- Rate cut makes Egypt more attractive to investors: Credit Suisse. (Speed Round)

- Egypt signs USD 500 mn agreement with LuLu Hypermarket. (Speed Round)

- Health Ministry kicks El Ezaby, Roshdy from pharmacy registry. (Speed Round)

- El Sisi meets Trump, Macron and Johnson at G7 summit. (Speed Round)

- Yearly gains on EM ETFs have almost evaporated as trade fears bite. (What We’re Tracking Today)

- African countries could “leapfrog” the Fourth Industrial Revolution. (The Macro Picture)

- Sawiris wants to get in on Egyptian mining. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 27 August 2019

El Sisi meets Trump at G7 summit.

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to yet another slow news day. We have coverage of the final day of the G7 — during which El Sisi met with US, UK and French leaders — as well as the news that we’ve signed the final USD 500 mn agreement with India’s Lulu Hypermarket for a series of new shopping malls. Aside from that, it’s tumble weeds as far as the eye can see. We do hope that things start happening again soon.

Fresh from the G7 summit, President Abdel Fattah El Sisi is heading immediately to Yokohama, Japan, to take part in the Tokyo International Conference on African Development (TICAD), Ahram Online reports. The event begins tomorrow and will run until 30 August.

The G7 summit came to a close yesterday, rounding off a busy three days that were mostly focused on The Donald and his beef with China. The US president struck a more conciliatory mood yesterday, hinting at delaying or canceling raising tariffs on Chinese products just 24 hours after telling reporters he regretted not going higher with the hikes. Trump coupled his about-face with claims that China had initiated a resumption of trade talks, prompting Chinese Foreign Ministry spokesperson Geng Shuang to say he was “not aware of” China making such a phone call.

Chinese vice-premier Liu He maintained in separate remarks that China wants to de-escalate hostilities. “An escalation of the trade war is not good for China, it’s not good for the US, and it’s also not good for the interests of people across the world,” he said.

Could a Trump-Rouhani meeting also be in the cards? Literally anything is possible. French President Emmanuel Macron appears to be on a diplomatic roll, announcing in a press conference that Iranian President Hassan Rouhani could be open to meeting Trump. The Donald also said a meeting would be possible, describing Iran as a country of “tremendous potential,” but ruled out lifting economic sanctions.

One positive non-Trumpian outcome from the summit: Pledges of financial support for the Amazon rainforest. International leaders at the summit vowed to provided USD 22 mn and immediate logistical support, including military personnel, to help battle the fires that have been raging in the Amazon for two weeks, the BBC reports.

The plan is being spearheaded by Emmanuel Macron, who has been embroiled in a war of words with Brazilian President Jair Bolsonaro over the fires, and who has threatened to block the EU-Mercosur trade deal if the crisis is not addressed. Bolsonaro, who initially claimed his government didn’t have the resources to tackle the fires, has since dispatched 44k troops and military aircraft to six states struggling with them. He has said that the support from the G7 treats Brazil "as if we were a colony or no man's land."

Wildfires in Brazil, though common in the dry season, have increased by up to 89% this year. This comes amid extensive rollbacks to environmental protections by Bolsonaro’s government, and a significant increase in deforestation. International outcry has abounded over the Brazilian government’s perceived lack of action to stop the fires, and now Brazilian businesses and trade groups, reportedly fearing boycotts of their products, are also strongly expressing their concern.

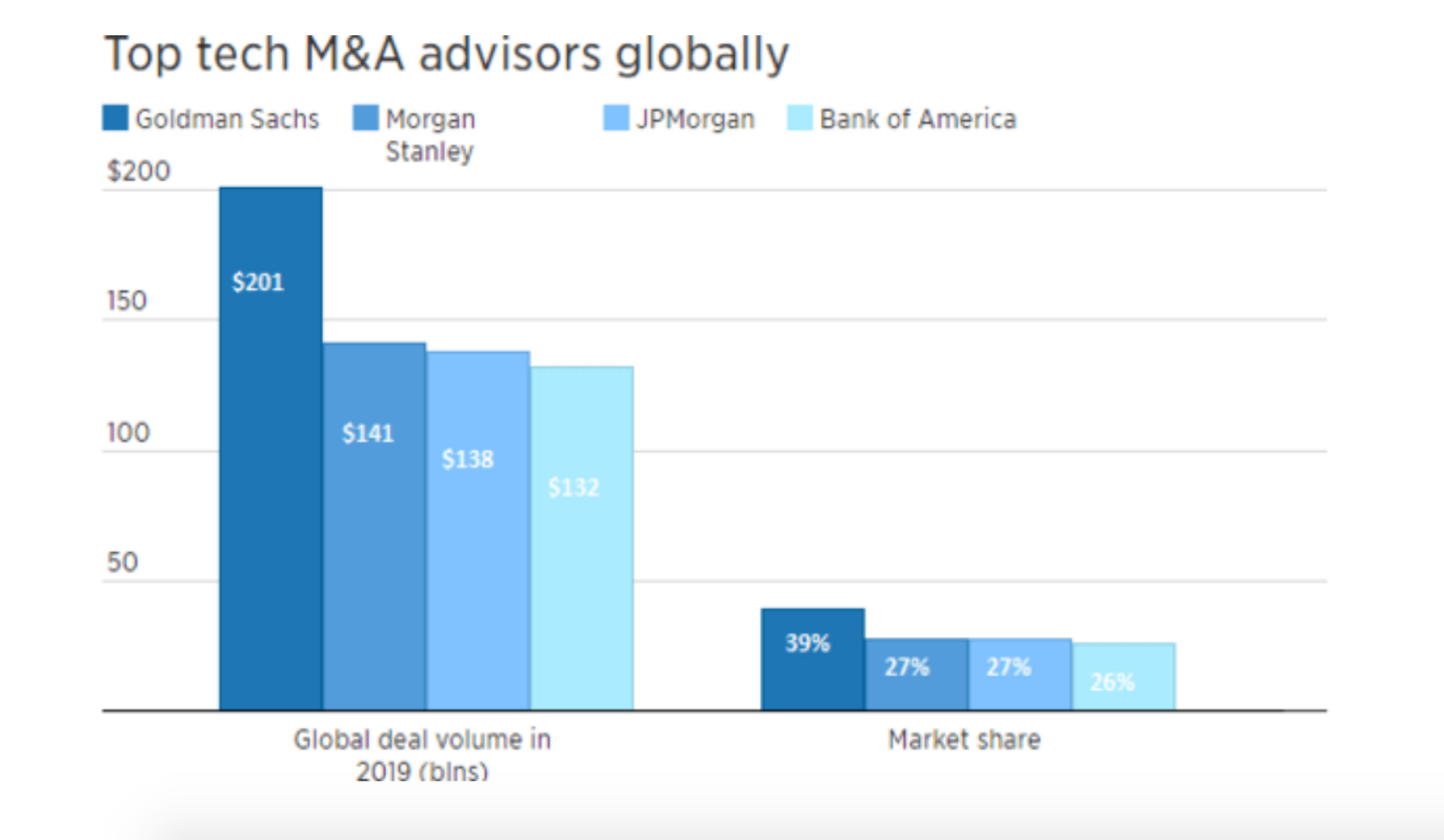

Goldman Sachs took the lion’s share of this year’s M&A transactions in terms of value thanks to its management of three major tech M&As, Alex Sherman writes for CNBC. Dealogic data shows that Goldman’s share of the tech M&A market has increased to 39%, taking a 12% lead over rivals Morgan Stanley and J.P. Morgan Chase. The investment bank was tapped to lead Salesforce’s USD 15.7 bn purchase of Tableau Software — this year’s biggest tech acquisition — as well as Ultimate Software’s USD 11 bn acquisition by a consortium of private equity outfits and Broadcom’s USD 10.7 bn acquisition of Symantec’s enterprise business.

Is WeWork’s IPO doomed to flop? Communal workspace WeWork’s planned IPO next month is “the most ridiculous IPO of 2019,” New Constructs Investment Analyst Sam McBride tells Yahoo Finance. According to McBride, WeWork has positioned itself as a tech company but is really no more than “a brick-and-mortar leasing business.” And as companies are beginning to face economic headwinds, one of the first cost-cutting measures they are likely to take is to lay off employees and cut down on office space — including coworking spaces offered through WeWork. Investors are already somewhat bearish on the company, which reported USD 900 mn in losses in 1H2019 and is now looking to raise some USD 3.5 bn when it goes public in September.

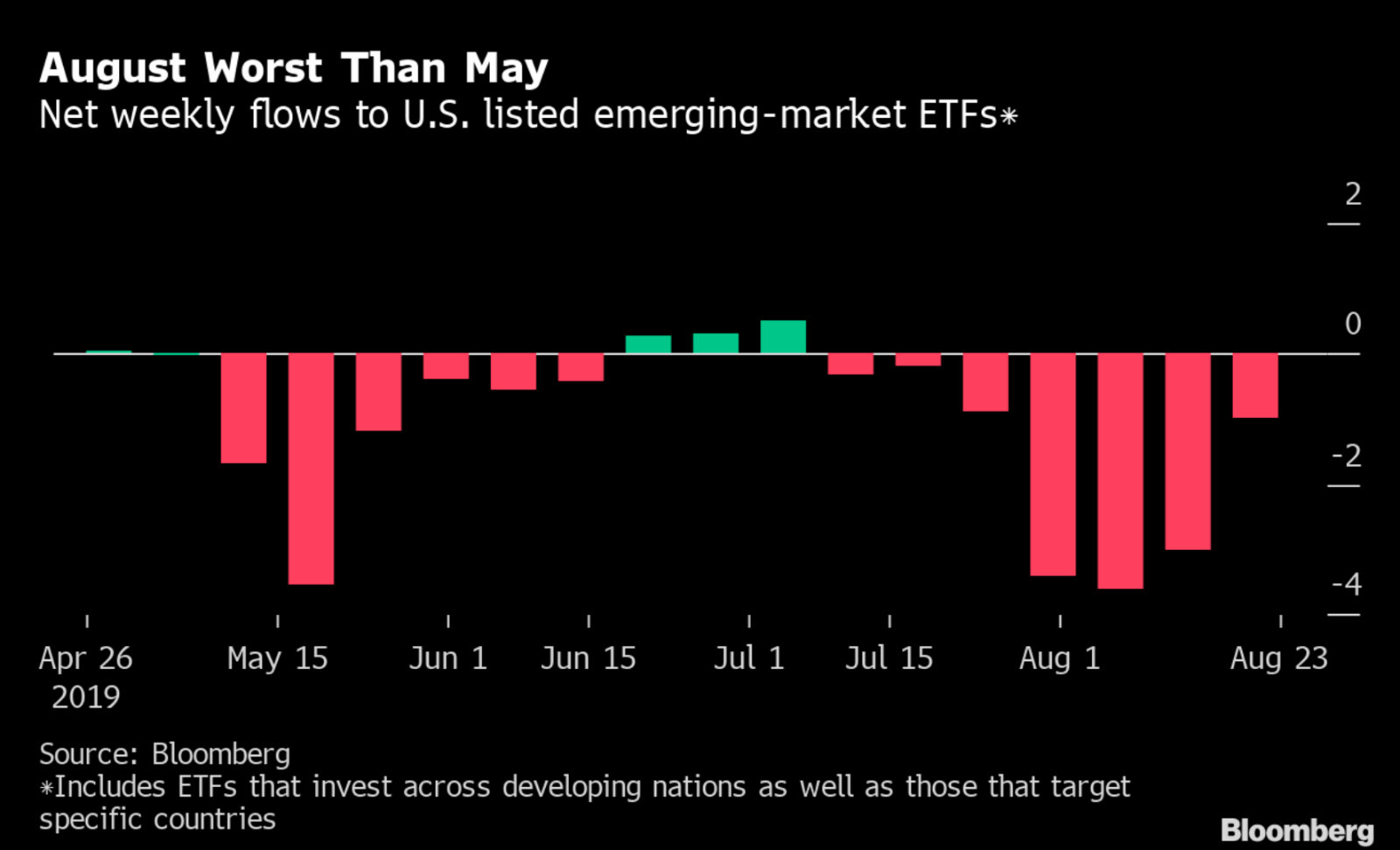

Yearly gains on EM ETFs have almost evaporated as trade fears bite: Gains made by EM ETFs this year have been all but wiped out after outflows extended into a seventh consecutive week, according to Bloomberg data. Investors withdrew USD 972.3 mn from US-listed ETFs last week, meaning net inflow now stands at just USD 109.9 nm for the year. Equity ETFs were responsible for the selloff, with the iShares MSCI EM ETF losing USD 556 mn. Bond funds meanwhile saw small inflows. The market has now lost USD 12.3 bn over the past seven weeks, substantially higher than the USD 7.8 bn loss during the six-week sell-off during May and June.

The weakening lira: A bad omen for EM currencies? The Turkish lira weakened against the USD on Monday “as Japanese investors cut risk assets” over concerns of the escalating US-China trade war, according to Reuters. The latest installment in the US-China soap opera pushed investors towards safe haven investments such as sovereign bonds and gold, and away from EMs such as Turkey. The rising tension “means that EM FX will continue to weaken for the foreseeable future. In the absence of a thawing in trade frictions it remains a market to be structurally short EM and buy USD on any dip,” according to currency analysts at Societe Generale.

Is Big Tech losing its luster? The likes of Facebook and Google, once seen as the pinnacle of cool for talented young creatives, are increasingly being run as “state-like global bureaucracies,” the Financial Times says. And with an increase in high-profile cases that call their ethics into question (ahem, Cambridge Analytica), a lack of diversity, and the very real costs of a burnout-heavy work culture, more prospective employees are now eschewing the high salaries and Big Tech dreams.

And employee activism is rising: An increasing number of employees in the sector are protesting against the ugly side of Big Tech, the AP reports. Workers Amazon, Microsoft and Salesforce are mounting campaigns against industry ties to the US military and border security, while Google employees have protested against the company’s complicity with Chinese censorship.

Sawiris wants to get in on Egyptian mining: Naguib Sawiris told Reuters yesterday that the new Mineral Resources Act may persuade him to invest in Egypt’s gold and copper mining industries once the details of the legislation have been revealed. “We’re waiting for the details of the law. They issue a law and then the devil is in the details. Once this is done, we intend to look for gold and copper,” he said. El Sisi ratified the legislation last week.

We will apparently find out who will be taking the helm of the national football team today, according to Ahram Online. After several foreign coaches proved disappointing, the Egyptian Football Association is set on tapping an Egyptian for the top job, EFA interim head Amr El Ganaini said yesterday.

Enterprise+: Last Night’s Talk Shows

It was a quiet night on the airwaves yesterday, with President Abdel Fattah El Sisi’s meetings with Trump and Boris Johnson on the sidelines of the G7 summit meriting only a brief mention by Masaa DMC’s Eman Hosary (watch, runtime: 00:21). The president mainly focused on exploring solutions to Africa’s challenges, fighting terrorism and climate change during his France visit, she noted (watch, runtime: 00:39).

Egypt officially joined the Metz Charter on Biodiversity during the summit, Hosary said (watch, runtime: 00:36). The charter aims to promote the implementation of the three Rio conventions on climate, desertification and biological diversity. Africa is the continent most impacted by climate change despite accounting for only a fraction of the world’s emissions, El Sisi reportedly said. We have more on the El Sisi’s visit to the G7 in this morning’s Speed Round, below.

It’s a busy week for El Sisi, who will be meeting with African and Asian businessmen this week on the sidelines of the Tokyo International Conference on African Development (TICAD), El Hekaya’s Amr Adib said (watch, runtime: 02:00). The event is being co-chaired by Egypt and Japan and runs from 28-30 August.

A USD 500 mn agreement signed with India’s LuLu Hypermarket also earned some airtime with Hona Al Asema’s Lama Gebriel (watch, runtime: 00:38). We have more on the agreement in the Speed Round, below.

Speed Round

Speed Round is presented in association with

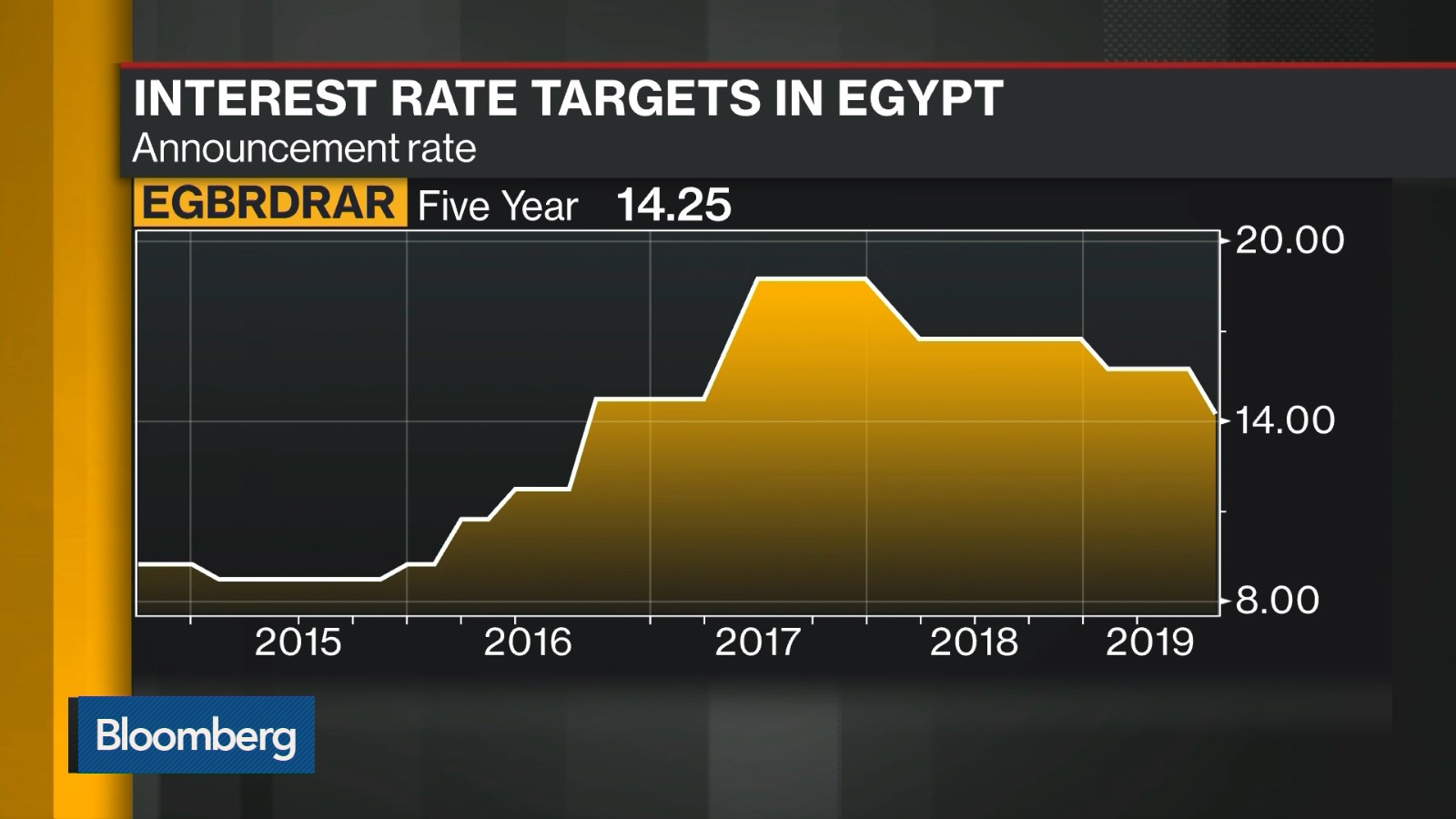

Egypt’s rate cut makes the market even more attractive to investors, says Credit Suisse: The CBE’s interest rate cut last week is making Egypt — already a “fundamentally attractive” market — all the more appealing for institutional investors, Credit Suisse’s Managing Director and Head of MENA equities Ahmed Badr told Bloomberg (watch, runtime: 04:49). Badr singled out companies such as Juhayna and Domty for being particularly attractive investments thanks to the recovery in consumer spending, but noted that real estate is not faring so well, with supply outweighing demand considerably. While it had been expected that the rate cut would make highly leveraged outfits like Palm Hills more attractive to investors, this hasn’t really proven to be the case because of the market dynamics, Badr added.

It may take time for the market to feel the long-term impact of monetary easing: The CBE made the right move with an aggressive rate cut, and is likely to continue its easing cycle, Badr says. But given the global sell-off, which is being driven by stock losses and risk withdrawal from emerging markets on the back of the trade war, the impact of the rate cut has not yet reached the Egyptian market as a whole. “In the long-term…[it’s] definitely positive for many high-leverage names, and for assets. But in the short-term, given what’s happening in the markets now, it’s not really filtering through,” he said.

INVESTMENT WATCH- Egypt signed a USD 500 mn agreement with India’s LuLu Hypermarket on Monday for four new retail outlets in Sixth of October City, New Cairo, and Obour City, the cabinet said in a statement. The company is also planning to build two logistics centers from which it will be targeting exports, particularly frozen fish, to markets in the GCC and Europe, the cabinet previously said.

Advisers: Arab Legal Consultants acted as counsel on the transaction.

DISPUTE WATCH- Health Ministry permanently suspends El Ezaby, Roshdy from pharmacy registry: A Health Ministry body has permanently removed pharmacists Ahmed El Ezaby and Hatem Roshdy from its registry over licensing-related breaches, Al Shorouk reported. The ministry’s Central Administration for Free Treatment and Licensing (CAFTL) has reportedly notified the Pharmacists Syndicate of its decision to suspend the two pharmacists. A number of other pharmacists have also been removed for one year.

Licensing-related breaches: A court ruling earlier this year ordered that El Ezaby and Roshdy be removed from the registry after finding them guilty of illegally buying the commercial names of 14 and 11 other pharmacists, respectively. This allowed them to open more than one pharmacy in a breach of the law. A Cairo court in 2017 ordered that an El Ezaby branch be shut down following a lawsuit brought by the Pharmacists Syndicate which alleged that the company had violated licensing regulations.

El Ezaby says decision is not valid: El Ezaby, who heads the Pharma Cosmetics & Appliances Chamber, told AMAY yesterday the decision was “illegal”. The owner of the locally recognized brand said that the CAFTL does not have the legal authority to take the decision, which he said should fall under the authority of the Central Administration for Pharma Affairs. El Ezaby said that he is in talks with the ministry to resolve the issue.

Business as usual: Most of the pharmacies affiliated with El Ezaby and Roshdy will continue to operate as normal,saida source from the Federation of Egyptian Chambers of Commerce (FEDCOC)’s pharma division. Only the two pharmacies to which El Ezaby has licenses were ordered shut down while 150 other branches, which are under his brand but not license, are still operating normally, the source said. El Ezaby could pass on the license to another pharmacist to ensure the two branches remain open. The same applies to Roshdy’s 70 branches, the source said.

LEGISLATION WATCH- Parliament to review Data Protection Act in October: A draft of the Data Protection Act will be presented to the House of Representatives in October, Mohamed Hegazy, the head of the Communication Ministry’s legislation committee, told Al Mal. The legislation would introduce minimum one-year prison terms and fines ranging between EGP 100k and EGP 1 mn for anyone who illegally collects, trades, or discloses users’ personal data. Global tech companies have been lobbying the House to replace prison terms with fines, warning that severe punishment could scare investors.

Background: The 54-article legislation lays out the ground rules for how businesses use personal information collected online. The bill, which was initially expected to be presented to parliament last year, guarantees users’ right to access their private data at any time as well as give them the right to take legal action against parties responsible for data breaches and misuses of private information. The legislation also stipulates that a unit to protect personal data be established under the Information Technology Industry Development Agency (ITIDA) whose members shall be selected by the Justice Minister and given powers of arrest.

Warm words between El Sisi and Trump at G7 summit: US President Donald Trump said that Egypt has made “tremendous progress” during talks with President Abdel Fattah El Sisi yesterday, according to a White House statement. The two leaders met for the first time since April on the sidelines of the G7 summit in France to discuss trade, efforts to combat terrorism and solutions to the conflicts in Libya and Syria, an Ittihadiya statement said. “Egypt has made tremendous progress under a great leader’s leadership,” Trump said ahead of the talks. “[El Sisi] is a very tough man, I will tell you that. But he’s also a good man, and he’s done a fantastic job in Egypt.” El Sisi wrote on social media following the meeting that the talks “entrenched the strength and depth” of US-Egyptian ties.

Kushner’s Mideast peace plan coming soon? El Sisi and Trump also discussed the situation in Palestine, the statement says, without providing any further details. Trump told the press ahead of the meeting that his long-awaited Mideast peace plan may be revealed by the Israeli elections in September, the Jerusalem Post reported. El Sisi, Foreign Minister Sameh Shoukry, and intelligence chief Abbas Kamel had met earlier this month with White House advisor Jared Kushner to discuss the Trump administration’s Israel-Palestine peace plan. Palestinian sources alleged in June that Kushner’s “Peace to Prosperity” plan involves trying to persuade us to give up a chunk of Sinai in order to create a greater Gaza area stretching to El Arish.

El Sisi holds talks with Macron, Johnson: El Sisi discussed economic ties, counterterrorism and regional issues with British Prime Minister Boris Johnson and French President Emmanuel Macron at the summit. The president raised the Middle East peace process and efforts to contain illegal immigration with Macron, and talked tourism with Johnson, presumably as it pertains to the resumption of British flights to Sharm El Sheikh.

EARNINGS WATCH- Elsewedy Electric’s net profit dropped 2.6% y-o-y in 2Q2019 to EGP 957.8 mn, down from EGP 983.8 mn during the same period last year, the company said in its earnings release (pdf). Revenues increased 2.1% to EGP 10.3 bn, which the company says was driven primarily by its turnkey projects segment. “Elsewedy Electric is well on its way to meeting the strategic objectives management has laid out for the year,” CEO Ahmed El Sewedy said. “Driven by our dynamic turnkey segment, Elsewedy’s top line has continued to display solid growth, registering an expansion of 7% year-on-year to record EGP 21.6 bn during the first half of the year.”

MOVES- Ahmed El Bassiouny named CBE sub-governor for economic research: Ahmed El Bassiouny (LinkedIn) has been appointed as sub-governor of the economic research at the Central Bank of Egypt (CBE). El Bassiouny succeeds Naglaa El Nozahy, who is currently the governor’s advisor on African affairs, Middle East News Agency reported. El Bassiouny will also maintain his position as sub-governor of the monetary policy sector.

Correction : 27/08/2019

A previous version of this article incorrectly stated El Bassiouny’s new title as head of the economic research division, rather than sub-governor of the division.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

Countries across Africa have the potential to “leapfrog” the Fourth Industrial Revolution, with their “strong economic growth, increasing regional economic integration and diversification and young entrepreneurial demographic,” Dow Chemical’s president of sub-Saharan Africa Craig Arnold writes for the World Economic Forum. The key to this growth, Arnold says, is doubling down on boosting manufacturing by creating an attractive investment climate and carefully crafting public policy that can support industry. That includes good governance, a regulatory environment that helps rather than hampers investment, and a legislative framework that protects investors.

But it’s not just any manufacturing: Arnold says that African countries need to focus on “advanced manufacturing” as opposed to “sub-optimal scale manufacturing.” This means the development of a high value-added industrial base capable of supplying the world with cutting edge technologies. How do we do this? By sourcing cheap and reliable energy supplies, increasing trade, investing in education and training, building efficient relationships between public and private sectors, and optimizing the usage of resources, he says.

Egypt in the News

Coinciding with the El Sisi-Trump meeting at the G7 yesterday, human rights are once again getting attention in the foreign press: The Wall Street Journal’s Gerald Seib looks at the number of US citizens currently detained in Egypt, and asks why Trump hasn’t used his influence to secure their release. The Trump administration has had successes in freeing people in the past, but Seib says they have had a “limited impact” as more are detained after.

Syrians face renewed hostility: Syrians living in Egypt are concerned that the government will place harsher restrictions on their businesses after a popular Syrian restaurant in Alexandria was closed for “health code violations”, Al-Monitor reports. ِِِA video of the restaurant owner prompted a hostile social media campaign calling for the expulsion of Syrians, two months after lawyer Samir Sabry stoked fears of a “Syrian takeover” and called for tighter controls on Syrian businesses.

Other stories getting attention in the press:

- At Kabab Café in New York’s Little Egypt, improvisation and originality are the name of the game. Craving some cow-foot stew, lamb brain, camel, crocodile, or ostrich meat, or some spicy alpaca sausage? All are on the table, courtesy of chef and owner Ali El Sayed, the New Yorker reports.

- The Economist says that Egyptians are feeling nostalgic for the Mubarak era, which the magazine says was “less awful” than the country’s current climate.

- Egypt has been flagged as the top high-risk location for British holidaymakers to get food poisoning, with 95% of travel illness claims from British tourists coming after a trip to Hurghada, the Lancashire Post reports. It’s safe to say this is not a list we actually wanted to top.

Worth Listening

It’s the story of space travel, but not as we know it, Jim. A group of women who trained in secret to become astronauts in 1961 narrowly missed out on going into space because of gender bias. The Mercury 13, female aviators who took the same grueling physical endurance tests as their male counterparts — and in some cases, outperformed them — are only now becoming known for their role in the first US human spaceflight program. After the private funding that had financed them was cut in 1962, members of the Mercury 13 pushed for a government sub-committee hearing in the hope of forcing NASA to start admitting women, but they were ultimately unsuccessful. One male astronaut from the Mercury Seven even testified that it “went against the social order” to have women in space.

The largely untold contribution of women to our early space history — through their work as engineers, in the control room, and as astronauts — is the theme of this episode of the When Women Win podcast. Science journalist Sue Nelson and Rana Nawas have a chat about why sidelining female talent is to the ultimate detriment of science and technology (listen, runtime: 34:04).

Diplomacy + Foreign Trade

Egypt’s exports of chemicals decreased 10% in 1H2019 y-o-y to USD 2.4 bn from USD 2.7 bn in 2018 due to the delay of export subsidies and the low participation of companies in international exhibitions, Chemical & Fertilizers Export Council executive manager Walid Azzab said, according to AMAY. The government last month announced a new EGP 6 bn per year export subsidy framework.

Energy

BP to drill new wells in Atoll, Katameya fields in Nile Delta

BP is preparing to drill two new wells in the Atoll and Katameya natural gas fields in its North Damietta offshore concession in the Nile Delta, according to an Oil Ministry statement. The drilling work will cost USD 280 mn. The Atoll field is expected to produce 100 mcf/d of gas when it comes online in 4Q2020, while the Katameya field will produce 60 mcf/d of gas from 2Q2020.

Shell to drill Montu well at West Delta concession this month

Shell is set to begin drilling at the Montu well in its West Delta deep marine concession in the Mediterranean Sea this month, the company said in a statement (pdf). The Discoverer India drillship will drill 6k meters below the water’s surface, setting a new record as the deepest well in Egypt. The well is estimated to have a reserve of 4.7 tcf of natural gas and will take five months to drill.

Egypt in talks with Huawei to transition to a smart grid

Electricity Minister Mohamed Shaker met yesterday with Huawei’s regional corporate head, Michael Li, to discuss the ministry’s plans to transition to a smart electricity grid, according to Al Masry Al Youm.

Basic Materials + Commodities

Obourland to begin operating new farm by the end of 2020

Cheesemaker Obourland is planning to begin operations at its new cow farm by the end of 2020 to help reduce the cost of buying raw milk, Investor Relations Manager Ramy El Ghazaly told the local press. The farm is initially set to produce 10 tonnes of milk per day, with production expected to increase to 50 tonnes per day in two years’ time.

Real Estate + Housing

ORA Developers plans to invest up to EGP 5 bn in ZED project in 2019 and 2020

ORA Developers is planning to invest between EGP 4-5 bn in its ZED project west of Cairo in 2019 and 2020, CEO Haitham Mohamed told Reuters’ Arabic service. The company is also looking to buy 850 feddans in the North Coast.

Automotive + Transportation

Egypt, World Bank looking into setting up cargo railway between Alexandria, Sixth October dry port

Transport Minister Kamel El Wazir met on Sunday with a World Bank delegation to discuss a potential cargo railway line connecting Alexandria with the Sixth of October dry port, according to a ministry statement. El Wazir tapped the Egyptian National Railways to conduct a feasibility study on the line. The USD 100 mn dry port has yet to be constructed.

Egypt and China talk collaboration in plans to build electric car factory

Public Enterprises Minister Hisham Tawfik discussed with Chinese Ambassador to Cairo Liao Liqiang incentives the government will offer to partners in the joint project between China and El Nasr Automotive to set up an electric car factory, the ministry said in a statement (pdf), without providing further details. The ministry signed last month an agreement with an unnamed Chinese auto company to establish the factory, and is expected to sign the partnership MoU soon. Tawfik will travel to China next month to meet with auto manufacturers and visit their factories.

On Your Way Out

Food security startup Proteinea wins first place in Changelabs accelerator cycle: Proteinea, an Egyptian startup that provides food security and agriculture services, won first place in startup accelerator Changelabs’ first cycle, Al Mal reports. The startup was awarded EGP 1.5 mn from Blom Bank and the Dutch Development Bank (FMO).

The Environment Ministry is slapping fees on the use of Egypt’s “natural reserves,” including beaches, according to Egypt Today. According to the ministerial decision, Egyptians will be required to pay a EGP 25 “entrance fee” for any area that falls under the “natural reserves” category, while foreigners will be required to pay USD 5 during the daytime and USD 10 in the evening. It remains unclear whether these fees are applicable to privately owned beaches.

Egyptian college student Nancy Awad is offering female orphans in Egypt digital literacy classes with her initiative, Benat Seshat, according to StepFeed. Awad tells Stepfeed the initiative is meant to give the girls and women a concrete skill that will better equip them for the workforce. Benat Seshat’s pilot program brought together 40 young women aged 13-40.

The Market Yesterday

EGP / USD CBE market average: Buy 16.47 | Sell 16.61

EGP / USD at CIB: Buy 16.48 | Sell 16.58

EGP / USD at NBE: Buy 16.50 | Sell 16.60

EGX30 (Monday): 14,291 (-0.4%)

Turnover: EGP 787 mn (32% above the 90-day average)

EGX 30 year-to-date: +9.6%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.4%. CIB, the index’s heaviest constituent, ended down 0.3%. EGX30’s top performing constituents were Abu Dhabi Islamic Bank up 5.1%, Heliopolis Housing up 2.4%, and CIRA up 2.2%. Yesterday’s worst performing stocks were Ezz Steel down 4.6%, Palm Hills down 3.3% and Sidi Kerir Petrochemicals down 2.6%. The market turnover was EGP 787 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -44.5 mn

Regional: Net long | EGP +18.6 mn

Domestic: Net long | EGP +26.0 mn

Retail: 59.9% of total trades | 68.4% of buyers | 51.4% of sellers

Institutions: 40.1% of total trades | 31.6% of buyers | 48.6% of sellers

WTI: USD 53.94 (+0.56%)

Brent: USD 59.01 (+0.53%)

Natural Gas (Nymex, futures prices) USD 2.23 MMBtu, (-0.04%, September 2019 contract)

Gold: USD 1,536.00 / troy ounce (-0.08%)

TASI: 8,257.86 (+0.20%) (YTD: +5.51%)

ADX: 4,997.22 (+0.58%) (YTD: +1.67%)

DFM: 2,729.04 (+0.49%) (YTD: +7.88%)

KSE Premier Market: 6,527.49 (+0.48%)

QE: 9,787.77 (+0.30%) (YTD: -4.96%)

MSM: 3,927.08 (-1.33%) (YTD: -9.17%)

BB: 1,530.75 (-0.20%) (YTD: +14.47%)

Calendar

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

30 August / 1 September (Saturday or Sunday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8 September (Sunday): The Supreme Administrative Court has postponed appeals filed by the State Lawsuits Authority and a number of companies to bring back the now-canceled 15% import duty on iron billets after two judges resigned from the panel, Mubasher reported

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9 September (Monday): Japan Arab Economic Forum, Nile Ritz Carlton, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17 September (Tuesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.