Cold water thrown on Turkey-Israel gas pipeline + Nord Stream 2

Remember that potential gas pipeline between Turkey and Israel? It’s not happening anytime soon. That’s according to Turkish Foreign Minister Mevlut Cavusoglu, who told reporters that a pipeline between the two countries will not be possible in the short term, Reuters reports.

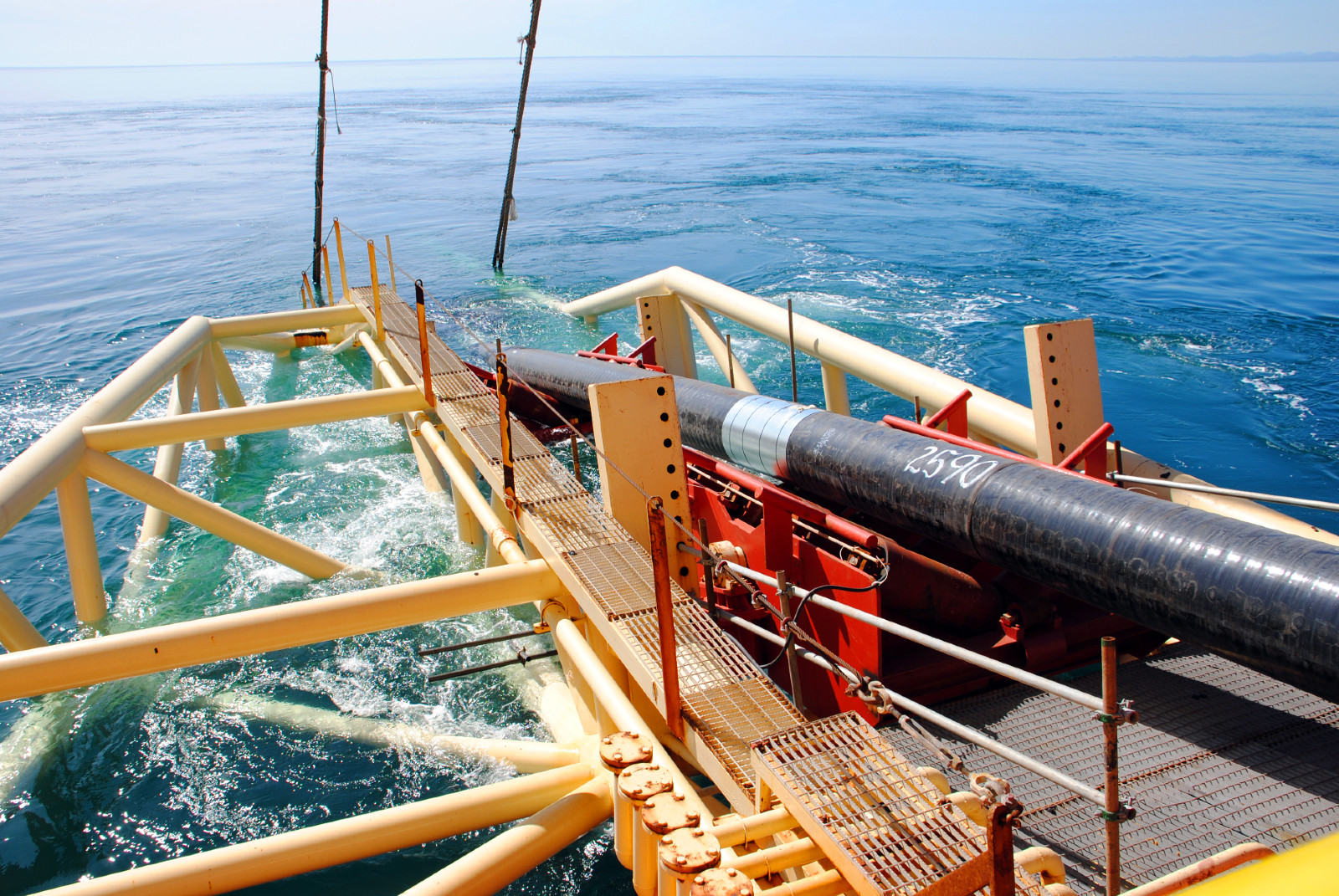

Refresher: The plan would see a subsea pipeline linking Israel’s largest offshore gas field, Leviathan, to Turkey, allowing Israel to ship its gas directly to Southern Europe. Industry figures had already raised flags about the viability of the proposed pipeline, from complex regional geopolitics and competing territorial claims to questions about whether Israel can export enough gas to make it viable.

Israel is relying on Egypt and its LNG facilities for now: Israel has “spoken to our Egyptian partners on the potential to increase the amount of gas through Egypt for LNG sale to Europe,” Jonathan Miller, energy envoy at the Israeli foreign ministry, told Bloomberg, adding that Israel is not able to expand LNG capacity of its own.

And is also downplaying the pipeline plan: The idea of an eastern Mediterranean pipeline should be thought of as a “concept” rather than a concrete plan to ship Israeli gas to Europe, Miller said.

Nord Stream 2 (and the USD 11 bn spent on it) is also sleeping with the fishes: The war may have “killed off” for good the gas pipeline from Russia to Germany after months of delays due to geopolitical tensions, analysts told CNBC. “It would be unthinkable for Germany or any other European country to do a U-turn and authorize the pipeline after Russia’s behavior,” one said.