- Macro Group makes its EGX debut. (The Big Stories Today)

- We officially have EV charging tariffs. (The Big Stories Today)

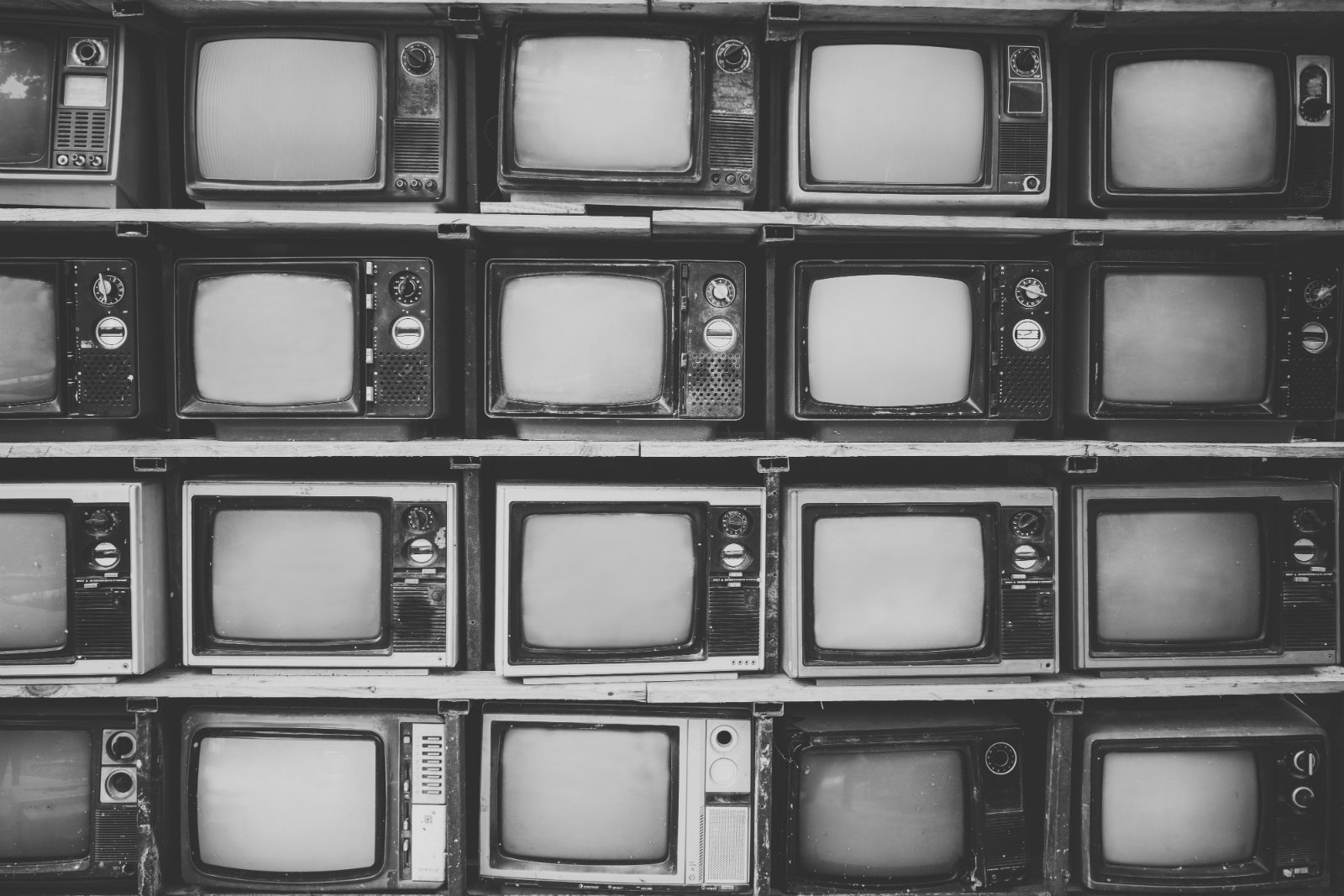

- Streaming wars: How the age of the narrowcast is changing our media landscape. (Cinema)

- First veggie burgers, now sunflower seed coffee? (For Your Commute)

- There’s plenty of football to keep you busy this weekend. (Sports)

- Latest adaptation of Agatha Christie’s Death on the Nile is out with mixed reviews. (On the Tube Tonight)

- The decision-making pitfalls of the emotional mind. (Under the Lamplight)

Thursday, 10 February 2022

PM — Streaming wars are upon us

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Well, ladies and gentlemen, we’ve made it through another week. Is the rest of February going to trudge by this slowly?

THE BIG STORIES TODAY-

#1- Cosmeceuticals giant Macro Group’s shares began trading on the EGX this morning under the ticker MCRO.CA, according to an EGX statement (pdf). Macro raised EGP 1.3 bn in its IPO, which saw it sell 264.5 mn shares at EGP 4.85 apiece, valuing the cosmeceutical company at around EGP 2.8 bn. The IPO saw around 5600 investors participating in the retail and institutional offerings, the EGX said, around half of whom were new investors. The company’s debut on the bourse marks our second IPO of the year, after Al Khair River for Development and Investment’s (aka Nahr El Khair) got the ball rolling last month.

Macro’s shares popped in intraday trading, rising to an intraday high of EGP 5.28 (up 15%) before paring its gains to close at EGP 4.51 apiece, ending the day down 7%.

#2- Annual urban inflation rose to 7.3% in January, from 5.9% in December, according to figures released today by statistics agency Capmas. On a monthly basis, consumer prices went up by 0.9%.

#3- We officially have EV charging tariffs: The Electricity Ministry has set the tariff it consumers will pay to charge their electric vehicles, announcing the decision earlier today in the Official Gazette (pdf). The rates differ based on whether the charging station is public or at privately owned and commercial establishments. The move would go a long way to getting the nascent EV industry off the ground, Mohamed Mansour, co-founder and CEO of Infinity (which is building EV charging stations across the nation) told us last month.

^^We’ll have these stories and more in Sunday’s edition of EnterpriseAM.

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Lots of Emirati interest in Egypt acquisitions: First Abu Dhabi Bank has offered to buy a majority stake in leading financial services corporation EFG Hermes in an all-cash acquisition that values it at EGP 18.5 bn. Meanwhile, Aldar Properties will spend at least AED 5 bn (c. USD 1.4 bn) on acquiring retail and education assets in Egypt, the UAE and Saudi Arabia.

- Inching closer to “Euroclearable” status: The board of directors has been formed for our new central clearing and depository company, Egyptian Central Securities Depository in another step toward making local debt “Euroclearable.”

- Thndr lands USD 20 mn series A investment: Stock trading app Thndr has closed a USD 20 mn series A round co-led by Tiger Global, BECO Capital and Prosus Ventures, and featured additional participation from Base Capital, firstminute, and existing investors Endure Capital, 4DX Ventures, Raba Partnership and JIMCO.

CORRECTION- In our story this morning on amendments to the Income Tax Act, we incorrectly said that the amendments would see property owners pay a lump sum tax ranging from EGP 1.5k-4k when they sell their real estate assets, replacing the current 2.5% tax paid by sellers on properties’ disposition or quick sale value. The amendments would, if passed, only apply the lump sum amount to properties that were sold before 19 May, 2013 — when the law was originally issued. Any sales after that date would still be subject to the same 2.5% tax. The story has been corrected on our website.

THE BIG STORY ABROAD- The short answer: There isn’t one. The global business press is finally beginning to demote the Ukraine story, with no concrete updates to report save for some fresh military drills from Russia. Elsewhere, ongoing protests in Canada against vaccine mandates is creating a spillover effect on business, with the US-Canada border now closed and threatening to create yet more supply chain issues, Reuters says.

|

FOR TOMORROW-

German Foreign Minister Annalena Baerbock will be in town tomorrow for a two-day visit that will see her meet with Foreign Minister Sameh Shoukry and other officials, the German Embassy in Cairo said in a statement. Baerbock is also expected to discuss potential collaboration between the two countries on the COP27 climate summit in Sharm El Sheikh this November.

The FIBA Intercontinental Cup kicks off tomorrow here in Cairo and wraps on Sunday, 13 February.

???? CIRCLE YOUR CALENDAR-

There are two conferences taking place in Cairo next week:

- The Arab Sustainable Development Week will kick off on Sunday, 13 February and run through to Tuesday at the Arab League headquarters and the Nile Ritz Carlton.

- The three-day Egypt Petroleum Show (EGYPS) begins at the Egypt International Exhibition Center on Monday, 14 February, and runs until Wednesday.

Keen on a trip to Kinshasa? EgyptAir will launch three direct weekly flights to the Congolese capital of Kinshasa starting 27 March, Al Mal reports. This marks the first direct air link between the two capitals. All Cairo-Kinshasa flights until 1 July will be 35% off, provided tickets are bought before the new line’s launch.

☀️ TOMORROW’S WEATHER- Expect cooler weather tomorrow with the mercury peaking at 17°C and falling into the single digits overnight. That’s probably the last gasp of winter as the mercury looks set to return to the 21-24°C range for the following 10 days, our favorite weather app suggests.

???? FOR YOUR COMMUTE

Can beanless coffee compare to the real thing? One producer claims it does, reports Bloomberg (watch, runtime: 3:15). The latest development in the foodtech revolution, which has already laid claim to eggs, meat, chicken and milk, comes as global warming takes its toll on coffee producing regions. Foodtech startup Atomo Coffee is using upcycled plant-based ingredients, such as sunflower seed husks and watermelon seeds, to reinvent your cup of java, which, according to them, tastes just like coffee.

Coffee growers have been among the most impacted by climate change, as rising global temperatures force traditional producers to move uphill in rainforest that have not been touched yet and potentially causing further deforestation, Atomo CEO Andy Kleitch says.

Coffee futures were one of the fastest growing commodities last year, rising faster than oil and natural gas. Global supply constraints coupled with trouble in the world’s major exporting regions brought coffee prices to a 10-year high last year, with analysts predicting that the tightness could last well into 2023.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

The anti-recommendation: Death on the Nile. The mystery thriller based on the Agatha Christie novel of the same name has a star-studded cast, including Kenneth Branagh (who is also the film’s director), Gal Godot, Russell Brand, Emma Mackey, Rose Leslie (of Game of Thrones fame) and Armie Hammer, among several others. The movie (currently in cinemas in Egypt) is the third adaptation of the 1937 novel, follows the same plot: The murder of a passenger on board the S.S. Karnak turns the cruise into a whodunit mystery as the investigator tries to find the murderer before another killing happens. Critics aren’t exactly raving about the film, with Rotten Tomatoes giving it a 68% rating, while Metacritic’s weighted average score is 52%. The Financial Times, CNN, and Bloomberg each have reviews. You can catch the trailer here (watch, runtime: 2:06).

⚽ It’s a football-filled weekend: In the Premier League, Liverpool and Leicester City hit the field at 9:45pm as the Reds try to narrow their 12-point gap with Manchester City, which is currently in first place. Arsenal and Wolverhampton also have a match at the same time.

The Egyptian Premier League also has two matches today: The National Bank of Egypt SC v Smouha (5:30pm) and Ismaily v Future (8pm).

Over in Spain’s Copa del Rey, the semi-final match between Athletic Bilbao and Valencia kicks off at 8:30pm. The victor from the match will go to the final against Real Betis, which beat Rayo Vallecano 2-1 yesterday.

It’s also quarter-final night at the Coppa Italia: Atalanta and Fiorentina meet at 7pm, while Juventus v Sassuolo has a 10pm kick-off. The victors from tonight’s matches will meet at the semi-final.

Bastia and Nantes are also vying for a spot in the French Cup semi-final when they meet at 10pm tonight. Monaco has already qualified.

Things are heating up tomorrow in the European leagues, with several interesting matches to keep an eye on: Sevilla v Elche (La Liga) and Paris Saint Germain v Rennes (Ligue 1) both kick off at 10pm tomorrow. In the Bundesliga, Leipzig and Köln meet at 9:30pm.

But it’s Saturday that’s going to see the most action: In the Premier League, Manchester United meets Southampton at 2:30pm. At 5pm, three separate matches kick off: First up is Crystal Palace v Brentford, with the former currently two points ahead in the 13th spot. Leeds United is also meeting Everton in a match with similar stakes: The two teams are ranked 15th and 16th, respectively, with just a few points keeping them from falling out. We also have Watford v Brighton kicking off at the same time. Watford hasn’t come out on top of any of its last 10 meetings in the PL, while Brighton is relatively safe in the 9th spot. Later on at 7:30pm, Norwich City meets defending champions Manchester City.

In La Liga, the match of the week between Villareal and Real Madrid starts at 5:15pm, following a 3pm match between Cadiz and Celta Vigo. Rayo Vallecano v Osasuna kicks off at 7:30pm, and Atletico Madrid v Getafe will round out the evening at 10pm.

We also recommend watching Bayern Munich v VfL Bochum (Bundesliga) at 4:30pm, Napoli v Inter (Serie A) at 7pm, and Lyon v Nice (Ligue 1) at 10pm, all on Saturday.

Al Ahly FC will look to secure the bronze medal in the FIFA Club World Cup in its match against Saudi Arabia’s Al Hilal at 3pm on Saturday, while the final match between Chelsea and Palmeiras kicks off at 6:30pm.

Finally, Zamalek FC has its first group stage match at the CAF Champions League against Angola’s Petro de Luanda at 6pm on Saturday.

???? EAT THIS TONIGHT-

An oldie but goodie: Birdcage at Semiramis Intercontinental. This is one of our favorite Thai spots in the city. And while it’s on the pricier side of things, it’s definitely worth the splurge for a good meal. We recommend starting off with the green papaya salad, and love the Pekin duck, Pad Thai, and green curry for the main course. Finish off the meal with Kloy Tod (fried banana in coconut milk) or their sweet sticky rice with coconut ice cream.

???? OUT AND ABOUT-

(all times CLT)

Take an art and food tour of Zamalek: Qahrawya is organizing a tour of Zamalek’s art exhibitions, local handicraft shops, and foodie destinations this Saturday at 9am, starting with coffee at Granita. You can register to join here.

Cairo Runners and Al Burouj are organizing an 8k women’s race on Saturday, 26 February at Al Burouj compound at 8am. The event also includes a 2k family run. Runners can register here before next Friday, 18 February.

???? UNDER THE LAMPLIGHT-

Exploring human irrationality: Thinking, Fast and Slow, by renowned psychologist and Nobel Prize Laureate Daniel Kahneman, is an exploration of the underlying mechanisms that shape the human mind. The global bestseller builds on Kahneman’s research on the prospect theory, which suggests that, if given two equal choices, people will choose the option presented to them in the form of potential gains, instead of potential losses. Kahneman explores this theory — which earned him the Nobel — and more, emphasizing the effect of “cognitive biases” and how unconscious errors of thought can warp our vision of the world and lead to failures in judgment, whether for more minor matters such as planning holidays or more grave ones, such as investing illogically in the stock market. Understanding the emotional and the logical systems that shape our judgments , as Kahneman explains, can enable us to live better, more enlightened lives, and will ultimately help guard us from the mental pitfalls that get us in trouble. The New York Times has a review of the book.

???? GO WITH THE FLOW

The EGX30 fell 0.2% at today’s close on turnover of EGP 292.4 mn (72.3% below the 90-day average). Foreign investors were net sellers. The index is down 3.1% YTD.

In the green: EFG Hermes (+2.9%), ADIB (+2.9%) and Abu Qir Fertilizers (+2.15%).

In the red: ElSewedy Electric (-5.6%), Medinet Nasr Housing (-5.2%) and Rameda (-4.9%).

???? CINEMA

Streaming wars: How the age of the narrowcast is changing our media landscape: In Egypt and abroad, the pandemic has accelerated the shift to streaming content. Content being, of course, the stream of information and entertainment that beams out at you from your digital devices (phone, TV, tablet, gaming console, you name it).

Gone are the days of broadcast: “We are no longer in the era of broadcast, we are in the era of narrowcast, where different genres are made for different people. Nothing caters to everyone,” Ergo, Media Ventures Investment Manager Gamal Guemeih tells us. Which means that, the more you watch, the more tailored your options will be — and the less likely you are to stumble upon media outside of your comfort zone. While digital technologies are making it easier to make and distribute films, many films are not being seen because they are buried under heaps of titles that your favorite streaming platform pushes to its viewers. Just because algorithms say so.

The surge and subsequent slowdown altered global trends in streaming. Globally, Netflix gained a record 37 mn subscribers in 2020 as social distancing kept people indoors and screen-bound — a trend that slowed down in 1Q2021 when the streaming giant added a mere four mn new subscribers (two thirds of its projections). Coupled by growing demand for content, the slowdown in the growth of streaming platforms has resulted in a number of newfound trends emerging in the industry, including an increase in intellectual property content, the consolidation of streaming services, and streaming services expanding their offerings to include video games and live sports. Other trends include acquiring rights for hybrid or early releases of movies, shifting to weekly rather than binge content drops and introducing more international content to the platforms.

Video-on-demand streaming is surging in MENA, with projections that the regional streaming industry will “spike” by 2026. Prominent regional players include MBC Group’s Shahid VIP, OSN, Amazon (in the UAE), StarzPlay, WATCHiT, and soon to launch in MENA this year, Disney+. Meanwhile, Shahid VIP, which launched in 2008, gained 1.4 mn subscribers by the end of Ramadan 2021 — a 43% y-o-y increase from the same period in 2020 (most of which is attributed to its North America launch in November of that year). This in spite of the dearth of local content on streaming platforms and limited relevant digital regulations.

Local, regional and international players are looking to build out their original content portfolios. In addition to bringing international catalogs to Egyptian audiences, streaming platforms are increasingly producing local and regional content. Netflix already has two Egyptian productions under its belt, and the release of Egyptian, Lebanese, Emirati collaboration Perfect Strangers earlier this year marked the streaming giant’s first foray into Arabic film. Meanwhile, Shahid VIP has churned out tens of titles over the past three years — largely to meet demand from users who are spending more hours watching streaming services than before.

Even PE firms are going long on content. The industry has drawn interest from private equity firms like Apollo and Blackstone looking to capitalize on the boom by investing in and buying up Hollywood production houses as they try to get a slice of the USD 115 bn streaming pie — even as bottom lines are squeezed by plateauing subscriber growth and streaming companies struggle to balance the USD 100 bn outlay on content.

On the flipside, with cinema hard-hit, it makes sense for filmmakers to seek out OTT opportunities. As movie theaters continue to decline in popularity (not to mention, affordability) more filmmakers have turned to over the top video (OTT) to ensure that their films are seen in both Egypt and the US, where filmmakers are increasingly embracing the opportunity to make films at all. In a first for Arabic film, Shahid VIP launched its first pre-theatrical film release of drama Saheb El Makam (The Enriched Saint) in time for Eid El-Adha in July 2020, and last month, filmmaker Amr Salama dropped his first series on Shahid VIP, Bimbo.

Movie theaters and TV can complement — or compete — with one another. “Cinemas and streaming are complementing in some respects and competing in others,” explains Guemeih, who notes that short films and documentaries have become increasingly visible thanks to the rise of streaming platforms, even if feature-length films have become less so.

Digital revenues for entertainment are on the rise. A PricewaterhouseCoopers report found that digital revenue rose to make up 42% of total entertainment and media revenue in the region in 2020 — up from 37% the previous year — with projections that it will reach 46% by 2024. The digital content transition in the entertainment and media landscape is fueled largely by the region’s bulging youth population, with an estimated 60% of the population under the age of 25.

Digital infrastructure and financial exclusion remain barriers for the industry. The latest figures by Data Reportal found that 2020 was a year of rapid digitization, recording a 2.9% y-o-y increase in mobile connections and a 8.1% y-o-y increase in internet usage. This in spite of average download speeds rising by only 31.5% y-o-y from 2019 — a challenge that the ongoing EGP 37 bn high-speed fiber optic network project promises to address. And with a mere 3.5% of the population aged 15+ paying bills or making purchases online, it has made it doubly challenging for streaming platforms to roll out their subscription services, opting instead to rely on advertising-based or hybrid advertising and subscription-based models, according to PWC.

???? CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of a 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

1H2022: The Transport Ministry to sign a memorandum of understanding with Abu Dhabi Ports to set up a transport route across the Nile to transport products from Al Canal’s Minya sugar factory.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

4-20 February (Friday-Sunday): 2022 Winter Olympics, Beijing.

11-12 February (Friday-Saturday): German Foreign Minister Annalena Baerbock will be in Cairo for a two-day visit.

11-13 February (Friday-Sunday): FIBA Intercontinental Cup, Cairo.

13-15 February (Sunday-Tuesday): Arab Sustainable Development Week. Arab League headquarters, Nile Ritz Carlton.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

14-19 February (Monday- Saturday): An art exhibition created by marginalized children will be held at Townhouse Gallery. The event is organized by the Sawiris Foundation for Social Development, AlexBank, Townhouse Gallery, Al Ismaelia for Real Estate Investment, and Ubuntu Art Gallery.

15 February (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

15 February (Tuesday): Orange Ventures’ deadline to receive applications from seed-stage fintech startups.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

21 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

22 February (Tuesday): The Egyptian National Railway is holding a forum to gauge public interest in its plans to delegate the management and operations of freight transport to the private sector.

22-24 February (Tuesday-Thursday): Investment Forum, General Authority For Investments (GAFI) Main Office, Nasr City.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

28 February- 1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourirsm Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

3 March (Thursday): Fawry’s extraordinary general assembly (pdf) to vote on EGP 800 mn capital increase.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 March (Thursday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff.

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

29 March (Tuesday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.