- Egypt launches first oil and gas bid round of 2021. (Speed Round)

- Is the gov’t putting together a package of incentives to speed the buildout of natural gas filling stations? (Speed Round)

- Credit Agricole and NBK Egypt will hike capital this year to meet CBE requirements. (Go with the Flow)

- Watch Perseverance land on Mars tonight — live. (Happening Now)

- Multinationals push back on Riyadh ultimatum + Ford joins JLR in push to kill gasoline engines. (End-of-Week Followups)

- Mom and Dad still with you? Cherish them this weekend. Ain’t none of us getting any younger. (Weekend Reading)

- So much football this weekend… (On the Tube)

- ESG investors vs Big Oil. (Green Economy)

- Line up early for some of the best croissants, bread and seasonal sweets you’ll find this side of the Mediterranean. (Weekend Eats)

Thursday, 18 February 2021

EnterprisePM — Egypt launches first oil and gas bid round of 2021

TL;DR

WHAT WE’RE TRACKING TONIGHT

…and that’s a wrap, ladies and gentlemen. We hope this chilly Thursday has been kind to you as we all slide into the weekend.

THE BIG STORY THIS AFTERNOON: Egypt just announced its first oil and gas auction of 2021 — and it’s the first to use the new Egypt Upstream Gateway (EUG) digital platform to serve out data. Meanwhile, trading in CI Capital shares will resume now that Banque Misr has confirmed it’s not going to up the price on offer as it seeks up to 90% of the financial services outfit. We have more on both stories below.

*** CATCH UP QUICK on the top stories from this morning’s edition of EnterpriseAM:

- Ezdehar targets USD 100 mn first close for its next SME fund by mid-year and is mulling whether to start an impact investing fund.

- Covid has been a boon for Egypt’s startups, but we need regulatory overhauls to bring in more investment.

- The Damietta LNG plant is on track to finally come out of its eight-year slumber next week, starting to export again just as global demand for LNG picks up.

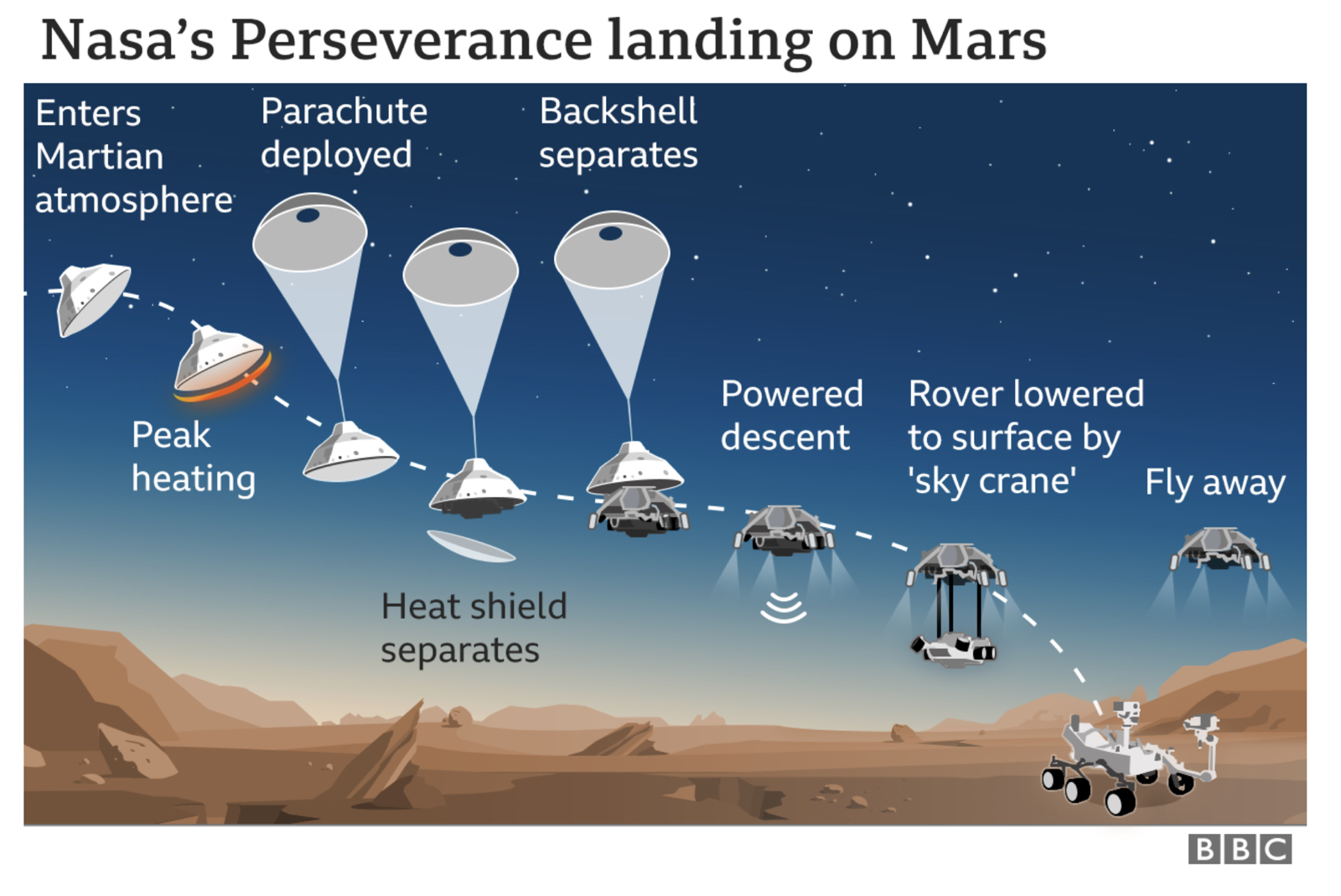

HAPPENING NOW: NASA’s Perseverance is preparing to land on Mars, delivering an SUV-sized rover and a little robotic helicopter to start searching for signs of past life, the Wall Street Journal reports.

How can you watch it? NASA will broadcast the landing live starting at 9:15pm CLT on its Youtube channel. The BBC has a solid rundown of what to expect:

THE BIG STORY ABROAD heading into the weekend is El Face’s decision to ban the sharing of news in Australia over a move by lawmakers there to force Big Tech to pay publishers for content. The story has global ramifications: Canada, the EU and the UK are all mulling laws similar to that under consideration in Australia, the Financial Times reports. And it doesn’t end with paying for content: Egypt and members of the EU have all discussed how to fairly tax tech giants that do business here.

Facebook’s ham-handed ban has blocked everything from Australia’s national weather service to a support line for victims of domestic violence — and Facebook’s own Facebook page, according to a list compiled by ABC News Australia’s Kevin Nguyen. The story is getting wide pickup by everyone from Reuters to CNBC.

Mr. Stonks goes to Washington today: Robinhood CEO Vlad Tenev, Reddit chief Steve Huffman, Roaring Kitty himself, and the shorts from Melvin Capital are all due to be grilled today by members of the US House of Representatives investigating the /rWallStreetBets debacle that (ostensibly) pitted day traders against hedge funds in the battle over GameStop, Blackberry and other (marginal) stocks. The Financial Times, Guardian and Reuters have the story.

You know you’re a true finance nerd if you’re asking: Is it gonna be livestreamed? And the answer, of course, is, “Yes. Yes, it is.” Tune in here at 7pm CLT.

SIGN OF THE TIMES #1- The UAE’s first ambassador to Israel is on Twitter, writing in English, Arabic and Hebrew.

YOUR STATUTORILY REQUIRED COVID UPDATE- It’s a good news / bad news kind of day. First up: The BioNTech / Pfizer jab is significantly less effective against the South African variant of the coronavirus that causes covid. On the plus side: Anthony Fauci “says there's new evidence that a COVID-19 vaccine may not just protect the people who get it but also shield others whom they come in contact with.”

Pups versus PCR: Germany has trained sniffer dogs to detect covid-19 with a 94% accuracy by smelling the “corona odour” that comes from cells in infected people, reports the World Economic Forum. Sniffer dogs have already been employed in airports in Finland and Chile, with people already deliberating whether the pups can be used in events such as concerts to sniff out covid-19 cases.

|

- Saudia Arabia’s ultimatum that international companies set up headquarters in Riyadh is (predictably) going over like a lead balloon, Bloomberg writes. KSA said earlier this week that global firms need to set up their regional HQs there if they want to continue to do business with government companies.

- Carmakers’ rush to an all-electric future is gathering speed: Hot on the news that Jaguar Land Rover is planning to phase out petrol-powered cars by 2036 (see our note earlier in the week) comes word that Ford will invest USD 1 bn in a European EV facility to make its range of passenger cars “completely all-electric” by 2030.

- And it’s not just on land that companies are getting serious about cutting emissions: Shipping giant Maersk will launch the world’s first carbon-neutral container ship in 2023 — and will immediately begin phasing out the use of vessels running on fossil fuel or its derivatives in favor of ships propelled by dual-fuel technology, it said yesterday.

- Guess who loves the commodities rally we talked about earlier this week? The world’s biggest mining company. Rio Tinto has paid out the biggest dividends in its history thanks to the surge in iron prices, which rose almost 85% in 2020, the Financial Times reports. The company joins other big miners, BHP and Glencore with generous divvys thanks to growing Chinese demand for commodities and expectations for large-scale infrastructure investment in the coming months and years.

???? WEEKEND READING–

Let’s start with a mediation on aging, shall we? If they’re still in your lives, cherish your mom and dad. Deanna Dikeman’s heartbreaking series Leaving and Waving chronicles 27 years of waving goodbye to her parents from the edge of their driveway. It’s “a story about family, aging, and the sorrow of saying good-bye,” she says, as her parents become older, wizened. Until there is one. And then none. Get the overview here and then explore the poignant images on her website.

Then go read the New Yorker’s profile of Nancy Floyd, who has taken a 9am selfie for nearly 40 years as a study of how she would grow old. The images are fascinating, and so is her interview with Neale James on his Photography Daily show, which includes a beautiful gallery of images.

Want to live a healthier (if not longer) life? You want to start getting a little bit of exercise. How much? Start with this piece in the New York Times, which states the obvious for the 1,000th time: “People who often exercise and stay active are much less likely to develop heart disease than people who rarely move, whether that exercise consists of a few minutes a day of jogging or multiple hours a week of walking.”

TIP- Have the kid help with chores around the house. It’s not only less work for the olds, it builds character. The New York Times devotes a whole column to timeworn wisdom that’s been passed from generation to generation.

SIGN OF THE TIMES #2, presented without comment: The [seekoseeko] adviser will see you now. On Instagram, wherein the Gray Lady wonders whether Emily Morse is the Dr. Ruth (remember her?) of a new generation. (Editor’s note: Why are we using badly transliterated slang instead of the three-letter English word? As longtime readers know, it’s one of many words or phrases that the algorithms hate — resulting in our being sent to bad places instead of your inbox.)

PSA- A number of top US business schools declined to participate in the Financial Times and Economist’s annual rankings of top MBA schools. Among the holdouts who said covid made it difficult for them to gather data are Egyptian favourites Harvard, Wharton, Columbia and Stanford, the WSJ writes.

???? WEEKEND EATS-

Wake up early tomorrow and be first in line at Ratios Bakery in Maadi. A crowd from across the capital city descends on Samer and Jackie’s joint for fantastic baked goods (takeaway or to enjoy it with friends and coffee in the cozy garden). Ratios is known for its sourdough bread, pastries, sweets, and savory creations, all baked fresh daily with seasonal specials on par with anything you’d be offered abroad. The resident 13-year old is partial to the pain au chocolat, while we love the donut holes. Reader “A Cairene Cook” tips Ratios’ turkey and roast beef sandwich with caramelised onions and the sticky cinnamon rolls — and you can never go wrong with their ciabatta twist or country bread. There’s lots more on Instagram or get a Google Maps pin here. Open Friday and Saturday 8am-1pm and Monday through Thursday 8am-2pm.

???? OUT AND ABOUT-

Finish off the workweek with some standup comedy, with Darb 1718 (Google Maps) hosting an open mic standup night at 8pm CLT organized by Al Hezb El Comedy. You can choose to chill and laugh or get on the stage and perform. Already got plans for today? Al Hezb El Comedy also have an open mic standup night tomorrow at 8pm CLT at KMT House (Google Maps).

Egyptian Frank Sinatra cover band The Sinatras will be performing today at 9pm CLT alongside singer Farida Tamer. Venue: The Room Garden City (Google Maps).

???? ON THE TUBE THIS WEEKEND

Alt-history drama For All Mankind is back for season two starting tomorrow, with a new episode every Friday. The series explores an alternative reality in which the Soviet Union beat the United States in the race to the moon. This season’s trailer sees the moon becoming militarized as the Cold War heats up. Catch the season two trailer here (watch, runtime: 2:42). The show airs on Apple TV+.

We keep hearing that you guys are documentary buffs: The Most Unknown is out on Netflix today. It sends nine scientists to extraordinary parts of the world to uncover unexpected answers to some of humanity’s biggest questions. Directed by Ian Cheney and bringing together scientists from a range of disciplines, the film pushes the boundaries of how the story of science is told. The New Yorker is out with a short and sweet review.

Will Smith is the host of Netflix’s new docuseries, Amend: The Fight for America, which looks at the fight for equal rights in America through the lens of the US Constitution's 14th Amendment.

A recommendation for your weekend family movie night: Pixar’s Soul on Disney+ has stirred up some talk on the interwebs for its emotional story and fantastic animation. The film follows Joe (voiced by Jamie Foxx), a middle-school band teacher who has a passion for jazz. Joe falls in a pothole that sends him to another realm to help someone find their passion, he soon discovers what it means to “have soul.” Soul is Pixar's first film to feature a Black lead, as well as the first to be completed remotely amid the pandemic. You can also make it a night out if you’ve cancelled covid: Soul is still on in cinemas nationwide.

???? Egypt’s basketball team takes on Uganda tonight at 10pm CLT in the Group E FIBA AfroBasket 2021 Qualifiers, with Egypt currently leading the group after defeating Morocco 99-76. AfroBasket is the biennial men's basketball continental championship and the match will take place in Tunisia. Egypt’s team ranks no. 60 in the FIBA World Ranking. You can watch the match on beIN channel 8 HD or through FIBA’s online platform (subscription required).

⚽️ ALL FOOTBALL, ALL THE TIME-

There are a whopping 16 matches on today in the Europa League. Among the highlights to look out for at 7:55pm CLT: Manchester United will play against Real Sociedad, Tottenham will face off against Wolfsburg, Milan goes up against Crvena Zvezda, and Roma will hit the field with Braga. Meanwhile at 10pm CLT: Arsenal will play against Benfica, Antwerp against the Rangers, and Granada against Napoli. You can check out the full schedule here.

There’s plenty of football for the weekend as well: La Liga has one match on tomorrow and four on Saturday: Real Betis will play Getafe at 10pm tomorrow while Saturday’s matches feature Eiche against Eibar at 3pm CLT, Atletico Madrid vs. Levante at 5:15pm CLT, Valencia and Celta Vigo at 7:30pm CLT, and Valladolid against Real Madrid at 10pm CLT.

Serie A has two matches on tomorrow and three on Saturday. Fiorenta will play Spezia at 7:30pm and Cagliari take on Torino at 9:45pm CLT on Friday. On Saturday, Lazio will hit the field against Sampdoria at 4pm CLT, Genoa goes up against Verona at 7pm CLT, with Sassuolo playing Bologna at 9:45pm CLT.

As for the English Premier League (PL), Wolves will play against Leeds tomorrow at 10pm before a four-match dash on Saturday. Southampton will face off against Chelsea at 2:30pm CLT, Burnley against West Brom at 5pm CLT, Liverpool against Everton at 7:30pm CLT, and Fulham against Sheffield United at 10pm CLT.

Speaking of which: The PL’s CEO Richard Masters is not a fan of a USD 6 bn plan to create a “super league” of Europe’s best-known teams across all leagues, he said during the Financial Times’ Business of Football Summit. Masters argues that the super league would be destructive to the value of domestic football across Europe, partly because it would not have the normal promotion and relegation process. Participating teams would continue to play in their domestic leagues during weekends, with super league matches being played midweek. Among the 15 teams potentially participating are PL’s Manchester United and Liverpool and Spain’s Real Madrid and FC Barcelona.

???? UNDER THE LAMPLIGHT-

What do Warren Buffet and Bill Gates have in common (other than their bns of wealth) — both have touted Business Adventure by John Brooks as their favorite book about business. Business Adventure looks at 12 dramatic stories inside Wall Street from Ford to Xerox to explore the intricacies of corporate life and the volatile nature of the world of finance.

???? WEEKEND WEATHER- Look for a mixture of sun and clouds both Friday and Saturday with a daytime high of 17°C and an overnight low of 9°C both days. There’s a chance of a sprinkle on Friday. Brisk winds on Friday will die down a bit on Saturday.

Long range forecast: Expect daytime highs of 19°C most of next week with the mercury plunging to 8°C overnight.

SPEED ROUND: ENERGY

First oil and gas auction of ‘21 is also the first to use the new Egypt Upstream Gateway

24 oil and gas blocks up for grabs in the first auction of 2021: The Oil Ministry has kicked off our first oil and gas exploration tender of the year, with 24 blocks being up for grabs, the Oil Ministry said in a statement on Thursday. The round, which concludes on 1 August, includes nine blocks in the Mediterranean Sea, 12 in the Western Desert and three in the Gulf of Suez, an Oil Ministry source told Reuters today.

Brought to you by the Egypt Upstream Gateway: The announcement came during the official launch of the Egypt Upstream Gateway (EUG) digital platform, which provides E&P companies that have signed on to it with geological data for exploration and production activity. The platform, which was 12 months in the making, was developed in cooperation with Schlumberger.

Who’s likely to take part? 10 oil and gas companies have signed on to the EUG, suggesting they have appetite to participate in the tender. These companies include Eni, Apache, and Germany’s Wintershall Dea, according to the announcement.

A good way to close a natgas-strong week: The auction comes at the heels of the sleeping giant that is the Damietta LNG Terminal waking up after an eight-year slumber. As we noted this morning, the plant will export a 150-160k cbm shipment of natural gas — its first commercial sale since 2012 — during the final week of February. That, combined with rising demand for natural gas and a commodities super-cycle, and it’s looking good for Egypt’s gas export hub ambitions.

SPEED ROUND: GREEN(ER) ECONOMY

Fill ‘er up

Are natgas filling station operators getting a package of incentives? Builders and operators of the natural gas filling stations that will be part of our transition to a natgas-fuelled economy may see a package of incentives courtesy of the CBE, according to statements from an executive at Natural Gas Vehicles Company (Car Gas) to the local press. Car Gas, which says it will build 170 NG filling stations this year at a cost of about EGP 2.5 bn, expects financial aid from an as-yet announced program that will be launched by the central bank, the Oil Ministry and the MSME Development Agency, says Car Gas chief marketing officer Ahmed Hafez. We’re waiting for callbacks from all three agencies and hope to have more for you on Sunday.

This isn’t the first time we’ve heard of a potential program for operators. CBE Governor Tarek Amer said at the Go Green Exhibit last month that the CBE plans to make some EGP 5.3 bn in subsidized funds available to banks to back the construction of as many as 287 new natural gas filling stations.

The only program announced so far will help car owners transition to natgas engines. Under the program, the CBE will make EGP 15 bn available for banks to loan out to car owners wanting to swap cars more than 20-years old for new, dual-fuel models (background here and here). Borrowers would pay a fixed 3% rate with repayment periods of 7-10 years. The CBE initiative comes in addition to the EGP 1.2 bn set aside by the MSME Development Agency last year.

GO WITH THE FLOW

Credit Agricole and NBK Egypt plan capital raises + it looks like Banque Misr is upping its bid for CI Capital

The EGX30 fell 0.3% at today’s close on turnover of EGP 1.3 bn (9.8% below the 90-day average). Local investors were net buyers. The benchmark index is down 1.1% for the week, but up 4.9% year-to-date.

In the green: Orascom Investment Holding (+4.3%), Abou Kir Fertilizers (+3.3%) and Sidi Kerir Petrochemicals (+3.2%).

In the red: Orascom Financial Holding ( -6.2%), Palm Hills Development (-3.2%) and ElSewedy Electric (-2.7%).

MARKET NEWS WORTH KNOWING-

Credit Agricole and NBK Egypt plan capital raises this year to meet CBE requirements: Credit Agricole Egypt will hike its capital by mid-September to meet the Central Bank of Egypt’s (CBE) EGP 5 bn minimum capital requirement, which is part of the Banking Act that was passed late in 2019, Managing Director Jean Pierre Trinelle told Al Mal. Credit Agricole Egypt had increased their authorized capital to EGP 6 bn last March, Trinelle added. Meanwhile, NBK Egypt’s board approved a capital raise of EGP 3.5 bn to comply with the CBE requirement as well as increase the authorized capital from EGP 2.5 bn to EGP 10 bn, according to an EGX filing (pdf).

EARNINGS WATCH- CI Capital’s net profits fell 12% y-o-y in 2020 to EGP 475 mn, with NBFS contributing 90% of the company’s bottom line, according to the company’s earnings release (pdf). Consolidated revenues dipped 10% y-o-y to EGP 2.4 bn, with NBFS activity contributing 84% of the top line. The firm’s total on-balance-sheet financing portfolio grew 10% y-o-y in 2020 to reach EGP 10.3 bn. Commenting on the year’s performance, the report said that CI Capital demonstrated resilient performance in 2020, despite an unprecedented challenging year, fueled by the strong performance of its NBFS platform and solid balance sheet. CI is optimistic that it is in a solid position to capitalize on the ongoing recovery in business activity and capital markets in 2021.

Banque Misr isn’t going to up its offer for CI Capital shares, according to a bulletin out just now from the Financial Regulatory Authority. Trading in CI Capital shares was suspended earlier today amid speculation that Banque Misr intended to change its offer price. Banque Misr will pay EGP 4.70 per share and is seeking to take up to 90% of CI. The financial services firm’s shares closed today at EGP 4.65.

GREEN ECONOMY

ESG’s truth keeps marching on..

ESG investors vs Big Oil: As ESG investing continues to gain more prominence in board rooms across the world and driving up demand for green economy assets, oil majors have started to feel the pressure, with Total CEO Patrick Pouyanné even sounding the alarm that maybe the world is adapting to climate change a little too fast.

His arguments: The move to divest from carbon and into renewable energy is too expensive at the moment for oil and gas majors, particularly as demand for renewable energy assets is driving up their acquisition prices. While Total has pledged bns in renewables investment, targeted net-zero emissions by 2050, Pouyanné says that this “bubble” in asset prices is making it impractical in the short term.

How expensive are these assets? Valuations that are often up to 25x earnings are “just crazy today,” Pouyanné said, blaming scarcity of renewable energy assets. The UK’s auction for offshore wind rights earlier this month could see GBP 8.8 bn paid to the state over 10 years, largely by oil and gas majors.

The market is still irresponsible: His other major argument is that divesting oil and gas assets simply transfers them to less responsible energy players, namely the Russians and the Saudis. State-owned oil companies, including Saudi Aramco and the Abu Dhabi National Oil Company, “are not prepared to stop producing, he tells the Financial Times.

Poor 2020 earnings? That has nothing to do with it obviously (cough cough): His statements come at a time where oil majors took a hit on the back of falling oil prices in 2020. Total saw USD 7.2 bn in losses in 2020, while BP posted a loss of USD 5.7 bn last year — its first in a decade, according to CNBC.

And in this corner… Investors are undeterred, continuing to pile on the pressure on majors. Aviva — one of the UK’s largest asset managers with GPB 355 bn AUM — threatened to fully exit its stakes in 30 oil, gas and mining companies if they don’t do more to tackle climate change.

Meanwhile, the world’s largest asset manager, BlackRock, threatened to vote against company directors who do not align with global efforts to reach net-zero greenhouse gas emissions by 2050. “We expect directors to have sufficient fluency in climate risk and the energy transition to enable the whole board—rather than a single director who is a ‘climate expert’—to provide appropriate oversight of the company’s plan and targets,” the firm said in a document yesterday which ran on Bloomberg.

WORTH READING

How to make buck off a podcast

The podcast industry is still figuring out how to make a buck. While podcasting is the fastest-growing advertising medium, few are able to make a living running a show as the industry brings in less than USD 1 bn in ad revenue annually, writes Axios. Meanwhile, consumer adoption continues to outpace monetization, with more than 90 million people in the US alone estimated to be listening to podcasts every month, according to a 2019 survey by Edison Research.

The top 1% of podcasts account for 99% of downloads. Only a few big players are making sizable earnings, including the podcasting department at The New York Times, which made USD 30 mn in revenue in 2019. Vox’s podcasting business has eight figures of annual turnover, and podcast host Joe Rogan recently signed a USD 100 mn exclusivity agreement with Spotify.

How is monetization done now? The podcast ecosystem was built in a decentralized manner via RSS feeds which deliver new episodes to podcast apps (like Apple Podcasts, Google and Spotify). Some platforms including Spotify use “streaming ad insertion,” to place host and voice talent-read ads within different podcasts. Others rely on radio-like audio ads that are automatically placed within episodes. As for podcasters themselves, monetization often means striking partnerships with brands to promote their products or services in audio form or through affiliate links. Less common methods of monetization include organizing events and meetups or selling merchandise, Entrepreneur writes.

Consolidation of services is key to building an advertising market. Major companies have begun investing to expand their podcast empires by aggregating podcast firms together and creating an end-to-end supply chain complete with advertising, distribution and hosting. Spotify acquired podcast advertising company Megaphone last year for USD 235 mn in a bid to make their streaming ad insertion technology available to podcast publishers themselves. Meanwhile, Apple last year reportedly acquired Scout FM, a startup that creates radio-like stations for podcasts to offer listeners a curated selection of podcasts and Amazon acquired Wondery in December after competing with Sony for the podcast publisher. ss

We’re seeing examples of this in MENA as well: Sowt Podcasts launched the Zamakan Podcast Network that aims to promote podcast discoverability and monetization for podcast producers, the platform said. Zamakan will consolidate all production services including hosting, outreach and publishing, ad sales, and live events for network members. The project received funding from the Google News Initiative under its Innovation Challenge fund.

We’re already making a buck on Making It: Our podcast about building a great business right here in Egypt has run for three seasons thanks to our friends at CIB, the United States Agency for International Development and EFG Hermes. We’ve sat down with high-profile business leaders from industries including fintech, manufacturing, investment banking, diagnostics, retail, and F&B. We try to have episodes to meet everyone’s taste, while exploring how the Egyptian economy fosters homegrown and multinational business.

Pictured above is Edita CEO Hani Berzi at our studio — you can listen to our chat here or check out episodes from season three:

- Chris Khalifa, CEO of Zooba

- Bahaa Alieldean, Partner in Alieldean, Weshahi & Partners

- Nancy Zayed and Hisham Shawki, Cofounders of MagicCube

- Ali Elfakharany, CEO of Arqam FC

- Ashraf Sabry, CEO of Fawry

- Hossam Abou Moussa, partner at Actis

- Ahmed Galal Ismail, CEO of Majid Al Futtaim Properties

- Hend El Sherbini, CEO of Integrated Diagnostics Holding

You can check out all seasons of Making It on: Apple Podcasts | Google Podcasts | Anghami | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here. Well be back for season four later this spring.

Local podcasts you should also give a listen:

- Radical Contemporary Podcast by our friend Nour Hassan is about sharing, discovery and appreciation of artistic and personal expression in the MENA region and beyond.

- Mommy’s Happy Hour is the first Egypt-based podcast produced by UAE’s Amaeya Media. Listen to mother-of-twins Heba Shunbo recall her experience with getting pregnant later on in life.

- The Potcast is an Egyptian lifestyle podcast that covers issues such as mental health and addiction.

- Egyptian Streets is out with their own podcast where they talk to Egyptians around the world driving social change. They’ve talked to satirist Bassem Youssef and graphic designer Deena Mohamed.

What to look forward to: Advertising spending in podcasts in the US is expected to increase 45% this year to USD 1.13 bn while the global podcast industry is expected to be worth USD 60.5 bn by 2027, reports CMC Markets.

CALENDAR

February: France’s finance minister, Bruno Le Maire, is set to visit Egypt.

6-27 February (Saturday-Saturday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic).

7-28 February (Sunday-Sunday): The Finance Ministry will receive applications from companies wishing to take part in the second phase of its program for the immediate payout of export subsidy arrears to exporters, minus a 15% fee.

20 February (Saturday): Final results of applications for private university places will be announced on the Higher Education Ministry’s electronic university admissions site

22-24 February (Monday-Wednesday): Second Arab Land Conference on land management, efficient land use, among other topics.

22 February- 5 March (Monday-Friday) Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

26 February (Thursday): The Afro Future Summit will take place virtually.

26-28 February (Thursday-Saturday): The second edition of the Egypt International Art Fair will be held at Dusit Thani Lakeview Cairo.

28 February (Sunday) Deadline for businesses, sole traders, and those generating income from sources other than their day job to file wage tax returns through the electronic filing system.

March: Potential visit to Cairo by Russian President Vladimir Putin.

1 March: Eastern Mediterranean Gas Forum comes into effect.

1-5 March (Monday-Friday): Aswan Forum for Peace and Development will take place virtually.

4-6 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.