- LEGISLATION WATCH- SME Act to cabinet within two weeks. (Speed Round)

- CABINET WATCH- USD 7 bn Russian Industrial Zone Gets nod, National Advertising Regulatory Authority is in the pipeline. (Speed Round)

- All conditions met to export gas from Leviathan to Jordan, partners say. (Speed Round)

- Winding-down of African private equity funds is creating dealflow in frontier markets, EFG Hermes’ Khalpey says. (Spotlight)

- Egyptera to settle on waste-to-energy feed-in tariff next week. (Speed Round)

- Tourists, hotel chains are returning to Egypt. (Speed Round)

- Egypt’s struggling job market is a “blessing in disguise” for entrepreneurship, World Bank blog writes. (On Your Way Out)

- The Market Yesterday

Thursday, 8 March 2018

Tourists, hotel chains returning to Egypt

TL;DR

What We’re Tracking Today

Greetings from Dubai, where we will shortly join every listed company from Omm El Donia in boarding planes back home to spend the weekend with family. Today, we have the next-to-last installment of our coverage from here in the form of an interview with EFG Hermes Frontier boss Ali Khalpey. On Sunday, we’ll bring you a sit-down with our friend Mohamed Ebeid, co-CEO of the firm’s investment bank. Our talk with Ali appears in today’s Spotlight, after Speed Round, below.

Egypt is fielding proposals from 10 investment banks to manage its EUR 1-1.5 bn eurobond issuance in April, Finance Minister Amr El Garhy said yesterday, according to Al Mal. El Garhy had said earlier this week that Egypt will settle on the winning banks within two weeks. HSBC, Citigroup, JPMorgan Chase & Co, Morgan Stanley, and National Bank of Abu Dhabi had managed the USD 4 bn issuance that Egypt successfully closed last month. Vice Minister of Finance Ahmed Kouchouk also told the newspaper that the ministry is hoping to attract interest from “different types” of investors than those it attracted in its USD-denominated issuance.

Separately, El Garhy confirmed that the government has nixed its plans to issue yuan-denominated bonds (known as Panda bonds), Al Masry Al Youm reports.

Government to sign new agreements with AFD today: Investment Minister Sahar Nasr and Transport Minister Hisham Arafat will sign a number of agreements today with the French Development Agency (AFD) and French Embassy in Cairo, according to an emailed statement. Details on the agreements were not disclosed, but we’re expecting them to cover fresh financing for the Cairo Metro and Alex tramway development projects, to which the AFD has already committed EUR 300 mn and EUR 100 mn, respectively. Arafat had been in meetings with the agency to discuss additional funding packages and was said to be signing two agreements with the AFD, one each in May and September, for both projects.

Egypt is participating in the ITB Berlin Convention, which kicked off yesterday and wraps on 11 March in Germany. A number of Egyptian tour companies and hotel operators are participating in the exhibition. Full details are available here.

Today is International Women’s Day. Barbie-maker Mattel marked the occasion by releasing a new line of Barbie dolls based on real women who have made history and serve as inspirational role models for young girls. The 17-doll lineup includes the likes of acclaimed Mexican artist and activist Frida Kahlo, body activist and model Ashley Graham, and NASA mathematician and physician Katherine Johnson, according to BoredPanda.

Celebrate Women’s Day by doing something cool with your daughter. As one of the dads around here is constantly head telling the resident 10-year-old: Anything a boy can do, a girl can do better.

Best (and most blatant) women’s day publicity stunt: DHL Egypt has hired 20-year-old Nasra as its first delivery woman in the MENA region to mark International Women’s Day, General Manager Ahmed El Fangary tells Youm 7.

The Downtown Contemporary Arts Festival (D-CAF) will kick off on 9 March with a special “women-dedicated” seventh edition to mark International Women’s Day, Egypt Today reports.

Meanwhile: Alfanar is hosting an interactive discussion about the latest trends in social entrepreneurship and sustainable development in vulnerable communities in Egypt and the region. The session will take place on Sunday at the Nile Ritz Carlton, 9:00am CLT. Panelists include Social Solidarity Minister Ghada Waly, Olayan Financing CEO and Alfanar Chairman Lubna S. Olayan, and our very good friend Nadina Okasha, SODIC director of strategy, research & PR. You can sign up here.

PSA- The Cairo-Suez desert road will be closed in both directions from 11:00 pm to 06:00 am on Thursday and Friday for road work, Ahram Gate reports.

On The Horizon

Infinity Solar is scheduled to inaugurate its 50 MW solar power plant in Benban, Aswan next week. Infinity has already conducted trial operations and connected the plant to the national grid, making it the first company to complete a solar power plant under the feed-in tariff program, according to CFO Mohamed Shehata. Electricity Minister Mohamed Shaker is expected to attend the inauguration.

Verdict coming in anti-Uber, Careem lawsuit: The Administrative Court will issue a verdict on 20 March in the case filed by 42 taxi drivers demanding that local operations for ride-hailing services Uber and Careem be shut down.

Enterprise+: Last Night’s Talk Shows

It was a night of miscellany on the airwaves last night as the talking heads shuffled between topics, including updates from the ITB Berlin tourism expo, the presidential elections, and the Russian industrial zone.

Although security is still a significant concern in the minds of tourists when they consider travel to Egypt, there is a general optimism about the situation, Tourism Minister Rania Al Mashat said from ITB Berlin. The tourism industry produced “very satisfactory” results in 2017, she told Kol Youm’s Amr Adib, and hopes are for the market to continue improving in 2018. Al Mashat said she is in talks with German and Chinese officials to draw more of their tourists here (watch, runtime: 41:59).

Egypt’s embassies across the globe are gearing up to receive voters for the upcoming presidential elections from 16-18 March. Masaa DMC’s Osama Kamal spoke to ambassadors in Frankfurt (watch, runtime: 12:00), Kuwait (watch, runtime: 5:45), and DC (watch, runtime: 5:48), who explained to him that travelers as well as expats will be able to vote from abroad. Yahduth fi Misr’s Sherif Amer said that the Arab Summit in Saudi Arabia has been pushed to April from March to accommodate the election schedule (watch, runtime: 1:10). Adib, meanwhile, continued to loudly “encourage” his audiences to participate in the poll (watch, runtime: 9:55).

The 5 mn sqm Russian Industrial Zone (RIZ) that will be built in East Port Said will create as much as 35,000 new job opportunities, Cabinet spokesman Ashraf Sultan told Al Hayah Al Youm’s Nahawand Serry. The RIZ, which Cabinet approved yesterday, is expected to draw in around USD 7 bn in investments (watch, runtime: 4:00).

Sultan also discussed new legislation on waste management, which Environment Minister Khaled Fahmy told Serry will solve Egypt’s garbage problem (watch, runtime: 38:21).

Meanwhile, legislation on cybercrimes will not see the state police social media posts expressing opinions, but will target fake news, as well as libel and slander, House ICT Committee chair, Nedal Al Saeed told Adib about the bill currently under discussion (watch, runtime: 2:41)

The EGX has been on an upward trend despite the global slump that followed the US’ decision to impose tariffs on imported steel and aluminum, Kol Youm’s Amr Adib joyously exclaimed, attributing the rise in market activity to “optimism” triggered by economic improvements (watch, runtime: 4:00).

UN Human Rights Council chief Zeid Ra’ad Al Hussein’s statements before the Security Council on Egypt’s “pervasive climate of intimidation” were on the receiving end of Kamal’s ire on Masaa DMC (We have more in Egypt in the News). Kamal slammed Al Hussein’s criticism of the Egyptian government, saying that measures such as blocking websites are necessary in the fight against terrorism (watch, runtime: 5:52).

Speed Round

Egypt, Turkey, and Tunisia are making a comeback as popular tourist destinations after a period of political instability marked with terror attacks over the past few years, according to Expatica. “A period of relative calm has tempted tourists to set their fears aside and rediscover these classic destinations, lured by the promise of sun, sea and rock-bottom prices.”

Major hotel brands are also flocking to Egypt and “working to sure up their footprints” in the country as tourists gradually return. “Nowhere is the coming hotel boom in Africa more evident than it is within Egypt’s project pipeline…there are presently 52 projects in Egypt’s hotel construction pipeline” that are expected to add 19,466 hotel rooms once complete by 2021, says Hospitality Net. Hilton had recently announced, following the launch of its new 593-room facility in Heliopolis, that it was planning to open Africa’s first Waldorf Astoria in Cairo later this year.

LEGISLATION WATCH- A draft law on small and medium-sized businesses is due to the Ismail cabinet in two weeks’ time, a trade and industry ministry official tells Al Masry Al Youm. The bill, which means to offer tax and non-tax incentives that would encourage SMEs to join the formal economy, will not be granting any tax exemptions, but will likely only impose a single levy on small businesses, according to Ragab. It will also allow for the use of real estate assets as collateral for funding, in addition to facilitating funding and licensing procedures, he added.

CABINET WATCH- The Ismail Cabinet signed off yesterday on the preliminary agreement to set up the USD 7 bn Russian Industrial Zone (RIZ) in the Suez Canal Economic Zone, according to a statement. Russia’s Industry and Trade Ministry spokesperson had said last month that Egypt and Russia are expected to sign the final contracts establishing the zone on the sidelines of a joint trade commission meeting in Moscow this month. Talks on the RIZ — which had initially been announced in 2014 — had hit a roadblock last summer but resumed smoothly in October.

The ministers also signed off on amendments to the Unified Building Code that would grant consultants and specialists registered with the General Organization for Physical Planning the legal authority to inspect construction projects. These experts would also be mandated with taking the necessary legal action to halt and report any violations.

Also approved during the weekly meeting:

- Draft legislation on solid waste management after including proposed amendments. The law will now be referred to the Council of State for review;

- A draft law establishing the National Advertising Regulatory Authority to regulate billboards on roads and bridges;

- Allowing landowners to pay fees to legalize their ownership in instalments over three years, with interest;

- An agreement to disburse the third USD 500 mn tranche of the African Development Bank’s USD 1.5 bn loan;

- A JPY 993 mn (USD 9.4 mn) grant from Japan for the Egypt-Japan University of Science and Technology;

- Two separate grants from the US to finance water sanitation projects and develop family planning and reproductive health services.

The partners in Israel’s natural gas field Leviathan announced that all conditions have been met to allow the supply of gas to Jordan’s electric company, Reuters reports. “They said the capacity of the pipeline that will connect to Jordan via a direct pipeline and one that runs via Egypt would allow the flow of up to 10 bcm of gas a year.” The Leviathan partners signed a 15-year USD 10 bn agreement to supply 1.6 tcf of gas to Jordan’s National Electric Power Company in 2016.

Meanwhile, Noble Energy and Delek Drilling are looking to purchase the rights to use the East Mediterranean Gas Company’s pipeline to transport gas to its customers in Egypt, according to the newswire. The companies did not provide further details, but Delek said “there was no certainty” that talks will lead to a binding agreement. Reports had emerged last month that Delek and Noble had begun talks with EMG’s shareholders to acquire the company, and that the flow of EMG’s pipeline would be reversed if the agreement goes through. Delek and Noble had signed an agreement with Alaa Arafa-led Dolphinus Holding last month that would see the latter import USD 15 bn worth of gas from the former two.

Egyptera to settle on waste-to-energy feed-in tariff next week: The Egyptian Electricity Utility and Consumer Protection Agency (better known as Egyptera) is expected to settle on the feed-in tariff for waste-to-energy projects next week, sources at the agency tell Al Borsa. The newspaper claims the Electricity Ministry is planning to set a FiT rate of EGP 1.03-1.04 per kWh for refuse-derived fuel, which is the same rate the ministry charges homes in the highest energy consumption tier. Egyptera officials are pushing to set the tariff for RDF at EGP 1.35 kWh. This contradicts earlier reports that Cabinet had agreed to set a FiT rate of EGP 1.60 for refuse-derived fuel, while setting the rate for biogas and burnable agricultural waste at EGP 1.45 and EGP 1.30 per kWh, respectively.

Egypt received the third and final USD 1 bn tranche of the World Bank’s USD 3.15 bn development loan, Investment and International Cooperation Minister Sahar Nasr announced yesterday Reuters reports. The bank’s executive board had approved the disbursal of the final tranche in December. Top state officials had said at the time that the tranche would be used to bolster FX reserves, while its EGP equivalent will be paid out to different government offices and ministries to help finance development projects under their administration. Separately, Nasr said that Egypt also received USD 150 mn from the G7, but did not provide further details.

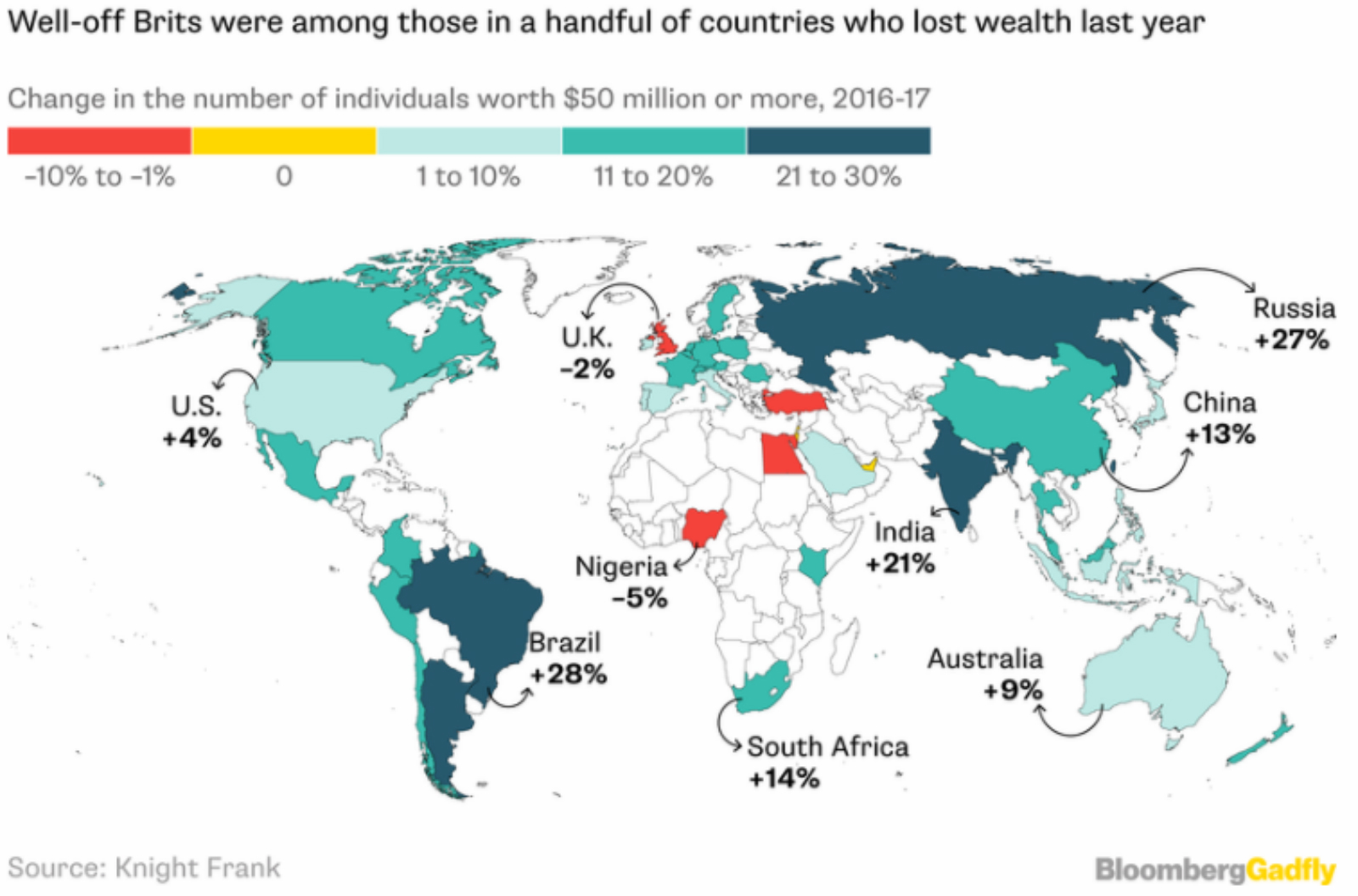

Egypt was one of four countries that saw the number of people with a net worth of over USD 50 mn fall y-o-y in 2017, according to real estate firm Knight Frank. Egypt joins the UK, Nigeria, and Turkey, who all saw a drop despite a global increase of 10% y-o-y, Bloomberg Gadfly reports.

Need a refresher on the Bankruptcy Act? Our friends at Sharkawy & Sarhan have put together a handy primer on the recently enacted legislation, which effectively decriminalizes bankruptcy, creating a “win-win situation for all the related parties in the bankruptcy process.”

Spotlight: EFG Hermes One on One 2018 in Dubai

Sentiment among international investors toward Egypt and frontier markets was strikingly positive at this year’s EFG Hermes One on One. A striking number of Egyptian companies, in particular, having meeting schedules dominated by group meetings rather than the titular one-on-ones. To set things in perspective, we had chats with our friends Mohamed Ebeid, Co-CEO of Investment Banking at EFG Hermes, and Ali Khalpey, CEO of EFG Hermes Frontier. On Sunday, we’ll have our interview with Ebeid.

Today, Khalpey discusses who did well in 2017, the one big overhang on frontier markets this year, and how the wind-down of Africa-focused private equity funds is impacting activity across FM. Edited excerpts:

Emerging and frontier markets did very well in 2017, said Khalpey. We’re seeing interest from asset allocators in EM and more financing dedicated to frontier managers. It’s interesting, really: Global EM investors now appear to be looking for alpha in non-core markets.

Specific beneficiaries? Argentina and Vietnam have done very well. Egypt was a big beneficiary in 2017. We’re now seeing that spill over into peripheral markets.

Valuations have now become polarized, with markets including Vietnam and Argentina looking quite expensive: Pakistan and Nigeria are looking very attractive on valuation. Pakistan in particular, which experienced 10% devaluation, passed people by, we may see another 5-7% devaluation there, but it’s already starting to look quite attractive. In Nigeria, the Naira came down after oil slid. Since then, there’s been a significant recovery in oil prices and portfolio flows on the back of the country being heavily weighted, so I’m not certain there’s much more scope for devaluation here now. Nigeria has seen economic growth and recovery as well as structural reforms, which has made the country a good growth story set to continue over the next few years.

Khalpey agreed with Ebeid that investors are taking predominantly a bottom-up approach when it comes to EM and FM in 2018, meaning they’re choosing individual stocks that look compelling rather than wider industry or macro themes. Investors are playing Argentina for MSCI inclusion. The same goes for Kuwait and perhaps Saudi Arabia. Vietnam has got a very solid growth story, but again, the market is a bit expensive at the moment. In Nigeria, banks are extremely attractive. And in Pakistan, we’re seeing considerable interest in names including banks and cement are interesting.

Liquidity and foreign ownership limits are challenges on the frontier: With some frontier markets doing a few mn US a day in turnover, liquidity is still a very significant challenge getting into and, particularly, out of markets. But really, you also need to take into account foreign ownership limits. Take Vietnam, one of the most liquid frontier markets that trades USD 300 mn a day. The foreign ownership restrictions make it a less-than-fully tradable market for foreigners. So even if investors like the story and have the liquidity, restriction on their ownership stake limits their ability to buy. So if you want to buy the best banks in Vietnam, you can’t. You want to buy the best retailer, you can’t. Vietnam is making a lot of progress on removing the foreign ownership caps, but it’s currently on a sector by sector basis and it’s a long-term plan.

The other caveat for frontiers is politics, considering elections in places like Bangladesh, Pakistan, Zimbabwe and one in Nigeria in 2019. EFG Hermes generally tends to ignore politics on the long term basis, but (in the short term) it will make noise and draw attention to the downsides of some markets.

There will probably be three significant IPOs in frontier markets this year, and EFG Hermes has one of them. It will be our first in frontier markets.

What’s being done to bring more names to the market in FM? Frontier market IPO activity will be a lot more muted than it is when you compare to a place such as Egypt. Egypt can turn the tap on aggressively and quickly to bring new listings. That said, we do have a very interesting IPO mandate in a frontier market that we hope to execute this year. Instead, we’ll see activity on the frontier biased more toward M&A and other equity capital market activities. Vietnam is the one market that’s an exception: It’s a place where markets revalue, valuations go up, and new issuers come to the market very quickly. The only other market that can match Egypt or Vietnam in that respect is Pakistan, which has underperformed since the upgrade to MSCI emerging market status. Pakistan has been down 40% since the MSCI upgrade all the way to December. It has rebounded since, but the valuation story hasn’t been appealing for issuers over there, it hasn’t gotten to the point that they’d be tempted to return to the market.

Look for plenty of ECM activity in Nigeria and in other frontier markets where companies suffered have been through devaluations. The big push will be recapitalization that has to happen, a lot debt and equity needs to be raised for companies that have had hits from the currency impact.

The winding-down of Africa-dedicated private equity funds is going to create a lot of dealflow. Funds such as Carlyle, ECP, Actis and Helios, who raised raise funds from 2008-2011, those funds are now coming to the end of their lifespans. Seven years is about average for the life of a PE fund. So as they come to the end of their duration, they’ll need to dispose of assets. I think we’re very well positioned in this respect, as the General partners are people who have been important clients of ours for 10, 15 years and more.

EFG Hermes Frontier is pushing swaps and participation notes to ease investors into frontier markets: We launched swap products that have enabled solid, EM-dedicated investors to transact, and we have expanded our p-note product from Saudi Arabia to all frontier markets. So now there are access products for EM investors who hasn’t necessarily got a custody arrangements in place; they can now transact straight away.

Egypt in the News

There is a “pervasive climate of intimidation” in Egypt ahead of presidential elections that has been marked by arrests, torture of detainees and “silencing” of independent media, UN Human Rights Council chief Zeid Ra’ad Al Hussein decried. “Potential candidates have allegedly been pressured to withdraw, some through arrests. Legislation prevents candidates and supporters from organizing rallies. Independent media have been silenced, with over 400 media and NGO websites completely blocked,” Al Hussein said, according to Reuters.

The Foreign Ministry issued a statement denouncing Al Hussein’s remarks as “false allegations” that reflect a “deep disregard” for what has been achieved through Egypt’s efforts to promote human rights.

Poverty is rising in Egypt and economic policies have done little to improve the lives of ordinary Egyptians, Edmund Bower writes for The Independent. “The increase of prices across the country has meant that Egyptians who were once just about getting by are now slipping deeper into poverty.” Bower says that despite rising poverty rates nationwide, “the president retains real support, surprisingly, even among those struggling to survive in the current climate.”

There could be unforeseen obstacles for Israel as a result of Egypt’s handover of the Tiran and Sanafir islands to Saudi Arabia, Zvi Mazel writes for The Jerusalem Post. Mazel cites concerns over how the Multinational Force of Observers will continue to oversee the islands as part of the peace agreement between Egypt and Israel. He also notes that Saudi Arabia and Israel are technically “still officially at war, though there is a community of interest and both are at the forefront of the fight against the Iranian menace.” Mazel says: “It would seem that Israel has nothing to fear… but this is the volatile Middle East where anything can happen and Israel might well be facing unforeseen obstacles as a result of this move at some point in the future.”

Egypt has inadvertently been disrupting cellular coverage in Israel for two weeks as the military uses cyber warfare against Daesh in Sinai, The Jerusalem Post reports. An unidentified Egyptian official tells Reuters that Egypt had not intended to jam Israeli networks but confirmed that “obviously, we want to stop the terrorists from communicating.” The AP, Arutz Sheva, and Honest Reporting also carried the story.

The military’s campaign against Daesh affiliated fighters in the North Sinai is unlikely to succeed due to the regime’s blunt force approach, Gregory Aftandilian and Hrach Gregorian write for The Hill. While, the Algemeiner’s Zvi Mazel says the operation should be extended if it means to eradicate the threat entirely.

Also worth a quick skim:

- The increasing cases of torture in Egypt are not always politically motivated, Khaled Hassan writes for the Carnegie Endowment for International Peace.

- Reporters Without Borders condemned “the disproportionality” of photojournalist Mohammed Abu Zeid’s death sentence to his crime of covering a protest.

- Up to 10 Coptic Christian asylum seekers in Melbourne are pleading with the Australian government to be allowed to stay, days before they are scheduled to be deported, says SBS News.

- Duke University gave 40 students, faculty, and community members a crash course on Egyptian politics.”

- The foreign press takes note of Egyptian women’s efforts on int’l women’s day with The Straits Times report on Rania Seddik’s GebRaa and Xinhua’s look at how APE’s women turn waste into beautiful products.

- i24NEWS follows the story of a former Israeli Mossad agent who posed as a French painter in Egypt in the 1950s.

- The Global Post’s Salma Islam takes a look at the Grand Egyptian Museum, which will hold 100k artifacts, including 5,000 items found in King Tutankhamun’s tomb.

- A new exhibit of Egyptian mummies at Chicago’s Field Museum aims to give visitors an up-close view, according to the Chicago Parent.

On Deadline

Turkish TV production companies are the only ones paying the price for President Recep Tayyip Erdogan’s anti-Arab policies, Jehan Fawzy writes for El Watan, citing MBC’s recent decision to stop airing Turkish soap operas as an attempt to block Turkish propaganda. Fawzy says the decision to suspend shows offers no real solution to the political crisis with Ankara, but only harms producers who have made their fortunes off these shows that entranced so many Middle Eastern viewers.

Worth Watching

Saudi’s King Abdul Aziz and Winston Churchill’s 1945 lunch date in Egypt: The interwebz though it timely to begin circulating rare footage of Saudi Arabia’s founding King Abdulaziz Al Saud having lunch with then-UK Prime Minister Winston Churchill at Egypt’s Auberge hotel in 1945, as current Crown Prince Mohammed bin Salman left Egypt for the UK, where he’s expected to ink USD bn-worth of agreements (watch, runtime: 1:00).

Diplomacy + Foreign Trade

Shoukry and Ghandour talk GERD, bilateral issues: Foreign Minister Sameh Shoukry met with Sudanese counterpart Ibrahim Ghandour yesterday to follow up on developments related to the Grand Ethiopian Renaissance Dam (GERD) and other bilateral issues, according to a ministry statement. The two ministers reaffirmed their commitment to resolutions from a February meeting where they agreed to uphold water-sharing protocols signed in a 1959 treaty, which Sudan had accused Egypt of violating. Negotiations over GERD have been postponed while Ethiopia selects a new prime minister after Hailemariam Desalegn resigned in a surprise move last month. Talks had reached a stalemate after Ethiopia and Sudan both refused to acknowledge the results of environmental impact studies showing the dam would severely cut into Egypt’s Nile water supply, which took a toll on Cairo and Khartoum’s souring ties. Both countries have been slowly mending relations and Sudan’s ambassador returned to his post in Cairo this week after he was recalled almost three months ago for “consultations.”

Qatar will not be barred from attending an Arab summit in Saudi Arabia next month, Crown Prince Mohammed bin Salman said yesterday, The Associated Press reports. MbS, as he’s widely known, also predicted the standoff with Doha could last a “long time.” He also described Iran, Turkey and militant groups as the “contemporary triangle of evil.” Bloomberg also has the story.

Meanwhile, Qatar Airways says it expects to sustain heavy losses this year due to the boycott, CEO Akbar Al Baker tells Bloomberg. “The carrier will need to find new streams of financing to survive since it has no access to the equivalent of US Chapter 11 bankruptcy protection. That might include an equity injection, something the government is prepared for.”

South Sudan has filed to join the Arab League, a source told Al Shorouk. South Sudan seceded from Sudan, a member of the Arab League, in 2011.

Energy

El Sisi, Descalzi discuss Eni’s work in Egypt

President Abdel Fattah El Sisi sat down yesterday with Eni CEO Claudio Descalzi to follow up on the Italian company’s projects in Egypt, including the Zohr gas field, according to an Ittihadiya statement (pdf).

Basic Materials + Commodities

Ukraine’s grain exports to Egypt grew 10.5% in 2017

Egypt’s imports of Ukrainian grains increased 10.5% y-o-y in 2017, remaining the top destination of Ukraine’s grain products, according to Unian Information Agency. Egypt also accounted for 12.8% of Ukraine’s total agricultural exports during the year.

Real Estate + Housing

Mountain View and Redcon sign EGP 500 mn project in New Cairo

Mountain View and Redcon Construction have signed an EGP 500 mn agreement to co-develop an administrative-commercial project in New Cairo, Mountain View Chairman Amr Soleiman tells Al Borsa. Sales for the project, which will be built inside the 50-feddan Mountain View II complex, will open in six months.

Egypt Politics + Economics

Court upholds four-year prison sentence for former El Watan reporter

The Giza Criminal Court upheld yesterday a four-year prison sentence and EGP 20,000 fine against former El Watan reporter Ahmed El Khateeb, Al Shorouk reports. El Khateeb was referred to trial last year after Al Azhar’s Grand Imam Sheikh Ahmed Al Tayeb filed a lawsuit against him, claiming he defamed the institution by spreading false news.

Dozens smash police cars after officer kills man in Dakahlia cafe

Dozens of people smashed two police cars outside the Manazala General Hospital in Dakahlia on Tuesday after a police officer “accidentally” shot a man dead while on patrol, Al Masry Al Youm reports. The police officer is being held for four days pending investigation into the incident, the newspaper adds.

Court adds Tarek El Zomor and 318 Wilayit Sinai members to terror list

The Cairo Criminal Court has added the fugitive Jama’a Islamiyah leader Tarek El Zomor and 318 members of Daesh’s North Sinai affiliate Wilayit Sinai to Egypt’s terror list for three years, Al Shorouk reports. The decree freezes their assets and bans them from travel.

Philippines releases Egyptian “falsely” accused of joining Daesh

Philippine Authorities have release an Egyptian man and his Filipina girlfriend after prosecutors found that police might have fabricated evidence linking the couple to Daesh, Reuters’ Arabic service reports.

On Your Way Out

Egypt’s struggling job market is a “blessing in disguise” for the country’s budding entrepreneurial scene, as more people are creating their own jobs, Mostafa Amin writes for the World Bank’s blog. Amin — who co-founded news platform Egyptian Streets, startup directory Wassel, and delivery-based bakery Breadfast — says that, while the country’s brain drain is undeniable, new talents are constantly emerging. “Egypt is full of resources and opportunities. Education needs to be reformed and improved, and some social aspects need a revamp. But this market is ready for entrepreneurs and is well worth the effort.”

A fire at the Sheikh Zayed Transformer Station yesterday has caused an estimated EGP 24 mn-worth of damages, an Electricity Ministry source tells Al Mal. Italy’s Gitra, which was developing the project, will pay for the damages, as the station was still on a trial run. The fire was contained, and power fully restored to Sheikh Zayed and Six October City.

The Market Yesterday

EGP / USD CBE market average: Buy 17.56 | Sell 17.66 EGX30 (Wednesday): 16,384 (+2.3%) THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 2.3%. CIB, the index heaviest constituent ended up 3.6%. EGX30’s top performing constituents were Eastern Co up 6.7%, Elsewedy Electric up 4.7%, and Orascom Construction up 4.2%. Yesterday’s worst performing stocks Egyptian Resorts down 1.9%, Heliopolis Housing down 1.8%, and Juhayna down 1.5%. The market turnover was EGP 1.9 bn, and foreign investors were the sole net buyers. Foreigners: Net Long | EGP +266.6 mn Retail: 52.2% of total trades | 48.4% of buyers | 56.0% of sellers Foreign: 27.0% of total | 33.8% of buyers | 20.1% of sellers WTI: USD 61.32 (+0.28%) TASI: 7,453.17 (+0.21%) (YTD: +3.14%)

EGP / USD at CIB: Buy 17.56 | Sell 17.66

EGP / USD at NBE: Buy 17.55 | Sell 17.65

Turnover: EGP 1.9 bn (67% ABOVE the 90-day average)

EGX 30 year-to-date: +9.1%

Regional: Net Short | EGP -15.7 mn

Domestic: Net Short | EGP -250.9 mn

Institutions: 47.8% of total trades | 51.6% of buyers | 44.0% of sellers

Regional: 13.0% of total | 12.6% of buyers | 13.4% of sellers

Domestic: 60.0% of total | 53.6% of buyers | 66.5% of sellers

Brent: USD 64.34 (-2.20%)

Natural Gas (Nymex, futures prices) USD 2.78 MMBtu, (+0.00%, April 2018 contract)

Gold: USD 1,326.60 / troy ounce (-0.08%)

ADX: 4,519.58 (-0.09%) (YTD: +2.75%)

DFM: 3,181.96 (-0.72%) (YTD: -5.58%)

KSE Weighted Index: 412.08 (-0.23%) (YTD: +2.66%)

QE: 8,371.11 (-0.69%) (YTD: -1.79%)

MSM: 4,928.10 (-0.39%) (YTD: -3.36%)

BB: 1,366.29 (-0.62%) (YTD: +2.60%)

Calendar

07-10 March (Wednesday-Saturday): ITB Berlin Convention, Berlin, Germany.

12-16 March (Monday-Friday): AmCham’s 40th Doorknock mission, Washington D.C., USA.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo.

02-03 April (Monday-Tuesday): Pharos Holding’s investor conference: In Search for Egypt Alpha, Cairo.

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labor Day, national holiday.

02-03 May (Wednesday-Thursday): Cisco Connect Egypt 2018, Nile Ritz-Carlton Hotel, Cairo.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.