- What SPACapocalypse? Swvl shares rise on Nasdaq debut. (IPO Watch)

- EBRD downgrades our 2022 growth forecast as war in Europe stokes inflation. (War Watch)

- Russian wheat exports are up despite the war — and some of that has come our way. (Commodities)

- Local fintech Khazna raises USD 38 mn in equity and debt in series A funding round. (Startup Watch)

- SFE signs an agreement with Norway’s Scatec + Fertiglobe + OC for the Ain Sokhna green hydrogen plant. (Green Energy)

- That Israel-Turkey gas pipeline? Looking like a pipe dream. (Energy)

- The IFC has acquired a 5% stake in consumer healthcare giant IDH. (M&A Watch)

- Car sales rose more than 20% in February despite supply bottlenecks. (Automotive)

- Gov’t relaxes visa restrictions in bid to boost tourism. (Tourism)

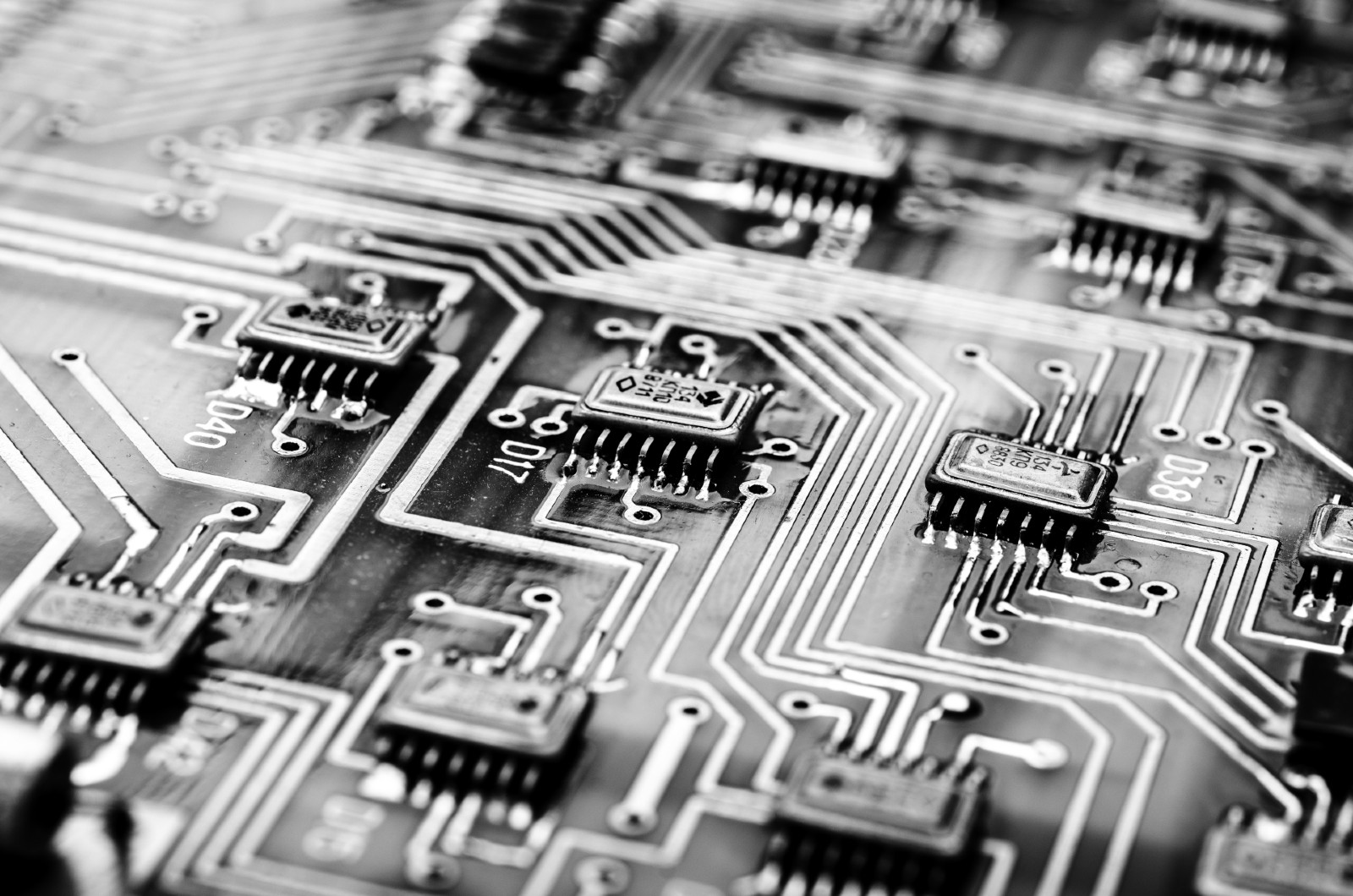

- The global semiconductor shortage has an upside for Egyptian chip designers. (What’s Next)

- Global M&A plunges. (Planet Finance)

Sunday, 3 April 2022

AM — Swvl isn’t phased by SPACapocalypse as shares rise on Nasdaq debut

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and welcome to the first workday of Ramadan. We hope the day treats you well. We have an exceptionally heavy news day for you — but first, Ramadan:

RAMADAN RECOMMENDATION #1- Choose your mosalsal now and stick to it. Need a starting point? Have a look at our Your Wealth guide to the season’s most-anticipated serials. (And forgive us our sin in that roundup: Mike is the fake-lawyer character in Suits, not Harvey. We’ve amended the writeup accordingly.)

RAMADAN RECOMMENDATION #2- We’re traditionalists. Dates and chocolate don’t mix in our corner of the universe. Until, that is, we tried the Ramadan line of stuffed dates from our friends at Mōko (more on them here). We’re (only slightly) ashamed to admit we thought of how to box-out the resident 14-year-old as we hoovered the better part of two boxes. Peanut in dark chocolate was our favourite, followed closely by almond (in milk chocolate), snickers (also milk chocolate) and coffee (dark chocolate). And don’t feel too bad for the resident 14-year-old — what she lost on dates, she made up for in chocolate: Mōko’s halawa pistache and dark chocolate mint were her favourites.

Ramadan reminders:

- Shops are staying open for longer: Shops, malls, cafes and restaurants are now allowed to stay open until 2am, rather than 10pm, until the end of Eid. The decision was confirmed in the Official Gazette on Thursday.

- Banks are now running on reduced Ramadan hours: Banks across the country are now only open between 9:30am and 1:30pm.

- Shortened EGX trading hours: The trading day now runs10am and 1:30pm.

SO, WHEN DO WE EAT? Maghrib prayers are at 6:16pm CLT this evening, and you have until 4:21am to eat / hydrate / caffeinate.

PSA- Brace yourselves for an eight-day heat wave. Our favourite weather app sees the mercury in the capital city rising from 30°C today to 35°C tomorrow and then on to 43°C each of Wednesday and Thursday. Apple’s weather app agrees, but the national weather service is guiding for a high this week fo just 36°C. Expect more seasonally appropriate temps starting some time next week.

NEWS TRIGGERS THIS WEEK-

We could get an announcement on the government’s privatization plans: Ministers will meet this week to discuss which state-owned companies will be offered on the EGX this year, Planning Minister Hala El Said said last week. “We are reviewing the program in light of recent developments, and we have 10 companies that we are considering to offer with advisors, and we aim to offer four to five companies during 2022 in the energy, ins. and financial sectors,” she told Bloomberg Asharq. The government had originally aimed to sell shares in as many as 10 firms in 2022, but the deteriorating global market conditions have forced it to rethink its plans.

Suez Canal Authority scales back IPO plans a bit? The agency is now planning to offer stakes of 10-15% in some of its subsidiaries via IPO on the EGX, chairman Osama Rabie told Bloomberg Asharq, down from 20% previously. Rabie said in February that the authority plans to list stakes in two or three of its companies, without disclosing an expected timeline.

Remember, there are at least three flavours of privatization sales. Ministers can consider a new listing on the EGX (which we need to add both depth and breadth to the market), offer for sale more shares of an already-listed company; or sell some or all of a company to a strategic investor in a private transaction.

WILL FRESH INFLOWS CONTINUE? Egyptian bonds saw net inflows of EGP 611 mn over the last week, the first time the needle moved in that direction Russia invaded Ukraine five weeks ago, Al Borsa says. The cost of insuring against losses on Egyptian bonds fell to 531 bps after the central bank’s surprise rate hike and the refloating of the EGP.

Fair value for the EGP? Renaissance Capital is the latest to say that the EGP is just about at its fair value against the greenback, with Yvonne Mhango writing in a note to clients that it is “is “just shy of our fair value estimate” of EGP 18.40 / USD 1. Mhango expects the CBE to maintain exchange rate flexibility, with FX rates ending the current fiscal year at EGP 18.50 / USD 1 and the next fiscal year at EGP 19.40 / USD 1.

It’s PMI week: Purchasing managers’ index figures for March for Egypt, Saudi Arabia, the UAE, and Qatar will be released on Tuesday, 5 April. By that specific gauge, Egypt’s private sector has been in contraction since November 2020. Headwinds intensifying last month due to the conflict in Ukraine are unlikely to have changed that.

Foreign reserves: March’s foreign reserves figures will be announced some time this week.

ALSO- Inflation figures for March are expected on Sunday, 10 April, one week from today.

COVID WATCH- Egypt saw an average of 559 new covid-19 infections per day last week, down from 625 per day the week before. We also saw a daily average of eight deaths, according to Health Ministry figures released yesterday. Around 32.5 mn people are now fully vaccinated, and more than 2 mn have had their boosters, the statement added. It appears that we are doing better than others, with the UK announcing record covid levels with around 1 in 13 people having tested positive for the virus over the past week.

WHO accreditation to make it easier to export our vaccines: The Egyptian Medicines Authority has received accreditation from the World Health Organization for its locally-made vaccines, the authority said Thursday. The move will make it easier for Egypt to export locally-made vaccines, such as the Chinese Sinovac shot, Heba Wali, head of the state-owned vaccine maker Vacera, told us. Egypt will also eventually produce an mRNA derivative under a WHO-backed initiative designed to equip developing countries with the necessary tech to speed up the vaccine rollout. Egypt has already shipped a batch of locally-made Sinovac to Palestine and is currently in talks with several other countries, she said, without disclosing further details.

|

WAR WATCH- Ukraine retakes Kyiv region + apparent progress in peace talks: The weekend witnessed major developments on the frontlines and at the negotiating table in Russia’s war on Ukraine:

- Ukraine has regained control of the entirety of the Kyiv region, deputy defense minister Hanna Maliar said in a statement. The Russian military has withdrawn from western Ukraine to refocus its military efforts in the east after suffering heavy losses around Kyiv. (AP)

- Zelensky + Putin could launch direct talks soon: Moscow negotiators have informally agreed to most of a draft peace proposal, which is now developed enough for Ukrainian President Volodymyr Zelensky and his Russian counterpart Vladimir Putin to discuss directly, Ukraine’s chief negotiator told local TV. (Reuters)

- The UK thinks allies could concede too much for peace: A senior British government source has said the UK is worried the US, France and Germany will push Ukraine to “settle” in eagerness to secure an early peace. (The Times)

CIRCLE YOUR CALENDAR-

Companies have exactly one week to file their first quarterly ESG compliance report: Listed firms and non-bank financial services companies need to submit their first quarterly ESG report by 10 April, the FRA said (pdf) on Sunday. The regulator is making it mandatory for corporates to publicly disclose their performance on key environmental, social and governance (ESG) metrics each year when they submit their annual financial statements, starting 2023. Reach out to Moustafa Taalab at InkankIR, our parent company, if you need some help.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s What’s Next day: We have our weekly deep-dive into what makes and shapes pre-listed companies and startups in Egypt, the UAE and KSA, touching on investment trends, future sector insights and growth journeys.

In today’s issue: While the global semiconductor shortage is undoubtedly a bad thing for businesses working in electronics assembly and manufacturing, it’s also presented us with a silver lining: The semiconductor chip design sector is booming, and Egyptian firms are riding the wave. In this week’s What’s Next, we talk to semiconductor companies to judge the appetite for the local sector and the challenges they face to reach their full potential.

IPO WATCH

Swvl rises on Nasdaq debut, eyes dual listing on the EGX

Swvl shares rise on Nasdaq debut: Shares in Cairo-born mass transit app Swvl rose on their Nasdaq debut on Friday as the company concluded its SPAC merger with Queen’s Gambit Growth Capital. Shares rose to an intraday high of USD 10.30 after opening at USD 9.60 before paring gains to close at USD 10.00. The company — now known as Swvl Holding following the merger — offered a 35% stake to investors in a sale that originally valued it at USD 1.5 bn.

New investors headed for the exit on Friday: Queen’s Gambit saw a redemption rate of almost 85%, Swvl CFO Youssef Salem told Enterprise, signaling volatile trading against the backdrop of a difficult year so far for SPACs (and the Nasdaq more generally). The company received USD 164.8 mn in gross proceeds from the sale, including USD 111.5 mn in pre-funded private investments in public equities (PIPE) and USD 53.3 mn in cash, the company said in a statement.

An equity financing facility is plugging the gap: “We have a backstop facility agreement worth [just over] USD 471 mn, which is larger than the size of the redemptions,” Salem told us. The money is being provided by US financial services firm B Riley Financial, he said, and is a committed equity facility against which the company will draw down over time. Swvl also expects to obtain an additional USD 10 mn PIPE commitment in 2Q 2022, which it said was subject to certain closing conditions.

There will be headwinds — but Swvl is not concerned: “There will definitely be some short-term volatility, because there are a lot of macro events factoring in like the Russia-Ukraine war,” Salem said. “But we’re not anchoring too much on day-to-day trading, because at the end of the day, the capital is raised and the investors are in,” he added. “Obviously, it’s important to maintain a high share price and raise more capital, but a fluctuation between USD 9.50 and USD 10.50 is not going to impact the company’s activities on a day-to-day basis.”

Backing the company: International backers participating in the company’s PIPE include the European Bank for Reconstruction and Development (EBRD), auto parts maker Teklas’ VC arm Teklas Ventures, our friends at Chimera, as well as Agility, Luxor Capital Group, and Zain Ventures.

SPACs have been under pressure in recent months as investor enthusiasm has waned amid market volatility and an extended sell-off in tech stocks. Average redemption rates soared to 90% in February, up from just 14% a year before, while the number of SPAC mergers terminating pre-IPO is increasing. The De-SPAC Index, which tracks 25 US SPACs listings, is down more than 50% in the past 12 months, Bloomberg writes.

And they’re facing more stringent regulation: Swvl’s debut came just days after the US securities regulator voted in favor of major reforms designed to bring SPAC sponsors’ disclosures under greater scrutiny, the Financial Times reports, in a move that some analysts have characterized as a crackdown on blank-check firms.

Swvl is the second MENA SPAC to hit the Nasdaq after Anghami made its debut earlier this year.

LOCAL ADVISORS: Law firm Ibrachy & Dermarkar is Swvl’s legal advisor on the merger, while Vinson & Elkins and Shahid Law Firm are acting as advisors for Queen’s Gambit.

LOOKING AHEAD- A dual listing on the EGX on the cards? Both Swvl and the EGX have raised the possibility of a dual listing in Egypt. “We’re currently in advanced talks with the EGX about a dual listing, but the exchange needs to first establish a link with the Nasdaq to allow for the trades to be fully fungible between the two, so we can convert the shares listed on the Nasdaq to trade them on the EGX,” Salem told us. EGX boss Mohamed Farid said on Thursday that the exchange is exploring the requirements for a dual listing.

Or we could be looking at a local IPO… Another scenario should there be complications with the dual listing could be a local IPO on the EGX, but that would not be ideal as the company would have to list from scratch, Salem said.

…or a dual listing with another Arab exchange: The company is not ruling out any possibilities and is looking at the most liquid and largest exchanges in the Middle East, but Salem said that the company is focusing on the EGX dual listing.

Big expansion plans are underway: Salem tell us that the company is looking to expand to the US, UK, Colombia, Peru, Mexico, and South Africa over the next six months, in addition to recent entries into new markets in Europe and South America:

- Swvl recently entered Central Europe with its acquisition of German public transport company Door2Door, which it expects to finalize in 2Q2022. This marks Swvl’s second acquisition of a European company, after it bought Barcelona-based mobility platform Shotl last summer.

- The company is also investing USD 15 mn in Argentina over the next three years following its acquisition of Viapool.

The company’s revenues are expected to reach USD 141 mn this year, an almost 80% y-o-y increase from 2021, Swvl’s Head of Public Policy and Government Relations Sherif Fouda told CNBC Arabia (watch, runtime: 1:32). The company expects revenues to almost triple y-o-y in 2023, Fouda added.

WAR WATCH

EBRD trims Egypt’s growth outlook for 2022 + FinMin mulling price of oil in 2022-2023 budget

EBRD trims Egypt 2022 growth outlook on inflation concerns: The European Bank for Reconstruction and Development (EBRD) has downgraded Egypt’s 2022 growth outlook due to rising food and energy price inflation caused by the conflict in Ukraine. The lender expects the economy to grow at a 3.1% clip this year, down from the 5.0% it had penciled in last November, according to its latest Regional Economic Update (pdf). The economy will then rebound in 2023, growing 6%, according to the bank’s figures.

Imported inflation is to blame: The EBRD attributed the downgrade to Egypt’s dependency on food and oil imports, which it says makes it more vulnerable to price hikes caused by the Russia-Ukraine war. “In Egypt and Tunisia especially, food and fuel subsidies (and/or price caps) might limit inflation for households, but create a burden for public finances,” the bank wrote. The government has already capped prices of unsubsidized bread and announced an EGP 130 bn economic support package since the war began in a bid to mitigate the impact of inflation on consumers.

Things aren’t looking good on the tourism and supply chain fronts either: “A drop in tourism as well as general supply chain bottlenecks and volatility could also affect important growth drivers,” the bank wrote , adding that Ukrainian and Russian tourists accounted for around 20% of arrivals in Egypt in recent years. Weaker tourism income could add further pressure on the exchange rate should the crisis become protracted, it warned. The Central Bank of Egypt has already allowed the EGP to depreciate against the USD in order to absorb part of the impact, falling some 15% in recent weeks.

The silver lining: The turmoil in the global energy markets could help Egypt realize its gas export ambitions as Europe searches for alternative sources of energy, the EBRD wrote, adding that this would happen only if “Europe engaged more actively to resolve current tensions and facilitate pipeline access.” Egypt is one of the countries that Europe is looking to to help solve its gas shortfall as it decreases its reliance on Russian supplies, and Oil Minister Tarek El Molla has pointed to the possibility of us exporting more LNG given elevated energy prices across the board on the back of the war.

Shoukry lines up French backing

Foriegn Minister Sameh Shoukry called on the EU for support, asking French counterpart Jean-Yves Le Drian on a call for economic and political support as Egypt grapples with fallout from the war in Ukraine. Shoukry is asking France, which holds the presidency of the EU council, to back Egypt in talks with both EU and international financial institutions, according to a Foreign Ministry statement.

EU financial support could be the latest in a stream of international fiscal support. We are already in talks with the IMF on a new program, under which the IMF will provide the Egyptian government with support. Saudi Arabia deposited USD 5 bn with the Central Bank of Egypt (CBE), as our Gulf neighbors move to help shore up our finances amid global fallout from Russia’s war in Ukraine, prior to which we received support from both the UAE and Qatar.

Foreign Ministry could budget for oil at up to USD 85

The Finance Ministry could set oil prices at USD 80-85 a barrel in the FY 2022-2023 budget, Vice Minister of Finance Ahmed Kouchouk told CNBC Arabia (watch, runtime: 1:25), suggesting the ministry closely monitoring market dynamics as it works on the new budget.

Analysts are expecting Brent to remain above USD 100 a barrel for the remainder of this calendar year as the spillover effects from the Ukraine conflict continue to weigh on an already tight market. In its latest forecast, Goldman Sachs lowered its Brent projections by USD 15 to USD 120 per barrel through 2H 2022 and currently expects prices to average USD 110 in 2023.

BACKGROUND- The current FY2021-2022 budget had assumed an average Brent price of USD 60, well below the prices it has reached since the start of the Russia-Ukraine war. While we export natural gas and produce oil, we’re a net oil importer. Each barrel we import now costs the state about double what it had forecast in the current fiscal year’s budget.

Brent crude settled at USD 104.39 on Friday, posting its biggest weekly drop in over a decade after the US ordered an unprecedented release of its strategic reserves to temper prices, Bloomberg reports.

COMMODITIES

Russia upped wheat imports in March, while Ukrainian shipments remain blocked

Russia boosted wheat exports by 60% in March despite disruption caused by its war in Ukraine, Bloomberg writes, citing consultant ProZerno. The country exported some 1.7 mn tons of wheat in March, with shipments running at a “rapid” rate in the second half of the month after an initial slowdown in February, as most challenges with payments and shipping vessels were resolved.

We’re apparently still receiving shipments from Russia: Russia’s agricultural exports — which also include corn, barley and sunflower oil — rose 15% y-o-y to hit 2.5 mn tons in March, with Egypt among the top buyers, according to figures from Swiss data firm Agflow cited by Bloomberg. The business news information service did not clarify the type or amount of commodities we’ve been receiving from the country.

It’s another story for Ukrainian exports, which remain “tepid” as Russia continues to block access to the country’s ports. The loss of Ukrainian commodities including grain and sunflower oil means global food markets are continuing to feel the strain, Bloomberg reports, even as Russia ships supplies to some of the customers who usually buy from Ukraine..

Mideast at “breaking point” over soaring prices -UN: Ramadan-observing Middle Eastern nations are “struggling to access enough food because of a toxic combination of conflict, climate change and the economic aftermath of Covid-19,” the United Nations World Food Programme’s MENA director Corinne Fleischer said on Thursday. “People’s resilience is at a breaking point. This crisis is creating shock waves in the food markets that touch every home in this region.”

Some good news for our food security woes: Our domestic wheat harvest season began on Friday, the Supply Ministry confirmed in a statement. With global wheat markets in disarray, the Madbouly government has shifted its wheat procurement focus to local sources, and hopes receive between 5 mn and 6 mn tonnes this season — markedly higher than the 3.5 mn tonnes procured from domestic farmers last year.

Scrap metal export ban

The Trade Ministry has banned the export of salvaged and scrap metals for six months in a bid to help manufacturers struggling with price hikes and shortages of raw materials, it announced in a statement yesterday. Scrap metals including copper, steel, lead, aluminum, and zinc are subject to the ban, which came after the Federation of Egyptian Industries called on the government to protect factories from rising input costs and mitigate supply chain disruptions. The move comes a few weeks after the ministry slapped a three-month export ban on staple food commodities to shore up supplies amid turmoil in the global food market caused by the Ukraine conflict.

The inflationary wave set off by the war has heavily impacted steel and other building materials. Steel prices have jumped to around EGP 21k from EGP 15.5k over the course of two weeks due to a significant rise in imported scrap metal prices, which accounts for around 60% of the cost of steel, head of the FEI’s metal industries division Mohamed Hanafy told us last month. In Europe, steel prices soared 51% in the first three weeks of Russia’s invasion, according to Bloomberg.

STARTUP WATCH

Fintech app Khazna raises USD 38 mn in series A funding

Local fintech startup Khazna has raised USD 38 mn in equity and debt in a series A funding round, according to a press release (pdf). The round was led by US-based Quona Capital and includes previously announced funding from Nclude — the new USD 85 mn fintech fund launched by state-owned banks Banque Misr, the National Bank of Egypt, and Banque du Caire and managed by the UAE’s Global Ventures.

Early backers doubled down on the company, one of the hottest fintech players in the market, with our friends at Accion Venture Lab and Algebra Ventures both writing tickets.

Also participating in the round: Austria’s Speedinvest, Saudi Arabia’s Khawarizmi Ventures, and AB Accelerator by Arab Bank, as well as Egypt’s, Disruptech and CVentures. The company’s debt financing will be provided by Lendable, while Arab Bank Egypt is acting as the security agent facilitating the transaction.

What does Khazna do? Khazna’s app caters to the 50% of Egyptians who use smartphones and lack access to formal financial services, offering them general purpose credit; buy now, pay later (BNPL); and bill payment services.

This comes as Khazna is eyeing expansions: Khazna could set up a SPAC in 2024, which could be listed either at home or abroad co-founder and CEO Omar Saleh said last week. The fintech player is considering acquiring three technology companies operating in the local market, as well as expanding abroad in one or two regional markets in the first quarter of 2023.

BACKGROUND: Khazna has raised USD 47 mn since it started in 2020 and has a leadership team that includes former executives from the World Remit, Valeo, Uber, CIB, Jumia, Match Group, and Arqaam Capital.

SUEZ CANAL

Suez Canal revenues up 20% y-o-y in 1Q 2022

Suez Canal revenues rose 20% y-o-y in 1Q 2022 to USD 1.69 bn, the Suez Canal Authority (SCA) said in a statement. The number of ships transiting the canal increased nearly 16% y-o-y to register 5.3k vessels, while net tonnage was up 7.4% y-o-y at 313.3 mn tons. The SCA raised fees by 6% for most ships at the start of February, and is targeting revenues of USD 7 bn from the canal in 2022, after hitting a record USD 6.3 bn in 2021.

Global shipping costs have increased sixfold since war broke out in Ukraine, SCA Chairman Osama Rabie told Bloomberg Asharq, leading the authority to introduce another round of fee hikes for transiting vessels. Vessels carrying crude and petroleum products will pay a 15% surcharge as of 1 May, up from 5% currently, while charges are also being raised for other types of vessels. The number of transiting ships fell “slightly” short of expectations in 1Q on the back of Russia’s war, Rabie added, though not enough to impact revenues.

GREEN ENERGY

Scatec inks Ain Sokhna green hydrogen pact with SFE and OC

Welcome to our much greener future: The Sovereign Fund of Egypt (SFE), Norway’s Scatec, Nassef Sawiris-backed ammonia producer Fertiglobe and Orascom Construction signed an agreement on Thursday to establish and operate their planned 100 MW green hydrogen plant in Ain Sokhna, according to a cabinet statement.

Who’s doing what: The facility will be built and operated by the consortium, with a long-term off-take agreement with EBIC, one of Fertiglobe’s subsidiaries in Egypt. The project is set to come online by 2024, making it Egypt’s first operational green hydrogen plant.

Also signed on Thursday: A second agreement on the purchase of hydrogen from the project with Fertiglobe subsidiary the Egyptian Fertilizer Company, according to the statement.

Background: The consortium had announced its plan to establish the plant back in October, saying it would be used as feedstock for green ammonia production. The announcement came as Egypt works on a strategy to channel bns of USD of investment to create a local industry amid a rising global interest in green hydrogen. Cairo’s plans have attracted major global players seeking investments in the sector in the country. Head to our explainer here for everything you need to know about green hydrogen and what Egypt plans to do with it.

Another company interested in Egypt’s nascent hydrogen industry? Eni, whose CEO Claudio Descalzi was in Cairo last week for talks with President Abdel Fattah El Sisi. The two discussed cooperation on green hydrogen and Egypt’s LNG exports, an Ittihadiya statement said Thursday. The Italian energy giant has reportedly submitted a bid to set up a hydrogen production facility in Egypt.

ENERGY

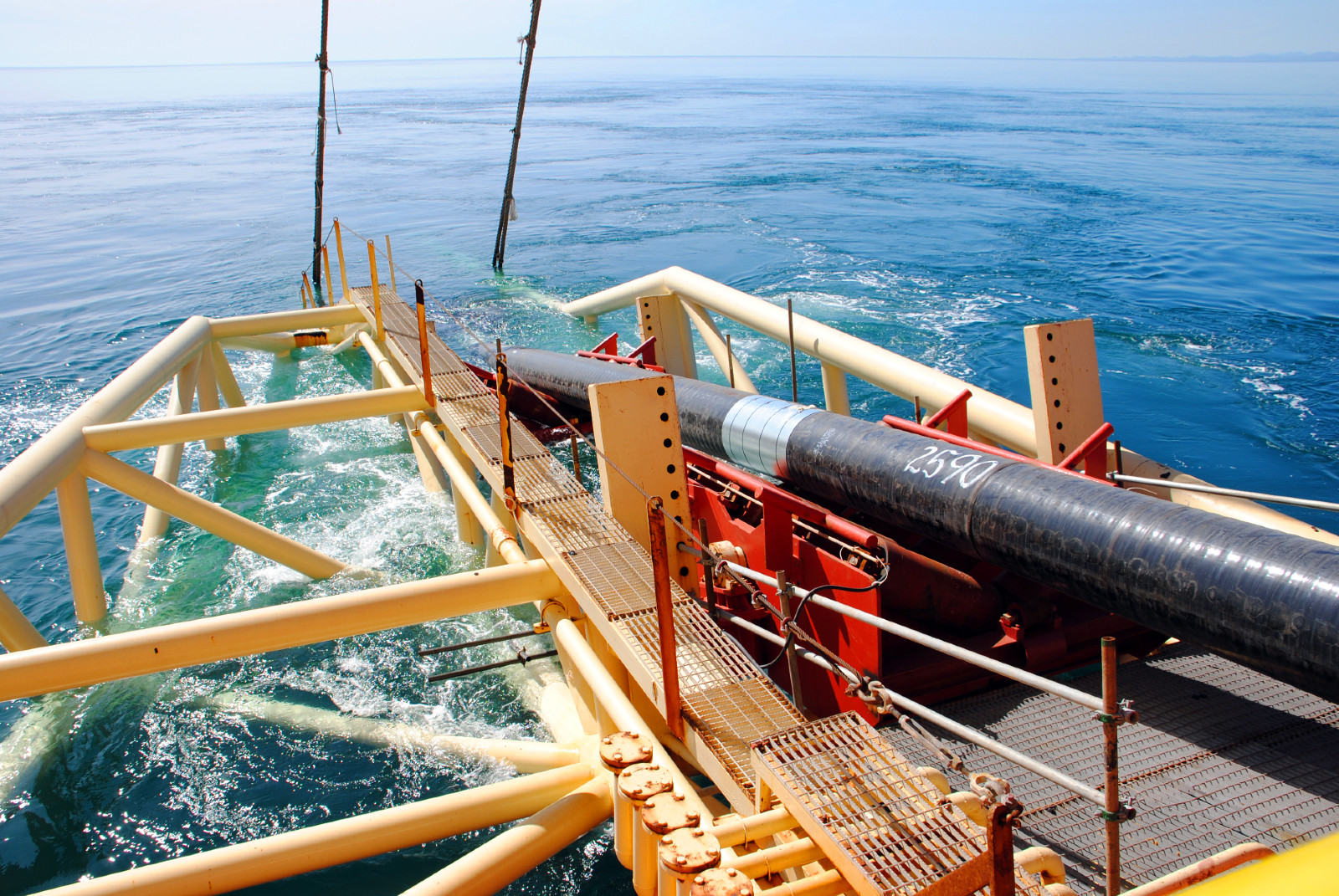

Cold water thrown on Turkey-Israel gas pipeline + Nord Stream 2

Remember that potential gas pipeline between Turkey and Israel? It’s not happening anytime soon. That’s according to Turkish Foreign Minister Mevlut Cavusoglu, who told reporters that a pipeline between the two countries will not be possible in the short term, Reuters reports.

Refresher: The plan would see a subsea pipeline linking Israel’s largest offshore gas field, Leviathan, to Turkey, allowing Israel to ship its gas directly to Southern Europe. Industry figures had already raised flags about the viability of the proposed pipeline, from complex regional geopolitics and competing territorial claims to questions about whether Israel can export enough gas to make it viable.

Israel is relying on Egypt and its LNG facilities for now: Israel has “spoken to our Egyptian partners on the potential to increase the amount of gas through Egypt for LNG sale to Europe,” Jonathan Miller, energy envoy at the Israeli foreign ministry, told Bloomberg, adding that Israel is not able to expand LNG capacity of its own.

And is also downplaying the pipeline plan: The idea of an eastern Mediterranean pipeline should be thought of as a “concept” rather than a concrete plan to ship Israeli gas to Europe, Miller said.

Nord Stream 2 (and the USD 11 bn spent on it) is also sleeping with the fishes: The war may have “killed off” for good the gas pipeline from Russia to Germany after months of delays due to geopolitical tensions, analysts told CNBC. “It would be unthinkable for Germany or any other European country to do a U-turn and authorize the pipeline after Russia’s behavior,” one said.

M&A WATCH

IFC acquires 5% stake in IDH

The IFC now owns a 5% stake in consumer healthcare giant IDH: The International Finance Corporation (IFC) and its IFC MENA Fund have together raised their stake in Cairo-headquartered Integrated Diagnostics Holdings (IDH) to 5%, according to a disclosure (pdf) to the London Stock Exchange.

The stake purchase is part of “a larger overall engagement” between IDH and the IFC, which saw the international lender start buying stakes in the company back in May 2021 to back IDH’s dual listing on the EGX and LSE. The engagement includes a USD 60 mn debt financing package to help finance IDH’s expansion into Pakistan, according to the disclosure. The company last year announced a USD 45 mn loan from the IFC to support its growth plans in emerging markets, in addition to its current presence in Egypt, Jordan, Nigeria and Sudan. IDH is in the final stages of an acquisition that will see it expand to Pakistan.

AUTOMOTIVE

Car sales up more than 20% in February

Passenger car sales rose more than 20 % y-o-y in February, according to industry figures from the Automotive Information Council (AMIC), which showed that around 19.7k cars were sold during the month, up from 16.3k in February last year.

The breakdown:

- Total auto sales rose: Overall, the auto industry sold 25.6k vehicles during the month, up 15% from last year.

- Truck sales were also up: Truck sales rose more than 11% y-o-y to nearly 4.3k.

- Bus sales extended their drop: Some 1.6k buses were sold in February, down nearly 20% y-o-y.

February sales extended a run of growth from last year, despite industry insiders telling us they expect a hit from shortages of components, rising inflation, and disruption to local production. Last year saw the sector shrug off the global chip shortage as strong demand pushed sales to their highest levels since the EGP float in 2016.

Give it a month, though: The impact of the war in Ukraine on the industry — including soaring commodity prices, further supply disruptions and the EGP devaluation — won’t begin to be felt properly until March.

Car prices were rising — until the gov’t imposed caps: As of last week, car dealers are not able to hike prices above the price set by the official seller. Distributorships that sell at higher rates will face fines of up to EGP 2 mn. Many dealers have been hiking car prices, or refusing to sell at all, since the EGP devaluation. It’s not clear how long the price freeze will last.

AMIC data is self-reported by member distributors, who include the majority of (but not all) industry participants.

TOURISM

Egypt makes it easier to get a visa on arrival

Egypt has widened the number of people eligible to obtain a visa on arrival as it looks to support the tourism sector, which has been hit by the conflict in Ukraine. All visitors to Egypt are now able to receive a visa on arrival, according to a ministry statement, while those coming from South Africa, Kazakhstan, Armenia, Georgia and Azerbaijan are also newly eligible to apply for an electronic visa, in a move designed to make it easier for people to enter the country.

The catch: Visitors from countries that had previously needed to apply for a visa in advance must hold a valid visa from the US, the UK, the Schengen Area, Japan, or New Zealand in order to receive a visa on arrival.

This is only the latest measure announced by the government to support the tourism industry — and there could be more to come. President Abdel Fattah El Sisi yesterday directed officials to continue efforts to support the tourism sector and reach out to alternative markets to mitigate the war’s impact, according to an Ittahidya statement. An existing program that provides cash subsidies to charter flights has been extended for another year until April 2023, while the government has also launched a new global marketing campaign and extended pandemic-era support to tourist vendors.

Russia’s invasion of Ukraine has not been good for Egyptian tourism: Egypt’s Red Sea resort towns are being hit by the loss of Ukrainian and Russian tourists, which made up around a third of inbound visitors prior to the conflict. There have been mixed reports on the war’s effect on occupancy rates: Industry figures said earlier this month that occupancy rates in Sharm El Sheikh had fallen below 35%, down from more than 60% in January, while another tour company told the Financial Times that rates in Red Sea resorts had fallen to just 5%.

Tourism is a key sector: Tourism revenues are a crucial source of hard currency for Egypt, and the sector accounted for almost 9% of GDP prior to the pandemic. After being hit hard by covid, the industry saw revenues return to pre-pandemic levels in 2021, surpassing USD 13 bn.

IN OTHER TRAVEL NEWS- House approves bill guarding EgyptAir against Russia risk: MPs have approved a draft law allowing the Finance Ministry to ins. EgyptAir against potential losses on flights to and from Russia, which were suspended last month due to the ongoing war in Ukraine, Youm7 reported last week.

TRADE

Trade Ministry streamlines import registration procedures

Fast-tracked registration procedures for exporters to Egypt: The Trade Ministry has announced changes to streamline its import registration procedures in a bid to make it easier for overseas companies to export goods to Egypt, it said in a statement Thursday. The amendments will see exporters added to the official trade registry within 15 days of submitting the required documents, which can now be done via embassies rather than only through the General Organization of Export and Import Control (GOEIC), the ministry said.

And better dispute resolution: Grievances submitted by exporters who were removed from or denied approval to the registry will be reviewed and settled within 15 days by a new dedicated committee, the statement reads. Only the president of the GOEIC has the authority to remove exporters from the registry, which will be updated on a monthly basis via the Official Gazette and the General Organization for Export and Import Control’s website.

A (partial) answer to the EU? The EU last year filed a case at the World Trade Organization (WTO) against Egypt’s “arbitrary” registration requirements, alleging that they violate trade rules and are responsible for a 40% fall in European exports to Egypt.

Background: The government in 2016 began requiring some foreign companies to register with GOEIC before exporting goods to Egypt. Registration is currently required for 29 categories of goods, including agricultural and food products, cosmetics, toys, textiles, garments, household appliances, furniture, and ceramic tiles.

MOVES

TE’s Osman gets third term after rule change, EFG Hermes appoints COO at Vortex Energy

Magued Osman has been reappointed as chairman of Telecom Egypt for a third term, according to an EGX disclosure (pdf) filed Thursday following an extraordinary general meeting. Company rules had prevented people from serving more than two three-year terms, but shareholders agreed to amend the rules during the meeting, allowing chairpeople to serve more than two terms if approved by the communications minister. Adel Hamad will also serve a second term as the company’s CEO and managing director after being reappointed during the meeting.

EFG Hermes-led Vortex Energy has appointed Ana Peris Caminero (Linkedin) as chief operating officer and a member of the investment committee, according to a press release (pdf). Caminero was most recently director of renewable business development at Spain’s Naturgy. Prior to that, Caminero worked with Unión Fenosa and Eurelectric in the power generation business and greenfield project development.

LAST NIGHT’S TALK SHOWS

It was an extremely slow night on the airwaves yesterday as the country’s talking heads shifted their attention from the Egyptian economy to the first day of Ramadan and its many, many TV dramas (catch our roundup here). Ala Mas’ouleety’s Ahmed Moussa had a lot to say about the first episode of military series Al Ekhtyar 3 (watch, runtime: 9:18), while Al Tasea took us through the Supreme Council for Media Regulation’s decision to pull Donya Tanya starring Laila Elwi from the screens (watch, runtime: 2:33).

PLANET FINANCE

Global M&A has fallen to its lowest level since 2020 as soaring inflation, the conflict in Ukraine and tighter regulations put the brakes on a surge of dealmaking activity, the Financial Times reports. A little over USD 1 tn worth of transactions were agreed in 1Q 2022, down 23% from the same period in 2021, according to Refinitiv data, which shows that every region in the world saw a decline in activity. The biggest acquisition of the quarter was Microsoft’s USD 75 bn takeover of games publisher Activision.

Private equity is the outlier: Flushed with cash, private equity firms spent a record USD 288 bn during the quarter, up 17% from last year, the data shows.

|

|

EGX30 |

11,238 |

0.0% (YTD: -6.0%) |

|

|

USD (CBE) |

Buy 18.22 |

Sell 18.32 |

|

|

USD at CIB |

Buy 18.20 |

Sell 18.30 |

|

|

Interest rates CBE |

9.25% deposit |

10.25% lending |

|

|

Tadawul |

13,090 |

+0.4% (YTD: +16.0%) |

|

|

ADX |

9,929 |

-0.2% (YTD: +17.0%) |

|

|

DFM |

3,537 |

+0.3% (YTD: +10.7%) |

|

|

S&P 500 |

4,546 |

+0.3% (YTD: -4.6%) |

|

|

FTSE 100 |

7,538 |

+0.3% (YTD: +2.1%) |

|

|

Euro Stoxx 50 |

3,919 |

+0.4% (YTD: -8.8%) |

|

|

Brent crude |

USD 104.39 |

-0.3% |

|

|

Natural gas (Nymex) |

USD 5.72 |

+1.4% |

|

|

Gold |

USD 1,923.70 |

-1.6% |

|

|

BTC |

USD 46,252 |

-0.2% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 0.01% at Thursday’s close on turnover of EGP 1.22 bn (20.4% above the 90-day average). Local investors were net Sellers. The index is down 6% YTD.

In the green: Orascom Construction (+5.0%), Qalaa Holding (+4.9%) and GB Auto (+3.6%).

In the red: EKH (-4.4%), AMOC (-4.4%) and Medinet Nasr Housing (-2.7%).

CALENDAR

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

15 February-15 June (Tuesday-Wednesday): ITIDA’s Technology Innovation and Entrepreneurship Center is organizing the first Metaverse Hackathon.

14 March-30 June: The “Escape to Egypt” exhibition at the Coptic Museum, in celebration of its 112th anniversary.

April: Fuel pricing committee meets to decide quarterly fuel prices.

April: Ghazl El Mahalla shares will begin trading on the EGX.

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

10 April (Sunday): Deadline for listed companies and NBFIs to submit quarterly ESG report.

11 April (Monday): The deadline to submit bids for Chelsea FC.

14 April (Thursday): European Central Bank monetary policy meeting.

Mid-April: Trading on the Egyptian Commodity Exchange to start.

21 April (Thursday): EGX-listed Taaleem will hold an extraordinary general assembly to discuss the mechanism to build and own nonprofit and private universities.

22-24 April (Friday-Sunday): World Bank-IMF Spring Meetings, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

30 April (Saturday): Deadline to apply to the Tatweer Misr Innovation Competition.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

1 May (Sunday): Suez Canal Authority raises tolls for different vessels.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

5-7 June (Sunday-Tuesday): Africa Health ExCon, Al Manara International Conference Center, Egypt International Exhibitions Center, and the St. Regis Almasa Hotel, New Administrative Capital.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

3Q2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release first financing product.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

Early July: Polish President to visit Egypt.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

August: Work to extend the capacity of the Egypt-Sudan electricity interconnection to 300 MW to be completed.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 25 fintech startups.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve Finterest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

4-6 November: The Autotech auto exhibition kicks off at the Cairo International Exhibition and Convention Center.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.