- Nafeza customs system registration deadline delayed until October. (Speed Round: Infrastructure)

- The Ever Given’s owners may have struck an agreement (in principle) with the SCA. (Speed Round: Suez Canal)

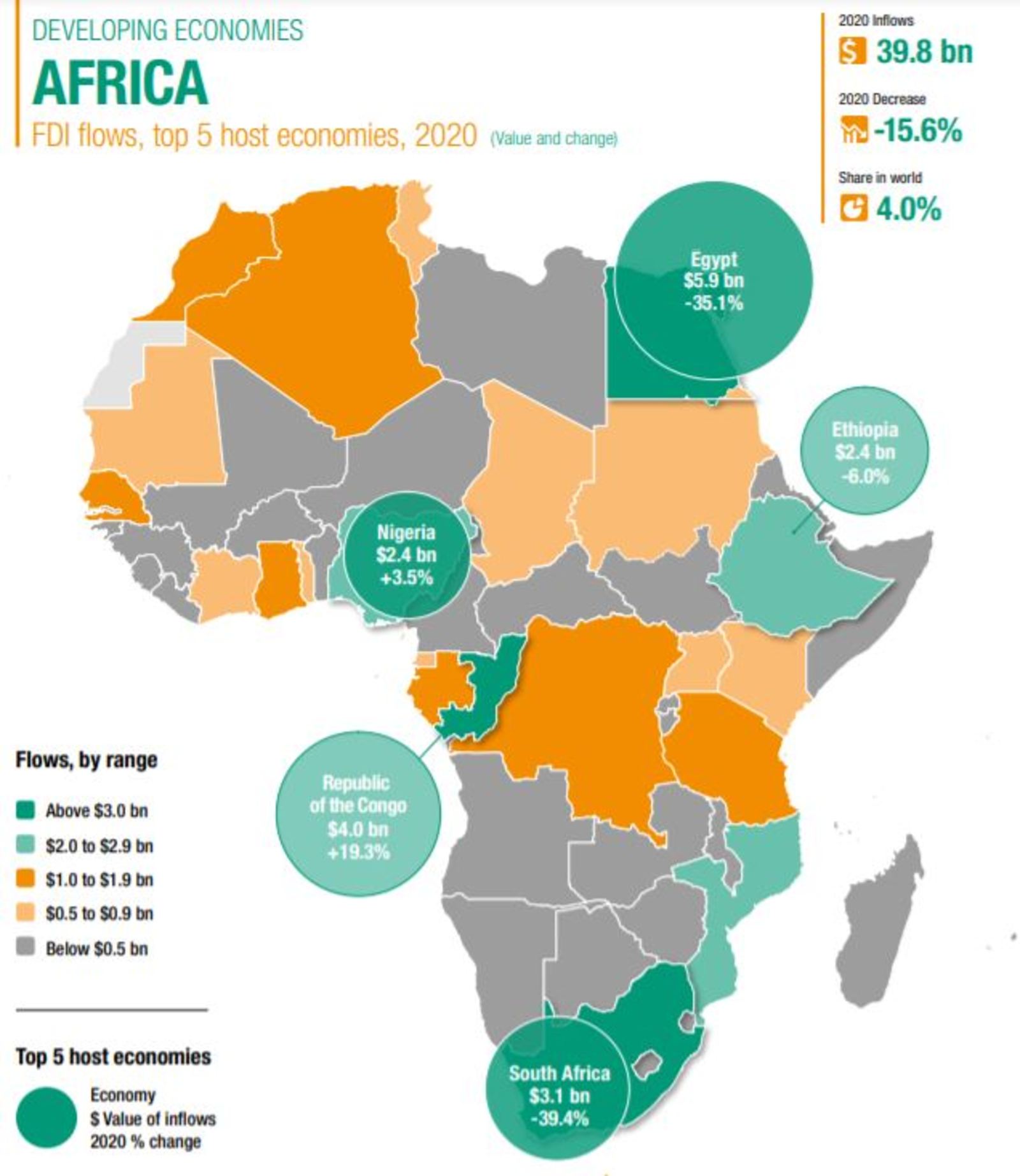

- Egypt is still Africa’s FDI darling. (Speed Round: Economy)

- Is a new Alzheimer’s drug a groundbreaking treatment — or the FDA’s biggest mistake? (Pharma)

- AI can give market researchers a peek into your deeper psyche. (Science & Tech)

- Foreign firms may manage the national rail system if negligence continues- El Wazir. (What We’re Tracking Tonight)

- It’s day two of the CIB PSA World Tour Squash Finals 2020-2021. (What We’re Tracking Tonight)

- TONIGHT’S EURO GAMES: Sweden v. Poland, Slovakia v. Spain, France v. Portugal, Germany v. Hungary. (On The Tube Tonight)

Wednesday, 23 June 2021

Nafeza customs system delayed until October

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, everyone, and welcome to another brisk newsday.

THE BIG STORY TODAY- The Madbouly government has postponed the launch of one-stop customs portal Nafeza until October. Importers, shippers and other companies had previously faced a 1 July deadline to become compliant.

HAPPENING NOW- The Suez Canal Authority and the owners of the container ship Ever Given may have reached a settlement agreement, according to an unconfirmed report in the domestic press. We have more in this afternoon’s Speed Round, below.

ALSO- The government may hire foreign firms to manage the national rail system if “laziness and negligence” continue, Transport Minister Kamel El Wazir said in a statement this afternoon, following two consecutive train crashes over as many days reignited debate on the state of Egypt’s ailing rail network. Bloomberg also has the story.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Sudan has called on the UN Security Council to hold an urgent session to discuss the Grand Ethiopian Renaissance Dam and push for a quick resolution before Ethiopia resumes unilaterally filling the dam next month.

- We’re really going to need those locally produced covid jabs: Egypt and six other countries have used 80% of the shots sent by Covax.

- Don’t expect fuel prices to rise next month: The former oil minister says it’s unlikely the government’s pricing committee will make us all pay more at the pumps.

THE BIG STORY ABROAD? There are two of them, actually:

- From Europe to the US of A, developed economies are worrying about the spectre of rising inflation. Fed boss Jay Powell is taking great pains to reassure us all that 1970s / early 1980s-style inflation in the 10% bracket is unlikely.

- Russia literally fired warning shots at a British navy destroyer that Moscow claimed encroached on its waters in the Black Sea. The story leads the front pages of Reuters and Bloomberg.

SIGN OF THE TIMES- Canada’s 3iQ Corp today listed its BTC Fund on Nasdaq Dubai, saying it is the MENA’s first digital asset-based fund, according to a press release. The listing of the fund from Canada’s largest digital asset manager will offer investors indirect exposure to the cryptocurrency. The fund was also listed in Toronto last year and the dual-listing allows investors to transfer their units from the Toronto Stock Exchange to Nasdaq Dubai and vice versa. The fund invests in long-term BTC holdings as what it claims are a safer alternative to investing in crypto, according to its prospectus.

The news comes as BTC continued to rebound this morning from its year-to-date low, climbing above USD 34k earlier today. Ether is also gaining steam this afternoon.

|

YOUR STATUTORILY REQUIRED COVID STORY- UK eyes eased travel restrictions for double-jabbed Britons this summer: The UK government is considering plans to allow UK travellers fully vaccinated against covid-19 to travel to over 150 of the amber list countries and skip quarantine on arrival back home, Bloomberg reports. The change isn’t likely to come into effect until August.

Is this good news for Egypt? Not yet. Egypt is among those listed on the “red list” and visitors here would still need to quarantine on the way home as the proposal currently stands.

???? CIRCLE YOUR CALENDAR-

It’s day two of the CIB PSA World Tour Squash Finals 2020-2021 at Mall of Arabia. Yesterday’s games saw top seed Nour El Sherbini lose to France’s Camille Serme, while world no.2 Nouran Gohar overcame fellow Egyptian Salma Hany. In the men’s, the ElShorbagy brothers, Marwan and Mohamed, both came out on top, beating world no.1 Ali Farag and World Junior Champion Mostafa Asal.

Up today: In the men’s draw, world no.1 Ali Farag plays fifth-seed Mohamed El Shorbagy and last year’s victor Marwan El Shorbagy faces Mostafa Asal. In the women’s, world no.1 Nour El Sherbini will play Salma Hany while Nouran Gohar plays France’s Camille Serme. The tournament runs until 27 June. Tickets are currently on sale for the final two days on TicketsMarche.

The Clean Energy Business Council (CEBC) MENA are holding a webinar titled Energy Efficiency in the MENA region: Status and Outlook on 6 July at 3:30pm. The session will focus on energy efficiency developments and provide recommendations for businesses and policymakers. Later on next month, CEBC will also host the webinar Women Entrepreneurs in Clean Energy on 21 July at 3pm in cooperation with the initiative, Women in Clean Energy MENA and WiRE.

The British Egyptian Business Association (BEBA) is organizing a virtual education week from 5-6 July with three seminars planned. The first, taking place at 10am on 5 July, will discuss skills-based learning while the future of investment in education will be the topic on the table at 12:30pm the same day. On 6 July, a talk on the digitalization of education in Egypt will be held at 12pm.

???? FOR YOUR COMMUTE-

Microsoft joined the USD 2 tn market cap club during trading yesterday thanks to pandemic-fuelled demand on computers, gaming systems and cloud computing platforms, according to CNN Business. Microsoft's stock has gained 64% since March 2020. Microsoft joins a club that includes Apple and Saudi Aramco — and we could see Amazon and Alphabet’s Google follow soon: each has a market cap of about USD 1.7 tn right now.

Speaking of Big Tech: Firms are scrambling to sign green energy agreements with global providers, writes the Wall Street Journal. As ESG considerations factor more into business and investment decisions, tech firms are trying to reduce emissions coming from their massive energy use in power-hungry data centers and the like. Amazon, Google, Facebook, and Microsoft are four of the top six corporate buyers of publicly disclosed renewable-energy- purchase agreements, accounting for 30% of the global total. The dilemma that currently stands is whether these new agreements replace existing polluting energy production or just increase the capacity of overall power generation.

???? ON THE TUBE TONIGHT-

Fatherhood is the latest Netflix Original film and stars comedian Kevin Hart in the lead role. When his wife dies shortly after child birth, Hart’s character must come to terms with the fact that he is now a single father … a role he was less than prepared for. Raising a daughter on his own is no easy feat and Hart has always been great at being aggravated. Like many single-parent films before it, you can expect the typical storylines of bodily fluids suddenly flying around, losing the kid, sleepless nights, custody battles, etc. What makes Fatherhood a bit more interesting is the fact that it’s based on a true story, encompassing the tale of Matthew Logelin who had first presented his experience as a single father on his blog, writes Time Magazine.

⚽ Group E and Group F are up tonight in Euro 2020: Group E matches kick off at 6pm, with group leader Sweden playing against Poland, currently in the group’s last place. Meanwhile, Slovakia will go up against Spain, with both teams relatively neck-in-neck. At 9pm, the group of death will be hitting the field and see France go up against Portugal and Germany play Hungary. France is currently leading the group with four points, while Germany and Portugal both have three and Hungary has one.

Last night’s fixtures: Croatia took the lead against Scotland with a 3-1 victory and England beat the Czech Republic 1-0.

???? OUT AND ABOUT-

Rock bands Retrograde and The Cadillacs are performing at Cairo Jazz Club in Agouza tomorrow at 9pm.

Hilton Cairo Heliopolis is holding their Spread of Wellness Festival on Friday from 10am.

???? UNDER THE LAMPLIGHT-

If you’ve been keeping up to date with the real-life legal drama that is the Carlos Ghosn case, you’ll want to check out this book: The former Nissan CEO spent decades trying to build a new model for the automotive industry through the colossal partnership between Nissan and Renault, but the business plan was always disrupted by culture clashes, internal fighting between executives and engineers, and government interference. Hans Greimel and William Sposato explore the entire ordeal in Collision Course: Carlos Ghosn and the culture wars that upended an auto empire by talking to key players including Ghosn himself. Readers will get a comprehensive picture of the entire saga, from Ghosn’s entry into the position, his initiatives over the years, to his great escape to Lebanon — all of which has come to be known as the “Ghosn Shock” in Japan.

☀️ TOMORROW’S WEATHER- Welcome, heatwave. Tomorrow will see the mercury rise to 40°C, while the next few days will have daytime highs between 39°C and 42°C, our favorite weather app tells us.

SPEED ROUND: INFRASTRUCTURE

Nafeza customs system delayed until October

FinMin delays Nafeza deadline till October: Importers, multinationals, and foreign companies selling goods to Egypt through seaports now have until the last day of September to sign up for the Customs Authority’s new one-stop platform, Nafeza. The Finance Ministry pushed next week’s 1 July deadline in response to calls from business groups, according to a ministry statement. The digital platform — which will require shippers to begin using a global best practice system known as the Advance Cargo Information (ACI) pre-registration system — will now officially come online on 1 October.

Anyone who isn’t registered when the deadline rolls around won’t be allowed to release imported goods out of customs at seaports, the statement read. Authorities have been piloting the new system since April and had originally planned to make it compulsory at all seaports in July, before making it mandatory at other ports of entry at a later stage.

The delay aims to allow stakeholders more time to prepare for the new system, the statement read, after local and foreign players made specific requests to Finance Minister Mohamed Maait to delay its rollout.

The business community is okay with Nafeza, but needs more time to adapt: Calls to delay the system boil down to the speed of the transition, the head of the Alexandria Chamber of Shipping, Mohamed Moselhy, told us. Moselhy, who is in favor of the new digital system, said businesses need more time to get used to it. Calls for a delay were nearly unanimous within the business community, with all parties including importers, clearance agents, and foreign companies all requesting a delay, said Khaled Nassif, a technology advisor to the Egyptian Company for E-commerce Technology (MTS), a majority state-owned company that is in charge of getting the new system up and running.

Where we are so far: Nafeza now has nearly 7.7k activated accounts and some 2.2k that are yet to complete their registration, Maait said in the statement. Around 1.5k are currently part of the ongoing pilot phase of the system and have already started using the ACI.

Nafeza is being rolled out in a bid to speed up customs procedures, improve border security and eliminate room to cheat on customs and taxes: Through Nafeza, businesses importing goods at ports will file shipping documents and cargo data digitally and ahead of arrival via the ACI, which is a World Customs Organization (WCO) protocol that runs on blockchain technology. The collected data sets are used to identify high-risk or dangerous cargo prior to loading.

Want a breakdown of all you need to know on how to prepare for the new ACI system? We had an in-depth explainer earlier this month.

IN OTHER INFRASTRUCTURE NEWS- Hyundai Rotem will upgrade the 118 km Naga Hammadi-Luxor line’s communication and signalling system, under an agreement with the National Railway Authority worth USD 110 mn, according to a statement.

SPEED ROUND: SUEZ CANAL

Ever Given resolution in the foreseeable future?

Lawyers representing the Ever Given’s owner and ins. company have reached an agreement in principle with the Suez Canal Authority (SCA) over compensation claims, Al Masry Al Youm reports. The ship’s ins. provider, UK P&I Club, said earlier this month that it was engaged in “serious and constructive negotiations” with the SCA, and hoped a resolution was on the horizon, while the SCA said earlier this week that it had received a “suitable” compensation offer from Shoei Kisen, the owners of the Ever Given, for the six-day blockage of the canal in March. The SCA did not disclose a figure at the time.

An imminent release of the ship and its crew? The mega vessel will be released from Egypt as soon as official procedures are complete, the lawyer added. The ship, as well as its 18k containers and 26 member crew had been held in the Great Bitter Lake pending negotiations since March, with a small number of crew members whose contracts had expired being allowed to disembark in April.

What’s the latest offer on the table? The SCA has earlier slashed its demands to USD 550 mn from USD 916 mn, but the ins. companies were reportedly only willing to only pay out USD 150 mn.

We’re awaiting a potential ruling on the compensation case on 4 July: The Ismailia Economic Court had postponed its hearing to early next month based on the request of representatives of both sides, who wanted more time to reach a settlement agreement.

SPEED ROUND: ECONOMY

Egypt is still Africa’s FDI darling

Egypt was the top recipient of foreign direct investment (FDI) in Africa in 2020, attracting USD 5.9 bn in inflows during the year, according to UNCTAD’s 2021 World Investment Report. This corresponds to net FDI of USD 5.5 bn as outflows stood at USD 327 mn during the year, the UN’s trade and investment body said. The figure is an upward revision from the USD 5.5 bn estimated by UNCTAD in a report last January.

Egypt is a regional powerhouse when it comes to FDI: Inflows into the country were well over half of the USD 10.1 bn of North Africa, and accounted for 15% of a total of USD 39.8 bn coming into the entire continent.

But covid still bit: Net FDI into Egypt dropped on an annual basis more significantly than the regional average. The figure dropped 35.1% y-o-y — almost double the 16% decrease in Africa and more than the 25% average fall in North African economies. Still, the drop was on par with the global average, which saw FDI plunge thanks to the pandemic.

Where we got some brownie points: FDI into Egypt is still primarily concentrated in the energy and natural resources sectors, whether this involves development work at the supergiant Zohr natural gas field or other oil and gas projects. This could change as Egypt prioritizes diversification, the report says, citing recent progress on activating the long-dormant USD 16 bn Saudi-Egypt investment fund.

Where we took a hit: Across Africa, new greenfield project announcements particularly suffered, falling 62% throughout the year. The only greenfield project in Egypt that got a mention in the report was Chinese smartphone Realme recently setting up shop with a USD 210 mn regional distribution and after-sales service facility in Cairo that will act as a hub in Africa.

Globally, FDI fell by 35% in 2020 as inflows were “severely hit” by the covid-19 pandemic. Inflows dropped to USD 1 tn, down from USD 1.5 tn and to their lowest level since 2005. The poor FDI performance was primarily during 1H2020 when the pandemic was at its peak, with cross border M&As and finance agreement mostly recovering during the second half of the year.

Emerging markets fared a little better, but still suffered from a lack of greenfield investment: FDI into EM fell only 8% in 2020, compared to a whopping 58% across their developed counterparts. This was primarily due to Asia holding firm in the face of the FDI collapse. This gave emerging markets a larger share of global FDI as they now account for two thirds of overall inflows, up from under 50% in 2019. However, greenfield activity fell sharply in the developing world, with new project announcements dropping 42%, compared to 19% in developed countries. The number of new financing agreements was also down in developing countries by 14%, more than the 8% drop in advanced economies.

READ THE FULL REPORT: Tap / click here for the landing page or download it directly here (pdf).

GO WITH THE FLOW

Mining outfit ASCOM losses widen in 1Q2021

EARNINGS WATCH- Qalaa Holdings’ mining subsidiary ASCOM posted wider losses in 1Q2021 than it did a year ago, with EGP 30 mn in red ink on its bottom line against EGP 23.2 mn in the same period a year ago, according to its consolidated financials (pdf). Net financing costs jumped to EGP EGP 35.9 mn in 1Q2021, compared to EGP 23.7 mn in 1Q2020.

IN MARKET NEWS- National Printing wants 100% of Shorouk Modern Printing: National Printing Company plans to submit a mandatory tender offer (MTO) for 100% of Shorouk Modern Printing & Packaging at EGP 52-54 per share, according to an EGX filing (pdf). National Printing has assigned an independent financial advisor to assess the fair value of Shorouk Modern Printing’s shares ahead of submitting the potential MTO. National Printing is already an 89.9% shareholder of Shorouk.

The EGX30 rose 0.7% at today’s close on turnover of EGP 1.63 bn (22.5% above the 90-day average). Foreign investors were net sellers. The index is down 5.3% YTD.

In the green: AMOC (+4.3%), Ezz Steel (+3.3%) and Abou Kir Fertilizers (+3.0%).

In the red: Orascom Investment Holding (-3.4%), MM Group (-1.9%) and Medinet Nasr Holding (-1.4%).

PHARMA

Is new Alzheimer’s drug a groundbreaking treatment, or the FDA’s biggest mistake?

When the first new Alzheimer’s drug in 20 years was approved by the FDA earlier this month, many expected the celebration of this small victory against a devastating disease. Instead, a string of resignations followed from members of the committee who had reviewed and evaluated the safety and effectiveness of the drug. They protested that the new medicine — aducanumab, known by the shelf name Aduhelm — was both unsafe, and had shown no real efficacy against the cognitive dementia caused by the disease.

So what exactly is this new drug? Researchers believe that aducanumab attacks the amyloid-protein plaques that impair the cognitive function of the brain. High doses of the drug seemed to be effective at slowing cognitive decline for early-stage patients, though further study was recommended.

Did the trials at least have promising results? Absolutely not. During the clinical trials, about 42% of patients experienced brain swelling or bleeding after the first dose. The prohibitive cost of the drug, a whopping USD 56k a year, has also sparked outrage.

What do the experts say? The Peripheral and Central Nervous System Drugs Advisory Committee had advised against approving the drug after finding no sufficient evidence that it could actually impede the cognitive decline of dementia, according to The New Yorker. Ten committee members voted no, one voted uncertain, while another abstained. With not a single vote in favor of the medicine from a committee of experts, why did the FDA approve it anyways?

The prevalence of the disease may have something to do with it: Alzheimer's is ranked as the sixth leading cause of death in the US, and is the primary cause of dementia, which affects an estimated 50 mn people worldwide, according to World Health Organization estimates. The quest for an Alzheimer’s treatment has been high on medical researchers’ agendas for decades, with the first treatment for the disease trialled in 1987 and bns of dollars pumped into global research since. The global societal cost of dementia in 2015 was estimated at USD 818 bn, equivalent to 1.1% of global GDP.

Desperate for a solution, the FDA seems to have ignored conventional wisdom: Aducanumab was approved using the authority’s “Accelerated Approval Pathway,” which OKs drugs that fill unmet medical needs based on indications — not guarantees — that they are likely to have clinical benefits.

The FDA’s perspective: In a statement, the FDA said it anticipated “an expectation of clinical benefit,” from the drug’s approval, and that it believed that “the benefits [of aducanumab] for patients with Alzheimer's disease outweighed the risks of the therapy.” The FDA also said it would require the manufacturer Biogen to conduct further clinical trials to verify the drug’s safety and efficacy, and could remove it from the market if it proves ineffective.

Besides, some say they have found the medicine helpful: A 68-year-old patient who was part of the trials said that the drug helped him feel less confused, with his family also noticing improvement, according to the BBC. Meanwhile, the first Alzheimer’s patient outside a trial context received the first dose of the intravenous drug last week.

Our take: It’s likely too early to tell, but the FDA seems to have jumped the gun on this one, potentially putting the public at risk. Still, no treatment comes without its risks and side-effects, and the possibility that this medicine may make life a little more bearable for Alzheimer’s sufferers and their loved ones likely informed the FDA’s decision.

SCIENCE AND TECH

AI can give market researchers a peek into your deeper psyche

Market researchers know you more than you know yourself: Market research has changed drastically from the days of people knocking on doors with a clipboard asking for a few minutes of your time. Today, market research can tap into our every move on the internet: From what we search, what we click on, what we buy, to how long we stay on each site. With no mortal capable of making sense of all this data, technology has come to the rescue, offering artificial intelligence (AI) and data processing to interpret human behavior, better than humans themselves can.

People don’t always know why they’re attracted to things, but AI does: Companies such as Colourtext track patterns among internet users to determine how things or people are truly perceived, writes the BBC, helping them break down or defy traditional categories that the market research industry uses to define our taste. For example, by analyzing the readership of major UK news sites, they found that Boris Johnson was perceived as more of a celebrity than a politician (sorry Boris).

Even your face is a potential data trove: The advent of software that analyzes facial expressions has added even more to market researchers’ toolkits, enabling the detection of subconscious feelings alongside spoken answers. Even if someone says they don’t like a rom-com (because it’s embarrassing), the AI will be able to detect the authenticity of their statement based on facial cues. The software can even take into account the age, gender, and race of the person it’s analyzing to give an accurate study of what they’re feeling.

How does it work? When the US fast food restaurant chain Del Taco changed its decor and menu and wanted to get a sense of the customer’s opinion, they tapped US analytics software house Medallia to use this kind of technology. Medallia’s team stepped in with a survey app and asked restaurant goers to answer questions via video on their smartphones. The data from the videos were all streamed into the cloud for analysis and used to expose underlying emotions about the food they were eating by looking at their language, tone of voice, and facial expressions as they spoke. The technique gives a “much richer view than a traditional survey,” believes Carl Wong, an industry insider.

Traditionally, people may not have answered surveys very truthfully: “Talking to a camera is a very effective tool, but what people say is often miles apart from what they feel, there are so many unconscious factors at play,” Jon Puleston, who analyses online material for consumer research giant Kantar, told the BBC. AI can help researchers bypass embarrassment, reluctance, or unconscious biases that may affect how a participant responds to survey questions, by revealing more about what they think from their facial expressions.

Video surveys are just the tip of the iceberg: Social media analysis, sentiment analysis, consumer engagement monitoring, heat mapping, and quick polls, are just some of the tools now leveraged by researchers. With all these options available, companies are opting for ultra-specific analyses to answer precarious business questions as quickly as possible, according to an op-ed in Marketing Interactive. And with covid-19 causing rapid changes to consumer habits, marketeers now require more agile research methods to keep up with the sudden changes in business environments.

But human intelligence isn’t completely irrelevant just yet: Qualtrics echoes the need for agility, but maintains that a blended approach to analyzing information that utilizes human intelligence and creativity is the most effective method of creating and communicating ideas in a compelling way.

CALENDAR

22-27 June (Tuesday-Sunday): The CIB PSA World Tour Finals for 2020-2021 will take place in Cairo.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26 June (Saturday): International Cooperation Ministry and Egypt Ventures’ Generation Next entrepreneurship conference, Cairo, Egypt

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt. The Big 5 Egypt Impact Awards will also be taking place at the event on 27 June.

30 June (Wednesday): The IMF will complete a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: The Cairo International Book Fair, Egypt International Exhibition Center.

July + August: Thanaweya Amma exams take place.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

1 July (Thursday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 July (Thursday): Deadline for 17 EGX-listed companies to file their 1Q2021 earnings.

1-10 July (Thursday-Saturday): The government’s fuel pricing committee will meet to announce 3Q prices.

4 July (Sunday): Ismailia Economic Court to hold hearing on Ever Given compensation case.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday).

23 July (Friday): Revolution Day (national holiday).

2-4 August (Monday-Wednesday): Egypt is hosting the Africa Food Manufacturing exhibition at the Egypt International Exhibition Center.

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.