking rather bleak, if the World Economic Forum’s (WEF) Global Risks Report for 2022 (pdf) is anything to go by. The report — which outlines the 10 biggest threats the world faces in the years ahead — showed that officials and business leaders have little faith in an accelerating global recovery and the future of the world as a whole. The WEF’s perception survey found that 84% of respondents were concerned or worried about the outlook for the world while only 12% are positive and 4% are optimistic. The world is now in a “perfect storm” of economic and health crises coupled with the long-term looming threat of climate change, WEF Managing Director Saadia Zahidi explained to Bloomberg TV (watch, runtime: 05:42).

Climate-related risks make up half of the 10 biggest threats: Climate action failure tops the list of risks, followed by extreme weather, biodiversity loss, social cohesion erosion, livelihood crises, infectious diseases, human environmental damage, natural resource crises, debt crises, and geoeconomic confrontation.

Before we think of the disasters of the future, there’s a crisis currently at hand — the pandemic that keeps on giving: The spread of new variants and a rise in global case counts have pushed back the end of the pandemic and the uncertainty that accompanies it. Meanwhile, the issue of vaccine disparity continues to underline global inequality, with the poorest 52 countries only having a 6% vaccination rate. This unequal recovery from the pandemic will compound social fractures and geopolitical tensions at a time where the world needs to better cooperate to cope with issues of common interest.

Covid-19 has accelerated the timeline for the anticipated breakdown of social cohesion: Social cohesion erosion is the risk that has worsened the most globally since the start of the pandemic, according to the report. It is a critical threat that spans the short, medium, and long terms through economic, political, technological, and intergenerational inequality. Protests and unrest were rampant during the past two years as these inequalities were brought to light during the pandemic, with the World Bank estimating that the richest 20% of the world’s population will have recovered half their losses in 2021 while the poorest 20% will have lost 5% more of their income. It will take the global economy at least until 2023 to create the jobs lost to the pandemic, but even then, many of these jobs are expected to be of low productivity and poor quality, according to the International Labour Organization. These income disparities risk further increasing polarization and resentment within societies, the report writes.

The result? Less financial and political capital available for stronger climate action: The Earth’s climate is the most pressing long-term existential threat, especially in the next five to 10 years, the report says. However, with so much allocation going towards ending the pandemic and settling local and regional unrest, climate action might be put on the back burner. Post-covid recovery favors short-term stability over the green transition while loose monetary policies further distort green, market-based solutions or investments, the report writes.

And promises made aren’t necessarily promises kept: The report alludes to the pledges made during COP26 where governments vowed to take important steps to avoid global warming rising above the disastrous 1.5°C scenario. However, as the United Nations Environment Programme’s Emissions Gap Report 2021 (pdf) shows, reaching the 1.5°C target remains unlikely. Instead, the current trajectory is expected to steer the world towards a 2.4°C warming, with only the most optimistic of scenarios holding it to 1.8°C.

The cost of complete climate inaction is steep: Not taking a bolder and faster approach towards climate change in the coming years, could lead to a “too little, too late” situation and ultimately a “hot house world scenario” with runaway climate change that makes the world all but uninhabitable, the report writes. If the world fails to achieve the net zero emissions goal by 2050, financial losses are projected to be between 4% and 18% of global GDP with different impacts across regions — not to mention the loss of lives and livelihoods.

Meanwhile, the pandemic also increased digital dependence, which intensified cybersecurity threats: Cyber vulnerabilities was a key risk the report brought up, with a 358% increase in malware and a 435% increase in ransomware in 2020 alone, as more people joined the “ransomware as a service” industry, the report states. Meanwhile, there has also been growth in deepfakes and “disinformation-for-hire” services which can do everything from sway an election to deepening mistrust between societies, business, and government. On a corporate level, cybersecurity threats have increased costs for businesses as cyber crime has forced companies to pay up to bns to unlock data, systems, or stop their attacks. Even for those who err on the side of caution, cyber ins. rates have soared, going up 204% y-o-y in the US in 3Q2021.

Migration and space exploration were also brought to the table as major risks the world faces: Economic hardship, worsening impacts of climate change and political persecution will force mns to leave their homes in search of a better future in the coming years, the report writes. Yet in many countries, lingering effects of the pandemic, increased economic protectionism and new labor market dynamics are resulting in higher barriers to entry for migrants who might seek refuge. Meanwhile, outer space could be another geopolitical battleground as an increase in private and public activity crowds out the developing world and gives even more advantage to rich countries.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: The World Economic Forum annual meeting, location TBD.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

January: Sovereign Sukuk Act executive regulations expected to be finalized.

January: Tenth of Ramadan dry port tender to be launched.

January: Three-month trial period of ACI for air freight to begin.

9 January – 6 February (Sunday-Sunday): 2021 Africa Cup of Nations, Cameroon.

Second half of January: Egypt will host the Egyptian-Bahraini Joint Committee.

Second half of January: Regulations for installing EV charging stations will be published.

15-19 January (Saturday-Wednesday): World Art Forum, National Museum of Egyptian Civilization, Cairo.

16 January (Sunday): SODIC shareholders will vote on the company’s new board of directors at an extraordinary general meeting.

17-19 January (Monday-Wednesday): World Future Energy Summit, Abu Dhabi.

18 January (Tuesday): Founder and Principal of Newton International Management Ayman S. Ashour will give a talk titled Exits and Reset Dilemmas at Consoleya.

19 January (Wednesday): EgyptAir will operate an exceptional Casablanca-Cairo flight to bring home Egyptians expats stranded in Morocco following border closures.

20 January (Thursday): Kadmar Shipping’s new line transporting agricultural crops between Alexandria and Russia begins its operations.

20-21 January (Thursday-Friday): South Korean President Moon Jae-in will visit Egypt as part of his diplomatic tour of the region.

23 January (Sunday): Deadline for Macro Pharma to IPO on the EGX.

25 January (Tuesday): The IMF will release its World Economic Outlook.

25 January (Tuesday): 25 January revolution anniversary / Police Day.

25 January (Tuesday): Techne Summit announces awardees of Corporate Innovation Program.

25-26 January (Tuesday-Wednesday): Federal Reserve interest rate meeting.

27 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30-31 January (Sunday-Monday): Ins. Federation of Egypt medical ins. forum.

End of January: The Egyptian-Romanian business forum will take place with the aim of strengthening joint investment relations.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX this month.

February: Suez canal transit fees set to increase 6%, exempting cruise ships and LNG carriers.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

3 February (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3 February (Thursday): January PMI figures for Egypt, Saudi Arabia, and the UAE will be released.

4-20 February (Friday-Sunday): 2022 Winter Olympics, Beijing.

11 February (Friday): Deadline for Anghami SPAC merger.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

15 February (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

15 February (Tuesday): Orange Ventures’ deadline to receive applications from seed-stage fintech startups.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

July: A law governing ins. for seasonal contractors will come into effect.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

Late October – 14 November: 3Q2022 earnings season.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.