- MaxAB acquires Moroccan startup WaystoCap after a USD 15 mn series A top-up. (Speed Round: Startup Watch)

- Credit Suisse seems optimistic on Egypt’s economic recovery but warns of a fourth covid wave. (Speed Round: Economy)

- SODIC’s net income almost tripled in 2Q2021. (Go with the Flow)

- Oil Ministry sets up a new USD 1.6 bn methanol plant. (Speed Round: Energy)

- Rich countries are under pressure to cough up their new SDRs to poorer nations. (What We’re Tracking Tonight)

- Promising results from new J&J vaccine trials are leading the foreign press. (What We’re Tracking Tonight)

- It’s not just Salah: No Premier League players are travelling to “red list” countries for next month’s World Cup qualifiers. (What We’re Tracking Tonight)

Wednesday, 25 August 2021

EnterprisePM — MaxAB acquires Morocco’s WaystoCap after USD 15 mn series A.

TL;DR

WHAT WE’RE TRACKING TONIGHT

It’s a mixed bag this afternoon, ladies and gentlemen, as capital markets guides the conversation locally, while covid is leading headlines globally.

THE BIG STORY TODAY- Score another foreign acquisition for an Egyptian startup: Following last week’s announcement that mass transit startup Swvl acquired Europe-based Shotl, B2B food and grocery startup MaxAB has acquired Moroccan ecommerce and logistics platform WaystoCap for an undisclosed sum. We break down the transaction in detail in the Speed Round below.

** CATCH UP QUICK on the top stories from this morning EnterpriseAM:

- Siemens inks new green hydrogen MoU: Siemens Energy and state-owned Egyptian Electricity Holding Company (EEHC) have signed an MoU to jointly build up the green hydrogen industry in Egypt.

- New SDRs are heading our way: Egypt will receive a foreign currency boost equivalent to c. USD 2.8 bn through the IMF’s new USD 650 bn SDR allocation.

- Nafeza arrives on 1 October, like it or not: The Finance Ministry has no plans to respond to calls from some in the business community to postpone the roll out of the ACI system on 1 October.

THE BIG STORY ABROAD- Apart from Afghanistan, promising results from new J&J vaccine tests topped the conversation in the foreign press. Johnson & Johnson today reported a ninefold increase in antibodies in those who have received a second booster jab, citing interim data from a clinical trial. Trial participants appear to have been administered a second shot six months after receiving their first J&J jab. A study in July found that the single-shot vaccine provides immunity for at least eight months.

Your daily dose of covid news: The origins of the virus remain a mystery even to US spooks. US intelligence agencies have not been able to determine whether covid-19 evolved naturally or was manufactured in a lab in an assessment personally ordered by President Joe Biden, the Wall Street Journal reports. Officials were unable to access lab data held by the Chinese government, and thus weren’t able to come to a firm conclusion on its origins, the paper reports.

It’s not just Salah: The Premier League will not allow any players to compete in upcoming international games taking place in “red list” countries, it said in a statement yesterday. The decision was taken unanimously by Premier League clubs, and will mean that almost 60 players will be unable to represent their countries at the World Cup qualifiers next month. Egypt, Brazil, and Argentina are among the 60 countries currently on the British government’s red list, which features countries where the risk of contracting covid is highest.

|

???? CIRCLE YOUR CALENDAR-

It’s Jackson Hole week: The Federal Reserve Bank of Kansas City’s annual gathering of central bankers and policy makers at Jackson Hole will take place on Friday, 27 August. This is the second year in a row that the gathering will take place online.

The Tokyo 2020 Paralympics will run through 5 September, with Egypt sending a 49-athlete-strong team to the games.

???? FOR YOUR COMMUTE-

Rich countries are under pressure to cough up their new SDRs to poorer nations: International pressure is mounting on developed countries to forego their share of the IMF’s USD 650 bn emergency support package, agreed earlier this year to help countries through the pandemic, the Financial Times reports. Low-income countries received only USD 21 bn of the issuance of special drawing rights (SDRs), while USD 375 bn went to the 40 richest countries. Developing countries got USD 275 bn. International organizations and IMF head Kristalina Georgieva are calling on the richest to redirect their allocations to low-income countries, which the IMF estimates need some USD 450bn to recover from the pandemic. Egypt received SDRs worth USD 2.8 bn, which were disbursed earlier this week.

???? ON THE TUBE TONIGHT-

Starring Jane Fonda and Lily Tomlin, Grace and Frankie try to find solace after they discover that their husbands were romantically involved for over two decades. Delving into themes of divorce, loss, and ageing, this witty sitcom is funny one moment and heart-wrenching the next. The raw and authentic chemistry between the two lead actors is probably due to the history the cast has on a number of projects together such as Newsroom and West Wing to name a few. Despite being in the pipeline for over a year, the show’s production was halted last year due to covid but the first four episodes of the final season premiered last week on Netflix.

⚽ There are a couple of games in the Egyptian Premier League tonight: Ghazl El Mahalla will play against El Mokawloon tonight at 7pm, while Pyramids are away to Misr Lel Makassa at 9pm.

If you haven’t heard already: Zamalek were crowned champions last night after beating Entag El Harby 2-0. This is their first league title since 2014-2015, and finally ends Al Ahly’s spell of dominance which has seen the club win the league for five consecutive seasons.

???? OUT AND ABOUT-

The iconic Wust El Balad will be taking stage tonight at 9pm at Cairo Jazz Club 610. The band will be playing all their top hits that combine traditional Arabic music with a modern and Western twist, from their very first hit Antika to their latest single Talamizna.

???? UNDER THE LAMPLIGHT-

How not to run a company: Written by Wall Street Journal reporters Eliot Brown and Maureen Farrell, The Cult of We: WeWork, Adam Neumann and the Great Startup Delusion follows the downward spiral of a Silicon Valley unicorn, demonstrating that lofty ambitions and grand visions aren’t always enough to make it in the startup game. The bestselling book documents a company’s fall from grace while revealing deeper problems in the US financial system, while laying out the fundamentals of corporate governance, venture capital, and other financial topics.

☀️ TOMORROW’S WEATHER- Expect much the same as today in the capital, with daytime highs of 39°C and nighttime lows of 25°C, our favorite weather app tells us. In Sahel, the mercury will max out at 32°C during the day and fall to 23°C at night.

SPEED ROUND: STARTUP WATCH

MaxAB acquires Moroccan startup WaystoCap

Cairo-based B2B food and grocery startup MaxAB has acquired Moroccan ecommerce and logistics platform WaystoCap for an undisclosed amount, following a fresh USD 15 mn capital injection from its investors, TechCrunch reports. The new investment takes the company’s total series A funding to USD 55 mn, enabling it to expand outside of Egypt for the first time.

Who are the investors? This round of funding was raised from RMBV, International Finance Corporation (IFC), Flourish Ventures, Crystal Stream Capital, Rise Capital, Endeavour Catalyst, Beco Capital and 4DX Ventures. These are the same investors who took part in the company’s funding round earlier this year, which at USD 40 mn is one of the largest series A’s in Africa this year. The platform said back then it would use the proceeds to set up a branch in every key city in Egypt, with an eye to setting up shop in other MENA countries.

WaystoCap is an up-and-coming B2B marketplace + logistics firm: Founded in 2014 and backed by Y Combinator, WaystoCap operates an online B2B marketplace and provides customs and logistics services to businesses trading in Africa. The company has a physical presence in four African countries, as well as the US, the UK and Spain. The company last raised venture capital in 2017, when it landed a USD 3 mn in a seed round from investors including YC.

MaxAB’s acquisition will see over 70k retailers “benefit from its technology, expanded end-to-end supply chain solutions and business intelligence tools as well as WaystoCap’s knowledge and expertise,” the company said. The Egyptian company’s expansion plans coincided with WaystoCap's ambitions to grow its business locally, so both companies agreed to work together through the acquisition, MaxAB co-founder and CEO Belal El Megharbel told TechCrunch.

MaxAB: A refresher. The retail-tech startup, founded by Belal El Megharbel and Mohamed Ben Halim in 2018, connects informal food and grocery retailers with suppliers through an Android app. It provides retailers in underserved areas access to a variety of products, the ability to order stock online, a rapid delivery service, and access to credit. Brands using the platform have access to various tools including real-time demand monitoring, helping them make informed decisions about their purchasing.

SPEED ROUND: ECONOMY

Credit Suisse singing our praises, but warns of a fourth wave

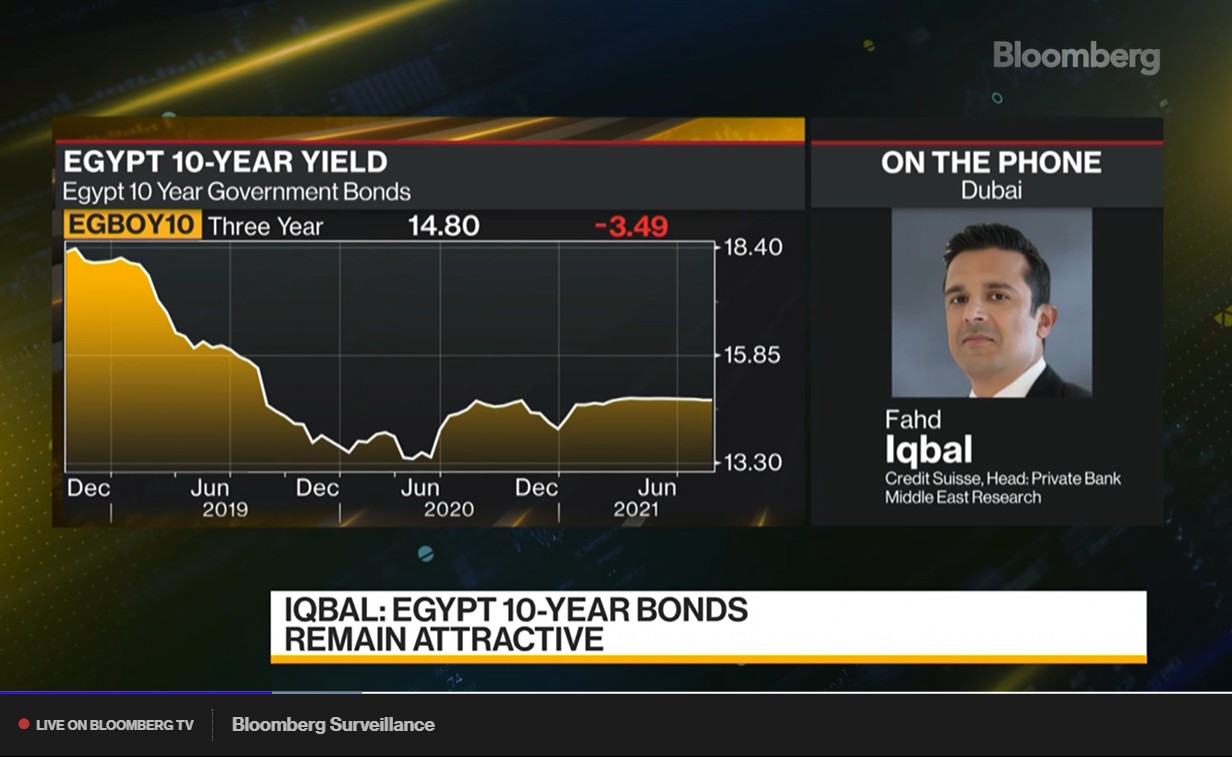

Credit Suisse seems optimistic about our post-covid recovery, as the economy shows signs of real growth, t-bills remaining attractive and muted risks from the Grand Ethiopian Renaissance Dam (GERD) conflict, Fahd Iqbal, Credit Suisse’s head of private bank Middle East research, told Bloomberg’s Middle East: Daybreak show this morning (watch, runtime: 09:06).

Good news for the wider Egyptian economy: Credit Suisse was upbeat on the chances for a strong post-covid recovery, Iqbal said. “It hasn’t just been a base effect. We are actually seeing genuine growth kicking in.” And while that growth has not been observed in the likes of Egypt’s PMI readings, “but we’re confident that it will improve further in each tune,” he noted.

Bonds over shares: Government bonds are still attractive and the T-bill trade should remain comfortable for the rest of the year, he noted. The risk-reward tradeoff is much more attractive in government bonds than in equities, where valuations remain low. “What’s holding equities back is the low liquidity that you have, whereas the T-bill market really simply offers you better liquidity and certainly better payoff,” Iqbal said. Government debt instruments have seen strong inflows from abroad so far this year, with foreign holdings of bills and bonds standing at between USD 28-29 bn at the end of May, little changed from a record high of USD 28.5 bn in mid-February.

Are you just as confused about this as we are? It may not last into next year, as the risk of a government rate hike could impact payoffs in the T-bill trade, Iqbal says. Higher rates attract the carry trade who look for returns on higher bond yields. Egypt’s relatively high real interest rates have largely been responsible for the inflows.

Iqbal downplayed the impact of GERD in growth, saying that while there is a political risk stemming from the GERD, the conflict would likely be resolved.

He DID NOT downplay the risks of a fourth wave: A fourth wave of the coronavirus poses the greatest short-term risk to Egypt’s economy, Iqbal said—especially since the high population density in Cairo makes it difficult to enforce social distancing measures. “Morbidity has been pretty much the highest that you’d find anywhere else in the Middle East as a result, so it’s been a concern for us that you could see another wave coming in through.” Health Minister Hala Zayed this week warned that rising case numbers could herald a fourth wave incoming at the end of September.

SPEED ROUND: ENERGY

Look out Methanex

The Oil Ministry has formed a new state-owned petrochemicals company that will join Methanex in producing methanol in Egypt. A shareholder agreement has been signed establishing Misr Methanol and Petrochemicals, which will manufacture methanol, ammonia, and other petrochemicals, the Oil Ministry announced today in a statement.

Around USD 1.6 bn will be invested in the first phase of Misr Methanol’s plant, the statement said, adding that the project is planned to be established in the SCZone’s Ain Sokhna site. It aims to produce 1 mn tonnes of methanol and 400,000 tons of ammonia annually, a portion of which will be exported.

The new company will be jointly owned by Abu Qir Fertilizers, Helwan Fertilizers, and Al Ahly Capital Holding, where Abu Qir and Helwan will each hold a 35% stake, and Al Ahly Capital will hold the remaining 30% stake.

Two’s company: The new entrant to Egypt’s petrochemicals industry will presumably be competing for market share with Methanex, which for a decade has been Egypt’s only methanol producer. The Vancouver-based Methanex Corporation holds a 50% stake in its Egyptian affiliate, with the remaining shares split between Egyptian Petrochemical Holding Company (ECHEM), Egyptian Natural Gas Holding Company (EGAS), Egyptian National Gas Company (GASCO), and Arab Petroleum Investments Corporation (APICORP). The company has a production capacity of 1.3 mn tonnes of methanol annually.

GO WITH THE FLOW

SODIC net income almost triples in 2Q2021

EARNINGS WATCH- SODIC’s net income after minority interest almost tripled y-o-y in 2Q2021, reaching EGP 122 mn compared to EGP 42 mn in the equivalent period last year when the covid lockdown hit the company’s sales, according to the company’s earnings release (pdf). Revenues rose 39% to EGP 1 bn from EGP 735.6 mn in 2Q2020.

The lockdown quarter was tough on the company: The company’s net income fell 77% during 2Q2020, which coincided with the government’s three-month lockdown during the initial wave of the coronavirus. Gross sales slumped 33% as consumer demand fell and cancellations rose.

It was a different story in 2021: Gross contracted sales rebounded in 2Q2021, nearly doubling to EGP 1.9 bn from last year. More than half of sales were in the company’s The Estates and Karmell developments in west Cairo, while the remaining 48% were in east Cairo. The SODIC East project was the single-biggest contributor to earnings, accounting for 29% of the company’s sales. Cancellation rates were slightly down from 2Q2020, representing 10% of total gross contracted sales, down from 13% last year.

IN OTHER MARKET NEWS-

Pharos Securities has its name changed to Al Ahly Pharos Securities, according to an EGX statement (jpg) out this morning. The brokerage was sold to National Bank of Egypt-owned Al Ahly Capital in late 2019 in a transaction reportedly worth EGP 120 mn.

MARKET ROUND-UP

The EGX30 rose 1.04% at today’s close on turnover of EGP 2.3 bn (38.2% above the 90-day average). Regional investors were net buyers. The index is up 2% YTD.

In the green: Pioneers Holding (+8%), AMOC (+8%) and Egyptian for Tourism Resorts (+6.7%).

In the red: Egypt Kuwait Holding (-1.1%), Cleopatra Hospitals (-0.7%), and Raya Holding (-0.4%).

CALENDAR

24 August-5 September (Tuesday- Sunday): Tokyo 2020 Paralympics

27 August (Friday): Jackson Hole Economic Symposium.

September: Delegation of Russian companies to visit Russian Industrial Zone.

1-3 September (Wednesday-Friday): Digi Sign Africa, Cairo International Convention Centre, Cairo, Egypt.

2 September (Thursday): The new EGX mechanism for calculating closing share prices will come into effect.

3-5 September (Friday-Sunday): The World Karate Federation will hold the third competition of the 2021 Karate 1-Premier League in Cairo.

5 September (Sunday): Paralympics closing ceremony, Tokyo

5-7 September (Sunday-Tuesday): The Arab Security Conference, The Nile Ritz-Carlton, Cairo, Egypt.

7-8 September (Tuesday-Wednesday): Euromoney Conferences will host the GlobalCapital Sustainable and Responsible Capital Markets Forum 2021, featuring Vice Minister of Finance Minister Ahmed Kouchouk.

8-9 September (Wednesday-Thursday): Egypt-International Cooperation Forum (ICF), Cairo

7-9 September (Tuesday-Thursday): Egy Health Expo, Al Manara International Conference, Cairo, Egypt.

9 September (Thursday): DevOpsDays Cairo 2021 is being organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs.

11-12 September (Saturday-Sunday): International Conferences on Economics and Social Sciences, Cairo

12 September (Sunday): International schools begin 2021-2022 academic year

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

13-21 September (Monday-Tuesday): 76th session of the general assembly, New York

15 September (Wednesday): The CFO Leadership & Strategy Summit is taking place in Egypt.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 September (Saturday): Expiration of United Nations Investigative Team to Promote Accountability for Crimes Committed by Daesh/ISIL

21-22 September (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

22-25 September (Wednesday-Saturday): Cityscape Egypt, Egypt International Exhibition Center, Cairo, Egypt.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

October: New legislative session begins.

October: Romanian President Klaus Iohannis could visit Egypt in mid this month to discuss ways to boost tourism cooperation between the two countries.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): State-owned companies and government service bodies selling goods and services to customers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November 2021 (Tuesday-Wednesday): Africa fintech summit, Cairo

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.