- 15-18 year olds in Egypt could soon receive Pfizer shots. (The Big Stories Today)

- Are SPACs already gaining traction in Egypt? (The Big Stories Today)

- The House postpones discussion on the Unified Budget Act to 14 November. (What We’re Tracking Tonight)

- Meet our analyst of the week: Sigma’s Hani Amer. (Go With The Flow)

- Emaar Misr and Obour Land bottomline is up in 3Q2021. (Go With The Flow)

- Purchasing managers’ indexes for Egypt, Saudi Arabia and the UAE will land tomorrow. (What We’re Tracking Tonight)

- Get used to hearing a lot more about the Matrix…sorry, the metaverse. (For Your Commute)

- Can you resist Taco Tuesday at Bonita? (Enterprise Recommend)

Tuesday, 2 November 2021

PM — 15-18 year olds in Egypt could soon receive Pfizer shots.

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

It’s another news dump day on hump day, ladies and gentlemen. And if you’re like some of us here and lost interest in yet another day of our world leaders disappointing us on the environment, we have teenagers getting approved for vaccinations here at home, interest for SPACs on the EGX, Fed day kicking off and more Black Mirror-type shenanigans from world tech giants.

THE BIG STORIES TODAY-

THIS JUST IN- Children aged 15-18 will be offered Pfizer vaccines in Egypt, acting Health Minister Khaled Abdel Ghaffar said in a cabinet meeting today, according to a Madbouly cabinet statement. Details of the rollout for the age group will be announced within hours, the minister said, adding that unvaccinated university students will not be allowed on campuses as of 15 November.

SPACs already gaining traction in Egypt? Two companies are already poking into setting up SPACs to acquire and list fintech players in Egypt, according to Zulficar & Partners founding partner Anwar Zeidan. The two unnamed companies are in the non-banking financial services space and are currently in talks with the Financial Regulatory Authority about the necessary steps they need to take in order to list, as the authority works on setting up regulations to govern the blank-check companies. The announcement comes a day after the FRA yesterday greenlit the proposal to allow SPACs in Egypt.

Could Egypt be getting a slice of a USD 673 mn BlackRock climate-focused infrastructure fund? BlackRock's Alternative Investments’ global head of renewable powers David Giordano named Egypt as an “attractive investment” among emerging markets, as its climate-focused fund plans to invest in renewables and other green projects, according to Reuters.

^^ We’ll cover these stories in greater detail in tomorrow’s EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Wheat prices rise again: State grain buyer GASC paid 1.5% more for Russian wheat purchased in the latest international tender as reduced crop production in some of the world’s biggest producers and higher shipping costs are pushing up global prices.

- Chip shortage weighs on car sales: Passenger car sales dipped slightly in September, falling more than 2% y-o-y from the same month last year, with industry leaders reporting that the culprit remains shortages of the chips used in modern vehicles.

- Edita’s first production line in Morocco will be up and running within days, IR director Menna Shams El Din confirmed to Enterprise yesterday.

HAPPENING NOW- The House of Representatives has adjourned discussions on the Unified Budget Act until 14 November, according to Youm7. The House wants the input and testimony of Finance Minister Mohamed Maait on a number of articles of the bill, but has given its preliminary approval on all other articles.

Background: The draft act aims to merge legislation governing the state’s annual budget and fiscal governance into an updated bill. If passed, the bill would require the government to present a medium-term budgetary and fiscal strategy to the House of Representatives each year. The act would also alter how the state budget allocates funding by imposing a top-down structure that would require the government to set spending limits for each ministry, which would then divvy up the funding for the bodies and organizations under its purview.

Tourism Minister Khaled El Anani is at the Travel & Tourism Expo in London, which is running 1-3 November. The minister held a presser with UK media yesterday, answering questions about Egypt’s covid safety measures and the opening of the Grand Egyptian Museum next year.

It’s also Fed day: The US Federal Reserve begins its two-day meeting today, in which it is widely expected to announce the winding down of its USD 120 bn a month asset purchase program instituted at the start of the pandemic to stimulate the economy. All eyes will be on the Fed’s Open Market Committee’s decision on whether it will pull the trigger on scaling back its program, which Fed chief Jay Powell has previously said could happen in November.

The Fed will no doubt have inflation on its mind: The knock-on effect of global supply chain delays, shortages of a range of goods, and soaring prices threatens to seriously undermine economic recoveries, according to new research by Bloomberg Economics. Across the world, production slowdowns and clogged distribution networks are bringing significant shortages — nearing a 20-year high in the US, UK and euro area. The Bloomberg gauges provide plenty of data — including factory gate prices, the ratio of inventory-to-sales for retailers, and the backlog of orders for service-sector firms — supporting the Fed’s assessment in September of supply-side disruptions and strong demand driving up prices and inflation.

What’s it all leading to? Stagflation, but not quite as we know it, Jim. The current environment is best described as stagflation-lite, Bloomberg notes, as continued high inflation remains a challenge for central bankers. Keeping rates low would allow the recovery to continue, but prices could spiral — while tightening would quell inflation but stifle demand. Traders anticipate two rate hikes from the Fed in 2022, but Bloomberg Economics modelling suggests that “if inflation runs strong and unemployment falls, even two hikes next year might not be enough.”

Over in China, citizens have been told to stockpile food and other essentials, as authorities further tighten the country’s strict covid-19 containment measures to suppress a small outbreak, the Financial Times reports. The government hasn’t directly cited covid as a reason to store essential items, but 54 new locally-transmitted cases were reported on Monday. China’s food prices are generally volatile, and vegetable prices have surged in recent weeks, due to inclement weather, the salmon colored paper added.

THE BIG STORY ABROAD- Over 100 countries have pledged to halt deforestation by 2030 at COP26: World leaders from some 110 countries, along with 30 financial institutions, have committed to end deforestation by 2030 at the COP26 UN climate summit in Glasgow today, the BBC reports. Some USD 19.2 bn in public and private funding have been committed to the cause so far and will go, in part, towards supporting efforts in developing countries to combat forest fires, revitalize land damaged by deforestation and help indigenious communities protect forests. Details on how exactly the pledge will be enforced and whether it will follow the same fate as a separate 2014 pledge so far remain unclear but some set of standards for sustainable supply chains and trade agreements appear to be in the pipeline.

Also from COP26: A US-led commitment to reduce global methane emissions by 30% by 2030 is in the pipeline through a joint US-EU pledge, with some 90 countries, including Brazil, reportedly signing on to the pledge to clamp down on methane, Bloomberg reports. The US-led effort could see limits placed on gases coming from some 1 mn oil and gas rigs in the country and expand federal oversight to some 425k miles of pipeline that were previously unregulated. A component of the initiative also stipulates a plan to capture 70% of methane emitted from landfills in the US, but the effort will rely primarily on voluntary action.

But developing nations must step up to help less developed countries in the transition to net zero, writes South African President Cyril Ramaphosa for the Financial Times. “The needs of workers and communities in industries and geographies that will be hurt by such a transition must be carefully considered,” calling for developed economies to provide grants, loans at concessional rates of investment to ensure the transition is “just.”

ALSO GETTING COVERAGE- Yahoo has pulled its services from China, effective today, citing an increasingly challenging business environment, the WSJ and Bloomberg report. This comes less than a month after Microsoft’s LinkedIn exited Beijing, also pointing fingers at the “challenging operating environment”. While Microsoft’s announcement was a big blow to China which has already been suffering from a wave of closures from foreign companies, Yahoo’s move is more symbolic than anything. Yahoo has been shutting down main services such as email and news in China starting 2013 and coincided by chance with the tech crackdown in the country.

Iconic Syrian singer Sabah Fakhri passed away today in Damascus at the age of 88, with his son telling AFP that Fakhri died a natural death. The musician’s passing is a “huge loss for Syrian art,” Anas Fakhri added. Born in Aleppo and hailed as one of Syria's greats, Fakhri gained popularity for creating Syrian folk music that often included Arabic poetry in its lyrics, revitalising traditional Arabic music genres such as Qudud Halabiya and Muwashshah. The National and Sky News are also out with obituaries.

In his memory, here are some of our favorite songs by Fakhri: Fouk El Nakhl | Qaddok El Meyas | Ebaatly Gawab | Ya Mal El Sham

|

FOR TOMORROW-

It’s PMI: November’s purchasing managers’ indexes for Egypt, Saudi Arabia and the UAE will land tomorrow. Last month’s PMI reading hit a four-month low as the private sector continued to contract, with weaker customer demand driving down new orders and output. On the upside, firms reported a record level of confidence in upcoming business activity, while employment rose for the third consecutive month.

Other key news triggers in November:

- Foreign reserves: October’s foreign reserves figures will be out sometime this week;

- Inflation: Inflation figures for October will be released next Wednesday, 10 November;

- There’s no MPC meeting this month — the central bank will next meet on 16 December to review interest rates for the final time this year. The CBE has yet to issue its MPC calendar for 2022.

The Africa Early Stage Investors Summit kicks off tomorrow, starting with an investors meetup, sponsored by the Cairo Angels, at Consoleya in downtown Cairo. The summit will continue on Thursday and Friday with virtual sessions featuring speakers from angel networks, VC funds, accelerators, and the public sector, among others.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

☀️ TOMORROW’S WEATHER- The mercury will inch back up again to 31°C during the afternoon tomorrow before falling to 19°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

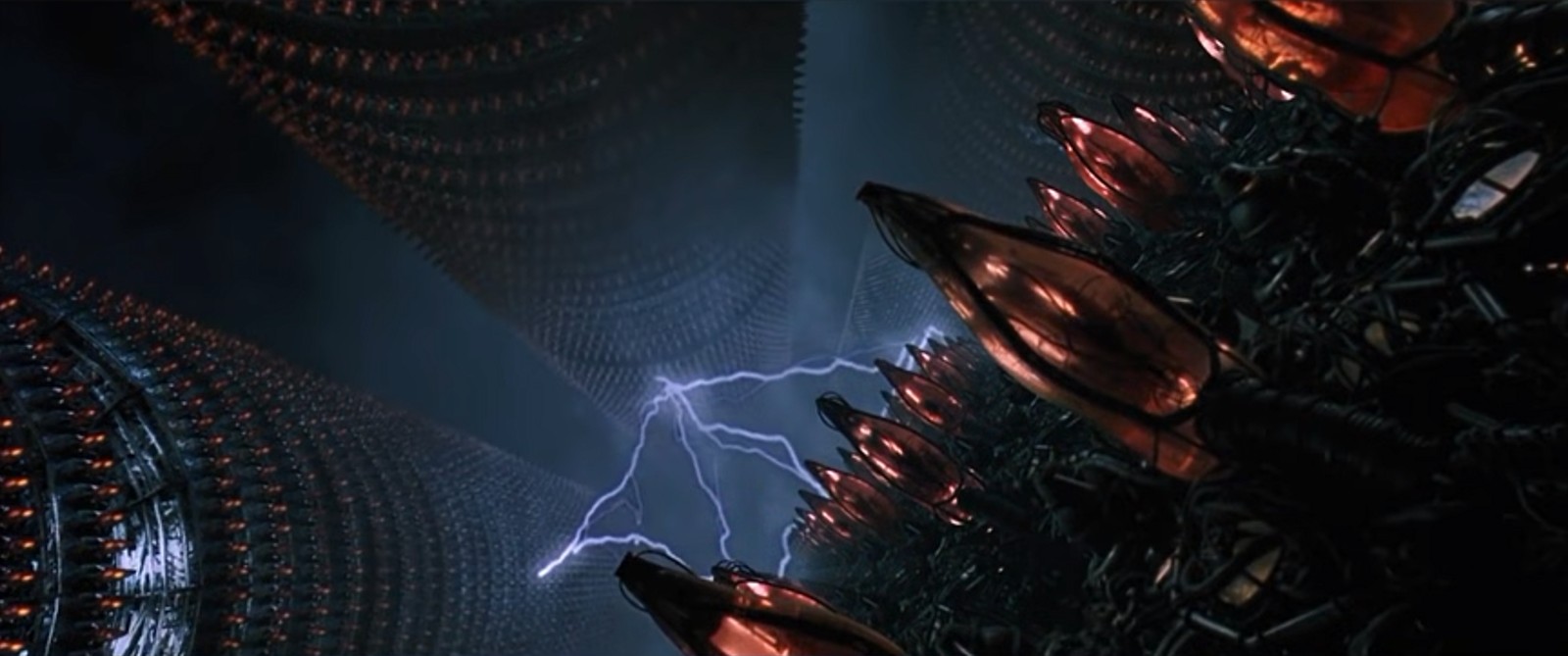

Get used to hearing a lot more Matrix…sorry…metaverse talk: Facebook’s Matrix, sorry, Meta’s big venture in the “embodied internet” is spurring other companies to follow suit. Now the world’s largest chipmaker, Nvidia, is also staking its claim on virtual territory: “You might not think you’ll be in the metaverse, but I promise in the next five years all of us will be in one way or another,” company exec Richard Kerris told Bloomberg.

Nvidia has a vested interest in all things virtual: A widely used and fully realistic digital world will require more AI with greater processing power. Nvidia seems to be positioning itself to become the main provider of metaverse-related processors, expanding out of its existing video-game-chip market. The company’s bid to acquire competitor Arm from SoftBank would bring it the semiconductor tech that powers the sensors and cameras in most of our smartphones, which also happen to be crucial components in the VR hardware that we’ll apparently all be plugging ourselves into daily, five years down the road. Nvidia is also pushing its Omniverse software, which, like Meta’s Horizon Worlds, hopes to become the ubiquitous operating system for the metaverse.

The what-averse? If this is a reality you’re not yet acquainted with, find our recent explainer on the topic here.

Could saving the planet mean we all work a little less? For rich countries, a four day work week could be exactly what puts us on track to peeling back our carbon emissions and making the planet a little less hostile to human life, Simon Kuper writes for the Financial Times. If every additional hour of time spent working contributes to more carbon released into the atmosphere — in the form of commuter emissions and consumption — then rich countries “need to get poorer” if they really want to halt climate change, Kuper argues. Consumption currently accounts for about 60% of global emissions according to research from the Norwegian University of Science and Technology. Generally speaking, as nations grow wealthier, their carbon emitting activities grow larger, which makes the promise of continued GDP growth untenable for our warming planet.

The argument for a shorter workweek also rests on the case for improving personal well-being: A mere 1 in five full-time workers feel “engaged” at work, according to a global study by Gallop. The ideal work week for maintaining well-being comes out — shockingly — to a mere eight hours a week, according to a Cambridge University study polling some 70k UK workers. But a four day work week might not work for everyone, and lower income workers couldn’t afford to take that kind of hit to their incomes. But then again, research has shown that better rested workers with more downtime are often even more productive than when working a traditional 9-5.

Siri, call 911: Apple is reportedly rolling out a new feature on iPhones and Apple Watches that will make them capable of detecting automobile collisions and automatically contacting emergency responders, sources told the Wall Street Journal. The new safety feature would rely on motion sensors that are able to detect sudden increases in gravity forces that take place in the event of a crash, but the company has yet to confirm if it will actually be utilizing the technology in the coming generation of devices next year.

???? ENTERPRISE RECOMMENDS

Ready to read a novel set in the pandemic? + Taco Tuesday at Bonita

???? ON THE TUBE TONIGHT-

(all times CLT)

Zack Snyder is back for more with the Netflix original film Army of Thieves: Acting as a prequel to Army of the Dead, the cheeky heist movie follows Gwendoline, who puts together a crew to rob three major safes across Europe. In typical fashion, the crew consists of a number of misfits who clash heads, but manage to pull off some serious heisting in the action-packed feature. The colorful cinematography and the cast are what really makes this film a success, with the film currently trending in the top position in Egypt as well as the US.

⚽ The fourth matchday of the European Champions League’s round of 32 begins today, with Malmö set to face Chelsea while Wolfsburg plays against Salzburg, both at 7:45pm. Meanwhile six matches will take place at 10pm: Dynamo Kiev vs. Barcelona, Atlanta vs. Manchester United, Bayern Munich vs. Benfica, Villarreal vs. Young Boys, Seville vs. Lille, and Juventus vs. Saint Petersburg.

???? EAT THIS TONIGHT-

Who can resist a taco? Bonita Taquero in New Cairo’s O1 Mall is a fusion Mexican food truck that brings international flavors to tacos and burritos. Their taco selection has fillings ranging from brisket, BBQ chicken strips, and tenderloin steak to smoked salmon and buttermilk fried sea bass. Their burritos are equally gratifying, with our favorite being the classic grilled chicken breast. They’ve also got Mexican essentials such as nachos, quesadillas, and chicken and shrimp fajitas. The real kicker: don’t leave without getting a helping of their warm churros or milky tres leches cake. Bonita has a Taco Tuesday offer every week where you can fill up on tacos to your heart’s content.

???? OUT AND ABOUT-

(all times CLT)

The world finals of the Red Bull Car Park Drift are taking place in Egypt on Friday. The racing event will be held at Al Manara International Conference Center from 12-5pm.

???? UNDER THE LAMPLIGHT-

What happens in the pandemic, stays in the pandemic: If you’re looking for a fun novel that resonates with the times, look no further than Gary Shteyngart’s Our Country Friends. Delivered with Shteyngart’s signature tongue-in-cheek style, it tells the story of a group of friends who agree to ride out the pandemic together in an upstate New York country house, but don’t initially realize what being cooped up together for so long will really entail. What starts out as an exciting gathering turns into six months of lockdown, allowing for new romances and friendships to emerge, and old grudges to take on a dangerous new life. Shteyngart opted out of an all-white set of characters and the cultural and age diversity of the characters allows the author to portray a range of experiences during the pandemic.

???? GO WITH THE FLOW

Meet our analyst of the week: Sigma’s Hani Amer

OUR ANALYST OF THE WEEK- Hani Amer, senior manager at Sigma Capital’s research department (Linkedin).

My name is Hani Amer and I’m a senior manager at Sigma Capital’s research department. I monitor the analysts who cover fast-moving consumer goods (FMCGs), fertilizers, petrochemicals, and healthcare. I started my career at MubasherTrade as an equity analyst and I worked with my mentor Amr Elalfy for much of my eight-year tenure there. I started off covering the banking sector, then also took on the NBFS industry. It was a huge learning experience, especially since this is where I learned how to cover companies for the research unit. I then moved to buy-side research at Concord International Investments where I covered the FMCG sector before becoming the vice president of research before moving to Sigma. I was lucky to have a number of good mentors I still look up to, including Mubasher’s Nader Arafa and Concord’s Salma Taha.

The best part of my job is the excitement of the market. It’s very dynamic and we see the impact of big events right away. In my day-to-day duties I really enjoy finding interesting stories in the companies we cover, and coming up with trading ideas that are unique.

The worst part of my job is the uncertainty. Selloffs in the market aren’t always caused by local events, but global crises, such as an increase in oil prices, are reflected as well. It can be difficult to feel that things are out of your hands. That isn’t to say that there isn’t anything happening in Egypt that’s causing a selloff, I think the potential implementation of the capital gains tax has really had an impact on trading.

My theory of investment is to really understand and believe in what you’re investing in. That means constantly staying updating with market and sector trends and how the company fits into them. But you shouldn’t stick to just one company or sector, it’s very important to diversify your portfolio, and there are a number of them that look very attractive in the coming period.

Healthcare seems like it could get my vote as a result of the universal healthcare system, while technology is very up and coming as the government pushes for financial inclusion. Other than that, the F&B is always a good defensive sector as people will always consume their products, and I’m also banking on the banking and education sectors in the coming period.

The most important factor I look at before I recommend a stock is the firm’s management. I assess their credibility by looking at their past targets and what actually materialized. It shows experience and knowledge to set ambitious, but reasonable expectations. Other than that, the sector itself has to have potential, and a story, so that the firm can use it to its advantage.

There are too many gray areas at the moment to forecast whether the EGX30 will close in the green this year. I mean, of course I hope it does [laughs], but the uncertainty in markets globally is also a reality here in Egypt. The EGX30 has been seeing a lot of fluctuations in the past period, and I think that’s a result of many things being up in the air, such as the GERD crisis that is still not resolved.

I don’t think 2022 will be the year for Egypt. There are still a lot of steps to take before we get to that point. Maybe 2023 could be that year, once everything that is still uncertain becomes determined.

The last great thing I watched was El Ens W El Nems starring Mohamed Henedy. I saw it in the cinema with the family and Henedy always makes me laugh to be honest.

I don’t really read outside of my job. I always have the newest CFA books on hand though. It keeps me updated with new techniques and helps me with my work.

In my downtime, I usually spend it with my family. We like to go to the sporting club or the mall. But freetime for myself… that doesn’t happen often thanks to the kids [laughs].

Obour Land’s net income grew 12% y-o-y in 3Q2021 reaching EGP 111.2 mn, according to a company earnings release (pdf). 3Q2021 revenues grew some 3% y-o-y reaching EGP 820 mn, up from EGP 795.5 mn over the same period in the previous year despite “a tough third quarter in terms of sales and cost of sales,” according to Obour Land Vice Chairman Ashraf Hamed Sherif. 9M2021 net income was also up 7% y-o-y totalling EGP 255.2 mn.

Emaar Misr reports ballooning net income in 3Q2021 to EGP 1.5 bn, up from EGP 526.6 mn in 3Q2020, according to a company earnings release (pdf). Company revenues reached EGP 3.8 bn in 3Q2021, up from EGP 1.4 bn in 3Q2020. Net income during 9M2021 reached a total EGP 2.8 bn for the real estate developer, compared to the EGP 1.2 bn recorded over the same period the previous year, while revenues from the first 9 months of 2021 reached EGP 7.6 bn, up from EGP 2.4 bn in 9M2020.

MARKET ROUNDUP-

The EGX30 rose 0.9% at today’s close on turnover of EGP 1.39 bn (9.2% below the 90-day average). Local investors were net sellers. The index is up 7.7% YTD.

In the green: GB Auto (+9.0%), Palm Hills Development (+3.5%) and TMG Holding (+3.1%).

In the red: Ibnsina Pharma (-2.8%), Egypt Kuwait Holding-EGP (-2.3%) and Abou Kir Fertilizers (-2.2%).

???? CALENDAR

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.