- FinMin looks to issue callable bonds amid expectations of interest rate cuts. (Speed Round)

- Prime Holding completes due diligence on Pharos brokerage, investment banking arms. (Speed Round)

- Elsewedy, Scatec Solar launch new Benban solar plants. (Speed Round)

- Up to 80% of Suez Canal CDs to be reinvested in September: Sources. (Speed Round)

- EMs consider “diaspora bonds” to finance economic growth. (The Macro Picture)

- US markets give us a break from the doom and gloom. (What We’re Tracking Today)

- Shoukry discusses Libyan conflict with US Secretary of State Pompeo. (Diplomacy + Foreign Trade)

- It turns out blackface isn’t funny. (Egypt in the News)

- The Market Yesterday

Tuesday, 20 August 2019

FinMin to issue callable bonds.

TL;DR

What We’re Tracking Today

We’re just two days away from the Central Bank of Egypt’s Monetary Policy Committee meeting. The general consensus among economists we polled in our survey this week is that the MPC will push ahead with the first rate cut since February, with most anticipating a 100 bps cut.

Naeem Holdings’ Yara El Kahky is among those who see the MPC keeping rates on hold for now. “We are adopting a conservative point of view that they want to assure that any inflationary pressures are contained in the August reading,” she said. Naeem expects the MPC to make 100-300 bps worth of rate cuts between September and December.

The Central Bank of Egypt sold EUR 610 mn worth of one-year euro-denominated treasury bills yesterday, according to official data. The t-bills were sold at an average yield of 1.49%.

A delegation from the World Bank is in town today to visit several Egyptian ports to take note of the ports’ financing needs to improve infrastructure and its naval fleets.

PSA- The Financial Regulatory Authority published a guide (pdf) on the rules and regulations governing companies under the Capital Markets Act.

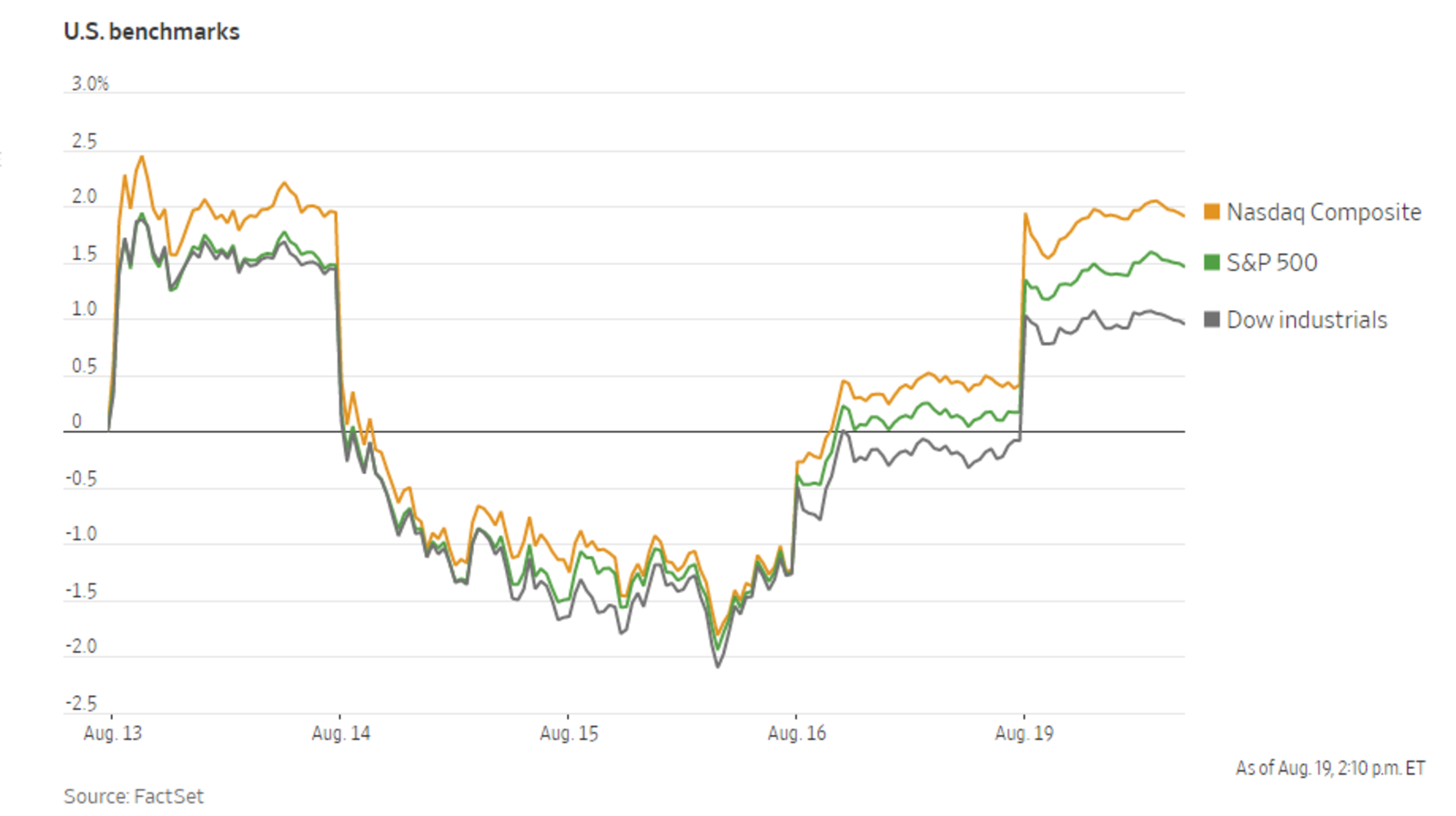

US bank and tech stocks rose at the beginning of the trading week yesterday, helping the Dow Jones, S&P 500, and Nasdaq recoup some of last week’s losses, according to the Wall Street Journal. Shares breathed a sigh of relief as the Trump administration signaled it is working on a new round of trade talks with Beijing, and expectations grow for a rate cut at next month’s Federal Reserve meeting. Bond yields also rebounded from recent lows. The yield on US 10-year bonds rose to 1.598% yesterday from 1.540% Friday.

The continuing strength of the USD looks set to “deepen an emerging markets selloff” and send commodity prices soaring, the WSJ says. The greenback is defying the odds and has kept rising this year, with the USDX up nearly 11% from its 2018 lows. This makes it more expensive for countries to service USD-denominated debt, which stood at USD 6.4 tn at the end of 1Q2019, compared to USD 2.7 tn a decade ago, according to the Institute of International Finance.

German recession likely -Bundesbank: Germany is likely to enter a recession in the third quarter amid a slump in exports and industrial output, the country’s central bank said yesterday. Bundesbank economists wrote in the bank’s monthly update that the economy could continue to decline for the second consecutive quarter in 3Q, warning that there are currently no signs of an end to the industrial slump. “This could also gradually start to weigh on a number of services sectors,” they wrote. Data last week showed that output fell by 0.1% in 2Q.

But the US may be off the hook this time: Strong retail performance, monetary easing, and a robust services sector are all reasons why the US should avoid a recession next year despite the recent equity sell-off and the yield curve inverting, analysts have said, according to CNBC. An inverted yield curve, coupled with slowing global growth, have increased market jitters over a possible recession. But economists note that the fundamentals remain strong, and have cast doubt on the reliability of the yield curve for predicting recessions. “The curve inversion might be more an indicator of extreme market nervousness at present, of increasing central banks action, skewed bond ownership, and of global search for yield, rather than a sure sign that US is about to enter a recession,” JPMorgan equity strategist Mislav Matejka wrote in a note yesterday.

Crude oil futures rose 2.2% to trade above USD 56 a barrel, as a Houthi rebel drone attack on Saudi Arabia’s Shaybah oilfield tapped into market fears over supply risks. Meanwhile, a lull in US-China trade tensions is giving a push to oil and other risk assets, Bloomberg reports.

CEOs look to redefine the purpose of a corporation: CEOs from almost 200 US companies have indicated that the emphasis on shareholder value may be a thing of the past. The Business Roundtable — a pro-business lobbying group comprised of executives from some of the biggest US corporations — pledged in a statement yesterday to “deliver value” to all stakeholders, including employees, suppliers and wider society, rather than just shareholders. “While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all our stakeholders,” the group said, committing to invest in employees, fairly treat suppliers, and protect the environment.

Crypto giant plans to rival Zuck’s Libra: The world’s largest cryptocurrency exchange Binance is planning to compete with Facebook’s Libra by launching its own “regional version of Libra,” Venus, Bloomberg reports, citing a Chinese statement on Binance’s website. The Malta-based company is looking to partner with governments and other key players on its “open blockchain project,” which it says is intended to “empower developed and developing countries to spur new currencies.”

Apple is upping its game in the streaming war: Apple will spend USD 6 bn to produce original TV shows and movies as it looks to compete with Netflix, Amazon, HBO and Disney, sources tell the FT. This is a significant budget increase from the USD 1 bn initially allocated for the company’s foray into TV, but still well below the USD 15 bn Netflix is spending this year. Apple’s TV+ subscription service is set to launch in the next two months, but has not yet revealed details on pricing or content.

Enterprise+: Last Night’s Talk Shows

Gov’t almost ready to push ahead with privatization program: Public Enterprises Minister Hisham Tawfik told El Hekaya’s Amr Adib that the committee in charge of the state’s privatization program has completed 96% of the preparations for state companies due to either sell shares or offer shares in an initial public offering before the end of the year. Banque du Caire is among the companies “on its way to IPO” as part of the second wave of the state’s privatization program, Tawfik added (watch, runtime: 7:02).

The Chamber of Commerce is bullish on gold: Adib also interviewed Ehab Wassef, deputy head of the gold division at the chamber of commerce, for his two cents on where gold prices are headed. “Gold is still a safe investment as its price is expected to rapidly rise,” Wassef said (watch, runtime: 6:05).

The PM’s directive to accelerate work on a new axis project also got some airtime: Al Hayah Al Youm’s Lobna Assal took note of a directive by Prime Minister Moustafa Madbouly to speed up ongoing works at a two-way axis near El-Tawarei Canal linking Gesr El Suez to the Belbeis desert road (watch, runtime: 2:33).

Egypt, EBRD sign grant agreement for railway renovation: The government signed a EUR 1.5 mn agreement with the European Bank for Reconstruction and Development (EBRD) to renovate railway locomotives and develop a railway freight system, Al Hayah Al Youm’s Lobna Assal reported (watch, runtime: 4:22).

Harvard economic report receives coverage: Masaa DMC’s Eman El Hossary reported that Prime Minister Moustafa Madbouly held a cabinet meeting to review the findings of a report by the Harvard Center for International Development (watch, runtime: 2:00). The report forecasts Egypt’s economy to grow at an average 6.8% clip over the coming decade due to diverse and specialized exports.

Speed Round

Speed Round is presented in association with

EXCLUSIVE- FinMin looking to issue callable bonds amid expectations of interest rate cuts: The Finance Ministry has begun amending its plans for its upcoming bond issuances to include the sale of callable local bonds as a means of hedging against fluctuating interest rates, two government sources tell Enterprise. The ministry expects the Central Bank of Egypt (CBE) to resume its monetary easing cycle this year, and is looking to prevent having to pay higher than necessary yields, the sources said.

What exactly are callable bonds? They are simply bonds that allow the issuer (in this case, the government) to recall them if interest rates were to change, and re-issue them with new yields. “If they expect market interest rates to fall, [the issuer] may issue the bond as callable, allowing them to make an early redemption and secure other financings at a lowered rate. The bond’s offering will specify the terms of when [the issuer] may recall the note,” Investopedia explains.

Background: The Finance Ministry is planning to reduce Egypt’s debt-to-GDP ratio to 77.5% by the end of FY2021-2022, from 90.5% at the end of FY2018-2019. This is lower than the previous target the ministry announced in March, which aimed to lower debt to 80% of GDP by 2022. The ministry’s strategy includes diversifying its debt instruments, including returning to zero coupon bonds and moving ahead with its first green bonds issuance. An official told us in April that the ministry plans to issue this fiscal year EGP 7 bn of green bonds, USD 5 bn of eurobonds, and EGP 725 bn of local debt.

M&A WATCH- Prime Holding completes due diligence on Pharos brokerage, investment banking arms: Prime Holding has completed the due diligence process on Pharos Holdings’ securities brokerage and investment banking units ahead of their planned acquisition, Prime said in a bourse filing (pdf). The two companies are now discussing the results of the due diligence and will sign the final acquisition agreement following approval from the Financial Regulatory Authority.

Elsewedy, Scatec Solar begin commercial operations at new Benban solar plants: ElSewedy Electric has reached full commercial operation at two solar energy plants in Aswan’s Benban solar power park, according to a company statement (pdf). The two plants, which cost a combined USD 140 mn project, were built by ElSewedy and Electricite de France (EDF), and partially financed by the European Bank for Reconstruction and Development and the French Development Agency. The plants have a combined production capacity of 290 GWh per year, enough to power more than 140k households.

Scatec Solar has also begun commercial operations at its fourth Benban solar plant with a production capacity of 65 MW, the company said in a statement. Scatec now produces 260 MW from its project in Benban, and expects to complete the remaining two plants over the next couple of months bring total output to 390 MW.

EARNINGS WATCH- ِAmer Group reported net income of EGP 297 mn in 2Q2019, down 16% y-o-y from EGP 354 mn in 2Q2018, the company said in a bourse disclosure (pdf).

Up to 80% of Suez Canal CDs to be reinvested in September -sources: A large majority of Suez Canal certificate of deposits (CDs) holders will reinvest the money into new certificates after they mature on 4 September, analysts and bankers told Reuters’ Arabic service. Mona Moustafa, manager at internet stock trader Arabeya Online, said that up to 80% of CDs may be reinvested, while a small minority might put the money into real estate instead. An anonymous government bank analyst said that this was because of CDs’ appeal among bank customers without investment experience. "The holders of the Suez Canal investment certificates do not have the culture of investing in the stock market and their money is not the size that allows them to invest in real estate, so I expect the funds to enter again," the source said. The Suez Canal Authority raised more than EGP 60 bn in 2014 by offering five-year CDs to Egyptians at a 12% interest rate. The proceeds were used to fund the construction of the new Suez Canal and several new tunnels.

The CBE could take the CDs into consideration when it meets Thursday to review interest rates. “The central bank may resort to stabilization to preserve the source of debt income to the government and to ensure that the Suez Canal funds are not in the hands of the people, which may raise inflation,” Moustafa said.

But it’s a “weak possibility”: Shuaa Securities’ Esraa Ahmed told Enterprise that there’s a chance that the CBE will factor the CDs into their decision-making, but said that it’s a “weak possibility” that it alone will persuade them to leave rates on hold. And the bank analyst said that a rate cut is unlikely to cause CD holders to bail out. “Although interest rates are expected to decline at the next CBE meeting, this will not prevent the investment certificates' beneficiaries from reinvesting in certificates again because saving products are the best and safest place to invest,” they said.

EGX to train investor relations staff at listed public sector companies: The Public Enterprises Ministry signed yesterday an agreement with the Egyptian bourse to train investor relations staff members in EGX-listed public sector companies, the EGX said in a statement. The training program is designed to increase trading activity on these companies and improve the quality of their bourse filings, among other things. Some 56 companies are expected to benefit from the training.

Ministerial committee to improve governance: The Madbouly Cabinet has formed a ministerial committee to improve governance and contracting processes at public sector companies, Public Enterprises Minister Hisham Tawfik said, according to the statement.

MOVES- Elaraby Group CEO Ibrahim Elaraby was elected as the chairman of the Federation of Egyptian Chambers of Commerce on Monday, Hapi Journal reported. Elaraby will head the federation until 2023.

Calling all MBA seekers: Nexford University to offer USD 200k in startup funding to its scholarship graduates: US-based Nexford University is planning to offer USD 200k (EGP 3.3 mn) in startup funding to100 Egyptian BBA and MBA students who earn a scholarship at the university, according to an emailed statement (pdf). The program will see Nexford dole out funding to five scholarship graduates each year. Applications to Nexford’s entrepreneurship scholarship will be open until 15 September.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

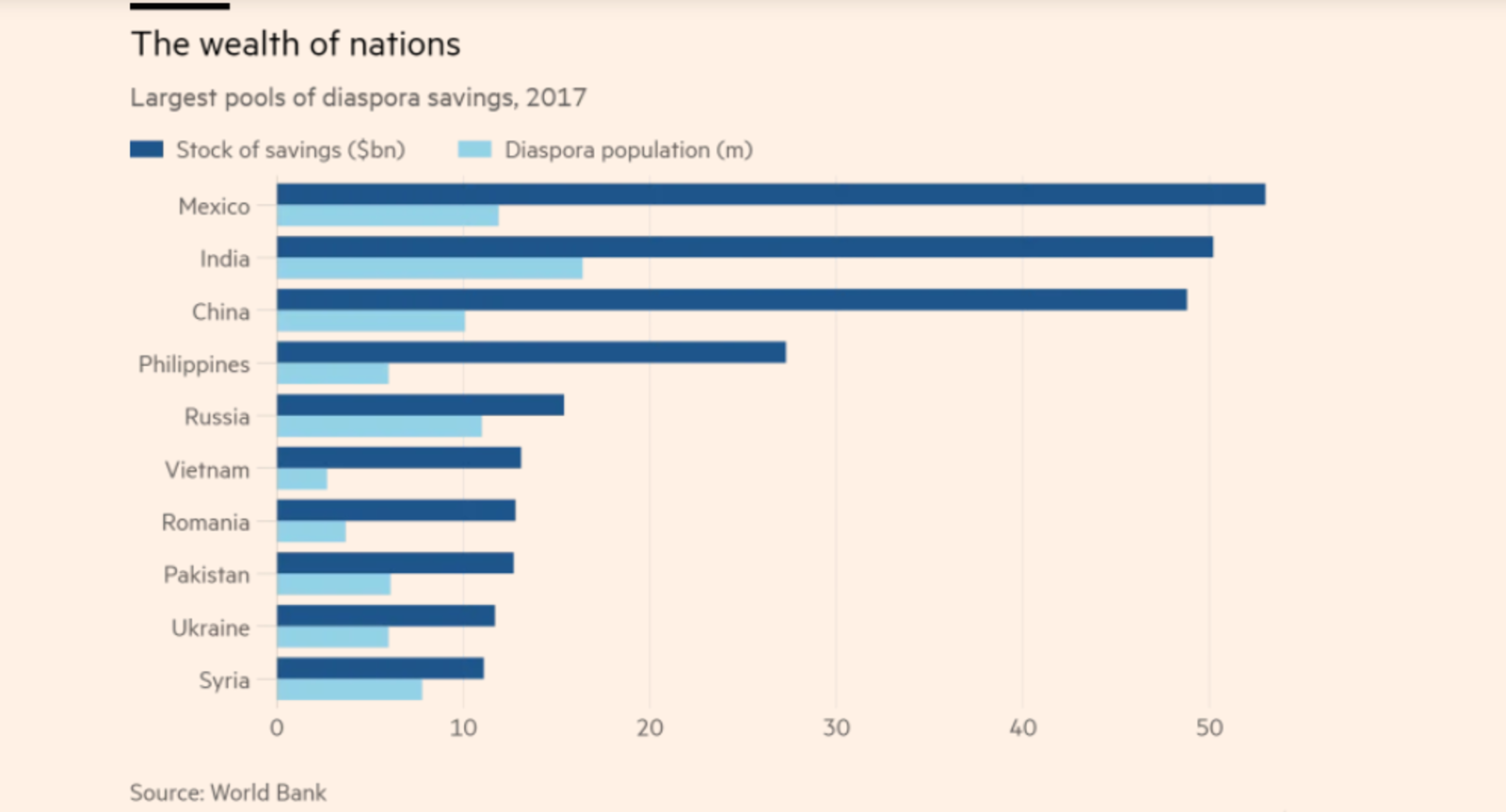

EMs look to lure remittances into “diaspora bonds” to finance economic growth: As emerging markets struggle with historically low FDI, a growing number of countries are looking to convince their expatriate workers to channel their savings and remittances into “diaspora bonds” for productive investment, Steve Johnson writes for the Financial Times. Whereas sending money home to their families is a one-off transaction and many bank deposits in EMs offer low interest rates, diaspora bonds can help migrants save “a significant amount,” according to World Bank economist Dilip Ratha. “The advantages of this approach are, in theory, manifold. With foreign direct investment into emerging markets having fallen to historic lows, bond financing is less volatile than the alternatives of cross-border portfolio flows, bank deposits and bank lending, all of which can be withdrawn at any time,” Johnson says.

So…why aren’t diaspora bonds a huge thing in EMs yet? Cross-border remittances in emerging markets add up to around USD 500 bn each year, but only a small amount of that has successfully made its way to diaspora bonds. Although the likes of India and Israel have benefited from these bond issuances, they remain “a niche part of financial markets.” According to Ratha, the issue is on the supply side: “Investment banks ‘don’t have a lot of appetite for innovation,’ and are happier selling plain vanilla paper, he said. Furthermore, diaspora bonds are classed as ‘retail bonds,’ and so require more regulation than those aimed at professional investors, with higher retailing and marketing costs.”

Image of the Day

Cairo Gossip put out a photo gallery from a few of Egypt’s most prominent photographers in celebration of World Photography Day, which falls on August 19 every year. The photo pictured above was taken in the Western Desert by travel photographer Coucla Refaat.

Egypt in the News

The use of blackface has become common in comedy shows in Egypt and the region, but is coming under increasing criticism, Declan Walsh writes for the New York Times. Walsh notes that several actors, including Egypt’s Shaimaa Seif, have defended their appearance in blackface as “a harmless joke,” but many are calling out these comedy shows for their racism, which frequently targets Sudanese people. “Whatever the intent of such performances, critics say they amplify a tolerance of racism that takes many forms in the Arab world. Slavery was not formally abolished in some Persian Gulf countries until 1970. In many places, the word ‘abeed,’ meaning slaves or servants, is still the racial epithet of choice for dark-skinned people,” Walsh says.

Other headlines worth a brief look include:

- An Egyptian wanted for questioning by the FBI for alleged links to Al Qaeda says he has “nothing to hide,” reports the New York Times.

- Comic theater and climate change: This Bloomberg video explores the theater groups educating Egyptian farmers on the effects of climate change (watch, runtime: 1:51).

Worth Listening

Australia’s first Egyptian-born Muslim female member of parliament Down Under:

Egyptian-Australian Anne Aly’s childhood combined the carefree lifestyle of 1970s Australia with overt and institutionalized racism directed towards her as an immigrant. Later, she studied at AUC alongside enormously privileged classmates, provided for two children as a single parent, and navigated the post-September 11 landscape in Australia, where Muslims were widely demonized.

From academia, to policy, to politics: An academic and policy adviser, she has recently made the shift into politics, becoming the first ever Muslim woman, first Arab, first Egyptian-born and first counter-terrorism expert to take a seat in Australia’s Parliament. In this conversation on Radio Brisbane (listen, runtime: 49:55), she discusses her early experiences of assimilation, the commonalities between violent, radical movements — from white supremacy to Islamist militancy — and why she holds out hope that politics still offers a way to make meaningful change in people’s lives.

Diplomacy + Foreign Trade

Shoukry, Pompeo discuss political solutions to Libyan conflict: Foreign Minister Sameh Shoukry discussed the need to find a political solution to the Libyan conflict with US Secretary of State Mike Pompeo during a phone call yesterday, according to a ministry statement. The State Department said that Shoukry and Pompeo “shared concern over prolonged violence and instability in Libya, and agreed on the need to achieve a political solution” in a statement. The two also talked about tackling the threats posed by Islamic State and Al Qaeda, as well as the Israeli-Palestinian conflict, and the wars in Yemen and Syria.

Egypt is set to sign customs agreements with the US, Belarus, and a number of EU countries, according to a Finance Ministry statement (pdf). The agreements are meant to expedite customs clearance, cut down on customs costs, and improve regulation to increase cross-border trading. The Customs Authority has finalized the draft agreement it will sign with US Customs and Border Protection, and expects to sign its agreement with Belarus next month, the ministry said.

Energy

Idku gas exports fall 25% in August on increased local demand

Natural gas exports from Shell’s Idku terminal have fallen 25% in August compared to July due to an increase in local consumption, an EGAS source told the local press. The facility has exported 450 mcf/d so far this month, down from 600 mcf/day in July. This was driven by an increase in domestic consumption, which has risen to 6.35 bcf/d due to the high temperatures.

Egyptera refuses to renew Italgen’s electricity license for not building wind farm

The Egyptian Electric Utility & Consumer Protection Regulatory Agency (Egyptera) has reportedly refused to renew Italian renewable energy company Italgen’s license to generate and sell electricity, unnamed sources told local press. Sources say that the company failed to build a wind energy facility it had planned to construct. Authorities are now studying the company’s appeal after it provided proof that it had invested in conducting studies for the project.

Acwa Power studying supply bids for 2.25 GW Luxor power plant

Acwa Power is studying bids submitted by Siemens, General Electric and Mitsubishi Electric to supply production units and equipment for its 2.25 GW power plant in Luxor, according to the local press. Sources say the company is aiming for an agreement before the financial closure of the project in 2Q2022. Acwa is developing the USD 2.3 bn power plant in partnership with Hassan Allam, and expects to begin commercial operations by the end of 2022.

Infrastructure

Supply minister breaks ground on EGP 2 bn Upper Egypt logistics zone

Supply Minister Ali El Moselhy broke ground yesterday on the EGP 2 bn logistics zone in Qena, according to Al Mal. The zone is set to be completed over three years and will generate 30k direct and indirect jobs for Qena residents.

Egypt’s ITDA to tender five logistics centers in September

The Internal Trade Development Authority (ITDA) will launch next month tenders to build five logistics centers in Kafr El Sheikh, Suez, El Wadi El Gedeed, Sharkia, and the Red Sea — at an initial investment cost of EGP 14.2 bn, Supply Minister Ali El Moselhy said. The planned centers will span 120 feddans in the Red Sea (developed at a cost of up to EGP 7 bn), 35 feddans in Sharkia (at EGP 3 bn), 30 feddans in Suez (at EGP 2.5-3 bn) and five feddans in Kafr El Sheikh (at EGP 700 mn). The ITDA awarded contracts to Egyptian and foreign investors to develop six similar projects in March. The authority is also in talks with unnamed Greek investors to establish a 10.1k feddan, USD 30 mn project in El Wadi El Gedeed to produce and package dates.

Health + Education

El Nozha Hospital to begin construction on New Cairo project in September

El Nozha International Hospital is planning to begin construction on its new EGP 400 mn branch in New Cairo in September, board member Ahmed El Noury told the local press. The new hospital will have a capacity of 100 beds, with first-phase operations set to begin in 1Q2020.

El Nahda University plans investing EGP 1.5 bn in expansions

El Nahda University in Beni Suef is planning to spend EGP 1.5 bn on constructing four new schools, the University’s president Hossam El Mallahy told Al Mal. It will also purchase new land to accommodate the expansion, which will increase the number of schools at the university to 11.

Real Estate + Housing

Alhokair’s Marakez to break ground on Mansoura mall in December

Alhokair Group’s Marakez Real Estate Investment expects to break ground on its planned mall in Mansoura in December and could invest EGP 5 bn in the project, Internal Trade and Development Authority (ITDA) head Ibrahim El Ashmawy said, according to Mubasher. Marakez had previously said it plans to invest EGP 1.4 bn.

Banking + Finance

AT Lease to launch factoring, SME-focused leasing services in 1Q2020

Al Tawfeek Leasing is planning to begin offering factoring and leasing services for SMEs during 1Q2020, CEO Tarek Fahmy has said. The company had been planning to launch these services before the end of the year.

Law

Ragy Soliman establishes Adsero – Ragy Soliman & Associates law firm

Former Orascom Telecom general counsel Ragy Soliman has set up Adsero – Ragy Soliman & Associates law firm, according to a statement. “The firm will initially focus on transactional work, including M&A, capital markets, financing, structuring, corporate affairs and high-stake commercial litigation” before becoming a full service firm, the statement said.

Egypt Politics + Economics

Court sentences six to death in terror case

A court sentenced six defendants convicted of terror offences to death yesterday, Ahram Online reports. Forty-one other defendants were handed life sentences, seven received 15-year terms, while 14 others were acquitted. The defendants were found guilty of setting up an illegal group known as ‘the popular resistance committee’ in Kerdasa, and killing three people. The story was also picked up by the Associated Press.

On Your Way Out

El Fishawy receives one-month jail sentence: Actor Ahmed El Fishawy was given a one-month prison sentence for failing to pay EGP 234k in child support for his teenage daughter, Egypt Independent reports. El Fishawy’s ex-wife’s, Hend El Hennawy, has been involved in court disputes with him since 2005 over their divorce.

The Market Yesterday

EGP / USD CBE market average: Buy 16.52 | Sell 16.66

EGP / USD at CIB: Buy 16.55 | Sell 16.65

EGP / USD at NBE: Buy 16.52 | Sell 16.62

EGX30 (Monday): 14,304 (-0.7%)

Turnover: EGP 917 mn (57% above the 90-day average)

EGX 30 year-to-date: +9.7%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.7%. CIB, the index’s heaviest constituent, ended down 0.3%. EGX30’s top performing constituents were Heliopolis Housing up 2.4%, Palm Hills up 2.1%, and Orascom Investment Holding up 1.8%. Yesterday’s worst performing stocks were Telecom Egypt down 5.2%, Eastern Co down 2.3% and CIRA down 2.2%. The market turnover was EGP 917 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -108.4 mn

Regional: Net Long | EGP +24.1 mn

Domestic: Net Long | EGP +84.3 mn

Retail: 62.7 of total trades | 65.6% of buyers | 59.8% of sellers

Institutions: 37.3% of total trades | 34.4% of buyers | 40.2% of sellers

WTI: USD 56.21 (+2.44%)

Brent: USD 59.73 (+1.88%)

Natural Gas (Nymex, futures prices) USD 2.20 MMBtu (-0.41%, September 2019 contract)

Gold: USD 1,506.90 / troy ounce (-0.41%)

TASI: 8,565.79 (+0.45%) (YTD: +9.44%)

ADX: 5,027.62 (-0.23%) (YTD: +2.29%)

DFM: 2,790.71 (-0.22%) (YTD: +10.32%)

KSE Premier Market: 6,605.90 (+0.51%)

QE: 9,806.13 (+0.24%) (YTD: -4.79%)

MSM: 3,868.62 (+0.16%) (YTD: -10.53%)

BB: 1,529.32 (-0.07%) (YTD: +14.36%)

Calendar

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

22 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

24 August (Saturday): The Supreme Administrative Court will hear appeals filed by the State Lawsuits Authority and a number of iron and steel companies to bring back the Trade Ministry decision to impose 15% import duty on iron billets. The was postponed from 17 August.

25-27 August (Sunday-Tuesday): G7 Summit, Biarritz, France.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

1 September (Sunday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule into the stock manipulation case, in which Gamal and Alaa Mubarak are involved in along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.