- Centamin rejects USD 1.9 bn Sawiris-backed Endeavour merger proposal. (Speed Round)

- Americana minority shareholders demand Adeptio revalue the company. (Speed Round)

- The coming of corporate sukuks means Egyptian corporates are finally getting serious about debt. (Speed Round)

- Egypt’s non-oil business activity hits two-year lows in November. (Speed Round)

- Wasla Browser raises USD 1 mn in follow-on funding round. (Speed Round)

- Hurghada became one of the top 100 most-visited cities worldwide in 2019 -Euromonitor. (Speed Round)

- Is legal crowdfunding coming to Egypt? (Speed Round)

- Your morning commute read: What a cold war between the US and China might look like. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 4 December 2019

Centamin rejects USD 1.9 bn Sawiris-backed Endeavour merger proposal

TL;DR

What We’re Tracking Today

It’s the final day for retail investors look to subscribe to Rameda Pharma’s IPO: The penultimate day of Rameda’s retail offering closed 8.8x oversubscribed, with orders for 165.78 mn shares covering the 18.83 mn shares on offer, according to the local press. Rameda shares will debut on the EGX under the ticker RMDA a week from today.

Rameda isn’t the only offering closing today: Institutional investors have until today to submit bids for the Saudi Aramco IPO which, as of Monday, was more than 2x oversubscribed, attracting bids worth SAR 144.4 bn, financial advisors said. The retail offering closed on 28 November and investors ordered SAR 47.4 bn in shares, around 1.5x the number of shares offered.

Amendments to the Public Enterprises Act will hit the House of Representatives after the anticipated cabinet shuffle, deputy chairman of the House Industrial Committee Tarek Metwally said yesterday.

Proposals to restore the Information Ministry are getting flak: Head of the Supreme Media Council Makram Mohamed Ahmed has come out against a proposal put forward by MPs last week to bring back the Information Ministry, saying the move could threaten freedom of the press.

The annual RiseUp Summit opens its doors tomorrow at the AUC campus in New Cairo. Tap or click here for the full agenda if you’re a denizen of planet startup or otherwise want to get in on the action.

A delegation of eight Danish food and agriculture companies will visit Egypt this month to talk trade, head of the trade council at the Danish embassy in Egypt Hanzada Farid told Al Mal.

Manpower Minister Mohamed Saafan is in Cote d’Ivoire for the International Labor Organization’s African Regional Meeting, according to Al Shorouk. The four-day meeting finishes Friday, 6 December.

Other stuff you can go to this week:

- The 2019 Payment and Digital Inclusion Forum and Exhibition wraps up at the International Exhibition Center today.

- The regional Pitch by the Pyramids competition takes place on Sunday, 8 December.

News triggers to keep your eye on in the coming days:

- Inflation figures for November are out next Tuesday, 10 December.

The Cascades Spa at Somabay has 65 treatment rooms and facilities extended over 7,500 SQMs offering a range of first-class treatments and services with a further 750 m2 Thalasso-Tonic Hydrotherapy Pool. Containing 830 m3 of sea-water sub-divided into a number of distinct zones with water jets, currents and counter-currents, showers and bubbling baths

The Cascades Spa at Somabay has 65 treatment rooms and facilities extended over 7,500 SQMs offering a range of first-class treatments and services with a further 750 m2 Thalasso-Tonic Hydrotherapy Pool. Containing 830 m3 of sea-water sub-divided into a number of distinct zones with water jets, currents and counter-currents, showers and bubbling baths

Trump dials back rhetoric on France sanctions: President Donald Trump seemed interested in defusing tensions with France a day after threatening to impose 100% tariffs on handbags and wine in retaliation for a French tax on digital services, the Wall Street Journal reports. French Finance Minister Bruno Le Maire vowed that the EU would respond in kind if the US follows through on its threats. Speaking during the NATO summit in London, Trump referred to the tensions as a “minor dispute,” adding that “we’ll probably be able to work it out.”

…but then poured a bucket of ice cold water on the prospect of reaching a trade agreement with China soon, telling reporters in London yesterday he has “no deadline” and “like[s] the idea of waiting until after the [2020 presidential] election.” There had been hope in recent weeks that the US and China were closing in on a “phase one” trade agreement, but Trump told reporters that he thinks that Washington can twist Beijing’s arm for a better agreement. The Financial Times and Bloomberg have more.

Markets slumped in the wake of Trump’s comments, with the Dow Jones Industrial Average falling 1% — its biggest one-day fall since early October — while the S&P 500 dropped 0.7% and the Nasdaq Composite also fell 0.6% yesterday, according to the Wall Street Journal.

All this coincided with Democrats saying POTUS is eligible for impeachment: House Democrats released yesterday a report saying that the impeachment inquiry confirmed Trump used his political power for personal gain by attempting to convince Ukraine’s prime minister to investigate presidential candidate Joe Biden. The report did not include a decision on “whether to formally recommend Mr. Trump’s impeachment and removal,” leaving it up to another committee to decide, the New York Times notes. You can read the 300-page report here, if you are so inclined.

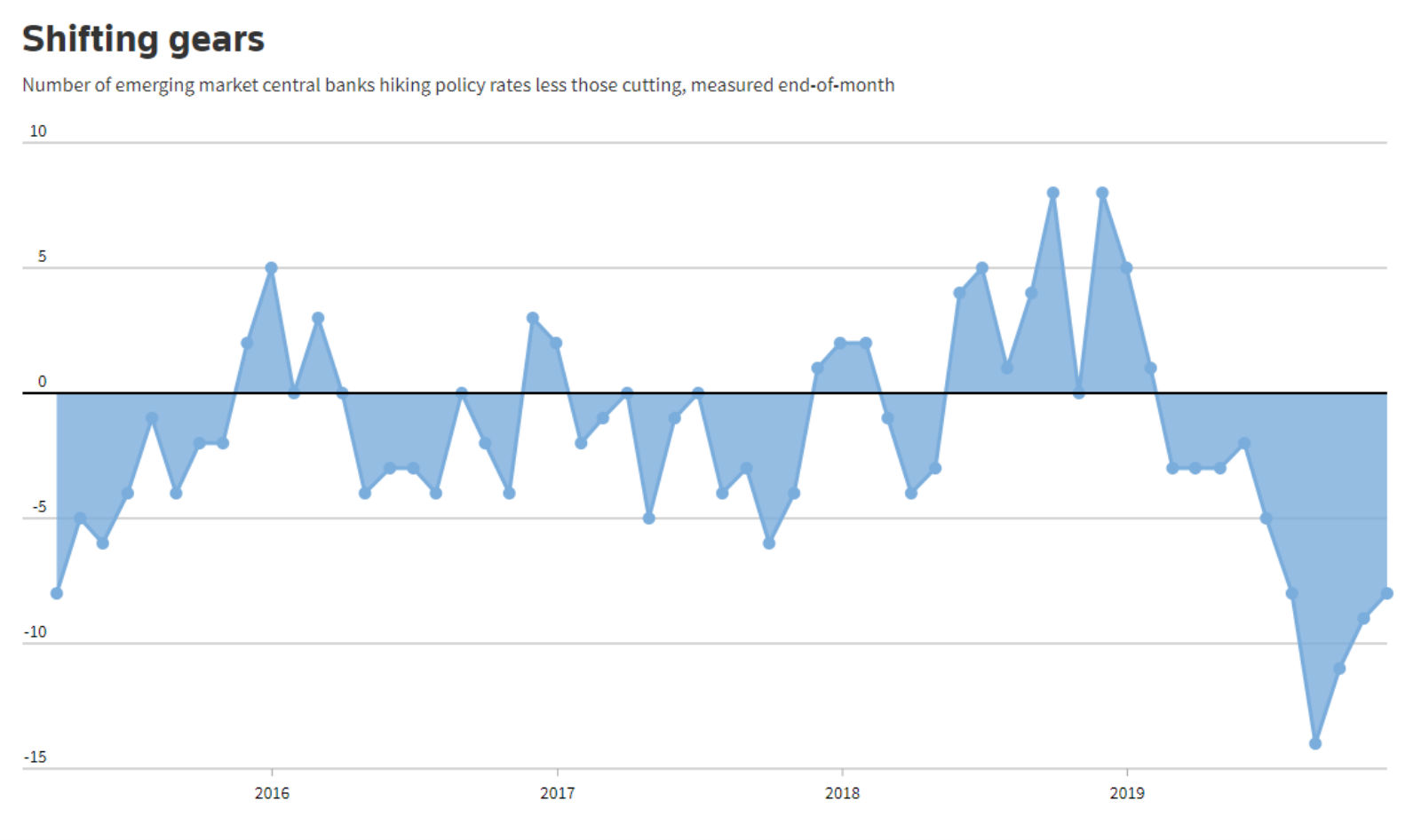

Emerging markets carry on with monetary easing cycle: November was the 10th consecutive month of rate cuts by emerging market central banks, who continue to take their cues from the US Federal Reserve, says Reuters. Last month saw eight net cuts, slightly fewer than October’s nine, and falling short of August, which saw the largest number of coordinated cuts in a decade. Egypt’s 100 bps cut in the November meeting was among the most pronounced. The CBE’s Monetary Policy Committee is next due to meet on 26 December.

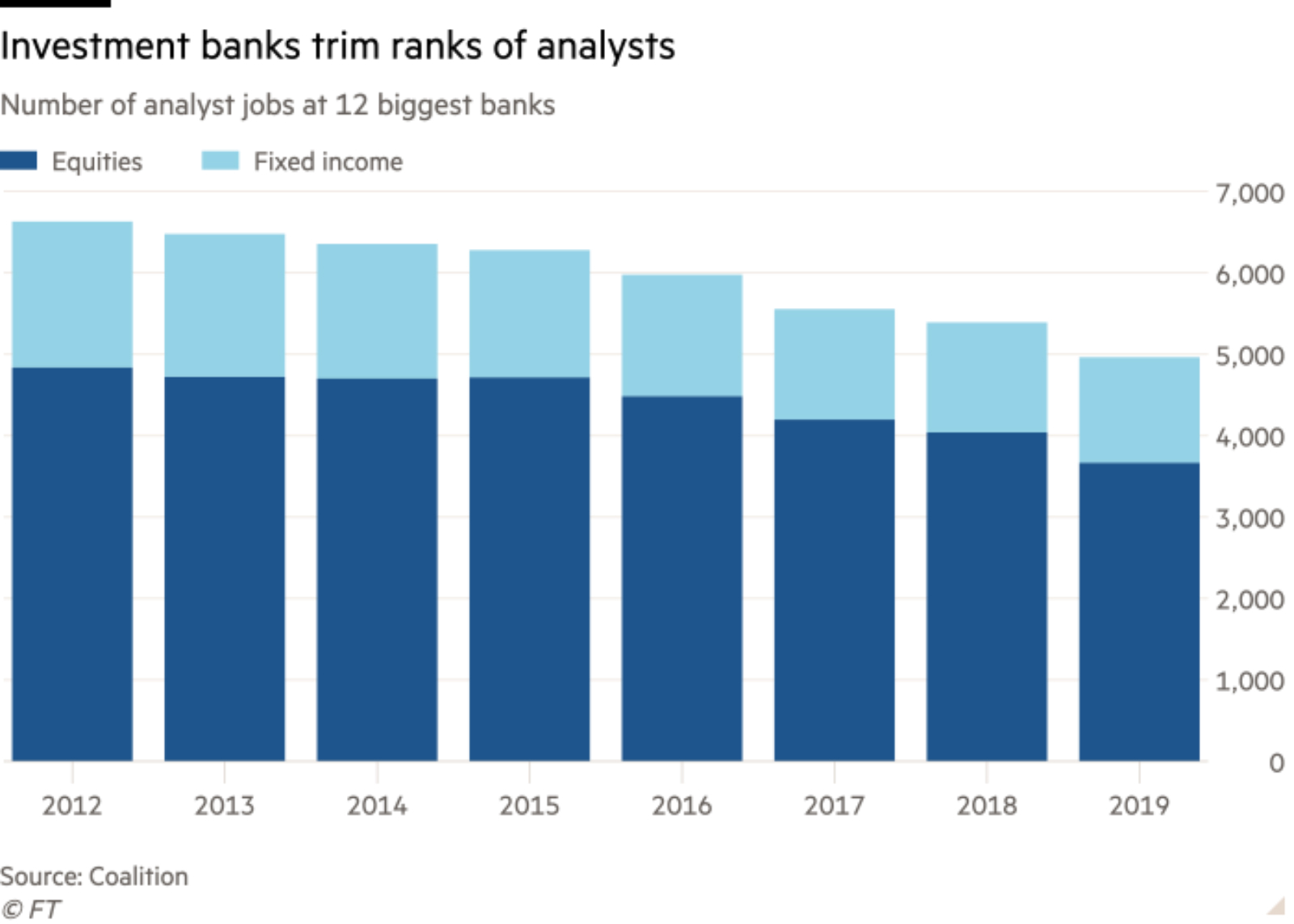

It’s not a particularly great time to be an investment analyst (as we discussed earlier this week). Regulatory and commercial considerations are pushing investment banks to cut back on research departments — especially in Europe, which has seen analyst numbers fall by up to 26% since 2011, the Financial Times reports. Globally, the number of analysts working at the 12 biggest investment banks fell almost 11% between the end of 2017 and 1H2019, according to data provider Coalition.

Comoros raises funds four times its GDP: Comoros, the Arabic-speaking island off the coast of East Africa with a USD 1.2 bn economy, has raised nearly USD 4 bn in financing for tourism and infrastructure projects, the country’s Foreign Minister Souef Mohamed El-Amine said, according to Bloomberg. El-Amine gave no further details beyond saying the proceeds were secured during a meeting in Paris this week that was attended by representatives from Egypt, Saudi Arabia, Kuwait, China, Japan, alongside hosting nation France. The two gulf state’s funds, the World Trade Organization, and Arab League committed to the funding.

We set a new world record this decade (and not the kind we should be celebrating): A new report from the UN’s World Meteorological Association (pdf) finds that the current decade is on track to set a new temperature record, as grim climate news shows no signs of letting up, AP reports. 2019 is expected to be the second or third warmest year recorded since measurements began, with the dubious honor of first place going to 2016.

*** Something to read on your commute this morning: What Cold War II between China and the United States might look like, by historian and public intellectual Niall Ferguson. Read it alongside this piece about Chinese researchers trying to come up with a way of generating photos of real people using only samples of their DNA. Both pieces are via the New York Times.

*** Something to listen to on your commute this morning: The backstory to Making It, our new podcast, or episode one (food emporium Gourmet) or episode two (AI-backed personal assistant Elves) before this week’s episode is out tomorrow in time for your drive home.

*** Want to reach out to a guest who’s appeared on our show or been interviewed by Enterprise in print? Drop us a line at makingit@enterprise.press. Tell us who you are, who you’re looking to speak with (and give us a sense of why … you know … so we know you’re not a stalker) and we’ll make sure the message gets across.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s inauguration of national projects in Damietta yesterday was the talk of the town on the airwaves last night.

Tallying the projects: The largest of the national projects was the 330 feddan Damietta Furniture City (DFC), says Masaa DMC’s Ramy Radwan. DFC is expected to include 150 furniture factories, some 1500 smaller workshops, exposition halls, banks, hotels and other facilities. Other projects include a multi-purpose cargo facility in Damietta Port, the 5-star Hotel El Lessan by Steigenberger, a civic education center, an electricity plan in western Damietta, expansions to a sewage treatment plant in Ras El Bar, and a number of social housing projects. Hona Al Asema’s Reham Ibrahim (watch, runtime: 3:28) and Yahduth Fi Misr’s Sherif Amer (watch, runtime: 3:13) also took note of the inaugurations.

The three 14.4 GW plants built by Siemens, Orascom Construction, and Elsewedy Electric will save Egypt EGP 12 bn a year, Electricity Minister Mohamed Shaker said during the inauguration ceremony (watch, runtime: 48:33). The plants saved the country EGP 7.3 bn in FY2018-2019, and this figure will rise to EGP 12 bn in 2022 and EGP 16 bn when they reach full capacity, meaning that the project will recover its costs within 5-7 years, Shaker said. El Sisi also noted that the government has spent EGP 615 bn to improve the country’s electricity generation capacity (watch, runtime: 5:42).

Other topics that made it to the airwaves last night include:

- CBC’s Hona Al Asema (originally hosted by Lamees Al Hadidi) will officially stop airing this week, and Reham Ibrahim and Amr Khalil will begin hosting a new program, Min Masr, which first airs on Saturday at 11 pm CLT. According to Ibrahim, the new show is one with a “wider scope” (watch, runtime: 3:22).

- When are we getting a Senate again? Hona Al Asema’s Reham Ibrahim sat down with Ahmed Maklad, a member of a union of youth politicians, for a talk on a draft law to regulate the newly-reconstituted Senate, the recent surge in the number of youth governors, and other related topics (watch, runtime: 13:34). We should be heading to the polls to elect Senate members next year.

- Egypt’s first robotics company: Masaa DMC’s Ramy Radwan, meanwhile, had a chat with the founder of Egypt’s first company producing industrial robots, David Samir (watch, runtime: 3:05). The name of the company, which began as an AI startup in 2007, was left unsaid.

- Egypt’s tourism industry continues to attract praise: Radwan took note of a report by the Independent’s travel desk suggesting that Egypt will be one of the world’s top tourism destinations next year (watch, runtime: 2:23).

Speed Round

Speed Round is presented in association with

M&A WATCH- Centamin rejects USD 1.9 bn Sawiris-backed Endeavour merger proposal: The board of gold mining company Centamin has unanimously rejected a proposal by Endeavour Mining for a USD 1.9 bn all-share merger, the Wall Street Journal reports. The London-listed operator of Egypt’s Sukari gold mine said the offer would disproportionately benefit Endeavour’s shareholders and that it was better able to maximize shareholder returns by operating alone.

Centamin’s shares reacted positively to the news, leaping nearly 15%.

The must-read on the transaction: Endeavour’s pitch to investors (pdf) on why the transaction makes sense. Endeavour says the merger would create a top-15 global gold producer with a favorable cost structure, strong balance sheet and significantly enhanced capital market profile that would make it attractive to larger funds that look at the industry.

What did Endeavour propose? Endeavour offered to exchange 0.0846 of its shares for every Centamin share, valuing Centamin’s share capital at around USD 1.9 bn based on the company’s market price on 2 December. Endeavour’s shareholders would hold a 52.9% stake in the company, and Centamin’s would own the remainder. Endeavour might consider a more appealing offer if Centamin agrees to “friendly discussions” on the pros and cons of a potential merger, CEO Sébastian de Montessus told the Financial Times. Reuters also has the story.

Endeavour’s statement on the proposal is here. You can read Centamin’s board statement here.

Sawiris’ La Mancha urges Centamin to reconsider: Naguib Sawiris’ La Mancha, the largest shareholder in Endeavour with a 29.88% stake, “strongly urged” the Centamin board to open merger talks in a statement (pdf). “We believe in the strategic rationale for this proposal and are fully supportive,” Sawiris said. “Moreover, we can add significant value in Egypt, which is opening-up its mining sector through a new, more supportive mining code, and increase the potential for further expansion in the country.”

The Egyptian government “welcomed” the prospect of the merger and would have been happy to see it materialize, Oil Minister Tarek El Molla told Reuters Arabic. Endeavour’s proposal sends a positive message that international companies are eyeing Egypt’s mining sector, El Molla said.

You can learn more about Centamin here (pdf) in the investor deck it prepared for EFG Hermes’ annual London conference this past fall.

M&A WATCH- Americana minority shareholders demand Adeptio revalue the company: Minority shareholders of the Egyptian International Tourism Projects Company (Americana Egypt) have filed a complaint with the Financial Regulation Authority demanding that Adeptio purchase shares based either on the company’s net asset value or its market price over the past three months, according to Al Mal. Americana’s shareholders and the FRA last month dismissed a mandatory tender offer submitted by the Gulf-based investment outfit to purchase shares at EGP 3.9 per share, with the regulator rejecting the methods and objectivity of the valuation. Adeptio responded by threatening legal action, insisting that the offer — which is far below the EGP 24 share price demanded by Americana shareholders — is fair, and that the valuation was conducted by a reputable financial consultant.

Shareholders have refused to study Adeptio’s valuation, claiming that it undervalued the company due to restructuring undertaken by Adeptio after its 2016 acquisition.

Background: Adeptio completed in 2016 the acquisition of a 67% stake in Americana Egypt’s parent company, Kuwait Food Company (Americana), handing them indirect ownership of more than 90% of the subsidiary’s shares. The FRA then ordered Adeptio to submit an MTO to buy the remaining 9.563% shares, which it contested in an economic court only to have the court reject the appeal. A 15-day grace period was set for Adeptio to submit the MTO after Adeptio had requested a 30-day extension on the initial deadline that expired on 21 October on the grounds that it has yet to complete its fair share evaluation on Americana, which the FRA approved.

DEBT WATCH- Corporate sukuks to debut in Egypt in the coming weeks? CIAF Leasing plans to issue Egypt’s first corporate sukuk in the coming weeks, Financial Regulatory Authority official Sayed Abd El Fadeel told Reuters. The aircraft leasing company will sell USD 50 mn in Islamic bonds, he said, adding that Abu Dhabi Islamic Bank is on board to manage the issuance. A second undisclosed company could also receive approval in the coming weeks to launch a USD 1 bn sukuk issuance, he said.

Talaat Moustafa Group is also getting ready to launch a EGP 4.5-5 bn sukuk program, sources told the press. The three-year program could begin as early as January with a first issuance of up to EGP 2 bn to finance one of the company’s real estate leasing projects, the sources said. The sources claimed that EFG Hermes is acting as lead managers for the issuance, while Baker McKenzie is assuming the role of a legal advisor.

All of this comes as companies are waking up to the potential of debt: The value of total securitized bond issuances has more than tripled this year to EGP 18 bn, up from EGP 5.3 bn last year, FRA head Mohamed Omran said at a press conference yesterday. Throw in the advent of short-term issuances and it’s hard not to ask: When will we start seeing people trading corporate paper?

November was a month to forget for the non-oil private sector, the PMI suggests: Non-oil private sector business activity hit two-year lows in November as output, new orders, and employment fell, according to the Markit / Emirates NBD purchasing managers’ index (pdf). The gauge fell for the fourth consecutive month to hit 47.9, its lowest reading since September 2017. A reading above 50.0 indicates that activity is expanding, while a reading below that mark means it is contracting.

Output and new business activity suffer amid market slowdown: The decline in output accelerated in November due to falling orders, while new business — particularly among exporters — struggled in a challenging economic environment.

Low demand led input price inflation to fall to one of its weakest levels on record, as businesses cut prices at the fastest rate recorded by the PMI.

Employment has also been affected due to a lack of new business, falling for the first time in four months in November, although the increase in employment last month was the largest seen in 13 months.

Business sentiment remained positive (if a bit softer than in October), with a large number of firms expecting output to rebound in the coming year.

STARTUP WATCH- Wasla Browser raises USD 1 mn in follow-on funding round: Cairo’s Wasla Browser, a startup that allows lower income users to browse the internet without charge, secured USD 1 mn in funding from Egypt Ventures, Glint Ventures, and Ebtikar for Financial Investments, in addition to a group of strategic angel investors, according to a company statement (pdf). Wasla Browser will use the investment to push its go-to-market strategy, expand its team, and launch new product verticals.

Why Wasla exists: The average worker in a developed country needs to work 40 minutes to afford 2 GB of internet. In Africa? The comparable figure is 29 hours.

STARTUP WATCH- Cairo-based cleaning services startup Jinni raised a six-figure investment from AUC Angels, MenaBytes reported, without disclosing the actual figure. Founded in 2016 by husband and wife Mostafa Ghannam and Alaa Shams, the startup provides residential and commercial cleaning services. The company plans to use the investment to improve its technology and promote its recently-launched educational center for cleaners, Ghannam said.

REGULATION WATCH- Is legal crowdfunding about to become possible in Egypt? Egypt is mulling how to work with the European Bank for Reconstruction & Development (EBRD) on a bill that would regulate crowdfunding, Financial Regulatory Authority Chairman Mohamed Omran said, according to Al Mal.

More export subsidy details leaked: The local press was out yesterday with more leaks of the executive regulations for the Export Subsidy Fund’s new framework. Details of how the government is planning to compensate personal and medical care manufacturers and leather product makers made it to the papers yesterday evening. The rates those industries will be receiving for exporting their products abroad are largely similar to those of the food, engineering, and furniture sectors, which we noted yesterday.

How much? Only companies that achieve a minimum value-added rate of 40% (ie. use local content of more than 40% in their export-bound products) will be eligible. Medical supplies and leather product manufacturers that achieve an added value of over 80% will be eligible for subsidies of 10% of the value of their exports.

The Export Subsidy Fund will be committed to covering 50% of freight costs for exporters shipping to African countries. This is applicable to all industries covered by the scheme.

LEGISLATION WATCH- Market regulator, Justice Ministry putting the final touches on Insurance Act: The Justice Ministry is finalizing the draft of the new Insurance Act, which will grant the authority more oversight over the insurance industry, and will ship it to the House of Representatives for approval, Financial Regulatory Authority (FRA) boss Mohamed Omran said, according to the local press. According to Omran, the ministry is currently working on weaving in the proposed changes from different ministries and other relevant entities before the House discusses it. Omran did not clarify the expected timeline for the process.

Background: According to draft details which leaked earlier this year, the Insurance Act would, if passed, raise the minimum requirement for the issued and paid-in capital of life and property insurance companies by 150% to EGP 150 mn and double the ceiling for life insurance payouts to EGP 80k. The Insurance Federation of Egypt was said to have voiced concerns at the time that the capital requirements are unnecessarily high and said it would urge they be reduced. However, following several rounds of consultations later in the year, it was reported that the authority has largely kept the requirements unchanged. Reports also emerged in July that the final draft will be granting the watchdog considerable power to regulate the industry. From what we know so far, the act would grant the FRA significant new powers over licensing, business formation and board composition, and monitor bank deposits.

Foreign reserves inched up slightly to USD 45.354 bn in November, up from USD 45.25 bn in October, the Central Bank of Egypt said yesterday. Reuters has the story.

Hurghada broke into the 100 most-visited cities worldwide in 2019, coming in at number 82, according to a report by Euromonitor International. “With infrastructure improvement, such as the renovation of Terminal 2 at Hurghada International Airport and investment in the hotel sector, the city is expected to see a growth of over 41% during 2019, which will further elevate its ranking,” the report says. Euromonitor notes that the Red Sea resort town could soon make it to the top 50 cities on the ranking, provided the political and security situation remains stable and the government keeps up its tourism promotion and development work. Cairo, meanwhile, was the 42nd most-visited city worldwide this year, rising five spots from last year. International arrivals to Egypt’s capital city rose 18.3% y-o-y to 6.8 mn in 2019 from 5.8 mn in 2018.

As a whole, Egypt remains North Africa’s most popular tourist destination, which Euromonitor attributes to the Tourism Ministry’s “active reform strategy” and the return of UK and Russian tourists. In the MENA region, Cairo is the fourth most popular city to visit. Hong Kong and Bangkok remain the top two cities on the ranking, while New York City fell out of the top 10 cities. Bloomberg also has the story.

MOVES- Central Bank of Egypt (CBE) Deputy Governor Lobna Helal is reportedly planning to step down after receiving an offer of “a major post,” Masrawy reports. The newspaper didn’t specify the position, noting only that Helal could potentially be succeeded by CBE Sub-Governor Rami Abulnaga. Helal’s storied professional career, which started in the private banking sector and led her to the central bank, has some speculating she may have been offered a seat at the cabinet table in the economic group.

MOVES- The board of directors of the Housing & Development Bank has accepted the nomination of Hassan Ghanem (Linkedin) as their new chairman, succeeding Mohamed El Sebai, who resigned earlier this week for personal reasons, according to a bourse disclosure (pdf).

Medhat Kamar (LinkedIn) will become the chairman of the Egyptian Arab Land Bank until the board of directors’ current term ends in September 2020, reports Al Mal. Kamar was vice chairman, until his boss, Amr Kamal, resigned from his post and nominated him to take the lead. A veteran banker, Kamar joined the board as vice chairman in September 2017. He was formerly a senior risk officer at the National Bank of Egypt.

Suez Cement posted net losses of EGP 495.9 mn in 9M2019, compared with an EGP 335.4 mn profit made in the same period last year, according to the company’s quarterly consolidated earnings statement (pdf). Revenues slipped to EGP 4.9 bn during the period from EGP 5.11 bn last year. Suez Cement’s CEO, Jose Maria Magrina, said that the cement industry is suffering with the lowest average market prices since the EGP float. “Without any serious changes in legislation in favor of the cement industry that will reduce costs, or reduce production, we do not expect a recovery in a market that is plunging further into recession,” Magrina warned.

EARNINGS WATCH- Bank Audi Egypt’s net profits increased 6.5% y-o-y to EGP 1.1 bn in 9M2019, up from EGP 1.02 bn during the same period last year, according to Al Mal. Revenues rose 20.3% y-o-y to EGP 2.1 bn from last year’s EGP 1.75 bn.

The next episode of Making It will be out tomorrow afternoon, just in time for your drive home. Our next guest is the CEO of a top financial services firm who speaks with us about culture, transformation, ego and why hiring at the bottom of the pyramid and promoting from within is the way to go. Look for it on email and in your podcast feed tomorrow at around 2:15pm CLT.

Our second episode with the co-founders of Elves, the AI digital assistant is already out. Listen to it here on our website or check it out on Apple Podcast or Google Podcast.

Egypt in the News

All eyes on GERD talks in the foreign press: High-level talks between Egypt, Ethiopia, and Sudan on the construction of the Grand Ethiopian Renaissance Dam (GERD), which wrapped up in Cairo yesterday, are continuing to generate coverage in the international press. Technical teams may be heading for a “major breakthrough,” says the East African, indicating that Egypt and Ethiopia may each have ceded some ground, and be moving towards a compromise. An Irrigation Ministry statement out following the meeting was scant on details, saying only that the officials agreed to continue hashing out contentious matters. The three countries’ representatives are next due to sit down in Washington on 9 December to assess the outcome of the first two rounds of talks.

Meanwhile, reminders of how much is at stake for Egypt in these discussions, as we move closer to a state of “absolute water crisis” by 2025, courtesy of AFP and the Guardian.

Diplomacy + Foreign Trade

Foregin Minister Sameh Shoukry is flying to Italy today for the Rome Med 2019 – Mediterranean Dialogues, which gets underway tomorrow, according to a ministry statement. Libya and Turkey’s recently-signed border demarcation MoUs are expected to come up in Rome tomorrow and at a NATO summit currently underway in London. Erdogan has been quoted by a regional newspaper as saying Turkey doesn’t intend to discuss the agreements, but Greek Premier Kyriakos Mitsotakis is adamant to bring it up in London. Shoukry discussed the issue yesterday with Libya’s Deputy Prime Minister Fathi Al-Magbari, the ministry said in a statement.

What’s at stake? The agreements could potentially infringe upon territorial waters claimed by Egypt, Cyprus, and Greece. According to a map shared by a Turkish diplomat following the accords with Turkey’s Anadolu Agency, this is what Ankara is looking to lay claim to. The specific sea strip Ankara is after is part of a planned natural gas pipeline that would link the eastern Mediterranean’s fields to Italy and the European mainland via Cyprus, which wants to leave Ankara out of the equation. Turkey has had those plans in place since nearly a decade ago, which explains why Turkish drilling vessels are routinely spotted in the wrong places.Al Monitor also has a comprehensive take on the situation.

Also from Shoukry’s day: The FM held talks with the US’ newly-appointed ambassador to Egypt Jonathan Cohen, the ministry spokesperson said on Twitter.

Manufacturing

Obour Land to invest EGP 30 mn in new production lines

Obour Land plans to invest EGP 30 mn to add new production lines in 2020, Deputy Chairman Ashraf Hamed said, according to Al Mal. The company will also establish a new dairy factory in the middle of next year that will produce 36k tonnes of milk a year.

Tourism

Tui to relaunch flights from Edinburgh and Glasgow to Sharm in November 2020

Travel operator Tui will relaunch flights from Edinburgh and Glasgow to Sharm El Sheikh in early November 2020, in an expansion of its winter 2020 and summer 2021 holiday program, Insider reports. Tui is one of several airlines to resume services to Sharm shortly after the UK government lifted its four-year flight ban.

Egypt’s Hotac to announce Shepheard Hotel renovation tender winner next week

The Holding Company for Tourism and Hotels (HOTAC) is planning to announce next week the winning bid in its tender to renovate and manage the Shepheard Hotel, HOTAC Chairman Mervat Hataba told the press. HOTAC is currently reviewing two offers, one from a Saudi and another an Iraqi company. The company is in the final negotiation stages. Hataba said last September that HOTAC was reviewing four offers from Kuwait, Iraqi, and Saudi investors.

Automotive + Transportation

National Authority for Tunnels delivers Metro Line 4 sites to contractors

The National Authority for Tunnels has handed over the sites of the first phase of Metro Line 4 to a consortium of construction companies, including Petrojet, Concord, Arab Contractors, and Orascom, a source in the Transport Ministry said to Al Mal. The first phase of the line will include 17 stations and run for 18 km between Fustat and the outskirts of Sixth of October City.

Banking + Finance

African Development Bank mulls USD 500 mn loan to reduce budget deficit

The African Development Bank is considering providing a USD 500 mn loan to Egypt to help plug the budget deficit and finance national projects, Vice President Khaled Sherif told Masrawy. Egypt received USD 1.5 bn over three years from the bank between 2016 and 2018.

Egypt’s NBFS watchdog to issue nano lending licenses soon

The Financial Regulatory Authority (FRA) has received two applications from unnamed microfinance companies looking to obtain a license to to begin offering nano lending services, microfinance development expert at the FRA Ahmed Abdel Gawad said. The authority is expected to issue the licenses by next month, Abdel Gawad added. Nano lending services were greenlit by the regulator in November. Among the few lenders ready to offer the services is Tamweely Microfinance, we noted last month.

Law

Shalakany represents GM Egypt in capital increase dispute, Emaar Misr in NUCA settlement

Shalakany Law Firm successfully defended General Motors Egypt in a dispute filed at the Cairo Economic Court regarding the company’s recent capital increases, the firm said in a statement (pdf). The case claimed that two capital increases worth USD 90.3 mn were invalid. The firm also acted as legal counsel for Emaar Misr in its settlement with the New Urban Communities Authority over the Cairo Gate residential development in Sheikh Zayed, it said in a separate statement (pdf).

Sports

Mo Salah comes fifth in Ballon d’Or 2019

Mo Salah came fifth in the 2019 Fifa Ballon d'Or, as Lionel Messi triumphed for a record sixth time, according to Ahram Online. Virgil Van Dijk came in second, followed by Cristiano Ronaldo, and Sadio Mane. Salah was also nominated for the award last year and came in sixth place.

Egyptian squash champs Farag, El Welily top world rankings for December

Egypt’s Raneem El Welily and Ali Farag have topped the PSA’s world squash rankings for December. Farag is followed by compatriots Mohamed Shorbagy, Karim Abdel Gawad and Tarek Momen, while El Welily heads up a list including Nour El Sherbini, Nouran Gohar and Nour El Tayeb, as Egypt continues to dominate the sport.

On Your Way Out

Egyptian shaabi singer Shaaban Abdel Rehim, 62, died on Tuesday at Maadi Military Hospital following his return from Saudi Arabia, where he had appeared on stage in a wheelchair due to his illness, according to Gulf News. Known for his catchy, politically-themed lyrics and his snazzy suits, Abdel Rehim shot to fame in 2000 with the song “I Hate Israel.”

The Market Yesterday

EGP / USD CBE market average: Buy 16.06 | Sell 16.18

EGP / USD at CIB: Buy 16.07 | Sell 16.17

EGP / USD at NBE: Buy 16.05 | Sell 16.15

EGX30 (Tuesday): 13,470 (-0.5%)

Turnover: EGP 716 mn (0% below the 90-day average)

EGX 30 year-to-date: +3.3%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.5%. CIB, the index’s heaviest constituent, ended down 0.7%. EGX30’s top performing constituents were Qalaa Holdings up 2.4%, Palm Hills up 2.1%, and Heliopolis Housing up 1.3%. Yesterday’s worst performing stocks were Elsewedy Electric down 2.5%, Egyptian Resorts down 2.3% and Orascom Development Egypt down 1.9%. The market turnover was EGP 716 mn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +26.0 mn

Regional: Net Short | EGP -36.8 mn

Domestic: Net Long | EGP +10.8 mn

Retail: 51.8% of total trades | 48.4% of buyers | 55.3% of sellers

Institutions: 48.2% of total trades | 51.6% of buyers | 44.7% of sellers

WTI: USD 56.41 (+0.55%)

Brent: USD 60.82 (-0.16%)

Natural Gas (Nymex, futures prices) USD 2.45 MMBtu, (+0.45%, January 2020 contract)

Gold: USD 1,482.40 / troy ounce (-0.13%)

TASI: 7,883.30 (+0.63%) (YTD: +0.72%)

ADX: 5,030.76 (-0.25%) (YTD: +2.35%)

DFM: 2,678.70 (-1.22%) (YTD: +5.89%)

KSE Premier Market: 6,622.68 (-0.59%)

QE: 10,186.09 (+1.79%) (YTD: -1.10%)

MSM: 4,056.79 (-0.45%) (YTD: -6.17%)

BB: 1,540.53 (+0.17%) (YTD: +15.20%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company.

December: Indian automotive delegation to visit Egypt.

1-6 December (Sunday-Friday): Vietnamese trade delegation visits Egypt.

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

1-4 December (Sunday-Wednesday): Cairo ICT 2019, Egypt International Exhibition Center, Nasr City, Cairo.

2-4 December (Monday-Wednesday): African Economic Conference, Sharm El Sheikh.

2-13 December (Monday- Friday) The COP25 Climate Change Conference, Madrid

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

4 December (Wednesday): Subscription to the Aramco IPO is expected to begin.

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus.

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids.

8-9 December (Sunday-Monday): The 6 th CEOs THOUGHTS 2019.

9 December (Monday): Officials from Egypt, Sudan and Ethiopia will convene in Washington to assess progress made during two subsequent round of technical talks on the rules of filling and operating the Grand Ethiopian Renaissance Dam.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected).

11-12 December (Wednesday-Thursday): “Forum on peace and sustainability in Africa,” venue TBD, Aswan.

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

21-22 December (Saturday-Sunday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the third round of Grand Ethiopian Renaissance Dam negotiations in Khartoum, Sudan.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

13 January 2020 (Monday): The irrigation ministers of Egypt, Sudan, and Ethiopia will hold the fourth and final round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.