- El Garhy puts onus on CBE to reduce borrowing costs, eyes shift to long-term borrowing from short-term debt as inflation looks set to fall to single digits. (What We’re Tracking Today)

- EU could provide as much as EUR 3.8 bn in financing to help Egypt transform into regional energy hub. (Speed Round)

- RenCap’s Ahmed Badr on why the MENA trade of 2018 is out of Qatar and the UAE and into Egypt and KSA. (Spotlight)

- Mass-transits app Swvl closes the largest funding round in Egypt tech startup history. (Speed Round)

- Careem announces major data breach. (Speed Round)

- OC completes mechanical work at Natgasoline, the largest methanol plant in the United States. (Speed Round)

- Beltone’s Auerbach Grayson to open London office in first international expansion. (Speed Round)

- The Market Yesterday

Tuesday, 24 April 2018

Swvl closes Egypt’s largest startup funding round yet, Careem announces major data breach

TL;DR

What We’re Tracking Today

The state of government finances, part I: Finance Minister Amr El Garhy is rightfully putting the onus on the Central Bank of Egypt to help reduce the cost of borrowing — not just for businesses, but for the state, possibly unlocking bns that today goes to debt service and that tomorrow could help provide more government services or reduce the budget deficit. That’s the take-home message from an interview El Garhy gave Bloomberg while in Washington, DC, for the IMF and World Bank spring meetings.

What’s going on? “Egypt is considering shifting away from costly short-term domestic debt towards longer-term borrowing, as falling interest rates provide cheaper options to finance its fiscal deficit, according to the nation’s finance minister. It will increasingly rely on five- to seven-year bonds instead of Treasury bills that have shorter maturities and currently make up the bulk of local-currency borrowing.”

Inflation (and CBE action) are the triggers to watch: “We’re contemplating this but we’re still waiting for better inflation figures and more action from the central bank.” Inflation in the single digits next year, El Garhy said, should “convince the central bank of taking the interest expense down further.”

The state of government finances, part II: As tempting as it is for journalists and analysts alike to keep hammering at the expenditure side of the government spending equation (what, with subsidy cuts and enhanced spending on health, education, welfare and infrastructure), the business community remains concerned that the Ismail government be tempted to squeeze blood from a stone. A common refrain among business leaders — from owners of SMEs to c-suite officers at large corporations — is that the state not just ensure compliance from existing taxpayers, but widen the tax base. The same applies for fees to access government services: Readers should not be alarmed to read that the government is looking to see revenue from port fees rise by as much as EGP 1.8 bn in the next budget year, as a senior government official told us yesterday. This is likely accounted for by running ports around the clock, fee agreements that bring back major shippers who had walked away from the table in the current year, and an expanded array value-added services, as we’ve recently reported. The government is also raising (or looking to raise) fees for government services including passport issuance, residence visas, and vehicle and gun registration. Expect this to be a theme going forward.

Our friends at Renaissance Capital are holding their third annual Egypt Investor Conference in Cape Town today and tomorrow. Senior management from leading Egyptian companies will meet one-on-one with South Africa-based investors at the gathering. As part of our exclusive coverage of the conference, we interviewed Renaissance Capital MENA CEO Ahmed Badr on his take on Egypt, Saudi Arabia, and the finance industry post-Mifid II. Our talk with Ahmed appears in today’s Spotlight section, below.

The subscription period for retail investors who want a piece of CI Capital’s IPO ends today. The firm’s Mahmoud Attalla was on TV last night talking up the offering. We have more in Last Night’s Talk Shows, below.

Ten people were killed and at least 15 injured in an attack on pedestrians in Canada. A long suspect drove a white rental van across sidewalks in Toronto in an overnight attack that borrows from the terrorist playbook, but that police have so far said does not appear to have been directly related to Islamist terrorism. The home pages of the Globe and Mail and Canada’s CBC have more, and the story is front-page news in the business press globally (Wall Street Journal | Financial Times | CNBC | Reuters).

It’s earnings season in Amreeka: Facebook, Google, Boeing, and Chevron are among those expected to post this week “their strongest first-quarter profit gains in seven years at around 20%,” according to Reuters, which notes that stock performance was muted yesterday ahead of the expected string of earnings reports.

Emerging markets assets are being pressured by rising borrowing costs in the US and the sustained performance of the USD against other currencies. “Equities and currencies [are] down more than 1% and on track for their biggest one-day drops in at least weeks,” Peter Wells writes for the Financial Times. “Higher US yields also make EM assets less attractive for investors and often prompt investors to rotate some of their holdings back into USD-denominated assets.”

Dress like a bn’aire: Season three of Bns, one of our favourite TV shows and the best-ever about finance, “masterfully captures the changing dress code of the finance world.” (WSJ)

Selfie-taking monkeys do not own the intellectual property rights to the images they take, a US appeals court has ruled. (WSJ).

PSA- Expect stronger-than-usual winds and “unstable weather” today in Cairo, North Sinai and the northern cities of Upper Egypt, the national weather service warns.

PSA- YOU DON’T NEED TO GO TO WORK TOMORROW. Pardon our shouting. Banks and the EGX will be closed tomorrow in observance of Sinai Liberation Day. Enterprise is also taking the day off, and we’ll be back on Thursday at our usual time.

What We’re Tracking This Week

EXCLUSIVE- Egypt and Saudi Arabia are expected to sign contracts for their USD 1.6 bn electricity interconnection project “within days,” a senior government official told us yesterday. Egypt has completed all the necessary prep work for the project, which should see the two countries exchange up to 3 GW of power, but the Saudi side has yet to set a date for the signing, sources also told us yesterday. Egyptian Electricity Transmission Company boss Gamal Abdel Rehim said last week that the contracts would be signed in June.

LEGISLATION WATCH- The Ismail Cabinet could sign off on the executive regulations to the Universal Healthcare Act as early as the end of the week, Health Minister Ahmed Rady said on Sunday. Al Ahram claims to have obtained a leaked copy of the regs — which will set out prices for private healthcare under the act and regulate the role of private insurance companies. The regs should be followed by an announcement with details on the three new healthcare regulators that are being established under the new law, which should go into effect as of July in Canal governorates and expand to cover the rest of the country over the coming 15 years.

Also on the legislative front: The Housing Committee is expected to begin “within days” hearings on amendments to the legislation governing rent control. The House Planning and Budgeting Committee was supposed to complete its review of the proposed Auctions and Tenders Act yesterday, but we’ve heard nothing yet.

A Russian delegation is visiting Egypt later this week to resume talks on a Russian industrial zone in the Suez Canal Economic Zone (SCZone) that could attract investments worth as much as USD 7 bn, SCZone chief Mohab Mamish announced yesterday, according to Al Masry Al Youm. Contracts for the zone could be signed “soon,” Mamish added. Talks on the RIZ — which had initially been announced in 2014 — ground to a halt last summer, have been back on since October.

On The Horizon

French foreign minister Jean-Yves Le Drian is due in Cairo before the end of the month.

EU foreign policy chief Federica Mogherini is set to visit Cairo on Monday, 30 April. She’s expected to sign a number of cooperation agreements.

Uber / Careem appeals scheduled: The Supreme Administrative Court has postponed to Saturday, 28 April a hearing on an appeal by Uber and Careem of a lower court decision that ordered the two companies to suspend operations. The Administrative Court has scheduled a separate hearing for 15 May. The two companies continue to operate under a Court of Urgent Matters ruling suspending the initial suspension.

Enterprise+: Last Night’s Talk Shows

The airwaves offered up a mixed bag of nuts last night, which included CI Capital’s IPO, a new anti-tourist harassment law, and a Human Rights Watch report claiming North Sinai residents are in need of urgent aid.

Subscription for the retail offering of CI Capital’s IPO closes today, CI Capital Chairman Mahmoud Atallah reminded Hona Al Asema’s Lamees Al Hadidi. Atallah said that favorable economic conditions encouraged the company to follow through with its initial public offering this month, adding that the institutional tranche of the offering was more than 6x oversubscribed. The company had priced the share in at EGP 7.70. Trading should start on 30 April (watch, runtime: 1:41:43).

Anyone caught harassing a tourist will face a fine of up to EGP 10,000: The House of Representatives approved yesterday to legislative amendments that imposes penalties of EGP 3,000-10,000 on anyone who “harasses tourists or visitors of archaeological sites or museums. The amendments define harassment in a list of activities that includes, but is not limited to promoting, offering, or selling any good or service to tourists (presumably without a permit to do so), and also begging. The House also gave a preliminary nod to amendments that impose harsher penalties of up to life in prison and fines ranging between EGP 1-10 mn for the smuggling, looting, or damaging of Egyptian artefacts, Ahram Gate reports.

The amendments were necessary since harassment of tourists drives visitors away from Egypt, said the Secretary-General of the Supreme Council of Antiquities, Mostafa El Waziri, on Al Hayah Al Youm (watch, runtime: 5:39). They are, however, not enough, according to Egypt’s self-proclaimed Indiana Jones Zahi Hawass, who said that tourist harassment should be punishable with prison sentences (watch, runtime: 4:29).

Egypt is once again in the spotlight on human rights following a Human Rights Watch report claiming the military campaign to root out Daesh in North Sinai has stopped essential goods from reaching 420k residents in four northeastern cities. Armed Forces spokesperson Tamer El Refai dismissed the report, calling it untrue and based on “flawed sources” in a statement to Youm7 on Monday.

Supply Minister Ali El Moselhy also reaffirmed that North Sinai residents have full access to food commodities and other essential goods. He told Lamees that some goods were in short supply early on in the campaign, but that close coordination between the ministry and Armed Forces quickly plugged the gap (watch, runtime: 9:43). The report, however, is naturally receiving widespread coverage from a foreign press hungry to air any dirt on Egypt, including from the Guardian.

Meanwhile, Lamees dove into the legal aspects of a marriage between Egypt’s smaller political parties under the Support Egypt Coalition (parliament’s majority bloc) with legal expert Shawki El Sayed (watch here, runtime: 3:57 and here, runtime: 6:10). While Labor Minister Mohamed Saafan spoke to Al Hayah Al Youm’s Khaled Abu Bakr about progress on government efforts to register seasonal, private-sector workers (watch, runtime: 8:28).

Speed Round

EU could provide as much as EUR 3.8 bn in financing to help Egypt transform into regional energy hub as two sides ink energy cooperation agreement: Egypt and the European Union signed a memorandum of understanding on energy cooperation yesterday that is widely expected to pave the way for Egypt to become a gas export hub to Europe. Under the four-year agreement — which covers cooperation on electricity, as well as oil and gas — the EU and Egypt will work together to help the country realize its goal of becoming a regional hub for LNG exports through continued support and the adoption of new energy efficiency strategies, the EU and Egypt said in a joint release. Egypt could receive as much as EUR 3.8 bn in funding for energy projects, EU Energy Commissioner Miguel Arias Cañete told the press yesterday, Al Masry Al Youm reports.

Egypt becomes part of EU energy security framework: The EU will also provide Egypt with support on renewable energy through “technological, scientific, and industrial cooperation… [as it] recognizes Egypt’s active participation in the ongoing Euro-Mediterranean energy cooperation and the country’s growing pivotal role in energy supply and transit to the Euro-Mediterranean energy market,” the statement said, adding that the agreement will “contribute to fulfilling the EU’s strategic objectives to enhance security of supply and diversification.”

Background: The agreement was signed during Cañete’s visit to Cairo, which wraps up today, during which he has been meeting with top state officials, including President Abdel Fattah El Sisi, and the heads of European oil majors in Egypt to discuss ways to further boost energy cooperation. Energy cooperation talks with the EU had started in December, after Cairo reached a preliminary agreement with Nicosia to establish a pipeline connecting the Cypriot Aphrodite field to one of Egypt’s liquefaction plants in Idku or Damietta for re-export to Europe. Egypt’s Dolphinus Holdings has also signed a similar-style agreement with Israel worth USD 15 bn. The EU has extended Egypt EUR 300 mn in energy support grants so far, according to an EU handout picked up by Al Mal. Oil Minister Tarek El Molla had previously said that Egypt would be ready to export natural gas by year’s end, once new fields, including the supergiant Zohr, begin feeding more output into the grid.

Egypt is ready to become an LNG exporter, Qalaa Holding Founder and Chairman Ahmed Heikal tells CNBC, citing new gas discoveries as well as Egypt’s liquefaction capacities as proof to investors that “Egypt is ready to perform a very important role as a hub for energy, especially gas exports.” El Molla had said on Sunday that Egypt was looking to attract as much as USD 10 bn in new foreign investments in the oil and gas sector in FY2018-19.

INVESTMENT WATCH- Swvl closes the largest funding round in Egypt tech startup history: Mass transit ride-hailing app Swvl received USD 8 mn in Series A funding, the company said in a statement on Monday (pdf). The funding is led by regional venture fund BECO Capital, alongside Africa-based investor DiGAME, global VC fund Silicon Badia, Raed Ventures, Arzan VC, and Oman Technology Fund. EDventure Holdings Chairman Esther Dyson also participated in the round. The funding makes it the largest-ever round of VC funding for an Egyptian tech startup, surpassing the USD 2 mn raised by personal services app Elves. “With this funding, Swvl aims to solidify its position in Egypt and establish the company as a global leader in the affordable smart mobility space, offering fixed routes for a fixed flat fare at prices that are up to 80% cheaper than on-demand ride-hailing services,” said co-founder and CEO Moustafa Kandil.

“Swvl intends to invest EGP 300 mn in the local market in the upcoming 3 years to empower as many micro-entrepreneurs as possible in Egypt and the region and to become one of the biggest job creators in the country,” said co-founders Mahmoud Nouh and Ahmed Sabbah.

Swvl also plans to expand beyond Egypt to other emerging markets across the Middle East, Southeast Asia and Africa region within 2018, the company added.

Careem announces major data breach from January: In other news this morning from the ride-sharing sector, Careem said yesterday that client data was compromised when its servers were breached back in January. The Dubai-based business said that they have “no evidence of fraud or misuse” to suggest that credit card data and passwords were stolen, claiming that the hacker only managed to obtain names, email addresses, phone numbers, and trip history. Careem said it had been investigating the incident since it became aware of it on 14 January and has asked customers to take steps, such as changing their passwords and reviewing their credit card statements, to ensure that everything is in order. The issue received some attention on Masaa DMC last night from Eman El Hosary (watch, runtime: 5:28).

Orascom Construction (OC) has completed mechanical at Natgasoline, the largest methanol production facility in the US, the company said in a press release on Monday (pdf). The production facility, located in Beaumont, Texas, will have a capacity of up to 1.75 mn tonnes per annum. The main contractor for the project was Orascom Engineering & Construction USA.

In other OC news, the company has qualified for a contract to develop infrastructure on the 610 feddans expansion in New Cairo, said the head of the New Cairo Authority Moustafa Fahmy. OC and Arab Contractors were the only two out of the seven contractors bidding on the project to qualify for the EGP 200 mn development.

IPO WATCH- First companies under state IPO program to list on EGX as early as September or October? Here we go again. Apparently, the government expects the first batch of companies under its IPO program to list shares on the EGX by the end of the first quarter or beginning of the second quarter of FY2018-19, Finance Minister Amr El Garhy tells Youm7. The committee overseeing the program is still deciding which 4-6 companies (from a list of 23) it intends to offer on the EGX in 2018, according to El Garhy, who adds that companies that are more “ready” than others will receive priority.

Caveat lector: Two things here, folks. Or perhaps three. First, the local press continues to confuse “IPOs” with “stake sales” — the first batch of companies to offer shares could do so as early as fall, as the minister suggests, but we think they’re more likely to be stake sales by already-listed companies via accelerated book builds. Indeed, EGX boss Mohamed Farid had also said that he expects only two IPOs under the program this year and only a few listed state-owned companies offering additional shares on the EGX before the year was up. Second, the local press has done an abysmal job of covering the timeline here, butchering the words of various government officials and generally failing to come up with a coherent narrative. So we’re taking a “we’ll believe it when we see it” approach to coverage of the expected timeline on this story. Third, can we just call this a privatization program? Yeah, we know, “IPO” takes the sting out of it all for our (still-Socialist-at-heart) fellow citizens, but really: This is partial-privatization by another name, and calling it an IPO program is something of a misnomer.

Beltone Financial’s New York-based brokerage subsidiary Auerbach Grayson & Company will open its first international office in London this coming June as part of its global expansion drive, the company announced in a press release (pdf). “In addition to consolidating its offering to align with MiFID II regulations, the expansion will establish closer ties with UK and European clients,” the statement read. Beltone Financial acquired a 60% stake in Auerbach Grayson in October 2016.

INVESTMENT WATCH- TEDA Egypt is looking to attract a total USD 5 bn in investments to its Ain Sokhna industrial zone over the next four years, throughout which the second phase of the project will be developed, Executive Director Li Daixin said yesterday, Al Shorouk reports. Companies have already committed up c. USD 500 mn to second-phase projects, he said. TEDA had said last week that it was looking to attract USD 3 bn worth of Chinese investment to the zone, without elaborating on the nature of the investments or the prospective investors.

Expect a flurry of Chinese textile investments coming as talks with leading Chinese textile companies ratchet up. TEDA plans to hold talk this week with Shandong Ruyi to develop a factory in the zone, according to Al Mal. This comes as a delegation of 50 Chinese companies met with Trade and Industry Minister Tarek Kabil, who pitched them on the opportunities in the Egyptian textiles sector, according to a ministry statement.

On a related note, the FY2018-19 budget projects that the Suez Canal Economic Zone (SCZone) will make a net profit of EGP 1.5 bn, up from EGP 1.3 bn in FY2017-18, according to Al Mal. Revenues for the SCZone, which includes the Ain Sokhna industrial zone, are expected to reach EGP 3 bn.

The UAE’s Rotana Hotel Management Corporation is launching a new 200-room five-star hotel in New Cairo, 4 Hoteliers reports. According to the announcement, made at the Arabian Travel Market (ATM) in Dubai, the new management agreement will raise the company’s total rooms in Egypt to 726. “The announcement of our second five-star hotel in Egypt rightly reflects the rising market demand in the country and the wider region,” says President and CEO Omer Kaddouri. Chairman Nasser Al Nowais had said in February that the company would operate a new hotel in New Cairo’s Fifth Settlement without naming the hotel or its owner, but said it was under construction and would take one to three years to complete.

MOVES- AccorHotels has appointed Frank Naboulsi as the hotel management group’s new regional Vice President for luxury brands in Egypt, Trade Arabia reports. Naboulsi will be responsible for supporting AccorHotels’ portfolio in Egypt, which includes Fairmont Nile City and several Sofitel hotels across the country. He had been with the Fairmont Brand since 1991, serving in several managerial positions in Canada and the US before joining Fairmont Nile City in 2007 as general manager and regional vice president, Egypt.

EARNINGS WATCH- Dairy products maker Juhayna Food Industries reported a 39% y-o-y jump in net profits to EGP 81 mn during 1Q2018, according to a company earnings release (pdf). Revenues were up 21% to EGP 1.553 bn.

*** SMART PEOPLE WANTED. We’re hiring at both Enterprise and at our parent company, Inktank. We’re looking for critical thinkers who have outstanding English-language writing skills. Don’t apply if you are not (at an absolute minimum) unafraid of numbers. We offer a great, casual work environment, the opportunity to work with smart people who care about what they do, and plenty of intellectual challenge. You’ll do your best work here, whatever your profession is. Check out the open positions, from creative director to reporter, from Enterprise editor to senior investor relations advisor at Inktank.***

Spotlight

We spoke yesterday with Renaissance Capital MENA CEO Ahmed Badr ahead of his Egypt conference in South Africa, picking his brain on the essentials of Egypt, Saudi Arabia, and the finance industry post-Mifid II. Edited excerpts:

Fear not the flight of the carry trade: We think the central bank will cut another 200-300 bps between now and the end of the year. There is no need to be too concerned about losing the carry trade, which is still going to stay. When looking at yields in the bond market anywhere in the world, there aren’t many attractive opportunities. Even with the cuts, Egypt still attractive for fixed income investors. Obviously, we will reach a point when the carry trade will fade away, something even the government would welcome at some point. We think it’s all about a shift from the “hot money” (an accurate term in my mind) and portfolio investors who are buying T-bills or just parking money in whatever instrument there is available, towards equities and FDI. We’re in that transitional phase now, which is key and positive provided that there is an attractive landscape for investors, local or foreign.

Is Egypt ringing out among investors on the strategic level? Indeed. There’s a lot of interest from clients who have never looked at Egypt before. As a matter of fact, we’re hosting a large group of investors in Cairo in the next few weeks.

And this interest is across the board. Banks are still very attractive. Everyone favors them, even though they are very conventional. We’re also seeing a lot of interest in the consumer sector — a call we made back in January 2017 when we said consumer companies would do better than people think thanks to the sheer size of the informal economy. Healthcare is garnering interest, even though it still presents regulatory challenges for foreign investors. Nonetheless, South African healthcare investors are attending our annual Egypt investor conference for the first time in two years. The next-best-thing is education, even though it is similarly challenging for foreign investors because of the regulatory environment. We don’t see education taking off this year, but it could in 2019.

A real estate bull growing quiet? Everyone has been bullish on real estate for a long time now, and I was among them for a long time. I’m not so much now. It will do well in the short-term as interest rates come down and people move their cash into properties. However, I’m getting concerned because, over the past 10 years, people have been moving their money out of banks and into properties, driving up prices to a point where people — investors, not people owning to live in the properties — probably already own more than they can afford. There remains genuine demand, but the prices have pushed the market towards investors rather than homeowners.

An alarming trend: I’m also finding the way many of the smaller developers are pushing payment terms over eight and 10 years quite alarming. We won’t see a crash in prices as the Egyptian market is a cash market. What ends up happening when there’s a sign of a bubble in this type of landscape is that transactions dry up completely. I see these starting to dry up over the next 12 months. So share performance is likely to be strong in the short term, but in the long run I see the sector struggling. That’s why transactions such as the potential merger of Madinet Nasr for Housing & Development and SODIC makes a lot of sense for both sides.

Why Ahmed doesn’t like cement: One industry we do not favor is cement, and it comes down to the glut in the market. Even with the real estate boom, it’s in oversupply, and this is driving some foreign companies to consider exiting. This is not to mention the fact that our traditional regional export markets have fallen on hard times.

The 2018 MENA trade: Out of UAE and Qatar and into Egypt KSA: From a regional perspective, Egypt and Saudi Arabia are the only two markets that I favor and believe they will actually do well in the whole of MENA. They’re the only reform stories in the region at the moment, and they’re both long-term. I’m not bullish on Qatar or the UAE at all, and you can see now that liquidity in these markets has dried up. We’re advising clients to look more attentively at Saudi Arabia and Egypt and be less focused on UAE and Qatar. That is the trade for 2018.

Why KSA is the flavor of the year: With Saudi Arabia, the political issues are now behind us, but more importantly, there is the potential MSCI upgrade to emerging market status as early as the end of May. Coming on the back of the FTSE EM upgrade, investment banks are really pushing Saudi Arabia as the key trade. When the impact of the MSCI upgrade takes full effect in May 2019, it will very likely attract about USD 14 bn in passive flows that just follow the index – and that’s very conservative estimate. I think it could be substantially more.

Saudi Arabia is a huge consumer market. The underlying challenge was that purchasing power went the way of falling oil prices, but that’s reversing with oil hovering now at USD 70. Saudi Arabia is adamant on pushing oil prices higher, OPEC is adamant about it, too. It doesn’t have to hit USD 80, as some analysts have been saying. Oil analysts rarely get the price right. Keeping the pricing sustainable at around current levels makes a lot of sense for the country. Saudi Arabia is not only a reform story that’s shifting its economy from hydrocarbon to non-hydrocarbons, but one that is getting a boost from stronger oil prices as it does so.

Is there a deleveraging story at play for Egypt? Not for the private sector yet. Companies were previously looking to borrow, but at high interest rates that didn’t make much sense. Even if they had gone to the international capital markets, it would still be the same. Now, with local interest rates going down, it is much easier to raise USD debt for Egyptian companies. There is more confidence in the economy and more confidence in the currency. There’s actually demand for local currency debt, which is something we’re exploring and that hasn’t happened in a very long time. We’re advising on several USD issuances and exploring LCY.

RenCap has mandates in hand: There is appetite among local companies to go into the debt market right now, and we have live mandates being executed as we speak — one of which is expected to close in May and which our special situations team is working on.

On the impact of Mifid II: Mifid II in general has changed the face of the industry significantly. When you’re a player that knows its niche as we do — as an EMEA frontier specialist — you are in a better position. The challenge is that we need to continue being niche, so we’ll continue to focus on markets like Egypt. When you look at our international competitors, they shy away from places like Egypt.

In Egypt to cooperate, not compete: We’ve been licensed in Egypt for the past five months and the official opening of the office will take place in the next month. We currently hold key licenses for underwriting and promoting IPOs and plan on becoming a fully licensed investment bank across all operations in Egypt, with the exception of brokerage services, where we will trade through local partners. On the research side, we’re getting building out a team of three analysts led by Ahmed Hafez. We currently have two investment bankers, and are expecting to grow the team to five by the end of June. The roll-out of our Egypt operations is in line with our strategy to expand the firm’s frontier markets offering which has already proved successful. That’s clear in our FY2017 results, where we reported 43% year-on-year growth in net profit (pdf) to USD 15.6mn coming from increased activity in our core EM and frontier geographies.

Even at this size we are able to balance our local team with our global distribution platform. Our Egyptian business will call on team members in places such as Moscow, London, and New York. Access to this kind of global expertise is really what differentiates us from local or regional platforms. Even though our local team has this international force behind it, we’re not going to shy away from working with local investment banks, too.

What am I reading? I just started reading Jordan Belfort’s the Way of the Wolf, where he talks about how he turned a bunch of mediocre people into sales geniuses. It’s not the Wolf of Wall Street story, but about how to turn anyone into a great salesperson. It’s aggressive, because he’s half-crazy, but it works and it’s very entertaining. The most interesting recent movie I’ve seen is the Winston Churchill biopic The Darkest Hour. At one point Churchill says, “Those who never change their minds, never change anything.” A quote I find fitting in our business.

Egypt in the News

It was another quiet day for Egypt in the international press, with only a handful of stories worth a noting:

Saudi Arabia’s decision to reopen its movie theatres after a 35-year hiatus is good news for Egypt’s film industry. The move opens up an important new market for Egyptian films, not only because of the large community of Egyptian expats in the kingdom, but also because the Saudi audience has a preference for Egyptian film, says Egyptian film critic Tarek El Shennawi, according to Al Arabiya.

Meanwhile:

- It’s nothing but tough times ahead for Egypt’s rice farms, as the government clamps down on the cultivation of water-intensive crops with a new agriculture bill that means to circumvent the impact of Ethiopia’s grand dam on Egypt’s Nile water supply, says Reuters.

- Israel’s Haaretz has taken interest in Egypt’s new Cyber Crimes Act, which received final approval from the House of Representatives last week.

- From the Algemeiner: Ninety years on, the Muslim Brotherhood faces an uncertain future.

- Media freedom files, part I: The Egyptian Organization for Human Rights (EOHR) reportedly expressed deep concern over charges brought up against Al Masry Al Youm for its coverage of the elections, All Africa reports.

- Media freedom files, part II: UNESCO went ahead with awarding Egyptian photojournalist Shawkan the 2018 Guillermo Cano Press Freedom Prize a day after Egypt’s Foreign Ministry objected to his nomination, Reuters reports.

- Egypt’s publishing industry is suffering from a severe lack of funding, according to the Arab Weekly.

Diplomacy + Foreign Trade

Egypt signed an agreement with OPEC Fund of International Development (OFID) that will see it receive USD 53.2 mn in funding for phase two of a program to upgrade irrigation and sewage systems, according to a statement from the Investment and International Cooperation Ministry. Egypt had received USD 30 mn for phase one of the program.

The Military Production Ministry signed on Sunday contracts with European development organizations to manufacture waste disposal equipment and develop recycling plants as part of an EGP 932 mn national strategy for solid waste management, Al Shorouk reports. The contributing organizations are the German Development Bank (KfW), the German Development Agency (GIZ), the European Union, and the Swiss Agency for Development and Cooperation.

Tourism

Travco to open new Steigenberger-run hotel in Sheikh Zayed this year

Egypts’ Travco Travel Company has signed a 50-50% partnership agreement with German investors to build a new hotel in Sheikh Zayed this year, according to Chairman Hamed El Chiaty. The company has also signed a management contract for the 300-room hotel with Steigenberger. The opening date is slated for early next year.

Egypt Politics + Economics

Man who killed ADIB CEO Nevine Loutfy sentenced to death

The Giza Criminal Court has sentenced to death the man convicted of murdering ADIB Egypt CEO Nevine Loutfy last year, Al Masry Al Youm reports. In addition to premeditated murder, Karim Saber was also convicted of drug and weapon possession, as well as auto theft. Loutfy was found murdered in her 6 October home in November 2016. At the time of her death, Loutfy had been the first Arab woman to lead an Islamic bank.

On Your Way Out

Egyptian-German ensemble Cairo Steps and German band Quadro Nuevo received the prestigious Jazz Music Award in a Thursday ceremony in Berlin for their joint album “Flying Carpet,” Nile International reports. Culture Minister Inas Abdel Daim, who is also a flautist, joined Cairo Steps at the ceremony as one of the prize recipients.

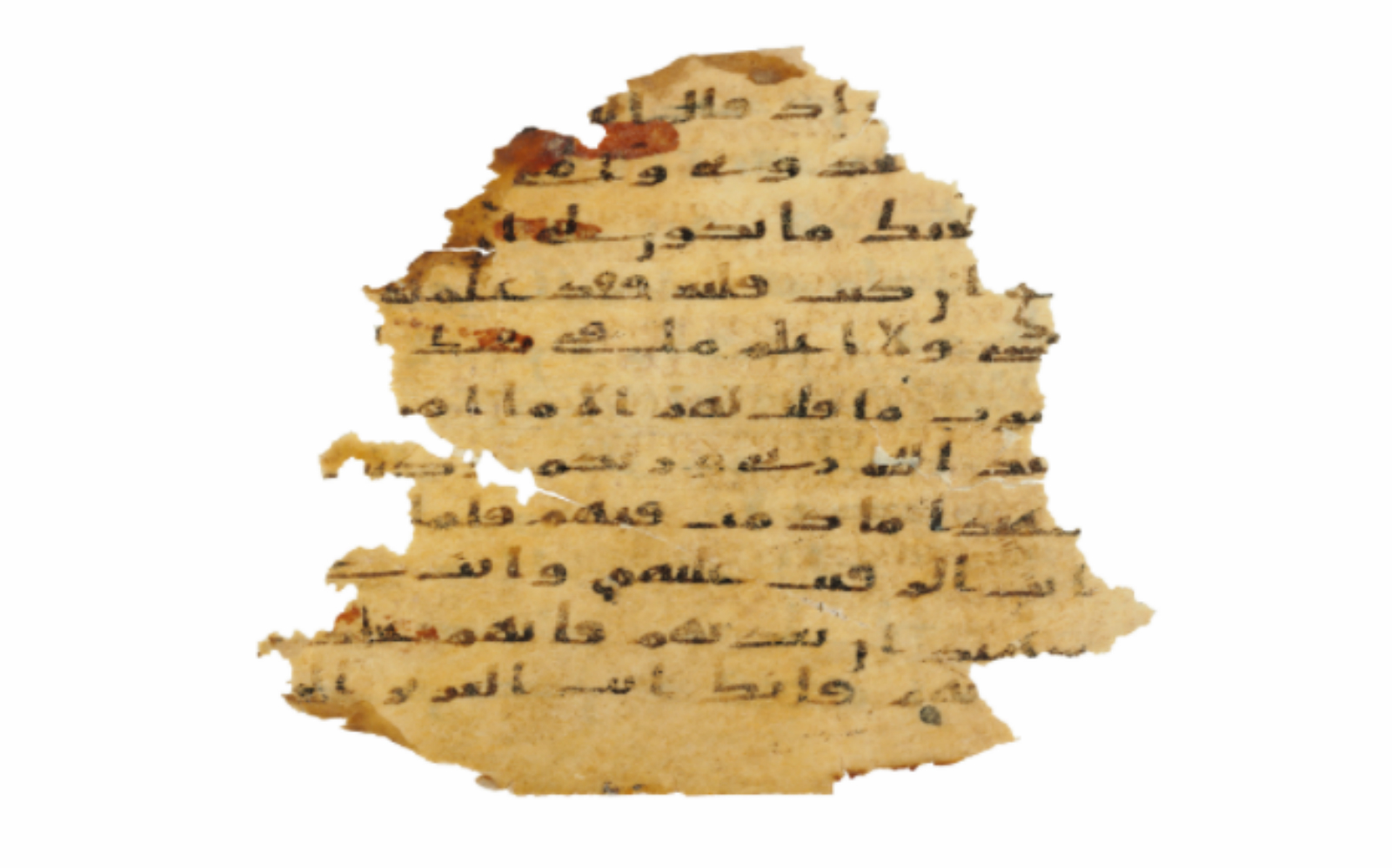

Christie’s London is auctioning off nine 7th century pages from the Quran on Thursday, according to their website. The folios, which are on sale for USD 112.2k-168.4k, were likely crafted in Egypt as biblical text in the Coptic language shows clearly under the Arabic script, according to the Times of Oman.

The Market Yesterday

EGP / USD CBE market average: Buy 17.65 | Sell 17.75

EGP / USD at CIB: Buy 17.65 | Sell 17.75

EGP / USD at NBE: Buy 17.57 | Sell 17.67

EGX30 (Monday): 18,081 (+1.0%)

Turnover: EGP 1.9 bn (64% above the 90-day average)

EGX 30 year-to-date: +20.3%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 1.0%. CIB, the index heaviest constituent ended up 1.0%. EGX30’s top performing constituents were Qalaa Holdings up 5.6%, Amer Group up 5.1%, and TMG Holding up 4.2%. Yesterday’s worst performing stocks were GB Auto down 2.6%, Pioneers Holding down 1.7%, and Elsewedy Electric down 1.5%. The market turnover was EGP 1.9 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +286.3 mn

Regional: Net Short | EGP -169.2 mn

Domestic: Net Short | EGP -117.1 mn

Retail: 58.1% of total trades | 55.5% of buyers | 60.8% of sellers

Institutions: 41.9% of total trades | 44.5% of buyers | 39.2% of sellers

Foreign: 21.0% of total | 28.5% of buyers | 13.4% of sellers

Regional: 17.5% of total | 13.0% of buyers | 22.0% of sellers

Domestic: 61.6% of total | 58.5% of buyers | 64.7% of sellers

WTI: USD 68.84 (+0.29%)

Brent: USD 74.84 (+0.17%)

Natural Gas (Nymex, futures prices) USD 2.74 MMBtu, (+0.11%, May 2018 contract)

Gold: USD 1,326.00 / troy ounce (+0.15%)

TASI: 8,335.35 (+0.95%) (YTD: +15.35%)

ADX: 4,693.47 (+0.23%) (YTD: +6.71%)

DFM: 3,061.97 (-0.57%) (YTD: -9.14%)

KSE Premier Market: 4,779.27 (+0.06%)

QE: 9,157.57 (+0.02%) (YTD: +7.44%)

MSM: 4,756.03 (-0.11%) (YTD: -6.73%)

BB: 1,298.60 (-0.19%) (YTD: -2.49%)

Calendar

20-27 April (Friday-Friday): Seventh edition of El Gouna International Squash Open, El Gouna.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

30 April (Monday): High Representative of the EU for Foreign Affairs and Security Policy and Vice President of the EU Commission Federica Mogherini visits Cairo.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

03 May (Thursday): Egypt’s Emirates NBD PMI reading for April released.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

05-06 May (Saturday-Sunday): Inclusive Growth and Job Creation Conference, venue TBD, Cairo.

07 May (Monday): International Data Corporation’s CIO Summit, The Nile Ritz-Carlton Hotel, Cairo.

07-08 May (Monday-Tuesday): Fourth annual Egypt CSR Forum, InterContinental Semiramis Hotel, Cairo.

17 May (Thursday): Expected date for the start of Ramadan.

17 May (Thursday): CBE’s Monetary Policy Committee meeting.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.