Global households aren’t hopeful on the economy — though the jobs market is set to hold up in 2023

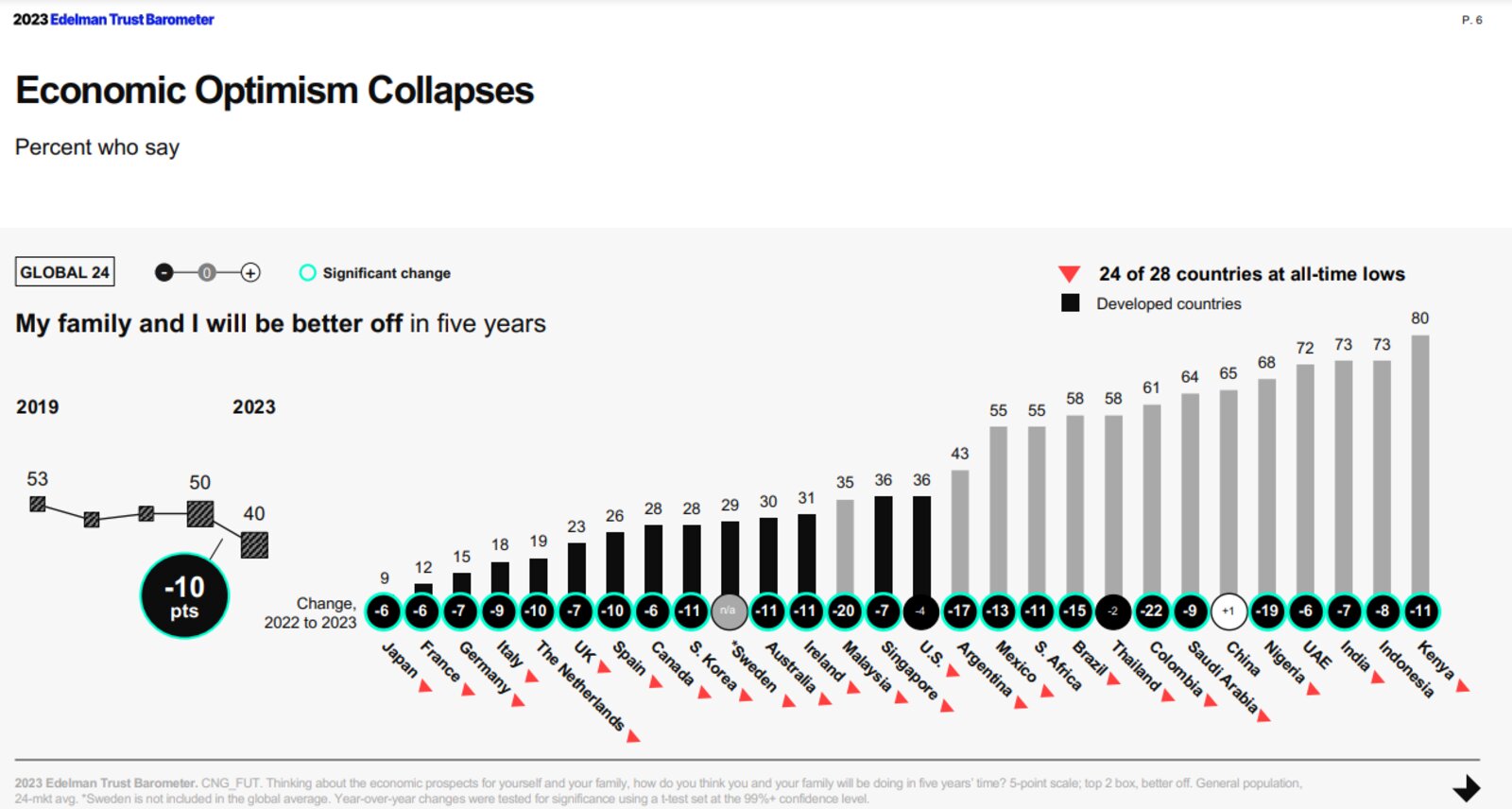

Most people globally feel pessimistic about their financial future: Only 40% of people surveyed in an annual global survey think their household finances will be better off in five years’ time — down a full 10 percentage points on last year’s reading, Reuters reports. Alongside pessimism on the economy fuelled by high inflation and the fear of job losses, the 2023 Edelman Trust Barometer (pdf) also measured a continued rise in distrust of key institutions, particularly among low-income families. The survey’s results are based on responses from more than 32k people in 28 countries in November last year.

When it comes to jobs at least, those worries could be misplaced: The global jobless rate is set to remain unchanged at 5.8% in 2023 even amid a slowdown in growth, the Wall Street Journal reports citing an International Labor Organization report (pdf). The UN agency expects the global economy to enter its first stagflationary period since the 1970s — but unemployment won’t rise in tandem, its says, as more older workers in countries with aging populations take retirement and young people stay in education for longer.

Is the global gold rally just getting started? Gold prices are projected to soar to record highs of more than USD 2k per ounce within months, as the US Federal Reserve slows the pace of its rate hikes, Reuters reports citing Bank of America analysts. Spot prices for gold are up 18% since November to more than USD 1.9k an ounce, as cooling inflation presages a slowdown on rates from the Fed, the news outlet reports.

REMEMBER- Gold took a beating last year as rising rates attracted investors to bonds and pushed the USD higher, making the precious metal more expensive in many markets, including Egypt. Local gold prices saw record highs on the back of the EGP’s depreciation with the price of 21-carat gold rising to EGP 1.8k in December.

|

|

EGX30 |

15,838 |

+1.8% (YTD: +8.5%) |

|

|

USD (CBE) |

Buy 29.57 |

Sell 29.66 |

|

|

USD at CIB |

Buy 29.57 |

Sell 29.67 |

|

|

Interest rates CBE |

16.25% deposit |

17.25% lending |

|

|

Tadawul |

10,728 |

0.0% (YTD: +2.4%) |

|

|

ADX |

10,264 |

+0.5% (YTD: +0.5%) |

|

|

DFM |

3,334 |

+0.3% (YTD: -0.1%) |

|

|

S&P 500 |

3,999 |

+0.4% (YTD: +4.2%) |

|

|

FTSE 100 |

7,860 |

+0.2% (YTD: +5.5%) |

|

|

Euro Stoxx 50 |

4,157 |

+0.2% (YTD: +9.6%) |

|

|

Brent crude |

USD 84.46 |

-1.0% |

|

|

Natural gas (Nymex) |

USD 3.67 |

+7.3% |

|

|

Gold |

USD 1,919.30 |

-0.1% |

|

|

BTC |

USD 21,186 |

+1.5% (YTD: +28.4%) |

THE CLOSING BELL-

The EGX30 rose 1.8% at yesterday’s close on turnover of EGP 2.78 bn (65.4% above the 90-day average). Local investors were net buyers. The index is up 8.5% YTD.

In the green: Fawry (+8.8%), Eastern Company (+6.7%) and Sidi Kerir Petrochemicals (+6.5%).

In the red: Alexandria Containers and Cargo (-3.9%), Heliopolis Housing (-1.5%) and Orascom Construction (-1.4%).

Asian markets are largely down in early trading this morning. Futures suggest a more mixed picture when European indices open, though Wall Street looks set to open in the red across the board later in the day.