- State banks won’t be able to prop up the EGP for much longer than “a few more months at most,” but don’t expect the EGP to plunge –Capital Economics (Speed Round)

- EBRD has appetite for privatization program, sees Egypt as one of its top two investment destinations in 2019 –Heckman. (Speed Round)

- Pharos Holding signs a global agreement with Exotix Capital. (Speed Round)

- Brace for a busy few days: RiseUp, Africa 2018 Forum, Food Africa Expo, EFG Hermes Egypt Day Summit. (What We’re Tracking Today)

- EDEX 2018 dominates the airwaves on its last day. (Last Night’s Talk Shows)

- WSJ on Egypt’s middle-class squeeze + AP’s defense expo coverage are driving the int’l conversation on Egypt this morning. (Egypt in the News)

- What would it take for decarbonization to take root? (Worth Reading)

- My Morning Routine: Amal Enan, executive director, Egyptian-American Enterprise Fund

- The Market Yesterday

Thursday, 6 December 2018

State banks can’t prop up the EGP much longer, but don’t expect the currency to plunge

TL;DR

What We’re Tracking Today

It’s PMI Day: The Emirates NBD purchasing managers’ index for November is due out at 6:15am CLT. You can download the press release here when it arrives. October’s PMI gauge was largely unchanged from September’s reading.

Sir Suma is back in town: EBRD boss Sir Suma Chakrabarti will launch today the institution’s “Economic Inclusion Policy Dialogue in Egypt” at an event at which Trade Minister Amr Nassar and Education Minister Tarek Shawki are expected.

The fall conference season reaches a crescendo this weekend. Don’t expect a quick resolution: The fun continues well into next week:

Startup-fest RiseUp kicks off on Friday and runs until Sunday at the Greek Campus in downtown Cairo. Click here for the full speaker lineup or here for the conference agenda. RiseUp launched its Startup Manifesto ahead of the gathering, where high-profile attendees include the UK’s Trade Commissioner for Africa, Emma Wade-Smith.

Egyptian government and business leaders will roll out the red carpet for African heads of state and business execs as they gather this weekend at the Africa 2018 Forum in Sharm El Sheikh. The website for the two-day event is here.

Food Africa Expo runs Saturday through Tuesday at the Cairo International Convention & Exhibition Centre. Expect a strong showing by members of Egypt’s Food Export Council, led by our friend Hani Berzi. The gathering’s website is here.

EFG Hermes is hosting its annual Egypt Day Summit this coming Tuesday-Thursday at the Four Seasons Hotel, offering investors the chance to meet face-to-face with Egyptian execs as well as senior government officials. We look forward to seeing many of you at Tuesday’s CEO Dinner.

The top story in global business news this morning is … odd? Canada has arrested Huawei’s global chief financial officer in Vancouver and extradited her to the United States, where she faces charges she violated US trade sanctions against Iran. (Globe & Mail | WSJ | FT | Reuters | Bloomberg)

Asian shares are down this morning across the board and US futures suggest a lower open for Wall Street later today. Reuters says traders are reacting negatively to the Huawei CFO’s arrest, suggesting it is “fanning fears of further tensions between China and the United States.” Global stocks slid in trading yesterday as “optimism around a trade detente between the U.S. and China faded and concerns around growth in the U.S. resurfaced,” the WSJ notes.

OPEC meets today in Vienna. Oil is down slightly this morning after closing lower yesterday in “cautious trading.”

Thaw in the Qatar Smackdown? “Qatar’s emir has received an invitation to attend the Gulf Co-operation Council meeting in Saudi Arabia on Sunday, raising the prospect of a thaw in a damaging spat that has divided the Gulf nations,” the FT’s Simeon Kerr writes from Dubai.

MUST-READ for fintech types: The FT’s Jemima Kelly has an excellent piece out this morning arguing that the light touch regulators from Kuwait, Bahrain and Abu Dhabi to Arizona have taken by establishing fintech “sandboxes” is not necessarily the right move — for the nascent industry, for banking or for consumers and investors. The Alphaville piece requires only registration, not a subscription, to read.

The world’s first “baby transplant?” In the first successful case of its kind, a woman in Brazil who had received a womb transplant from a deceased donor gave birth to a baby girl, Reuters reports. Read again last week’s story about genetically edited babies in China and grimace (at least) at what the future could hold.

Dubai’s first synagogue is moving out of the shadows as regional attitudes towards Israel soften, Bloomberg writes. While some of the three-year-old synagogue’s 150 members are still hesitant to reveal its location or speak openly about its activities, the UAE’s recent tolerant stance has persuaded others to begin opening up about the house of worship.

The most-clicked links in Enterprise this week included:

- Central Bank of Egypt’s announcement that it will terminate its repatriation mechanism (CBE, pdf)

- Egypt scraps discounted customs exchange rate for non-essential imports (Enterprise) + what it could mean (Enterprise)

- Infographic on 13 new rules, reforms and mechanisms the EGX has put in place since September 2017 (EGX, pdf)

- Brown Brothers Harriman’s family business magazine (BBH, pdf)

- For companies, it can be hard to think long term. Here’s a toolkit. (Enterprise)

- Abraaj’s fall from grace prompts investors to sharpen due diligence (FT)

- A worthy critique of how we broke capitalism (Enterprise)

Enterprise+: Last Night’s Talk Shows

EDEX 2018, which came to a close yesterday, remained the star of last night’s talk shows.

Several new products, including Egypt’s first radar, were unveiled at the expo, Military Production Minister Mohamed El Assar said on Al Hayah Al Youm. Preparations will be underway soon for next year’s edition of the event, he said (watch, runtime: 9:34). El Assar also recapped his meetings with officials during the expo with Masaa DMC’s Osama Kamal (watch, runtime: 9:07). Next year’s edition will likely run for five, instead of three, days due to the “overwhelming” positive feedback on this year’s event, head of the Armed Forces’ Arming Authority Tarek Saad Zaghloul told Yahduth fi Masr’s Sherif Amer (watch, runtime: 1:12).

Djibouti has granted Egypt a 1 mn sqm parcel of land on which to build a logistics zone to use as a hub for exports to the rest of Africa, Osama Kamal noted on Masaa DMC (watch, runtime: 5:28).

The Religious Endowments Authority’s EGP 1.037 tn worth of assets were the main topic of conversation for the authority’s chairman, Said Mahrous, on Al Hayah Al Youm (watch, runtime: 4:54).

Historian Ashraf Sabry talked about Egypt’s role in WWI with Masaa DMC’s Osama Kamal (watch, runtime: 7:20).

Speed Round

State-owned banks won’t be able to prop up the EGP for much longer than “a few more months at most,” Capital Economics said in a research notethat suggests the Central Bank of Egypt had been leaning on state banks to mobilize their FX liquidity and thereby avoid agitating the IMF by directly intervening. Even though the EGP has outperformed its emerging market peers, Egypt’s treasury market has seen an outflow of USD 8 bn in recent months. And since April, the yield on 10-year local currency government bonds has jumped by c. 300 bps while the EGX has lost 30% — all of it driven by “a withdrawal of foreign investment.”

Background: Capital Economics had first flagged the possibility the CBE was pushing banks to prop up the EGP, a refrain Reuters picked up last month.

Factoid of the morning: The share of treasury bills held by foreign investors has tumbled from 33% in April to less than 20% now, Capital Economics writes.

How soon is soon? “It’s difficult to know for how long this process could be sustained. At the current rate of depletion, banks would exhaust their FX assets in eight months,” the consultancy said. “Banks’ foreign assets have fallen to 4% of total assets and they could drop to 2.5% of total assets, the level prior to the 2016 devaluation, by early 2019.”

So, what now? The central bank has two options, Capital Economics argues: Allow the pound to weaken or draw down its FX reserves to defend the current rate.

How much could the EGP slip? Not much. “Given the improvement in Egypt’s balance of payments position in recent years and that the pound doesn’t appear to be overvalued, we doubt that the currency would experience a major leg down in this scenario. It would also send a positive signal about policymakers’ commitment to a fully floating exchange rate,” Capital Economics’ Jason Tuvey writes in the note. “Overall, we expect the pound to fall from USD 17.90 at present to USD 19 by the end of next year and to USD 20 by end-2020,” CNBC also breaks down the report.

EXCLUSIVE- Egypt was among the top two recipients of EBRD’s investments worldwide in 2018, Managing Director for the Southern and Eastern Mediterranean Janet Heckman told Enterprise in a recent sit-down. Edited excerpts:

We expect to sign the final contracts for a EUR 148 mn loan for the Kafr El Sheikh Kitchener Drain depollution project at the Africa 2018 Forum, which kicks off on Saturday, 8 December in Sharm El Sheikh. The forum will also see us signing an MoU with Falak, a startup accelerator, to provide technical support and a training program on developing startups and incubators in Egypt. We’re taking a very active role at the forum and will take advantage of the gathering to sign several small private sector transactions.

Overall, we plan to invest some EUR 1.2 bn in Egypt in 2019. We’ve primarily been investing in the transport sector, which is key in making Cairo a more livable city. The EBRD is also keen on green investments, which accounted for around 65% of our projects this year. Our other investments are in local private sector companies that are looking to expand their operations, mostly in Africa. We’re seeing a lot of Egyptian companies, such as Elsewedy Electric, eyeing investments in countries like Ethiopia and Kenya — and finding great success there.

We’ve had an excellent year here in our areas of investment, including infrastructure, renewables, agribusiness, manufacturing, and services. We see that foreign investors, especially from the Gulf, are drawn to Egypt for its big population of 100 mn, growing consumer sector, and variety of trade agreements. Egypt’s reform program has encouraged us to up our investments in the country and we’ve expanded our operations here and will continue to do so as long as the reform momentum is maintained.

Curbing debt, spurring private sector growth are key: The Egyptian government has made extremely difficult decisions. It has not been easy to put in place such an ambitious reform program and follow through with it. Going forward, what’s really critical is tackling debt. We share the same view as the IMF and other international financial institutions that the private sector is really the best way for the state to avoid incurring additional debt. An important factor here is for the CBE to resume its monetary easing cycle; the current interest rates of 16-17% are very demotivating for the private sector.

We are concerned about the state privatization program being put on hold, since it is one of the key sources of financing to plug the EGP 10 bn budget gap. The government has reiterated its commitment to the program, but there remains of question mark on the timing. The program is very important for the EBRD; we see it as a means of increasing private ownership and efficiency.

We remain interested in buying a stake in any of the entities in the program — Banque du Caire is of particular interest.

Pharos expands global reach in tie-up with Exotix: Our friends at Pharos Holding have inked a global agreement with emerging markets specialists Exotix Capital that will allow Exotix’s clients to trade the Egyptian market through Pharos Brokerage and to access the firm’s research products, the firms said in a joint statement (pdf). Pharos and Exotix began working together earlier this year when they inked a chaperone agreement under which Pharos was allowed to meet and trade with clients across the United States. “This growing network should drive both Pharos and Exotix to increase our joint share of international investment flows. As Egypt’s IPO programme recommences in 2019, this relationship also offers the potential to increase the exposure of Egypt’s capital markets to new institutional clients.”

INVESTMENT WATCH- AlGioshy Steel will invest EGP 500 mn to add a second production line at its steel rebar factory in Sixth of October by the end of 2019,CEO Tarek AlGioshy told Reuters on Wednesday, noting that it will not be financed by bank debt thanks to high interest rates. AlGioshy Steel started production of rebar back in January at its EGP 500 mn factory. The company also plans to build an iron ore plant, but has not yet set a date to begin.

Cleopatra Hospitality Group plans to build two holiday resorts in Marsa Matrouh at a cost of c. EGP 10 bn over the next five years, Group Chairman Mohamed Abou El Enein said yesterday. Cleopatra Group will self-finance about one-third of the cost and seek bank finance for the rest. The company is also eyeing new investments in Africa, including Ghana and Guinea, worth USD 100 mn, Abou El Enein said.

Banks say new tax treatment of income from gov’t debt won’t hit 2018 P&L: CIB’s 2018 financial results will not reflect the impact of proposed amendments to the tax treatment of bank income from government debt, it said in an EGX disclosure (pdf). The Federation of Egyptian Banks has recommended that loan loss provisions stay out of the new tax treatment. In a similar EGX disclosure (pdf), QNB also said the amendments would not affect its 2018 results.

REGULATION WATCH- FRA sets framework for sukuk issuers: The Financial Regulatory Authority (FRA)has set the regulatory framework for sukuk issuers — who will operate special purpose vehicles (SPVs) that exclusively issue sukuks, the FRA announced yesterday. The framework outlines regulations for licensing and establishing SPVs, whose activities under the framework will be limited to investing on behalf of sukuk holders who get paid on a profit / loss basis rather than a fixed coupon rate. The issuers are permitted to invest only in sectors compliant with sharia law. The framework also regulates sukuk tenors, investment durations, expected return rates, dividend sharing, and the sukuk exchange and return mechanism. The issuer is also responsible for obtaining credit ratings, asset management, and conducting feasibility studies on an asset.

Those seeking a sukuk issuer license must have a paid-in capital of at least EGP 10 mn, with 50% coming from a single shareholder and 25% from a financial institution. Most board members of a sukuk SPV must have at least three years of experience as finance professionals and must have neither a direct nor indirect stake in the investments of the SPV.

Are you new to sukuks? They are forms of co-ownership and co-investment in cash-generating assets. Because they’re sharia-compliant, they cannot generate income from interest on debt and are therefore ‘asset-based,’ rather than ‘asset-backed.’ The former means that the sukuk holders co-invest their money in partnership with companies (or SPVs) set up for the sole purpose of issuing sukuks. Sukuks were introduced through recently passed amendments to the Capital Markets Act — which also allowed margin trading, futures market, and green bonds.

Gov’t dismisses traders’ claim of delay in letters of credit for wheat shipments: The government has responded to a Reuters report quoting traders who claimed state grain buyer GASC has not issued letters of credit to cover 16 wheat shipments, saying guarantees either have been or would be issued, the news agency reported.

Size matters: Delays have happened before, but this time the combined size of the wheat shipments is massive — 945k tonnes — with shipping dates as far back as last month, the traders said. They said they were not aware of the reason behind the delay, but that GASC had blamed it on the Finance Ministry and said to expect it drag it on until January.

Egypt signs agreements with global companies at EDEX 2018: France’s Naval Group and Egypt’s Marine Industries and Services Organization (MIASO) signed an MOU to establish a JV to maintain and insure the Egyptian navy’s French vessels for five years, the Defense Ministry said. Egypt’s air force also signed agreements with France’s Dassault Aviation to insure its Rafale aircrafts, China National Aero-Technology Import & Export Corporation for unmanned aerial vehicles, and with Italy’s Leonardo for Radar Systems to supply advanced equipment. The value of the agreements were not disclosed.

Egypt in the News

Topping coverage of Egypt in the foreign press was the defense expo, which the AP’s Brian Rohan set in the context of Cairo’s ongoing bid to diversify its weapons procurement program to increase the proportion of non-US hardware it buys. Defense analyst Ben Moores predicts that Egypt will import weapons worth USD 9 bn over the coming decade, making it the world’s seventh-largest market.

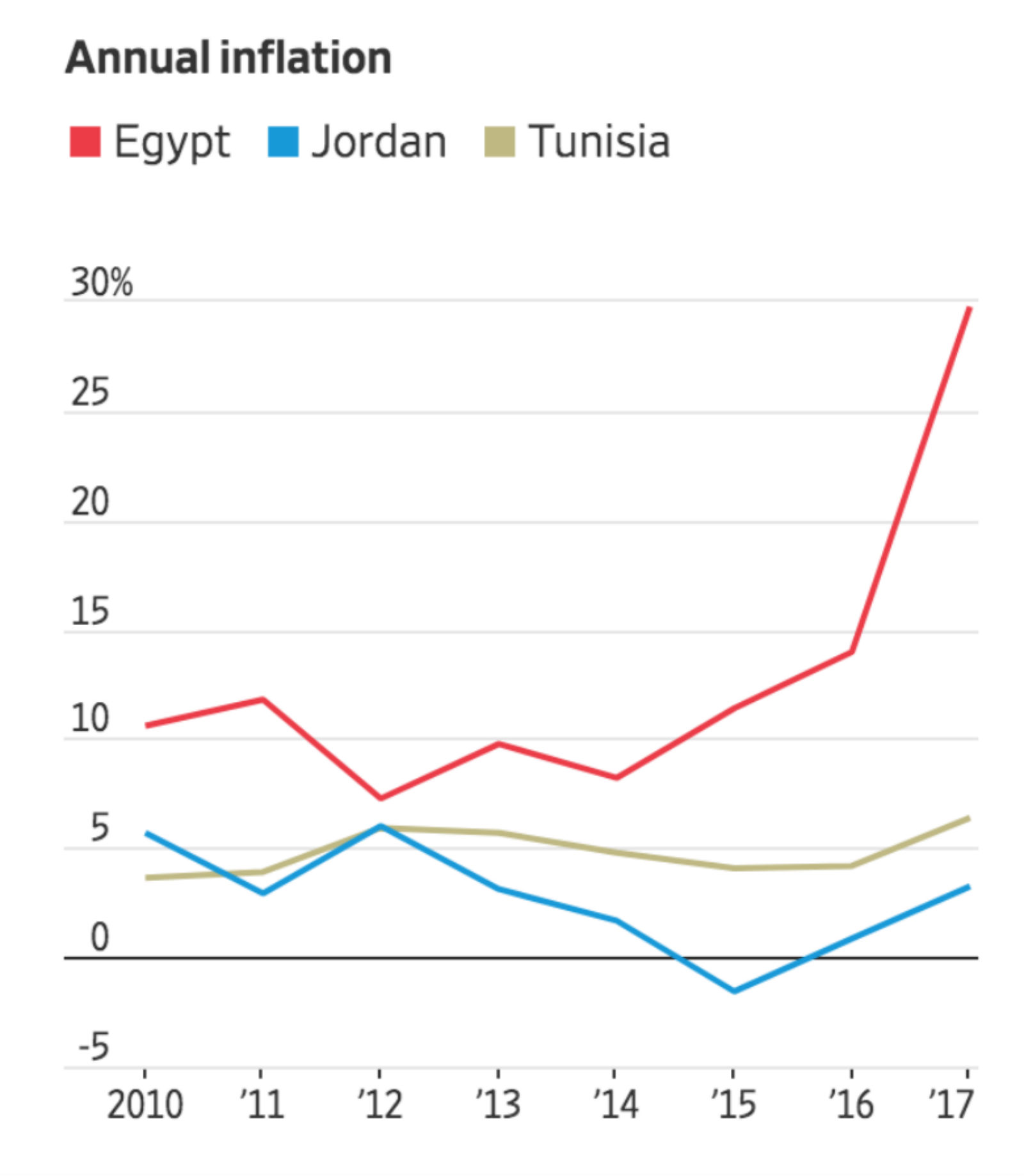

WSJ on our middle-class squeeze: “In Egypt and elsewhere in the Middle East, a wave of austerity is making it harder for many people to make ends meet,” Jared Malsin and Amira El-Fekki say in the Wall Street Journal. Following the standard pattern of stories on the economy immediately following the EGP devaluation in 2016, the vox-pop-based piece offers nothing insightful, beyond noting that Egypt was the hardest hit economically from the relatively stable Arab Spring countries.

Oh Pharrell, let my people go: There was plenty of Ancient Egyptian inspiration during Chanel designer Karl Lagerfeld’s 17th annual “Metiers d’Art” show, the AP noted. The Temple of Dendur (don’t worry: not stolen, but gifted) at the New York Metropolitan Museum was the venue for the extravagant event, where celebrities such as Pharrell Williams were seen walking the runway in attire heavily inspired by the Ancient Egyptian theme. Sadly, we know 3,000-year-old mummies who wore it better.

On The Front Pages

The government is paying attention to the availability of basic commodities and their prices on the market. That’s the message Al Ahram and Al Akhbar are sending readers this morning. Al Ahram and Al Gomhuria also continued to give front-page spots to EDEX 2018, which wrapped up yesterday, and the slew of meetings President Abdel Fattah El Sisi held with foreign officials on the event’s sidelines.

Worth Reading

What would it take for decarbonization to take root? While the use of renewables is on the rise — taking in double the investment for power generation as coal, gas, oil and nuclear combined — the global energy system still derived 85% of its power from fossil fuels, according to the Economist. Combining a massive boost in renewables with nuclear power and fossil fuels with capture and storage (CCS) will go a long way to producing serious amounts of clean electricity.

But can this keep up with the heavy pollutants? For fields like heavy transportation, heating, and industry, where electricity and lithium-ion batteries aren’t useful, decarbonization is a much bigger challenge. In the last year of available data, 2014, those three sectors produced 41% of global carbon dioxide emissions. To keep global warming below 2°C, industry alone will have to cut emissions by 50-80% to 2050. And that’s before we start talking about extracting hundreds of bns of tons of CO2 from the atmosphere through negative emissions.

We need to think beyond a one size fits all solution: Scientists led by Steven Davis at the University of California Irvine have released a report mapping out a net-zero-emissions energy system achieved with technologies available today. These ‘fairly simple and finite tools’ include hydrogen and ammonia, biofuels, synthetic fuels, ccs, and removal of carbon from the atmosphere, as well as electricity and batteries.

Diplomacy + Foreign Trade

Post-Brexit trade between Egypt and the UK kicks into gear: Trade and Industry Minister Amr Nassar discussed post-Brexit economic cooperationwith UK trade envoy Sir Jeffrey Donaldson and UK ambassador to Egypt Sir Geoffrey Adams, according to a ministry statement (pdf). The post-Brexit era will focus on joint projects in manufacturing, education, vocational training, and healthcare in eastern and western African countries. We had heard last month that the two countries are in early talks to seal a post-Brexit trade agreement. UK’s Trade Commissioner for Africa Emma Wade-Smith is arriving today, presumably to take part in the talks.

Ireland and Egypt are approaching a renewal of live trade after Irish Minister of State Pat Breen and Egypt’s Deputy Agriculture Minister Mona Mehrez discussed issues surrounding health certificates for Irish exports, Independent reports. Mehrez said Egypt is willing to consider amending existing health certificates for breeding stock.

Regeni’s lawyer names 20 more Egyptians she suspects in student’s killing: Giulio Regeni’s family’s lawyer announced yesterday she has a list of 20 additional suspects she believes were involved in the student’s murder, according to the Guardian. Attorney Alessandra Ballerini urged the five key suspects to come forward, the AP reports.

Energy

Siemens Gamesa captures 97% of wind energy market in Egypt and 53% in Africa

Siemens Gamesa holds 97% of the wind energy market in Egypt and 53% in Africa, the company said in press release (pdf). Siemens Gamesa has generated 986 MW of wind energy for the country. The firm said its Gabal El Zayt and Zaafarana projects are the largest of their kind in the Egypt, with the latter being the largest wind farm in Africa. Siemens Wind Power and Gamesa Corporation merged back in 2017.

Real Estate + Housing

70% of land in the New Administrative Capital sold

70% of land in the first phase of the New Administrative Capital (or 17,000 feddans) has been sold, the New Administrative Capital’s spokesperson Khaled El Hosseiny said during a press conference, according to Ahram Online. Most of the developers are Egyptian, Hosseiny said, in an attempt to calm criticisms that major contracts have been granted to the Chinese and government entities. The project is mainly funded through private investment in land sales, he added following a flurry of recent rumors that development of phase one is being funded through the state’s budget.

Banking + Finance

valU to extend its services to more online shoppers in Egypt

EFG Hermes Finance’s valU is in talks with six e-commerce companies to extend its payment-on-instalment services to more online shoppers, EFG Finance CEO Walid Hassouna said, according to Al Mal. The company expects items purchased online to account for 10% of next year’s sales. He added that the company was planning to expand to three or four additional governorates other than Cairo, Alexandria, and Hurghada.

Legislation + Policy

Egypt’s parliament wants to participate in drafting Ride Hailing Apps Act

The House of Representatives’ Transportation Committee is looking to have parliament take part in drafting the Ride Hailing Apps Act’s executive regulations, sources familiar with the matter said, according to Al Mal. Despite this not being the official role of parliament, the sources said the move is precautionary to prevent disputes between the various ministries tasked with drafting the regs, especially the Transport, CIT, and investment ministries. The regulations are supposedly due out before year-end.

Egypt Politics + Economics

Mohamed Badie and Khairat El Shater Sentenced to life in prison

A Cairo Criminal Court handed down another life sentence to Ikhwan leader Mohamed Badie, Khairat El Shater, and four other defendants for violence-related charges from 2013, according to Ahram Gate. It is the second time Badie and El Shater are sentenced to life in this case. The Court ruled against them in 2015 but ordered a retrial when new counts were added to the charges. The news came as authorities arrested yesterday Ahmed Suleiman, who served as justice minister under Ikhwan president Mohamed Morsi, on charges of belonging to an illegal group, sources told Reuters.

Sports

Egypt will not bid to host 2019 African Cup of Nations

Egypt will not bid to host the 2019 African Nations Cup as it does not want to compete with Morocco, the Egyptian Football Association said, according to BBC Sport. The Confederation of African Football (CAF) is considering Morocco and South Africa as replacement hosts for the championship after it voted on Friday to strip Cameroon of its hosting rights.

My Morning Routine

My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions because we simply can’t help ourselves. Extracts from our conversation this week with our friend Amal Enan, executive director of the Egyptian-American Enterprise Fund.

Who are you? My name is Amal Enan. 32 years old. I’m the proud wife of a very inspiring and brilliant Egyptian tech entrepreneur, daughter of a superb working mother and doctor who taught me strength, determination and the power of dreaming, and lastly, sister to the most awesome human who is definitely way cooler and a much more energetic go-getter woman working in the entrepreneurship ecosystem. You can say I’m fully invested in supporting women and entrepreneurs just by looking at my family.

What do you do? I’m the executive director of the Egyptian-American Enterprise Fund (EAEF). EAEF is a private investment fund seeded by the US government to invest in Egypt’s thriving private sector. Our mission is to promote job creation, financial inclusion and to improve quality of life in Egypt by backing talented management teams in sectors of high development impact.

What’s your morning routine? You’ll laugh — mine is a little different from the morning routines featured here so far. I wake up at 6am and make a point of not checking my phone first thing in the morning; on most days it works. I meditate every morning for 20 minutes, no matter what. For me, leaving the house without meditating is like leaving the house without brushing my teeth. It’s a non-negotiable commitment. The practice helps me stay grounded throughout my day, less reactive and a better listener. Next, I sit and write three full pages of unscripted writing. It’s something I learned from The Artist’s Way, a book on reviving our inner creativity. I really enjoy my morning writing; it helps me clear my head and be more connected with my true intentions and purpose. I spend a few more minutes thinking of things I am grateful for and running through things I want to accomplish today while sipping on a cup of hot water with a slice of lemon. I’m not “good” for much longer — before you know it, it’s 7am and I’m reaching for my coffee and getting up to speed on email and Instagram!

What does the rest of your day look like? I aim to leave my place by 7:30am to catch a morning workout class at my favorite spots or do yoga at home. I never leave the house without sunscreen. To keep my commute interesting, I’m always listening to an audiobook or podcast. It absolutely absorbs me and I tune out all the traffic. I’m currently listening to Michelle Obama’s ‘Becoming’ and think it’s fascinating I get to hear a former First Lady speak to me while I navigate Cairo. Some of my favorite podcasts include ‘How I Built This,’ ‘Hidden Brain,’ ‘Stuff You Should Know,’ and ‘The Art of Charm.’ It’s also when I catch up on Enterprise and TheSkimm to stay current on world affairs.

For the rest of the day I’m either meeting with our current investment companies and portfolio managers or meeting with new potential partners and promising potential investments. Otherwise, I’m hunched over my computer at the office firing emails and memos to get things moving. My favorite time is when we pose the question, “What are we going to eat today?” I really love lunch with colleagues and sharing random insights on this or that. I like to be home by 7pm to have dinner with my husband and talk about our day. I’m in bed by 10pm — not so fun, but I need my 8 hours of beauty sleep.

What’s the best thing you’ve watched / read lately? That’s a tough one — I just finished ‘Educated,’ and recently enjoyed reading ‘Homegoing’ and ‘CommonWealth.’ Nothing really beats Harry Potter or childhood detective stories — I was a big Agatha Christie fan growing up. As for non-fiction, I’m reading Homo Deus. I also recently enjoyed reading and/or listening to ‘Shoe Dog’ and ‘Daring Greatly.’ A lot of my movie-watching happens on flights or Netflix binging with my husband but I went to see ‘Yommedine’ in the theater and was in awe. I really like documentaries, especially those on strong women. I loved watching ‘RBG,’ ‘Being Serena,’ and ‘Looking for Oum Kalthoum.’

What’s the origin story of EAEF? Enterprise Funds were first pioneered in Eastern Europe way back in the 1990s before the model made its way to Egypt. Following the fall of the Berlin Wall and liberalization of a number of economies in Eastern Europe, the US government established Enterprise Funds to support those economies during their transition and strengthen their private sector. Fast forward to 2011, after the Arab Spring, the US revived the model and established two funds: one for Egypt and one for Tunisia to support their economies during the post-2011 economic turbulence.

What’s EAEF’s niche? Impact. EAEF is a private entity governed by a board of directors, all of whom have international private sector experience and leverage their expertise and network to advance Egypt’s investment potential. The chairman of EAEF, James Harmon, was the former chairman of the Ex-Im Bank and an active emerging markets investor. We are a small team and we rely predominantly on enabling and working through local fund managers with presence on the ground. Our real niche is social impact; we are a long-term investor with a strong commitment to our development mission and that is a quality much appreciated by our partners and stakeholders.

What do people not understand about your business? That we genuinely believe in the dual bottom line. For a long time, the industry has been conditioned to think in terms of trade-offs like sacrificing social impact for profits. Our investments all prove that the two can co-exist, that excellent management teams solving for underserved sectors are capable of achieving both competitive returns and sustainable social value. Another misconception was that we would crowd-out other investors whereas it is evident today that EAEF acts as a catalyst to attract new foreign investors to the market. We are always eager to partner with value-adding investors for the purpose of attracting diversified sources of capital to the country. We care and think a lot about how we can do more for Egypt.

How is the “business of finance” (or impact investing in general, if you prefer) changing? The wave of impact investing is large and growing, particularly from US and UK foundations, endowments and family offices. These investors now care more about aligning their investment activity with their values and are upholding investment managers to this commitment. Development financial institutions have always cared about impact and serving their greater mission but with private investors now also joining the cause, we are seeing more advancement in the space in terms of both defining and measuring impact as well as new, creative and efficient investment models for reaching the people in need. This is also widening the window for blended finance where public funding instruments partner with private investors who now share the same objectives to reduce the risk profile of the investments and create greater avenues for value creation. What’s interesting is that investors are sincere and are asking the harder questions; they are no longer content with wishy washy answers and just checking ESG boxes.

What do you do in your free time? I love creative writing and spend hours on the weekend between reading and working on my writing. I also like to deepen my yoga practice and take long walks in our neighborhood, mainly to get good coffee. I also recently returned to tennis and am spending more time with family. I try to get out of Cairo at least once a month; we are blessed with a great variety of landscapes in Egypt and I love it.

How do you stay organized? I walk around with a notebook. I write down everything I want to do, break it down into smaller achievable tasks and tick them off one at a time. I love the rush of dopamine from checking something off and it gets me to aim for the next thing. I certainly can do better on time-management and showing up on time. An optimist’s dilemma.

What’s the best piece of business advice you’ve ever been given and by whom? ‘Always have compassion, put yourself in the other person’s shoes.’ I grew up witnessing how my mother thrives on helping others and her advice never failed me in both life and business. Also: ‘It’s not the smartest people in the room who are the most successful, it’s the emotionally intelligent who get much further.’ That one’s from James A. Harmon. I got lucky with an inspiring boss who believes in the potential of people and encourages young women to grow.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Wednesday): 12,587 (-0.3%)

Turnover: EGP 603 mn (24% below the 90-day average)

EGX 30 year-to-date: -16.2%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.3%. CIB, the index heaviest constituent ended up 1.2%. EGX30’s top performing constituents were CIB up 1.2%, and EFG Hermes up 0.5%, and Orascom Construction up 0.5%. Yesterday’s worst performing stocks were Heliopolis Housing down 3.3%, Pioneers Holding down 3.2% and Palm Hills down 3.0%. The market turnover was EGP 603 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +41.3 mn

Regional: Net Short | EGP -20.8 mn

Domestic: Net Short | EGP -20.5 mn

Retail: 67.6% of total trades | 64.2% of buyers | 71.0% of sellers

Institutions: 32.4% of total trades | 35.8% of buyers | 29.0% of sellers

WTI: USD 52.73 (-0.30%)

Brent: USD 61.56 (-0.84%)

Natural Gas (Nymex, futures prices) USD 4.44 MMBtu, (-0.63%, January 2019 contract)

Gold: USD 1,243.70 / troy ounce (+0.09%)

TASI: 7,883.63 (-0.27%) (YTD: +9.10%)

ADX: 4,830.38 (-1.38%) (YTD: +9.82%)

DFM: 2,632.15 (-1.63%) (YTD: -21.90%)

KSE Premier Market: 5,389.96 (+0.39%)

QE: 10,589.98 (-0.12%) (YTD: +24.25%)

MSM: 4,552.30 (+0.39%) (YTD: -10.73%)

BB: 1,322.28 (-0.28%) (YTD: -0.71%)

Calendar

December: The government will announce the second phase of its privatization program before year-end, Public Enterprises Minister Hisham Tawfik said. The committee overseeing the state privatization program is also scheduled to hold a meeting next month to look into how market conditions developed since the privatization program was put on ice

06 December (Thursday): Egypt’s Emirates NBD PMI for November released.

07-09 December (Friday-Sunday): RiseUp Summit, The Greek Campus, Downtown Cairo (location).

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

08-10 December (Saturday-Monday): Fourth Food Africa 2018 expo, Cairo International Exhibition and Convention Centre, Nasr City, Cairo.

09-10 December (Sunday-Monday): Cairo Regional Centre for International Commercial Arbitration’s Sharm El Sheikh VII conference, Egypt Hall, SOHO Square, Sharm El Sheikh

10 December (Monday): The Financial Regulatory Authority will hear a grievance appeal by Beltone against a six-month suspension handed to its investment banking arm over “irregularities” the authority says it found in Sarwa’s IPO, Al Mal reported.

11 December (Tuesday): The EFG Hermes CEOs Dinner. Four Seasons Hotel, Cairo

11-13 December (Tuesday-Thursday): The EFG Hermes Egypt Day Summit. Four Seasons Hotel, Cairo.

11 December (Tuesday): TVET Future Chef Competition – Season II, Cairo, venue TBD.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13 December (Thursday): Minister of Tourism Rania El Mashat speaking on “Egypt’s Tourism Reform Program (E-TRP) Revealed,” AmCham, Cairo.

13-15 December (Thursday-Saturday): Forum on “ The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheikh, venue TBD.

13-15 December (Thursday-Saturday): Vodafone Developers 010 Innovation Hackathon, Smart Village.

14-16 December (Friday-Sunday): AutoTech 2018, Cairo International Exhibition and Convention Centre, Nasr City, Cairo.

18-19 December (Tuesday-Wednesday): Federation of Egyptian Chambers of Commerce leaders are scheduled to meet with their Saudi counterparts in Aswan to launch a collaboration project to support SME development in Egypt and Saudi Arabia, head Ahmed El Wakeel said.

19 December (Wednesday): Cairo Economic Court to rule into an appeal by pharma companies

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

January 2019: Flat6Labs will launch their 12th startup accelerator cycle.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

10-13 January 2019 (Thursday): International Property Show (IPS), Egypt International Exhibition Center

19 January 2019 (Saturday) Cairo Criminal Court scheduled hearing of Gamal and Alaa Mubarak’s stock market manipulation case

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

26 January 2019 (Saturday): Supreme Administration Court’s Uber / Careem appeal date, Egypt.

28-29 January 2019 (Wednesday-Thursday): Banking Technology North Africa, Nile Ritz Carlton Hotel, Cairo, Egypt.

7 February 2019 (Thursday): Egypt Building Materials Summit, Venue TBD, Cairo, Egypt

11-13 February 2019 (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

19-20 February 2019 (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

26-28 February 2019 (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

27-30 March 2019 (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

June 2019: International Forum for small and medium enterprises (SMEs).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.