- New electricity prices to be unveiled today, will come into effect on 1 July as expected. (What We’re Tracking Today)

- SMEs could get a massive tax break if they join the formal economy. (Speed Round)

- Israel’s Delek could invest up to USD 200 mn to gain access to subsea natural gas pipeline to Egypt’s Sinai. (Speed Round)

- Goldman Sachs uses a World Cup twist to make macro research readable. (What We’re Tracking Today)

- Egyptian American Enterprise Fund sees investments in Egypt grow to USD 130 mn as of end-2017. (Speed Round)

- Overdraft won’t blow budget deficit target, El Garhy says. (Speed Round)

- Starting today, banks and other financial institutions will be allowed to establish mutual funds. (Speed Round)

- The Creature Named Okasha looks set to return to the airwaves when talk shows return from Ramadan hiatus. (Last Night’s Talk Shows)

- The Market Yesterday

Tuesday, 12 June 2018

New electricity prices to be unveiled today, will come into effect on 1 July as expected

TL;DR

What We’re Tracking Today

HOLIDAY WATCH- Everyone from the Central Bank of Egypt to the EGX and the Ismail Cabinet has now confirmed that with Ramadan set to end on Thursday, we will have a four-day long weekend running Friday-Monday. Enjoy seeing all the people you’re getting away from in Sahel while we revel in having the capital city to ourselves. We’re off on Sunday and Monday, but will be back in your inboxes on Tuesday morning.

Want a safinga chaser? Mark the looming end of the holy month with the WSJ’s Orientalist-headlined “Beers at Ramadan: Dubai Relaxes Rules as Gulf Countries Adapt to Draw Business” and then marvel that booza (no, not *that* booza) has crossed the pond to New York, where a new shop in Brooklyn (where else?) will serve the sahlab-based ice cream.

Prime Minister-designate Mostafa Madbouly has yet to unveil his cabinet lineup. Madbouly is apparently still meeting with prospective candidates, and the echo chamber from the local press is again highlighting the candidates, adding Mac Optic President and CEO Ahmed Radwan to the list of potential entrants to cabinet. Sources tell Al Mal that Madouly gave candidates a 48-hour window to respond to his offer. The new cabinet was expected to be sworn into office before the Eid El Fitr break.

President Abdel Fattah El Sisi spoke in public for the first time on the new cabinet, saying that change in government was necessary, according remarks picked up by our friends at Al Masry Al Youm. The president thanked outgoing Prime Minister Sherif Ismail and his cabinet on behalf of a grateful nation.

Electricity Minister Mohamed Shaker will announce new electricity prices at a press conference today. The rate hikes will come into effect on 1 July as widely expected, Reuters’ Arabic service reports. The price hikes will be implemented across the board, but the lowest consumption tier be shielded from the full brunt of the rise, Shaker told Youm7. Previous reports had suggested that prices would rise by as much as 55% and that the ministry was mulling having imposing a surcharge on consumption during peak hours for users in the uppermost bracket.

Capital Economics is the latest to suggest the Central Bank of Egypt will leave interest rates on hold when its monetary policy committee meets on 28 June, writing in a note to clients yesterday that, “Inflation should resume its downward trend later this year, eventually allowing the CBE to push ahead with rate cuts. We expect the easing cycle to be resumed at September’s MPC meeting and that the overnight deposit rate will be lowered by a further 350 bps this year, taking it to 13.25%, and by another 200bp in 2019. That is a quicker pace of easing than most anticipate.”

The Donald Trump-Kim Jong Un summit in Singapore got underway in the week hours of this morning as we were writing today’s edition. Dude shook hands with a guy who assassinates political rivals living abroad, kidnaps innocent civilians, threatens to lob nuclear weapons, and blows relatives to pieces with anti-aircraft fire. “I think we will have a terrific relationship,” The Donald said. But Canadians? Close the borders, bubba. Damn them and their cheap cars and milk tariffs (and healthcare, multiculturalism and lack of handguns). Hit the front pages of the New York Times, Washington Post, Politico or Axios for the blow-by-blow as the day unfolds — the whole summit looks set to wrap in less than seven hours.

If not by the EM Zombie Apocalypse, the End Times will be inaugurated by Donald Trump’s “America First” trade policy. That’s the suggestion from IMF boss Christine Lagarde, who warned yesterday that “the global economic outlook is darkening by the day.”

Latest sign we are indeed in the early days of the End Times: Back-to-back front-page headlines in our favourite non-business newspaper announcing Dennis Rodman arrives in Singapore ahead of Trump-Kim summit and Actor Robert De Niro slams Trump at Toronto event, apologizing for President’s ‘idiotic’ behavior.

Abraaj founder Arif Naqvi “scrambles as [his] empire teeters,” the headline in the Wall Street Journal blares, quoting the 57-year-old CEO as saying a dispute over the use of investor funds for general corporate purposes was “caused by differing interpretations of Abraaj’s agreement with investors. ‘We felt we were within our rights to interpret it the way we wanted,’ he said. ‘In hindsight would we have done things differently? Possibly.’” The Journal spoke with former Abraaj staff who said that “Mr. Naqvi had a dominating attitude that laid the groundwork for trouble. Several of these former employees blame the problems on what they say was Mr. Naqvi’s overly ambitious expansion beyond Middle East deals.”

It looks like internal OPEC politics could play against Saudi’s bid to ramp up production. Other OPEC members, including Iraq, have voiced opposition to lifting production curbs, according to Bloomberg. Iraq “rejects unilateral decisions made by some producers which do not consult with the rest,” Iraqi Oil Minister Jabbar Al Luaibi said in a statement. “Producers from within and outside OPEC have not yet reached the goals set,” he added. Iraq, the second largest producer in OPEC, is now lending its voice to both Iran and Venezuela.

And the award for the best use of a marketing hook to make sell-side research readable goes to…Goldman Sachs for its “The World Cup and Economics 2018” (pdf). You can hit the landing page for the publication here or flip to page 17 of the pdf version to Goldman’s synthesis of football and economic analysis as applied to Egypt: “An economic recovery to match a footballing renaissance…While there are still significant risks of delivery, so far the [reform] programme has been surprisingly successful: the current account deficit is gradually correcting alongside inflation and business, and investor confidence has been restored.”

Okay, but who does Goldman think will win the World Cup? Not the Pharaohs, who GS suggests won’t make it to the group of 16: “England meets Germany in the quarters, where Germany wins; and Germany meets Brazil in the final, and Brazil prevails.”

The Band’s Visit was named best musical at the Tony awards and snagged a further nine awards to boot on Sunday night, the Associated Press reports. Starring Katrina Lenk and Lebanese-American actor Tony Shalhoub, who was named best actor in a musical, the play promotes tolerance and cultural understanding through the story of an Egyptian police band that gets stranded in a remote Israeli town. The critically-acclaimed musical is based on a 2007 Israeli film of the same name and won consistent critical acclaim when it opened in November last year (watch, runtime: 01:25).

Five pieces offering food for thought this morning:

#1– How secure is your encrypted messaging service? Slack promises that traffic to and from its app is fully encrypted in transit and at rest. WhatsApp and Signal also boast end-to-end encryption. But there are still ways for evildoers and other parties to get access to your chats: Former Trump campaign chairman Paul Manafort used Telegram and WhatsApp, but “investigators were able to read backups of the conversations on his iCloud” account. And a former US Senate Intelligence Committee aid arrested for allegedly lying to the FBI during a leak investigation sent chills through reporters when prosecutors quoted Signal messages in the indictment. Did they find a way in? Or did someone save screenshots of messages? Read How did investigators read James Wolfe’s Signal messages?

#2– How secure is that back-office investment bank job? Citigroup suggests it will cut up to half of its 20k jobs in technology and operations over the next five years as “machines supplant humans at a faster pace,” the FT reports in an exclusive that has been widely picked up by the financial press. “If replicated across the industry, the potential job losses would represent a steeper rate of cuts than in 2007-2017, when almost 60k jobs were cut from eight of the world’s top 10 investment banks,” the salmon-colored newspaper writes. “If your job involves a lot of keyboard hitting then you’re less likely to have a happy future,” Barclays investment bank boss Tim Throsby is quoted as saying.

#3– How low can ETFs go? On the fee side, that is. Both BlackRock and VanEck slashed fees on popular exchange-traded funds last week in “the latest salvo in an increasingly ferocious price war between ETF providers [as] … money has typically flowed to the largest funds, since they have the most liquid shares, giving operators economies of scale that they are able to pass on to customers.”

#4– How likely is it that alien life will resemble your spouse? “The evolution of life everywhere in the universe is constrained by the laws of physics, which means that aliens would have to resemble creatures we already know,” writes a professor of astrobiology in a ridiculously cool essay for the Wall Street Journal.

#5– How to shoot yourself in the foot: Firing your driver can lead to the complete collapse of your business empire. Just ask Martin Sorrell, the former WPP boss who transformed a maker of wire supermarket baskets into the world’s largest comms group — and whose professional undoing began the night he fired his driver in a “moment of executive intemperance.” Sorrell resigned in April after the ensuring board-led investigation, and the Financial Times has talked to more than 25 people who worked closely with the ad man. “What has emerged is a picture of routine verbal abuse of underlings and a blending of Sir Martin’s corporate and private life that jarred with some colleagues.”

So, when do we eat? For those of us observing, Maghrib is at 6:57 pm CLT today. You’ll have until 3:08 am tomorrow to finish your sohour.

What We’re Tracking This Week

It’s T-minus two days until the World Cup kicks off in Moscow, withthe first match being played between Russia and Saudi Arabia, two of the lowest-ranked teams in the competition. That bodes well for us, but the Pharaohs don’t seem set to do that much better without Mohamed Salah, who (the nation hopes) will lead us out of that very same group. Whether Salah will play in Egypt’s match against Uruguay — our first in the championship and the most difficult for the national team at the group stage — remains uncertain, Egypt’s national team doctor tells the Associated Press. You can tap or click here for the full World Cup schedule.

Fans in Russia, meanwhile, have created stone mosaics of Salah and other star footballers who will be at the World Cup, including Argentina’s Leo Messi, according to RT.

Salah’s star power was not lost on Chechnya’s (controversial) leader, who is being accused of using an appearance with the Liverpool striker “to score a public relations boon” while he leads a crackdown grounded in political Islam, the AP says. Some of Salah’s supporters have said that the footballer should issue a statement condemning the Chechen leader’s policies, but the New York Times notes that Salah was an unwilling participant in Ramzan Kadyrov’s publicity stunt, having been literally hauled out of bed by the Chechen strongman.

In non-football news expected this week:

- The US Federal Reserve looks likely to hike interest rates when it meets tomorrow

- Brexit legislation is before the UK House of Commons today and tomorrow

- The European Central Bank meets on Thursday

On The Horizon

Call your dad this coming Sunday: It’s father’s day in Canada, Ireland, Mexico, the UK and the United States, among other countries. Not in Egypt, though: Depending on who you ask, Egypt (a) doesn’t have Father’s Day or (b) celebrates it on Thursday, 21 June.

Conveniently, 21 June is the first day of summer. Just sayin’.

The central bank’s Monetary Policy Committee meets on 28 June to decide on interest rates.

Saudi Arabia could be upgraded to MSCI emerging markets status this month.

Unified port fees will permanently come into effect in July, SCZone chief Mohab Mamish has said, Youm7 reports.

The World Bank is offering seed funding, access to mentorship for agritech startups through its “DigitalAG4Egypt” program. The deadline for submissions is 1 July. Tap or click here for more information.

Enterprise+: Last Night’s Talk Shows

Dig a hole. Make it deep. Crawl into it. Pull the earth in on top of yourself. We can think of no other way to cope with the news that the creature named Tawfik Okasha is returning to television after Eid. That’s right, folks: Okasha, the enemy (the Anti-Murrow if you will) of that is good in broadcast media (not that there is much of it) will reportedly return to host his “Misr Al Youm” program on the Assema channel twice a week, according to Al Ahram. The channel released a 45-second promo earlier this week. Okasha’s comeback comes nearly a month after a court accepted his appeal against a one-year prison sentence and EGP 5,000 fine for faking his PhD diploma. The former MP had earlier been kicked out of the House of Representatives for a variety of misdeeds and had previously been convicted of assault after beating his wife. Needless to say, we will do whatever we can to minimize his appearances in Last Night’s Talk Shows when our roundup returns after Eid.

Speed Round

EXCLUSIVE- SMEs could get a massive tax break if they join the formal economy: A Finance Ministry committee tasked with drafting a new SMEs Act has proposed that small businesses earning more than EGP 1 mn a year (and less than a ceiling that has yet to be determined) pay a nominal 1% tax on their revenues under new legislation now in the drafting stage, sources from the ministry and Tax Authority told Enterprise this week.

Small businesses earning anything below that amount will be divided into three tiers and charged a flat tax based on their top line, the sources confirm. We had reported last month that businesses with annual revenues of EGP 250k or less would face a fixed tax bill of EGP 2,000 per year under the proposal. Those with top lines between EGP 251-500k would pay EGP 5,000 a year, while enterprises making EGP 501k-1 mn would be taxed EGP 10,000. The brackets are designed to widen the tax base by giving incentives for small businesses to join the formal economy.

New definition of ‘small business’ under the proposed act? The committee is currently studying a new universal definition for SMEs, which will likely be based not only on revenues, but also the size of the company’s paid-in capital, the sources tell us. The maximum revenue threshold to qualify for the special 1% tax rate would be worked out as part of that process. The new definition of what constitutes an SME would have to be adopted by the Central Bank of Egypt, the Tax Authority and the Trade and Industry Ministry, all of whom are already working from a compromise definition agreed to last year.

Other incentives are still under study. The tax breaks aren’t the only incentives that could be on offer for small businesses that decide to go legit: The committee is reportedly considering offering perks including further tax exemptions for a period of time, lower prices for power consumption, covering social insurance costs, and issuing expedited temporary permits for the installation of utilities and infrastructure, among others. Sources had previously told us that access to water and electricity would be conditional on a business registering with the Tax Authority.

The act would also impose penalties and sanctions for violations, according to our sources. These may include provisions that give the Finance Minister greater power to crackdown on fraud and attempts to manipulate or trick the system to gain access to benefits granted to SMEs under the law.

Israel’s Delek could invest up to USD 200 mn to gain access to EMG’s subsea natural gas pipeline to Egypt’s Sinai: Shareholders in Israel’s Delek Group will meet on 1 July to vote on investing USD 200 mn to buy the rights to use a subsea pipeline that would allow the company to export natural gas to Egypt, according to a regulatory filing to the Tel Aviv Stock Exchange picked up by Reuters. The company has been in talks to buy stake in the East Mediterranean Gas Company (EMG), which owns a pipeline that had once been used to transport Egyptian LNG to Israel “under a 20-year agreement, which collapsed in 2012 after months of attacks on the pipeline by militants in Egypt’s remote Sinai Peninsula.” Access to EMG’s pipeline would allow Delek and Texas-based partner Noble Energy to move forward with a 10-year, USD 15 bn agreement to export gas from Israel’s Tamar and Leviathan fields to Egypt via Alaa Arafa’s Dolphinus Holdings.

Background: The agreement, formalized in February and still awaiting regulatory approval, is the first of many that Egypt is hoping to sign as it presses ahead with plans to turn the country into a regional energy export hub, aided by recent gas discoveries in the East Mediterranean. A similar pact with Cyprus is in the works, including a plan to build a USD 800 mn underwater pipeline to connect the Aphrodite field with liquefaction plants in Egypt’s Idku or Damietta. The plan is to then re-export a portion of the LNG to Europe after satisfying local demand. Egypt is hoping to reach natural gas self-sufficiency before the end of 2018, as more production units from the Zohr gas field come online.

Our friends at the Egyptian American Enterprise Fund (EAEF) reported that their investments in Egypt reached USD 130 mn as of the end of 2017, according to the fund’s 2017 annual report (pdf). EAEF’s investments have also attracted another USD 130 mn from foreign institutional investors. Highlights from 2017 include buying a stake in the Orchidia Pharmaceutical Industries from SPE Capital, formerly Swicorp Private Equity. The fund also expanded investments with local fund managers, including in midmarket fund manager TCV. The EAEF also committed USD 550,000 to a total investment of USD 5.5 mn made in partnership with Egypt Ventures and the International Finance Corporation to seed regional startup accelerator Flat6Labs. “As Egypt’s macroeconomic environment has stabilized, the private sector’s role as a primary engine of growth has become more essential,” said Chairman James Harmon. “We are pleased with the progress of the EAEF and are cautiously optimistic about the future of the Egyptian Economy,” he added.

M&A WATCH- Egyptian private equity firm Omega Capital made an offer to acquire 20% of British Egyptian Company for General Development Company (Galina) for EGP 75 mn, Galina Chairman Abdel Wahed Soliman tells Al Mal. The agrifoods company, which is 98% owned by the Soliman family, produces frozen fruits and vegetables and exports 95% of its produce.

BUDGET WATCH- Overdraft won’t blow budget deficit target, El Garhy says. Some EGP 70 bn in overdraft spending for the soon-to-close FY2017-18 budget will not impact Egypt’s targeted budget deficit for the year, said Finance Minister Amr El Garhy. The budget deficit is still on track to fall to 9.8% of GDP by the end of June despite the overdraft, which was approved by the House of Representatives on Sunday. Spending for the year had outpaced projections largely on account of higher debt service costs, said El Garhy.

As for the ministry’s plans to hedge against a further increase in oil prices, El Garhy said that a decision would be made on whether to employ a bank to adopt a hedging strategy after the Eid El Fitr break next week. He confirmed a story we noted this week that ministry was indeed looking for strategies to hedge against continued rising oil prices and that the ministry had spoken to international banks and institutions.

REGULATION WATCH- As of today, banks and other financial institutions will be allowed to establish mutual funds, as per a decision from the Financial Regulatory Authority (FRA) published in the Official Gazette, Al Shorouk reports. Banks that want to set up mutual funds must seek CBE approval, while other financial institutions such as insurance companies and pension funds must seek approval from FRA. The FRA signed off on the new regulations last month, just weeks after allowing securities and brokerage firms to trade in investment funds, which had previously been accessible only through banks.

FRA raises daily limit on EGX intraday trading: The avalanche of new regulations from the board of the FRA continues: It has approved raising the daily limit on the percentage of shares that can be traded intraday, FRA said in a statement picked up by Ahram Gate on Monday. The daily limit was doubled to 0.01% of a company’s total shares, from 0.005%. The new regulations also allow brokers to trade on the same stock multiple times in the same day.

FRA also approved setting a three year grace period for listed companies that have not yet complied with new listing regulations. Listed companies which have not met new listing regulations will be moved to the EGX’s over-the-counter (OTC) market from the main market for a three year period until they can meet requirements, said FRA Chairman Mohamed Omran. Omran also stated that OTC dealmarket transactions will require a non-objection from FRA.

Property developers are looking to deregulation of the energy market to provide them with new recurring revenue streams: Heliopolis Housing & Development is in talks with the Electricity Ministry for permission to sell power in its New Heliopolis project, Vice Chairman Wael Youssef tells Al Mal. If approved, the company will build a EGP 525 mn transformer station for the new development and will have the ministry install electricity meters, he added.

Background: As we noted back in April, the Egyptian Electricity Utility and Consumer Protection Agency (Egyptera) has reportedly been holding high-level meetings to discuss the pricing scheme for power produced and sold under an independent power producer (IPP) framework. Under the framework, private companies are allowed to directly sell power to consumers while paying the state a fee to use the national grid for transmission.

LEGISLATION WATCH- The House of Representatives gave preliminary approval yesterday the National Press Authority bill and referred it to the Council of State (Maglis El Dawla) for review before it goes to a final vote, Youm7 reports. The legislation — one of the three bills born out of the process of dividing part two of the Press and Media Act — outlines the structure, responsibilities, and jurisdiction of the National Press Authority, which will govern the work of state-owned newspapers, setting minimum wages for employees, appointing editors-in-chief and board members, and implementing pricing schemes for ads. The nine-member authority, whose head will be appointed by the president, will include representatives from the Council of State and Finance Ministry, in addition to journalists and media professionals working in different mediums, all serving terms of up to four years.

The House gave a preliminary nod to the bills on Sunday, a day after the Culture and Media Committee decided on the split, which created three laws each pertaining to a separate regulatory body (Al Shorouk has a solid primer on the responsibilities of each one). The laws are also expected to contain provision on the protection of journalists.

LEGISLATION WATCH- Parliament was apparently serious about passing legislation to monitor social media: House Speaker Ali Abdel Aal referred yesterday a draft law to “regulate” social media platforms in Egypt to Parliament’s ICT and legislative committees for discussion, Al Shorouk reports. The legislation means to crackdown on social media subscribers who use these platforms for libel and slander, targeting Egypt in their posts, Rep. Bassam Fleifel, who drafted the law, told the newspaper. The law would grant prosecutors the authority to block certain social media accounts if they are found to be “harmful to national security” and would impose fines and prison sentences on individuals who create fake social media accounts.

The Cyber Crimes Act apparently wasn’t enough: Fleifel put forth this bill after it was made clear that the Cyber Crimes Act — which the House of Representatives approved last week — is not intended to allow to government to monitor or block social media platforms.

The bill reportedly would also see the establishment of a new “Egyptian Facebook,” but details on this portion of the legislation are scant, save for stipulations that would require users to be at least 18 and provide their national ID to create an account. (Guaranteeing its popularity…) ICT Minister Yasser El Kady had said earlier this year that Egypt is working towards creating its own Facebook-like social media network.

In what seems to have been a bid to cast the legislation in a positive light, Fleifel said he took inspiration from China. Yes, China — the same country that has a ban in place on Facebook (making it one of three countries on the face of this planet to do so), YouTube, Google, and around 8,000 other websites, in addition to WhatsApp…

Egypt has made it to the list of the world’s 10 worst countries for workers’ rights on the left-leaning International Trade Union Confederation’s Global Rights Index for 2018, alongside Algeria, Saudi Arabia, Turkey, Kazakhstan, Bangladesh, Guatemala, and Colombia. Egypt received a score of 5, meaning that it offers no guarantee of rights, according to the index, which considers factors such as the ability to strike peacefully. You can view the full report here (pdf).

Saudi Arabia, Kuwait, and the UAE have pledged USD 2.5 bn in aid to Jordan after protests against proposed tax increases and austerity measures culminated in the resignation of Prime Minister Hani Mulki, according to a joint statement released by the Saudi Press Agency. The aid package will include a deposit in the Central Bank of Jordan, guarantees on World Bank loans, annual support for the government’s budget for five years, and funding for development projects. Stratfor MENA analyst Ryan Bol noted in an interview with Bloomberg that Saudi Arabia and the UAE had “stopped economic aid to Jordan nearly 17 months ago because of Jordan’s refusal to fall in line behind Saudi Arabia’s regional policies.” The story is also getting prominent play in the Wall Street Journal.

Egypt in the News

It’s another quiet day for Egypt in the int’l press, with coverage dominated by Ethiopia and World Cup. Coverage of Egypt in the foreign press remained squarely focused on positive developments on the Ethiopian front and the World Cup opener against Uruguay in just a few days’ time.

Other headlines that might be worth a minute or two of your time this morning:

- An Algerian-made short film highlights “joblessness, corruption and inequality” in Egypt and other countries in the region “after Arab Spring optimism turned sour,” Salah Slimani and Caroline Alexander write for Bloomberg.

- Egypt-born NBA prospect Anas Mahmoud wants to see basketball growing in popularity in Egypt, according to Rolling Out.

- Egypt’s water desalination and purification methods may be in need of an upgrade, suggests a study cited by Middle East Online.

On Deadline

Columnists remain fixated on the changes taking place with Cabinet, particularly when it comes to how the incoming government will handle the economic reform agenda. Al Shorouk’s Ziad Bahaa El Din urges the new government to focus on developing services and work programs that would improve citizens’ living standards and counteract some of the burdens of reform. Talaat Ismail shares the sentiment, saying in a separate column that these measures are necessary to keep people from reaching their breaking point with tough austerity measures.

Worth Reading

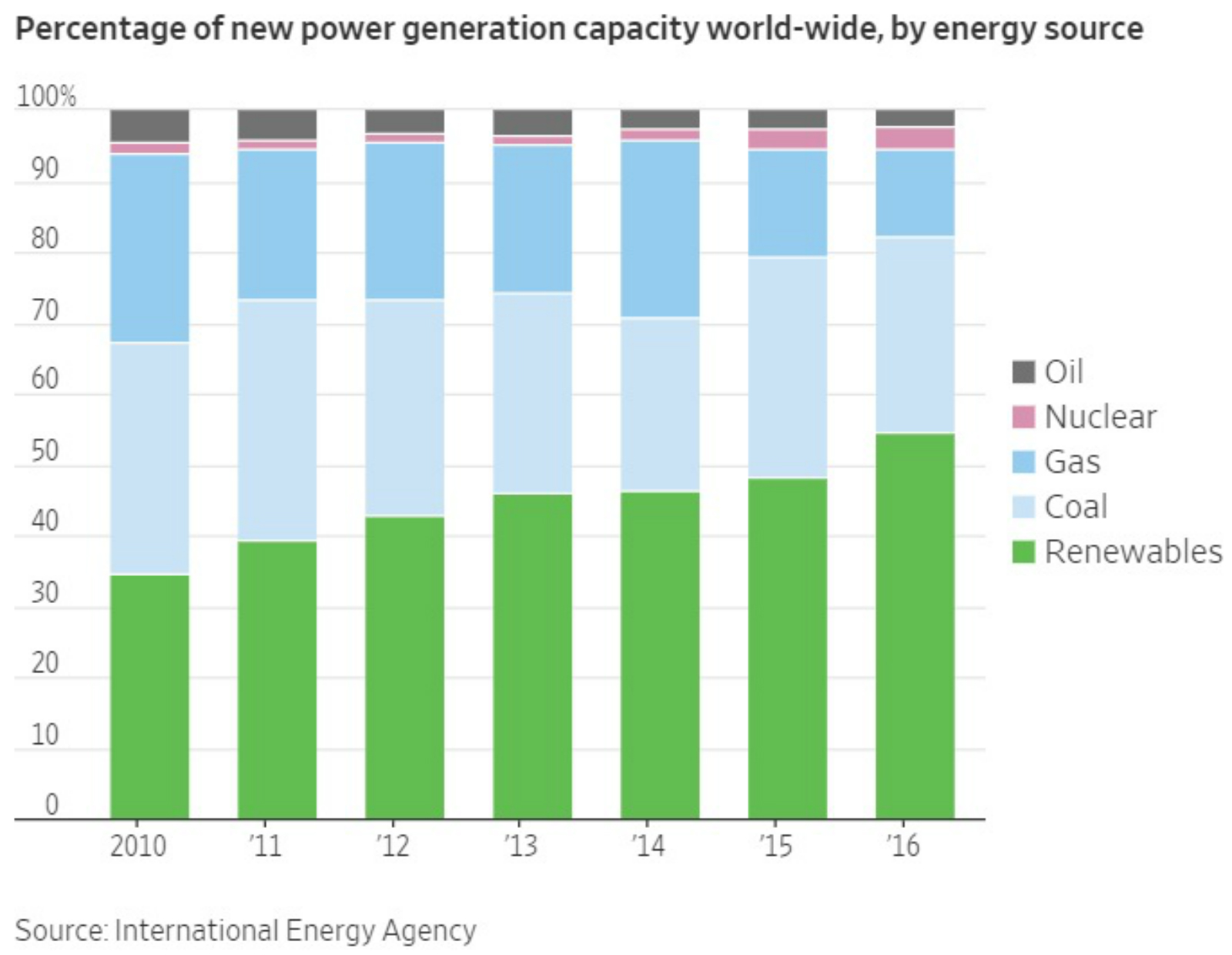

Investment in renewables has overtaken conventional energy sources: After years of government incentives such as tax breaks and subsidies, private investment in renewables has now overtaken that in fossil fuel and nuclear power, writes Russell Gold for the Wall Street Journal. In 2016, about USD 297 bn was spent on renewables — more than twice the USD 143 bn spent on new nuclear, coal, gas and fuel-fired power plants, according to data from the International Energy Agency (IEA). More than half of the power-generating capacity added around the world in recent years has been in renewable sources such as wind and solar, with IEA projecting that renewables will make up 56% of net generating capacity added through 2025.

It’s not just government support for the renewables industry that’s making a difference: Renewable costs have fallen so far in the past few years that “wind and solar now represent the lowest-cost option for generating electricity,” said Francis O’Sullivan, research director of the Massachusetts Institute of Technology’s Energy Initiative. Chinese government policies have also created a glut in the global market of very cheap and easily accessible solar panels. Innovation has also allowed wind power costs to fall significantly. With these lower costs, which are now comparable to those of fossil fuel sources, and threats to fossil fuel energy development from climate change policies in developed countries, it is perhaps not surprising that emerging markets are now increasingly looking to them for their energy needs.

You need look no further than here in Egypt to see the impact of this shift. The European Bank for Reconstruction and Development, the Asian Infrastructure and Investment Bank, and the International Finance Corporation have poured around USD 2 bn in investments in the Benban solar park alone. A EGP 3.5 bn solar park in the West Nile area is seeing interest from the likes of ACWA and Masdar. While the feed-in tariff program for wind has stalled, the Gulf of Suez area has already drawn interest from a host of major companies including Masdar, Engie, Toyota Tsusho, Marubeni and Siemens in developing wind farms there.

Worth Watching

Computer virus, meet computer antibodies: A team of mathematicians and British ex-spooks from Cambridge University created a cyber-defense system that mimics the human immune system. It uses artificial intelligence to identify hackers and stop them before they hit network systems, CNN reports. In creating Darktrace, software that attempts to secure corporate and government network, the British team aims to spearhead an industry shift away from old school anti-viruses and firewalls towards intelligent code for more efficient cyber security systems.

Diplomacy + Foreign Trade

Gulf countries take credit for bringing Egypt and Ethiopia closer together? Officials from the UAE, Kuwait, and Saudi Arabia reportedly put a lot of effort over the last several months in pushing Ethiopia to resolve its outstanding dispute with Egypt over the Grand Ethiopian Renaissance Dam (GERD), an unnamed diplomat tells Al Shorouk, claiming the Gulf countries even pledged more investments to Addis Ababa. Pressure from the GCC may even see Ethiopia agree to push its schedule for filling the dam’s reservoir to have it stretch over a period of 7-10 years instead of the current plan of three years. Egypt has been worried that the fast pace at which Ethiopia plans to fill its reservoir would impact its Nile water supply. The statements come one day after President Abdel Fattah El Sisi and Ethiopian Prime Minister Abiy Ahmed reached a breakthrough in the years-long talks on the GERD, agreeing to adopt a joint vision on the dam that respects the other’s goals and interests.

Egypt takes further steps in turning a new leaf with Ethiopia: Egypt also released 32 Ethiopian prisoners on Sunday during Ahmed’s three-day visit to Cairo, the Associated Press reports. The freed prisoners will arrive in Addis Ababa later on Monday, according to a tweet by Ahmed’s Chief of Staff Fitsum Arega. Egypt had also promised to help locate the bodies of 38 Ethiopians killed by Daesh in Libya in 2015, Arega adds.

Foreign Minister Sameh Shoukry met yesterday with UN Special Envoy for Syria Staffan de Mistura to discuss developments in the country, according to a ministry statement. Shoukry confirmed that Egypt would continue to push for a diplomatic solution to the crisis.

Meanwhile, Egyptian companies continue to press ahead with lucrative reconstruction projects. Among these is Global Consolidated Contractors (GCC), which is looking to carry out post-war reconstruction projects in Syria and increase its existing ones in Libya as part of expansion plans, CEO Moustafa El Hassan tells Al Mal. The company is already in talks with the Transport Ministry to establish a 4 sqm logistical zone near the Egypt-Libya border town of Salloum, selling construction materials like cement and tiles.

Energy

EETC issues tender for control center in Benban as developers complain of infrastructure issues

The Egyptian Electricity Transmission Company (EETC) issued a tender for a control center in Aswan’s USD 2.8 bn Benban solar park, according to company sources. The new center will manage the solar power plants under phase two of the feed-in tariff program, monitor production and progress on the development. ABB, Schneider, Siemens, General Electric, and NR Energy have all expressed interest and the EETC will begin receiving their financial offers next month and announce the winning bidder in August, the sources add. The tender comes as developers complain of delays in infrastructure development at the site.

Tourism

AccorHotels occupancy rates in Cairo exceed 85%

AccorHotels’ room occupancy rates are up significantly across their properties in Egypt, with rates in Cairo alone exceeding 85%, Managing Director Salah Oumouden tells Al Shorouk. Room bookings for the summer holidays rose 7% y-o-y compared to the same period last year, he added.

Telecoms + ICT

Telecoms are not happy about the government-imposed fee hike on phone lines

Mobile network operators are not too pleased that the government passed a bill imposing extra fees on mobile lines, according to Al Masry Al Youm. The move will adversely impact sales of new phone lines, said Orange Egypt VP Ashraf Halim. Sales are already hurting since the National Telecommunications Regulatory Authority (NTRA) forced MNOs to sell new phone lines only through their own distribution channels, he added. MNOs will be meeting with the NTRA to discuss how to implement the new fees. Buying a new line will cost consumers EGP 70, up from EGP 20 previously, while those with a monthly payment plan will see a EGP 10 monthly increase across the board.

Legislation + Policy

Have the gov’t and the House reversed their positions on settling building code violations?

House of Representatives chatter leaking into the press indicates that the government and parliament’s Housing Committee appear to have switched positions on legislation governing the settling of building code violations. Committee member Mohamed Abdel Ghany is saying that the committee would like to set a punitive fee of 15% of the property’s value for developers to settle on building code violations, while the government wants a standard fee of EGP 100 per sqm, a substantially smaller amount. Previous coverage of the legislation suggested that it was in fact the Housing Ministry that wants to set a fee of 25% of the property’s value, while the committee wants fees lowered to 5-10%. The committee and the government plan to settle the issue after the Eid break, said Abdel Ghany.

Egypt Politics + Economics

Gov’t is in talks with investors to participate in Sinai development projects

The government is in talks with several private sector investors from different sectors to participate in its development projects in the Sinai Peninsula, Tahya Misr Fund board of trustees member Reham Abu Ismail says. Work on the first 500k feddans phase of the development project is expected to begin after the Eid El Fitr break, according to Abu Ismail. The Housing Ministry had rolled out its EGP 32 bn development strategy for Sinai, which relies heavily on incentivizing investors to do business in the peninsula, earlier this year.

El Sisi issues presidential pardon for several prisoners

President Abdel Fattah El Sisi issued a decree to pardon an unspecified number of prisoners to mark Eid El Fitr. The decision was published in the Official Gazette yesterday.

The Market Yesterday

EGP / USD CBE market average: Buy 17.80 | Sell 17.90

EGP / USD at CIB: Buy 17.78 | Sell 17.88

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Monday): 15,921 (-1.4%)

Turnover: EGP 1 bn (91% BELOW the 90-day average)

EGX 30 year-to-date: +6.0%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 1.4%. CIB, the index heaviest constituent ended down 1.7%. EGX30’s top performing constituents were Abu Dhabi Islamic Bank up 1.7%, and Pioneers Holding up 1.6% and AMOC up 1.3%. Yesterday’s worst performing stocks were Egyptian Iron and Steel down 5.2%, Eastern Co down 4.3%, and Heliopolis Housing down 3.4%. The market turnover was EGP 1 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +63.3 mn

Regional: Net Short | EGP -10.4 mn

Domestic: Net Short | EGP -52.9 mn

Retail: 28.9% of total trades | 28.6% of buyers | 29.2% of sellers

Institutions: 71.1% of total trades | 71.4% of buyers | 70.8% of sellers

Foreign: 58.7% of total | 61.9% of buyers | 55.6% of sellers

Regional: 5.9% of total | 5.4% of buyers | 6.5% of sellers

Domestic: 35.3% of total | 32.7% of buyers | 38.0% of sellers

WTI: USD 66.12 (+0.03%)

Brent: USD 76.47 (+0.01%)

Natural Gas (Nymex, futures prices) USD 2.96 MMBtu, (+0.34%, July 2018 contract)

Gold: USD 1,302.20 / troy ounce (-0.07%)

TASI: 8,243.97 (-0.42%) (YTD: +14.08%)

ADX: 4,733.39 (+0.89%) (YTD: +7.62%)

DFM: 3,097.38 (+1.41%) (YTD: -8.09%)

KSE Premier Market: 4,754.33 (-0.62%)

QE: 9,203.32 (-0.23%) (YTD: +7.98%)

MSM: 4,602.78 (+0.03%) (YTD: -9.74%)

BB: 1,281.17 (+0.52%) (YTD: -3.80%)

Calendar

14 June (Thursday): 2018 World Cup kickoff match between Russia and Saudi Arabia, Moscow, Russia.

15 June (Friday): Egypt’s first 2018 World Cup match against Uruguay, Yekaterinburg, Russia.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

19 June (Tuesday): Egypt plays against Russia at 2018 World Cup, St. Petersburg, Russia.

25 June (Monday): Egypt plays against Saudi Arabia at 2018 World Cup, Volgograd, Russia.

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

1 July (Sunday): Application deadline for the DigitalAG4Egypt Challenge.

23 July (Monday): Revolution Day, national holiday.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.