Brace yourselves, startups. 2022 may be a bumpy year

Is the party up for startup funding? VC firms tell founders yes: It’s no secret that the VC funding gravy train is slowing down globally with the tech sector’s poor performance limiting VCs ability to raise funds, and the fallout dramatically affecting startups. As tech stocks nosedive and the Nasdaq continues to be on track for its second-worst quarter since the 2008 financial crisis, VC firms are warning their company founders that gloomy days are in store for the global startup industry.

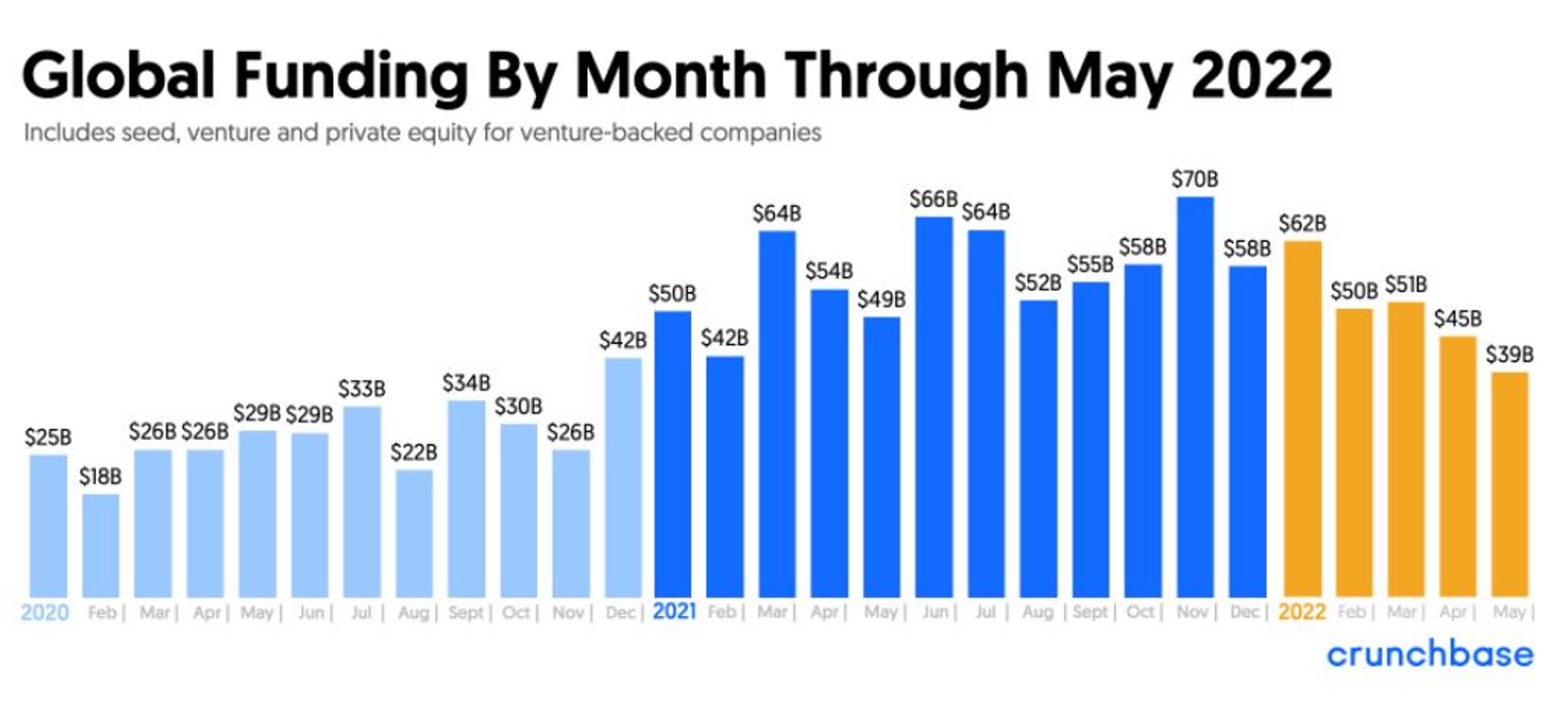

Startup investment has been in decline in the first five months of 2022, compared to last year, with the decline starting to be visible in March and April (thanks, Putin). VC funding plummeted 20% and 16.6% y-o-y in March and April respectively, according to a CrunchBase report. In May, global VC funding amounted to USD 39 bn, marking a 20% drop compared to the same month in 2021, it adds.

Global transactions in 2Q2022 are set to reach 6.9k, a 22% drop compared to 2Q2021, according to a report by CB Insights. Projected investments for 2Q2022 are expected to be 19% lower than 1Q2022, CB’s report notes.

Inflation and geopolitical conflicts are fueling this trend, with central banks everywhere looking to wind down the covid-era stimulus that fueled valuations. The Federal Reserve’s 50 bps interest rate hike last month spurred a massive selloff in equity markets — including for startups — which continue to haunt us to this day. Lightspeed Venture Partners proclaimed in a blog post that “the boom times of the last decade are unambiguously over,” and that many CEOs will face “trade-offs that only a few months ago would have seemed outlandish or unnecessary.

A far cry from last year: In 2021, VCs invested more than USD 600 bn in startups — twice the amount allotted to the industry in 2020, according to Reuters.

And VCs aren’t expecting this trend to reverse anytime soon: Sequoia Capital, acclaimed for early investments in Google and Apple, detailed in a presentation titled “Adapting to Endure”, that the recovery from this economic downturn will be long, compared to previous times of economic turbulence. Y Combinator (YC), the start-up incubator that helped spawn Airbnb, told their portfolio founders in an email to “plan for the worst.”

Big-tech is already implementing job cuts and hiring freezes. Snap, Facebook, and Uber have all announced hiring curbs in the coming months, while Robinhood and Peloton said they’ve cut jobs. Cloud software company Lacework recently announced staff layoffs, six months after the firm was valued at USD 8.3 bn by VCs.

The shifting market sentiment is reminiscent of 2008 and somewhat close to the economic fallout of the pandemic in 2020. During the 2008 crisis, Sequoia released a memo entitled R.I.P. Good Times, and implored start-ups to cut costs and “become cashflow positive.” In a 2020 memo titled Black Swan, partners at Sequoia admitted to dropping the ball, saying they underestimated “the monetary and fiscal policy response that followed the pandemic.” “This time, many of those tools have been exhausted,” the Sequoia partners said in a recent presentation.

The key messages YC and other investors are telling their companies? Forget “growth at all costs.” Founders must improve gross margins, curb spending and burn rates, limit hiring, and extend runways for 2+ years as soon as possible. Sequoia warned its companies that if they don’t slash costs, whether that be in marketing, research and development, or other areas, they will risk facing a “death spiral." If you can raise capital from new or existing investors, don’t think twice, YC told its founders.

What’s next for startups in these times of uncertainty? Founders have to prudently manage their cash flow cycles, reduce burn rates, and plan wisely when it comes to growth.“The message we wanted to get to founders was that for the best companies, this should be your time to shine, because when it’s easy for everyone to fund-raise and get demand you don’t see as much of the strength of some of the distinctive businesses and teams,” Michelle Bailhe, partner on Sequoia’s growth team, told CNBC.