What we’re tracking on 4 December 2019

It’s the final day for retail investors look to subscribe to Rameda Pharma’s IPO: The penultimate day of Rameda’s retail offering closed 8.8x oversubscribed, with orders for 165.78 mn shares covering the 18.83 mn shares on offer, according to the local press. Rameda shares will debut on the EGX under the ticker RMDA a week from today.

Rameda isn’t the only offering closing today: Institutional investors have until today to submit bids for the Saudi Aramco IPO which, as of Monday, was more than 2x oversubscribed, attracting bids worth SAR 144.4 bn, financial advisors said. The retail offering closed on 28 November and investors ordered SAR 47.4 bn in shares, around 1.5x the number of shares offered.

Amendments to the Public Enterprises Act will hit the House of Representatives after the anticipated cabinet shuffle, deputy chairman of the House Industrial Committee Tarek Metwally said yesterday.

Proposals to restore the Information Ministry are getting flak: Head of the Supreme Media Council Makram Mohamed Ahmed has come out against a proposal put forward by MPs last week to bring back the Information Ministry, saying the move could threaten freedom of the press.

The annual RiseUp Summit opens its doors tomorrow at the AUC campus in New Cairo. Tap or click here for the full agenda if you’re a denizen of planet startup or otherwise want to get in on the action.

A delegation of eight Danish food and agriculture companies will visit Egypt this month to talk trade, head of the trade council at the Danish embassy in Egypt Hanzada Farid told Al Mal.

Manpower Minister Mohamed Saafan is in Cote d’Ivoire for the International Labor Organization’s African Regional Meeting, according to Al Shorouk. The four-day meeting finishes Friday, 6 December.

Other stuff you can go to this week:

- The 2019 Payment and Digital Inclusion Forum and Exhibition wraps up at the International Exhibition Center today.

- The regional Pitch by the Pyramids competition takes place on Sunday, 8 December.

News triggers to keep your eye on in the coming days:

- Inflation figures for November are out next Tuesday, 10 December.

The Cascades Spa at Somabay has 65 treatment rooms and facilities extended over 7,500 SQMs offering a range of first-class treatments and services with a further 750 m2 Thalasso-Tonic Hydrotherapy Pool. Containing 830 m3 of sea-water sub-divided into a number of distinct zones with water jets, currents and counter-currents, showers and bubbling baths

The Cascades Spa at Somabay has 65 treatment rooms and facilities extended over 7,500 SQMs offering a range of first-class treatments and services with a further 750 m2 Thalasso-Tonic Hydrotherapy Pool. Containing 830 m3 of sea-water sub-divided into a number of distinct zones with water jets, currents and counter-currents, showers and bubbling baths

Trump dials back rhetoric on France sanctions: President Donald Trump seemed interested in defusing tensions with France a day after threatening to impose 100% tariffs on handbags and wine in retaliation for a French tax on digital services, the Wall Street Journal reports. French Finance Minister Bruno Le Maire vowed that the EU would respond in kind if the US follows through on its threats. Speaking during the NATO summit in London, Trump referred to the tensions as a “minor dispute,” adding that “we’ll probably be able to work it out.”

…but then poured a bucket of ice cold water on the prospect of reaching a trade agreement with China soon, telling reporters in London yesterday he has “no deadline” and “like[s] the idea of waiting until after the [2020 presidential] election.” There had been hope in recent weeks that the US and China were closing in on a “phase one” trade agreement, but Trump told reporters that he thinks that Washington can twist Beijing’s arm for a better agreement. The Financial Times and Bloomberg have more.

Markets slumped in the wake of Trump’s comments, with the Dow Jones Industrial Average falling 1% — its biggest one-day fall since early October — while the S&P 500 dropped 0.7% and the Nasdaq Composite also fell 0.6% yesterday, according to the Wall Street Journal.

All this coincided with Democrats saying POTUS is eligible for impeachment: House Democrats released yesterday a report saying that the impeachment inquiry confirmed Trump used his political power for personal gain by attempting to convince Ukraine’s prime minister to investigate presidential candidate Joe Biden. The report did not include a decision on “whether to formally recommend Mr. Trump’s impeachment and removal,” leaving it up to another committee to decide, the New York Times notes. You can read the 300-page report here, if you are so inclined.

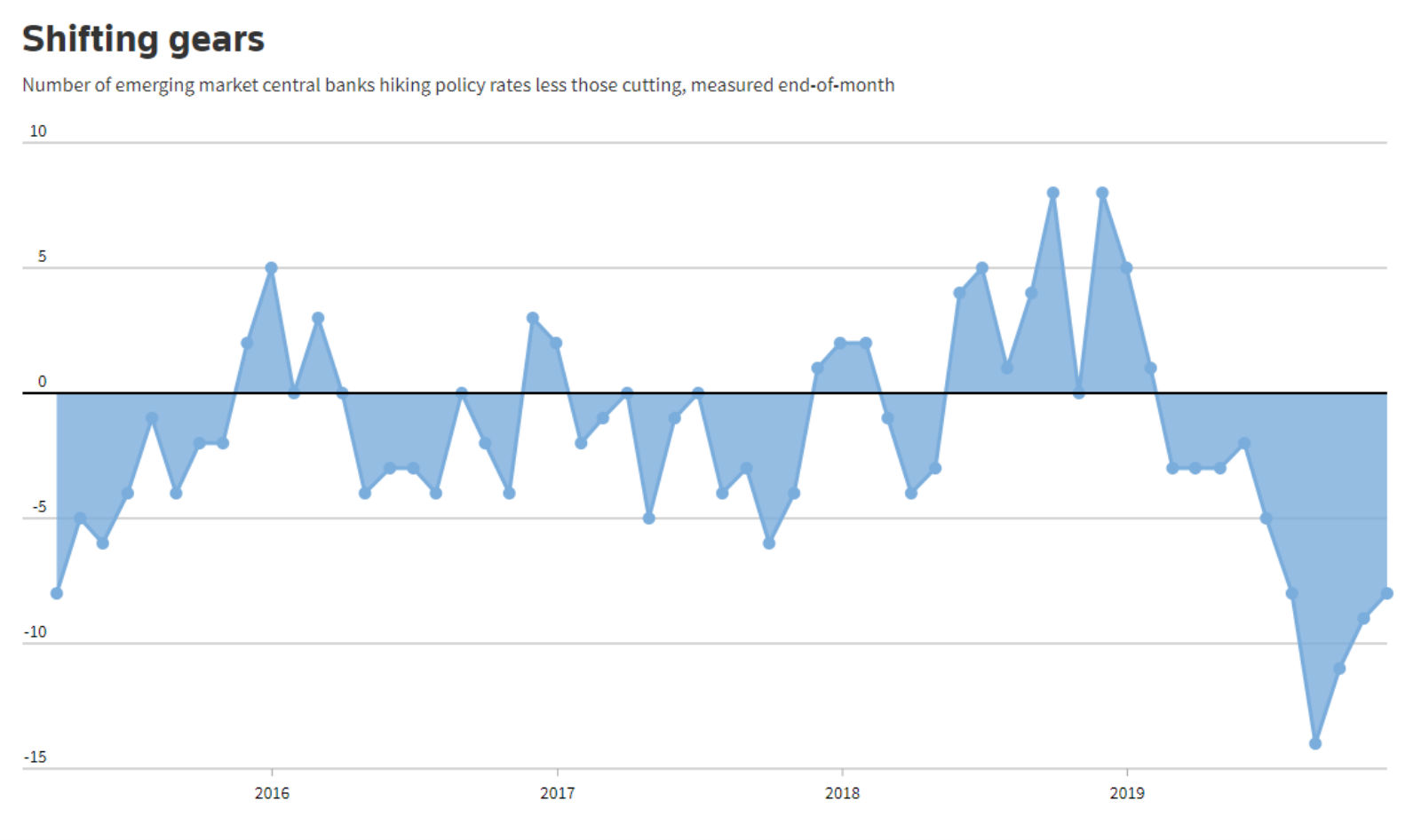

Emerging markets carry on with monetary easing cycle: November was the 10th consecutive month of rate cuts by emerging market central banks, who continue to take their cues from the US Federal Reserve, says Reuters. Last month saw eight net cuts, slightly fewer than October’s nine, and falling short of August, which saw the largest number of coordinated cuts in a decade. Egypt’s 100 bps cut in the November meeting was among the most pronounced. The CBE’s Monetary Policy Committee is next due to meet on 26 December.

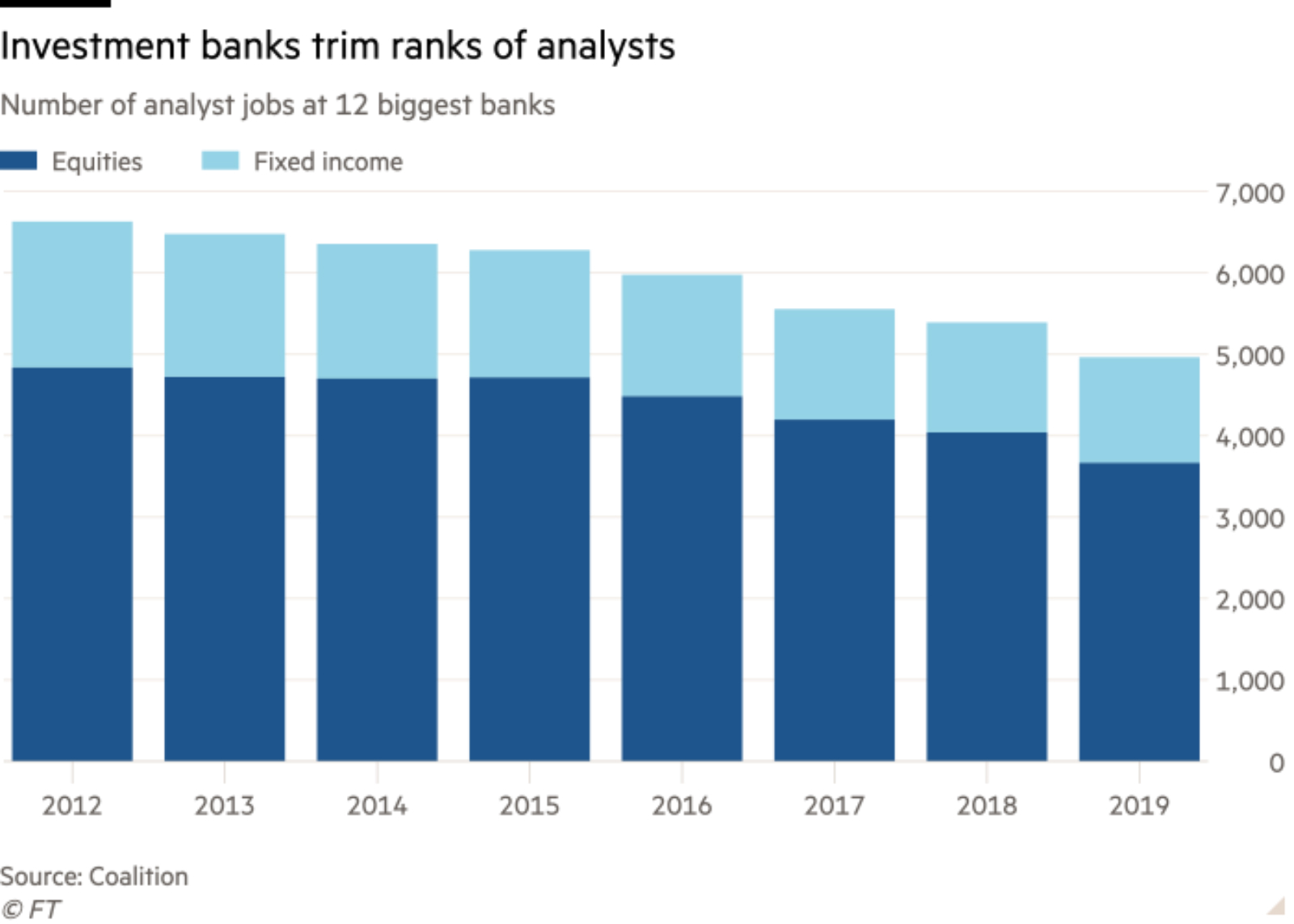

It’s not a particularly great time to be an investment analyst (as we discussed earlier this week). Regulatory and commercial considerations are pushing investment banks to cut back on research departments — especially in Europe, which has seen analyst numbers fall by up to 26% since 2011, the Financial Times reports. Globally, the number of analysts working at the 12 biggest investment banks fell almost 11% between the end of 2017 and 1H2019, according to data provider Coalition.

Comoros raises funds four times its GDP: Comoros, the Arabic-speaking island off the coast of East Africa with a USD 1.2 bn economy, has raised nearly USD 4 bn in financing for tourism and infrastructure projects, the country’s Foreign Minister Souef Mohamed El-Amine said, according to Bloomberg. El-Amine gave no further details beyond saying the proceeds were secured during a meeting in Paris this week that was attended by representatives from Egypt, Saudi Arabia, Kuwait, China, Japan, alongside hosting nation France. The two gulf state’s funds, the World Trade Organization, and Arab League committed to the funding.

We set a new world record this decade (and not the kind we should be celebrating): A new report from the UN’s World Meteorological Association (pdf) finds that the current decade is on track to set a new temperature record, as grim climate news shows no signs of letting up, AP reports. 2019 is expected to be the second or third warmest year recorded since measurements began, with the dubious honor of first place going to 2016.

*** Something to read on your commute this morning: What Cold War II between China and the United States might look like, by historian and public intellectual Niall Ferguson. Read it alongside this piece about Chinese researchers trying to come up with a way of generating photos of real people using only samples of their DNA. Both pieces are via the New York Times.

*** Something to listen to on your commute this morning: The backstory to Making It, our new podcast, or episode one (food emporium Gourmet) or episode two (AI-backed personal assistant Elves) before this week’s episode is out tomorrow in time for your drive home.

*** Want to reach out to a guest who’s appeared on our show or been interviewed by Enterprise in print? Drop us a line at makingit@enterprise.press. Tell us who you are, who you’re looking to speak with (and give us a sense of why … you know … so we know you’re not a stalker) and we’ll make sure the message gets across.