What we’re tracking on 18 May 2020

THE STORY OF THE DAY- We’re facing a 5pm-6am curfew for Eid El-Fitr as part of a series of tighter measures in effect next week to curb the spread of the virus that causes covid-19. The state will then begin easing some measures throughout June, Prime Minister Moustafa Madbouly said in a speech yesterday.

It also seems EgyptAir could resume commercial flights early next month, although Cabinet spokesman Nader Saad said only that an official announcement would be made in early June. We have the full story in this morning’s Speed Round, below.

Did you need a reminder that we’re in the midst of a heat wave? Look for daytime highs of 42-43°C in the capital city, according to the national weather service (pdf), with a chance of scattered showers this week in Cairo, Sinai and the North Coast, Egyptian Meteorological Authority head Mahmoud Shahin told Ahram Gate. The mercury still looks set to fall just in time for the holiday: Look for a daytime high of 32°C on Saturday (the last day of Ramadan) and 31°C on Sunday (the first day of Eid).

So, when do we eat? Maghrib prayers are at 6:43pm and you’ll have until 3:19am to finish caffeinating. Fajr is coming one minute earlier every day through the end of the Holy Month.

** You only have a few days left to tell us covid-19 is impacting your business. We run an annual reader poll asking what you expect of business conditions and the economy in the year ahead. Covid-19 has us thinking that the results of this year’s survey need updating. Take a minute and tell us how covid-19 has impacted your business, whether it’s changed your outlook on the economy, and what you think of WFH. We’ll have the results for you immediately after the Eid.

COVID-19 IN EGYPT-

Egypt has now disclosed a total of 12,229 confirmed cases of covid-19 after the Health Ministry reported 510 new infections yesterday — the highest single-day total yet. The ministry also said that another 18 people had died from the virus, taking the death toll to 630. We now have a total of 3,742 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 3,172 have fully recovered.

ON THE GLOBAL FRONT-

Covid infections are on the rise in Africa, the New York Times notes this morning, singling out Nigeria as “just one of Africa’s alarming hotspots” and adding that Tanzania and Somalia have also been hard hit. The news comes as some Asian countries are “battling new clusters of contagion,” the Wall Street Journal writes. Among them: China, which has quarantined some 8k people in the country’s northeast.

GLOBAL MACRO-

Fed chairman Jay Powell sat down with 60 Minutes’ Scott Pelley for a wide-ranging interview on the central bank’s emergency measures, predictions for the US economy, and what has to be done to ensure we end up with a recovery and not the Great Depression Mk II.

Here are the key takeaways from the interview:

- The US economy may not fully recover until a vaccine is found: “Certain parts of the economy will recover much more slowly. Travel, entertainment, things that we do that involve being around lots of other people. So for the economy to fully recover, people will have to be fully confident. And that may have to await the arrival of a vaccine.”

- The US economy will see a historic contraction this quarter: The contraction of the US economy in the second quarter “could easily be in the twenties or thirties.”

- And Great Depression-levels of unemployment: “[20-25% unemployment] sounds about right for what the peak may be.”

- Policymakers must do more: “It may well be that the Fed has to do more. It may be that Congress has to do more. And the reason we've got to do more is to avoid longer run damage to the economy.”

- But a note of optimism: “In the long run, and even in the medium run, you wouldn't want to bet against the American economy. This economy will recover. And that means people will go back to work. Unemployment will get back down. We'll get through this.”

You can watch a clip from the interview and read the full transcript here (watch, runtime: 13:46).

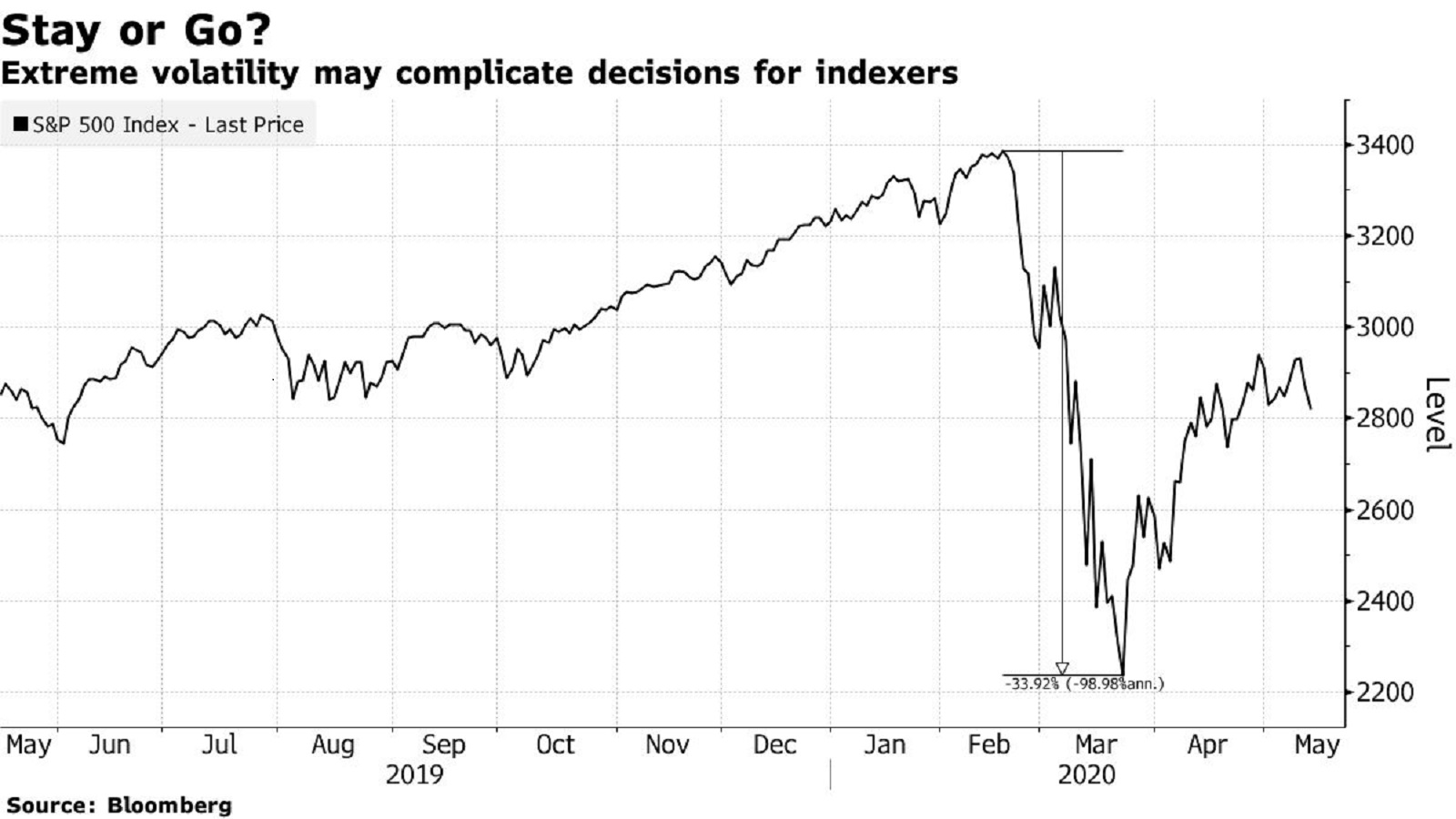

Managers of benchmark indexes like the S&P 500 will soon have to decide whether to dump companies likely to keep bleeding because of covid-19, with market volatility compounding an already difficult task. “The S&P 500 may be the world’s most-followed passive index, but covid-19 and its aftermath is going to force its constructors into some very active choices,” DataTrek Research’s co-founder Nicholas Colas tells Bloomberg, estimating that some 30 companies are hovering on the edge of eviction. The index recovered from its 23 March bottom because it’s anchored in tech and healthcare companies, but those working in retail, industry and energy are at risk.

The collapse in oil prices is increasing the likelihood that GCC currencies break the USD peg, which has been in place since the 1970s, the Financial Times reports. The risk that one of the GCC currencies decouples from the USD remains low, analysts say, but the temperature is rising on the Omani rial, which sunk to all-time lows against the greenback in forward markets last month.

This may not be a problem for much longer as the oil market begins to find its feet: US crude rose above USD 30/bbl for the first time in two months as last month’s huge production cuts ease the supply glut, Bloomberg reports.

AND THE REST OF THE WORLD-

The Evil Empire just got bigger: Never one to let a federal antitrust investigation get in the way of its ambition to dominate all of our online communication, Facebook has announced its acquisition of Giphy in a transaction Axios values at around USD 400 mn.

WATCH THIS SPACE- Nomura is going after Japan’s private market, the Financial Times notes. The firm’s new chief executive’s strategy is to “focus on private markets and Japan’s vast hinterland of unlisted companies,” pointing to “Japan’s substantial market for the trading and management of shares in unlisted Japanese companies.”

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: The highly unpopular private tutoring industry is back in a new (and possibly more insidious) form since the Education Ministry made research papers central to assessing students in public schools this year. We look at the businesses that have emerged to cater to this new system, and why the same issues that prompted the rise of private tutors is driving their growth today in the time of covid-19.