THIS MORNING: The 2021 Enterprise Reader Poll closes tonight; Civil servants, banks get Thursday off for Coptic Christmas; Sudanese PM resigns amid protests.

Good morning, friends, and welcome to a pleasantly brisk news day in which our economic record in 2021 leads is the big story. Expect corporate news to stage a comeback in a few days’ time — much of corporate Egypt seems to be dreaming of a three-day weekend before “really” getting back to work next week. At least if the autoreplies clogging our inboxes are anything to go by…

PSA #1- Today is your last chance to take our annual reader poll — and join us for breakfast. Every year, we ask our readers to weigh in on what you expect for the year ahead in our Enterprise Reader Poll. Take a few minutes to give us your take on the outlook for your business and industry, whether you’re planning fresh investments and new hires, and how your business fared in the year past. We’ll share the results with the entire community next week to help shape your view of the year — and will invite eight of you to break bread with us. Another dozen of you who complete the poll will also get special Enterprise mugs to enjoy your morning beverage of choice.

^^ The poll closes at midnight CLT tonight.

PSA #2- Banks and civil servants are getting this Thursday off, with a cabinet statement and the Central Bank of Egypt (pdf) announcing yesterday that 6 January will be off in observance of Coptic Christmas, which falls on Friday. We’re still waiting on confirmation from the EGX and the Manpower Ministry that the stock market will be closed and the private sector will be off on that day, but we’re optimistic.

PSA #3- Resident investors are no longer paying stamp tax on EGX transactions as of yesterday, when it was replaced by the 10% capital gains tax, the Financial Regulatory Authority (FRA) confirmed in a statement. The CGT will be imposed on net portfolio earnings at the end of the tax year after deducting brokerage fees.

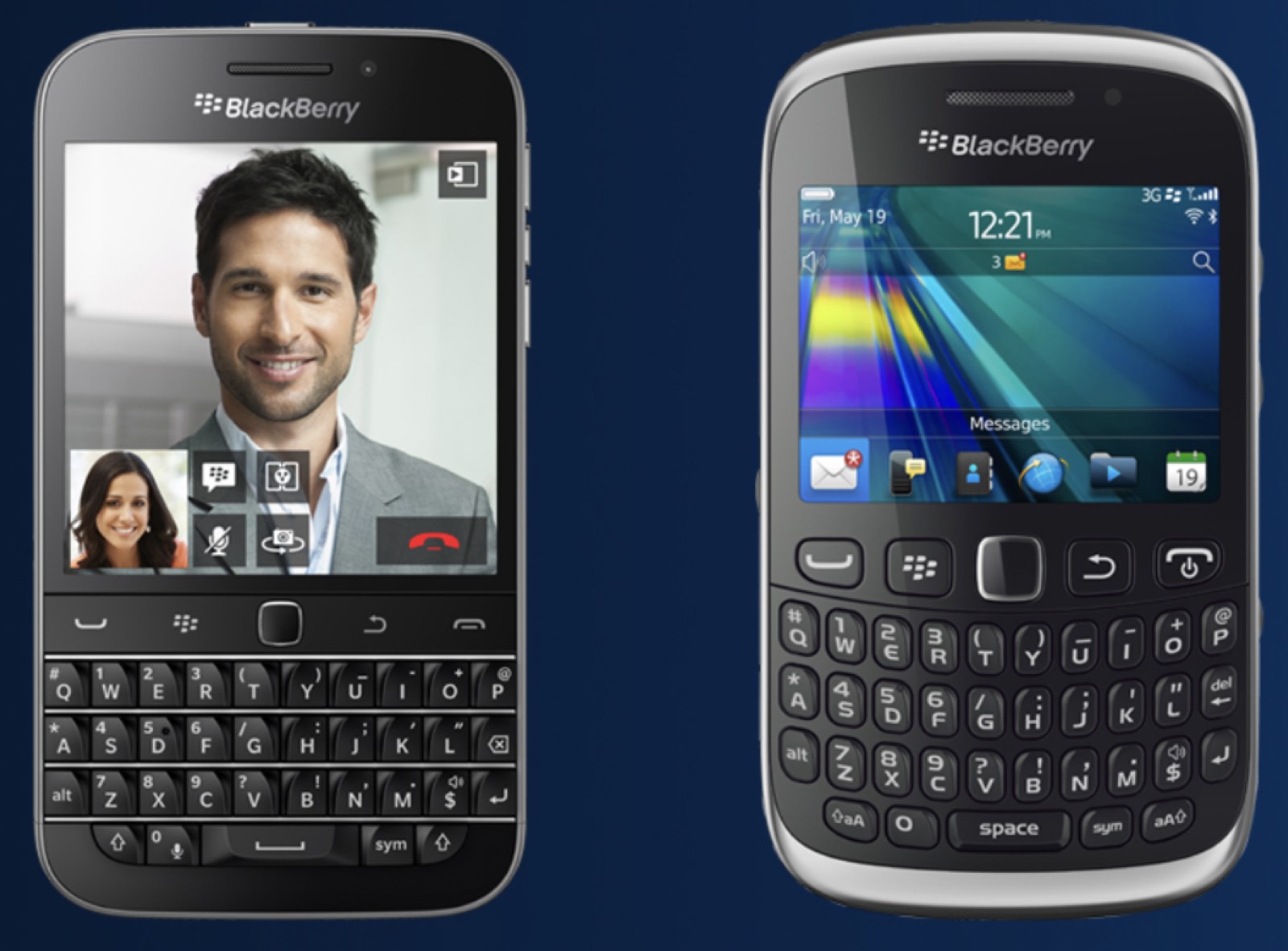

PSA #4- Your BlackBerry is probably going to die tomorrow — if you’re one of the three people reading Enterprise with an OG BB operating system on your vintage hardware. If you’re on BlackBerry 10 or earlier, don’t expect to be able to make calls, send an SMS or get on the interwebs as early as tomorrow morning. BlackBerry-branded handsets running Android will be just fine. The company has a press release out and you can get some of the back story from the Verge.

THE BIG STORIES ABROAD-

Sudanese Prime Minister Abdalla Hamdok has resigned, saying that he had been unable to fix the country’s widening political divide. He stepped down just a few weeks after signing a pact with the military to restore him to office following a coup in October. Hamdok headed the post-Bashir civilian-military administration that was supposed to lead the country to democratic elections this year, but was placed under house arrest by military leader Abdel Fattah Al Burhan in October during the army’s seizure of power. Hamdok’s pact with Burhan was widely rejected by protestors, who have continued to demonstrate against the return of military rule. The story is everywhere from Reuters and AP to France24, Bloomberg and the BBC.

It’s a relatively quiet morning in the international business press. The Financial Times has an interesting look at who’s up and who’s down in the corporate world thanks to the pandemic, while the Wall Street Journal jumps in its hot tub time machine to lead with the shocking revelation that “early-stage venture capitalists are now investing mns of USD in companies before they even have a coherent business plan” (shocking, we know) “while a growing number of VCs are saying that we are likely in a bubble.”

ALSO- Covid cases are continuing to surge in the US as the more virulent — though potentially less severe — omicron variant spreads, leading to disruptions in travel, retail and other sectors amid staff shortages. Almost 4k flights were cancelled worldwide and more than 8.8k were delayed on Sunday due to omicron and poor weather, according to stats from airline tracking site FlightAware.com picked up by Reuters — prolonging the holiday-season travel chaos seen last week.

|

CIRCLE YOUR CALENDAR-

Key news triggers to keep your eye on:

- PMI: Purchasing managers’ index figures for December for Egypt, Saudi Arabia, and Qatar will be released tomorrow. Figures for the UAE will be released on Wednesday.

- Foreign reserves: December’s foreign reserves figures will be announced before the week is out.

- Inflation: Inflation figures for December will be released on Monday, 10 January.

- Interest rates: The Central Bank of Egypt (CBE) will hold its first policy meeting of 2022 later this month. The CBE hasn’t yet published its meeting schedule for the year so we’re still waiting on an exact date.

OPEC+ is meeting this Tuesday, 4 January to decide whether to go ahead with plans to add another 400k barrels per day to the market in February. The cartel agreed in December to continue ramping up oil production despite concerns that omicron could dent demand. Pundits see it sticking to its planned monthly production increases at this week’s meeting.

The alliance of oil producers is remaining upbeat regarding the impact of omicron on the global oil market, according to a technical report seen by Reuters that predicts a “mild and short-lived” impact from the variant currently spreading around the world.

OPEC will discuss today who should be its next leader as Mohammad Barkindo of Nigeria prepares to wrap up his second and final term by mid-year. Barkindo has been the cartel’s secretary-general since August 2016.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: We ask several of Egypt’s leading education players what 2022 may bring for the sector. They say strong demand for quality education will continue, with the private sector playing an increasingly important role in filling market gaps. But focus is likely to shift towards education provision for middle-income families, particularly as continued inflationary pressures keep hitting disposable incomes. High inflation and cost crunches will also be a key challenge for operators, and could potentially slow the ramp up of investments. But at both the K-12 and university levels, we should expect construction and geographical expansion to remain key sector trends, they add.