There’s more pain ahead for the global auto industry + Productivity really takes a nosedive around holiday season

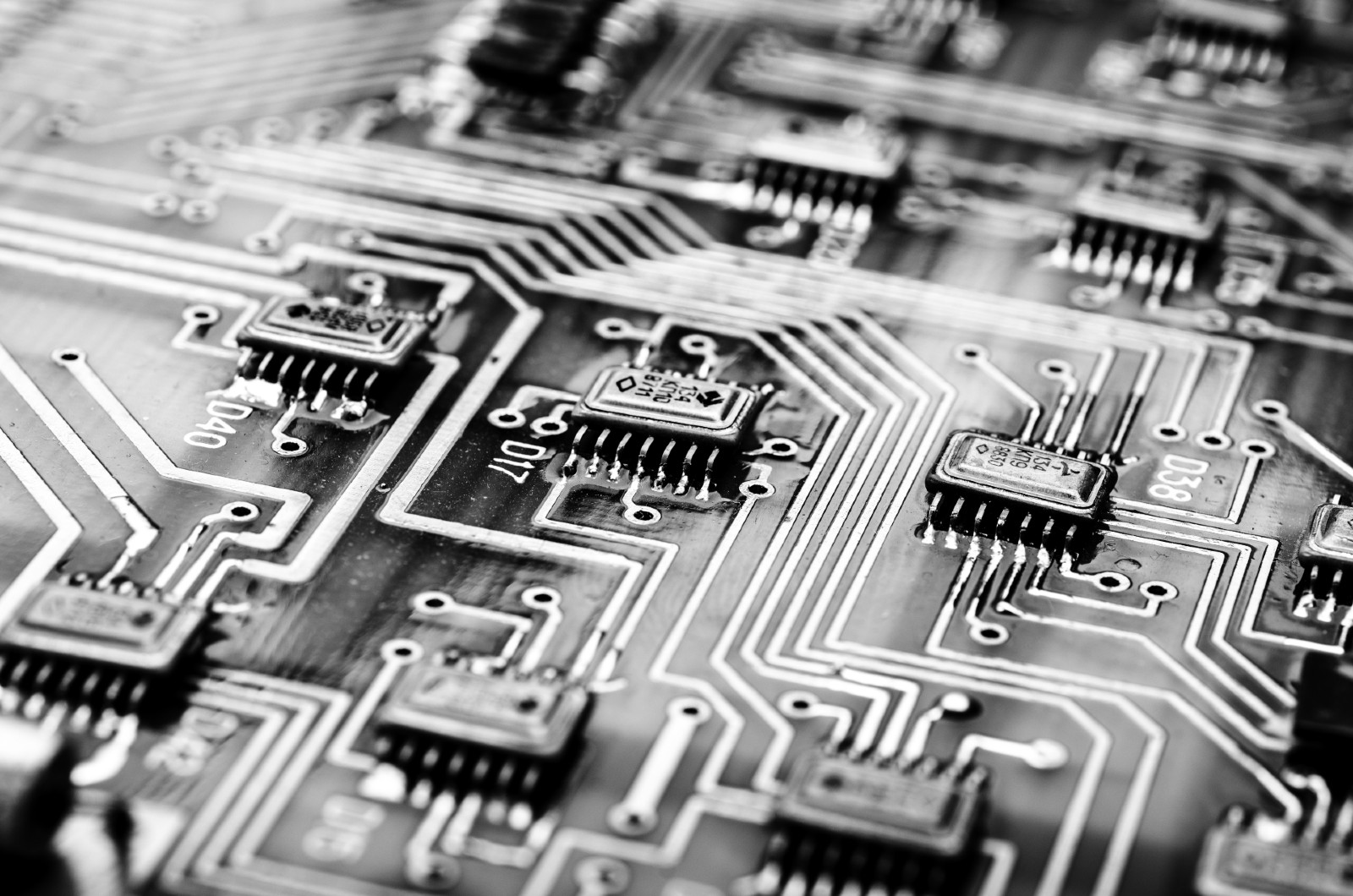

The global auto industry is preparing for semiconductor shortages to last until the end of 2023, driven by an increase in electric vehicle demand and “more connected functions” in regular fuel cars, the Financial Times reports. Advanced power chips known as silicon carbide chips (SiC) — which are specifically used for EVs — are expected to see a 14% compounded annual growth rate by 2030, the salmon-colored paper reports. Semiconductor manufacturers plan to expand plant capacity, but current production rates are struggling to keep up with the demand of long-term supply agreements. This shortage is piling onto the preexisting supply tightness caused by covid-19 lockdowns, which disrupted chip production and global supply chains, and is expected to take years to be resolved.

It’s the most wonderful time of the year — to not work: Across the globe as Christmas and New Year’s draw nearer, employees are likely to have checked out of work between 16-19 December, with their focus pulled to holiday planning, the Financial Times reports. And it’s not just the staff that have mentally clocked off — companies with lighter end-of-year workloads are using the slower pace to offer staff incentives, like bonus Christmas shopping days. Packed Christmas markets and bars are an indication that many are embracing the distraction of Christmas despite the cost-of-living crisis, the FT says.